|

221

|

Economy / Economics / The President creates a "Ministery of Extraterrestrial Affairs"

|

on: March 10, 2021, 09:11:54 PM

|

This is no joke, Ortega, president of Nicaragua is the political leader of a country that is struggling with economic and social issues. Currently, they are having difficulties to even get enough COVID vaccines - perhaps no the only ones. However, the president has seen fit to create a "Ministery of Ultraterrestrial Affairs and Celestial Bodies". I only have the link in Spanish. Would it be better to create a Ministery of Extraterrestrial Affair, bitcoin and cryptoassets?  What seems to be an stupid idea is actually an attempt from the president to sell the idea of Nicaragua building a satellite for a Chinesse company. This seems to be as realistic as the last promise about building a second "Panama Channel". |

|

|

|

|

222

|

Local / Primeros pasos y ayuda / Como camuflarme

|

on: March 10, 2021, 10:43:29 AM

|

|

Acabo de leer un post de CSIMiami sobre como las direcciones quedas asociadas a nuestro usuario. Seria posible "camuflarse" de alguna forma, por ejemplo dando alguna direccion de un exchange o rotarlas? Entiendo q asociar un usuario a una persona del mundo "real" no es tan sencillo, pero si con los medios q pueden tener algunos gobiernos y la capacidad de presionar incluso a los organizadores del foro.

A ver quien tiene ideas al respecto q pueda poner en practica.

|

|

|

|

|

223

|

Alternate cryptocurrencies / Altcoin Discussion / Anyone on ELROND

|

on: March 09, 2021, 03:02:33 PM

|

|

I would like to hear from anyone that is currently using ELROND and staking. What mechanics does it follow? What is the expected return? Is the project being developed? And any other bit of research that could be useful.

