Show Posts Show Posts

|

|

Pages: « 1 [2] 3 4 5 »

|

Finnish cryptocurrency exchange and crypto wallet services provider Prasos Oy is one step from being “frozen”, as most Finnish banks will no longer conduct business with them, Bloomberg reports March 9. Founded in 2012, Prasos has seen a ten-fold spike of transaction volumes reaching $185 mln in 2017, which became a subject of concern among the banks. Finnish banks do not have a codified set of regulations surrounding cryptocurrencies and the anonymous nature of cryptocurrency transactions could potentially run afoul of current Finnish anti-money laundering laws (AML). As a result, four banks; S-Bank, the OP Group, Saastopankki, and Nordea Bank AB closed Prasos Oy’s accounts in 2017. For now, Prasos has to manage all its clients’ transactions through one bank. Tomi Narhinen, CEO of Saastopankki, commented that the anonymous character of crypto operations breaches the AML laws of the European Union (EU). “In most cases it’s practically impossible or at least very hard to do business with cryptocurrency dealers and exchanges, because it can be impossible to determine the origin of the funds,” said Narhinen. https://cointelegraph.com/news/finnish-crypto-exchange-risks-collapse-as-banks-refuse-to-do-business |

|

|

|

Australian authorities have announced that Bitcoin-based sports betting website, Justbet, is currently the subject of an investigation. The website represented itself as Australian by registering its domain in an Australian Island territory, however, Justbet’s IP address can be traced to Costa Rica. Bitcoin Betting Website Under Investigation for Misrepresenting LocationThe Justbet website is registered by the Christmas Island Domain Administration (CIDA). CIDA claims to be a community-owned non-profit company that provides internet services to the citizens of Christmas Island – an Australian external territory. By using a ‘.cx’ address, Justbet is able to give the impression that it is subject to Australian regulation. The website, however, was registered by a Panamanian, and IP address trace indicates that the company is based in San Jose, Costa Rica. The company does not appear to be sanctioned by any of Australia’s gambling commissions. The investigation into Justbet has been prompted by calls from Tasmanian minister, Andrew Wilkie. Following Mr. Wilkie reporting Justbet to the Sports Integrity Initiative, the Australian Communications and Media Authority (ACMA) revealed that it had launched an investigation into the company regarding potential breaches of Australia’s Interactive Gambling Act. Read more https://news.bitcoin.com/bitcoin-sports-betting-site-under-investigation-in-australia |

|

|

|

The cryptocurrency markets are showing slight positive growth today March 10, with Bitcoin (BTC) rising back up above $9,000 and almost all of the top 100 coins, except one, listed on CoinMarketCap in the green as of press time. BTC had reached over $11,500 during its intra-week high on March 5, before dropping below $9000 yesterday, March 9. BTC is currently trading at around $9,500, up around 5 percent over a 24 hour period to press time.  Ethereum (ETH) is still below $800, but up from its monthly low under $700 yesterday, March 9. The top altcoin is trading now around $740, up around 5.5 percent over a 24-hour period by press time. Ethereum has consistently stayed below $1000 — a price point it had previously broken in mid-January — ever since the market dip in early February.  Of the top ten coins listed on CoinMarketCap, Bitcoin Cash (BCH) is up the most over a 24 hour period, around 9 percent, and trading around $1,084 by press time. Altcoin Ripple (XRP) is up the least of the top ten coin on CoinMarketCap, a little more than 1 percent over a 24 hour period, trading around $0.84 by press time. Total market capitalization for all cryptocurrencies is around $389 bln by press time, on the lower end compared to its February highs over $500 bln, but up from it’s monthly low of $344 bln March 9.  Although the markets are seeing a slight recovery today, the overall slump since the beginning of the year has been attributed to the $400 mln sell-off by the bankruptcy trustee of the former crypto exchange Mt. Gox. The more recently slump this week can be credited to global regulatory news, including the US Securities and Exchange Commission (SEC) announcement that all crypto trading platforms should register with the SEC. https://cointelegraph.com/news/99-out-of-100-top-coins-see-green-as-bitcoin-climbs-back-above-9k |

