Show Posts Show Posts

|

|

Pages: « 1 [2] 3 4 »

|

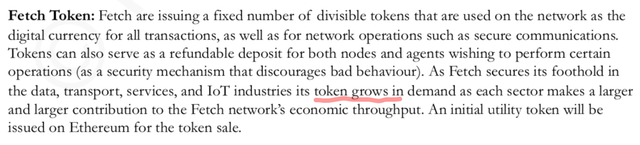

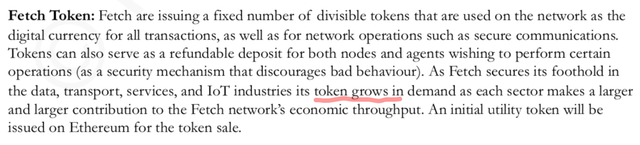

We check a startup that collected 6 million bucks in 22 seconds on Shitcoin Bingo We check a startup that collected 6 million bucks in 22 seconds on Shitcoin BingoOn Monday, Fetch AI startup hold a sale on the Binance Launchpad platform and collected a hard cap of 6 million bucks in 22 seconds. The hype was as if Kanye had dropped new Yeezys with the Apple Watch sewn into the tongue.  We are not hypocritical and sincerely pleased with this event. It perfectly demonstrates that either the jumps of the cryptocurrency didnít kill human excitement nor the scammersí tricks. Cryptocats still have BTC and ETH, and they donít mind investing in interesting startups. Wow!  Fetch AI is a futuristic idea in the style of Asimov and Heinlein. Artificial intelligence with Blockchain and other lit features will turn the Internet into a place where the seller and the buyer will easily and quickly find each other without any middlemen. The future of the economy is finding a haven in the powerful hands of the collective mind!  We were very surprised when we saw that a startupís uninformative video for 6 million in 22 seconds had so few views and reactions. But not all of us are Youtube fiends, right?  Binance has a Launchpad, Shitcoinoffering has Bullshit Bingo. We had to show you how to use it a long time ago. And now the time has come. We read Fetch AIís whitepaper and found a few matches with the classic scam ICO.           Turned out 12 out of 25 in total.  Letís add here the financial performance of the past project of the startupís founders. And a non-working website of the before last one. That doesnít seem that cool now.   And to say, this wasnít the first sale. Here are the numbers Binance gives about past Fetch AI sales.  Although the team still hasnít done anything except the website and whitepeaper. Yes, they have a whole staff of theoretical professors. But the fate of the project will be decided in the next six months. If during this period, investors wonít receive nothing except statements about the lack of money and press releases about the furious future and flying Lambos, Fetch AI wonít be interesting to no one. Just like Mars One. The idea is so fucking futuristic, like, straight from the cover of your favorite book: charmed everyone and pulled the wool over the eyes. And then: oops, sorry, guys, we couldnít. We sincerely hope that the story of 22 seconds on the Binance Launchpad will develop into a solid working project that will change the future. That everyone will see how investment in startups pays off. That Blockchain, like Adidas, says: Impossible is nothing. But so far we only have hype, shitcoin bingo, and sketchy startup founders. Thatís how we live. |

|

|

|

Did you know that KuCoin was more expensive than Binance, and promoted by Django Unchained Cobinhood is barely alive? Did you know that KuCoin was more expensive than Binance, and promoted by Django Unchained Cobinhood is barely alive? Last week, Binance launched a testnet for a decentralized exchange. The basis of DEX is the Blockchain Binance Chain. CEO, Changpeng Zhao, said that the transactions in the new Blockchain are instantaneous, and the generation of the block takes no more than a second. The market reacted instantly. Token Binance Ė BNB jumped in price and steadily established itself in the top 10 cryptocurrencies. We regretted that so far we have not invested all BTC in BNB and decided to check whether all stock exchange tokens can be a good investment. The correct answer is no 🙂 To get it, we marked the maximum and minimum of capitalization and cost of the token. And then calculated how many percents was eaten a bear market. But first, Coinmarketcap charts to visually define the current state of affairs. Enjoy!              Slide 1 Max Market Cap ($) 14. KuCoin 2 200 000 000 15. Binance 1 800 000 000 16. Qash 813 000 000 17. Cobinhood 490 000 000 18. Cryptonex 437 000 000 19. Huobi 300 000 000 20. BridgeCoin 222 000 000 21. Bibox 190 000 000 22. Coss 172 000 000 23. LaToken 118 000 000 24. Lykke 104 000 000 25. Bitmart 8 500 000 26. Bit-Z 5 900 000 Slide 2 Min Market Cap ($) 14. Binance 600 000 000 15. Cryptonex 53 000 000 16. Huobi 46 000 000 17. KuCoin 30 000 000 18. Qash 22 000 000 19. Bibox 13 000 000 20. BridgeCoin 8 300 000 21. Coss 6 200 000 22. Lykke 5 000 000 23. LaToken 3 400 000 24. Bit-Z 2 800 000 25. Cobinhood 2 800 000 26. Bitmart 980 000 Slide 3 The difference of Cap (%) 14. Bit-Z -53 15. Binance -68 16. Huobi -85 17. Cryptonex -88 18. BitMart -88 19. Bibox -93 20. Lykke -95 21. BridgeCoin -96 22. Coss -96 23. LAtoken -97 24. Qash -97 25. KuCoin -99 26. Cobinhood -99 Slide 4 Max Price ($) 14. KuCoin 22 15. Binance 20 16. Cryptonex 9,7 17. BridgeCoin 9 18. Huobi 6 19. Coss 2,73 20. Qash 2,32 21. Bibox 1,79 22. LAtoken 1,52 23. Cobinhood 1,42 24. Lykke 0,38 25. Bit-Z 0,2 26. BitMart 0,08 Slide 5 Min Price ($) 14. Binance 4 15. Cryptonex 0,95 16. Huobi 0,92 17. KuCoin 0,33 18. BridgeCoin 0,31 19. Bibox 0,12 20. Qash 0,07 21. Bit-Z 0,06 22. Coss 0,05 23. LAtoken 0,04 24. Lykke 0,02 25. Cobinhood 0,01 26. BitMart 0,008 Slide 6 (%) The difference of Price 14.Bit-Z -70 15.Binance -80 16.Huobi -85 17.Cryptonex -90 18.BitMart -90 19.Bibox -93 20.Lykke -95 21.BridgeCoin -97 22.LAtoken -97 23.Qash -97 24.Coss -98 25.KuCoin -98 26.Cobinhood -99 Interesting facts: KuCoin was the most powerful stock token for price and capitalization. But the companyís constant fuck ups and the listing of Shitcoins led to the fact that it dropped out of the Top 3. Jamie Foxx knows how to break free from slavery and shoot plantation owners. But even he is beyond the reach to save Cobinhood, that he used to promote, from screwing up. The guys had a fall of the token by 99%! No matter how LAtoken pumped anotherís and their coins on the stock exchange the guys couldnít do nothing with -97%. Which again proves that on some pampas you will not go far. Need a good product. The stability of Bit-Z coin is due to its short history (since last August). And the fact that it didnít become the part of a bull market. On the other hand, it didnít really help much BitMart. Therefore, we can assume that the exchange is not bad. Huobi and Cryptonex have lost a lot, but their current value and capitalization make the future look optimistic. Binance Ė top notch! You can scale, develop, and grow even on a bear market. And this is a great example for the others. That is why, cryptocats, donít be sad and work hard. Share your thoughts about investing in crypto stock exchanges in the comments and in out Telegram chat. Will discuss, hug, and raise Blockchain. Investing in a scam Ė a shitton of money. Subscribing to Shitcoinoffering Ė priceless. In Blockchain we trust! |

