Show Posts Show Posts

|

|

Pages: « 1 [2] 3 4 5 6 »

|

Announcing COTI’s schedule for the coming months: MainNet launch, TGE, IEO and Exchange Listings Summary Points Summary Points- COTI MainNet Release

- What happened in TestNet?

- What happens in Private MainNet?

- What happens in Public MainNet?

- When will I receive my COTI wallet?

- When will I receive my COTI coins?

- When will COTI finalise the raise?

- When will COTI list on an exchange?

- Schedule Summary

COTI MainNet ReleaseThe COTI team has been making great progress in bringing our project towards our promised MainNet release. From a simple payment dApp built on Ethereum in late 2017, to a fully fledged DAG based blockchain ecosystem in 2019, we are now closer than ever in delivering the technology we believe will be the first killer app for the blockchain, designed specifically for payments, backed by stable coins and focusing directly on the masses. For those who aren’t aware of the history of the COTI project, please see our most recent update article COTI: The Path to Adoption in which we detail our approach, implementation, and philosophy in creating what we consider to be “Blockchain 3.0”. Before going into the specific details of our MainNet, we’d like to invite you to take a look back on the more intimate details of our TestNet and our progress and achievements during this period. What happened in TestNet?COTI moved from Proof of Concept stage, in which we built our COTI Pay dApp on ETH, to the alpha version of our TestNet in September of 2018. Alpha TestNet was the very first implementation of our Trustchain DAG based infrastructure as detailed in our technical whitepaper and included setting up the base level infrastructure to support our DAG and the various features it includes, the COTI Pay dApp, the COTI-X exchange and our financial node infrastructure (Trust Score, KYC, DSP and Full Nodes).. On TestNet we performed months of simulations that included testing scaling and transactionary volumes, running with closed garden fixed nodes. In these tests we were able to demonstrate a TPS of 7K — 10K on TestNet. As DAG technology scales upwards based off the number of nodes and volume of transactions on the network, we are now confident the network will reach our intended baseline target of 100K+ TPS with the addition of full nodes and increased transactionary volume on public MainNet, once additional merchants, users and nodes are on boarded. TestNet also included onboarding our first round of enterprise clients in Netcore and Swiftency. Both companies facilitate next generation payments to their merchants user base and have built a solution on top of our infrastructure. Between these two clients, COTI has processed a combined $3M USD in transactions in less than two months, generating both success for our clients, early revenue for COTI and faith in the underlying COTI network. As COTI coins have not yet been created, these clients used BTC as a base currency for transacting on the network while in TestNet. Past these two enterprise clients, COTI also signed an agreement with Ormeus to develop the first version of a whitelabeled client solution. This agreement enables Ormeus to utilise COTI’s DAG (as a parallel DAG, specific to Ormeus) to issue their own coin, to use COTI’s merchant payment tools, as well as a bespoke implementation of our COTI Pay app that runs on Ormesus physical Point Of Sale (POS) terminals. This deal brought in $1.5m USD as a one off “cash” payment to COTI and future profit share of transactions process on the Ormeus network, an incredible achievement considering we have still not yet finalised our tech build, rollout and fundraise. This type of arrangement is indicative of future enterprise partnership agreements COTI will be signing, allowing for enterprise to issue their own coin on top of the COTI network with the full support of COTI. In recent months we have also signed agreements with several major enterprises, like Blue Cellular in Africa, Millenning and REMIIT in Singapore, and as such, expect to rapidly grow our numbers of users, merchants, usage and revenue as we onboard these clients and progress towards our Public MainNet. After a successful Alpha TestNet release, COTI moved into the beta version of our TestNet in December of 2018, adding greater scale and additional features to our initial TestNet release. With these successful developments, we are now confident and ready to release our MainNet, as planned and as scheduled. What happens in Private MainNet? What happens in Private MainNet?Private MainNet will be the first implementation of the COTI network that will be used by the masses. Unlike traditional blockchains, which begin with the create of a genesis block, the creation of a DAG begins with a genesis transaction, in which the COTI coin supply is created and assigned out to various wallets. As such, in the first week of April, we will have our genesis transaction event, which will involve the creation of the COTI coin, along with distribution of said coins to our liquidity pool and incentivisation pools. We will also move COTI coins earmarked for distribution to users participating in our private and public sales to a separate wallet. Again, a notable difference between a traditional blockchain and a DAG is in the way in which transactions are validated. Unlike PoW or PoS networks in which the algorithm is a central point to consensus and defines the truth about the network topology, a DAG based infrastructure uses two previous transactions to validate a live transaction. As such, there is a minimum level of transactionary volume required on a DAG before transaction can be validated in a timely manner. It is for this reason we have taken the approach of a Private/Public MainNet launch, ensuring that these requirements will be met and the network will function correctly before a full public release. The creation of the COTI coin will allow for additional enterprise clients to be on boarded onto the network and for these clients to transact on the network in more of a “real world” scenario, as compared to TestNet. Unlike TestNet, in which BTC was used to facilitate fees on the network, the use of COTI coins will mark the first use case of COTI being used as a means for transactionary fees. From this point on, all users, from general, to merchant, to enterprise, to those who issue their own coin on top of COTI, will use the COTI coin as a method of processing transactionary fees on the network. While Private MainNet will be closed for public access, COTI will release our block explorer as part of the Private MainNet release. This will give all members of the public a transparent view as to the inner workings and progress of the COTI Private MainNet. Watch the transaction confirmation process in COTI’s Trustchain protocolWhat happens in Public MainNet?The public MainNet is the first official release of the COTI network proper. The MainNet specs include the vision outlined in our whitepaper, as well as a solid foundation to nurture our sprouting fintech ecosystem. This is quite exciting, as it’s the first blockchain infrastructure that easily enables the creation of fintech products on a mass consumer scale. Some of the key technological innovations include an arbitration system that safeguards buyers and sellers from errors, fraud and counterparty abuse, as well as an enhanced privacy layer to protect transactions in a way which has not yet been possible for blockchains. DSP consensus adds an extra layer of security, solving the fundamental problem of double spending for all high performance distributed ledgers. Other advancements include one-click payment requests, which enables any merchant to easily integrate PayPal-like payment buttons on their website for instant checkouts. Trust scores resolve the lack of trust faced by most blockchains, while node managers introduce an automated way of discovering neighboring nodes and avoiding the potential risks associated with accepting data from other nodes. The main difference between our Private MainNet and Public MainNet is that arbitrators and full node operators can register from day one, and as such marks the first time the general public can interact with the network. As we onboard the first full node operators, some will become DSP and Trust Score nodes later on, as the network scales to include these participants. View COTI’s node operators around the worldWhen will I receive my COTI wallet?We will begin issuing wallets with the launch of Private MainNet. Since TestNet wallets (which many of our users already have) are incompatible with MainNet wallets, we need to issue over 85K + MainNet wallets to our users and onboard our 5K + registered merchants. Obviously this will take some time, and this process will begin in the second week of April, with the wallet distribution phase to be finalised before the release of Public MainNet. Full details of the MainNet wallet creation process and registration will be released in a separate post, along with a video tutorial, in the second week of April. When will I receive my COTI coins?Once our users have set up their MainNet wallets, COTI will begin the distribution of COTI coins to users who have purchased coins as part of our raise or have participated in our bounty program. This will coincide with Public MainNet release, as we want to ensure MainNet is functioning as it should, prior to the release of any coins to the general public or merchants. It is important to note that despite users holding coins in their wallets as of the public MainNet, COTI coins will not be available for trading on a secondary marketplace until our fundraising is complete and the COTI coin is listed on an exchange. With regards to COTI coin holders, we have decided to grant additional bonus coins to contributors that purchased coins before 1.1.2019. They will be granted a 1% bonus for each month from this date until tokens are distributed. For example, if you purchased 100 coins prior to 1.1.2019 and the TGE will be taking place on 1.6.2019, then you will earn a bonus of 5% (5 months * 1% bonus). When will COTI finalise the raise?In learning from the mistakes of other ICO’s, we have been very conservative in managing our treasury and burn rate, ensuring our project has a long runway. As we’d like accelerate our growth rate and start opening offices globally, ensuring more users, merchants and enterprise clients can join our network based off an aggressive go to market and business development strategy, and as requested by our community, we have decided to raise a last tranche of funds prior to our public MainNet release. Tokens sold at that stage will be sold at a higher price than in previous tranches as to not disadvantage early supporters. We have taken a two fold approach to finalising our raise. Firstly, by selling equity + bonus tokens via a crowd sourced equity funding platform, and secondly by running a more traditional token sale. For the pure token sale, we are currently in talks with several exchanges in regards to hosting an IEO that we expect will take place in June. When will COTI list on an exchange?As expected, we obviously cannot go into too much detail on this point, as we’re currently in talks with several tier one and two exchanges in regards to both an IEO and token listing. However, we expect a listing of the COTI coin on an exchange around July 2019. An important point to note here is that unlike some other ICO’s, COTI will list with a fully functioning MainNet with active users, merchants and enterprise clients on day one. Schedule Summary- First week of April: MainNet release for QA

