|

121

|

Alternate cryptocurrencies / Altcoin Discussion / The Ethereum VS Bitcoin Fork

|

on: January 17, 2021, 07:26:09 AM

|

One thing has been on my mind for a long time, and I wanted to talk about it here with the community. So, let’s start from the beginning. In August 2010, a hacker discovered a bug in Bitcoin’s codebase that allowed him to generate 184 billion bitcoins. These coins were sent to two different addresses that received 92 billion each in the famous block #74,638. This would later become known as the overflow bug. Information about this particular case can be found on the links below: https://bitcointalk.org/index.php?topic=822.0https://bitcointalk.org/index.php?topic=823.0https://decrypt.co/39750/184-billion-bitcoin-anonymous-creatorWithin 5 hours, Satoshi and the bitcoin developers rolled out a fix that patches the overflow bug incident. Version 0.3.10 patches the block 74638 overflow bug. http://bitcointalk.org/index.php?topic=823The Linux version includes tcatm's 4-way SSE2 SHA-256 that makes generating faster on i5, i7 (with hyperthreading) and AMD CPU's. Try the "-4way" switch to enable it and check if it's faster for you. Download from sourceforge: http://sourceforge.net/projects/bitcoin/files/Bitcoin/bitcoin-0.3.10/SHA1 16645ec5fcdb35bc54bc7195309a1a81105242bb bitcoin-0.3.10-win32-setup.exe SHA1 4f35ad7711a38fe8c880c6c9beab430824c426d3 bitcoin-0.3.10-win32.zip SHA1 e3fda1ddb31b0d5c35156cacd80dee6ea6ae6423 bitcoin-0.3.10-linux.tar.gz SHA1 b812ccff4881778b9090f7c0b0255bcba7b078ac bitcoin-0.3.10-macosx.zip It is no longer necessary to delete blk*.dat. The good block chain has overtaken the bad block chain, so you can just upgrade and it'll automatically reorg away the bad block chain. A fork happened, and the blockchain was forked back to the state before block #74,638. Some blocks were invalidated, and all the transactions that were carried out were rolled back. Bitcoin survived and prospered into what we have today, and rightly so. Nobody seemed to have a problem because something that was supposed to be immutable (Bitcoin) became mutable for a bit.

Now to the second part of the story. Six years later, in June 2016, we had the DAO hack. Over 3.5 million ether valued at $50 million were stolen from the DAO smart contract. ( https://www.coindesk.com/understanding-dao-hack-journalists) The days that followed created huge tensions within the Ethereum community that couldn’t be solved, so the blockchain had to fork and split into two. Those who believed in the immutability of Ethereum stayed with the original idea and called their new network Ethereum Classic. The majority supported the fork and stayed with Ethereum. The reason the fork happened was to return the stolen funds, but the Ethereum Classic folks didn’t want any of that. In my opinion, both the Bitcoin and Ethereum forks were carried out to benefit the communities. 1. But why is it that one network is being criticised for not being immutable while the other isn’t? 2. Why do people (including highly ranked Bitcointalk members) think of Ethereum Classic as the ‘real Ethereum’? 3. If that is how it should be, shouldn’t we also have a ‘real Bitcoin’ where two addresses hold 92 billion coins each? 4. Why is it not OK to perform a fork to refund stolen ether due to a buggy code, but it is OK to invalidate bitcoin blocks due to wrongly generated bitcoins? 5. Is bitcoin not attacked for the fork because the bug led to the creation of bitcoins much higher than the maximum supply? 6. Would the opinions have been any different if a much lower number of coins were generated? - Both forks fixed bugs in the codebase. One allowed to generate a huge number of bitcoins, the other to transfer big amounts of ether. |

|

|

|

|

122

|

Other / Meta / @theymos and admins: Have a look at this

|

on: January 15, 2021, 01:47:54 PM

|

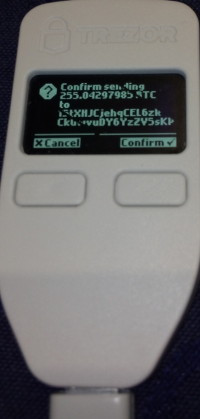

I tried to copy/paste a phishing email on the forum, but I ran into a weird bug. For some reason that addresses in the email can't be pasted into a block explorer. The explorer doesn't recognize the pasted address as a valid address. The other problem is previewing the message on Bitcointalk. When I copy/pasted the content in a new post and clicked on preview, this is what I get:  The address isn't visible in either the code or quote tags, even though it's there. And look at the email content. Is the message encoded in some way that causes this glitch? Has anyone experienced this before? Once I made the post, it became visible just fine. But you still can't look up the address on a block explorer after removing the special characters. What kind of sorcery is this? Here is the link to the post: https://bitcointalk.org/index.php?topic=5284407.msg56102812#msg56102812 |

|

|

|

|

123

|

Local / Trgovina / [M] Mijenjam $525 USDT (TRC-20) za Bitcoin ili Ether

|

on: January 13, 2021, 02:18:16 PM

|

Imam $525 u USDT TRC-20 tokenima i želim da za njih kupim bitcoin ili ether. Možemo koristiti https://coinmarketcap.com/converter/ da bi odredili tačne vrijednosti. Jedan dio sam spreman zamjeniti za bitcoin a drugi za ether, sve po dogovoru. Nije problem da koristimo escrow ako za to ima potrebe. Novce šaljem prvi visoko rangiranim članovima koji imaju pozitivan dojam u trgovanju. Ako ne, vi šaljete prvi. Ne koristim Telegram pa bi zamjenu volio uraditi preko PM sustava od foruma. Pišite u temi ko je zainteresovan. Hvala! |

|

|

|

|

124

|

Alternate cryptocurrencies / Marketplace (Altcoins) / I have $525 USDT (TRC-20), I want to buy Bitcoin or Ether

|

on: January 13, 2021, 02:05:19 PM

|

I am looking to purchase $525 worth of bitcoin (preferably), or ether if you can't do bitcoin. We can use CMC's cryptocurrency converter calculator to determine the correct amounts. https://coinmarketcap.com/converter/Exchanging one part of the funds for bitcoin and a second part for ether is also possible. Post in the thread if you are interested. We can use an escrow if there is a lack of trust. I am going first with any high-ranked members with provable trading experience/feedback that I feel I can trust. In all other cases, you will go first. The deal will be done over the forum PM system. No Telegram or emails! Please post in the thread if you are interested and if you have PMed me. I don't check the email connected to my Bitcointalk account all the time. |

|

|

|

|

125

|

Alternate cryptocurrencies / Altcoin Discussion / Have you claimed your Synthetix (SNX) tokens?

|

on: January 11, 2021, 10:05:46 PM

|

I came across a post on Facebook in one of the crypto groups where a user was talking about Synthetix tokens which have been skyrocketing recently. For those who don't know, Synthetix used to be Havven, an erc-20 token. The old Havven tokens have in the meantime migrated to a new address and changed their name to Synthetix. You can check how the token is performing on CoinMarketCap here.If I remember correctly, there was an airdrop of the old Havven tokens back in 2018. Over 37 tokens were airdropped to participants. Check your ETH wallets to see if you received any Havven tokens. Their contract address is > 0xf244176246168f24e3187f7288edbca29267739b. The new SNX tokens aren't visible on Etherscan, so chances are you have them in your wallet without knowing it. Check your ETH accounts manually, or insert your ETH address on Delta Balances that displays the SNX tokens. https://deltabalances.github.io/If they are still there, those airdropped tokens are today worth over $450! The easiest way to claim them is by using a Synthetix Dapp, known as https://mintr.synthetix.io/. You can connect the app with MetaMask or a hardware wallet such as Trezor or Ledger. After that, the tokens can be sold on a bunch of exchanges like Binance, OKEx, Coinbase Pro, etc. Good Luck! |

|

|

|

|

126

|

Other / Meta / Meriting a user who just merited you

|

on: January 11, 2021, 04:37:16 PM

|

|

Merits on Bitcointalk are sent for all kinds of posts. You can get merits for posting interesting guides and tutorials, helping someone solve a specific problem, and being knowledgeable and proactive. Even being funny, arrogant, or cynical can help at times.

