Grid+ leverages the Ethereum blockchain to give consumers direct access

to wholesale energy markets. This allows customers to respond intelligently, which

increases efficiency, decreases cost, and helps move us all to a cleaner future.

Announcements:

07/21/2017 - Blog: Why Ethereum Needs Stable Coins

07/17/2017 - Blog: No Country for Private Blockchains

07/17/2017 - Whitepaper Updated, specifically Token Mechanics! Available at gridplus.io

07/11/2017 - Whitepaper Released!

Press Coverage & ConferencesTTRcoin:

ICO: Grid+ намеревается перевернуть рынок электроэнергииTheMerkle:

Grid+ Set to Disrupt Electricity MarketsEthNews:

ConsenSys Introduces Grid-Based Solution For Energy InefficiencyTransactive Energy Systems 2017:

What is Blockchain’s Role in Transactive Energy Systems?Consensus 2017:

Energy Markets PanelRice Blockchain Conference:

Ethereum Smart Battery Swarm

AbstractIn the past ten years the cost of distributed energy resources (DERs) such as solar panels and wind turbines has decreased significantly. This has led to expeditious and widespread adoption. Additionally, battery prices are rapidly decreasing, making them economically viable to supplement variable generation renewable resources by storing energy for the electrical grid. The confluence of these developments has created an emergent electrical grid where the means of production are less centralized and the control systems are less likely to be strictly top-down. The concept of independently owned and controlled DERs is known as the transactive energy grid.

The transactive grid promises to increase durability of the electrical grid while simultaneously increasing efficiency and enabling the adoption of more renewable energy. However, the distributed nature of the transactive grid poses two major challenges primarily related to technical control and grid administration. Both challenges can potentially be addressed using a blockchain. The ConsenSys energy team has several years of experience building and demonstrating proof-of-concept blockchain-based distributed energy resource management solutions. Through this experience, ConsenSys identified the opportunity to form Grid+, which will build natively Ethereum-based utilities in deregulated markets. Grid+ will demonstrate production ready blockchain-based energy solutions at scale in competitive commercial environments. In doing so, Grid+ will enable the transactive grid of the future while proving the advantages of Ethereum over incumbent technologies.

Grid+ is developing a hardware and software stack to create a secure Ethereum enabled gateway and connect Internet-of-Things (IoT) devices. The hardware gateway, or “smart energy agent”, is an Internet-enabled, always-on appliance which will securely store cryptocurrencies and process payments for electricity in real-time. The agent will also programmatically buy and sell electricity on behalf of the user and intelligently manage smart loads (e.g. Tesla Powerwall or Nest thermostat). The software stack will work in conjunction with the smart energy agent to make payments using a combination of Grid+ designed payment-channels and a Raiden network hub (when available). Grid+ is developing a system architecture that allows a typical user to leverage cryptocurrencies while remaining unaware of it’s use. Interestingly, the implementation of a secure, always-on system with low friction payment rails provides a missing piece of critical infrastructure in the broader cryptocurrency ecosystem. The Grid+ infrastructure has many uses beyond electricity and will be key to enabling the widespread adoption of cryptocurrencies.

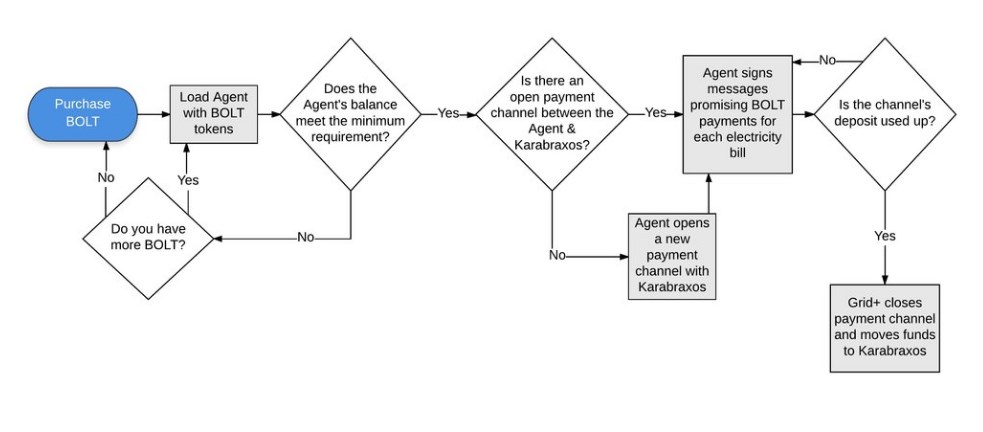

How does Grid+ Work?Grid+ functions as a commercial utility in select deregulated markets in the United States. Grid+ agent devices pay for all electricity bills automatically and in real-time. All payments are done over state channels using BOLT tokens. Each BOLT token is equal to $1.00USD and is are 100% backed by USD deposit. All fees from these payments are held by a fee vault smart-contract called Karabraxos.

Fast Token FactsToken Model: The Grid+ system will have a two token model. One token known as GRID and the other known as BOLT. GRID will be staked by Grid+ customers to allow customers access to near wholesale electricity prices. The other token known as the BOLT will be a stable token backed by USD deposits and issued by Grid+. BOLT can be used by Grid+ customers whom do not wish to have forex risk associated with cryptocurrencies such as Ethereum.

Token Sale: We will be holding a token sale of the GRID token sometime in Q3 of 2017.

Token Sale Cap: The sale of GRID tokens is planned to take place in a Reverse Dutch Auction with a cap which is yet to be determined.

LinksWebsiteWhitepaperTwitterMediumSlack