Reserve Protocol: Stable Decentralized Asset Backed Currency

We believe that everyone’s money should be secure. Billions of people around the world don't have a safe place to store their money. Banks in some countries can't be trusted, and some governments inflate their own currency to pay off debts, hurting citizens in the process.With a few exceptions (e.g. money laundering, terrorist financing), we believe anyone in the world should be able to transact with anyone else. This requires low-friction, cross-border transactions, which are hard to do with our existing financial systems.

Reserve project aims to solve both of these problems with a stable, decentralized currency that can’t be abused by a government because it is globally distributed outside of anyone’s control, and thus nearly impossible to shut down.

The volatility of existing cryptocurrencies significantly reduces their usefulness. A cryptocurrency with stable value would permit much wider usage as a stable store of value, medium of exchange, and standard of deferred payment. Demand for a short-term and long-term stable cryptocurrency is obvious.

Reserve Protocol is a decentralized stablecoin system that scales supply with demand and is built to maintain 100% or more on-chain collateral backing. This design strikes a careful balance between stability, decentralization, and profitability while supporting arbitrary increases or decreases in demand.

For more information about the protocol read our Whitepaper or visit our Website.

Tokens

The Reserve Protocol interacts with three kinds of tokens:

1. The Reserve token ($RSV) — a stable cryptocurrency that can be held and spent the way we use US dollars and other stable fiat money. It is a decentralized, 100% asset-backed stablecoin. Etherscan Link.

2. The Reserve Rights token ($RSR) — a cryptocurrency and protocol token used to facilitate the stability of the Reserve token. When the $RSV token is trading above $1.00, any excess $RSV tokens in this pool can be purchased from the Reserve smart contract. Purchases are made with $RSR, and only available to $RSR token holders. Once the purchase is made, the $RSR tokens are burned. Reserve estimates that about 2-5% of the USD value of the RSV in circulation will be burned in $RSR per year. This comes from estimates about $RSV velocity (for the transaction fees) and average collateral token appreciation rates (for thinks like tokenized treasury bills). Etherscan Link.

3. Collateral tokens — other assets that are held by the Reserve smart contract in order to back the value of the Reserve token, similar to when the US government used to back the US dollar with gold. The protocol is designed to hold collateral tokens worth at least 100% of the value of all Reserve tokens. Many of the collateral tokens will be tokenized real-world assets such as tokenized bonds, property, and commodities. The portfolio will start off relatively simple and diversify over time as more asset classes are tokenized.

Protocol

The Reserve Protocol holds the collateral tokens that back the Reserve token. When new Reserves are sold on the market, the assets used by market participants to purchase the new Reserves are held as collateral. This process keeps the Reserve collateralized at a 1:1 ratio even as supply increases.

Suppose the redemption price of Reserve is $1.00. If the price of Reserve on the open market is $0.98, arbitrageurs will be incentivized to buy it up and redeem it with the Reserve smart contract for $1.00 worth of collateral tokens. They'll continue buying on open markets until there is no more money to be made, which is when the market price matches the redemption price of $1.00.

The same mechanism works in reverse when demand goes up. If the price of Reserve on the open market is $1.02, arbitrageurs will be incentivized to purchase newly minted Reserve tokens for $1.00 worth of either collateral or Reserve Rights tokens (the latter only if there is an excess pool of Reserve tokens available), and immediately sell them on the open market. They'll continue selling on open markets until there is no more money to be made, which is when the market price matches the purchase price of $1.00.

There are three planned phases of the Reserve network:

A - the centralized phase — where Reserve is backed by a small number of collateral tokens, each of which is a tokenized US dollar.

B - the decentralized phase — where Reserve is backed by a changing basket of assets in a decentralized way, but still stabilized in price with respect to the US dollar.

C - the independent phase — where Reserve is no longer pegged to the US dollar, with the intent of stabilizing its real purchasing power regardless of fluctuations in the value of the dollar.

