http://bithumb.cafe/archives/33189Bithumb Verified account @BithumbOfficial 2h2 hours ago More Bithumb urgently ask our valuable customers not to deposit any fund into Bithumb wallet addresses for the time being. https://twitter.com/BithumbOfficialhttps://www.wsj.com/articles/korean-cryptocurrency-exchange-bithumb-loses-more-than-30-million-in-hack-1529465655Korean Cryptocurrency Exchange Bithumb Loses More Than $30 Million in Hack Security concerns have plagued the digital currency industry and impacted prices A customer leaves the Bithumb exchange office in Seoul earlier this year. A customer leaves the Bithumb exchange office in Seoul earlier this year. PHOTO: SEONGJOON CHO/BLOOMBERG NEWS By Eun-Young Jeong and Steven Russolillo June 19, 2018 11:34 p.m. ET 3 COMMENTS Seoul-based bitcoin exchange Bithumb said Wednesday it had lost over $30 million as the result of being hacked, the second cyber attack in two weeks to hit a major South Korean cryptocurrency exchange as safety concerns hamper the industry and weigh on prices. Bithumb said it had lost $31.56 million (35 billion won) worth of cryptocurrencies and has temporarily halted withdrawal and deposit services. The company said it would compensate customers for all lost assets. Bitcoin fell about 2% immediately after Bithumb disclosed the hack and recently traded around $6,600, according to research site CoinDesk. Bitcoin has lost over half its value this year and trades well below its all-time high of nearly $20,000 hit in December. Its low for the year came in February, at just under $6,000. “Anytime a hack happens, it’s bad for the industry as a whole,” said Yo Kwon, chief executive of Hosho Group, a cybersecurity startup focused on blockchain. “But these hacks happen so frequently that it almost seems like it’s just part of the market these days.” Bithumb once dominated global trading in cryptocurrencies. At the height of the cryptocurrency craze in South Korea late last year, it frequently reached No. 1 in terms of daily trade volume. It has since been surpassed by local rival Upbit, where the majority cryptocurrency trading in South Korea now takes place. Bitcoin prices fell earlier this month after another South Korean cryptocurrency called Coinrail said it lost 70% of its digital assets from a “cyber intrusion.” Investors have lost over $1.4 billion from exchange hacks globally since 2014, according to an analysis by The Wall Street Journal. In a paper published Wednesday by the Asia Securities Industry & Financial Markets Association, the trade group outlined what it believes are best practices for cryptocurrency exchanges. The paper included guidelines on various issues, including market manipulation, regulatory considerations and custody recommendations. “Despite the growth, there has been trouble in paradise,” the paper said, noting that hacks on some of the bigger exchanges in Asia have resulted in hundreds of millions of dollars worth of bitcoin being stolen. “In many cases, there is a lack of due diligence and independent insight on many of the industry’s new token sales that have led to failures caused by fraud, manipulation and mismanagement,” ASIFMA said. Mr. Kwon of Hosho Group, who counts several cryptocurrency exchanges as clients, said their lack of adequate security entices hackers to steal from them. “It’s such bait for hackers because the reward is so immense,” he said, adding that it can be an easier way to make money than stealing social security numbers or account information from more traditional companies. “If you hack an exchange and succeed, you immediately have assets that are worth something.” Write to Eun-Young Jeong at Eun-Young.Jeong@wsj.com and Steven Russolillo at steven.russolillo@wsj.com

|

|

|

|

This is one of the beauties of the blockchain. You can not hide it when no one is using your project. And you can evaluate which project is most used quickly. Without relying on third parties. Paul Everton |

|

|

|

ARBITAO: The New Way of Arbitrage Trading https://bitcointalk.org/index.php?topic=4455437.0 COINECT - AI-Based Decentralized Arbitrage Trading System https://bitcointalk.org/index.php?topic=4419682.0 Esse dois projetos estariam prometendo lucros com arbitragem. Eles ofereceriam uma plataforma e o robo deles operaria em diversas exchanges. Tinham o mesmo papo de 300 oportunidades economicas ou algo do tipo. Estavam começando a gastar bastante com publicidade, mas para gastar mais, criaram um ICO. E estavam com campanhas de assinaturas, social media etc. São scams bem bizarros. Foram desmascarados pelas montagens ridiculas e por falsificar algumas informações, copiar trechos do whitepaper etc. Mas achei curioso por oferecer um modelo similar ao da Atlas. Será que a Atlas sobreviveria ao escrutinio do forum global? Por sinal, por que raios a Atlas, que é uma empresa americana, não investiu no mercado global? |