- Third week of April: Private MainNet release (expected to run for 8–10 weeks after which we will launch the public MainNet). In addition, we will be releasing the COTI ledger explorer.

- At this stage, users can begin registering for COTI wallets (to be finalized before the public MainNet).

- Coin distribution: will take place once wallet distribution is complete and the MainNet is publicly opened.

- IEO / launchpad / token sale: planned for June

- Exchange listings to follow

Additional updates will be released soon. For now, on behalf of myself and the entire team at COTI, we’d like to thank you for your continued support!      Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group

|

|

|

|

The Global Potential for COTI to Optimize Remittance Services

The remittance market is vast, as billions of dollars circulate through it with continued year on year fiscal growth. However, it is fraught with challenges that make it costly, time-consuming and complex. COTI addresses these challenges head on with remittance being one of the many use cases of the COTI Trutstchain protocol in the finance industry.Read on below for everything you need to know about the remittance industry. What is remittance? What is remittance?Remittances are cross-border, peer to peer (P2P) transfers of funds typically sent by expatriates to their country of origin. According to World Bank statistics, global remittances will grow to $715 billion in 2019, up from $616 billion in 2018. Some of the main countries that receive remittances from migrant workers include China, India, the Philippines and Africa, as well as Latin American and Caribbean countries.  Why remittance services are used Why remittance services are used- Many people (ca. two billion) in developing nations do not have access to banking services

- Certain banks around the world are not part of the SWIFT network that is responsible for processing transfers

- Using a remittance service is more cost-effective than a bank wire

- Sending cash or cheques via post can take a long time and is not secure

- Effective means of distribution for disaster relief efforts

Shortcomings of current remittance servicesHigh costsRemittance fees include exchange fees, commissions and cable fees due to the SWIFT network that operates through several brokers. At the G8 Summit in 2004, member countries agreed to tackle the problem of high costs to move funds across borders. In 2008, the World Bank created a database that would enable people to compare prices of various remittance services to foster competition among the providers and subsequently drive down prices for consumers. In 2011, the Gates Foundation predicted that decreasing transfer fees from 10% to 5% could unlock upwards of $15 billion a year in poor and developing countries. Analysts believe that $32 billion in remittances are not sent because of high transactional and regulatory costs associated with cross-border money transfers.  Lack of transparency Lack of transparencyWhile the vast majority of transfers take place via online and wire transfers that are both transparent, a large amount of funds are transferred using more opaque methods. This has alerted financial intelligence units to the fact that remittances are one of the ways that money is laundered and used to fund terrorist activities. Furthermore, it is difficult to determine the route that funds are being transferred and why additional fees are levied. Many users are unaware that brokers charge extra fees for overseas payments as they are more focused on foreign exchange rates. Time-consumingRemittances take a considerable time to be settled because they are manually processed by a limited number of trusted institutions.  Complex ComplexThe process of remitting money is complex and is often difficult to navigate and understand. Fulfillments are not frictionless, as a single transfer goes through multiple intermediaries until it reaches its final destination. The process can be likened to connecting flights that enable people to travel anywhere around the world, even when there are no direct flights from their country of origin. MonopolisticBecause the number of trusted institutions processing remittances across borders is quite limited, this leads to a giant monopoly amongst trusted operators. Security issues Security issues have been a serious threat to traditional payment networks due to cyber attack vulnerabilities. Unbanked population remains unservedTraditional financial services are not available to billions of people worldwide, although remittances have an important role in the growth of developing countries. Limited business growthTo establish overseas remittance operations, businesses must cooperate with partners from other countries. To do so, trust is an essential component and verifying this trust necessitates substantial time and efforts. This is why many remittance service providers, except for monopolistic financial institutions, experience difficulties in expanding their business operations. COTI’s solution COTI COTI developed a revolutionary remittance solution for the cross-border payments industry with the following benefits: COTI can process over tens of thousands of transactions per second. COTI reduces intermediaries, while liquidity pools created by COTI in various countries eliminate bank credit lines. COTI provides price-stable coins pegged to fiat currency. These tokens are used as a conduit to transfer money in real time. COTI protects entities against errors, fraud and counterparty abuse. COTI uses price-stable coins which digitize payments on the Trustchain to enable instant transfers. COTI has designed a full Know Your Customer (KYC) and anti-money laundering (AML) support system, built directly into the platform to ensure compliance across all applications. COTI features a simple user interface with no bureaucracy and jumping around hoops. - New business opportunities

COTI enables companies to tap into the two billion unbanked population. COTI has partnered with top remittance companiesCOTI has already secured a number of strategic partnerships with remittance companies like Millenning and REMIIT.  REMIIT is a Korean blockchain remittance platform that allows a one-step solution for international money transfers. With COTI’s DAG-based blockchain 3.0 solution, REMIIT will have extreme scalability, price stability, instantaneity, ease of use, near zero fees and much more. “ COTI and REMIIT are similar in the sense that we both want to build a blockchain technology that can be used in our everyday lives by breaking the cross-border barriers of value transfers. With a common vision and a giant market to tackle, our cooperation in building a strong network to provide instant payments through stable tokens can just be what is needed to transform the cross-border money transfer and payment market.”Millenning is a Singapore-licensed remittance company that provides frictionless, fast and low cost payment solutions to corporate and individual users. COTI will be providing Millenning with a white label license to use its Trustchain technology to supply users with optimized remittance solutions from Singapore to European countries and other locations around the world.  COTI’s VP product Niv Abramovich And Millenning’s CEO and co-founder Coco Choo “In partnering with COTI, I’m happy that Millenning can leverage on its future-proof technology and distinguish itself as a proper licensed remittance company with a distributed ledger technology (DLT) solution to service customers with speed, miniscule costs and reliability,” commented Millenning CEO and co-founder Coco Choo.”Hear more about what Millenning had to sayCoco recently answered some of our questions about the remittance climate and what the future holds for the industry 1. As a remittance company operating in Singapore, what are the biggest challenges to providing such services?Two of the biggest challenges facing a fintech remittance company are:

- The concept of using tokens/token exchanges to facilitate money remittances requires global banking support. Exchanges need to have their own bank accounts to effect remittances, and this is currently a global challenge as banks are not supportive of crypto exchanges.