|

|

|

The cryptocurrency retirement account firm Bitira has announced the launch of two new features added to its business model, which includes fully-insured cold storage accounts and a variety of new cryptocurrencies such as bitcoin cash, ethereum, and more. Digital Asset Retirement FundsBitira is a “self-directed” individual retirement account (IRA) that provides investors control over their digital currency investments, but a custodian handles some of the account administration. Self-directed IRAs require a certified custodian that carries out the investor’s orders. This week Bitira has added insurance to their accounts with a consumer protection policy managed by Lloyd’s of London. Alongside that, digital IRA customers will receive data breach insurance with a Cybersecurity Policy from Hiscox. The company states that cryptocurrency investment funds at Bitira are also kept in cold storage and protected with multi-signature technology. “All assets held in storage are fully insured through an all-risk policy from Lloyd’s of London, the world’s leading provider of specialized asset insurance,” explains Bitira’s website. “Additionally, assets are protected during the transaction, against any internal cases of fraud or theft, by a second policy from Lloyd’s of London.” Read more https://news.bitcoin.com/retirement-custodian-bitira-offers-insured-multi-cryptocurrency-iras |

|

|

|

This week the Japanese financial services management group SBI Holdings has announced that it has acquired 40 percent of the Taiwanese digital currency hardware wallet startup Coolbitx. Over the past few months, SBI has been entrenched within the virtual currency industry as the bank plans to incorporate multiple types of cryptocurrency business models.

SBI Holdings Purchases Taiwanese Hardware Wallet ManufacturerJapan’s Strategic Business Innovator Group (SBI) is a financial services company launched in 1999 and is headquartered in Tokyo. Over the past year or more the banking firm SBI has increased its interest and ownership of businesses that have a focus on cryptocurrency solutions. This past October news.Bitcoin.com reported on SBI investing in eight types of crypto-related business models including hedge funds, derivatives, remittance, storage, exchange platforms, and mining. Now earlier this week SBI revealed it has purchased a large portion of a Taiwanese hardware wallet company called Coolbitx. SBI Aims to Further Enhance SecurityCoolbitx and the ‘Coolwallet’ has been around since 2015 and introduced a hardware wallet that looks like a credit card by utilizing near-field-communication (NFC) and Bluetooth technology. The card pairs with a phone in order to initiate the transfer of funds such as litecoin, bitcoin core, ripple, and ethereum. When the company launched the card, the startup’s founder, Michael Ou explained, “Our wallet gives you the convenience of a credit card, but with a better security.” SBI believes hardware wallet technology is important to the bank’s research and development in the digital currency environment. Read more https://news.bitcoin.com/japans-sbi-holdings-claims-40-stake-in-hardware-wallet-company |

|

|

|

Coinbase User Files Class Action Against Company, Claims Insider BCH TradingCoinbase, a major US-based cryptocurrency exchange and wallet platform, faces a class action lawsuit claiming that its employees and other insiders benefited from trading on non-public information that the exchange planned to introduce Bitcoin Cash (BCH) support last December, The Recorder Law reported on Friday, March 2. The complaint was filed by Coinbase user and Arizona citizen Jeffrey Berk, represented by two law firms, in the US District Court for the Northern District of California on Thursday, March 1. The introduction to the class action complaint brought against Coinbase explains that it is being made:

“on behalf of all Coinbase customers who placed purchase, sale or trade orders with Coinbase… during the period of December 19, 2017 through and including December 21, 2017... and who suffered monetary loss as a result of Defendants’ wrongdoing.”In the lawsuit, the plaintiff accuses Coinbase of “artificially inflated prices” by means of disclosing buy and sell orders moments after Coinbase launched BCH support on Dec. 19, 2017. The move may have caused the price of the cryptocurrency to soar by over 130 percent — from $1,865 on Dec. 18 it reached as high as $4,300 by Feb. 20, according to data from CoinMarketCap. Read more https://cointelegraph.com/news/coinbase-user-files-class-action-against-company-claims-insider-bch-trading