|

|

|

All transfers of the $800M marketcap ICON (ICX) are completely disabled due to fatal bug in smart contract (self.CryptoCurrency) submitted 5 hours ago * by NotYourMothersDildo https://etherscan.io/address/0xb5a5f22694352c15b00323844ad545abb2b11028Earlier this morning, a smart contract bug was first discovered in Yggdrash (YEED) that allowed anyone except the contract creator to enable and disable token transfers for everyone. A short while later the same bug was found in the Icon (ICX) smart contract. A few minutes ago, someone began spamming the contract with disable transfer transactions. ICX is unable to be moved from any wallet at this point. edit: And now Binance has suspended ICX withdrawls and deposits. edit2: Binance has re-enabled the ICX wallet. Currently token transfers are enabled but may be disabled by the smart contract and anyone with the gas to send in the command. https://www.reddit.com/r/CryptoCurrency/comments/8rfm9w/all_transfers_of_the_800m_marketcap_icon_icx_are/NotYourMothersDildo

31 points 5 hours ago

The actual bug is pretty fucking funny:

modifier onlyFromWallet {

require(msg.sender != walletAddress);

_;

} |

|

|

|

Famed hedge fund trader and bitcoin evangelist Mike Novogratz announced today that his Galaxy Digital Ventures is investing $15 million in blockchain startup AlphaPoint, a New York-based company that aims to simplify the way assets are issued on a blockchain by essentially offering customers the technology used to create crypto exchanges. In this way Novogratz, a onetime billionaire macro-trader for New York City’s Fortress Investment Group, is doubling down on his numerous blockchain and cryptocurrency investments, backing a proverbial pick-and-shovel maker in the budding sector. AlphaPoint, an early entrant to the cryptocurrency space, already counts customers that include commodities giant CME Group, the Royal Mint of England and more. But with the funds from Novogratz’s newly launched firm, AlphaPoint CEO Salil Donde hopes to expand that to include a wide range of other assets that have traditionally been difficult to trade. read more about on forbes |

|

|

|

Novo site para quem gosta de usar paper wallet criando ela off line. Ele cria endereços SegWit e Bech32. Achei muito simples e prático. Mas não tem muito review então use com precaução. Funções: - SegWit and Bech32 Support

- Hierarchical Deterministic (HD) Wallets

- (password-protected) Mnemonics

- Possibility to show extended public keys

- We have changed the additional entropy generation from mouse movements to using the NPM package more-entropy in the background

Tem muito mais funções que os outros sites desse tipo. Pode baixar num arquivo html e utiliza-lo offline. Ann do site: https://bitcointalk.org/index.php?topic=4461152.msg40004259GitHub: https://github.com/dalitsairio/coinglacier.orgSe visitar o site diretamente já vai criar uma carteira: coinglacier.org A paper Wallet já é criada no formato de uma folha. |

|

|

|

ChinaMoneySequoia Capital China is said to have led a US$400 million pre-IPO round in Beijing-based Bitcoin miner and mining chip designer Bitmain Technologies Ltd., valuing the firm at US$12 billion, according to Chinese local media reports citing insiders. Bitmain refused to comment on the matter. Sequoia Capital China did not immediately respond to China Money Network’s email seeking comment. The report also said that Bitmain plans to apply for an initial public offering in Hong Kong in September and expects to go public with market capitalization between US$30 billion to US$40 billion by the end of this year. Founded in 2013, Bitmain develops and sells Bitcoin mining machines using its application-specific integrated circuit (ASIC) chip technology. It has offices in Amsterdam, Hong Kong, Tel Aviv, Qingdao, Chengdu, Shanghai and Shenzhen. Jihan Wu, Bitmain’s co-founder said in an interview with Chinese media that his company will expand Bitcoin mining machines in the next few years to maintain its competitive edge. The company will also release artificial intelligent chips. Bitmain’s planned IPO follows China’s second largest Bitcoin mining machine manufacturer Canaan Inc’s IPO in Hong Kong in May. Canaan experienced a 28-times growth in revenues and 43-times growth in gross profit in the two years between 2015 to 2017 as Bitcoin mining reached its peak.