- Fintech remittances require considerable liquidity in the receiving-disbursing countries. Using a crypto or token conduit for fiat remittances requires that the token have liquidity at various overseas exchanges.2. Where do you see blockchain’s strengths in optimizing your services?We can optimize our services by using blockchain’s strengths of instantaneity and particularly its incorruptibility, as blockchain guards against fraud and counterparty abuse.3. What sets COTI apart for you, as compared to countless other blockchain payment projects?We are particularly attracted to COTI for its “can-do” mindset and its innovative approach in merging the usual remittance service with blockchain technology and token systems. This in addition to COTI’s price-stable coins pegged to fiat currency, which are used to digitize payments on the Trustchain and enable instant transfers.4. How do you see blockchain-based remittances panning out in the future, and when can they realistically be used?This is related to the two aforementioned challenges, as we cannot look at blockchain remittances in isolation. As a licensed remittance company, I believe that we have to contribute to an ecosystem of participating market makers to resolve at least one of the two major problems. This will effectuate the use case of blockchain and its tokenization for cross-border remittances.* * * * * Remittance is just one use case of the COTI Trutstchain protocol in the payments industry, with many more applications to come. Stay tuned for more updates! Want to hear what’s happening at COTI before anyone else? Be sure to join our channel to receive our most timely updates! Click to join.

Or join the discussion on our Telegram group.

|

|

|

|

In an era of 'everything digital', how is currency not? On March 12, 2019, 4 pm UTC (10 am CST), COTI CTO Dr. Nir Haloani will discuss our TestNet release, key technological innovations and how you can become a part of the COTI network. Be sure to save your seat for the webinar here.  |

