Where is all the money leaving PPT to? Maybe HVN..hmmm

maybe due to binance?  |

|

|

|

the launch of the beta will take a month. source: slack

Kidding me? no, nico said they need another month. LoL ok if that's the case then I'm out of Populous haha, fkng joke I was secretly hoping for this delay to happen. It would be to our disadvantage to release it now. Here's why: - These weeks of crypto FUD / news is exhausting everyone, and taking the wind out of alts. - Bitcoin correcting these weeks is sucking up investor focus out of crypto. - The Chinese new year at 17th of February is a yearly sell-off and buyback frenzy, better to wait that storm out. - The problems with the website security (ssl, https) is not worth rushing, let's wait for optimal security. - Extra exchanges would help wider adoption/investor interest, bithump is coming, open source smart contract would possibly get us to bittrex. Also exchanges are having new user stops/waiting lists. Let Binance and others get their user numbers up for a few more weeks. If we wait these obstacles out, and ride the wave after these February obstacles pass, we'll be in bull-heaven. I disagree with you. Populous team take wrong decision for sure, as release bate a big chance to test populous platform security,function etc.. You're a fucking retard. They've opened a public bounty program in order to stress test the security of the platform. You literally have no idea what you are talking about obviously... otherwise, you'd be aware of the bounty program. The bounty is open to the public, meaning that this is technically already an open beta, just in the security testing phase. Why are you even here if you just want to talk nonsense that has no fundamental basis. You are literally just talking shit out of your mouth.... Your FUD game is weak dude... GTFO of here. You'll never get cheap PPT lmao... Keep tring though. It'll only mak you look like more of a faggot Your crude way of replying won't stop me from expressing my opinion. Obviously, your knowledge is shallow. I'm still determined by my opinion. they made the wrong decision. just check PPt rank,trade volume and price on coinmarketcap these are clear signs of the veracity of my opinion. regarding They've opened a public bounty program in order to stress test the security of the platform. can you tell us how many of ppt holder,users are experts in the field huh  Ok, Populous will fail...feeling better? Time will tell. Whoever invested in PPT accepted Risk of losing money just like other coins. I actually assumed all money that I've invested in Cryptos are gone! |

|

|

|

I don't get all this moon talk and limbo nonsense.

I have a good slice of ppt in my portfolio in the hope to earn some passive income to support my family. And maybe build a trust-fund for my kids.

It would also be smart to add other types of passive income tokens like Spectre-AI and Debitum.

If you want some 1000x gains you'd be better of buying a CMC top 250~400 place coin/token. High risk/High reward.

Let's just wait for the platform to mature and see if it could hit 200 dollars by this summer. And maybe earn some passive income.

Be a little greedy, but don't be a delusional idiot expecting to become an instant billionaire. It's off-putting to new investors.