|

|

|

|

https://steemit.com/quantum/@vit05/arbitragem-de-cambio-quantum-atlas-furlan-e-a-sadia-teriam-algo-em-comumEsse texto seria uma resposta, mas tomou vida própria Sobre a campanha, vi que a agencia responsável é muito pequena. Focada exclusivamente em growth marketing. hagens.com.br. Ou seja, essas propagandas em midias socias que buscam exclusivamente o engajamento. Acho estranho dar tanto dinheiro para uma empresa pequena como essa. Na página deles não tem nenhum grande case. Tiveram habilidade em recrutar personalidades bastante conhecidas para essa tarefa. Tata Werneck é um fenômeno. Eu pouco a conheço, mas parece que ela é atriz, apresentadora, humorista etc. Nas midias sociais são poucos brasileiros que chegam perto do sucesso que ela faz. Principalmente em engajamento, as pessoas respondem ao que ela fala, repercute. E isso é refletido nas dezenas de campanhas que ela participa. Acho que não teria escolha melhor. E o Cauã é muito conhecido também, global e tal. Isso mostra um pouco do projeto da empresa Atlas. Eles buscam varejo. Jovens, que utilizam as redes sociais com frequência e conhecem pouco sobre Bitcoin, embora já tenham ouvido falar sobre os "lucros". Que possuem renda suficiente para uma poupança, ou titulos do governo, mas não o suficiente para se aventurar na bovespa. Por não possuir o suficiente para o longo prazo, ou não possuir conhecimento. E o melhor, quando sacam, não é um valor fora do comum. Facilita a liquidez. Ai começa a ficar ainda mais curioso. Essa galera tem Reais, dificilmente Bitcoins. Provavelmente estariam dispostas a arriscar em algo em que não vão pesquisar o suficiente sobre a mecanica e planejamento de uma empresa. Nunca leram um balanço ou esmiuçaram um código no github. Já que tem o endorsement de pessoas muito conhecidas, tem sede, tem milhares de empregados, tem investidores, tem chuva de prata E tem o Furlan. Quando ouvi que o Furlan participaria da associação criada pela Atlas, estranhei. Depois vi que não era o Luiz Fernando Furlan da Sadia, mas o seu primo. Só que fica uma curiosidade. Por qual razão não foram atrás de corporações ou grandes investidores? Porra, o ex presidente do CADE abre qualquer porta no Brasil. Teve contato direto com os principais empresarios do País. Com os principais politicos. Enfim, talvez foram, não sei. Mas isso me fez lembrar da interessante história da familia Furlan e do seu relacionamento com o cambio de moedas. Luiz Fernando Furlan é neto do fundador da Sadia. Foi um dos responsáveis por ela se tornar uma quase gigante internacional. Trabalhou para o governo do Lula como Ex-ministro do Desenvolvimento, Indústria e Comércio Exterior. Pois bem, saiu quando a sua empresa faliu e ele teve que correr para tentar resgata-la. E faliu depois de receber seguidas injeções de dinheiro nos mesmos moldes que a JBS recebeu. Via fundos de pensão e BNDES. Essa grana que ela havia recebido era para, também, criar uma gigante internacional. Que exportasse frango para o mundo todo. Ela já exportava bastante e explodiu criando laços com mercados que estavam em plena expansão. Russia, China, India etc. Por conta disso, tinha uma atuação pesada no cambio com derivativos. Com o tempo, ela virou uma empresa de especulação, o frango era um detalhe. A Sadia sempre foi uma empresa diferente. Utilizava os lucros da linguiça para algumas apostas e sempre foi próxima aos governos. Seu fundador chegou a ser Senador pela Arena. Ela fundou uma empresa de aviação para fugir dos buracos nas estradas e ganhou gordos incentivos por conta disso. A transBrasil. Fundou corretoras e investiu em outros ramos. O pai do Luiz Fernando Furlan foi um dos primeiros a pensar mais no mercado financeiro do que na fabricação de salsichas. Nos anos 80 havia feito uma série de operações no mercado e foi repreendido pelo sogro: Walter Fontana fizera na surdina um levantamento da compra e da venda de ações da Sadia nos últimos tempos. Osório Furlan havia realmente comprado papéis da Sadia. Mas, em vez de repassá-los para a fundação, anexara uma parte substanciosa deles ao seu portfólio. Sem que ninguém no clã soubesse, Osório ultrapassara o teto de 10% das ações que cabiam individualmente a cada sócio controlador. Abocanhara 14% das ações e, caso seduzisse alguns familiares, mandaria na empresa. Nada mal para Osório, que fora garçom em Concórdia, a cidadezinha catarinense onde nascera a Sadia, antes de se casar com a filha mais velha de Attilio Fontana e virar diretor da empresa. http://piaui.folha.uol.com.br/materia/o-setembro-negro-da-sadia/“Attilio Fontana desconfiava do mercado financeiro. Todas as vezes que um banco lhe oferecia ganhos fantasmáticos com papéis, ele dizia não. Um dos herdeiros da Sadia me contou que, certa vez, após ter recusado um investimento, Fontana reuniu os conselheiros da companhia, à época todos da família, e perguntou: “Essa empresa existe para quê?” Ele mesmo respondeu: “Para vender frango, vender peru e fazer solsicha. Se é para fazer diferente, é melhor abrir um banco. Mas não quero ter um banco, quero ter um frigorífico.””