|

|

|

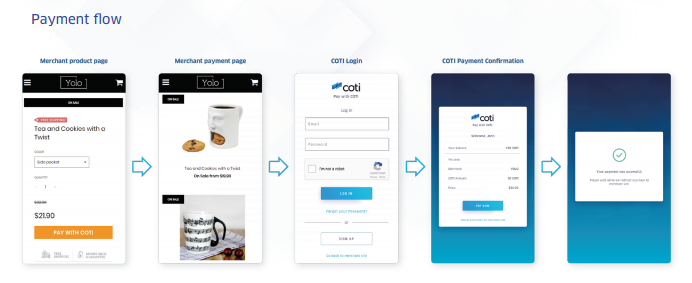

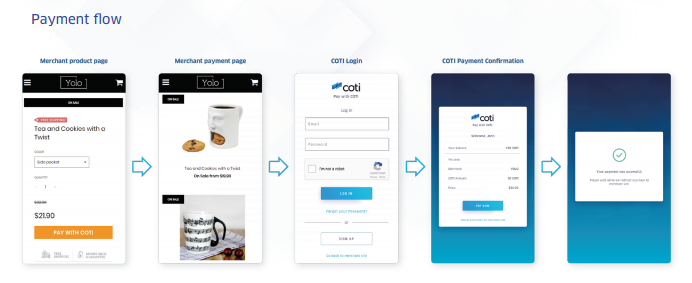

COTI: The Path to Adoption Written by Shahaf Bar-Geffen, COTI CEO Written by Shahaf Bar-Geffen, COTI CEOAs the saying goes, “May you live in interesting times” and for those involved in crypto throughout 2017 and 2018, this certainly has been the case. From the speculative bubble and bull run of 2017 driven solely by the hype of utility tokens, their intended network effects and the future promise of delivered tech, to the protracted bear market of 2018, in which a majority of utility tokens were found to be useless, delivered tech, if delivered at all, was underwhelming and the use of such tech non-existent, expectations surrounding cryptocurrencies and crypto projects have shifted dramatically in this time. 2017 was the year of decentralization and that mantra, the resulting hype and thus the ease of funding for ICOs, lead to a blatant disregard for the commercial and business development standards previously applied to fintech products, and was instead, at best, based off the premise of “Build it and they will come” and at worse “Promise it and they will come (or at least give you money)”. It seemed to be a foregone conclusion that decentralized versions of existing technology solutions were soon to take over the world and the main concern of the development community stemmed from how to scale such solutions for the explosive growth soon to come… As much as 2017 was notable for the promises of what blockchain technology could deliver for the masses, 2018 was most notable for the complete failure to deliver on these promises. Projects who delivered tech failed to see uptake of such tech, with many projects failing to deliver at all. As the speculative bubble began to burst, runways for projects without an actual budget and business plan began to shorten and project goals constricted, with many projects folding altogether. Decentralization proved to be somewhat of a myth as time and time again, projects were proven to have a centralized component. Scalability became somewhat moot, after all, why scale when you have next to no users? Regulation, previously a dirty word, was suddenly welcomed into the space, not shunned. Crypto now moves into 2019 as a much more mature, if not slightly wounded beast. Regulation has entered the space in a big way, driving the need for crypto projects to be compliant with regulatory authorities globally, curtailing the global funding free for all and cypherpunk hopes of true decentralization. Blockchain in itself is no longer seen as the solution, instead rather as the enabler. Most importantly, the lack of accountability, responsibility, transparency and deliverability of crypto projects in 2017/18 has resulted in a much more skeptical and discerning crypto market, with sentiment shifting from the speculative hype cycle and the resulting hypothetical promises into something much more realistic and more in line with traditional business goals- i.e the need for real companies with real products and real users who have an actual business plan… A Brief History of (COTI) TimeThe COTI project began in 2017 with relatively modest goals, to build a payment dApp on top of the Ethereum network. In a time in which Ethereum was shaping up to become the dominant transacting blockchain with Plasma, the Radien Network and sharding right around the corner, giving Ethereum the ability as Vitalik himself stated to, “scale it up to one hundred million (TPS)”, this seemed like a pragmatic approach, after all, why reinvent the wheel when it has already been created? With these improvements to Ethereum, COTI would have easily been able to implement its vision, that of an accessible to all, near instantaneous, low-cost payment solution built on blockchain technology. However, as time passed, it became apparent these solutions were increasingly some time off, if to be delivered at all. Mindful of the fact that other payment projects, such as OMG, had stalled while awaiting these improvements and with Ethereum limited to a measly 15 TPS, it became obvious that if COTI were to build a payment solution on top of Ethereum, it would be severely limited, entirely reliant on the underlying Ethereum network, its developmental timelines and basically unusable when compared to existing real-world payment solutions. After having already raised 15m USD, based on the original payment dApp built on an Ethereum premise of COTI, it would have been an easy out for COTI to simply deliver upon that promise, despite its obvious limitations, and fade into the general obscurity of the many ICOs who have now found their technology and/or business models to be entirely unsustainable. Instead, this was seen as an opportunity to not only deliver upon the original COTI vision, but also to greatly expand upon it, after all “those who cannot learn from history are doomed to repeat it” and to not learn from the collective trials and tribulations of 2017 would have been a significantly missed opportunity in developing a product in line with the needs and demands of the maturing crypto marketplace in 2019 and beyond. The Ten Commandments of Adoption“Do it right or don’t do it at all”In defining the philosophy that marks the current incarnation of the COTI project, our team took into account the lessons of 2017/18 and the critical issues surrounding blockchain technology that have limited its ability, use and adoption in the real world. We have adopted this philosophy into our approach moving forward with COTI and summarised it into the ten commandments below.  1) Simplicity 1) SimplicityBlockchain DApps need to be so simple that users could use apps without even knowing that they are using crypto. Blockchain should be an underlying technology, not something that is the sole or main selling point. Do users care which cloud service their favorite apps run on? Of course not — if it runs well. While the underlying technology that powers COTI is extremely complex, the user and merchant-facing tools developed have been designed with simplicity in mind.2) AccessibilityBlockchain dApps need to be accessible to as many users as possible. Utilising existing technology solutions and ecosystems that already have a foothold and user base is one of the most important aspects of bridging the gap between legacy and blockchain solutions. It is unrealistic to expect blockchain to completely replace legacy solutions in the short term. What is realistic is creating alternative solutions that provide a competitive advantage to legacy systems and allow them to operate side by side. In a world in which over five billion people own a mobile phone, it is of critical importance that dApps are accessible from traditional app marketplaces, such as Apple’s App store and Google’s Play store. The COTI Pay dApp will be available on the Apple App store, Google Play store and also as a web application.COTI will also offer merchants access to a merchant dashboard that provides detailed data and reporting functionality on their COTI Pay transactions. Within this dashboard, merchants can choose which COTI Pay-supported currencies they wish to accept, as well as their preferred settlement currencies. The dashboard will also provide merchants with wallet-like functionality that enables them to make payments to COTI Pay wallet holders and to other COTI Pay-powered merchants, as well as the ability to use COTI-X’s facility to exchange currencies.3) UsabilityCrypto solutions need to be as user-friendly as existing legacy solutions. Users are unwilling to wait more than a few seconds for transactions to be confirmed and both users and merchants are unwilling to pay high fees for simple transactions. Creating a crypto payment solution that utilizes the advantages of blockchain technology while retaining the same level of usability and functionality of legacy payment solutions, without their obvious disadvantages, is key to actual adoption. COTI offers a full POS (Point Of Sale) software suite that seamlessly integrates with COTI Pay. By utilizing the COTI POS, merchants will benefit from all COTI Pay advantages, while also being able to accept normal credit and debit card transactions. All that is required at the consumer and merchant end is access to the application on a mobile device to facilitate payments. COTI Pay Payment Flow, Mobile App COTI Pay Payment Flow, Mobile App COTI Pay Website Plugin4) Volatility COTI Pay Website Plugin4) VolatilityVolatility is one of the key weaknesses of cryptocurrency, especially in relation to payment solutions. Merchants will not accept a form of payment that may drop in value the next day, in the same way users are reluctant to pay with a currency that may appreciate in value the next day. Providing stability, and in turn confidence, to both users and merchants is key to new payment methods being adopted by the masses. Integrating a stable coin into crypto payment networks is undeniably the best way to counter this volatility and reduce any such associated risks for all parties involved. COTI has developed the COTI Dime, a generic price-stable coin pegged to USD 10 cents. The COTI Dime exists only within the COTI platform and serves as a price stabilization method ensuring usability for everyday and mainstream use by users and merchants. 5) Scalability 5) ScalabilityOnce a user and transaction base has been established, scalability becomes a key element that effects crypto payment networks. Many crypto users will remember the issues Bitcoin had at the height of the crypto boom, with an average transaction cost peaking at $55 and many transactions taking hours or days to confirm. Crypto networks must be designed with a scalability solution in place from the onset - not something that will potentially be added in or developed in time, as a network grows. The COTI Trustchain is based on a DAG (Directed Acyclic Graph) infrastructure, a much more efficient and scalable blockchain solution than a traditional ledger. The Trustchain TestNet, with a limited amount of nodes, is currently running at 10K TPS and will scale past 100K TPS once in production. This means the COTI network will be able to support and sustain a transactionary level that surpasses legacy networks such as Visa and Mastercard… from day one.6) LiquidityLiquidity for legacy currency (fiat) is something we all take for granted. After all, liquidity is essentially secured by the government of the issuing currency. In crypto, however, this is a different story, and many projects who have received significant amounts of funding have suffered from issues of liquidity, either from not being able to be listed on exchanges, or from a lack of consumer interest in their tokens. COTI has created COTI-X, an internal interoperability exchange and settlement layer on the COTI platform, serving three main purposes, an enabler of cross-currency payments, direct transfer of one currency to another and importantly, an enabler of liquidity on the COTI platform, via the conversion of COTI coin to COTI Dime and other cryptocurrencies/fiat. COTI has dedicated a pool of 45% reserve tokens specifically for creating and supporting liquidity for the COTI coin and COTI Dime via COTI-X, without the need for external exchanges or liquidity providers.7) ImmutabilityWhile blockchain can provide great security and transparency via the use of immutable ledgers, the lack of third parties in the transaction chain becomes an issue when a payment is completed but the service or product is not delivered by a merchant. In order to replace legacy payment solutions, crypto solutions need to provide the same level of buyer-seller protections that users currently have in legacy payment systems. While transactions can still be written to the blockchain in an immutable fashion, there must be recourse for a user in the event of a failed deliverance of a service or product. COTI has developed an Arbitration Service that offers dispute resolution through a decentralized collective of highly trusted network participants that allows for similar or surpassed levels of dispute resolution as offered on legacy payment solutions, such as PayPal, Mastercard or Visa. COTI Arbitration Process8 ) Portability COTI Arbitration Process8 ) PortabilityOne of the reasons there are so many different cryptocurrencies is that each currency serves a different purpose and has different features. There is no one size fits all cryptocurrency. In the crypto payment ecosystem, it makes no sense for a user or merchant to deal with multiple cryptocurrencies, as the overhead required to manage this outweighs the benefits of doing so. However, like state-sponsored fiat currencies or company issued reward points or gift cards, there is a specific demand for a bespoke solution that is indicative of a brand or particular ruleset. As such, governments and enterprises need to have the ability to issue their own cryptocurrency or token, backed by their own branding, real-world assets or other on-chain collateral, defined by their own criteria or rulesets. By creating the COTI platform, COTI gives enterprises and governments the ability to issue their own currency on top of our infrastructure, essentially white labeling our entire platform, enabling for extreme ease of deployment of a crypto-based solution without the necessary time, cost and expertise usually required. This enables our solution and the COTI network exposure to the billions of users who are catered to by enterprise and government.9) AnonymityAs crypto matures and continues to mature, the support of regulatory authorities is key to both the acceptance and adoption of cryptocurrency as a payment method or value transmission. As such, despite the founding premise on which Bitcoin was founded, for widespread support and adoption, a cryptocurrency that will serve for mass payments can’t be anonymous. In this sense, transactions themselves can still be private, however for full support or regulatory authorities, and in turn acceptance and adoption worldwide, users using crypto must follow industry standard KYC and AML processes to remain compliant with enterprise and government requirements. Privacy is a cornerstone for COTI, meaning transactions cannot be tracked back to a specific user, as a multi-address is implemented for each transaction by a one-way hash function. Users and merchants must undergo a KYC and follow AML processes to be involved in the COTI ecosystem.10) TransparencyTransparency is often used in reference to the blockchain itself, however, transparency regarding the operations of blockchain companies has been a constant conversation in the crypto community during the bear market, as runways and token prices for projects have collapsed. Due to the lack of oversight and regulation of companies in the crypto space, and with investors being sold utility tokens that represent no stake in the company itself, ICO’s have acted in a no rights and no responsibility manner towards token holders. Crypto companies should have the same, or greater, level of transparency regarding their funding, operations and future plans as real-world businesses. By moving to an equity-based funding model, COTI will open itself up to a level of transparency and responsibility to stakeholders that is representative of its status as not just a crypto project, but also of a real-world company.The Path to Adoption“Actions speak louder than words”Mindful of the many broken promises of other ICOs, COTI has taken great strides to not only deliver upon its original commitments but to greatly surpass them, based off the current needs of both our project and the crypto market in general. - Successfully created and launched the Alpha version of our own DAG known as the Trustchain. The Trustchain features a unique Proof of Trust (PoT) Algorithm & Consensus Algorithm, Double Spend Protection (DSP) and buyer-seller protections that combine legacy and blockchain elements to form a truly modern payment solution.

