|

Is his info so hard to believe? Either believe him, or don't. Geez, you act like he owes you something.

|

|

|

|

Isn't the 80/20 split done after the power is paid for? That way it is the profit you are splitting. It doesn't make sense otherwise.

Hell, no. If the split happens after power is paid for, cryptx would be on this in an instant. As long as all the hashpower gets sold or deployed, it is in AM's interests to restrict the franchise program to those with cheap electricity. Now, the thing I don't understand is - if AM is able to ship real miners (not just chips) to franchisees, surely they should have fully deployed in their immersion cooling facility by now? AM does not have enough and cheap electrical power to deploy all devices. That is clear - why else franchise? But my question was why not fill up their own immersion cooling facility in parallel? It shouldn't take long, if DTM's prospectus is to be believed, so I expect that would happen faster than franchising. |

|

|

|

Isn't the 80/20 split done after the power is paid for? That way it is the profit you are splitting. It doesn't make sense otherwise.

Hell, no. If the split happens after power is paid for, cryptx would be on this in an instant. As long as all the hashpower gets sold or deployed, it is in AM's interests to restrict the franchise program to those with cheap electricity. Now, the thing I don't understand is - if AM is able to ship real miners (not just chips) to franchisees, surely they should have fully deployed in their immersion cooling facility by now? |

|

|

|

|

I have not followed closely.

Antirack, what is your relationship with DataTankMining and Allied Control?

I've also asked a few times without getting a response. Different portions of the prospectus, forum conversations suggest that Allied Control and DataTankMining are the same entity, separate entities, supplier-customer, share the same management team, etc. What actually are the relationships?

|

|

|

|

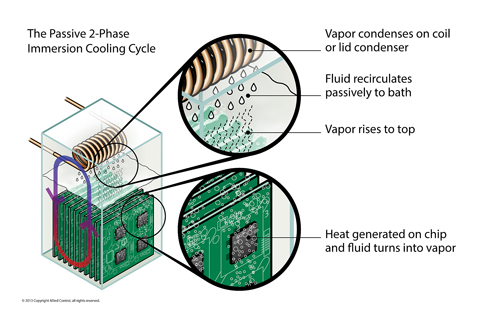

Passive 2-phase immersion cooling is often misunderstood. There is no need for a chiller, it uses a simple dry tower, which is essentially the same thing as a radiator in the front of your car or your water cooling system of a PC. And it also works in very hot climates. The systems are designed to work with hot water (aka hot water cooling). It takes very little energy to cool water from say 70C to 50C even when it's extremely hot outside like in Arizona or other hot places. (this hot water can in fact also be used to heat up buildings like schools or offices) http://www.electronics-cooling.com/2014/02/bitcoin-2-phase-immersion-cooling-and-the-implications-for-high-performance-computing/ The PUE of less than 1.01 includes the _total_ cooling process, including device and building cooling. There is nothing else required. There is no trickery. In fact it's less than that. If you'd use wet towers, or a river near by, it would be lower. But why waste the water and waste time with an open system (needs frequent cleanup)? Thank you for the explanation. We'll continue the discussion in HK 2014 I found the discussion quite informative. What are your thoughts on IM DCs now, after having learned more about the process at HK? All I'm saying is mount the Bitcoin mining chips (on small PCBs) directly onto your secondary cooling loop.

Why doesn't anyone (manufacturer + purpose-built mining facility) do this? |

|

|

|

|

DataTankMining said that he can build hardware today (most likely assuming AM BE200 chips) at < $0.44/G. I guess that means that at their quantity levels the chips themselves should be significantly less than $0.40/G today.

I've opined this before: I'm doubtful that BE200 will be the chip deployed for DTMA. Do you really think it will be the best chip on the market in quantity in 2-5 months time? I speculate that it was likely to be some other manufacturer, or perhaps BE300 if that were available.

But the exclusive partnerships and other tie-ups mix this up a bit.