Já nos anos 2000, a empresa continuava apostando em operações do mercado. O Consultor Malvessi fez uma pesquisa sobre a empresa e encontrou fatos curiosos Malvessi chamou a atenção para o excesso de operações financeiras feitas pela companhia. Demonstrou em um PowerPoint que desde 1996 o lucro da Sadia vinha, em grande parte, de transações com papel, e não mais com frango e peru. O recurso às aplicações financeiras se deu quando o presidente do conselho era Luiz Fernando Furlan.

2007. Nessa, disse que o lucro operacional — o que vem da venda dos produtos — representava 57% dos ganhos da empresa. Os outros 43% provinham de transações financeiras. Com essa habilidade no mercado financeiro, eles planejaram uma compra HOSTIL da Perdigão. Não conseguiram. Mas na operação o cunhado do Luiz Fernando Furlan utilizou informação de bastidores e lucrou bastante na Bovespa. Mais tarde foi acusado pela CVM por essa operação irregular a chamada inside trading. A compra acabou dando errado. Os fundos de pensão se uniram e evitaram utilizando os instrumentos do mercado. Mesmo assim, parecia que tudo estava indo bem na Sadia. Tinha caixa, pagava gordos dividentos. Até o tombo numa aposta. Planejando comprar um outro frigorifico por alguns Bilhões, alavancaram ainda mais as operações no mercado. Principalmente no cambio, apostando numa queda do dolar. No dia seguinte, às oito e vinte da manhã, o diretor-financeiro Adriano Ferreira entrou chorando na sala de Walter Fontana Filho. Disse-lhe para esquecer a compra da Frangosul e anunciou: havia perdido o controle das operações de câmbio e a Sadia estava com 5 bilhões de dólares a descoberto no mercado de derivativos. A empresa tinha fechado posições de câmbio a 1,60 real, apostando que o dólar não subiria. Mas, naquele dia, a moeda já havia ultrapassado 1,80 e essa diferença, pelo contrato com os bancos, tinha que ser paga em dobro. Quebraram. Sim. Uma empresa com milhares de funcionários. Escritórios. Um caixa gordo. Quebrou por apostar numa série de operações com cambio que deram errado. Tentaram ainda durante algum tempo um resgate do governo. Conseguiram um emprestimos de quase 1 bilhão do Banco do Brasil. Mas a ajuda do BNDES, que já havia ajudado a JBS, não chegou. A vontade do governo era outra. Queriam uma fusão com a Perdigão. A Perdigão, é bom frisar, tem como principais investidores os fundos de pensão das estatais e o próprio BNDES. Assim surgiu a Brasil Foods. A Sadia ficou com 32% da nova empresa — sendo 12% da família — contra 68% da Perdigão. Bom, hoje a BR Foods está um pouco confusa. Mudou o conselho, mudou presidente, mudou diretoria. O Previ e outros fundos começaram a ser mais atuantes exigindo TRANSPARENCIA. Um outro frigorifico tenta uma fusão, a China não quer mais flango, o Pedro Parente chegou etc. Não sei se existe uma relação direta entre a familia Furlan, BR Foods e a Atlas. Ou relação entre alguém que já tenha trabalhado na Sadia e a Atlas, ou com a aceleradora Wow. Ou com o fundo Tarpon. Talvez o Furlan, ex-CADE, atue como uma espécie de lobista apenas, embora seja um tento estranho que alguém com tantos anos no governo tenha se apaixonado logo pelo Bitcoin. Talvez ele tenha, assim como Satoshi, uma revolta contra o sistema bancário e os instrumentos que levaram a crise financeira. Mas a Atlas tem uma história pra lá de estranha. Uma sede que é apenas uma caixa postal num paraiso fiscal dos EUA, mas com uma subsidiaria num mega escritório em SP. Com dinheiro para campanhas milionárias, mas sem recursos para uma auditoria. O ex mentor da aceleradora, vira diretor. Que possui um algoritimo revolucionário trabalhando em exchanges internacionais, mas só vende planos no Brasil. É um conjunto de fatores que permitem especular os mais doidos cenários. Fontes: http://piaui.folha.uol.com.br/materia/o-setembro-negro-da-sadiahttps://www.instagram.com/tatawerneck/?hl=enhttps://portaldobitcoin.com/bancos-200-mil-atlas-brigas-abcb/https://www.istoedinheiro.com.br/noticias/financas/20061025/sadia-sem-segredos/14881https://www.bloomberg.com/news/articles/2018-05-21/biggest-pension-fund-in-brazil-turns-into-a-50-billion-activisthttp://g1.globo.com/Noticias/Economia_Negocios/0,,MUL775084-9356,00-OPERACOES+DE+CAMBIO+FAZEM+ACOES+DA+SADIA+E+DA+ARACRUZ+DESPENCAREM.html