|

|

|

Did you know that KuCoin was more expensive than Binance, and promoted by Django Unchained Cobinhood is barely alive? Did you know that KuCoin was more expensive than Binance, and promoted by Django Unchained Cobinhood is barely alive? Last week, Binance launched a testnet for a decentralized exchange. The basis of DEX is the Blockchain Binance Chain. CEO, Changpeng Zhao, said that the transactions in the new Blockchain are instantaneous, and the generation of the block takes no more than a second. The market reacted instantly. Token Binance Ė BNB jumped in price and steadily established itself in the top 10 cryptocurrencies. We regretted that so far we have not invested all BTC in BNB and decided to check whether all stock exchange tokens can be a good investment. The correct answer is no 🙂 To get it, we marked the maximum and minimum of capitalization and cost of the token. And then calculated how many percents was eaten a bear market. But first, Coinmarketcap charts to visually define the current state of affairs. Enjoy!              Slide 1 Max Market Cap ($) 14. KuCoin 2 200 000 000 15. Binance 1 800 000 000 16. Qash 813 000 000 17. Cobinhood 490 000 000 18. Cryptonex 437 000 000 19. Huobi 300 000 000 20. BridgeCoin 222 000 000 21. Bibox 190 000 000 22. Coss 172 000 000 23. LaToken 118 000 000 24. Lykke 104 000 000 25. Bitmart 8 500 000 26. Bit-Z 5 900 000 Slide 2 Min Market Cap ($) 14. Binance 600 000 000 15. Cryptonex 53 000 000 16. Huobi 46 000 000 17. KuCoin 30 000 000 18. Qash 22 000 000 19. Bibox 13 000 000 20. BridgeCoin 8 300 000 21. Coss 6 200 000 22. Lykke 5 000 000 23. LaToken 3 400 000 24. Bit-Z 2 800 000 25. Cobinhood 2 800 000 26. Bitmart 980 000 Slide 3 The difference of Cap (%) 14. Bit-Z -53 15. Binance -68 16. Huobi -85 17. Cryptonex -88 18. BitMart -88 19. Bibox -93 20. Lykke -95 21. BridgeCoin -96 22. Coss -96 23. LAtoken -97 24. Qash -97 25. KuCoin -99 26. Cobinhood -99 Slide 4 Max Price ($) 14. KuCoin 22 15. Binance 20 16. Cryptonex 9,7 17. BridgeCoin 9 18. Huobi 6 19. Coss 2,73 20. Qash 2,32 21. Bibox 1,79 22. LAtoken 1,52 23. Cobinhood 1,42 24. Lykke 0,38 25. Bit-Z 0,2 26. BitMart 0,08 Slide 5 Min Price ($) 14. Binance 4 15. Cryptonex 0,95 16. Huobi 0,92 17. KuCoin 0,33 18. BridgeCoin 0,31 19. Bibox 0,12 20. Qash 0,07 21. Bit-Z 0,06 22. Coss 0,05 23. LAtoken 0,04 24. Lykke 0,02 25. Cobinhood 0,01 26. BitMart 0,008 Slide 6 (%) The difference of Price 14.Bit-Z -70 15.Binance -80 16.Huobi -85 17.Cryptonex -90 18.BitMart -90 19.Bibox -93 20.Lykke -95 21.BridgeCoin -97 22.LAtoken -97 23.Qash -97 24.Coss -98 25.KuCoin -98 26.Cobinhood -99 Interesting facts: KuCoin was the most powerful stock token for price and capitalization. But the companyís constant fuck ups and the listing of Shitcoins led to the fact that it dropped out of the Top 3. Jamie Foxx knows how to break free from slavery and shoot plantation owners. But even he is beyond the reach to save Cobinhood, that he used to promote, from screwing up. The guys had a fall of the token by 99%! No matter how LAtoken pumped anotherís and their coins on the stock exchange the guys couldnít do nothing with -97%. Which again proves that on some pampas you will not go far. Need a good product. The stability of Bit-Z coin is due to its short history (since last August). And the fact that it didnít become the part of a bull market. On the other hand, it didnít really help much BitMart. Therefore, we can assume that the exchange is not bad. Huobi and Cryptonex have lost a lot, but their current value and capitalization make the future look optimistic. Binance Ė top notch! You can scale, develop, and grow even on a bear market. And this is a great example for the others. That is why, cryptocats, donít be sad and work hard. Share your thoughts about investing in crypto stock exchanges in the comments and in out Telegram chat. Will discuss, hug, and raise Blockchain. Investing in a scam Ė a shitton of money. Subscribing to Shitcoinoffering Ė priceless. In Blockchain we trust! |

|

|

|

Originally published at https://shitcoinoffering.com/spenderman-blow-200-million-investor-money-messi-golovkin-real-estate/Sharing with you the story of an Israeli crypto-entrepreneur Moshe Hogeg who have found and buried Stox and Sirin Labs. Originally published at https://shitcoinoffering.com/spenderman-blow-200-million-investor-money-messi-golovkin-real-estate/Sharing with you the story of an Israeli crypto-entrepreneur Moshe Hogeg who have found and buried Stox and Sirin Labs.Have you ever heard of Finney smartphone? That one on the blockchain that encrypts all of your messages and is a secure wallet for storing the crypto itself. I, myself, didnít try it Ė skimped 999 bucks and bet them on Rams. And Iím not sad about it. The chart shows that there are way more loser people in the world.  Sirin Labs startup, the producer of Finney smartphone, collected more than $ 150 million during the ICO. In January 2018, the SRN token cost $ 3.44, and the companyís capitalization was 340.5 million bucks. A year has passed, and we are talking about $ 0.03 and 15 million, respectively. CEO and co-founder of the company, Moshe Hogeg, stated that they will shift their ground from smartphone manufacturing to software developing. And they canít keep the team for longer than a year.  Definitely, bear market hit a lot of people. But I canít bring myself to blame on it the failures of the Israeli-Swiss startup. And that is why.  First of all, a single post on Instagram by Lionel Messi is estimated at 500,000 bucks. But they decided that an Argentine footballer for Sirin Labs wasnít enough so they brought Gennady Golovkin.  Former world middleweight champion earns on advertising about 550,000 dollars a year. Therefore, Sirin Labs could get it comparatively cheap, for 100 or 200,000. Although, most likely that two of them cost them more than a million bucks. Because they were not only serving faces for the photo shoots but also attend the conferences.  Moshe Hogeg believes that there is nothing wrong with that. And this should be new marketing.   You thought that Crypto and Blockchain are anarchy, brains, and code. But hell no, itís the same fucking Gomezes and Kardashians. They just have the new vocabulary and Consensus instead of MTV Music Awards.  Secondly, Moshe Hogeg has already launched the Stox startup ICO. Let him say that he is just an investor no one believes it. The situation with this prediction platform amazingly similar to Sirin Labs. Capitalization dropped to 900,000 bucks.  Although when investors gave money (weíre talking about more than 35 million dollars) startupers also painted the town red. And, oh dear God, the process was also promoted by football players and boxers. Messiís teammate from ďBarcelonaĒ Luis Suarez (Instagram post is estimated at 200,000 bucks).  And invincible Floyd Mayweather Jr. In this case, we can talk about at least $ 100,000. Thatís how much the scammers from Centra Tech gave the boxer.  Thirdly, this is Moshe Hogeg.  The entrepreneur was born in a family of the officer who worked in the Israeli Ministry of Defense. He didnít pass the exam for the school-leaving certificate. For seven years he served in the army as a dog trainer. And then found himself in the business. Before the Blockchain boom, Hogeg had two high-profile startups, Web2Sport and Mobil. Both shined brightly but just as quickly faded away. The launching platform for Mosheís new breakthrough was the merger of Invest.com and AnyOption. Thus, he earned money and credibility. Because AnyOption was a popular binary options service in Israel.  Now he is suing AnyOption shareholders that were ditched during the merger, and Chinese investor Zhewen Hu (invested 3.8 million bucks in Stox). At the same time, Hogeg behaves like Pablo Escobar. He spent $19 million on real estate in Israel, $7.2 million on Beitar (Jerusalem) football club, and $1.9 million on Tel Aviv University that will name a research center after his name. Recently, anonymous scammers punished Moshe for his fraud. He received an offer to buy Crypt Grin at a promising rate. But in the result, spent a significant amount of Bitcoins and had nothing in return. A classic Telegram fraud. Probably in this article should be some moral. Blockchain, unfortunately, didnít change the world yet, didnít change people, didnít calm down their blind thirst for profit, and spending money on things that are not necessary for life. And anyone can cheat here. Even a startuper whose projects collect hundreds of millions and is promoted by celebrities.  But to make it right is up to us. That is why letís not relax and work together on a brighter future. Donít be like Moshe. Take a step towards living a scam-free life, subscribe to our newsletter! In Blockchain we trust! |