So, the public IPO of both DTMA and DTMB units have been pushed back, right? Or does "capacity units" refer to DTMB only?

|

|

|

|

Maybe I'm wrong about this, but... the difficulty level tells how hard it is to find a block; from this we can also calculate expected interval between finding blocks. But this assumes that the network hashrate remains constant since the last difficulty adjustment. In reality, the expected mining returns would trend more closely with network hashrate, especially if the hashrate increases significantly.

Correct?

Its the other way round. Difficulty is a number that determines what the odds are to find a block with a given hashrate. Average time in seconds is: difficulty * 2^32 / hashrate. Difficulty is tuned so the entire network on average will find one block every 10 minutes. But if the overall network hashrate is bigger than before the previous adjustment, more blocks will be found than once every 10 minutes and so overall block generation time goes down, which will cause the next difficulty to rise. This is also what I understand, up to this part. But your individual block generation time for your particular hashrate remains exactly the same until the difficulty changes.

Here's where my understanding differs. 1. Block generation is probabilistic, so the generation time varies due to many factors. <-- correct? 2. When someone else publishes a block, all work we've previously done is wasted and we need to base our calculations on the new block. <-- half correct? 3. In addition, we wasted a small amount of effort (spent calculating on old data) that is proportional to latency <-- correct but usually insignificant? 4. Therefore, we are competing against the entire network hash, and our expected returns inversely varies closer to network hash than difficulty. <-- this is what i'm unsure about 5. Even if the above reasoning is wrong, a thought experiment shows that the conclusion must be correct. If network hash rate somehow doubles right after a difficulty adjustment, it is clear that our expected return will approximately halve even before the next difficulty adjustment. |

|

|

|

That said, your numbers dont quite add up either. At todays difficulty, which has been in effect since the end of last dividend, 1150TH will yield ~300 BTC per week, minus 73 hosting is ~227 BTC for this friday. Next difficulty is projected to be 17B which would result in ~238-73=~166 BTC. Okay probably a little more next week, since a few days will be mined with todays difficulty, but the week after that it will be in full effect, and difficulty might have gotten another increase.

Maybe I'm wrong about this, but... the difficulty level tells how hard it is to find a block; from this we can also calculate expected interval between finding blocks. But this assumes that the network hashrate remains constant since the last difficulty adjustment. In reality, the expected mining returns would trend more closely with network hashrate, especially if the hashrate increases significantly. Correct? |

|

|

|

I am not an EE or fabricator but I could obtain ~6,000 chips for a GB maybe a few more if friedcat is feeling generous about this project. Since, I am not a well known member and have not yet been vetted I would accept escrow for this order and would only place it if there was enough interest.

Edit: current price would be ~$5 per chip

If you believe this, pricing is below $.50 / GH/s at 6000 chips. |

|

|

|

How would DataTank Mining's interests be aligned with shareholders'? As far as I can tell, once the container has been sold, DTM just makes a tiny cut of electricity bills, so your only incentive is to keep the container operating? The cost of operation and building of DataTank infrastructure is passed through, there is no profit involved. DataTank Mining's profit comes from deploying 20% of _identical_ hardware alongside the public capacity. Hence, we only earn money if we are successful. The 20% fee on operating cost is used to fund the day-to-day operation, including on-site staff providing various services such as ongoing hardware re-deployments, maintenance and security. Thanks. For clarity, does the IPO also fund your 20% deployment of identical hardware, or will you be coughing up 2 BTC of your own for every 10BTC invested? DTMB holders can essentially convert to DTMA-equivalent with the at-cost purchase of mining hardware right? ie, for 0.0165 BTC / unit at current prices. How will you handle DTMB holders who want different things? Eg, some might want you to help negotiate to franchise their capacity. Others might want to handle their own franchising, while yet others may want to self-mine. Seems like it would be messy to communicate with individual shareholders going in different directions. If the shares are not fungible, there will be more complications when trading shares and issuing dividends on havelock. |

|

|

|

one month and 53 pages after my last post, the situation looks even more dire than my (optimistic) projections. i guess the end is near, but it is like watching a train crash in slow motion. |

|

|

|

|

Given that the container, immersion cooling, etc. are all based on existing technology within allied-control, and that two sites with low electricity costs and no legal problems have already been identified, why would it take so long (3-6m) to deploy containers? Surely the deployment time can be shortened and have less variance?