Exactly...Moon Limbo nonsense! |

|

|

|

Hi, I guess this PPT SCAM has finally come to an end. Not my words ,but got this from the Reddit pages. It blew my mind ,but DYOR. WAS PPT CEO CONVICTED OF FRAUD IN 2008? - DYOR After all the FUD that has been circulating regarding PPT, I decided to conduct my own investigation. I set out below the results of this investigation. I have nothing against PPT, i thought it was an amazing idea and I hope the platform and the idea is big enough to live on beyond this scandal. However the criminals running it need to be exposed before investors loose their money completely. I have provided all the relevant links so you can DYOR. With the help of my accountant to navigate through Companies House to Research Steve Nico Williams business interests past and present as per his Linkedin profile, a few tips from a detective friend and several other concerned investors we uncovered the following: Steve and David Williams were born Stephen and Samuel Adeyemi on 15 September 1979 and later changed their names to Darren Williams (Steve) and David Williams. Darren Williams is the CEO of Populous World according to Companies House documents. https://beta.companieshouse.gov.uk/company/10458726/filing-historyHe and David have had a variety of other Companies, all of which have failed to submit Company accounts for reporting procedures and these Companies have been struck off. Together with his Brother David and as per his linkedin profile, outlining that he is a publisher of Tramp Magazine, they appear to have dealings with Knight Capital Limited / Zloader – David Williams is the Director. This appears to be some sort of Equity Investment Company. However the website will lead you nowhere as all the links lead back to the home page. http://www.knightcapital.co.uk/#Ok, lets go back to Populous World. On 23rd January 2018, they were given a First Gazette notice for compulsory strike-off. https://beta.companieshouse.gov.uk/company/10458726/filing-historyHere is what my accountant emailed me after a few minutes of research: Ok basically a compulsory strike off is not good news and is in line with Directors walking away from Companies leaving it with a mass of debt. Looks like David and Darren Williams are the boys behind this.I spent literally 5 mins on the Companies House Register and find they have connections with Upward Capital OC 415936 a partnership,Olympus Research ,Bellaface ,Zloadr, Populous Data Analytical and if I had the time could probably find a lot more..All Companies except Zloadr have been struck off with no accounts ever submitted but Zloadr is strange and could be where they sort away their funds as it has a capital base of £317K on the last accounts but mostly made up on intangibles assets whatever they are with just 17K cash . Knight Capital Ltd has just become a Director of Zloadr !! Anyway overall they are not operating as responsible directors should and there appears to be a deal of camouflage behind what they are upto. So why, when a Beta platform was due to be released that week, did this strike off threat occur? Ask yourselves this? His accountant, if he had one, would have been on top of all Company filings and would never allow this to happen. That concludes some of Darren Williams aka Steve nico Williams recent work history and provides some history into the successful businesses he has run in the past. Ok, so lets move onto the article from the City News report dated January 2007 that was posted on Reddit a few days ago. We spoke with the journalist and they confirmed that the article was genuine, but he was hazy about the details as over 10 years ago. So lets dig a little deeper. The News Report mentioned Reading Crown Court! An email was sent to Reading Crown Court, which was then forwarded to Oxford Crown Court due to the case being moved (maybe due to the severity of the case) and Certificate of Conviction was emailed back to us stating that Darren Stephen Williams, born on 15 Sept 1979 was sentenced to 42 months in prison on 4 March 2008 for Fraud. An extract from the sentencing certificate is below, however for purposes to expel any further FUD on this matter and to enable you to DYOR I have left details of who to contact at the court directly so you can get your own certificate emailed directly to you. I might add here that the severity of this fraud was such that it took over a year to come to trial. ---------- Forwarded message ---------- From: "Oxford Crown, Enquiries" enquiries@oxford.crowncourt.gsi.gov.uk Date: 8 Feb 2018 10:19 Subject: RE: Case of Stephen Adeyemi and Samuel Adeyemi Dear Sir Your Email was sent on to Oxford as this case was transferred from Reading Crown Court to Oxford. I enclose the certificate of conviction. Officer of the court Crown Administration HMCTS | Oxford Crown Court | St Aldates | Oxford | OX1 1TL Phone: 01865 264200 GoldFax: 01264 785113 Email: enquiries@oxford.crowncourt.gsi.gov.uk Web: www.gov.uk/hmctsIn the Crown Court at Oxford Certificate of Conviction. No: T20070131 This is to certify that Darren Stephen WILLIAMS dob: 15-Sep-1979 at the Crown Court at Oxford was convicted on 04-Mar-2008 Upon indictment of: 1/1 – Attempting to obtain a money transfer by deception 1/2 - Attempting to obtain a money transfer by deception 1/3 – Obtaining a money transfer by deception 1/4 - Attempting to obtain a money transfer by deception 1/5 - Obtaining a money transfer by deception 1/6 - Attempting to obtain a money transfer by deception 1/7- Obtaining a money transfer by deception 1/8- Attempting to obtain a money transfer by deception 1/9– Attempting to obtain a money transfer by deception And was sentenced at the Crown Court at Oxford on 04-Apr-2008 and 30-Jan-2009 to 1/1 – 42 months imprisonment, Confiscation order for a nominal amount £1.00 or in default to serve 7 days imprisonment consecutive to any term the defendant is serving 1/2 - Count to remain on file 1/3 - 42 months imprisonment concurrent 1/4 - 42 months imprisonment concurrent 1/5 - Count to remain on file 1/6 - 42 months imprisonment concurrent 1/7 - 42 months imprisonment concurrent 1/8 - 42 months imprisonment concurrent 1/9 - 42 months imprisonment concurrent TOTAL SENTENCE 42 months imprisonment No recovery of defence costs order made. This certificate of conviction is subject to any appeal against conviction of which notice, or notice of application for leave to appeal, has been or may be given, under the Criminal Appeal Act 1968. Officer of the Crown Court: Date: 8th February 2018 what is the reddit link you found this? |

|

|

|

Hi,

Not my words ,but got this from the PPT Reddit pages. This guy reads my mind.

People who are invested in PPT are acting like the people who invested in Bitconnect loans. They all WANT TO BELIEVE and are quick to dismiss any negative allegations. Do your research and you will quickly find that there is no office, and no core team. The team members on the website are all freelancers, or 20 year olds with no experience, or Nigerians that either have no experience or are 20 year olds. These kids would be happy that they have a job and are getting paid some coin. In other words, they might not even know that theyre working for a scam. The CEO has no successful business experience, and is not public with his words nor presence. All messages in Slack are not permanent and the chat history disappears with every new line of chat. This is the only place that the CEO says anything.

Don't take everything said on Slack as truth. There are people who are paid to continue to convince others that PPT is a great investment and that retirement is around the corner. There are paid shills in all corners of the cryptocurrency space so beware!

I would be very surprised if this turns out to be a successful project. But I highly doubt it. If this invoice trading platform is such a great idea, a proper team with real business experience will likely come up and take the spotlight. My research tells me that this is the job of a conman. Do your own research into the legitimacy of the company and team before starting to FOMO about the intricacies of how a real Populous platform will make you money. (remember how people analysed and researched into how Bitconnect will make money. it turns out that the people were shady and the operation, a scam.)