|

|

|

|

This week the private bank headquartered in the Principality of Liechtenstein, Bank Frick, announced its customers will now have the ability to directly invest in cryptocurrencies. According to the financial institution, the company will offer account holders the means to purchase fives different cryptocurrencies that will be held in cold storage using the bank’s platform. Bank Frick Offers Direct Crypto Purchases Held in Cold Storage for Euros, Dollars, and Swiss FrancsLiechtenstein Bank Offers Account Holders Direct Crypto-InvestmentsBank Frick is a banking firm based in Liechtenstein that offers private financial services for a wide array of international clientele. On February 28 the bank announced it was enabling direct cryptocurrency investment for customers and the digital assets will be kept in cold storage under the bank’s supervision. Bank Frick is initially offering five cryptocurrencies including bitcoin core, bitcoin cash, litecoin, ripple, and ethereum. “Starting today, professional market participants and financial intermediaries are able to invest in the five leading cryptocurrencies,” explains the Liechtenstein bank. ‘Crypto-Banking and Traditional Banking’Bank Frick hopes it can offer institutional traders and market makers stronger protection from theft alongside traditional regulations that are applied to other asset classes. read more https://news.bitcoin.com/liechtenstein-bank-offers-account-holders-direct-crypto-investments |

|

|

|

Germany is taking a lead within European Union established economies, deciding upon slow regulation when it comes to the world’s most popular cryptocurrency, bitcoin. It will not tax the digital asset as a form of payment, miner rewards escape the sting as well, and even some exchanges will receive exemptions. Germany Slows on Taxing BitcoinBundesministerium der Finanzen, Germany’s Federal Ministry of Finance, issued a four page document outlining its tax regime regarding bitcoin, VAT treatment of Bitcoin and other so-called virtual currencies. Using a 2015 decision from the European Union Court of Justice on value added tax (VAT), the broader EU believes it can decide the fate of taxing bitcoin. Germany too is using it as a framework. Though filled with legalisms, the document seems to imply bitcoin as legal tender when a means of payment, thus exempting it from a typical usage tax. Interpreting usage of bitcoin “free of VAT…[the] use of Bitcoin is the use of conventional means of payment if it serves no purpose other than a pure means of payment serve,” the document defines. Read more https://news.bitcoin.com/bitpay-launches-bitcoin-cash-debit-card-top-ups |

|

|

|

Perhaps cryptocurrency’s largest institutional nemesis is JP Morgan Chase. Led by the ever-belligerent Jamie Dimon, it and he have taken numerous opportunities to sandbag bitcoin and its spawn. Theories about why have long circled, but now there appears to be proof the legacy bank is threatened by decentralized currency in digital form, according to an internal annual report. JP Morgan Chase One Chastised BitcoinersIn partial fulfilment of its fiduciary duty, JP Morgan Chase filed an Annual Report for 2017, Form 10-K: Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. It’s an exhaustive document mostly of interest to shareholders. This year, however, it contained unusual insight into the institutional mindset of the United States’ largest bank. Under the rubric Competition, deep in the report, the bank worries aloud: “The financial services industry is highly competitive, and JPMorgan Chase’s results of operations will suffer if it is not a strong and effective competitor. JPMorgan Chase operates in a highly competitive environment, and expects that competition in the U.S. and global financial services industry will continue to be intense.” read more https://news.bitcoin.com/jp-morgan-chase-fears-crypto-is-disruptive-competition |

|

|

|

The cryptocurrency market continues a slight uptrend with half of top 10 coins by market capitalization in the green on Tuesday, Feb. 27. Total Capitalization Bitcoin (BTC) has slowed its advance but still managed to increase by 3.79 percent over a 24-hour period with a current trading value of $10,812.50. Among the top 10 coins, IOTA has seen the highest change of 8.21 percent over the last 24 hours, and is now trading at $2.04. IOTA Charts A number of other altcoins are growing as well. NEO has increased by 7.24 percent, trading at $144.98 at press time, while Ethereum (ETH) showed a little growth of 1.51 percent over a 24-hour period. Conversely, some altcoins are currently in the red. Ripple (XRP), Litecoin (LTC), and Cardano (ADA) are down with a respective decrease of 0.24, 2.15, and 1.11 percent. The total market cap hovers above $460 bln after a small sell-off yesterday at $420 bln. The average Bitcoin transaction fee is at its lowest multi-month levels of about $2.4 per transaction, likely contributing to the cryptocurrency’s growth over the past couple of days. Yesterday, Feb. 26, Cointelegraph reported on the milestone release of the 0.16.0 version of the Bitcoin Core client, which now fully supports the Segregated Witness (SegWit) scaling solution, designed to reduce transaction fees and confirmation times in the Bitcoin network. source https://cointelegraph.com/news/crypto-market-slightly-grows-some-altcoins-in-the-red |