Watch how the CEO, Nevin Freeman, explains the protocol at the London Business School

Roadmap

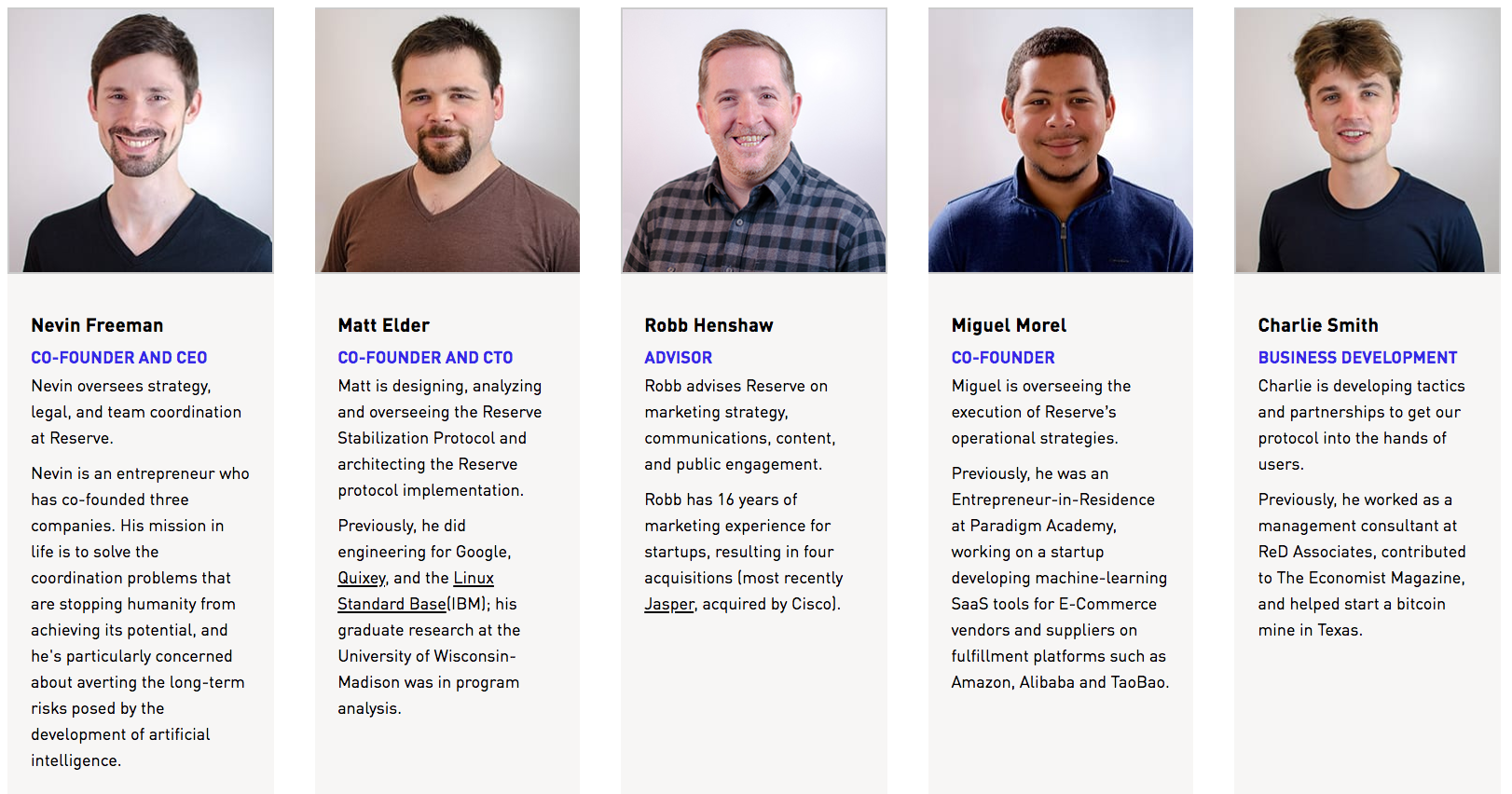

Core Team

Nevin Freeman- Co-Founder and CEO