Did you hear that as the beta release was delayed once again, people were told that it would come out in just "a few hours" again and again and again. Until it became a joke on telegram and slack. This would be a great scenario for the CEO to cash out and sell his stack bit by bit at inflated prices. All the while, we now know that there was no intention of a Beta release by 31st Jan the entire time. Just lies and deceit. Now, investors are told that the beta will release within a month. How many times do you have to be fooled to realise that the CEO is a dishonest man. Think with your head screwed straight, without greed clouding your thoughts, like the investors of bitconnect then, the truth will leak into your mind also.

Authorities and journalists have been contacted to expose this scam. This could end up being another infamous crypto scam that will affect about 10k people who are holding a serious about of PPT in hope of something that won't ever happen.

How can you compare Populous to Bitconnect? Did Bitconnect have a paper and specific methodology explaining how their business works? Populouos business is nothing new, it's a peer to peer lending...It only integrates Blockchain into the business. |

|

|

|

Hmm...are you saying the Populous Data Analytics LTD is the same as Populous World? I see to difference addresses: BERKELEY SQUARE HOUSE BERKELEY SQUARE LONDON UNITED KINGDOM vs. 9068, 1 Primrose Street London EC2A 2EX The last names are the same but populous ceo is Steve Williams! |

|

|

|

|

That's what we needed....coinciding crypto bear market with populous delaying the launch of their platform.

|

|

|

|

Allright, so I'm new to this stuff (bear with me!)

I am looking at various blockchain invoice finance platforms out there and I found Hive and Populous.

Can someone explain to me how what they do is different from guys like MarketInvoice?

In case of MarketInvoice the source of Capital is banks...in case of Populous source of capital for lending is anyone in the world, similar to populous we have P2P lending without blockchain such as LendingClub. |

|

|

|

When there is a transfer of ownership of the invoice (i.e. a "sale" of the invoice), then by definition the transaction must be factoring, not invoice discounting. Invoice discounting is a type of loan/financing that does not involve a transfer of title. The only exception in the world is the UK, where invoice discounting/financing is basically the same thing as factoring. Here is a quote from Wikipedia https://en.wikipedia.org/wiki/Factoring_(finance)#Reserve_account: Factoring is the sale of receivables, whereas invoice discounting is a borrowing that involves the use of the accounts receivable assets as collateral for the loan. However, in some other markets, such as the UK, invoice discounting is considered to be a form of factoring, involving the "assignment of receivables", that is included in official factoring statistics. It is therefore also not considered to be borrowing in the UK. In the UK the arrangement is usually confidential in that the debtor is not notified of the assignment of the receivable and the seller of the receivable collects the debt on behalf of the factor.Now if you tell me that Populous is going to focus only on the UK market, which represents less than 4% of global GDP, then the transaction steps they've outlined make sense. In the rest of the world, which encompasses more than 90% of the global opportunity, the transaction as described by Populous will not work. In the USA for instance, non-notification factoring represents only 12% of the total pie, and is only available to larger companies under long term contracts and based on a pool of receivables (never one-off transactions). In addition, the due diligence that invoice sellers are put through under non-notification/confidential factoring is akin to bank lending; it's thorough and complex, thereby expensive to do. The way that Populous imagines these transactions is completely ridiculous, and provides no protection for the invoice buyers. You mentioned that under the Populous model, the sellers will pledge corporate assets while company directors are to give personal guarantees... do you really think that Populous will pay the costs involved in international litigation to recover against sellers based outside of the UK? I doubt they will do that even inside the UK, as enforcement of these types of pledges is very expensive from a legal standpoint, and wouldn't work for any facility of less than $150,000-200,000. Again, for these transactions to work, the buyer of the invoices needs to take control of the repayment from the ultimate customer. Under Populous' current model, there isn't even a notification mechanism for the invoice buyer to be informed when the invoices have been cashed out... how then is the buyer supposed to know whether non-repayment is caused by debtor default (so that credit insurance can be invoked) or by the seller's non-compliance (so that legal action can be taken against the pledges)  It makes zero sense. I found the definition of factoring vs financing from investopedia which I think it's a better source than wikipedia: https://www.investopedia.com/terms/i/invoice-financing.asp |

|

|

|

another month and still no BETA we are waiting for months since november  as i remember january should be full lanch not BETA..cmon Nico ur black u should work fast as black peeps do  Guys! BETA is out! Please go to beta.populous.co. You can sign up there. I can confirm it! When you sign up there is an option of investors and borrowers. You can sign up now!!!!  Just waiting for their official tweet for populous to skyrocket! The email verification link doesn't work for me! |