Whatever the reason is that someone merited your post, you might sometimes (or all the time) feel like you need to respond in the same way. So, you end up rewarding the user who rewarded you with some merits as well. Especially if you were awarded more merits than you thought you would or deserve.

Did you ever find yourself thinking: that user just sent me x merits, I will go through his/her post history and find something to merit? That thought has often popped into my head, and I have indeed done it a few times myself.

When you merit someone who just merited you, do you feel good doing it?

Do you feel like it looks like an agreed exchange, even if it isn't?

Do you think it's not a proper use of the merit system?

Even if you merit a post that clearly deserves to be awarded, you didn't come across it naturally. You searched for it intentionally. I am curious what other users think about this.

|

|

|

|

|

127

|

Local / Altcoins (Hrvatski) / Ethereum Mixeri

|

on: January 04, 2021, 03:37:14 PM

|

Za Bitcoin mixere već znamo, a šta je sa Ethereum mixerima? Jako malo informacija o miksanju ETHa ima na forumu. Da li neko ima bila kakva iskustva o tome? Nisam htio da pretražujem po Google-u. Pronašao sam jednu startu temu iz 2018 > https://bitcointalk.org/index.php?topic=2930843.0. U pitanju je stranica i mixer https://eth-mixer.com/index.html. STRANICU NISAM KORISTIO I NIPOŠTO NE JAMČIM ZA NJIH!

ANN na forumu nema puno komentara. Ali u zadnjem postu, jedan korisnik kaže da je uspješno izmiksao 10 ETH preko ove stranice. Napravio je određene pogreške pa je mislio da je ostao bez tokene ali nakon razgovora sa korisničkom službom, sve je rješeno. I have talked to the support team behind ETH-Mixer.com

Here's what happened, I tested the platform using 0.1ETH, sent the ETH to the mixer and it went right to my wallet in just 5 minutes. Then, I sent approx 10 ETH to the same address but I had trouble receiving the funds. I contacted the support for without hope to retrieve my funds back but the support is surprisingly responsive to my encrypted email via PGP. They helped me through the entire process until I get my ETH back.

I know it is my fault not reading the guidelines on how the mixer works. But their team behind is so professional which deserves to be credited.

Thank you ETH-Mixer.com.

P.S. Don't make the same mistake as I did, read the guidelines first. - Na stranici između ostalog navode opciju timedelay. Korisnik sam odredi neki vremenski okvir nakon kojeg će dobiti svoje tokene. Recimo stavite timedelay od 3 sata. Tokene dobivate na adresu 3 sata nakon što ste ih poslali za miksanje. To bi po njima trebalo da osigura dodatnu zaštitu ako bi neko krenuo da istražuje i analizira porijeklo novca. - Tokom prvog miksanja stranica korisniku daje mixing code. Prilikom ponovnog korištenja usluge, ovaj mixing code se upisuje kako bi se spriječilo da od mixera dobiješ tokene koje si prethodno poslao. - Ne vode nikakvu evidenciju o korisnicima. Tako bar kažu. - Miksanje traje oko 5 minuta ili duže ako se koristi opcija timedelay. Naknade su 0.001 ETH za svako miksanje + nasumice odabran iznos koji je manji od 2% od ukupno miksanih tokena. Ovaj iznos nije fiksan, da se ne bi moglo analizama utvrditi koji je stvarni iznos koji je poslan na miksanje. Sve uslove korištenja možete pronać ovdje: https://eth-mixer.com/faq.html STRANICU NISAM KORISTIO I NIPOŠTO NE JAMČIM ZA NJIH! |

|

|

|

|

128

|

Other / Meta / The unsung heroes of Bitcointalk

|

on: January 03, 2021, 09:14:34 AM

|

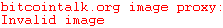

Since it is the start of a new year, I thought it would be a good time to remember some exemplary behaviour by members of the Bitcointalk community throughout the years. The below examples show how some of our members acted when they received money that didn't belong to them. It shows how they performed in situations where they could have taken advantage of someone else's mistakes. The list is not based on my personal ranking of best to worse, I just posted the examples as I came across them. 1.In April 2014, the user johoe discovered a bug that allowed to expose private keys for specific addresses. He informed the community and blockchain.info about his findings and saved many users from losing money You can get more info on this particular case here: https://bitcointalk.org/index.php?topic=581411.0He made a list of addresses here and here that got exposed and asked the members who owned the coins on those addresses to prove their ownership so he could send them back. Hello, there were a large bunch of new broken addresses today (several 100s in one day). I took the liberty of saving some funds before they got swiped by others. If you can convince me that they belong to you (signing a message with the address is obviously not enough; the private key is already known), I will send the funds back. Look into the file http://johoe.mooo.com/bitcoin/broken.txt, to see whether your address was broken. johoe returned the 255 bitcoins he swept to blockchain.info. Their users were affected by the bug, and he instructed them to contact the platform for refunds. The money has been returned to blockchain.info. Please write to blockchain support to claim refund.  Source: https://bitcointalk.org/index.php?topic=581411.msg9791998#msg9791998In total, johoe posted that he swept over 870 bitcoins to his own wallet to save the funds from being stolen by someone else who discovered the same vulnerability. I wanted to do a little after-math of how much money was moved by whom. It is hard to get exact numbers. Often I have no way to know whether a transaction is legitimate or if someone is stealing money from weak addresses. I think every item on the following list is correct but there may be more.