|

|

|

The hottest Shitcoinoffering investigation. All possible tools used: Google maps, British lawyers and cheeky Instagram. The hottest Shitcoinoffering investigation. All possible tools used: Google maps, British lawyers and cheeky Instagram. Did we already explain why you shouldnít believe a cryptocurrency startup just because they called themselves an STO? Oh, right, we did when told you about Bolton Coin. By the way, those guys took our article very negatively and demand to remove it. Of course, we wonít do it. After all, they canít even explain why they are an STO that recognizes SEC. And what is their difference from the common scam ICO? Well, fuck them. Thereíre other adventurers on todayís agenda, Faba Invest. For those who are too lazy to read the article in full, we responsibly declare: these startupers are flunkeys who were too lazy to make their fake more or less attractive. Whitepaper is on the level of the studentís presentation, an idiotic idea, there is no need for a Blockchain, but they want to collect 67.5 million bucks. But we will try to enlighten the cryptocats so they wonít give them a cent.  The idea of Faba is to create a collective venture fund. Kind of, we chip in Ethereum and buy Faba tokens. And the founders of the project withdrawal ETH in Fiat and invest in other startups.  In which startups they invest decide all major owners of Faba tokens. 40% of all tokens are in the hands of team members. That is why the story with voting doesnít look legit. Here are the expectations:  And here is the reality. At the moment, the guys assure that they have invested in six projects:  Two of them are ICO, the third sells Nutra, the fourth Ė shrooms, the fifth Ė medication for baldness, the sixth produces hydrogen and renewable resources. The amount of investment is unknown. But it is unlikely large. After all, the next Faba sale will begin on March 1 and the founders have no fucking idea how much money they will collect. Otherwise, they wouldnít write Soft Cap of 4 million bucks. By the way, how do you like the abyss in 63.5 million between goals? These shitinvestors are so experienced strategists that they are trying to shot in the dark.  The expected profit for the owners of security Faba tokens is also different. But it is very optimistic:  It is so fun to look at the expectations of investing in the future unicorn. Just imagine a picture of how joyful Satoshi and Buterin are riding a rainbow 🙂 Faba Invest doesnít undertake any obligations to investors. The USA and China are out of the list of potential lucky investors. Legally the company is located in London.  In addition to Faba Invest and Unique Casino, there are 270 companies registered in this building. I wonder how they all fit in there?  In the UK, Faba is registered by Connexion Capital. And, most recently. Just in time for the sale.  The website of Connexion Capital is registered in Sweden for a US company.  And Faba is Czech or Swiss.   But, most likely, the Czechs. At least, the companyís mentor with the name of a pornstar is from here.  Here is her Instagram. Will be useful in case of insomnia.    It would be cool if she will answer the questions of Icobench experts because the CTO of Faba Invest Alexander Nakonechny is unable to cope with this task.  What can you do? Judging by LinkedIn, the guy didnít work anywhere before Faba. He was an independent business advisor.   The projectís CEO is Robert Fiocius. In addition to Faba, he works at Boston Capital Services (not to be confused with Boston Capital Ė these are different companies) and DIC Development. Therefore, we can assume that he is just a waxwork. They invited him to the project for the money in exchange for showing up at the right places. But it doesnít look that cool. You have a startup for over 60 million bucks, and your CEO has two more jobs. But there is no MVP, and he wonít appear in the near future.  The recent Airdrop made Telegram chat quite popular.  Summarizing all the above: Ė Faba invest 100% does not meet SEC requirements for STO Ė Experience and skills of team members are questionable Ė The blockchain is only needed here to raise funds during the sale Ė Registration, geographical and other company info in various sources differ Ė The business concept of the project doesnít base on anything, as well as the expected profit for investors.  Dear cryptocats, write in the comments what you think about Faba Invest and our investigation. Together we will win. By subscribing to our newsletter you confirm that you cannot be fooled by shitty startups, but you knew that, didnít you? In Blockchain we trust! |