|

|

|

|

|

224

|

Economy / Economics / Bitcoin could win the currency war

|

on: March 09, 2021, 02:48:13 PM

|

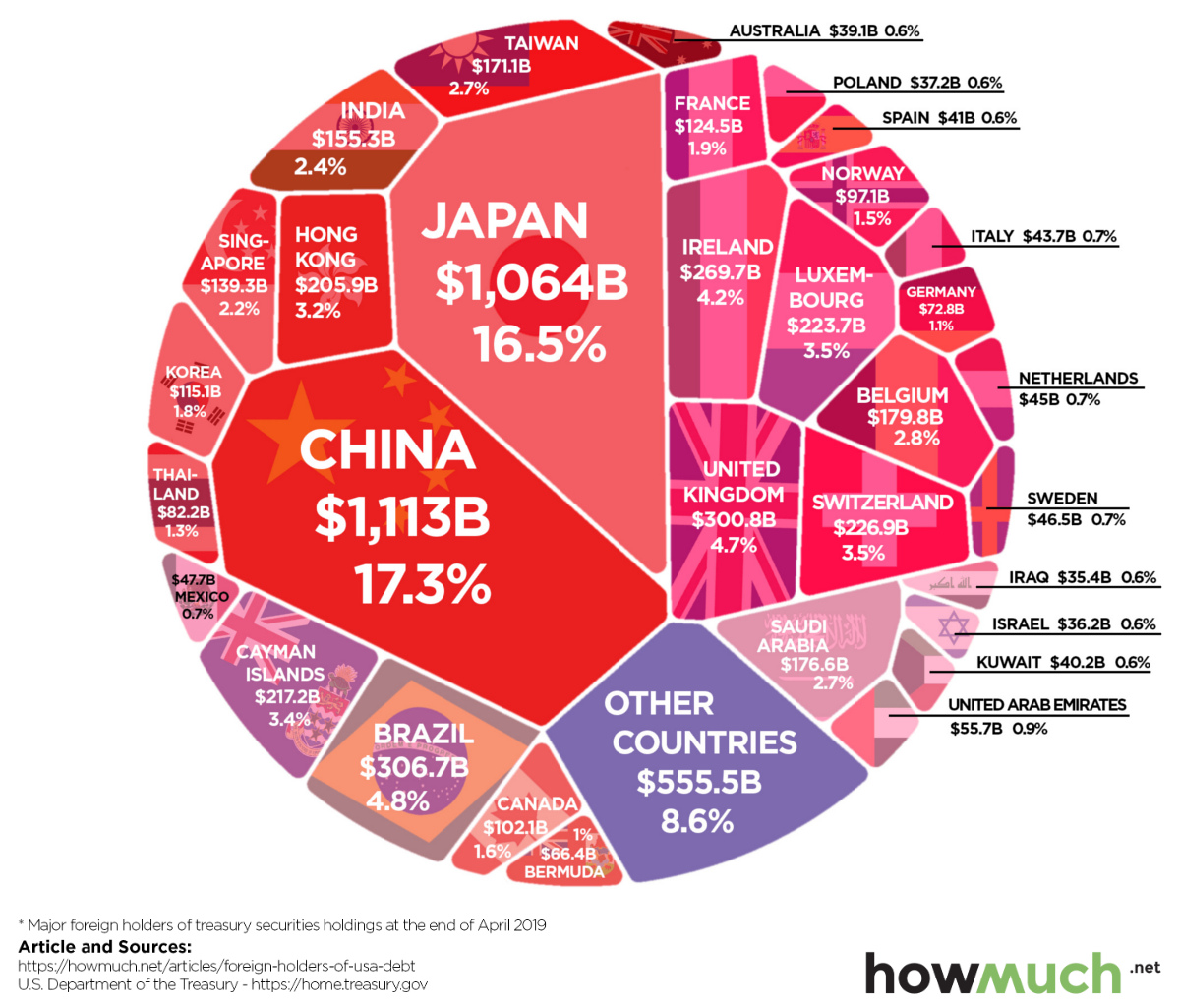

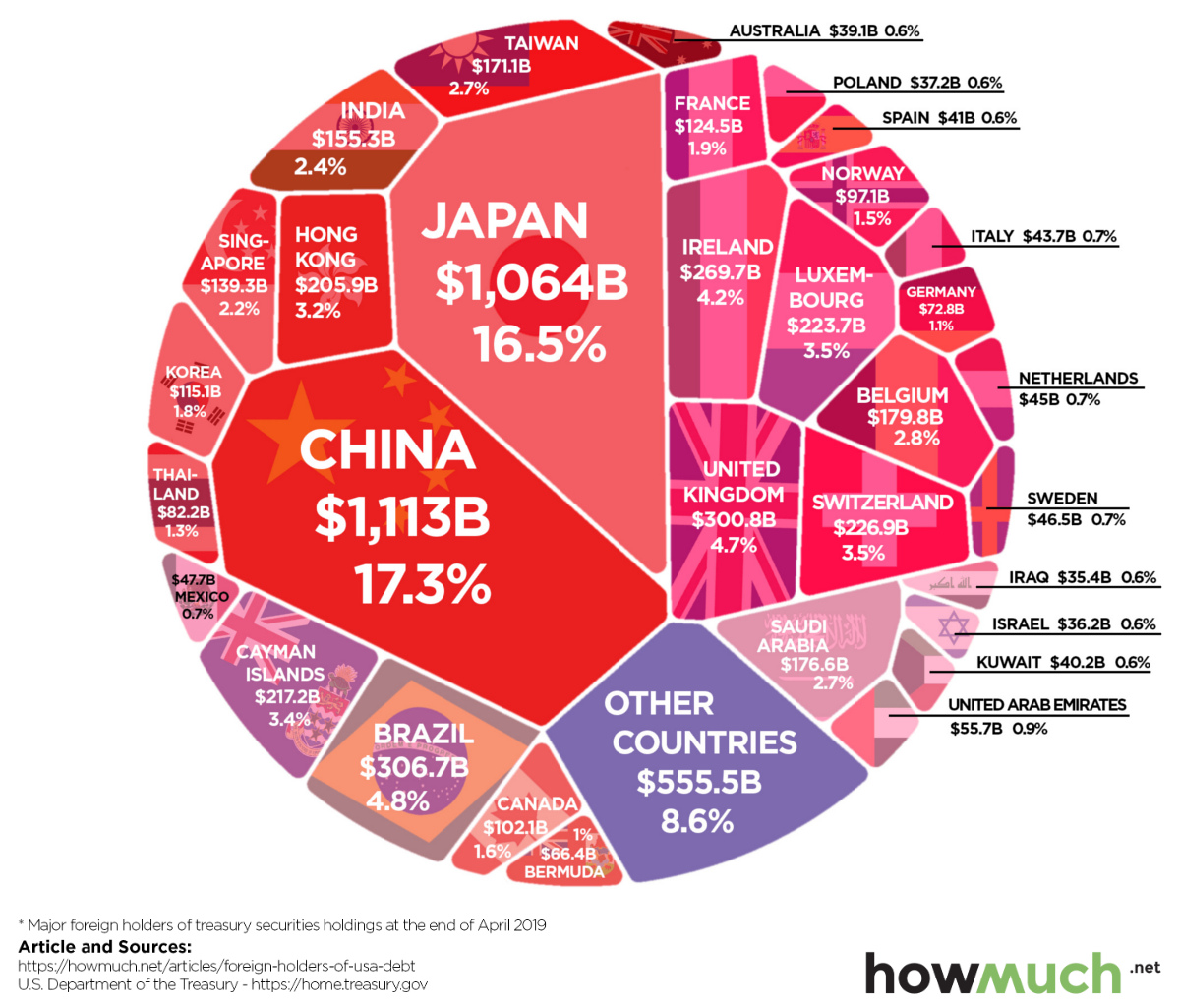

During world war I and II, the European nations ended up in debt and lost their preeminent colonial power both in terms of economy an military power. On the other side of the world, the U.S. now challenged a declining and divided Europe for leadership of the world. In the course of the war, financial dominance had moved across the Atlantic from London to New York, as the U.S. became the world's largest creditor. It was also much more powerful in other ways. The war had boosted American industry and speeded up the conversion of U.S. economic strength into diplomatic and military power. By the end of the war, the U.S. was the world's largest manufacturer and had the largest stock of gold to back its dollar. Its navy rivalled the British, up until then the world's biggest. sourceIn our times we are now seeing China and the USA competing for the world economic dominance. USA seems to be the incumbent while China is showing growths averaging 6% a year and its GDP seems to be nearing that of the USA. While possibly not as strong in military terms, the nuclear deterrent guarantees that a return to a "shameful century" won't be back anytime soon. Just have a look at the economic side of the argument:  While there is not an open war, there is a fight for dominance that is being fought with trade agreements, currency devaluations, sanctions and diplomacy (soft and hard). COVID has been a useful tool for all governments to print money at will, with the backing of the economic elites that own real stocks in much larger proportion than cash. I see that bitcoin will benefit immediately (already doing so) from a tailwind of irresponsible money printing, but more than that, I see it benefiting from the silent economic wars in which even the theoretical winners may end in a sea of debt that, once again, will be paid printing monopoly money. Ray Dalio phrases the opportunity: “And you have a situation when there is a rising power challenging an existing power, there is competition, and there is a risk of war. And so how they deal with each other, whether there is a greater good or whether they are fighting with each other, is the defining moment.” |

|

|

|

|

226

|

Economy / Economics / Tokenising carbon emissions and creating an efficient and verifiable market

|

on: March 08, 2021, 12:13:21 PM

|