870.7 BTC saved by me (they went through 15tXHJCjehqCEL6zRCkGwvuDY6YzZV5sKP)

105.9 BTC stolen by 1M77fUCzQrmY8jHRRgpzDVPAK5eQ31bwxZ

53.0 BTC saved by Blockchain.info

36.2 BTC stolen by various 1xy and 1aa addresses.

3.7 BTC saved by bithernet (1PGfLgFtRHgdgvPNvmHMjtsWwF4fyG1jvh), not yet returned

0.24 + 0.084 + 0.016 BTC stolen by 1824bso2XgKTm7XThA75A2gdMpt3jSxW5M, 15hM4CMs7JZ3JjQHmvGhS4NKSsqhKMsQXu, and 1MKSWH9pShsLdV54cRLDQ9JKarsjXK4ms5

That's about 1070 BTC total. Source: https://bitcointalk.org/index.php?topic=581411.msg9888800#msg9888800johoe deserves special recognition for his actions. 2.In December 2012, the user TheButterZone, received almost 520 bitcoins in a few different transactions to one of his addresses by mistake. He made a thread on Bitcointalk to try and find who sent him the money. He even thought someone was trying to set him up for a crime. Even a collision was mentioned as a reason the bitcoins were accidentally sent to him. TheButterZone moved some of his own bitcoins that he kept at the same address. The 520 accidentally received bitcoins were transferred to a paper wallet for added protection. In his post, he asks the sender(s) to prove ownership of the coins by signing a message, after which he will send them back to the original owner. The whole story is available on the link below. https://bitcointalk.org/index.php?topic=133122.0“…the 519.70399999 has been moved to the paper wallet http://blockchain.info/address/1D58NtxrZF4iUnGAFojnqNpPuGi9rrcyVf . I am operating under the conclusion (even if mistaken) that 1TBZjmXho6mdGhoESaMV2svtqJXYtWfEp had a collision and somebody/some computer didn't realize (or care) that it was already in use. SO, if you also have the private key for 1TBZjmXho6mdGhoESaMV2svtqJXYtWfEp, sign with it and I will verify it matches mine, then send your BTC to the new address of your choosing.” Source: https://bitcointalk.org/index.php?topic=133122.0I am not sure how this saga concluded, but his intention to inform the community and give back what doesn’t belong to him deserves every praise. 3.In June 2010, Gavin Andreasen announced his bitcoin faucet on Bitcointalk. He was giving away 5 bitcoins per user to spread the word and give new users a chance to test out bitcoin. It didn’t take long for someone to find a way to abuse the system. Luckily, it was wobber who had no intentions of keeping the claimed coins and gave them back. He only wanted to test if it could be abused. gavinandersen

I've been able to drawn 50 BTC in minutes using Tor. Please add some address filter too, so the same address can't be used twice. I'll also provide a Tor blacklist if you'd like.

PS: I've paid back those BTCs.

It's out job to disarm thieves so this currency won't be subjected to the same atrocities as in real world.

This currency shall not be used for one to be rich and in control and others poor and under control. Source: https://bitcointalk.org/index.php?topic=183.msg1533#msg1533He suggested that one address shouldn’t be able to claim coins more than once. Gavin took note of his proposal and changed the configuration so that an address can only use the faucet once. I am going to add a one-donation-per-bitcoin address rule to make it a teeny-tiny bit harder to cheat. Source: https://bitcointalk.org/index.php?topic=183.msg1541#msg1541The amounts wobber claimed from the faucet, might not have been a lot at the time, but his actions reminded me of simpler times when people were decent. That’s why I think he deserves mention in this thread. 4.The next case doesn’t involve a user from Bitcointalk. It involves the companies Bitmain and BitGo. Due to a bug in BitGo’s recovery tool, a user ended up paying over 85 bitcoins in transaction fees for a 16 BTC transaction he sent in April 2015. You can view the transaction id here.The user who was affected contacted BitGo and Bitmain and explained what happened. The transaction got mined by AntPool. This is BitGo’s reply on the incident that led to these enormous fees: We (BitGo) have investigated this issue and determined it to be a bug introduced over a year ago in our fork of bitcoinjs-lib. The exact line of the cause is here: https://github.com/BitGo/bitcoinjs-lib/blob/744b0f76803b8fa233ee3b221364b42bdbf9b7f1/src/util.js#L142We had since fixed this bug in April 22, 2014 (a month later) here: https://github.com/BitGo/bitcoinjs-lib/commit/fbc7377dbfb3da0fd911f2740c18cfcd41becc1b. However, we missed updating the reference to this fix in the legacy recovery tool. The root cause of the problem occurred during the output value serialization step when the redeem transaction was constructed. During the process of converting the number into bytes for use in the transaction, bitwise operators were used in this old version of the code, which converted the output value (in satoshis) to a 32 bit int, causing an integer overflow and truncating the output of 10227087437 satoshis (102.27 btc) to 1637152845 satoshis (16.37 btc). Kudos to the other members of the public who discovered this as well. We would like to thank rstn for his patience and we are in private communication with him to ensure he achieves full restitution of funds. After they realised what happened, the mining pool returned the entire sum to the original owner. Hats off to Bitmain, AntPool, and BitGo for acting professionally. OP’s confirmation that he received a full refund and his comments can be seen on reddit here. 5.The last case of exemplary community behaviour comes from BitcoinFX in 2010. This is connected to Gavin’s faucet that I talked about in example #3. When BitcoinFX saw Gavin’s request for someone to refill the faucet, BitcoinFX made a donation of 500 bitcoins. Here is that post and the hash of the transaction. 500 BTC Donation incoming to the Faucet !

~ Only original Bitcoin users will ever understand the true economic value of Pizzas and Haircuts. Bitcoin for ALL Source: https://bitcointalk.org/index.php?topic=183.msg7536#msg7536

That’s all for today. I am sure there are many more examples where members did the right thing, but it’s hard to find. Feel free to share similar examples that you know of. Happy New Year! |

|

|

|

|

129

|

Bitcoin / Development & Technical Discussion / How many of you check the code of open source software?

|

on: December 29, 2020, 09:52:45 AM

|

There is no doubt that open-source software is better compared to closed-source software. There is a lot of content on this topic, so there is no reason to discuss the advantages of open source. There is another thing I would like to know. The crypto community preaches "Verify, Don't Trust!" How many of us actively check the code of the software, wallets, and everything else crypto-related that we use? Do you have the programming skills, time, and experience to inspect the codebase and deem it OK to be used? Or do you trust that others have done so and take their word for it? Do you find it odd that you are placing your trust in other individuals to have done the job for you in an industry where you are supposed to be your own bank, banker, and security department? According to a study I found, it was discovered that 91% percent of open-sourced code contained certain parts that are either outdated or not actively developed. The 2020 OSSRA report reaffirms the critical role that open source plays in today's software ecosystem, revealing that effectively all (99 percent) of the codebases audited over the past year contain at least one open source component, with open source comprising 70 percent of the code overall. More notable is the continued widespread use of aging or abandoned open source components, with 91 percent of the codebases containing components that either were more than four years out of date or had seen no development activity in the last two years. That by itself is no reason for concern, but the following part could and should be: The most concerning trend in this year's analysis is the mounting security risk posed by unmanaged open source, with 75 percent of audited codebases containing open source components with known security vulnerabilities, up from 60 percent the previous year. Similarly, nearly half (49 percent) of the codebases contained high-risk vulnerabilities, compared to 40 percent just 12 months prior. You can read the whole report here: https://www.securitymagazine.com/articles/92368-synopsys-study-shows-91-of-commercial-applications-contain-outdated-or-abandoned-open-source-components |

|

|

|

|

130

|

Economy / Gambling discussion / How to adjust and work with the bet365 live streaming

