hey guys, long term investor in ETH and lurker of this forum.

Iím a big fan of crypto but also in to real estate.

Realt has been around for a few years.

CityDAO getting backing from Mark Cuban and others. Propy just listed on Coinbase I think.

I think there will be growing demand for yield, and real estate tokenized can be a source of sustainable yield.

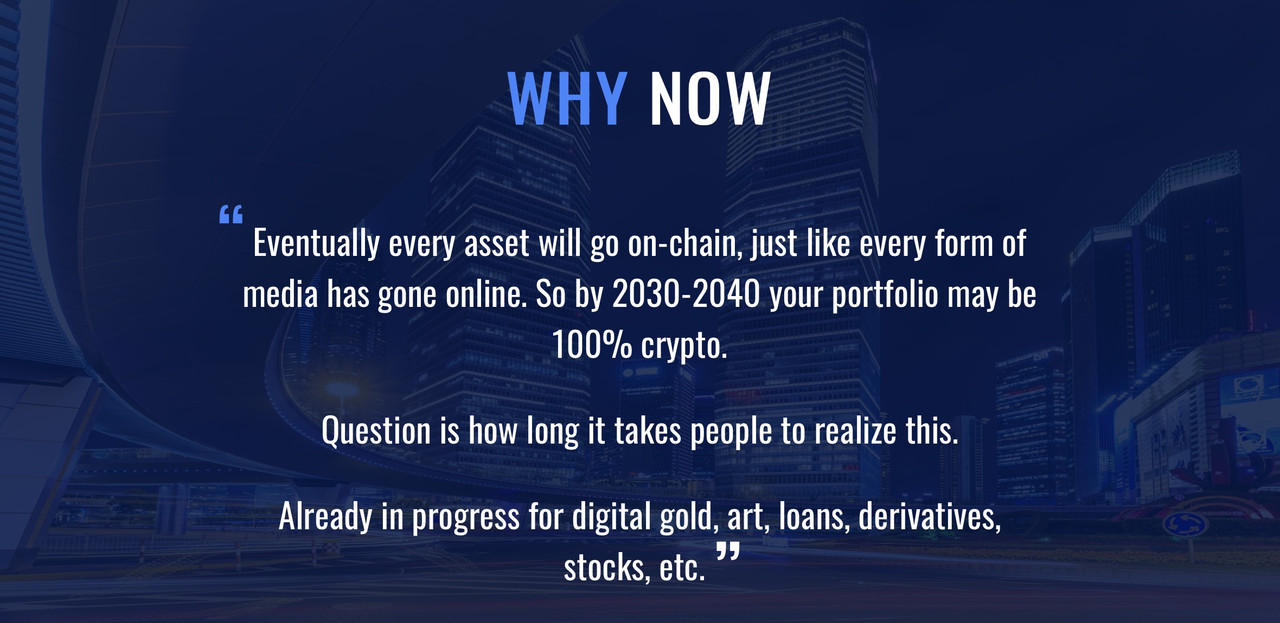

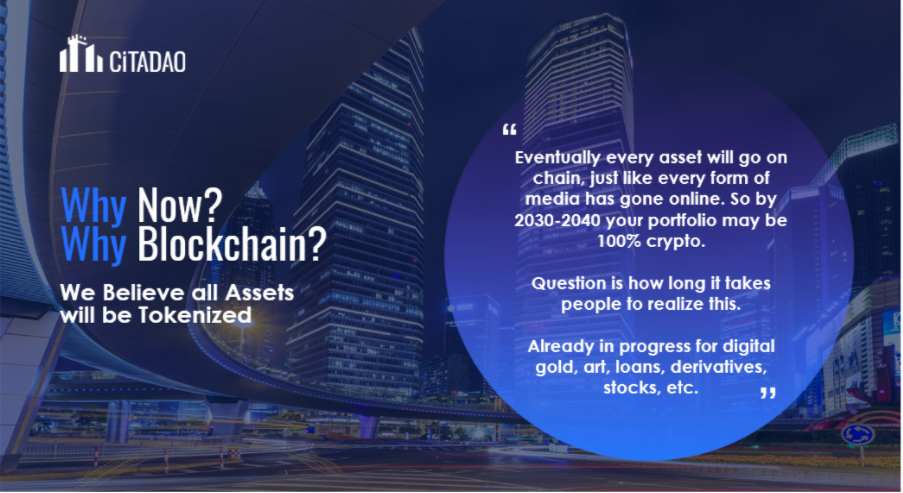

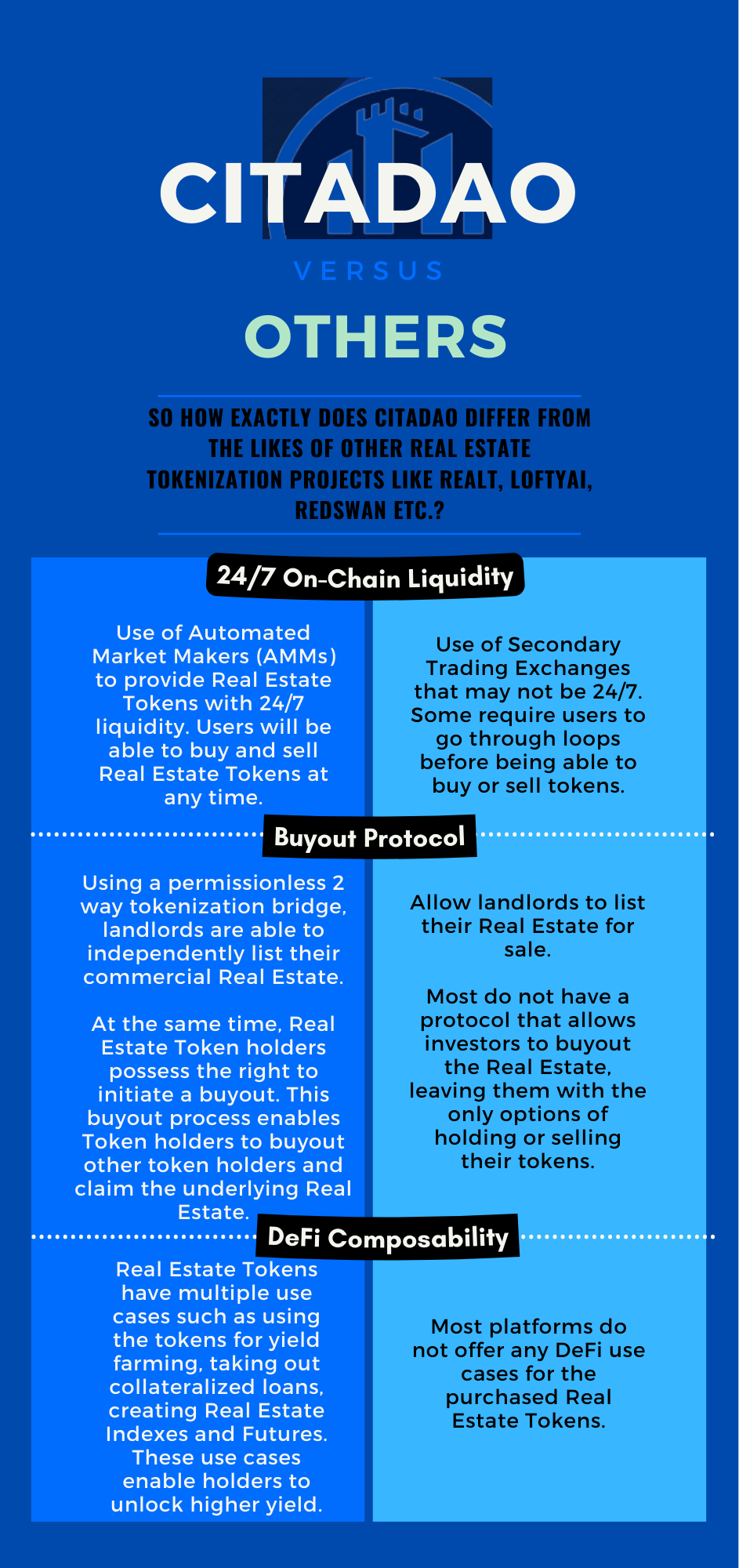

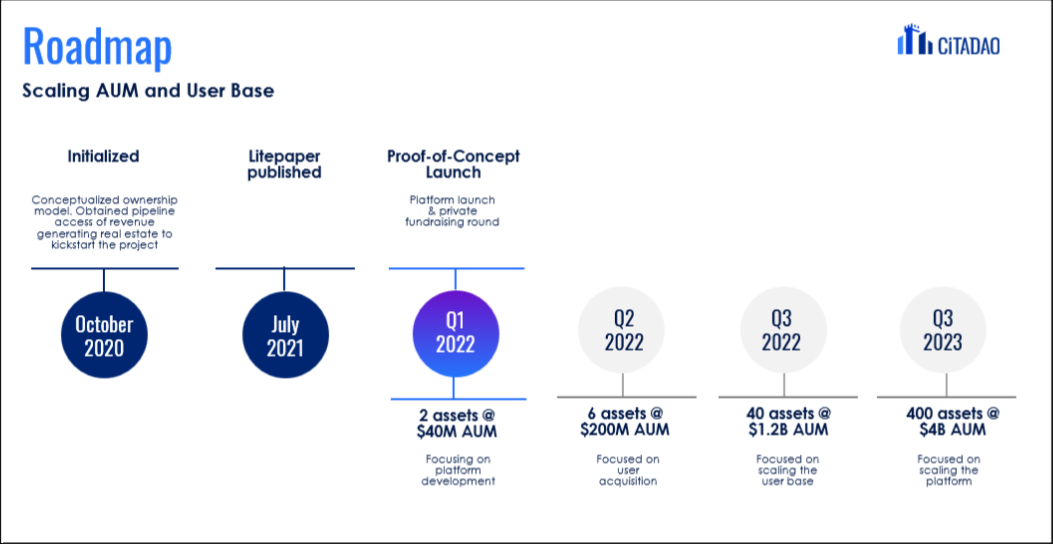

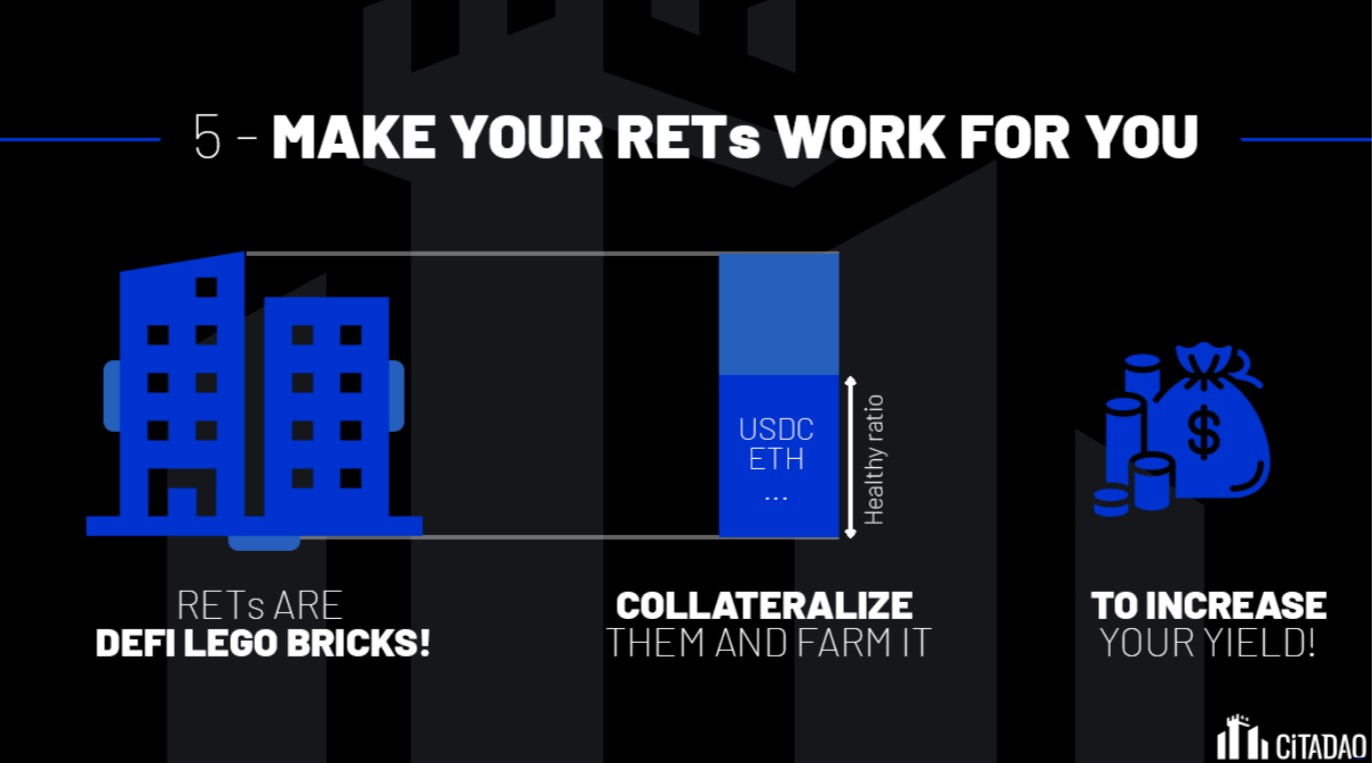