|

|

|

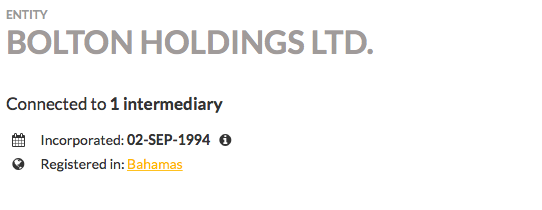

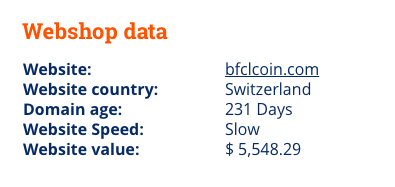

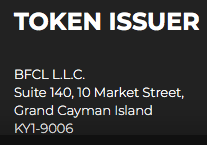

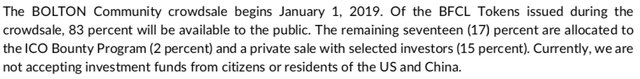

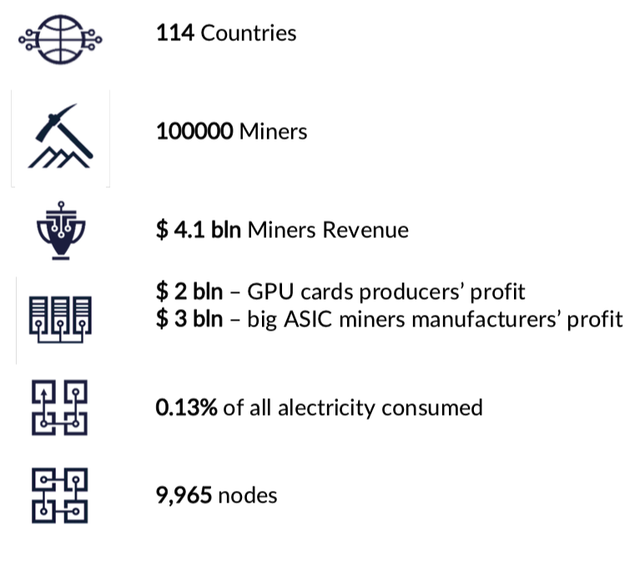

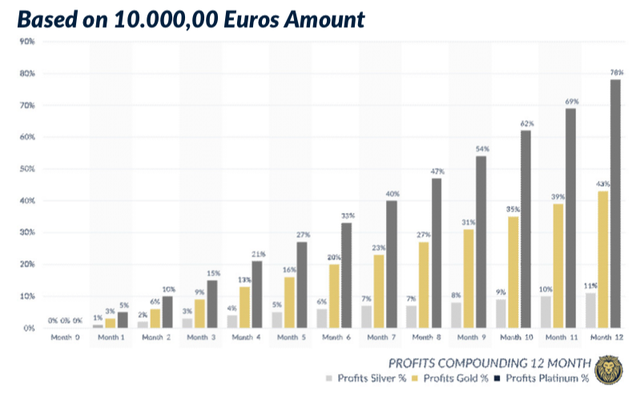

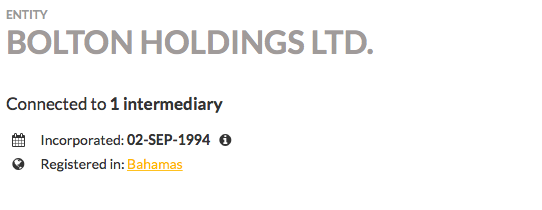

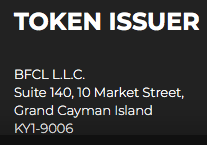

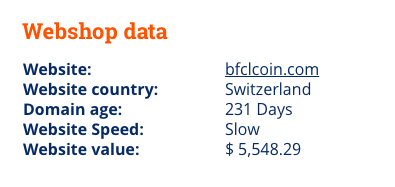

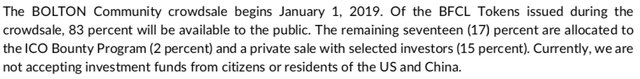

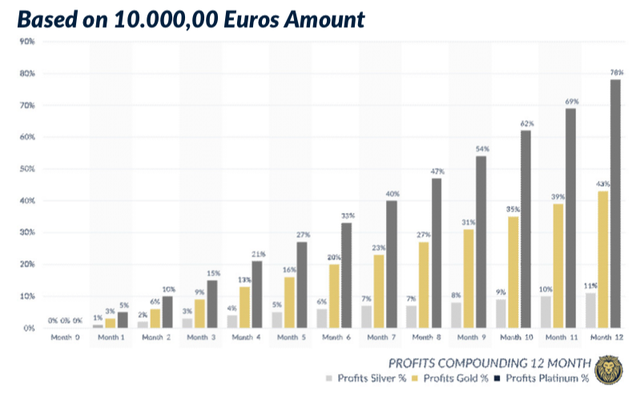

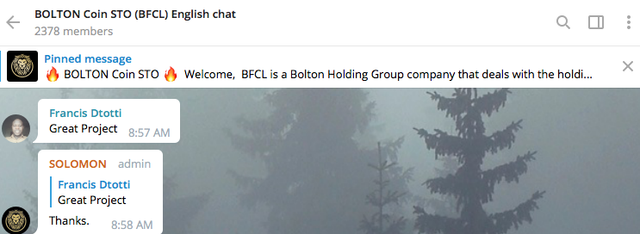

Read the original article at https://shitcoinoffering.com/african-kids-aks-663-million-bucks-scam-sto-bolton-coin/ The fraudsters are already into new hype Ė STO. Learn how to check these startups for inconsistencies with legal norms. The fraudsters are already into new hype Ė STO. Learn how to check these startups for inconsistencies with legal norms. STO (Security token offering) right now is called the only right solution for startups on the Blockchain. After all, ICO (Initial coin offering) already pissed everyone off with their idle mess and super high probability of scam. In a nutshell, why STO wins over ICO in investorsí money safety. STO is tokenized securities. And buying them, you become the company shareholder. This is not an ICO, where the shitcoins could only generate income due to speculation on the stock exchanges. In all other cases, these were chewing gum wrappers with doodled Lambos. You eat gum and left a wrapper. But it will never be real Lambo.  With proper investment in STO, the chances for Lambo are bigger. And in the case of the fraud from startups' founders, pretty authoritative offices will mediate for you like SEC (US Securities and Exchange Commission). But there are a few ďbutĒ: - You can't invest in STO if your annual income is less than 200 thousand bucks - You don't have $ 1 million bucks worth of real estate. - Your organization doesn't own assets for 5 million bucks That is why, dear schoolers, giveaway-guys, and unemployed cryptoshitters, in STO there's no chance for you. So does it mean that shitcoin era over? Long live transparent and honest Blockchain? Judging by STO Bolton Coin https://bfclcoin.com ó no fucking way:)  Let's start with the fact that Bolton Coin is a subsidiary of Bolton Holdings Limited. Here is their official website. You wonít understand shit from it, except that the guys are based in Dubai. And they have a very odd email address.  Another Bolton Holdings in the Bahamas.  And in Wales.  As for Bolton Coin, the website is located in Switzerland. The company that produces tokens is registered in the Cayman Islands.   Let's agree that all this looks too odd for a company that decided to obey the laws and make investors happy? https://www.youtube.com/watch?time_continue=59&v=3BBJejtwNUEFrom this video, you absolutely can't understand what the company offers. Brokers, calls, stocks - everything and nothing in particular. But the first screen of the landing page shows us that the startup has collected some long money.  And you need to hurry up to jump into the outgoing train. Just look at this calculator of pure happiness. From my experience, that this is a strong indicator of a scam project. A common thing for shitcoin startups.  According to the economic model (like many other things, you can find it in whitepaper), the startup founders say that they have found the best and most cost-effective conditions for miners (we already heard this somewhere). And STO doesn't hold for citizens of China and the United States.   Stop! Such formulation tells us that this is not the STO we mentioned at the beginning of the post. It turns out that here everything is written in water, and hit up lemmings won't be able to prove anything later. LOL  Bla bla bla. The reward for spam, loud statements about smart, cheap, and stable things. My God, there isnít a single sentence without a scam stamp! And yet, Bolton Coin outlined 3 areas they will make money in. The first is real estate. The guys claim that the market continues to grow, and they know where to invest in. And in general, they will earn all the money in the world because they will pay for real estate in cryptocurrency. Thatís it. It turns out that a room in Manhattan costs more if you pay for it with XRP:) The second area is mining.  The guys drew a picture but forgot that to mine crypto in a bear market is not very profitable. But just like the scammers from Swiss Alps Mining, this doesnít stop them. They claim to have the most advanced knowledge of energy saving, video card cooling, and other stuff. Of course, without any clarification. Why, if they will find losers anyway?  The third area is mining in Africa. Now 10-year-old kids will go into the mines to get cobalt under the supervision of AKs engraving with Bolton Coin name on them. This wasnít in the whitepaper. But there is no additional information. Just everything we already knew: cheap labor, resource-rich land, and so on.  In total, guys want to collect 663 million dollars. 30% of the total amount will go to every of the three areas. The remaining 10% is for other expenses.  For investors, there are three options for doing business. It looks like a deposit in a bank ó the more you hodl, the higher the percentage of accrual.  And here they draw the California dream of hustling.  But how the fuck cryptocurrency is related here? Why is there a Blockchain? It looks like the prospector are going to Alaska, and the whalers are going after Moby Dick and collecting money for these expeditions. So how does this fucking mess differ from other ICOs?  Looks like thereís no difference at all. And this is not an STO but a big fat scam. If you didnít have enough of the previous arguments, look Ė this is how the project founderís LinkedIn profile looks like.  An Instagram account is also deleted. Only facebook account works. And most likely was created for the start of the project.  The other team members have same story. The former COO, for example, didnít even mention relation to Bolton Coin. But we can guess the nature of his activities ó something in between Drake and Godfrey.  The Chief of Advisors and the Chief Legality Business worked together on the already dead UMC project. Interestingly, how many people were hit up for money there? And finally, attention please, telegram channel of the project that collected almost 100 million bucks and plans to collect another 500. This is the STO we deserve.  Share your thoughts, what is the future of startups in cryptocurrency? Leave comments and subscribe to our social media pages. By subscribing to our newsletter you confirm that you cannot be fooled by shitty startups, but you knew that, didnít you? In Blockchain we trust! |

|

|

|

|

Hi guys! I was asked by one my subscriber to analyze Navi ICO... Analyzing of ICOs is not my main activity on shitcoinoffering! We are trying to become global, to write about Blockchain, crypto, market, exchanges etc. ICO scams aren't our focus. So, I'd like to know your opinion: should we analyze this ICO or it doesn't need your attention ?

|

|

|

|

Where did cryptocats spend more than 25 million dollars ?  Read the original article here https://shitcoinoffering.com/fake-shitty-twitting-winters-day/The cryptolosersí times seems to be gone along with the bull market. Many of them have jumped off and returned to everyday activities like online casinos and sports betting. Those who stayed, look adequately at their cryptocurrency portfolios and donít chase easy money in the form of some giveaways or other bullshit. Letís just remember in one picture how the scammers have hit lemmings up for cash with fake cryptocelebritiesí accounts and popular websitesí twins. Cry, laugh and live on. With dignity. Fake MyEtherWallet/MyCrypto $7 570 000 Fake Ver $6 000 000 Fake Telegram ICO $5 100 000 Fake Buterin, Zhao, McAfee $4 200 000 Fake Seele ICO $1 900 000 Fake Durov $500 000 Fake Musk $137 000 Fake Bitfinex $31 000 Fake Sun $30 000 Total: $25 468 000 |

|

|

|

Originally published on https://shitcoinoffering.com/more-than-usd-1-5-bln-has-been-stolen-from-exchanges/The history of hacker attacks in one picture Originally published on https://shitcoinoffering.com/more-than-usd-1-5-bln-has-been-stolen-from-exchanges/The history of hacker attacks in one picture June 2011 Mt. Gox (8 750 000) September 2012 Bitfloor (250 000) February 2014 Mt.Gox (487 400 000) July 2014 Poloniex (60 000) January 2015 Bitstamp (5 000 000) August 2016 Bitfinex (72 000 000) July 2017 Bithumb (31 800) December 2017 NiceHash (60 000 000) December 2017 Yobit (15 200 000) January 2018 Coincheck (500 000 000) February 2018 BitGrail (170 000 000) June 2018 Bithumb (31 000 000) June 2018 Coinrail (37 000 000) July 2018 Bancor (23 000 000) September 2018 Zaif (60 000 000) January 2019 Cryptopia ? (the company declared that the losses were ďsignificantĒ) Total: more than 1 469 660 000 dollars Investing in a scam Ė a shitton of money. Subscribing to Shitcoinoffering Ė priceless. Note. All numbers are in dollars at the rate of cryptocurrency for the day of the hacker attack.In Blockchain we trust! |