|

|

|

Coindash has announced that 20,000 ETH have been sent to the company’s wallet from the address associated with the hacker that stole approximately 37,000 ETH during the company’s ICO last year. The transaction constitutes the second instance in which the hacker has returned funds to Coindash. Coindash Receives 20,000 ETH From Wallet Associated With Hacking CulpritOn February 23rd, Coindash announced via its blog that 20,000 ETH had been transferred to the company’s wallet at 12:01:41 AM +UTC. During July of last year, the hacker altered the deposit address displayed on Coindash’s, then siphoning approximately 37,000 ETH tokens from ICO contributors – at the time valued at approximately $10 million USD. The 20,000 ETH tokens returned to Coindash are currently worth approximately $17 million. The transaction comprises the second time that the hacker has returned funds to Coindash, as 10,000 ETH tokens were sent to one of Coindash’s Ethereum wallets on September 19th, 2017 – then equating to approximately $3 million. Ironically, the hack suffered by Coindash last year, then described as “damaging event to both our contributors and our company,” now appears to have been responsible for the company netting a significant dollar-value increase in capital. Following the most recent transaction, the combined dollar-value of the returned 30,000 ETH at the time of respective execution equates to approximately $20 million – or double the fiat-value of the stolen ETH at the time of the theft. Israeli Authorities Notified of TransactionHacker Returns 20,000 ETH to Coindash. The CEO of Coindash, Alon Muroch, has issued a statement regarding the news, stating “Similar to the hack itself, the hacker’s actions will not prevent us from the realizing our vision, Coindash product launch will take place next week as originally intended.” Coindash’s product launch is currently scheduled for February 27th. Coindash’s blog states that the company “notified the Counter Cyber Terrorist Unit in Israel” regarding the transaction, and that “The hacker’s Ethereum address will continue to be tracked and monitored for any suspicious activity.” source https://news.bitcoin.com/hacker-returns-20000-eth-coindash |

|

|

|

Original Pizza Day Purchaser Does It Again With Bitcoin Lightning NetworkLaszlo Hanyecz, the man that completed the world’s first documented Bitcoin (BTC) transaction for a physical item in 2010 -- 10,000 BTC for two pizzas -- has now bought two more pizzas using the Bitcoin Lightning Network. Hanyecz posted on the Lightning-dev mailing list today, Feb. 25, that he had to get his friend in London to “sub contract” out the pizza delivery to a local pizza place in order to pay on the Lightning Network, because “pizza/bitcoin atomic swap software” is yet unavailable. However, according to Hanyecz, the transaction still “demonstrates the basic premise of how this works for everyday transactions. It could just as well be the pizza shop accepting the payment directly with their own lightning node.” The original BTC-pizza transaction took place on May 22, 2010 and has been celebrated as Bitcoin Pizza Day ever since. There is a Twitter feed dedicated to a daily posting of what 10,000 BTC equals according to that day’s market value -- today’s value is tweeted as $97,560,750. This time around Hanyecz paid 649000 satoshis, or 0.00649 bitcoins, which equals around $62 for both pizzas. In order to receive the pizza, Hanyecz decided that the best way to prove he had paid for it was to show the driver the first and last four characters of the hex string of his Lightning payment hash preimage, and if it matched with what the driver had, he would get his pizza. Hanyecz posits the pizzas as prizes to be received only if the lightning transaction can be done successfully, writing that if he couldn’t show the driver the pre-image, “the pizza would not be handed over and it would be destroyed.” The trial was a success, Hanyecz got his pizzas, but he added that “it's probably not a good practice to share the preimage.” READ MORE https://cointelegraph.com/news/original-pizza-day-purchaser-does-it-again-with-bitcoin-lightning-network

|

|

|

|

Venezuela’s president Nicolas Maduro has ordered the country’s consular services, as well as several other services and gas stations, to accept any cryptocurrency including the nation’s own petro. In addition, he has announced the launch of another cryptocurrency, this time backed with gold. Maduro’s OrdersMaduro has ordered various government services to accept any cryptocurrency including the petro, Venezuela’s oil-backed currency which began its private pre-sale on February 20. This announcement was broadcasted nationwide from the Miraflores Palace and also reported on the website of the Superintendency of Cryptocurrencies. Read more https://news.bitcoin.com/venezuela-orders-government-services-to-accept-any-cryptocurrency/ |