DataTank Mining is NOT allied control, right? Or is it the same?

Based on the forecast in pg 15 of the prospectus, deployment in 3 months would mean that DTMA will not reach ROI. 6m would be worse of course. Has anyone done figures that are more promising?

Along that reasoning, a deployment in 3-6 months had better not use AM BE200 chips else it will not ROI. Hopefully there will be a better chip by then. Spongebobtech? AM BE300 (4th gen)?

When a better chip becomes available after DTMA starts operations, what is the procedure for swapping to the new chip and how would it be funded?

How would DataTank Mining's interests be aligned with shareholders'? As far as I can tell, once the container has been sold, DTM just makes a tiny cut of electricity bills, so your only incentive is to keep the container operating?

|

|

|

|

I'm getting some weird values on long term dividends:

16-may 0,0005729600

23-may 0,0005763800

30-may 0,0005395500

06-jun 0,0004080500

13-jun 0,0003440500

20-jun 0,0003003530

27-jun 0,0002377380

04-jul 0,0001751230

11-jul 0,0001125080

18-jul 0,0000498930

25-jul -0,0000127220

01-ago -0,0000753370

Stop FUDing! When the share price drops to 0.0178, our annual yield will be back to 100+% again, as it should be. You'll see! |

|

|

|

So it seems that the smart-miner group developed their own ASICs, customized CGMiner and have a massive mining operation. I don't do any mining, so some of these questions may be nonsense. 1. Based on what we know, the ASICs operate correctly right? After all, you don't turnaround problems with the ASICs in a deployed mining farm within a week. 2. Is it plausible that a CGMiner that has been customized to work with their smart-miner would correctly submit low difficulty shares yet fail to submit solutions? Not sure how miner s/w and h/w typically work, but in my naive view, it seems unlikely that the portion of the code that deals with distinguishing a solution and submitting it would actually need to be customised? 3. Xie insinuated that Eligius could have deleted / effaced their solutions from the block list, but did not outright claim that this was done. Surely the default mining software would have logged whenever a solution was found and submitted... so he should know right? (Unless these logs were lost due to their frequent re-imaging of the miner platform or something) |

|

|

|

|

Thanks; the floating rate relieves some of my pain.

Not sure if you missed my previous question: When is the monthly profit distribution expected? I assumed it should have been at month end (ie May 31st). Or would it be on 17th of each month?

Any progress on the public spreadsheets?

|

|

|

|

Any pics of AM data centres ?? I remember ages ago their was some.. but the thread is 1000+ pages...I can't find it anymore lol even though i see flashing lights every day, I still love to see pics of more  Did you check out these pics by caoxg? |

|

|

|

http://www.rockminer.com/R60/If I^Hgoogle-translate understand correctly, they go even further to reduce risk to buyers. Pay 1 BTC for 1 RX-BOX, shipping 25 Jun. Add your own PSU and electricity. If your theoretical mining revenue within 60 days is less than 1 BTC, you'll get a refund of the difference. So in the worst case, you lose the cost of your PSU, 1036 kWh of electricity and any downtime due to your own facility. This should sell well, methinks?

|

|

|

|

I'm confused whether this venture is called Southern Appliance, YourStore, ApplianceStore, RecycledMoney or what-have-you  Here's some visualisation of the first 1/2 month of operations.  Some thoughts: - It's still early days, but parts revenue is almost negligible, and there is no discernable upward trend - nowhere close to $20k / month in eBay revenue (assuming that eBay revenue = parts sales), which was expected to be executed in the near-immediate time frame - what are typical profit margins for appliance and parts sales? - when is the monthly profit distribution expected? I assumed it should have been on May 31st. - I'd second DebitMe's call for a public spreadsheet (google spreadsheet preferred) to track everything - shareholder list, daily tracking, etc. You are probably keying in the data anyway, so I assume it would incur minimal effort. Improves transparency and easier for us to analyse. |

|

|

|

|