|

|

|

We prepared you a holiday spooky festive article about the Global Funeral Care scam that decided to hustle $ 57 million to upgrade the funeral industry. We prepared you a holiday spooky festive article about the Global Funeral Care scam that decided to hustle $ 57 million to upgrade the funeral industry.What it takes to spoil Christmas? Not that much! Kidnap Santa, craft sordid toys, put reindeer skeletons in a cart and fly to our festive, vibrant abode. Jack Skellington almost completed this mission. Yes, yes, Christmas is an excellent opportunity not only to watch ďReal LoveĒ and ďHome AloneĒ again but also a legendary cartoon by Tim Burton. Therefore, you may not even read this article but instead spend time with family, friends, and holiday TV shows. Besides, we will talk about an utterly creepy startup Ė Global Funeral Care. The guys decided to raise some cash on funeral business. They start their whitepaper with a report of this business volumes. Listen, when you talk this way about real estate, advertising or porn Ė itís understandable. But about the future of your family and neighborsí bodies, the growing funeral industry? Man, thatís fucked up. People have nothing sacred left. It turns out that soon there will no place for you and us left at the cemeteries. A vampire wonít be able to find a spare crypt even on the full moon. Talking about Muslims and Jews itís a complete waste because you need to bury them in 24 hours, and now itís almost impossible! But we have good news! Blockchain and Global Funeral Care will save the future of our remains. And hereís how: Did you understand any of this? No? Do not worry we didnít understand shit either 🙂 PRODUCT When have found at least some specifics among the ashes of Mahatma Gandhi, John Lennonís hair and Jeffrey Dahmerís teeth, it turned out that guys are planning to make the base of all funeral houses in the world. And based on the request (location, service, price) of the potential client, automatically show them the best option. According to the founders, all funeral services will be cheaper than they are now. Why? Well, only God knows why, because of Blockchain. Also, the customer will be able to buy all kinds of mourning supplies from retailers and wholesalers. There will be no commission if using the GFC token. Another token will interest those who want to advertise on the platform it will be free for them. WTF? That means that guys are not going to earn money on advertising, right? Why do we need to buy their shittotoken? Because they think it will grow? SEC, do you hear that? Besides, investorsí money will be used to create the Global Funeral Care Academy. I already see their signboard, it says ďDeathly Hallows.Ē TOKEN You think about ERC-20? Hell no! They promise to make their currency look like DASH. But only on their own Blockchain. We face this for the first time during the project. Guys decided to show some chic flex. Explaining why they need a new token, they say that it can do great without a platform, and the platform without it Ė not. Also, Masternode owners will be able to use GFC to vote on all projects of the Global Funeral Care Foundation. Kinda new EOS dancing at the funeral of Ethereum. But donít be sad, Vitalik! All GFC tokens will be able to mine. And on sales of the startup they will sell the GFCS token (our favorite ERC-20). Then, someday they will exchange it at the rate 1 to 1. Hard cap of this amazing project Ė neither more nor less than 57 million dollars. What for? Oh, the distribution of funds here is very poetic: to destroy the industry of the funeral business, go to the big exchanges and invest in marketing. How do you cryptocats? Now gravediggers have no money at all on the Blockchain. Therefore, all work is going to start only after sale. Github is dead like Fury after being knocked down by Wilder. But, unlike the dopest Irish, is questionable to rise again. PEOPLE The founder has only two companies where he has worked on the list. He was also their founder but they are long gone. Ashes to ashes. CTO was on the team of the potential Force Network shitlike stock exchange. It also seems to be barely warm. The developer has just graduated a Catholic college in Brazil. And didnít kill anyone in the City of God yet. And for a couple of months, SMO jumped high from an intern position to co-founder of a tourist linguistic startup. Itís almost as cool as to become a prophet being a carpenterís son! Dear Drakulas, are you also worried about the question: which of these handsome dudes is a priest, a grave-digger, and a Blockchain pro? SOCIAL MEDIA They didnít start to run their social media yet. And the sale will begin very soon. But the guys are still doing good. For real. Together they look like a late 90s death metal band from a small town in Denmark, where only dentists and farmers live. Thank you sincerely! You gave us the reason to laugh this holidays. And shitcoinoffering.com goes on a holiday vacay and will be back at the end of the year. And wishes you the same. Have a merry Christmas! Take a step towards living a scam-free life, subscribe to our newsletter! In blockchain we trust! |

|

|

|

Read the original article on https://shitcoinoffering.com/big-bang-ico-not-write-whitepaper/Dudes want to collect 25 million, but cannot even explain why. The classic symptom of unprofessionalism. Read the original article on https://shitcoinoffering.com/big-bang-ico-not-write-whitepaper/Dudes want to collect 25 million, but cannot even explain why. The classic symptom of unprofessionalism.Writing a whitepaper is a difficult and challenging process. Good writers get a lot of money for this work. But in many cases, it is worth it. After all, a great whitepaper will definitely attract investments. Over the past year, we have read about half a thousand whitepapers. There were really brilliant ones among them, when initially the project seemed like a scam but after reading it, the hand, by itself, groped to throw guys some money. But mostly they made us sleepy, were primitive and templated (like, there is so much paper in this field, but there are some problems, and if you give us your money, we will fix them, and will all be happy and rich together), and annoyed us with useless waste of time. But this is not even the worst option.

You can call it fiasco if whitepaper doesnít explain shit and confuses you like Pynchonís novels. Big Bang ICOís is one of these. I read their 18 colorful slides three times but didnít understand what guys wanted convey to the reader. First, they told what blockchain is, then how much money is spinning in the gambling industry now, and then they twisted some wild shit in the ďproblem-solutionĒ chain.

No, really! Just look at this chart and try to understand at least something.

Okay, we got it that we are talking about attracting traffic in gambling. But they did it all so fucking ass-backward that it is scary even to think about the case where guys really do collect the money. Even Ubex, a scamest scam, could make everything clear and promised all the money in the world to their investors. Of course, they wonít get any, because itís still the team of freeloaders. At least, they have an understandable whitepaper. Not like in this case.

And, at the same time, thereís not a single word about how they will spend the money from the upcoming sale. And that is 25 million bucks, by the way.

The situation with personal data is even worse than with the whitepaper. Peter Chen, CEO and Founder of Big Bang, posted some fake companies in his LinkedIn account. Names and addresses donít match at all.

But projectís CMO, Alex Chang, keep his mouth closed. He is a CEO of a failed TimeBox startup. He worked hand in hand with the advisor master of random shit, Jason Hung. And, apparently, followed his footsteps. Now heís advising a potential (will see closer to February) scam Game Gold.

But there are no questions to Changís work. Bitcointalk is active, as well as Telegram channel. You can see that guys made a huge airdrop before the sale.

But that doesnít mean it has become even a bit more interesting.

Can you see the inequality between subscribers and post engagement? SMM managerís worst nightmare.

We canít say much for now about the product itself (the platform with an unknown mission and a basic wallet nobody gives a shit about). Because they donít exist yet. They promise to develop those after the sale. But itís so fucking hard to imagine that someone will buy Big Bang tokens. One thing is to buy Basquiatís paintings when you donít get it, but you understand their value. And absolutely opposite is to pay idiots who cannot even articulate their ideas.

Post the examples of successful and failure whitepapers on your opinion in the comments. We will discuss them. |

|

|

|

Read the article on https://shitcoinoffering.com/talentico-son-ussr-hockey-legend-runs-70-million-bucks-scam/ Read the article on https://shitcoinoffering.com/talentico-son-ussr-hockey-legend-runs-70-million-bucks-scam/The project declares as MVP the electronic music festival that was canceled. Many earthlings would like to be producers: to create Oscar-winning movies, cast stars for the show business and sports, harass women. For a couple of years now, the underdog Blockchain projects were trying to play on this ambitiously dreamy note. Globatalent, Tokenstars, and other fraudsters attracted celebrities and tried to get all the money in the world. But so far have just failed. We hope that it wonít work with Talentico whose sales begin on December 18. The guys want to collect 70 million dollars. For the glory hole, oh, sorry, the glory space. One thousand square meters of coworkings, recording studios and all kinds of reality shows in every fucking megapolis of the world! And only those special ones who own Talent tokens will be able to use those things. In addition, headhunters will find potential talents for a reward. HODLERS Talent tokens ó to vote for investments in the project. The goal is for the future Ronaldos, Nadals, and Rihannas to give the part of the sponsorship contracts and prize money to their business angels. The guys are releasing token on Ethereum. But they donít really like Vitalikís Blockchain. Therefore, they plan to make it hardfork. They are very confident people, tho. It turns out they donít even need MVP. After all, MVP is ainít no shit, and the electronic music festival ó is so cool. Yeah, especially when it is so fucking awesome that it was canceled:) The team is so huge they had to give away a quarter of all tokens (about $ 30 million). This looks more like a party of homies, rather than a Blockchain startup. Thereís a lot of questions to its team line-up. The Talenticoís CEO ó Alexander Kharlamov, the son of the famous Soviet hockey player Valery Kharlamov. He also played (not very successfully), then worked in the trade union of hockey players of Russia and starred in the popular local TV show ďThe Battle of Psychics.Ē Among the advisors, there is the Olympic champion in Greek-Roman wrestling and the political ally of Vladimir Putin, Alexander Karelin, as well as singers, DJs, football players, boxers and pensioners. Almost all of them ó with Georgian roots. There are no Blockchain experts ó the classic case of talking heads. All they want is to chat on smoke breaks and be seen on the website to attract more money. It is hard to imagine that in our bearish time someone would buy this story. It is hilarious that shit-adviser Hossain doesnít believe in Talentico. And they call him not-an-actual-expert in response. Same shit, different day  And here is their gorgeous explanation why thereís the necessity of the Talent token. Because youíre not allowed on the festival with BTCs, Ethereums, or bucks. Maybe because of this the latter didnít take place? Cryptowales came and banned everyone from entering? The roadmap is pretty simple like Nickelback lyrics. It is unclear why the platform will be created after the opening of the first Gloryspace. Who will vote in this case? By the way, the building will be named in honor of Joseph Kobzon, the Russian Frank Sinatra, who allegedly had links with mafia. He was also in the Talentico team but recently died. The idea, the people, the calculations, the rationality of running a new token and Blockchain doesnít withstand any criticism must be sent to hell. Thatís right, tell it to those who will promote this shit without a shame. And they will, for sure. When you engage so many people with names to the project, you need to return the spendings any way possible. And here, just like in Holdíem, you wonít stop halfway. |