- Created a COTI demo shop, operating on the COTI testnet, allowing users to register and test purchase items using COTI demo coins as they would on a standard merchant website on the main net.

- Won several pitch competitions, including Google’s Pick a Startup Competition and Ian Balina’s Blockchain Pitch Competition.

- Released our code on GitHub for peer review.

- Created a WordPress “one-click” website payment integration module, allowing merchants to easily add COTI as a payment option into their website.

- Signed agreements with 20+ enterprises to use COTI as part of their payment solutions, including blue cellular (10m users), Processing.com(over $10B in transactions) and Millenning (a $1B remittance company).

- Registered 5,000+ merchants and 85,000+ users for access to COTI MainNet.

- Processed our first ever transaction from one of our clients, validated on the Trustchain network.

- Co-founded the Scalable Protocol Alliance in order to bridge real-world adoption by conveying a message of stability, scalability, and accountability, while leveraging DLT to solve real-world enterprise problems.

https://bit.ly/2R1vIeT https://bit.ly/2R1vIeT- Converted our token only ICO raise into an equity + bonus token issuance model (commonly known as a Simple Agreement for Future Equity with Bonus Token Allocation, or SAFE-T for short) and raised additional funds based off this model in the last six months.

Early Adoption to Mass Adoption“Every once in a while, a new technology, an old problem, and a big idea turn into an innovation.”COTI decided early on to focus its efforts around a blockchain for payments and stable coins because it believes that the first “killer app” for blockchain, the app that the masses will use, will be one that uses a price-stable coin that is designed specifically for payments. After all, payments are something that almost every person in the world does every day - and something that blockchain and cryptocurrencies do especially well, with the right design. COTI’s goal is to combine the innovative technology it has developed with an aggressive business development strategy based on partnership agreements and a referral program that ensures a significant amount of users and merchants from day one.  It is our aim that within the first twelve months of the COTI main net release, the COTI network will host the most transactions per day of any crypto network! It is our aim that within the first twelve months of the COTI main net release, the COTI network will host the most transactions per day of any crypto network!Moving forward with COTI and our plans for mass adoption, we have committed to — - Finalizing our raise prior to main net release, via an equity + bonus token issuance model. COTI will tentatively offer a final round to our supporters and the general public immediately prior to the release of main net. This will be at a higher token price/company valuation than previous raises to reflect the maturation and development of the project, as well as rewarding those who invested in earlier rounds.

- Launching the COTI main net by the end of Q1 2019.

- On-boarding the first 85,000+ registered users and 5000+ registered merchants as main net is released.

- Integrating partner payment networks on COTI, leveraging 10m blue cellular 10 million users, 50 million amount of Processing.com users and 5 million amount of Millenning users, among others.

- Launching the COTI incentive program to leverage the initial adoption of users, merchants, and partners to rapidly grow the network. COTI has dedicated 45% of the overall token supply to the incentive program and with a seed user based of a minimum 100K users initially, expect exponential growth by using this initial user base as a referral source to grow out the COTI network and user base.

For those interested in learning more, the COTI TestNet wallet can be accessed here. You can also test our demo shop by purchasing goods using your demo coins. Visit our GitHub to review the Trustchain code and read more in COTI’s technical whitepaper.

Private contributors who wish to participate in our second round of private funding can contact clientrelations@coti.io.      Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group

|

|

|

|

With 2018 coming to a close and 2019 soon on the horizon, we’re taking a look back at the year with all of its exciting milestones. We’ve launched products, scored top rankings in competitions and listings, received accolades across top media channels and signed a number of notable partnerships around the globe. Read on below as we review COTI in 2018.Our early beginnings…As you all may know, when we founded COTI back in early 2017, we aimed to create a decentralized payment app to solve the shortcomings of traditional and digital payment systems. After several months of research, we realized that blockchain in its current form was an inadequate tool to take current payment systems to the next level. In an ingenious move, we decided to build our own version of the blockchain by implementing DAG as the base layer, as well as a novel Trustchain consensus protocol based on proof of trust. We understood this was a moon shot and set about recruiting a dream team to optimize our technological solution for global payment networks that would solve the challenges of scalability, high fees and lack of buyer-seller protections.  The upcoming months were a whirlwind as our R&D team was hard at work to advance our technological protocol. By the time September 2018 rolled around, we had a huge win with the launch of our Trustchain AlphaNet and release of our code on GitHub. COTI Pay, our first payment app, along with our currency exchange COTI-X will also be going live in the next few weeks.  Building a viable blockchain 3.0 solution Building a viable blockchain 3.0 solution optimized for decentralized payment networks, merchants and stable coins is no easy feat, but we’ve been so lucky to have the support of our community, backers and advisors. We were honored to win first place at the Google-sponsored Pick a Startup competition, as well as first place in Ian Balina’s pitch competition during his Crypto World Tour in Tel Aviv. We have also been reviewed and ranked by multiple influencers from Top 7 ICO lists.  COTI quickly gains exposure COTI quickly gains exposureThe media has also taken note and we received some remarkable press mentions on Forbes, Yahoo Finance, CNBC, Inc., CCN, Euromoney and so many more.  So what did they have to say? So what did they have to say? Forbes reports that blockchain-based payment systems like COTI have opened up new alternatives to how consumer payments are conceptualized. Instead of taking three working days to clear money between accounts, now it can be done instantly. As for YAHOO! FINANCE, they’ve slated COTI as the first viable solution of its kind, creating a working proof of trust (PoT) blockchain consensus system built on DAG. Moreover, we had the chance to chat with Greg Kidd, the former CRO at Ripple Labs, in an exclusive webinar and held a meetup with Advanced Blockchain AG in the crypto hub of Berlin, covering key innovations of our Trustchain protocol. We also recently hosted Cardano, the leaders in blockchain and cryptocurrency, in an action-packed event in Tel Aviv looking at ways to unlock the future of blockchain and tech.  Adding to the momentum, 2018 was a year of noteworthy partnerships with payment processors like Processing.com, top remittance companies such as Millenning, as well as the biggest Pundi X competitor and countless others. We also had the opportunity to attend a number of well-known conferences around the globe, including the Japan Blockchain conference, Singapore Fintech Festival as part of the Israeli Delegation, Beyond Blocks Summit Seoul, CDAD in Vietnam, Consensus Singapore, and many other events.  Coming up for 2019… Coming up for 2019…We’re moving full speed ahead as our TestNet is quickly approaching, along with our main net debut in Q1 2019. Some of our key innovations that have made this all possible include our Trustchain consensus, Proof of Trust (PoT) consensus and algorithm and our Arbitration System to handle buyer-seller disputes. TestNet exclusive innovations include the Trust Score Node algorithm, multiDAGs, on-chain smart contracts, one-click payments, a stable coin framework and much more.  Lastly, a closing message from our CEO Shahaf Bar-Geffen: “2018 has been unbelievable since coming on board as COTI’s CEO. I’d like to thank the entire COTI team, advisors, partners and backers, as well as all of our supporters who have been with us since the beginning. Together we are working towards making the COTI vision a reality. With 2018 behind our backs, the proof is in the pudding with the milestones we’ve ticked off to date, and it’s only looking forward from here. From the COTI family to yours, we wish you the happiest holiday and new year to come!” We look forward to seeing you in 2019 when we release the main net and everything comes to fruition! Until then, be sure to stay updated on our blog, as well as our Telegram channel and Facebook.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group