|

|

|

I think there's a great misconception about how Populous platform works. It is not offering invoice factoring or discounting, but rather a loan from the invoice "seller" to the the invoice "buyer", with the faint promise that the loan will be repaid once the invoice "seller" is paid by the ultimate customer. This makes no sense at all. In real factoring/discounting, the sale of the receivable transfers ownership of the receivable to the factor (i.e. the buyer of the invoice), and the factor obtains all of the rights associated with the receivables. Accordingly, the receivable becomes the factor's asset, and the factor obtains the right to receive the payments made by the customer for the invoice amount. In other words, the buyer of the invoice should be the one repaid directly by the ultimate customer, not the seller. Otherwise the seller is being paid twice for the same invoice (once by the invoice buyer and once by the customer); this goes against the very essence of what a factoring transaction is. It is also possible to structure a collateralized loan transaction that uses the invoices as collateral for the ultimate repayment of the loan, but that isn't what Populous is doing. In fact, the transaction that Populous is envisioning makes no sense at all.

The way you describe how Populous works is just wrong. It IS an actual sale of the invoice at a discounted price. I suggest you some more research on the process. That said, it's a variation of invoice discounting and I'm not aware of any existing models that are similar, so you can't really make a direct comparison to traditional factoring or discounting. It'll compete in the same market, but it's not exactly the same type of business. If it were indeed, as you say, a sale of the invoice at a discounted price, then why is the process described as follows on Populous's website ( https://populous.co/about-platform.html):

-Deposits must be exchanged to Pokens.

-Invoice buyer transfers Pokens to invoice seller.

-Invoice seller transfers Pokens to invoice buyer on repayment of invoice.

-Withdrawal of funds in government currencies, Bitcoin or Ethereum.It is pretty clear from the above that the invoice seller is the one who is ultimately repaid by the customer, which is the very antithesis of an invoice sale or factoring transaction. You can clearly see in the process above that the invoice seller gets paid twice, once by the invoice buyer (in Pokens) and once by the ultimate customer (in fiat). The reason real factoring transactions don't work like this is that they are structured in such a way as to avoid the moral hazard of seller non-compliance. In real factoring, when an invoice is sold, ownership of the invoice is transferred to the buyer, so that the buyer recovers directly from the customer. That is the very essence of factoring/invoice discounting. This same process is explained in further detail on page 16-17 of the Feb 2017 Whitepaper https://web.archive.org/web/20170606070843/http://populous.co/populous_whitepaper.pdf: If the auction is successful:

1.6.9. The beneficiary of the auction receives the funds from the investor group, which has won the auction.

1.6.10. The investors from the other investor groups are refunded their bids.

1.6.11. When the borrower cashes the invoice, which he has auctioned, he sends the money to the platform.

1.6.12. When the funds are received, the investors from the investor group, which has won the auction, receive their winnings. Each investor receives dividends propor-tional to his bidding contributions.You can see clearly above that invoice "seller" is paid funds once by the investor group (paragraph 1.6.9.) and then a second time by the customer when the invoice is cashed out (paragraph 1.6.11.). From a functional perspective, this cannot be a "sale" of the invoice, because in such case the "seller" cannot be repaid directly by the customer, the right of repayment having been transferred to the buyer. Now, when you take away the right of direct repayment from the invoice "buyer", then this becomes nothing more than a simple loan, or an "IOU". There is no collateralization or other defensive mechanism protecting the invoice "buyer" from the seller's eventual non-compliance. In fact, there isn't even a way for the invoice "buyer" to know whether the invoice has been repaid/cashed out. You should really be asking yourself whether it's a good idea to invest in a team that can't even properly explain how a factoring transaction works... perhaps this is because they have absolutely no experience in this field. - Borrowers or invoice sellers sell their invoices at a discount depending on the risk credit rating calculated. So an invoice may be worth $1000 and the borrower may sell it for 10% less of it's value which is $900. This will rewarded the invested with $100 profit. - If the borrower/invoice seller sells his invoices through Populous, they will receive Pokens from the sale which they can send to us and we will transfer them fiat currency equivalent or they can keep the Pokens and do what they want with them. The invoice seller can transfer Pokens outside the platform to his/her wallet or sell even sell on other exchanges. Pokens are worth the same as the fiat currency the inovice was sold in. To offset the risk of default for any invoice sold by a invoice seller, There are three main things ppt do but this is on cases by case basis. 1) Credit insurance: Which is for large invoice amounts. 2) Charge on the invoice sellers company. Which is often known as a debenture registered a against the invoice sellers company. 3) Directors personal guarantee. By taking out credit insurance the insurance company basically says they will cover the value of the invoice if the invoice sellers customer does not pay. A debenture will allow the assets of the invoice sellers company to be legal taken to settle the debt should the invoice not be paid. Directors personal guarantee would allow recovery of the debt in a worst case scenario by selling property of the invoice seller, such as his or her house. These are used as recovery options and which are installed in the process of risk management of the invoice sale. Prior to that PPT carry our a full check on both the invoice seller and their customer in order to not get to the stage in which there would be a default. Wow, an official response from PPT staff, I am honoured! You are not addressing my main point; that the transaction as you have described cannot be a true sale of invoice (factoring) as long as the seller of the invoice is the one that receives payment from the customer (debtor). Even in "non-notification factoring", the buyer of the invoice (factor) assumes the identity of the invoice seller, and recovers money directly to an account controlled by them. Again, the idea that the seller should cash out on an invoice is the very antithesis of invoice factoring.The object of credit insurance is to insure against default by the customer (debtor) who is liable on the invoice, not the risk of non-repayment by the seller. Credit insurance never insures against the moral hazard that the invoice seller refuses to repay the invoice buyer, simply because factoring transactions don't require this type of coverage when they are structured properly (not the case on Populous platform). The next two defensive mechanisms you have outlined are typical in recourse factoring, however Populous is not a factoring platform, so again you are mixing up concepts. At best, Populous offers invoice discounting without the protections that are typically seen in those types of transactions. If you are still insisting that Populous does offer factoring solutions (and true sale of invoices), I challenge you to find a single public internet source where factoring is described in such a manner that the 1) invoice seller is advanced funds by the factor when the invoice is sold and 2) the invoice seller recovers funds from the customer in their own bank account and 3) transfers the money to the invoice buyer's account. If you type "How does invoice factoring work", here are the first 10 results that appear: 1) https://www.comcapfactoring.com/blog/how-does-invoice-factoring-work/Most factoring companies purchase invoices in two installments. The first installment – the factoring advance – covers about 80% of the receivable (this amount varies). The remaining 20%, less the factoring fee, is rebated as soon as your client pays the invoice in full. (this clearly implies that the invoice buyer receives the funds since they rebate the 20% balance, less the factoring fee 2) https://fitsmallbusiness.com/how-invoice-factoring-works/Step 4. Your Client Pays the Factor

