Arbitrage trade is actually highly profitable. No risk hedge arbitrage across the exchange!

To put it simply “ arbitrage across the exchange”, there is risk of price of BTC going down in the process of doing it.

796 Exchange makes arbitrage across the exchange more easily. As long as you execute hedge on 796 platform, you will be able to obtain riskless profit.

The BTC price of 796 Exchange is a little bit high, while $7 appeared in Mt. Gox market a few days ago. Cutting fees from both sides and transaction difference, the profit could get to 5% at least.

It is quite simple to achieve this when the price is over 3% more than that of Mt. Gox.

First, selling short 100 BTC at the price of $106 in 796 Exchange for example, you just need to deposit margin for 25 BTC.

Second, buy 100 BTC at the price of $100 from Mt. Gox.

Here finishes one arbitrage and gets 5% profit. When the price difference is close, you may terminate and settle the contract to realize profit. If high premium continues, you may repeat the operation and wait for settlement. (from July, we will carry out weekly settlement)( about settlement: 796 Exchange will cease BTC futures trading from 23:45pm to 24pm on the last business day of each week, during which suspend trading will be executed at the average price showed on Mt. Gox website at 23:50. And all the orders will be settled at that price and all pending orders will not be affected )

If the price in 796 Exchange is lower than that of Mt. Gox, and you have BTC in Mt. Gox, you could also do hedge arbitrage. It is just an opposite process.

All these are really easy!

Brief introduction of 796 Exchange

796 Exchange is established and operated by 796 Xchange Limited (Registration No. 1911752) which is incorporated under the laws of Hong Kong.

796 Exchange is a comprehensive financial website covering futures, stocks, funds, options as well as finance activities related to Bitcoin. We will constantly provide Bitcoin fans with investment channels relating to Bitcoin and promote the Bitcoin application development.

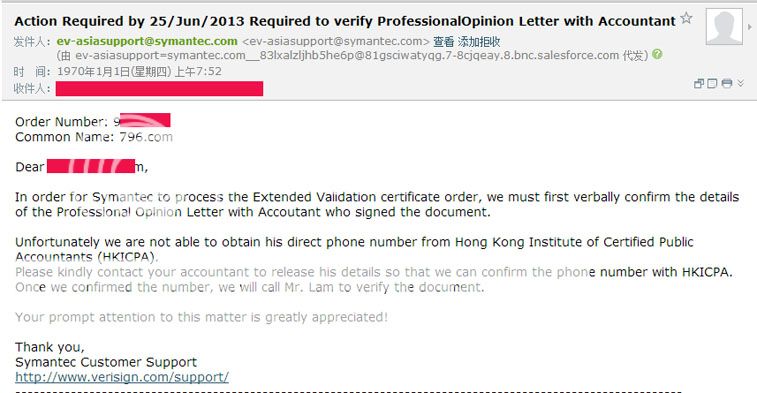

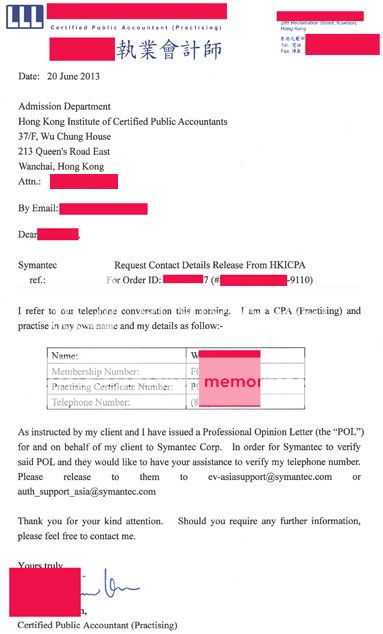

For safety measure, we have used VerSign's EV SSL security certificate, Norton’s safety signature, Google Authenticator together with our exclusive security code protection to prevent users’ fund from fraud to the greatest extent.

Details here:

https://796.com/other/about.htmlBTC Futures Rules:

796 Exchange has improved its BTC futures quite a bit comparing to the ordinary futures. Rules are set up to accommodate Bitcoin’s characteristics and market demand. We have enriched Bitcoin investment channels by providing users with two-way leveraged trading services.

796 Exchange applies floating leverage on BTC futures. Taking BTC as collateral and provide margin trading, when Bitcoin price at $100, buying long corresponds to a 2 times leverage while selling short corresponds to a 4 times leverage. If Bitcoin price exceeds $100, the leverage will be enlarged and when Bitcoin price is less than $100, the leverage will be shrunken.

Margin deposit required for buying long is 50% of the Bitcoin investing in the captioned transaction, and 25% for selling short. Every $1 change in BTC price reflects 0.01 BTC profit or loss. When loss of a transaction reaches 98% of the deposit, the contract will be terminated and settled. (equivalent to $49 drop when buying long and $24.5 rise when selling short).

You may visit here for details:

https://796.com/help.html