|

|

|

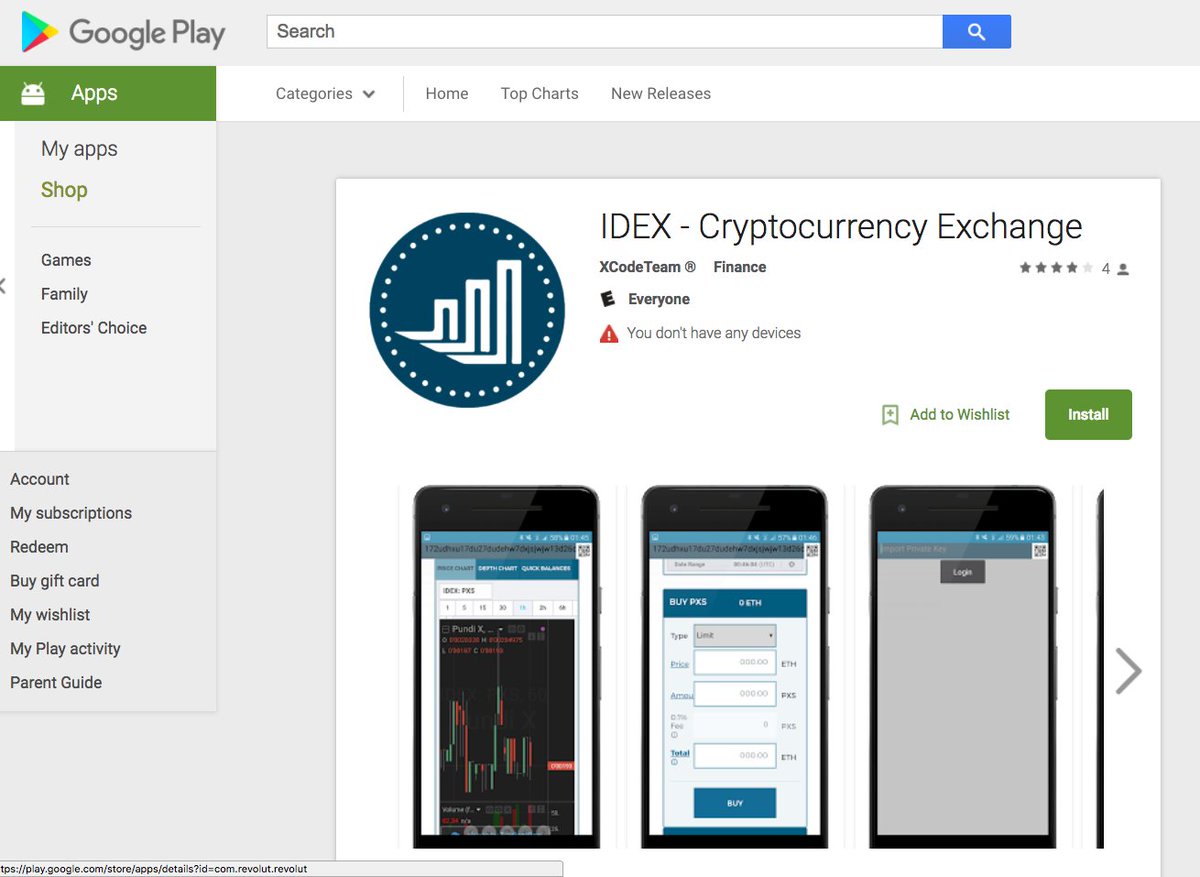

SOURCE https://twitter.com/Aurora_dao***Attention: DO NOT download the IDEX app in @GooglePlay pictured below. This is not official and we have requested that it be removed. Please make sure to bookmark the official site ( https://idex.market ) for all trading until we have announced otherwise.  |