I recently start contributing to a project called CitaDAO as they are doing something completely different and building a holistic Real Estate powered DeFi ecosystem, featuring a two-way asset tokenization bridge, ample liquidity, and bearer asset tokens that are composable with the broader DeFi applications and primitives. Real estate tokens will enable the DeFi community generate sustainable yield through real world productive assets, diversify their portfolio on-chain, AND serve the growing demand for on-chain yield.

Unlike past real estate tokenization attempts, we are taking a 100% DeFi approach that leverages composability with other projects in DeFi, allowing us to scale users and usecases rapidly (see recent partnership with XToken to provide concentrated liquidity on UniswapV3:

https://twitter.com/xtokenmarket/status/1461716880713039872).

Through our platform, Crypto Anons will soon be taking over meatspace real world assets and we shall see the physical world re-made in the likeness of our own Crypto community, and use tokenized real estate as collateral for permission-less loans on-chain via our collaboration with Chainlink on price feeds for real estate:

https://twitter.com/chainlink/status/1465814283938377729)

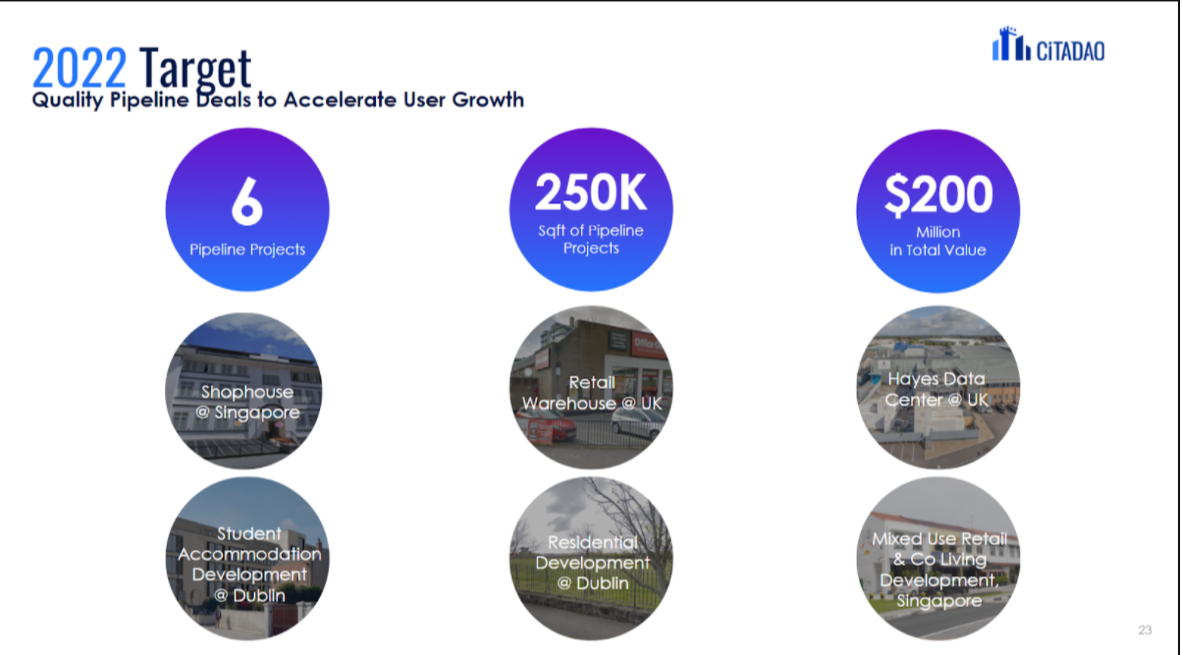

Lastly, there is a pipeline of projects to come on-chain via collaboration w a Singapore based family office, and the first property to be tokenized will be a $20m prime real estate located in the heart of Cardiff, Wales, UK - a building currently being leased to a global bank, partly chosen so the crypto anons can rent real estate out to the rent-seeking banks -- and partly for the stable rent 🙂

leave a comment if youíre interested or come checkout our website and join our discord! hopefully can join our growing contributors consisting of defi degen apes, legal, and real estate pros!