|

|

|

Sep. 27 we published a review of MoneyToken ICO where we claimed it as shittoken. https://medium.com/@shitcoinoffering/moneytoken-even-roger-ver-cant-save-it-57b07df286d4That time we didn't say that it was scam and one of MoneyToken employees called Mike asked me to delete this article relying on the opinion that facts we have used had no proofs and said that we try to FUD people. As a response, we said he could leave comments and prove that IMT wasn't scam... More proofs than "We have MVP, so it's not a scam", "The projects is launched and it works" we have not received from them...  " Moneytoken claims to be a crypto-backed loan platfrom: However they do not have an escrow service, they are opening a margin position when users get "loan" and if value of collateral goes down 30% your margin position gets closed. Plus users either pays daily interest or pays membership fee to get "loan" - During ICO, Roger Ver was a great asset for them to collect funds. Roger Ver didn't make any comment after ICO. When Roger was asked about Moneytoken on live chat investors' comment got deleted and they were kicked from the live video room - During ICO, Jerome (CEO) with his British accent was having videos in professional London style office and Moneytoken team was telling people that they have office in London. However, it was never clear where their office was. After the ICO, team showed their office, which was in Ukraine! - They did not register with SEC and they have accepted investors from US. - They have collected $38,000,000 from investors. Their website and margin trading system could be designed and coded for max $10,000. They have spent very little, nearly none in Marketing. - Jerome opened a new business in Ukraine right after ICO. At that time investors' token were locked with the reason that Moneytoken team was "waiting" for a "top" exchange to list IMT. - 2 months after ICO IMT (Moneytoken) was listed in LAToken, Bitforex, Coinsuper and IDEX - They banned hundreds of investors from their Telegram channel. There is no conversation on their channel except Moneytoken paid admins and some fake accounts. - Those fake accounts also trolled investors in non-admin Moneytoken channel that we scam victims talk. At the moment that channel is under attack with horrible images you wouldn't want to see (however, all the history of investors conversations are there) - There is no need for IMT as its only use case of IMT is to pay membership fee to get a "loan" (which is a margin position you can do for free) - There are many more I can add. Lastly, they claim to create a financial ecosystem in Ukraine without complying with SEC and countless red-flags" We started this topic to prevent investors being scammed and to find out the truth. Anyway, we want to be fair and we stand for truth. That's why please be free to share your opinion, facts and proofs. In blockchain we trust. |

|

|

|

Read original article on https://shitcoinoffering.com/bountie-ico-porn-dystopia-gamers/500 thousand bucks arena, forgotten listing and roadmap, fake partnerships, and other fuck-ups of the new eSports freeloaders. Read original article on https://shitcoinoffering.com/bountie-ico-porn-dystopia-gamers/500 thousand bucks arena, forgotten listing and roadmap, fake partnerships, and other fuck-ups of the new eSports freeloaders.We havenít talked about eSports for a long time now. Thatís a waste. In the field of startups, itĎs now very popular because, in fact, it is a startup itself. The fact that Dota 2 promoted Valve to the seven zeros audience is definitely a success. But in general, eSports is a deep dark forest. Still so far away from basketball, baseball, football, hockey, and soccer. Investments in eSports should be made as carefully as possible. In the future, huge money can roll in there. And scammers use this. Earlier we wrote about eSports, and they have fulfilled our hopes: raised almost $6 million, created a mediocre eSports news website, and an app that has 100 downloads on Google Play. No person in this world will ever need their shitcoin. Then they thought of investing in Kinguin but didnít dare to, and now are very happy about it. Just look at this channel: the scammers openly hustle for tokens, the admins have lost somewhere. Readers told us about Bountie.io and asked for advice whether to trust them or not. Because they say a lot of good stuff about the prospects of eSports and promise a lot of money too. Plus, how can you not believe the guys who work in partnership with MSI and Twitch? But neither MSI nor Amazon has mentioned this partnership. Nothing unusual for the eSport scam ICOs practice. You wonít be punished for that in here. Also, Bountie ICO founders claim they have raised a hard cap. The hard cap announced on the official website of Bountie is 20 thousand Ethereum, which is 4 193 000 bucks. And now put your hand on your heart and tell me, would you give money to the guys who donít have even a bit of experience neither in the Blockchain nor in eSports? The background of three of Bountie co-founders is digital marketing, web design, and sales. And then suddenly Blockchain and gaming. What the heck? Would you give money to the guys who are creating the roadmap just because why not? They havenít done shit. No product, no arenas, and even no MVP! By the way, about the arena. Today ICO is raising funds for the stadiumsí construction. Soon they will raise funds for the army and church 🙂 But letís be serious, the stadiums usually cost tens of millions of dollars. For 500 thousand you can only build a studio for SumaiL. Also, the team optimistically announced the listing on LATOKEN! Okay, LAtoken is a fucking scam, not a stock exchange. With no BNTE token on it. Absolute fucking fraud 🙂 https://wallet.latoken.com/market/Crypto/ETHAnother shit-smelling project in the portfolio of an outstanding adviser Nikolay Shkilev (Twogap, Whyral, EVO). Congratulations, man! But it all started so vividly. A million dollar worth idea! But their social media are pretty sensible, and their videos too. People ask what they are shooting. Given that there is no product we have the only possible answer remains ó porn dystopia. Thatís all, folks. Weíre gonna continue to bust myths. Scam doesnít sleep. Investing in a scam Ė a shitton of money. Subscribing to Shitcoinoffering Ė priceless. In blockchain we trust! |

|

|

|

Originally published on https://shitcoinoffering.com/hodor-hodl-door-little-bit-optimism-miss-much-right-now/Aloha! Have you sent your CV to your local KFC? Made a laser removal of your Vitalik tattoo, and peeled off Nakamoto lettering from knuckles with skin? Not yet? Then donít be in a rush to do it, everything will be fine. Yes, at first glance everything is really bad. Over the week, Bitcoinís capitalization fell by almost $15 billion, and the exchange rate fell by 30%. The last time main cryptocurrency of the planet showed such indicators ($80 billion and $4500 accordingly) in past yearís October. But back then it was growth. Now we see only bloody red ratings. There is a noticeable decadent mood in social media. Here and there, you can hear the calls for capitulation. The smarticles who didnít put a cent into the crypto but like to say with a meaningful look that these are the same tulips and dotcoms are creeping out of the shadow again. There is no point arguing with them, especially when everything falls down. But we can tell you, our dear cryptophiles, why you need to HODL 🙂 ETF will bring new investors for the crypto Youíve probably heard that the SIX Swiss Exchange (the fourth largest stock exchange in Europe, FYI) is launching the Exchange Trading Platform. Now, the capital owners who didnít know how to buy crypto or couldnít do it for some reasons will be able to buy reliable organizationís stocks (the ETP itself). With these funds, its employees will purchase BTC, XRP, Ethereum, Litecoin or Bitcoin Cash ABC, put the currency in their safe deposit and begin to manage it wisely (big data, top traders, etc.). They will charge only 2.5% a year for these services. Certainly, the product and its analogs will bring new investors to the market. And that will have a beneficial influence on the market itself. Lighting Network improves and scales the cryptoworld In December 2017, developer Alex Bosworth refilled his mobile account using the Lighting Network. Last February, the network already had 385 nodes. Now there are 4111 of them, and the amount of bitcoins engaged in transactions has reached 420. The rapid growth of LN has begun in the past few months. More and more people have experienced the benefits of using the network. It shows that the cryptocurrency world is evolving and scaling. And that means itís not a bubble. By the way, you can ask haters what innovations the banks have offered them recently? Cashback or better deposit conditions? LOL Natural selection eliminates greedy bums and gives a chance to rookies. Remember how a year ago people were kicking themselves for not buying Bitcoin for $ 4,000 and even scored some, when it rose up to $ 20,000. And looser web-designers and salespeople spontaneously were turning into project managers and PR specialists for shitproducts of any kinds. Fancy conferences, peated whiskey, Lambos on credit. This glorious guysí Walpurgisnacht lasted for a long time, but now itís over. The morning was hungover, evil, and put everything on its places. Those who understand the importance of the Blockchain and crypto ainít going nowhere. They stay on the barricades because the revolution is not over yet. And those who only saw it as an opportunity of beneficiation has booked themselves a flight back to the fiat world and lawsuits after the ICO. Letís wish the farewell. To the Moon will come only to brave and tenacious guys. World governments can no longer ignore cryptocurrencies Yes, yes, all these politicians and bankers are jerks who want to control us and our money. And decentralization is freedom, mobility, and globalization. But even such desperate cases like El Petro, сryptolira and CryptoRuble come in handy for the Blockchainís scalability. Enormous India has adopted a legislative framework for the cryptocurrency. All these facts state that crypto is a real and useful innovation. Not going to polish bronze on the Titanic with Dutch tulips. As for our beloved ICOs, even here the bear market must have a beneficial influence. Check out the charts of funds raised by startups by months. People are getting smarter. They begin to evaluate prospects and risks soberly, and wonít give their hard-earned coins to some crook. Thatís great! To sum up, there are no serious reasons for panic. Technology is evolving, the number of people wanting to use it is growing, and the exchange rate wonít fall all the time. Our dear cryptophiles, remember to keep putting one foot in front of the other. By subscribing to our newsletter you confirm that you cannot be fooled by shitty startups, but you knew that, didnít you? In blockchain we trust! |