Your client will pay the factor within 90 days according to the terms of the invoice.

Step 5. The Factor Forwards You the Remaining Balance (Minus Fees)

After receiving payment from your client, the factor will give you the remaining balance of the invoice, called the reserve amount, minus their fees.3) https://www.cit.com/thought-leadership/how-does-factoring-work/Step 3: Factoring Company Collects from Retailer

At invoice maturity, the factoring company collects from the retailer and credits the supplier's account. The factor fully manages the accounts receivable including the lock box, cash application and collection of past dues. Retailer deductions or disputes over delivery terms or product are reported to the supplier. The factor maintains the accounts receivable ledgers and provides this information to the supplier electronically via Internet reporting capabilities.

4) http://www.rtsfinancial.com/guides/what-factoring

Factoring is a transaction in which a business sells its invoices, or receivables, to a third-party financial company known as a “factor.” The factor then collects payment on those invoices from the business’s customers. And so on... Again, you can't just pull the definition of "factoring" and say Populous won't work because it doesn't fit the description. It's intentionally different. I understand your point about how the seller will receive cash from both sides, but I don't think it's accounts that they control. I don't know the mechanics for certain, but there are a couple of simple solutions that make sense so that's how I expect it to work out. It's not that hard of an issue to deal with so I'm not particularly worried that Populous is just going to leave open the risk that the Seller takes money from both sides and disappears. Disclaimer: I'm not Populous staff...I copied/pasted the answer from PPT in page 10 of this thread... What you're talking is Invoice Factoring....Populous is about Invoice Discounting/Financing....meaning the customer of the business is not aware of the arrangement between the Business & Lender (invoice buyer). |

|

|

|

I think there's a great misconception about how Populous platform works. It is not offering invoice factoring or discounting, but rather a loan from the invoice "seller" to the the invoice "buyer", with the faint promise that the loan will be repaid once the invoice "seller" is paid by the ultimate customer. This makes no sense at all. In real factoring/discounting, the sale of the receivable transfers ownership of the receivable to the factor (i.e. the buyer of the invoice), and the factor obtains all of the rights associated with the receivables. Accordingly, the receivable becomes the factor's asset, and the factor obtains the right to receive the payments made by the customer for the invoice amount. In other words, the buyer of the invoice should be the one repaid directly by the ultimate customer, not the seller. Otherwise the seller is being paid twice for the same invoice (once by the invoice buyer and once by the customer); this goes against the very essence of what a factoring transaction is. It is also possible to structure a collateralized loan transaction that uses the invoices as collateral for the ultimate repayment of the loan, but that isn't what Populous is doing. In fact, the transaction that Populous is envisioning makes no sense at all.

The way you describe how Populous works is just wrong. It IS an actual sale of the invoice at a discounted price. I suggest you some more research on the process. That said, it's a variation of invoice discounting and I'm not aware of any existing models that are similar, so you can't really make a direct comparison to traditional factoring or discounting. It'll compete in the same market, but it's not exactly the same type of business. If it were indeed, as you say, a sale of the invoice at a discounted price, then why is the process described as follows on Populous's website ( https://populous.co/about-platform.html):

-Deposits must be exchanged to Pokens.