|

on: December 24, 2020, 03:49:35 PM

|

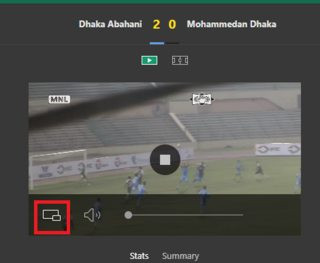

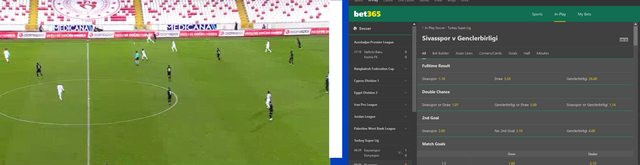

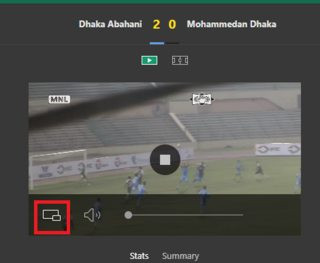

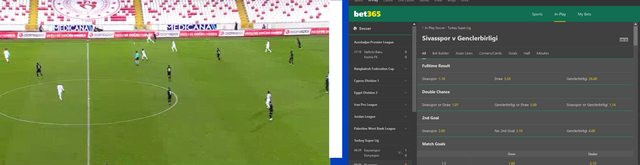

Bet365 is one of the biggest bookmakers in the world. Although it is not a crypto sportsbook/casino, many gamblers use it even on this forum. One of its best features is the live streaming. Depending on where you are from, you can view a wide range of sports and leagues. From football, basketball, ice hockey, greyhounds, horse racing, to Esports, and much more. If you are into sports betting, their live streaming offers players a chance to watch many matches live. The problem with bet365 is that they keep changing their layout and find new ways to 'hide' their live streaming feature. A few seasons ago, the streaming was so fast, that it was a few seconds ahead of many sports channels on satellite and cable for many leagues. They have adjusted this delay, and now you will rarely find a stream that will give you a significant advantage. After their most recent update, it is no longer possible to open a separate window for the live streams by logging in and clicking on Extra from the top of the page and clicking on Live Streaming. As you can see, the feature has been removed:

That is why I have decided to create this quick guide with pictures and step-by-step instructions on how to activate, adjust the size, and work with the live streaming on bet365. For those who have never used bet365, in order to watch their streams, you need to register an account, deposit money into it, and for some sports, make a bet on the match you want to live stream. But in most cases, betting on the match is not needed. In my experience, wagering is only needed for horse racing and greyhound races. 1.Once you are logged in, click on the In-Play button at the top. You can then browse through the various sports that are currently played (not all of them have live streams) or click on the Streaming button to get a list of matches with available live streams. From the available matches, select the one you want to watch be either clicking on the correct match or the small play buttons highlighted on the right.  2. 2.To activate the live streaming for your match, click on the highlighted Play button.  3. 3. The streaming window is very small, but we can make it bigger. Click on the highlighted button to open a new window just for the streaming.  4. 4.A new window will open that we can work with. For the next step, you need to use Mozilla Firefox. I haven't been able to find the same feature on Chrome. When the new window opens, stop the streaming and wait a little bit. You will notice that a new button appears at the bottom right on the stream. Click on it to activate picture-in-picture mode.  5. 5.You will now see something like this:  You can now adjust the size of the streaming window, move it around your screen, and make it fit together with other tabs and programs you have running. If you are using multiple computer screens, you can extend your desktop and move the streaming window on one screen and leave the bet365 match centre on the other.

SUGGESTIONTo skip steps 3-5, there is an add-on that you can install for both Google Chrome and Mozilla Firefox that will maximize a video to cover the full screen with just one click. The add-on is called Maximize Video and you can add it to your browser from the following links: Chrome - https://chrome.google.com/webstore/detail/maximize-video/bfpkgjlnboeecjmnbhbknmemmckmpomb?hl=enFirefox - https://addons.mozilla.org/en-US/firefox/addon/maximize-video/If you want to search for it yourself, just enter 'Maximize Video' in your search engine and you will come across the same links. After you started the live stream as explained in step #2, you can click on the Maximize Video button in your browser as highlighted below. You will notice that the video on screen will be selected and highlighted in red. Just click anywhere in the video and it will be automatically adjusted for full screen.   Enjoy! |

|

|

|

|

131

|

Other / Meta / My investigation on satoshi

|

on: December 21, 2020, 09:42:36 AM

|

I want to start off by saying that if I knew who satoshi was, I would never reveal his identity out of respect for what he gave us. It is his choice to remain anonymous and possibly choosing to continue his work from the shadows. It still remains a mystery who the man was, but looking at publicly available data won’t interfere with his privacy. After reading The Chain Bulletin report where a conclusion was made that satoshi lived in the UK while working on Bitcoin and is possibly British, I started my own research. I slowly went through all 27 pages of satoshi's post history. My goal was to check his spelling and find sentences and phrases to determine if those were written by a British person. Whether he lived in London or somewhere else, can't be defined from his posts. If there were records of him speaking live, it would make this task much more manageable. Since I am not aware of any, I had to focus on some of the differences in the spelling between US and British English.

Let me show you what I mean. 1. In US English, you can notice that the letter ‘z’ is often used instead of the letter ‘s’ in words such as modernized, formalized, optimization. The British forms would be modernised, formalised, optimisation. Here are a few examples from satoshi’s posts, so you can check for yourself whether he used British or US spelling. A) We could potentially schedule a far in future block when Bitcoin would upgrade to a modernised arrangement with the Merkle Tree on top, if we care enough about saving a few bytes. -US English spelling is modernized. Modernised is the British variant. B) Priority is a more formalised version of the concept you're describing. -Same as the above example. In US English, you would spell this word formalized, but satoshi spelt it formalised. C) The key was Gavin's idea for prioritising transactions based on the age of their dependencies. -Another example of satoshi using the British spelling form in words like prioritising, instead of prioritizing, which would be used by an American. D) There's something with MinGW's optimisation, I'm not sure but maybe a problem with 16-byte alignment on the stack... - Another example where satoshi spells the word with an ‘s’, instead of the American way with a ‘z’.

2.In the UK, words like colour or honour are spelt with ‘ou’. US Americans tend to drop the ‘u’. They will spell these two words as color or honor. When it comes to satoshi, I was able to find both forms in his posts. Unfortunately, I don’t have many examples to show. A) The foreground is now exactly the same colour as the BC in the old one. - In this example, he uses the British variant. But Satoshi also used the US form. He simply didn't pay that much attention to it all the time, or he could have also been familiar with the American way of spelling, so he adopted both forms. Here is an example: B) I have to guess it has something to do with your display color depth selection. - As we can see in the above example, satoshi used the US form.

3.-There is a difference between how the word ‘ dependent/dependant’ is spelt in American English and British English. Americans would spell the word with an ‘e’, but we can see that satoshi used the British style and spelt it with an ‘a’. Merriam-Webster's dictionary explains the difference perfectly: What to Know

The difference between dependent and dependant is merely a matter of preferred spelling. "Dependent" is the dominant form in American English for both the noun and adjective, while in British English, "dependant" is more common for the noun. "Dependent" is still used to indicate the adjective form in British English but its use in this form is uncommon. https://www.merriam-webster.com/words-at-play/spelling-variants-dependent-vs-dependantHere is how satoshi spelt the word in one of his posts: A) The OP_BLOCKNUMBER transaction and all its dependants would become invalid.