|

|

|

|

cointelegraphHypothekarbank Lenzburg has become the first bank in Switzerland to provide business accounts to blockchain and cryptocurrency companies, Cointelegraph auf Deutsch reported June 6. While Falcon Private Bank has provided crypto asset management services since last year, Hypothekarbank Lenzburg CEO Marianne Wildi confirmed that they are first bank in the country to open company accounts for blockchain and crypto-related fintech companies. Wildi said: "As a bank that sets itself up technologically and pursues a cooperative strategy in the field of fintech, it is also a matter of credibility to work together with the young sector of crypto and blockchain companies in Switzerland". Wildi noted that she was aware of "the money laundering problem in the area of crypto companies and Initial Coin Offerings (ICOs)”. The bank reportedly examined the relevant risk and compliance issues "very precisely," in addition to informing the Swiss Financial Market Supervisory Authority (FINMA) before deciding to cooperate with crypto startups.

|

|

|

|

Shifting from Central Planning to a Decentralised Economy: Do we Need Central Banks?by Professor Richard A. Werner, D.Phil. (Oxon) I. The Central Bank Narrative For more than the past four decades, public policy discourse, especially when touching on macroeconomic and monetary policy, has been dominated by the views held and actively sponsored by the central banks, particularly in Europe and North-America, as well as Japan. Their policy narrative has been consistent over time and virtually identical between central banks, which is why I shall refer to it collectively as the ‘central bank narrative’. It has been mirrored in the type of economics that central bankers have supported and that has indeed subsequently become dominant in academia and among the economists selected as the experts of choice in the major newspapers and television channels: the theoreticians advancing neo-classical economics. This central bank narrative (and hence also the dominant neo-classical economics, also known as ‘mainstream economics’) has at least five major pillars, which I shall list briefly:

The truth of the matter is: We don’t need central banks. Since 97% of the money supply is created by banks, the importance of central banks is far smaller than generally envisaged. Moreover, the kind of money that commercial banks create is not privileged at law. Legally, our money supply is simply private company credit, which can be created by any company, with or without banking license. Eurozone countries, having given up the right to their own currencies, can still create money and reflate the economy: the government, for instance in Spain, simply needs to stop the issuance of government bonds, and fund the entire public sector borrowing requirement from the domestic banks that create it out of nothing – and can do so at more competitive rates as the bond markets: this policy of Enhanced Debt Management (Werner, 2014b) not only would make it obvious that Spain does not need the ECB, but it would also put the national debt profiteers – the bond underwriting firms such as Goldman Sachs and Morgan Stanley – out of business. This reality of private money creation also means that we can, without legal obstacles, create a decentralized system of local currencies, without central bank involvement. The key principle of such decentralization is local autonomy, self-determination, self-responsibility and self-administration. These are in fact the fundamental principles of the co-operative movement, as championed by Hermann Schultze-Delitzsch and Wilhelm Raiffeisen over 150 years ago. This co-operative movement early on realized that a crucial role for co-operatives is in the creation of co-operative banks controlled by the local communities. Sadly, in the UK credit unions are not banks, since they are not allowed to lend to firms in meaningful amounts, and don’t have a banking license. Thus we need to create true community banks. Lord Action pointed out: “It is easier to find people fit to govern themselves than people fit to govern others”. “Towns were the nursery of freedom.” The German banking system is dominated by 1,500 community banks, which are also the majority of banks in the entire EU. This means that 80% of German banks are not-for-profit, which has strengthened the German economy for the past 200 years. A banking system consisting of many small banks is also far less prone to boom-bust cycles and it creates more jobs per given amount of loan than large banks. Thus community banks also result in a more equal income and wealth distribution. Local banking is highly popular in Germany, because SMEs get access to finance that would not be serviced by large banks. The community banks provide their services at competitive rates and support their customers also during recessions. With community banks, the wider community gets a bank whose goals are aligned with theirs, banks that pay taxes, banks that support local growth and jobs. At the same time community banks offer customers a place to put their money where it can benefit the local community, not far-flung projects or speculators. Can we tackle this challenge? Until the 1970s, there has been much optimism in economics and there have been high expectations that many of the problems of mankind would soon be solved. Was this a reasonable expectation? While it has not come true, it was a reasonable expectation. This is because “Our problems are man-made, therefore they may be solved by man. And man can be as big as he wants. No problem of human destiny is beyond human beings” John F. Kennedy