-Invoice buyer transfers Pokens to invoice seller.

-Invoice seller transfers Pokens to invoice buyer on repayment of invoice.

-Withdrawal of funds in government currencies, Bitcoin or Ethereum.It is pretty clear from the above that the invoice seller is the one who is ultimately repaid by the customer, which is the very antithesis of an invoice sale or factoring transaction. You can clearly see in the process above that the invoice seller gets paid twice, once by the invoice buyer (in Pokens) and once by the ultimate customer (in fiat). The reason real factoring transactions don't work like this is that they are structured in such a way as to avoid the moral hazard of seller non-compliance. In real factoring, when an invoice is sold, ownership of the invoice is transferred to the buyer, so that the buyer recovers directly from the customer. That is the very essence of factoring/invoice discounting. This same process is explained in further detail on page 16-17 of the Feb 2017 Whitepaper https://web.archive.org/web/20170606070843/http://populous.co/populous_whitepaper.pdf: If the auction is successful:

1.6.9. The beneficiary of the auction receives the funds from the investor group, which has won the auction.

1.6.10. The investors from the other investor groups are refunded their bids.

1.6.11. When the borrower cashes the invoice, which he has auctioned, he sends the money to the platform.

1.6.12. When the funds are received, the investors from the investor group, which has won the auction, receive their winnings. Each investor receives dividends propor-tional to his bidding contributions.You can see clearly above that invoice "seller" is paid funds once by the investor group (paragraph 1.6.9.) and then a second time by the customer when the invoice is cashed out (paragraph 1.6.11.). From a functional perspective, this cannot be a "sale" of the invoice, because in such case the "seller" cannot be repaid directly by the customer, the right of repayment having been transferred to the buyer. Now, when you take away the right of direct repayment from the invoice "buyer", then this becomes nothing more than a simple loan, or an "IOU". There is no collateralization or other defensive mechanism protecting the invoice "buyer" from the seller's eventual non-compliance. In fact, there isn't even a way for the invoice "buyer" to know whether the invoice has been repaid/cashed out. You should really be asking yourself whether it's a good idea to invest in a team that can't even properly explain how a factoring transaction works... perhaps this is because they have absolutely no experience in this field. - Borrowers or invoice sellers sell their invoices at a discount depending on the risk credit rating calculated. So an invoice may be worth $1000 and the borrower may sell it for 10% less of it's value which is $900. This will rewarded the invested with $100 profit. - If the borrower/invoice seller sells his invoices through Populous, they will receive Pokens from the sale which they can send to us and we will transfer them fiat currency equivalent or they can keep the Pokens and do what they want with them. The invoice seller can transfer Pokens outside the platform to his/her wallet or sell even sell on other exchanges. Pokens are worth the same as the fiat currency the inovice was sold in. To offset the risk of default for any invoice sold by a invoice seller, There are three main things ppt do but this is on cases by case basis. 1) Credit insurance: Which is for large invoice amounts. 2) Charge on the invoice sellers company. Which is often known as a debenture registered a against the invoice sellers company. 3) Directors personal guarantee. By taking out credit insurance the insurance company basically says they will cover the value of the invoice if the invoice sellers customer does not pay. A debenture will allow the assets of the invoice sellers company to be legal taken to settle the debt should the invoice not be paid. Directors personal guarantee would allow recovery of the debt in a worst case scenario by selling property of the invoice seller, such as his or her house. These are used as recovery options and which are installed in the process of risk management of the invoice sale. Prior to that PPT carry our a full check on both the invoice seller and their customer in order to not get to the stage in which there would be a default. |

|

|

|

Does anyone know why it's holding so strong in todays red sea?

look at the charts on BTC or ETH, and then compare them to PPT's charts. Line up the dates and take note of everytime the giants go down, they traditionally take the rest of the market with it. But Populous amazingly manages to grow in terms of BTC and ETH price, which means when the giants come back up the USD valuation goes up even further, Populous's price often grows to more than what it was before the giants dipped Yeh i understand, but why? It is interesting no one can answer a simple question.... Because they have been planning to launch their beta platform by end of Jan (supposedly tomorrow). We should see if they release the platform tomorrow or end of the week. I answered it dude..... Can you read? I said "There are some serious bulls behind PPT. And these are BIG bulls with a lot of money. Majority of the holders know the value of what they are holding, it is priceless. No price is worthy of my PPT. I wouldn't even sell it to you if you were offering me $1000 each." PPT has a verry strong group of holders. Someone ells has mentioned that above too. Is that enough of an answer for you? That interactive simulation of the Beta was very good in my opinion. Looks very clean. S/he was asking "at this specific time" when every crypto is going down...Your answer is general and opaque...who are the whales behind it? what is your source? You can pretty much find this logic in any other crypto forum. what is specific to PPT right now? The expectation that they launch their platform by end of Jan per this tweet: https://twitter.com/BitPopulous/status/957300876959535106I've been holding since august! |

|

|

|

Does anyone know why it's holding so strong in todays red sea?