|

|

|

Israel Tax Authority issued a professional circular on February 19 (4 Adar 5768), clarifying the country’s tax policy on cryptocurrencies in general and bitcoin in particular. “Bitcoin and its like” are discussed in what’s referred to as a “final circular” on crypto and value-added tax (VAT) along with capital gains. Israel VAT Good News on Crypto“The Tax Authority’s position, which was expressed in the past, is [bitcoin is] a property, not a currency,” the Israeli agency clarified upfront. Israel is the economic jewel of Southwest Asia, routinely ranking alongside countries many multiples its size in terms of innovation and output. Punching above its weight in cryptocurrency as well, the country has grappled with bitcoin since at least 2013 in one form or another. Openness to the decentralized currency idea extends all the way to its current Prime Minister. Its tax policy might be not only a regional trendsetter but a world model. Going forward, “For purposes of income tax – in accordance with the circular, a distributed means of payment is an asset, and therefore a person whose activity as aforesaid does not reach a business is only entitled to capital gains tax and the person whose activity in the field reaches a business (trade in a distributed method of payment and / Such a measure), tax will be paid as any business activity,” the circular noted, suggesting it was speaking to the Israel Securities Authority (ISA) policy as well. READ MORE https://news.bitcoin.com/israel-tax-authority-bitcoin-is-property-not-currency |

|

|

|

A new tax bill has been introduced in the Wyoming state senate on Feb. 16 that would exempt virtual currencies from state property taxation, and suggests an effective date be provided for the tax exemption implementation. Wyoming Senate Bill 111 was introduced by senators Ogden Driskill, Tara Nethercott, and Chris Rothfuss, along with representatives Tyler Lindholm, David Miller, and Jared Olsen. All are Republicans with the exception of Senator Rothfuss. The bill received 26 “ayes,” from a mixture of Republicans and Democrats, 3 “nays,” all from Republicans, and 1 “excused.” This Republican and Democratic backed bill comes as a growing bipartisan movement of US lawmakers are calling for more crypto regulation. The bill is short and to the point, proposing a list of “intangible items” that should qualify for property tax exemption, like fiat currency, gold, cashier’s checks, and “virtual currencies.” Virtual currencies are defined as anything that digitally represents value as a medium of exchange or unit of value, and as well as not being recognized as legal US currency. Taxation requirements for cryptocurrency profits in the US are a relatively grey area, with US citizens’ crypto assets being subject to federal property and payroll taxes. However, the personal finance service Credit Karma reported that only 0.04 percent of customers reported their crypto assets to the US Internal Revenue Service (IRS) in 2017 as of Feb. 13. source https://cointelegraph.com/news/wyoming-introduces-new-bill-to-exempt-crypto-from-property-taxation |

|

|

|

New Platform For Social Media Influencer to Increase Views and Save EarningsPATRON, a Japanese Blockchain-based platform, intends to transform the social influencer market by eliminating intermediaries taking a large share of profits. The company has partnered with Orlando’s Switchboard Live, allowing users to publish a single live stream on different platforms and grow the audience. Broadcast all at onceThe company is developing a sharing economy system which could work similar to Airbnb, with ‘hosts’ purchasing influential posts, Cointelegraph previously reported. Additionally, PATRON’s smartphone application allows social media influencers to stream live videos simultaneously to more than ten different platforms including the leading social media such as Facebook Live, Periscope, YouTube. This system could give PATRON users a way to increase views and grow their audience. Getting listedAccording to PATRON, the company is celebrating the fact they are now going to be listed on HitBTC, one of the leading cryptocurrency exchanges. This means they will have increased publicity and also will be able to charge a liquidity premium for their token. A liquidity premium is the price markup that results from a security being more easily traded. Illiquid goods like real estate and physical assets are valued as less because of the increased risk that comes from their liquidity. HitBTC is a European-based cryptocurrency exchange that has been in operation since 2014. They boast a significant amount of currency pairs and are now delving more into dealing with alt-coins. The listing of Pat coin on their service could help PATRON’s reach spread and increase the amount of money they raise in their Pre-ICO and ICO.