|

|

|

|

With over two decades of experience in Israel’s start-up sector, Nimrod is well respected for leading large-scale software projects that catalyze profound change.  A self-confessed crypto head, Nimrod Lehavi is a serial entrepreneur and advisor to a number of tech startups in Tel Aviv, including Orbs, one of COTI’s most recent partnerships. He is also the co-founder and CEO of Simplex, a FinTech and cyber security company that aims to introduce merchants to a world without fraud. As a board member of the Israeli Bitcoin Association, Lehavi saw opportunity in the Bitcoin ecosystem, where Simplex first got its start, enabling bitcoin exchanges, brokers, wallet holders and credit cards to operate with full fraud chargeback guarantee. Since then, Simplex has expanded its services to other verticals, providing a full suite solution to merchants who want to completely remove credit card fraud from their daily operations. Nimrod Lehavi commented: “There are no shortcuts to guaranteeing security for online payment processing. Our in-depth experience and collective track record at Simplex will position us to provide the best solutions for all businesses looking to operate in a risk-free online environment. COTI is one of them, and I’m excited to provide my insights into facilitating risk-free online payment processing.” “Over 3000 merchants have applied for our upcoming alpha net launch. It goes without saying that fraud-free payment processing will be at the forefront of the COTI network’s ongoing efforts. We couldn’t be happier to have Nimrod on board to advise us on eliminating online payment risk and making e-commerce safer for everyone around the globe,” added COTI CEO Shahaf Bar-Geffen. For further information, visit COTI and Simplex. You can also read COTI’s business overview and whitepaper. More about Simplex: Based on advanced AI technology, Simplex’s automated system streamlines online payment processing while assessing risk with maximum speed and accuracy. Simplex integrates with online crypto exchanges to fulfill the credit card payment process. Hence, Simplex is responsible for risk analysis, processing payments with the credit card company and finalizing the transaction. Simplex is licensed as a payment institution in the EU and operates in accordance with the Payment Card Industry Data Security Standard (PCI DSS). The COTI community is continuously growing at a rapid rate. If you have any questions, you are welcome to get in touch with us on Telegram or via email. We will be providing further updates in the near future.      Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

COTI recently featured across a number of sites including the David Pakman show, King Crypto and In it for the Money. See what they have to say below in this week’s COTI media roundup.  This week’s best of COTI in the media: This week’s best of COTI in the media:COTI’s CEO Shahaf Bar-Geffen recently sat down with David Pakman to discuss everything related to the cryptocurrency sphere. Many digital currencies suffer from scalability and volatility issues, as well as regulation shortcomings and lack of buyer-seller protections. COTI aims to solve these deficiencies through instantaneity, hedging services, regulatory frameworks and buyer seller protections. https://youtu.be/jj4zcuI6Vjg“The David Pakman Show” is a daily internationally syndicated politics and news talk show airing on radio, television, and the internet, and on Free Speech TV via DirecTV and DISH Network. King Crypto, a Bitcoin and cryptocurrency enthusiast, recently reviewed the COTI platform on his YouTube channel. King Crypto’s videos are designed to help newcomers and veterans of the digital currency world to make the best decisions possible. COTI received a 10/10 on his ICO Rating Sheet, which covered the website, team, vision, whitepaper and more. Check out what else he has to say about COTI and why his channel is one of the fastest growing crypto destinations on YouTube. https://youtu.be/SBJMQAcMH9wAsgar Folmann of YouTube’s In It for the Money recently reviewed COTI. In his video, he surveys everything from the community pre-sale all the way through to the business overview and whitepaper. Hear what he has to say about the project. Crypto Chemist reports on the COTI project: “COTI is the all new digital currency built for payments! COTI is revolutionizing the payment systems of crypto and they have a very strong team for their project!” Tune into his YouTube for the full review: https://youtu.be/QeIfJbZsK3YCOTI recently received an A- ICO rating by Crypto 99, who reflects on whether COTI can become the crypto version of PayPal. So what are some of the benefits according to Crypto 99? • Revolutionary technology (Cluster and Trustchain™) • Aim to solve many issues with both the Cluster and Trustchain™ • Exponential scalability • Large team with big-name experience • The payments space needs disruption See more of what he has to say: https://youtu.be/I9cqy2TY2WoFor our Indonesian speakers around the world, Ujang Saepuloh provides his insights about the COTI project. We also have something for our Russian audience, in a new video that speculates on whether COTI could become the next PayPal. Legit Crypto, a YouTube channel dedicated to cryptocurrency news, cryptocurrency price predictions, crypto talks and ICO reviews recently reviewed the COTI project. Check out what Danny, Legit Crypto’s host, has to say about COTI: https://youtu.be/Vf-jT5WIbfAYour Altcoins is an up and coming YouTube channel dedicated to providing information on the best altcoins in the cryptocyrrency market. Check out their latest video below that weighs in on COTI and whether it could be a HODLers paradise. https://youtu.be/Yw3RESZrwUAWe are excited to announce that COTI’s community pre-sale has reached its cap! $3,001,028 raised in 27 hours! For more details, get in touch with us on our Telegram group or via email.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

Please join us in welcoming Lindsey Maule, CEO of Silicon Valley VC Luna Capital, to COTI’s board of advisors. Silicon Valley VC Luna Capital has invested in COTI, Currency of the Internet, with CEO Lindsey Maule joining COTI’s board of advisors. Luna Capital’s mission is to identify winning projects and assets that are going to grow and improve the cryptocurrency ecosystem, solve problems, rise in market cap and provide long-term value. They are especially interested in DAG-based projects that strive to improve the limitations in blockchain technology today. “I believe DAGs are the next generation of blockchain and have the potential to disrupt the status quo in a range of industries,” said Maule. Lindsey was formerly head of cryptocurrency research at Precursor Ventures, a pre-seed/seed VC firm. She started trading and investing in cryptocurrencies in 2013 and has previous experience managing capital and a background in financial markets, business development, economics and statistics. Lindsey especially focuses on pre-ICO and ICO investments.  Lindsey Maule - Luna Capital Lindsey Maule - Luna CapitalCOTI CEO Shahaf Bar-Geffen commented: “Luna Capital is a crypto asset hedge fund that focuses on scalability coins and DAGs, which is a perfect fit for COTI. We are pleased to welcome Lindsey to COTI’s board of advisors, as she joins us in our mission to grow the COTI network and amplify our reach around the world and specifically in Silicon Valley.” For more information, please visit Luna Capital and COTI. We are excited to announce that COTI’s community pre-sale has reached its cap! $3,001,028 raised in 27 hours! For more details, get in touch with us on our Telegram group or via email.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

📌The COTI community is one of the main reasons for our success, so we'd like to keep you in the loop with all the new tech developments COTI will be introducing very soon. Starting tomorrow, COTI will be launching a new Telegram session called Tech Talks hosted by our Research Engineer Tal Dadia. Each session will discuss a new COTI tech topic, so we welcome anyone who'd like to join the conversation. Tech Talks will take place Monday to Thursday at 1 pm UTC in COTI's Telegram group https://t.me/COTInetwork. Be sure to bring your notebooks and questions!       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