look at the charts on BTC or ETH, and then compare them to PPT's charts. Line up the dates and take note of everytime the giants go down, they traditionally take the rest of the market with it. But Populous amazingly manages to grow in terms of BTC and ETH price, which means when the giants come back up the USD valuation goes up even further, Populous's price often grows to more than what it was before the giants dipped Yeh i understand, but why? It is interesting no one can answer a simple question.... Because they have been planning to launch their beta platform by end of Jan (supposedly tomorrow). We should see if they release the platform tomorrow or end of the week. |

|

|

|

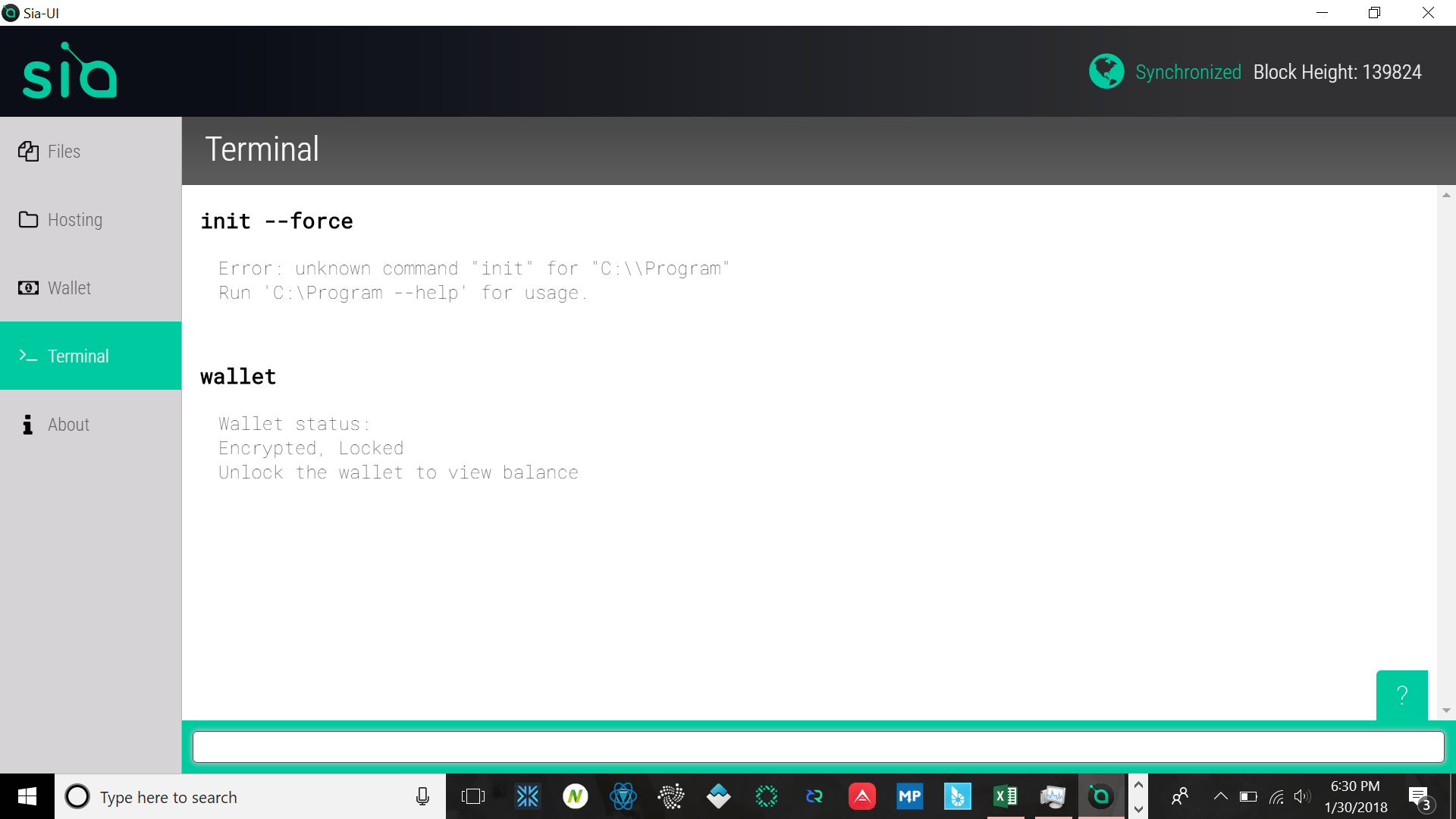

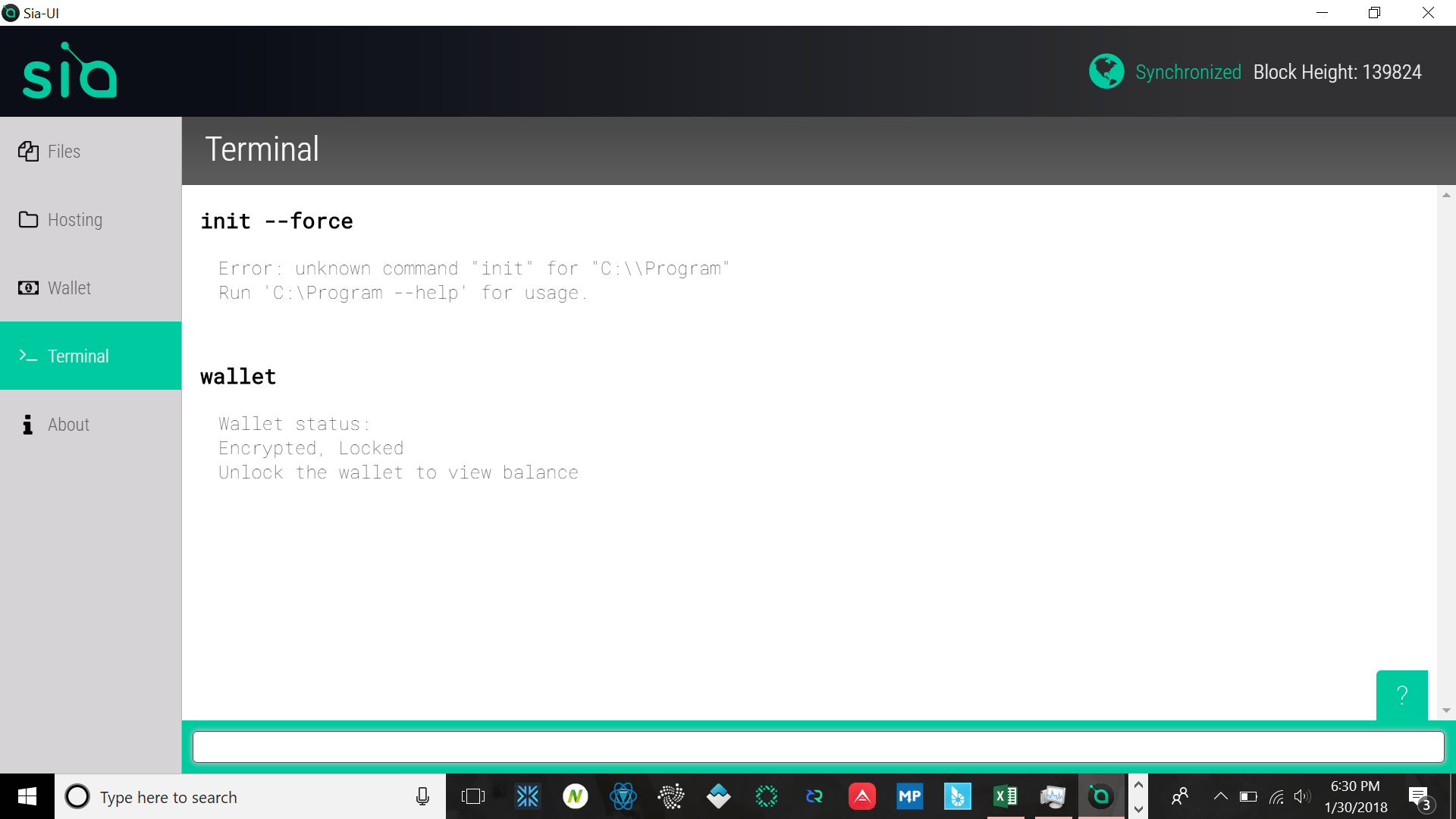

That's what I'm saying...I don't have any seed to begin with cause I can't make any New Wallet! Shut down wallet, then delete the wallet folder from the computer, reopen wallet, create new wallet. Same...Should I also delete AppData and reinstall the wallet? it took few days to synch...don't like to go through the same process. Try click on the "Terminal" tab and type wallet init --force  wallet init --force it works, thank you...it's strange we should do through the terminal! |

|

|

|

That's what I'm saying...I don't have any seed to begin with cause I can't make any New Wallet! Shut down wallet, then delete the wallet folder from the computer, reopen wallet, create new wallet. Same...Should I also delete AppData and reinstall the wallet? it took few days to synch...don't like to go through the same process. Try click on the "Terminal" tab and type wallet init --force  |

|

|

|

That's what I'm saying...I don't have any seed to begin with cause I can't make any New Wallet! Shut down wallet, then delete the wallet folder from the computer, reopen wallet, create new wallet. Same...Should I also delete AppData and reinstall the wallet? it took few days to synch...don't like to go through the same process. |

|

|

|

That's what I'm saying...I don't have any seed to begin with cause I can't make any New Wallet! |

|

|

|

I had word from an insider yesterday. Populous won’t be launching 31st there is a bug they can’t solve yet. They have known about this bug for at least a little bit

What functionality of the platform is this bug impacting? |

|

|

|

|