Some interesting things I discovered while going through satoshi’s posts: - He often referred to the blockchain as ‘ block chain’. There are many examples of that, here are just two: A) You do need to have downloaded the complete block chain (currently 71040 blocks) before you'll see any confirms. B) 0.3.2 has some security safeguards to lock in the block chain up to this point and limit the damage a little if someone gets 50%. - He referred to inputs and outputs as inpoints and outpoints. Does anyone know when and why these terms were changed to inputs and outputs? A) The network would track a bunch of independent outpoints. It doesn't know what transactions or amounts they belong to. A client can find out if an outpoint has been spent, and it can submit a satisfying inpoint to mark it spent. The network keeps the outpoint and the first valid inpoint that proves it spent. The inpoint signs a hash of its associated next outpoint and a salt, so it can privately be shown that the signature signs a particular next outpoint if you know the salt, but publicly the network doesn't know what the next outpoint is. Another example: B) The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. - Although this can’t be used as concrete evidence that satoshi is from the UK, this very much sounds like something a Brit would say, not an American. A) Sorry to be a wet blanket. Writing a description for this thing for general audiences is bloody hard. ‘Bloody’ is an intensifier that is not that common in America. You will rarely hear an American saying: “That is bloody difficult to do”. Here is what the BBC says about it: Bloody is an all-purpose intensifier that, according to the Oxford English Dictionary, once qualified as the strongest expletive available in just about every English-speaking nation except the United States. https://www.bbc.com/culture/article/20151109-english-speakers-or-not-brits-and-americans-swear-in-different-languages

That’s it. I wish I could have found more examples. If we had for, example, soccer/football, sidewalk/pavement, fries/chips, pants/trousers... we would have more proof. But I still feel like all this is leaning towards satoshi being British. What do you think? |

|

|

|

|

132

|

Local / Hrvatski (Croatian) / Zanimljiv podatak iz jednog starog posta od satoshija

|

on: December 18, 2020, 10:17:56 AM

|

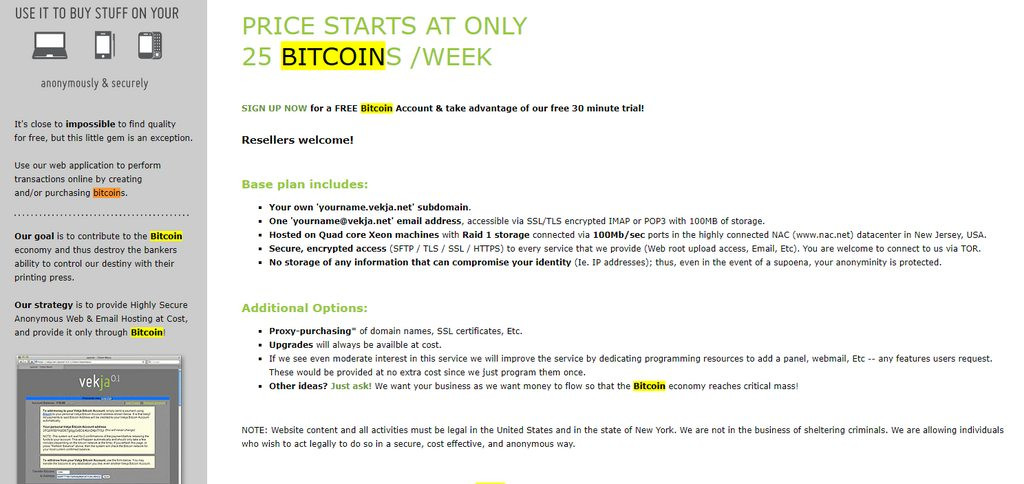

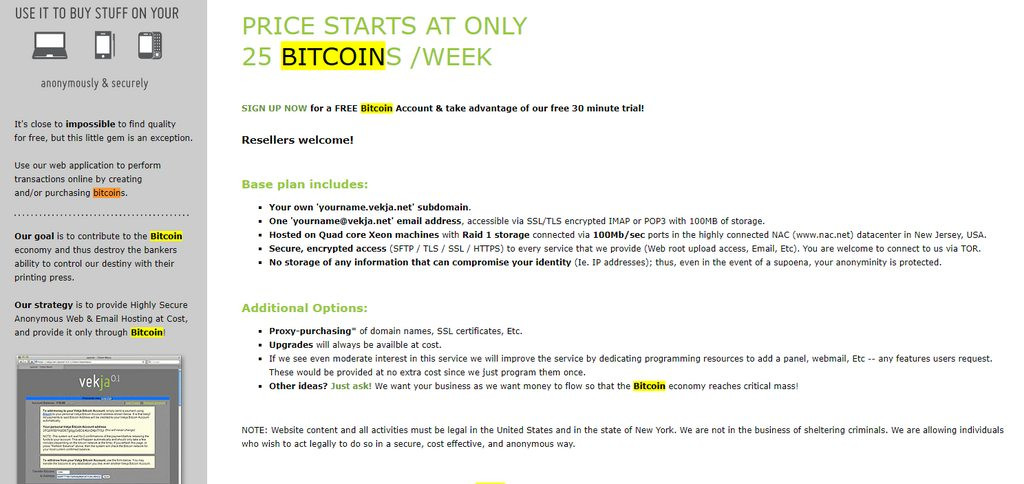

Pronašao sam jedan zanimljiv post iz prošlosti. Dok sam čitao satoshijeve postove tražeći nešto, naletio sam na jednu zanimljivu temu. U toj temi satoshi govori o veličini blockchaina i vremenu koje je potrebno da se kompletan blockchain preuzme i verifikuje. Satoshi je govorio o SPV novčanicima i kako će se oni koristiti u budućnosti. Zatim je nastavio razgovor spomenuvši nešto vrlo zanimljivo. Govorio je o online novčanicima i web novčanicima, i o tome koliko su oni jednostavni za korištenje, u poređenju sa upotrebom jednog potpuno novog bitcoin softvera. In the meantime, sites like vekja.net and www.mybitcoin.com have been experimenting with account-based sites. You create an account on a website and hold your bitcoins on account there and transfer in and out. Creating an account on a website is a lot easier than installing and learning to use software, and a more familiar way of doing it for most people. The only disadvantage is that you have to trust the site, but that's fine for pocket change amounts for micropayments and misc expenses. It's an easy way to get started and if you get larger amounts then you can upgrade to the actual bitcoin software. Da li nam je to tvorac bitcoina sugerirao da su online custodial novčanici dobro rješenje, naročito za manje iznose? Pokušao sam pronaći nešto više informacija o stranicama koje je spomenuo i uslugama koje su pružali. Prva platforma je vekja.net. Više nije aktivna ali postoje stari arhivski zapisi. Prodavali su "Bitcoin naloge" i pružali usluge web i email hostinga za 25 bitcoina tjedno još 2010. godine.  Druga stranica koju je spomenuo je www.mybitcoin.com. Dugo nije ažurirana ali ima mnoštvo vijesti i informacija o mjenačnicama, bitcoin novčanicima i razne tutorijale. Nema više online wallet usluge koliko sam uspio vidjeti. Ovaj stari satoshijev post mi je bio vrlo zanimljiv. Pogotovo kada uzmemo u obzir dokle je bitcoin danas stigao. Prije samo 10 godina, bilo je potrebno platiti 25 bitcoina tjedno za hosting. A pogledajte gdje smo sada... |