|

|

|

|

Investors Bet $4 Billion on a Cryptocurrency StartupPAUL VIGNA on WSJ A start-up company based in the Cayman Islands is on track to raise more than $4 billion through a yearlong sale of digital tokens—the largest fundraising of its kind. What buyers of the tokens still don’t know: how the company, block.one , will use the bulk of the windfall from its so-called initial coin offering. If the company ends up raising that much by the offering’s expected closing date, this coming Friday, it would be more than twice the size of the next largest coin offering— Telegram Group Inc. raised $1.7 billion—and would be larger than all but one or two of the world’s initial public offerings on stock exchanges so far in 2018. That a little known startup could raise so much money without a concrete plan for it speaks to trends in the topsy-turvy world of cryptocurrencies and views of the future of the online world. The company didn’t reply to a request for comment. Virtual currencies like bitcoin and ether experienced a meteoric rise in 2017, drawing interest from everyday investors as well as Wall Street. That helped fuel a frenzy around initial coin offerings. These differ from virtual currencies in that the tokens being sold are often tied to a product or service a company plans to develop or offer in the future. Although prices of bitcoin and other cryptocurrencies crashed early this year, investors kept shoveling money into coin offerings. ICOs raised $6.6 billion in 2017, and in 2018 they have raised about $7.15 billion, according to research firm Token Report, a total that doesn’t include block.one. Some coin offerings have been exposed as scams, and others are from companies that may never actually develop a product or service. But many investors see them as a way to strike it rich investing in startups the way venture-capital firms have for decades. While the ICOs run the gamut from gambling to matchmaking apps, the most hyped projects have been for so-called “platforms” that could redefine broad areas like the internet or smartphone apps, offering general-purpose platforms for developers. Block.one and its token, which it calls EOS, fall into this category. The idea is that such platforms could help reshape the architecture of the online world, ushering in an internet 3.0. It’s similar to Google’s Android, but the platform wouldn’t be owned by a single company. There is also hope that such platforms could vastly improve the future of online payments through the open-ledger blockchain technology that underpins bitcoin and other cryptocurrencies. One formidable competitor is Ethereum, the platform that underpins the currency ether. It has been successful in some ways—it’s the second largest virtual currency behind bitcoin. But it has struggled to scale: Ethereum can process only about 15 transactions per second. EOS and its rivals think they can beat Ethereum to mass adoption by creating systems that aren’t as decentralized, and so can process more transactions per second. Essentially, they are trying to occupy a space between Ethereum and Android. The money raised in the coin offering gives block.one a war chest that dwarfs its newer rivals. Theoretically, the company could use the funds to support the software it is developing, also called EOS. Yet block.one isn’t clear about how exactly it will spend the proceeds. The company plans to build a platform for hosting web applications; the first live version is set to be released in June. There’s a twist, though: The company doesn’t plan to develop the software after releasing it. It hopes to see others do that and has said it won’t operate any public network built upon the EOS software. To that end, block.one has pledged to invest more than $1 billion in startups building on EOS. It hasn’t said, though, what it will do with the remainder of the funds. Block.one is expanding. Its website lists eight jobs for software engineers in Blacksburg, Va., where the company’s chief technology officer, Dan Larimer, lives and works. The company also recently hired a new general counsel, former Bank of New York Mellon lawyer Lee Schneider, and a new chief financial officer, Rob Jesudason, who was CFO of Commonwealth Bank of Australia. Both report to Brendan Blumer, the company’s 31-year-old, Hong Kong-based CEO. None of the company’s executives responded to requests for comment. Besides the possibility of a new platform, investors are also drawn to the presence of Mr. Larimer, who has worked on other popular coin offerings. “I believe the (block.one) team has the technical capability of carrying this project out,” said Dafeng Guo, a 30-year Hong Kong citizen living in Shanghai. Mr. Guo started buying EOS last summer and said he was impressed by the project’s plans to become a mainstream platform. “I believe in EOS,” he said. Block.one has sold 900 million EOS tokens over nearly a year, most via daily auctions. Every 23 hours, it has auctioned off 2 million tokens, and accepted the high bid as the set price for that block. It has received proceeds from the sale in ether. To steer clear of regulators, the firm blocked investors in the U.S. and China, though some used technical workarounds to get in on the action. Based on those sales, which are visible through digital wallets, it appears the company will raise more than $4 billion.

|

|

|

|

|

For a long time I used the open source coinmarket API daily. I guess not just me, but a hundred people. Over the last few days, they seem to be limiting requests. But it is not very clear what that limit would be. I already tried to change with the trigger without any success.