Long-term goalOn Feb. 14, 2018, PATRON will begin their Pre-ICO, and on March 1, 2018, they will open up their public sale. This part of the fundraising stage is all about raising the money necessary to achieve their long-term goals. With the rise of companies like Instagram, Snapchat and Youtube, personalities can reach more people than ever. And with reach comes an ability to sell things. The whole influencer market is based on these personalities helping companies advertise their products in exchange for compensation. According to PATRON, the market is currently quite opaque- it is not easy for influencers to find clients. This created the business of being an agent and connecting these two parties, but with this comes fees that can add up. PATRON aims to become the company that disintermediates agents and provides a new means for the influencer market. The company intends to use the money from their ICO to hire the developers necessary to build the application and protocols that will be used on their platform. Additionally, they want to build a San Francisco presence so they can benefit from the network effects that occur there. source https://cointelegraph.com/news/new-platform-for-social-media-influencer-to-increase-views-and-save-earnings

|

|

|

|

On Feb. 16, six large-scale Blockchain projects OmiseGo, Cosmos, Golem, Maker and Raiden, that have completed successful multi-million dollar initial coin offerings (ICOs) last year, along with Japanese venture capital firm Global Brain have created the Ethereum Community Fund (ECF), to fund projects and businesses within the Ethereum ecosystem. The ECF will begin with $100 mln, likely raised by the six Blockchain projects. Some members of the Ethereum Foundation including Ethereum creator Vitalik Buterin plan to advise the fund. Buterin told TechCrunch: “Ethereum has grown beyond my expectations over the last few years, but the work is clearly not finished. Delivering value that matches the hype should be the mantra of 2018; efforts such as the ECF which help organize the development of the ecosystem are going to help to make that possible.”Buterin’s personal goal of funding open-source projectsIn September 2017, Buterin revealed that his advisor shares from $1.8 bln project OmiseGo and $370 mln decentralized cryptocurrency exchange Kyber Network will be allocated in a private fund to finance open-source projects building innovative technologies such as scaling solutions for the Ethereum Blockchain network. read more https://cointelegraph.com/news/how-will-a-100-mln-grant-help-ethereum-scale |

|

|

|

FCC Officially Warns Brooklyn BTC Miner Of ‘Harmful Interference’ To T-MobileThe U.S. Federal Communications Commission (FCC) has sent an official notice, dated Feb. 15, to a resident of Brooklyn, New York, Victor Rosario, citing that his Bitcoin (BTC) miner was causing harmful interference to T-Mobile’s broadband network. The “Notification of Harmful Interference” stated that the device was “generating spurious emissions on frequencies” for T-Mobile’s network. Continued use of his Antminer s5 Bitcoin Miner in a way that caused harmful interference would be breaking federal laws subject to penalties, “including, but not limited to, substantial monetary fines, ‘in rem’ arrest action to seize the offending radio equipment, and criminal sanctions including imprisonment.” The notice contains a caveat clarifying that not all Antminer s5 devices generate harmful interference, and suggesting that devices originally compliant with federal laws on radio frequency interference can be modified to make them non-compliant. Victor Rosario has 20 days from the date of the warning, which was delivered Feb. 15, to tell the FCC if he is still using the device, provide all labeling information, detail what he will do to prevent a repeat incident, and provide proof of purchase for the miner. Elsewhere in the US in Washington state, Bitcoin mining overloaded the electrical infrastructure of an entire county due to the increasing numbers of miners flocking to take advantage of Washington’s cheap electricity. In Iceland, cryptocurrency mining is set to use more power this year than all of the 340,000 Icelandic residents’ personal use put together. source https://cointelegraph.com/news/fcc-officially-warns-brooklyn-btc-miner-of-harmful-interference-to-t-mobile

|

|

|

|

Coincheck Produces Recovery Plan While Investors Flock to Withdraw Funds Japanese cryptocurrency exchange Coincheck has submitted a report to the country’s financial authority outlining measures it will take following the hack that lost 58 billion yen worth of the cryptocurrency NEM from its platform. However, customers rush to withdraw 40.1 billion yen of their funds so far as the exchange resumes yen withdrawal service. Coincheck’s Improvement PlansCoincheck has submitted a report to the Japanese Financial Services Agency (FSA) as mandated under the Order to Improve Business Operations. The order was handed to the exchange by the FSA following the hack that resulted in the loss of 58 billion yen (~USD$544 million) worth of NEM from its platform. In its report, Coincheck explains key areas of improvement to the agency. Specifically, the exchange detailed four of its plans: “1) investigating the facts and causes surrounding this case, 2) [providing] proper support for our customers, 3) strengthening current measures to manage system risk, 4) creating new measures for system risk management and preventing similar events in the future in addition to making it clear where the responsibility lies for different risks.” READ MORE https://news.bitcoin.com/coincheck-produces-recovery-plan-investors-withdraw-funds

|

|

|

|

|