|

|

|

|

133

|

Bitcoin / Hardware wallets / Ledger Live added full node support

|

on: December 18, 2020, 08:56:27 AM

|

I didn't see anyone write about this so I figured I could mention it briefly... In its newest release, Ledger Live has added support for full nodes. However, this is still an experimental feature and needs to be manually enabled by the user in the settings. To do that, go to Settings > Experimental feature, find the Connect Bitcoin full node feature and click on connect. Ledger states in its official support doc that they are currently not offering any support for bugs and problems related to the full node feature. There are known bugs that need to be fixed before a system-wide release. How to establish a connection?To connect your full node to LL, you need to use Ledger SatStack. It functions as a bridge between your full node and the LL client. It's an open source app. You can read more about it on GitHub. Minimum requirements:- The Full node option is available in version 2.18.0 of Ledger Live. You need to update your client to this version first. Ledger has posted the following requirements needed to run a full node: At least 2 GB RAM

350 GB disk space

A broadband connection without data restrictions

6 hours of daily uptime

To understand how to add and configure your bitcoin accounts and set up Ledger SatStack, read the official support doc. https://support.ledger.com/hc/en-us/articles/360017551659-Setting-up-your-Bitcoin-full-nodeKnown bugs with full node feature enabled- Unconfirmed transactions don't appear in your transaction history the moment they are sent. You will see them once they receive the first confirmation. - Confirmed coins are shown as pending. - The SatStach app has to be updated manually. Ledger Live can't check for updates to it like it does with the crypto apps on your device. There are more bugs. You can check them at the end of the official support doc. Official support doc and source of information: https://support.ledger.com/hc/en-us/articles/360017551659-Setting-up-your-Bitcoin-full-node |

|

|

|

|

134

|

Bitcoin / Bitcoin Discussion / An interesting fact from the posting history of satoshi

|

on: December 17, 2020, 08:04:21 AM

|

Here is an interesting fact from the past. While I was checking satoshi’s posts, I came across an interesting thread. In this thread, satoshi talks about the size of the blockchain and the time which is needed to download and verify it. He mentioned SPV clients and how they would be used in the future. He then went on to talk about something very interesting. He talked about online wallets and web-based wallets and how easy they were to use, compared with learning to work with a brand-new bitcoin software. In the meantime, sites like vekja.net and www.mybitcoin.com have been experimenting with account-based sites. You create an account on a website and hold your bitcoins on account there and transfer in and out. Creating an account on a website is a lot easier than installing and learning to use software, and a more familiar way of doing it for most people. The only disadvantage is that you have to trust the site, but that's fine for pocket change amounts for micropayments and misc expenses. It's an easy way to get started and if you get larger amounts then you can upgrade to the actual bitcoin software. Was the creator of bitcoin suggesting that online custodial wallets were a good alternative, especially for smaller amounts? I tried to find some more info about the sites he mentioned and their services. The first site was vekja.net. It no longer exists, but there are old archives of it. They were selling Bitcoin accounts, web and email hosting for 25 bitcoins/week back in 2010.  The 2nd site he suggested was www.mybitcoin.com. It hasn’t been updated for a long time but contains a lot of info about exchanges, wallets, and guides. No more wallet services though. I found this trip down memory lane very interesting. Can you imagine how far bitcoin has come? Just 10 years ago you needed to pay 25 bitcoins per week for email hosting. And look at it now… |

|

|

|

|

135

|

Other / Meta / I am getting a HTTP ERROR 403 when typing a certain sub-forum in the browser

|

on: December 11, 2020, 11:00:17 AM

|

I am not sure if this new error is somehow related to the changes theymos did because of the Small bug with the highlighting of forum subjects/thread titles. But every time I type a certain sub-forum in the Chrome search bar, I am getting the same error. You don't have authorization to view this page.

HTTP ERROR 403 I made two screenshots to show what happens when I enter Meta in the browser. You can't replicate this error by going to a particular sub from the forum directly. You have to spell it out in your browser. The error is present in Chrome, I couldn't replicate it in Firefox. The HTTP error is triggered only once, if you make the same search a 2nd time, it works just fine. It happens when searching for other sub-boards as well. 1.  2.  |

|

|

|

|

136

|

Other / Meta / Small bug with the highlighting of forum subjects/thread titles

|

on: December 09, 2020, 05:57:36 PM

|

I think I found a small bug while browsing in the Development & Technical Discussion sub-board. When you open a sub-board, and there are new posts and threads you haven't opened yet, the subject titles are highlighted in a dark blue color right? As soon as you open a thread that contains posts you haven't read yet and refresh that same sub-board, the dark blue highlighting is gone from that particular title. All good so far. But there seems to be some kind of bug right now that removes the highlighted titles even if you haven't opened that particular thread. More specifically, it removes the highlighted subject title of the thread below the one you accessed last. I hope you understand what I am trying to say. Here is a picture to explain what I mean  The last topic I read before making this screenshot was " setting up full bitcoin node," and as you can see the highlight is missing from it, as it should be. But the topic just below it (" Pollard's kangaroo ECDLP solver") is also not highlighted as unread although I never opened this thread today. I am sure it wasn't like this before, because I often refresh boards I am reading to see the newest posts on top, and it has never happened before. Is it a glitch of some sorts? Has anyone else noticed it? |

|

|

|

|

137

|

Other / Beginners & Help / A Deeper Look into the Skrill cryptocurrency TOS

|

on: December 08, 2020, 09:39:32 AM

|

In October 2020, I wrote A look at PayPal’s TOS, and What it Means for Users to let the Bitcointalk community know what exactly PayPal is offering its users. Since the payment processor, Skrill, provides a similar service since July 2018, I have decided to take a look at their offer as well. Let us first take a look at the official press release that states that users are only buying interests in specific cryptocurrencies and not the real asset. Just like with PayPal, it is not possible to purchase goods or services from official merchants. They are planning to introduce that option sometimes in the future. At this stage, customers will only be able to buy and sell interests in cryptocurrency and will not be able to transfer their cryptocurrency holding to other Skrill customers or use it to transact with merchants. This service will be added in the future. Update: The Cryptocurrency TOS now state that it is possible to transfer your interests to other customers/users. More on that a bit later. Who is this service for? Compared to PayPal’s service, which is currently only available for US customers, Skrill’s crypto service doesn’t accept citizens from the US, but accepts residents from the following countries: Australia, Argentina, Austria, Belgium, Brazil, Bulgaria, Canada, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Liechtenstein, Luxembourg, Malta, Mexico, Netherlands, Norway, Peru, Poland, Portugal, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, UAE and the UK. These cryptocurrency interests can be purchased on Skrill: Bitcoin Bitcoin Cash Dash EOS Ethereum Ethereum Classic Kyber Network Litecoin Tezos Stellar XRP 0x Supported trading pairs for crypto-to-crypto transactions: LTC/BTC XRP/BTC ETH/BTC BCH/BTC ETC/BTC XLM/BTC EOS/BTC ZRX/BTC Skrill enables you to do the following with your Skrill account: - You can purchase interests in a cryptocurrency with the money from your Skrill account, or buy interests in additional cryptocurrencies using the purchased crypto on Skrill. - Sell your interests in cryptocurrencies back to Skrill in exchange for fiat or interests in other cryptocurrencies. Users will be able to transfer their interests to other Skrill customers or receive interests from other users. This is one area where Skrill differs from PayPal, who doesn’t have this option of exchanging the interests for crypto assets. - In February 2021, Skrill introduced a new feature that allows its users to withdraw bitcoin and ethereum from Skrill to the customer's private wallet. This option will first be available in the EU and from their they plan to expand to the UK and other parts of the world. The Cryptocurrency Service enables you to:

