A

lengthy response to the claim that "bitcoin was only created to launder money"

Bitcoin’s Affect on US Banks Money LaunderingWhile the US banks are crying about over-regulation and Fox News reports that crypto increases money laundering to their viewers in America, we thought it would be fun to see

how much money American banks have laundered over the last decade.

Since the taxpayers covered the $21bn cost to bailout the banks a decade ago, they’ve surely learned their lesson and changed their ways.

While there is dispute in the press and government about the cost of regulating the financial industry being between $1.2 trillion or $2 trillion annually, the costs could easily be brought down if taxpayers realized how much money laundering is continually being found in the banking system.

Money Laundering and Manipulation by US BanksWhen

JPMorgan paid $65 million for manipulating the benchmark for interest rate derivatives, it took regulators years to investigate and prove, while the bank was allowed to pay a fine and neither admit or deny the regulators “claims” of wrongdoing.

Goldman Sachs paid $120 million for the same fraud investigated by regulators.

Bank of America paid $30m to settle charges it manipulated global interest rates for 6 years on customers purchased products from the bank.

In 2006, when Bank of America admitted to allowing

$3 billion to be laundered through a single Manhattan branch, the bank claimed in a statement to “take seriously it’s anti-money laundering obligations.”

Years later

Bank of America paid $17 billion in penalties for profiting off loans they knew would never be paid, while mocking the “due diligence” processes regulators required.

Their fine for not following money laundering procedures in 2017 was only $13 million. The “allegations” date back to 2010 and 2011, so the investigation and time for settlement negotiations must have cost the tax payers a lot for that one.

Citibanks Money Laundering FinesCitigroup puts so much effort dealing with money laundering “allegations,” it’s hard to imagine they have time to manipulate global interest rates.

They still found the time to manipulate interest rates though and overcharge customers back in 2008 and 2009.

Citibank paid a $100 million fine this year for the fraudulent activity. That’s almost ten years regulators and lawyers had to negotiate after a crime was committed for a settlement and story to tell the public.

They were also fined

$70 million in 2018 for failure to comply with anti-money laundering laws.

In Ireland,

Citibank was

fined €1.33 million as well this year for loan breaches, we’ll stick to the US fraud with these global banking giants, for the most part though.

In 2015

Citibank were

ordered to pay $700 million in consumer relief for illegal credit card add-ons charged to customers. If consumer fraud against 7 million banking customers isn’t a good way to market buying bitcoin, we don’t know what is.

In 2017

Citigroup kindly agreed to pay a

$97 Million settlement for laundering money in Mexico after their Banamex USA federal investigation took years to uncover the banks misdeeds.

JPMorgans Illegal ActivitiesSome might say Citibank is just one bank that had some bad apples, it’s no reason to “bank on bitcoin” in the US. They never followed JPMorgan and their illegal activities over the last few years.

JPMorgan admitted no wrongdoing when paying

$2.8 million in 2017, for eight years of lacking proper safeguards for customers.

In 2014 though,

JPMorgan paid out whopping

$2.6 billion to settle “allegations” that they helped Bernie Madoff rob people for 20 years. Then they settled other “claims” that they assisted Madoff with theft but it was only $218 million and $325 million to settle those.

Bernie Madoff’s Ponzi scheme was estimated to have cost investors between $12 and $20 billion. He was on the board of governors of the National Association of Securities Dealers, now called Finra. He also helped create the Nasdaq stock market, where JPMorgan earned the $3 billion it paid to settled for their connection to him.

That was only a couple of months after their 2013 settlement, where

JPMorgan paid $13 billion for selling fraudulent loans to customers.

JPMorgans CEO earned $20 million in 2014, $18 million in restricted stock, for helping the shareholders stop worrying about all the “illegal activities” they were caught for.

Wells Fargo Fraud ScandalsWells Fargo has been a nightmare since it was caught creating fake bank accounts using their customers details. Their recent SEC settlement for

$5.1 million was from 2009 to June 2013 “allegations” (they never admit wrongdoing, ever) they stole fee’s from customers like other banks do.

The

$1 billion fine Wells Fargo agreed to pay in 2018 for “bad acts against customers,” along with the

$2 billion fine from the decade old mortgage financial crisis.

They were also one of banks that banned buying bitcoin in the US with their credit cards.

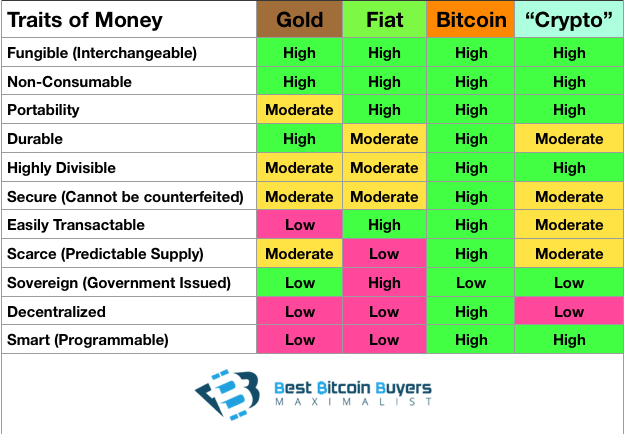

Perhaps

bitcoin having a controlled supply of 21 million coins conflicts with the banks and

federal reserve belief, to

create money and never be audited are

benefits to everyone who values the US dollar.

Bitcoin wasn't created to help money laundering anymore than banks were created to pay fines and admit no wrongdoing.

Source:

https://www.bestbitcoinbuyers.com/2018/11/14/bitcoin-will-save-us-taxpayers-millions-wasted-investigating-and-regulating-the-banks-money-laundering-schemes/