Matt Elder - Co-Founder and CTO

Miguel Morel - Co-Founder

Jesper Ostman - Protocol Development

Cathleen Kilgallen- Chief of Staff

Taylor Brent - Lead Protocol Engineer

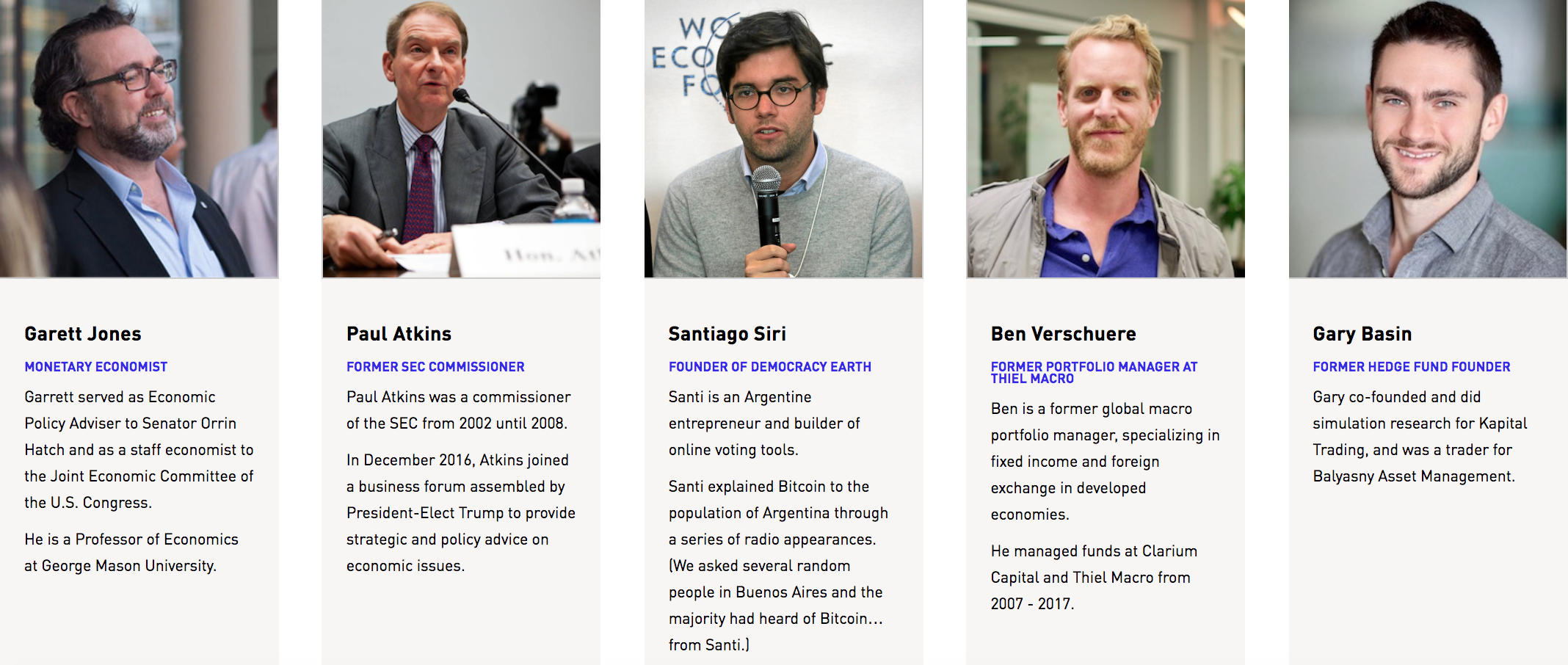

Advisors

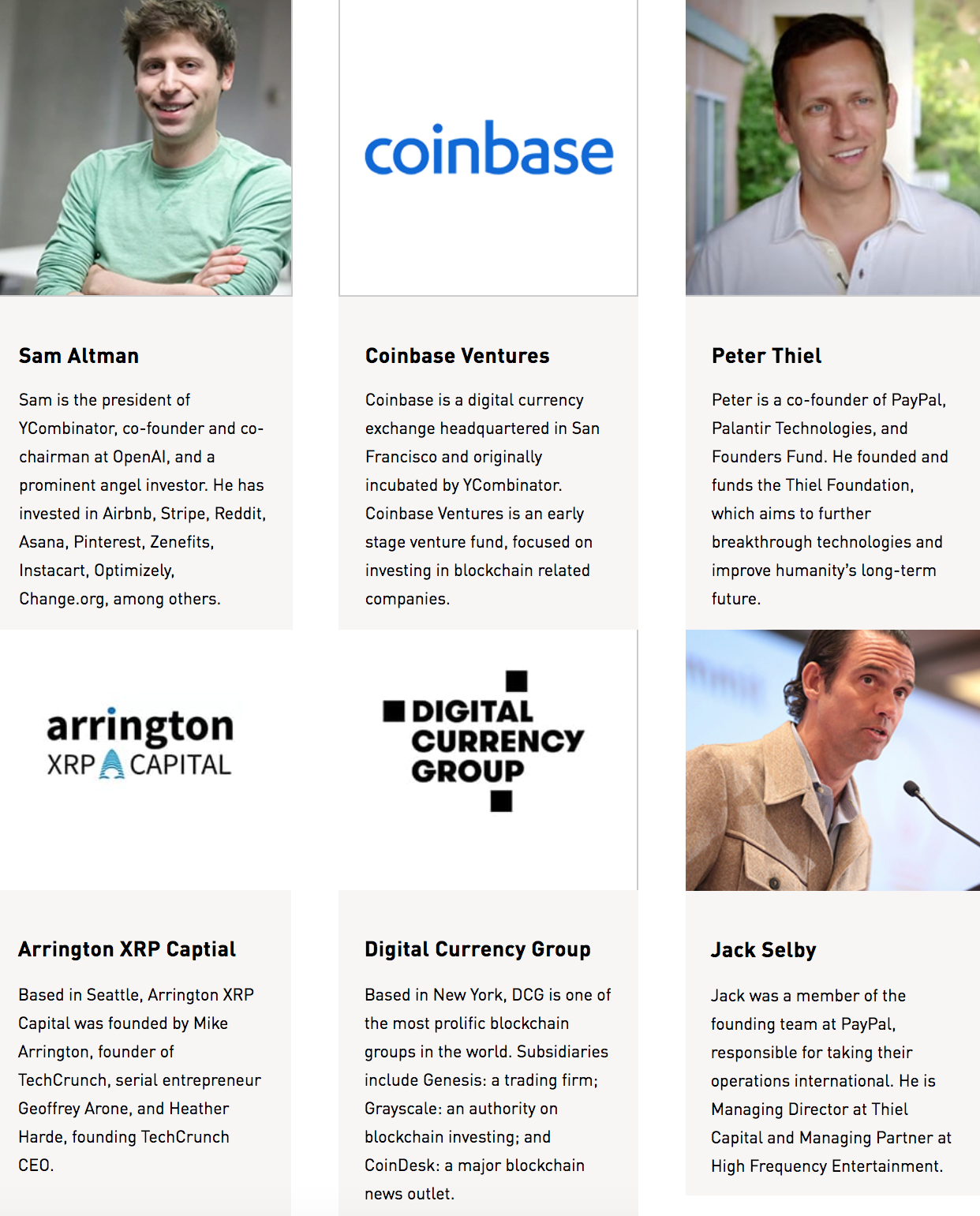

Notable Investors

Exchanges

Want to learn more?

VISIT OUR WEBSITE FOR MORE INFO

VISIT OUR WEBSITE FOR MORE INFO