3.1.4. transfer your interest(s) in one or more Supported Cryptocurrencies to an Existing Customer(s); and

3.1.5. receive transfers of interest(s) in one or more Supported Cryptocurrencies from an Existing Customer(s).” Once your purchase is completed, Skrill will hold the purchased interests on your behalf pooled together with the interests of all other Skrill users. That means you will never own the real assets or have access to the private keys protecting them. Only Skrill will. Skrill has included an Alerts feature where users will be notified when a crypto asset reaches a specific price range. This only serves to inform the user, and you can’t configure an automatic buy/sell order using the alerts feature.

Fees When users transfer their crypto interests to other Skrill customers, they will be charged a transaction fee. - For a P2P transaction to another Skrill user, the customer pays a fee of 0.50% of the total transaction. - A buy/sell order up to €19.99 includes a few of €0.99 per transaction. - A buy/sell order between €20 - €99.99 includes a fee of €1.99 per transaction. - Buy/Sell orders above €100 include fees of 1.50% per transaction. Source *If your Skrill account is denominated in a different currency other than euro, Skrill will apply an additional ‘ foreign exchange fee’ of 1.5% to your crypto transaction. More about that here.

Users can submit an ‘ Automated order’ which triggers a buy or sell order when the price reaches a certain point. Skrill also has a feature they call a ‘ Recurring Order’. This option allows users to choose an amount, and buy crypto interests at several different intervals until the full amount is reached. For example, you can set aside $10 every Monday to purchase interests in bitcoin until you get to a total sum of $100 worth of bitcoin. Read more about Recurring Orders here. Some of the things you can’t do with the Skrill crypto interests: - Buy from official merchants using your purchased crypto interests. - Upload or spend your crypto interests via Skrill Mastercards. - Transfer crypto assets to your Skrill account from a 3rd party wallet or withdraw crypto interests to a private wallet.

I find this part of their TOS a bit worrying, not sure how to interpret this correctly: 8.1. We make no guarantee that you will be able to buy or sell an interest in a Supported Cryptocurrency or make a P2P Transfer at the time of your request. We will only reflect the purchase or sale of your interest in your Skrill Account if we have been able to fulfil the Order with the Cryptocurrency Exchange. Why would they not be able to fulfil a user’s order? Problems with liquidity? I highly doubt it. Could they maybe use this part of their TOS as an excuse to limit certain orders at certain price ranges that might not be aligned with their best interests? Who knows? You should know that Skrill reserves the right to suspend or ban a user from using its cryptocurrency service at any given time for many reasons. Why would their partner (cryptocurrency exchange) require Skrill to exclude a particular user? Could Skrill be using this as an excuse to restrict those they consider successful crypto traders? They would be making money on the transaction fees either way. 10.3. We may at any time suspend or terminate your use of the Cryptocurrency Service without notice if:

10.3.1. we are required to take such action by the Cryptocurrency Exchange; Suppose a user is temporarily suspended from using the crypto service. In that case, Skrill reserves the right to sell some or all the interests of that user. Customers might lose money this way because Skrill might sell off your interests at a time when the value of the purchased interests has dropped. 10.6. Whilst your use of the Cryptocurrency Service is suspended, we may (using our reasonable discretion) sell off all or some of your interests by providing notice to you in certain circumstances,... 10.7. If we sell off your interests in Supported Cryptocurrencies, we will buy back the interest(s) at prevailing market rates. If the value of the Supported Cryptocurrency has weakened, this means that you may incur a loss relative to the amount you initially paid.

Pros: • P2P transactions between different Skrill customers are possible.

• The service supports 35+ countries.

• Automated buy and sell orders.

• A Recurring Order feature.Cons: • A custodial and centralized service.

• Crypto interests can’t be used to purchase goods/services from registered merchants.

• Isn’t available for customers from the USA.

• Foreign exchange fees applied to Skrill accounts denominated in all currencies except the euro.

• Transfer crypto assets/interests to 3rd party wallets outside of the Skrill network.

• Buy and Sell orders might not be completed for various reasons.

• A customer can be suspended and/or banned from using the cryptocurrency service.

• Suspended users can have their cryptocurrency interests sold off at the current price and incur losses in those trades.Sources of information: 1. https://www.skrill.com/en/footer/terms-conditions/skrill-cryptocurrency-terms-of-use/2. https://www.paysafe.com/gb-en/paysafegroup/news/detail/skrill-wallet-users-can-now-instantly-buy-and-sell-cryptocurrencies/3. https://www.skrill.com/en/siteinformation/fees/#buy-and-sell-cryptocurrency4. https://www.skrill.com/en/siteinformation/fees/#Currency-conversion5. https://support.skrill.com/PAYMENTS/Crypto/1326804412/What-is-a-Recurring-Order-And-How-Do-I-Create-One.htm |

|

|

|

|

138

|

Other / Beginners & Help / An Interview with Andreas M. Antonopoulos regarding 51% attacks on Bitcoin

|

on: November 27, 2020, 11:09:41 AM

|

In one forum post the other day, I stumbled upon a YouTube link that a user posted in which Andreas M. Antonopoulos talks about 51% attacks on the Bitcoin network. It is a scenario that seems possible to many, but Andreas perfectly explained why such an event would be difficult to carry out. When he visited Berlin for a crypto conference in 2019, he gave an interesting interview which you can watch here: https://www.youtube.com/watch?v=7w-Q2GOZJSQ

Here are the most important parts that were mentioned in the interview:Andreas was asked whether it would be possible for a nation state to acquire a sufficient amount of hardware to carry out a 51% attack on the Bitcoin network, and to completely take control of the whole network. Andreas considers that an impossible task, and gives several reasons to why that is. - The required amount of mining hardware needed for a 51% attack on Bitcoin is simply not publicly available for sale. Companies that manufacture and sell such mining devices, are already doing so at full capacity. Everything they manufacture, they sell very quickly. There are no hidden stocks that someone could buy up. He mentions an interesting fact that if someone wanted to carry out such an attack, he would have to constantly buy all the ASIC miners from all of the companies that exist on the market, for more than a year. With the sole aim of getting close to that 51% hashrate needed for an attack. So this is an impossible task. - The second assumption is that someone could buy the required materials, needed to produce a sufficient amount of mining devices for a successful attack. Andreas says that the best miners are made of 16-12nm silicon chips. Only those made with the best quality materials would have to be used to reach that rate needed for a 51% attack. If chips with lower quality materials were to be used, many more mining devices would be needed. The companies that produce this type of silicon, produce it mostly for graphics cards and devices for artificial intelligence units. They already have plenty of work to do and don’t have the capacity to meet the demands of a new client who would like to buy all of that to attack the Bitcoin network. - The third possibility that Andreas talks about is that someone builds their own factory where they would produce the required devices. The investment needed for such a venture would be tens of billions of US$. These devices would then consume a huge amount of electricity and create new expenses in the multi-million dollar regions.