COTI is happy to announce that we have partnered with two technology firms, Advanced Blockchain AG and nakamoto.to. Both firms possess a wide industry network and by leveraging this network, COTI will aim towards integrating its protocol — one that is scalable, fast and based on trust — into a range of businesses beyond the payments sphere. The two firms, with a strong belief in the COTI vision, have also invested capital into the COTI project. Advanced Blockchain AG is a publicly listed German company, focusing on the design, development and deployment of DLT software for companies and their operations and services. Michael Geike at Advanced Blockchain AG, commented: “With a strong focus on research and development, we can see the great potential of the COTI project. Together, we will explore real world implementation of the protocol across markets and industries.”  Michael Geike - Advanced Blockchain AGnakamo.to Michael Geike - Advanced Blockchain AGnakamo.to is a Berlin-based company that focuses on research, development, education and raising awareness on Distributed Ledger Technologies (DLT) with a special focus on novel DLT systems such as the Directed Acyclic Graph (DAG). Robert A. Küfner at nakamo.to commented: “Our business is focused on innovative DLTs, and COTI was a perfect match. Our team views COTI as a global tech solution, based on its DAG structure that is scalable and efficient.”  Robert A. Küfner - nakamo.to Robert A. Küfner - nakamo.toBoth the Advanced Blockchain AG and nakamo.to teams are comprised of high-level researchers and developers, all of whom work to advance the frontiers of DLT. The partnerships with Advanced Blockchain AG and nakamo.to and will serve to further the development of COTI’s Trustchain, which functions on a directed acyclic graph (DAG) structure. Together COTI, nakamo.to and Advanced Blockchain AG will continue to work towards advancing the utilization of the DAG and raising awareness about this alternative to blockchain. COTI CEO Shahaf Bar-Geffen further added: “The COTI protocol will eventually become a platform from which businesses can build countless other apps beyond the payments use case.” The partnerships also herald an important step in COTI’s marketing strategy across the European continent and in particular Berlin, the crypto-hub of Europe. Whilst nakamo.to will employ their marketing and community building techniques to spread the influence of COTI, Advanced Blockchain AG will be researching and exploring potential for development of the COTI protocol which may lead other businesses beyond the payments industry to also build their systems on the COTI protocol. The partnerships come at a very exciting time, with COTI looking to establish itself across the globe and allow businesses everywhere to benefit from the Trustchain.  Team meetup in COTI’s head offices in Israel Team meetup in COTI’s head offices in Israel      Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

Hexa Labs Hexa Labs will lend its expertise in developing advanced technical and design components within the COTI platform. Hexa Labs is a leading global consulting and advisory company whose proficiency lies in solving complex blockchain challenges. Hexa Labs creates effective solutions that assist its clients with launching industry-leading decentralized applications. Hexa Lab’s team of solution architects, blockchain experts, analysts, strategists and developers work to provide unprecedented solutions for smart digital wallets, blockchain infrastructure, smart contracts and secured systems. Their holistic service offering facilitates advanced application builds on multiple blockchains to efficiently deploy distributed ledger technology in a secure environment. Hexa Labs clients include three of the top 10 ICOs of 2017, including Orbs, one of COTI’s most recent partnerships. Uriel Peled, co-founder of Hexa Labs commented: “We are very excited to work with COTI. Blockchain technology is perfectly suited for payments, and COTI is taking full advantage of this. Our work with COTI will position them to become the leading digital payments network”.  Uriel Peled Uriel PeledShahaf Bar-Geffen, COTI’s CEO, further added: “Our partnership with Hexa Labs couldn’t have come at a more opportune time, as there’s a lot in store for COTI in the upcoming months — from our alpha net to the beta launch of our exchange and wallet. Expectations are high, so we’re excited to have Hexa Labs on-board advising the COTI team with regards to its decentralized application launch and maintenance.” For further information, visit COTI and Hexa Labs. You can also read COTI’s business overview and whitepaper. About COTI: COTI, Currency of the Internet, is a cryptocurrency that is tailor made for payments. It reconciles the best of digital currencies with the best of traditional payments, namely Visa and Mastercard, through its innovative base protocol known as the Trustchain. Based on a directed acyclic graph (DAG), The COTI Trustchain creates a scalable and blockless protocol that can be utilized by any industry that needs high throughput and trust to operate, such as the payments space. With low-to-zero fees, full buyer-seller protections, its Trust Scoring Engine and decentralised Mediation System, COTI combines the best of traditional payment methods with the best of digital currencies. For further information, visit COTI and Hexa Labs. You can also read COTI’s business overview and whitepaper. About COTI: COTI, Currency of the Internet, is a cryptocurrency that is tailor made for payments. It reconciles the best of digital currencies with the best of traditional payments, namely Visa and Mastercard, through its innovative base protocol known as the Trustchain. Based on a directed acyclic graph (DAG), The COTI Trustchain creates a scalable and blockless protocol that can be utilized by any industry that needs high throughput and trust to operate, such as the payments space. With low-to-zero fees, full buyer-seller protections, its Trust Scoring Engine and decentralised Mediation System, COTI combines the best of traditional payment methods with the best of digital currencies.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

COTI COTI has partnered with Isazi to further support its R&D efforts in developing its Trustchain™ algorithm and Mediation System. Isazi Consulting is a specialist AI, machine learning and optimization company that builds AI engines for companies from a range of industries. Isazi’s skills have been applied across a number of disciplines, including software and app development, fraud detection, pharmaceuticals and airline optimisation. The Isazi team is composed of highly talented individuals from the fields of computer science, biomedicine, information and electrical engineering, physics, applied and pure mathematics, and financial mathematics. Isazi has a strong connection to a network of universities and individuals around the world who are at the forefront of academia, and are therefore well positioned to implement cutting edge research that would normally take years to reach the business world.  Isazi Consulting specializes in AI and machine learning Isazi Consulting specializes in AI and machine learningIsazi will be assisting with COTI’s R&D efforts in preparation for the upcoming alpha net launch in August, in addition to the beta wallet and exchange launch in September.  Trustchain™ algorithm and Mediation SystemAshley Anthony, CEO of ISAZI Consulting , commented: Trustchain™ algorithm and Mediation SystemAshley Anthony, CEO of ISAZI Consulting , commented:“We partnered with COTI on the mathematical content and proofs of their core algorithms, and on designing simulations to stress test the system and rapidly prototype new algorithms. The design and implementation of a robust DAG-based cryptocurrency, algorithmically determined Trustchain™ and mediation system was a really interesting problem to solve! It has been a pleasure working with the technical team at COTI to solve this. They are knowledgeable, responsive and creative and are committed to building the world’s most reliable payment platform using cryptocurrency.” Shahaf Bar-Geffen, CEO of COTI, further added:“Our collaboration with Isazi will enable COTI to build the most solid infrastructure for our Trustchain™ algorithm and Mediation System. These are two of the fundamental components in the COTI ecosystem, so having Isazi on-board with their extensive knowledge in advanced algorithm and optimisation will set us off on the right track to achieving our milestones.” About COTI: COTI, Currency of the Internet, is a cryptocurrency that is tailor made for payments. It reconciles the best of digital currencies with the best of traditional payments, namely Visa and Mastercard, through its innovative base protocol known as the TrustchainTM. Based on a directed acyclic graph (DAG), The COTI TrustchainTM creates a scalable and blockless protocol that can be utilized by any industry that needs high throughput and trust to operate, such as the payments space. With low-to-zero fees, full buyer-seller protections, its Trust Scoring Engine and decentralised Mediation System, COTI combines the best of traditional payment methods with the best of digital currencies. For further information, visit COTI and Isazi. You can also read COTI’s business overview and whitepaper.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

COTI Research and Developers team We completed some of our ongoing research and development on all fronts of the COTI roadmap over the last few weeks, and progress is translating into real results. - We continued working on the User Types and Trust Score Update Algorithms (TSUAs). We have finalized all ITSA definitions and applied several machine learning modules. We also moved forward with our TSUAs algorithms and defined the algorithm for tracking trustworthy vs bad-acting participants in the network. In our AlphaNet, the modules will be used for consumers and merchants, whereas in our TestNet, Trust Scores will be included to track node behavior and to manage their reputation.