Is there any other site that provides a similar function to keep up with the market price of Bitcoin and altcoins?

|

|

|

|

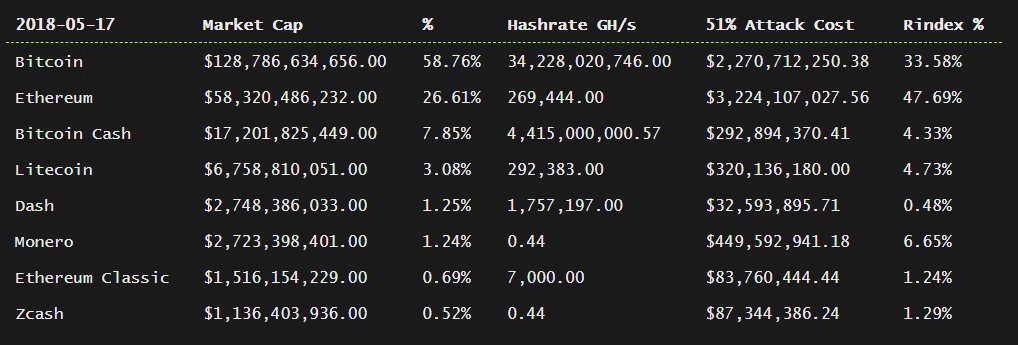

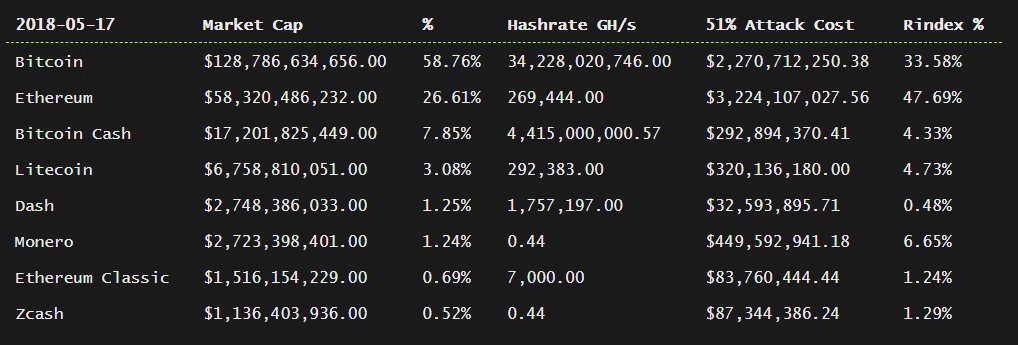

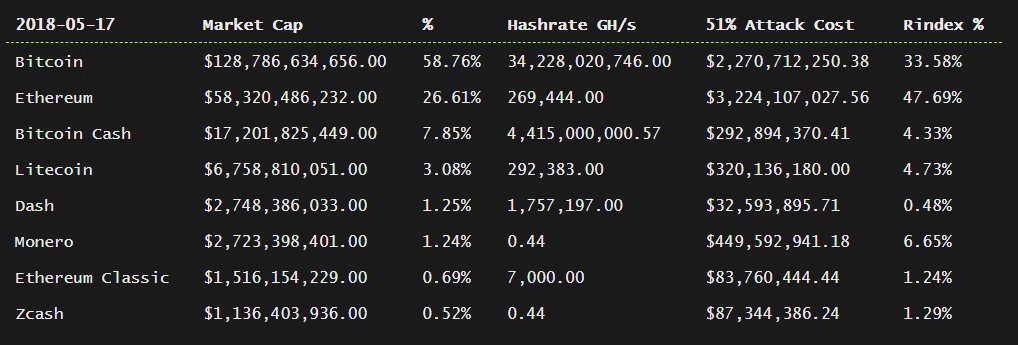

Source: http://rindex.io/attack-costAchei curioso esse número. É bastante improvável já que além desse custo ainda teria o risco de terminar sem nada. Mas isso mostra que pra maioria dessas shitcoin é algo bastante possivel. Como ocorreu com o Bitcoin Gold. Ainda mais para os projetos brasileiros... |

|

|

|

Is this chart correct? It would show how improbable something like that would occur to Bitcoin, even to a government. And yet, if the attack succeeds, it can end up without profiting. But I found it curious that some other currencies seem to have a relatively acceptable possibility. And like the shitcoin BGold, they are open to such an attack. This shows how risky it is to bet on bad projects or badly made copies. We're not in a casino, be careful where you invest.  Source: http://rindex.io/attack-cost |

|

|

|

|

Tenho essa curiosidade já que a maioria dos tópicos que vejo parecem ser de brasileiros. No entanto as duas abas específicas dos paises possuem movimentações próximas de posts. Não é pra saber onde mora, nem nada do tipo. Apenas a nacionalidade.