Even if such an attack were to be successful, it must be sustained. And that requires additional huge investments. Now, here is the problem. Those who mine Bitcoin honestly, get rewarded for their work with mining fees and newly created bitcoin. They cover their expenses (for electricity) and make a decent profit. Those who attack the network don't receive any compensation from the network because they don't include transactions in their newly created blocks. They must cover their own costs and maintain the attack. Andreas estimates that these costs amount to 2000-3000 BTC per day! Bitcoin created in this way would ultimately become worthless. Exchanges could blacklist it and it would never be sold. The attack could be resolved with a fork of the network, where the miners who respect the rules just continue with their work, while the other side that does not respect the rules and creates empty blocks would simply be excluded and blacklisted. The end result of all this is tens of billions of US$ spent on the purchase and manufacturing of mining devices, and millions of US$ of electricity costs for an attack that could be quickly discovered and resolved with a fork. The miners who attack the network can only prevent the confirmation of certain transactions, or carry out double-spend attacks. In both scenarios, those coins could be blacklisted and would have no value. The Bitcoin network would not be interrupted. It would become even stronger over time because it overcame and survived a 51% attack.

In the second part of the video, Andreas talks about the differences between miners and full nodes. Have a look: https://www.youtube.com/watch?v=7w-Q2GOZJSQ |

|

|

|

|

139

|

Local / Hrvatski (Croatian) / Intervju sa Andreas M. Antonopoulos u vezi 51% napada na Bitcoin mrežu

|

on: November 26, 2020, 03:27:47 PM

|

U jednom od postova sam sasvim slučajno naletio na link u kojem Andreas M. Antonopoulos govori o 51% napadima na Bitcoin mrežu. Jedna opasnost koja se mnogima čini realna ali Andreas je odlično objasnio zašto je jedan takav scernarij teško izvodljiv. Dok je bio u Berlinu na jednoj kripto konferenciji 2019, dao je zanimljiv intervju kojeg možete pogledati ovdje: https://www.youtube.com/watch?v=7w-Q2GOZJSQ

Evo najvažnijih dijelova tog intervjua:Pitanje koje je Andreasu postavljeno je da li bi bilo moguće da neko pribavi dovoljnu količinu hardvera, da izvrši 51% napad na Bitcoin mrežu, i u potpunosti preuzme kontrolu nad mrežom. Andreas smatra to nemogućim i iznosi nekoliko razloga zbog čega je to tako. - Potrebna količina mining hardvera za 51% napad na Bitcoin jednostavno nije dostupna u prodaji. Kompanije koje proizvode i prodaju mining uređaje već imaju pune ruke posla. Sve što proizvedu, vrlo brzo i prodaju. Dakle, ne postoje zalihe koje bi neko mogao kupiti. On iznosi zanimljiv podatak da ukoliko bi neko želio da izvrši jedan takav napad, morao bi da tokom više od godine dana pokupuje sve ASIC minere od svih kompanija koje postoje na tržištu i prodaju te uređaje. Samo s ciljem da bi se približio toj cifri od 51% hashrate-a potrebnog za napad. Ovo je dakle nemoguća misija. - Druga pretpostavka je da li bi neko mogao da kupi materijale potrebne za proizvodnju dovoljne količine uređaja za uspješan napad. Andreas napominje da se najbolji mineri prave od silicijskih čipova sa 16 - 12nm. Samo oni napravljeni od najboljeg materijala bi se morali koristiti kako bi se dosegao taj broj potreban za napad od 51%. Ukoliko bi se koristili slabiji materijali, bilo bi potrebno mnogo više uređaja. Kompanije koje proizvode tu vrstu silicija, to proizvode najviše za grafičke karte i uređaje za umjetnu inteligenciju. Dakle već imaju i previše posla i ne maju kapaciteta da zadovolje potrebe novog kupca koji bi to želio da kupi kako bi napao Bitcoin mrežu. - Treća varijanta o kojoj Andreas govori je o mogućnosti da neko napravi svoje postrojenje gdje bi proizveo potrebne uređaje. Investicija za jedan takav poduhvat bi bila nekoliko desetina miljardi US$. Ti uređaji bi zatim trošili ogromnu količinu električne energije i pravili nove multi milionske troškove.

Čak i da je jedan takav napad uspješan, on se mora održavati. A to zahtjeva dodatne velike količine investicija. Tu onda dolazimo do sljedećeg problema. Oni koji rudare Bitcoin poštujući pravila, za svoj posao budu nagrađeni rudarskim naknadama i novo-kreiranim bitcoinom. Pokrivaju svoje troškove (za električnu energiju) i ostvaruju određenu zaradu. Oni koji napadaju mrežu, od te iste mreže ne dobivaju naknadu jer u novo-nastale blokove ne uključuju transakcije. Sami moraju da snose troškove napada i održavanje istog. Andreas smatra da su ti troškovi između 2000-3000 BTC dnevno! Bitcoin kreiran na takav način bi postao bezvrijedan. Mjenačnice bi ga mogle staviti na crnu listu i nikada ne bi bio prodan. Napad bi se mogao rješiti forkom, gdje strana koja poštuje pravila samo nastavi sa svojim radom, dok druga strana koja ne poštuje pravila i kreira prazne blokove bi jednostavno bila isključena. Krajni ishod svega ovoga su desetine milijardi US$ za kupovinu i proizvodnju uređaja, milioni US$ na troškove struje za napad koji bi brzo bio otkriven i rješen forkom. Mineri koji napadaju mrežu mogu samo spriječiti potvrđivanje određenih tranksakcija ili izvršiti double-spend napad. U oba slučaja, ti coni mogu otići na crnu listu i ne bi imali nikakvu vrijednost. Bitcoin mreža ne bi stala sa radom. Postala bi vremenom i još jača jer je savladala 51% napad.

U drugom dijelu videa, Andreas priča o razlikama između minera i full node-a. Odličan izvor informacija. Pogledajte https://www.youtube.com/watch?v=7w-Q2GOZJSQ |

|

|

|

|

140

|

Other / Beginners & Help / Unpopular Opinions About Bitcoin

|

on: November 21, 2020, 10:28:58 AM

|

The Australian comedian Jim Jefferies had a piece called unpopular opinions. In his shows, he discussed things like shaming fat people, or not washing his hands after peeing. So today I am presenting Unpopular Opinions About Bitcoin. Every now and then I will start a new unpopular opinion based on something that is said or thought about Bitcoin. We will then discuss the unpopular opinion and try to oppose it with facts. First topic on the agenda for this thread:

Derek Sorensen claims that bitcoin will never become the world's #1 currency!? |

|

|

|

|