- We have finalized our Trust Score API, which will handle communication between the Trust Score Server, Full Nodes, and wallets. The first release of our ITSA + ML modules is now internally available.

- The first release of our Trust Score Node is developing rapidly, and we have finalized the first version that will support the TrustScore API. The current Trust Score Node consists of the following: double spending, mediation ruling, turnovers and merchant chargebacks.

- We have finished the second version of COTI’s Mediation System specifications. The mediation process and nodes are in our expedited development phase.

- Our research and development team is continuing work towards finalizing the first draft of the COTI base protocol. There has been a lot of progress in developing the following AlphaNet components:

1. Compose Hash AlgorithmWe are researching if multiple hash algorithms can assist us in reducing collisions. For example, if concatenation on the hash will be better as it will necessitate simultaneous collisions on both hashes. 2. Public-Key (Signature)We are currently researching the best algorithm to use for our public key signature. 3. Proof Of Work (PoW) AlgorithmWe have started working on our DAG attachment algorithm, which combines the Trust Score and other variants to define the PoW required for validating a transaction. The idea is that transactions with a low Trust Score will require more PoW. A higher Trust Score will require less PoW because lower Trust Score participants are more prone to spam the network with invalid transactions. The complexity of generating the PoW is going to be controlled by the Cluster in a way that is based on node load.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|

This past week COTI was in Gibraltar at the offices of the Gibraltar Financial Services Commission (GFSC) to present its case for complying with the 9 principles set out by the GFSC, which is required to obtain a distributed ledger technology (DLT) license. In today’s world, Know Your Customer (KYC) and anti-money laundering (AML) procedures are an integral part of the onboarding process of many financial service businesses. KYC/AML legislation, however, does not address legislatory execution, which is why KYC and AML requirements often differ from bank to bank. This shortcoming becomes all the more magnified as KYC/AML procedures are difficult to outsource due to divergent regulatory requirements around the globe. Therefore, it is more effective to institute KYC/AML procedures within the framework of a functional payment ecosystem. COTI, Currency of the Internet, is one such payment network that aims to provide KYC/AML services for its users in line with applicable laws and regulations. COTI’s onboarding process is streamlined through its partnership with a number of reputable identity verification providers, such as globaliD, banks and exchanges. Users that join the COTI network can select their preferred identity verification provider to perform all relevant KYC/AML procedures. KYC/AML data in the COTI network is also used to calculate Trust Scores, which determine transaction fees and payment confirmation times. While identity verification may not be a problem for well-banked populations in developed countries, it is a major challenge in developing countries. COTI offers a functional solution for the unbanked population, which amounts to two billion people around the world without access to financial services, by providing a simple, convenient and regulated onboarding procedure. Carlos M. Martins Carlos M. Martins, COTI’s Gibraltar business director, recently explained the importance of this license along with COTI’s regulatory status in our Telegram AMA. In the Q&A, Carlos also answered the community’s questions regarding COTI’s legal, compliance and regulatory framework. Carlos, how are you helping COTI?I run COTI’s Gibraltar office and make sure that all COTI processes and procedures are compliant with local regulations. I also ensure that the KYC process works as smoothly as possible. How would you say your role at banks, such as Soc Gen, has helped prepare you for this role?Having worked at Credit Suisse and Soc Gen, I was able to accumulate plenty of insights into the banking sphere. Some of the major banks are still struggling with cryptocurrency concepts, but they will get there eventually. As a result, the understanding of how payments are traditionally processed highlights certain imperfections of current payment systems and helps to improve the industry. Is COTI regulated?COTI has applied for a DLT license in Gibraltar. The license for the exchange is currently in its final stage. The exchange platform and the ICO are both regulated in line with local regulatory frameworks. Why is COTI registered in Gibraltar?Because Gibraltar was one of the first jurisdictions in the world to create a legal and legislative framework for DLT technology. As COTI’s aim is to do business in a prudent manner and to provide clients with the safety of having a clear regulatory framework, we decided that Gibraltar was a very viable option. Aside from that, the government is very welcoming, the regulator is business-minded, the local lawyers are at professional and we have 300 days of sunshine per year. In which countries does COTI plan to have an operational license?We are looking into other countries that are crypto-friendly with a sound regulatory framework. Canada, Luxembourg, Switzerland, Japan and Australia are some options, as well as other countries. What is a DLT license?DLT stands for Distributed Ledger Technology, but it’s not only about blockchain, Bitcoin and Ethereum. DLT covers the whole spectrum of operations linked to blockchain technology. COTI is using a DAG that is based on DLT technology. If a legal entity wishes to operate in Gibraltar using blockchain technology, it will need to apply for a DLT license. Such licenses need to be approved by the regulator. You are welcome to read more at the following link www.fsc.gi/dltWhy does it take a long time to obtain such a license?You need to demonstrate that you comply with the 9 principles set out by the local regulator. It is not only a matter of saying that you do something, but providing evidence that you effectively do what you say. Unfortunately, there are players in the market that have nice and shiny whitepapers, but do not live up to the expectations they have created. Before issuing a license, regulators need to make sure that they are not licensing someone who does not play by the rules. These things take time. In Gibraltar, as compared to other jurisdictions, it will take 3 to 4 months to receive the license from the date of application. What are the 9 principles?The principles are: honesty and integrity, customer care, resources, risk management, protection of client assets, corporate governance, systems and securities access, protection against financial crime and resilience. What will getting a DLT license mean for COTI?It means that the COTI ICO and exchange will be operating from Gibraltar. What do we need KYC/AML for? How reliable are these procedures?We need to make sure that the clients we onboard do not have a criminal background or any association to money laundering or terrorist financing. Our procedures are fully aligned with the 4th Anti-Money Laundering Directive (4AMLD), as well as 5AMLD. So this is quite reliable and well ahead of the game. Why is the KYC registration process taking so long? Can you do something to speed up the process?We have asked our clients to complete KYC/AML registration in order to prepare them for the upcoming ICO. Due to high demand, we have received a large influx of whitelist registrations. We value your patience during this time and apologize for any inconvenience this may have caused. Why is the US restricted?We have an appetite to conduct business in the United States and plan to expand into it in a prudent and responsible manner once our regulatory environment is well established. From a legal standpoint, the US government has instituted restrictions for citizens and residents participating in ICOs and cryptocurrency-related endeavours. Therefore, registration from restricted countries will not be possible in the initial stages, but we do plan to become widely-adopted globally. Carlos, how would you convince people to trust you with their documents?As of 25 May, 2018 the updated General Data Protection Regulation (GDPR) was released. The GDPR sets forth very stringent regulations regarding how client information is stored and managed. COTI complies with all such regulations for its KYC procedure. You can view the GDPR requirements online and how COTI complies with them. What do you think about the future of cryptocurrencies?In my opinion, this is a major revolution that will change everything. For the time being, the majority of regulators are trying to assess the crypto space according to what they know and the models that are familiar to them. They are growing into the space like everyone else and are learning at the same time. I am sure that DLT technology will be used to make regulations more efficient, effective and less cumbersome in some aspects in the future. Do you have anything to say to the community before the community pre-sale registration ends?It is great to have you all there supporting this project. You are making it happen, and we are very grateful for all the support you have provided us with. We are incredibly grateful to have such a loving and supportive community.       Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group Talk with us on Telegram Official Facebook Official Twitter Official Reddit Official Youtube Channel COTI Group |

|

|

|