As many of you know, carbon emissions are nowadays tradeable. This means that he allocation of CO2 emissions given to a country or central institution can be bought or sold by those who emit CO2 and greenhouse gasses so that a market of permissions is created. This market can be clearly be made efficient by the use o blockchain, yet not completely decentralised I recon. Certification, rights of emission, participants proof of identity and exchanges are all a default in the blockchain world. This could save millions?  |

|

|

|

|

227

|

Economy / Gambling discussion / The Venetian Casino for Sale

|

on: March 08, 2021, 10:56:57 AM

|

In case any of the "bitcoinaires" that populate this forum are interested, the iconic casino "The Venetian" is being sold. The owner group Vegas Sands is going to concentrate on the Asian casinos as they think the winds are not good for navigating in the old Strip. Even if not mentioned, this cannot be unrelated to the hardship in finances from COVID that is driving betting to a 10 year jump ahead into the online options. |

|

|

|

|

228

|

Local / Mercado y Economía / JP Morgan y "la baja demanda"

|

on: March 08, 2021, 10:48:05 AM

|

Ya hace algunas semanas q se habla que el banco JP Morgan, q gestiona fondos mayores q muchos PIBs de paises de Europa esta intentando negar la realidad o haciendo como q no existe. Dicen q la "demanda de bitcoin por parte de sus clientes es minima". Yo suelo interpretar lo q dicen en publico los bancos de inversion en segunda derivada: ejemplos: "Esta accion estara estable" - traduccion: "No te voy a decir q entres hasta que yo construya mi posicion. Para hacer " frontrunning" ya estoy yo. "Hay q mantener la posicion en la accion XYZ" - traduccion: "Estoy deshaciendo mi posicion, espera q acabe q me bajas el precio". "Esta accion ABC lo va petar, compra todo precio objetivo 1000" - traduccion: "Ya tengo mi posicion construida, ahora vas y compras para q suba el precio y yo pueda decir a mis clientes q su inversion ha subido". Con lo q si me quedo es con el hecho de q hablan de ello, y eso significa q algo andan haciendo. |

|

|

|

|

230

|

Other / Meta / Shame question - links in signature

|

on: March 07, 2021, 10:56:23 AM

|

|

I am a bit ashamed of asking this from a Hero rank, but I just want to make sure that I have read all applicable rules and understood these correctly. I would like to use my signature to link to a few books, crypto related, in a on-line sales service. This is a legit service and I would be acting just as a lead generator.