|

|

|

|

Source: CCNA malicious miner successfully executed a double spend attack on the Bitcoin Gold network last week, making BTG at least the third altcoin to succumb to a network attack during that timespan. Bitcoin Gold director of communications Edward Iskra first warned users about the attack on May 18, explaining that a malicious miner was using the exploit to steal funds from cryptocurrency exchanges. To execute the attack, the miner acquired at least 51 percent of the network’s total hashpower, which provided them with temporary control of the blockchain. Obtaining this much hashpower is incredibly expensive — even on a smaller network like bitcoin gold — but it can be monetized by using it in tandem with a double spend attack. After gaining control of the network, the attacker began depositing BTG at cryptocurrency exchanges while also attempting to send those same coins to a wallet under their control. Ordinarily, the blockchain would resolve this by including only the first transaction in the block, but the attacker was able to reverse transactions since they had majority control of the network. Consequently, they were able to deposit funds on exchanges and quickly withdraw them again, after which they reversed the initial transaction so that they could send the coins they had originally deposited to another wallet. Source: CCN

|

|

|

|

The lead developer of Monero has unveiled a new second-layer protocol that will allow users to create and trade digital assets on top of the privacy-centric cryptocurrency’s network. The open-source project, called Tari, will make it possible to program and issue non-fungible assets like loyalty points, in-game items, and concert tickets over the blockchain. The tokens will function similarly to ERC-721 tokens in the ethereum network (e.g. CryptoKitties), enabling users to take ownership of unique digital assets. “Tari will fundamentally change the way we interact with digital assets,” said co-founder Naveen Jain. “We are building an amazing team to steward the most useful decentralized platform in existence, empowering anyone to issue, manage, use and transfer their digital assets.” Though not the first project to use blockchain technology to allow users to trade digital assets, co-founders Jain, Riccardo “fluffypony” Spagni, and Dan Teree claim that it is the first to be optimized for this specific use case, making it ideal for businesses who desire to use it at scale. Tari will be structured as a sidechain to the main monero network, enabling users to merge-mine its token with XMR. Spagni, who is also the lead developer of XMR, stressed that this new project will not detract from his commitment to the Monero project, adding that he is stepping back from other professional obligations to make time in his schedule. He said: “I’m excited to draw from my experience to build something on top of Monero, and to create a modern digital assets-focused protocol that leverages the Rust programming language. We have the resources to expand Monero’s world-class developer community, and I look forward to launching and stewarding a next generation protocol that is truly useful.” Tari has received financial backing from a number of venture capital firms, including Redpoint, Trinity Ventures, Blockchain Capital, and Pantera. CCn |

|

|

|

Nome URL Fork https://www.bitcoincash.org 478,558 http://bitcoinclashic.org (Forked from Bitcoin Cash) http://cdy.one (Forked from Bitcoin Cash) https://bitcoingold.org 491,407 https://bitcore.cc 492,820 http://btcd.io 495,866 https://bitcointalk.org/index.php?topic=2316571.0 498,533 https://bithot.org 498,777 https://www.ub.com 498,777 https://bcx.org 498,888 http://supersmartbitcoin.com 498,888 http://oilbtc.io 498,888 http://www.btceasypay.com 499,345 https://btw.one 499,777 http://bicc.io 499,888 https://lightningbitcoin.io 499,999 https://bitcoinstake.net 499,999 http://bitcoinfaith.org 500,000 http://biteco.io 500,000 https://www.btn.org 500,100 https://www.bitcointop.org 501,118 https://www.bitcoingod.org 501,225 https://fbtc.pro 501,225 https://www.bitcoinfile.org 501,225 https://www.bitcoincashplus.org 501,407 https://b2x-segwit.io 501,451 http://p.top 501,888 http://www.bitcoinore.org 501,949 http://www.wbtcteam.org 503,888 https://bcs.info 505,050 https://bitvote.one 505,050 https://bitcoininterest.io 505,083 https://bitcoinatom.io 505,888 http://btsq.top/ 506,066 http://bigbitcoins.org 508,888 https://btcprivate.org 511,346 https://https://bitclassic.info 516,095 https://www.bitcoinclean.org 518,800 https://btchush.org 1st February 2018 https://www.bitcoinrh.org Unknown https://www.bitcoinlite.net Unknown https://www.bitcoinlunar.org Unknown https://www.savebitcoin.io Unknown http://bitcoinhex.com Unknown |

|

|

|

Phil Zimmermann is the creator of Pretty Good Privacy (PGP)I'm looking for some article or news where he expresses his opinion about Bitcoin and Cryptocurrencies, but I have not found any relevant. Is there any good article where he comments on this new economy? Could it be about any particular project or about blockchains.

|

|

|

|

|