|

|

|

Originally published on https://shitcoinoffering.com/stox-ico-mayweather-gotten-another-scam/Letís sort out the details of this weekendís notorious cryptocurrency scandal. This weekend the crypto world witnessed a rather unpleasant high-profile event. The Stox startup was accused of fraud, while the STX token hodlers were warned about an upcoming exit scam. The company responded with a threat to sue the authors and assured the community that a bright future lies ahead. This is Shitcoinofferingís attempt to figure out who should we trust, and most importantly, what should we do. What is Stox? Itís a platformthat predicts and forecasts the outcomes of sports, political and business events. A robust PR-campaign with the one and only Floyd Mayweather Jr. helped to raise 33 million dollars of investments in August 2017. STX token (ERC20) was being sold at $1,1 during the sale. The founders promised that itís gonna be the most popular DApp in the world. retired covetous boxer almost got locked up because of promoting the Centra Tech scam. As to the Stox app, itís got a long way to go before reaching the DApp top. As to the STX token, well it was constantly falling. Until it finally reached 4 cents. Thatís to the moon for ya, guys. The team is trying to get out of this sticky situation with all sorts of contests, giveaways and gifts based on the FInney blockchain, which belongs to friendly company Sirin Labs. No luck so far, too many fuckups. (Hi, admin! I guessed 5 results, but they are all canceled. Could you tell me who can fix this problem?) What happened during the weekend? A warning post about the upcoming Stox ICO exist scam was published on Reddit. As evidence they provided info that Stox partners Amazix and Commonlogic left the project and that one of the Israeli offices was closed and all staff got fired. Besides that, they showed transactions, where supposedly, the Stox bosses are revoking their tokens from their partners. In a few hours after the post got published (as the barely living shitcoinís price continued to fall), the Stox founders responded that this info is outdated, you shouldnít trust these guys and threatened the authors to file a lawsuit. However, they announced that they did actually fire the Israeli team. And that the partnership with Commonlogic and Amazix was put on hold. Who are Moshe Hogeg and Shay Ben-Asulin? Along with the Stox team, the author accused the projectís advisor Moshe Hegog of dumping STX tokens. Moshe is a famous figure in the crypto currency world, heís the founder and CEO of Sirin Labs, those smartphones which run on Finney blockchain. The PR-strategy of the startup was similar to Stox. They also had a star promoting the project (in that case they had Argentinian footballer Lionel Messi), which helped them make a hell of a lot money during the sale, more than 158 million dollars. Their expensive (prices start from $999) smartphone isnít ready yet. They are planning to make it in collaboration with Huawei and it will be the most protected smartphone in history. But thereís no to the moon here either. From the sale, they tokenís price dropped more than 10 times. Thereís a common opinion that Stox is an invest.com project. Some time ago, theyíve bought a binary exchange AnyOption. It was a straight up scam from Shay Ben-Asulin, a person who has problems with the law not only in his home country Israel, but also in the USA. Of course Stox is trying to deny connections with him. But in the light of the recent event, itís hard to believe this. What should we do? All thatís left for Stox and Sirin Labs token hodlers is to feel sorry for them. For those who didnít get into this mess - remember the team memberís names, advisors and partners. Weíll hope that both projects will show themselves from a better side and will pleasantly surprise us. But for now, this doesnít look good. What do you think? Investing in a scam - a shitton of money. Subscribing to Shitcoinoffering - priceless. Tell us what you think about our investigations in the comments. If they still arenít enough for you, we can always do some research on an ICO that has caught your eye. For free, honestly and from the heart. Together we will prevail! In Blockchain we trust! |

|

|

|

These frauds talk about cheap and ecological mining, accept any type of crypto currency, promise to make 7x in 3 years and each week they pay hodlers as a reward. All of this for 80 million dollars for a sale that will last a year. These frauds talk about cheap and ecological mining, accept any type of crypto currency, promise to make 7x in 3 years and each week they pay hodlers as a reward. All of this for 80 million dollars for a sale that will last a year.Hello to one and all! We would like to present our new friend and colleague, who drew our attention to an ICO project Togacoin. We rolled up our sleeves, put on our thinking caps and excitedly began to research this project. But our scam-detector went off even before we got to the whitepaper. Hereís why. Pretty soon weíre all gonna get a fever just by reading these words. Swiss Alps Mining, Securix and now Togacoin. Everyone is reassuring that they will succeed with with the help of ďgreen energyĒ. But these are just words. ďGreenĒ trains are roaming the Netherlands without any ICOs. And wannabe miners are just jumping the bandwagon and are trying to screw over naive guys and tree huggers. The legend has it that in Tenerife (Canary Islands, Spain) thereís a lot of sun, wind and appealing tax benefits all year long. Thatís why Togacoin founders will build a huge farm, that will mine crypto by using wind energy and solar power. Specially made for Sim City lovers. What kind of video is this anyways? In my childhood I built things that were way more interesting. Guys, whereís the Jacuzzi? The pre-sale price for 1 TGA coin is $0,45, now it costs $0,75, and ultimately the price will increase up to 1 dollar. Now pay attention! The sale began on July 4th and will end on May 1st of next year. Are you kidding me? Here we are, bitching people that canít manage to sell everything in a few months, but Togacoinís process lasts for a whole fucking year! How may investors will make it to the finale? Btw, they accept almost everything. Itís the first time I see something like this. Is it even legal? At least the calculator (oh how I love ďimagine yourself being a millionaireĒ revenue calculators) counts investments and profit only in dollars 🙁 Itís that easy to make 7x just in 3 years! Awesome, isnít it? Actually, at this point the jigsaw had fallen into place. 15 payments to hodlers for reaching a milestone soft cap? What kind of sorcery is this? Youíve been reading too many George C. Parker memories. It looks like a giant mindfuck. The founders didnít put much thought into allocating the funds. Development, administration and marketing donít count as project realization? Wow, thanks for this eye-opening revelation! We need to go make some memes now 🙂 They want to issue at most 120 million tokens. If they will be sold during all phases of the sale, they will make about 80 million dollars. Not bad for some Italian nonames, who are attempting to build a super profitable eco-mining farm on the Canary Islands. Btw, we havenít mentioned anything about the team yet. The startup has 4 co-founders. Almost like HOQU 🙂 Two of them are working for a service that helps create websites Misterdomain (judging from this source, itís kinda so-so). The third one doesnít give a fuck about his LInkedin. The fourth one represents Dead Poet Society. Iím kidding, heís just the namesake of an Italian poet, who died on a quiet night in 1974. We couldnít find anything about blockchain, mining or green energy in their CVs. We accidentally found the slogan for their project in their Telegram chat. How to earn bitcoin in this group? 🙂 Weíre gonna stop here. Donít give a penny to this scammers and warn your friends too. Read, love and subscribe to our social media pages. Take a step towards living a scam-free life, subscribe to our newsletter! Tell us what you think about our investigations in the comments. If they still arenít enough for you, we can always do some research on an ICO that has caught your eye. For free, honestly and from the heart. Together we will prevail! In Blockchain we trust! |