Is this allowed? Any restrictions or limits?

|

|

|

|

|

231

|

Economy / Economics / Economics of perpetual poverty - R. Kiyosaky and the dude on the street

|

on: March 07, 2021, 10:49:24 AM

|

I am not a great fan of Robert Kiyosaky, who many people will know for his best-seller "Rich Dad, Poor Dad", particularly when it comes to his continuous boostering of Real State as an investment and his simplistic approach to "good debt" and "bad debt", ignoring leverage and risks. However there is something to be said about the basic principles of poverty and "richness" that are the background of his discourse. I recon that, at first, when I listened to his audios, a million years ago, me and my usual cynism just could not take it seriously at fist: it was yet another book about becoming "rich" (LOL), but at that time I had many hours of travelling per day and podcasts had not been invented, so I listened, just as I could be watching Star Wars Episode IV. It soon became apparent this book was not about becoming rich, but rather about not being poor forever. For someone like me who has roots on a culture is (used to be?) conservative in the spending and risk averse, he was just stating the obvious: Do not spend more than you earn and f*kin* save a bit for the future. For gods' shake, you do not need 500 pages for that do you? No, you just need a few lines: a) Do not spend more than you earn. b) If you are breaking (a) rule, do not use debt to finance stuff that you do not need and goes down in value. Yes, that's your car unless you use it for work and is adequately sized, that is you 54 inch TV and the subscription to Netflix. c) If you get into debt, use it to finance you roof, not your swimming pool. Please, add at will but this is pretty much it. Oh, I think that I should add Warren Buffet's advice: use compound interest to your favour, not against you (see (b) & (c)). |

|

|

|

|

232

|

Local / Español (Spanish) / Subastando tweets - El primer tweet del CEO de Twitter valorado en mas de 1M USD

|

on: March 07, 2021, 12:10:40 AM

|

He puesto un articulo parecido en la seccion general del foro, pero creo q vale comentarlo tambien en la hispana. El primer tweet del CEO de Twitter convertido en un token no fungible (NFT) y "firmado" por el autor del mismo esta siendo subastado y ha alcanzado la cifra de 2 millones de USD.El contenido, "just setting up my twttr," Dorsey de Marzo del 2006 como veis no tiene mucho valor ni es una gran proclamacion de intenciones por parte de este emprendedor q ha llevado a Twetter hasta donde esta hoy, pero supongo q es el hecho de capturar digitalmente un momento de la historia lo que hace interesante este formato. |

|

|

|

|

233

|

Economy / Gambling discussion / Services of betting on your behalf

|

on: March 06, 2021, 11:54:15 PM

|

|

Hi everyone, I read some rumours of companies or groups offering services of betting on your behalf on matches in which the betting house got, for whatever reason, their odds wrong. A friend told me that he was successful in doubling his money, although the houses obviously close any account that looks suspicious. Do you guys know any of these services?

|

|

|

|

|

235

|

Other / Serious discussion / McAfee indicted for fraud related to Crypto

|

on: March 05, 2021, 09:05:13 PM

|

|

From NY, McAfee and Jimmy Watson, who worked on McAfee's cryptocurrency team, conspired to commit commodities and securities fraud. Thus is based on them influencing investors. The amount mentioned is 13M USD. McAfee is also held in Spain for tax evasion charges in USA.

This is the sign of the ICO and shitcoin era.

|

|

|

|

|

238

|

Economy / Economics / Electronic independence as policy in USA

|

on: March 04, 2021, 06:48:36 PM

|

A few outlets have echoed Biden's 100 days review of the semiconductors chain of supply, main due to the persistent low level of stocks that are hindering the works of the automobile industry, among others. This comes along other industries reviews.I see that electronical self-sufficiency could be equivalent to the current energetic independency or self sufficiency that many developed countries try to achieve. And for the future of Crypto and letting my imagination fly, I see that a national mining equipment manufacturer specialised in ASICS (be that GPUs or other) could be an asset to consider. |

|

|

|

|