|

|

|

Originally published on https://shitcoinoffering.com/cognida-ico-dont-trust-balina/The time when a startup behind one of the top 15 upcoming ICOs shit on all of its deadlines for rolling out a product, blew off its social media pages, made its sale into an open-air market and packed itself with very strange characters. Originally published on https://shitcoinoffering.com/cognida-ico-dont-trust-balina/The time when a startup behind one of the top 15 upcoming ICOs shit on all of its deadlines for rolling out a product, blew off its social media pages, made its sale into an open-air market and packed itself with very strange characters.We bloody love rankings. Whereís Marshall Mathersís latest album in the charts? How far is McGregor behind Khabib? Did Pepsi ever get the better of Coca-Cola? 😀 Itís the same with crypto. There are loads of ranking lists that claim to show just how awesome certain startups are. A lot of dudes believe them. One day we ordered some pizza together (it was Splinterís idea) and decided to check whether itís worth taking guidance from these charts. The project Cognida was chosen at random. Itís not a chart-topper yet, but is apparently among the 15 most anticipated ICOs. We did some Googling and found out that itís a data security system that runs on blockchain. Whatís more, it can work on any existing blockchain. Agnostic, as they say. All in all, the boys need 20 million bucks and to this end theyíve issued 550 million tokens, 54% of which have been put up for sale. Itís anyoneís guess where they sent a whopping 10% of the tokens and why. Itís unlikely that the only buyer so far put down 4 million bucks. Or have they overpaid their advisers? 🙂 By the way, this is the only official info regarding the tokens and their intended use. There is no sign of a Distribution of Funds or any other traditional ICO stuff. The sale is interesting too. No discounts announced for the private phase, delays and stupid explanations. It turns out that the sale has been going on for ages Ė it didnít actually finish on 20 July, but itís top-secret. Deals are made in private messages. More like a farmersí market than blockchain. As we can see, they were supposed to launch a completed network on 20 July. They have not. The same goes for many other promises. No fucks have been given about any of the roadmaps. By the way, which one of them is up-to-date? Looks like theyíve fucked up either way 😀 The news page only mentions conferences. Thatís obviously their number 1 priority. It is uncertain which phase the project is currently in. Phase zero, we think. Why else would the team still be hiding their GitHub page, which they promised to make public before the sale? What should the product be? In their words, ďreliable solutions on blockchain that make it possible to solve increasingly complex information exchange issues blah-blah-blahĒ. They even drew us a picture. Nevertheless, the guys havenít really put much effort into justifying the need for all this bullshit. Theyíve just put that itís cool coz blockchain and paid for some posts on crypto resources that warn about long-term investments. But they need cash for that. And a token. The rationale is, of course, a clusterfuck. Really looks like a shitty scam. More predictable and stable service costs? Have you lost your fucking minds? More predictable than Bitcoin? You donít say! Itís strange theyíre not promising a certain 100500x by the end of the year. The Facebook and Twitter pages are poor, as if it werenít a hyped ICO project, but a Rastafarian store in Alabama. Obviously, good work on social media does not rule out the possibility that a project is a scam. Ubex is great proof of this. But our confidence in the fact that Cognida really is a hyped-up startup is fading fast. To be completely fucking honest, itís already disappeared completely 😀 Do you agree that only very inept people could come up with such a shady pile of wank? Letís see who they are. Michael Hathaway is the co-founder and CEO of Windmill Enterprise. He has exactly the same name as Hollywood actress Anne Hathawayís brother, a little-known writer. Facebook is teeming with namesakes too. So some suspicion creeps in: is this Michael Hathaway real? LinkedIn shows that he graduated from Harvard and founded a company that no longer exists. He worked for a company whose website doesnít work. Then he managed a sketchy (it changed its name and had obscure clients) company alongside his current ICO partner at Cognida. And a year ago he finally founded Windmill Enterprise. To hold the ICO. Just look at how the timeframes of the two projects coincide. Not much is really known about Hathawayís partner. The guys claim heís written a best-selling book about blockchain. But if you dig a little deeper, it turns out that our Bing was just the co-pilot, i.e. co-author (if thatís actually him, of course). And the book is in 1,140,157th place for downloads on Amazon. Are you sure itís a bestseller? Thereís another Byington in the project, Dustin. Most likely Bingís son. Heís an adviser for Cognida. Facebook and LinkedIn claim that he was president of Wanchain itself. He left in May. Another adviser is a current Wanchain employee, Oliver Birch. Such are the traces of Chinese influence on the project. Another of the founding fathers, Wayne Lawyer, has hidden information on his LinkedIn profile concerning all projects linked to Hathaway Ė 3 organisations and 5 years of his life, donít you know. Indeed, Wayne only mentions IBM, HP and Dell. Kind of weird. Hereís the development team. Straight out of old TV series: Dallas, Santa Barbara and Twin Peaks. The one on the left is definitely a maniac who dismembers his victims in a bath of acid. Today we got the job done pretty quickly, so Cognida doesnít deserve any more from us. The boys paid for some high ratings from bloggers (Balina, your greed knows no bounds) and a few positive posts. But at the same time, they forgot about the foundations. Come on, make a decent community, show us a semblance of a product, prove that the idea and token are valuable. Donít blow your deadlines, for Godís sake! Moral of the story:Friends, donít believe in rankings: the example of Cognida shows theyíre not worth a single coin from your wallet. So analyse ICOs yourself and send us your findings. Weíll post them all, because blockchain is the future and we wonít let these arseholes ruin it.You can real the full article on https://shitcoinoffering.com/cognida-ico-dont-trust-balina/P.S. And don't forget to join our Telegram channel (http://t.me/shitcoinoffering) and chat (http://t.me/shitcoinofferingchat) to discuss this topic  |

|

|

|

Originally published on https://shitcoinoffering.com/breaking-shitcoinoffering-teams-statement/ Originally published on https://shitcoinoffering.com/breaking-shitcoinoffering-teams-statement/Dedication to Bitcoinís 10th Anniversary Shitcoinoffering is a non-profit organization founded by crypto enthusiasts in October 2017. The goal of Shitcoinoffering is to increase humanityís level of trust to blockchain and cryptocurrencies. The selected methods of Shitcoinoffering is to withstand some tendencies in the blockchain world. More specifically to combat fraudulent ICO founders and crypto exchanges. This year was both difficult and exciting for us. The first ICO investigation turned out quite naive. Thankfully, not a lot of people read them 🙂 But we expanded, and our audience continued to grow. We get messages daily from readers, who ask us to take a look at different projects and to render our verdict about them. If we think that a startup is good, we inform the reader about it privately. If not, then this startup ends up on our website or Medium. KuCoin banned our Twitter, but we started a new one. Reuben Godfrey joined our chat, bitched us and went on to create more projects. We hope those are honest ICOs this time. We didnít want to purposely send into free fall the price of HOQU and UBEX tokens. This wasnít our goal. We wanted people to know the truth about these projects. But honestly, this can be painful from time to time. We had no choice but to expand. English is not the only language spoken in the blockchain world, thatís why we created a Russian and Chinese version. These countries have a great interest in cryptocurrencies and an endless amount of scammy projects. We plan to create a Spanish, French and many other versions so that people all over the world get the chance to understand us. Also, very soon weíre going to have a new beautiful website. Any progress requires resources. Right now we are keeping the project alive with our own money. But we could use some help. That is why we have created wallets for donations. You can send your crypto here: Bitcoin: 1Q5je9QK3maYPT3rNgdBrbA8eiUwEuwQ9i BCash (yeah, that too): qzdkdqga35nxn7klmxh57dl6yh9l3rhe3s7uy2kczx Ethereum: 0x0c870e3c162097D3600e710109139C766a594E7d Besides this, weíre ready to accept applications for placing banner ads and paid publications. But, each member of Shitcoinoffering promises to adhere to the following rules: Each paid article will be posted with a ďsponsoredĒ tag. Without exceptions, even for Roger Ver 🙂 In the case of ICO advertising, we will conduct thorough research. If it looks like a scam, it will automatically get posted to our website, probably without a positive description, but definitely for free. The same rules apply for banner ads. We are already writing positive articles. Itís a big responsibility, but weíre already feeling confident about it. Never and for no amount of money will we harm the crypto investor. We will try to keep up with conducting researches of popular ICOs before the sale phase. Everything that is known to us, is known to our readers: this is our key motto, until the end of time. In blockchain we trust! |

|

|

|

|