|

461

|

Economy / Speculation / Re: What Could Have Caused Bitcoin to Flash Crash On Sunday?

|

on: April 23, 2021, 05:32:24 PM

|

There were two main theories I saw.

One was that mining rates dropped due to flooding in China which temporarily took out ~10-30% of the total hashrate.

The second reason was due to a funding rate indicator on leveraged positions that said there were a lot of longs open and a high funding rate for shorts (meaning short term shorts were paying people to open them and leave them open). I assume that could then build into a bias if the market starts to get a bit stagnant.

Why would the mining rates dropping affect the price though? I don't follow the connection between a drop in mining rates and price. Ostensibly, the mining rates follow the price, in that when the price goes up it induces more miners to invest in mining equipment to compete for a larger share of blocks, or when the price drops it might no longer be profitable to mine and it might take miners offline because they're losing money by operating. I don't see how a drop in miners would affect the price though, it seems to be the reverse of how it works. |

|

|

|

|

462

|

Economy / Economics / Re: "BTC not a currency per se but can be an alternative asset" China

|

on: April 23, 2021, 05:26:25 PM

|

It worries me when China has a hard stance, but it worries me even more when they speak softly. Is there still a ban on electronic trading of crypto for citizens?

My interpretation is that they have realised that the country has a lot to gain from backing bitcoin in some form. Countries that intend to grow at a fast pace or are trying to reanimate their economies catching the fintech and alternative assets train should be taking this approach.

China is going to introduce a digital Yuan (they're already testing it in live programs with citizens. Because of this, it is very unlikely they'll ever be bitcoin-friendly. They won't want anything to compete with the digital Yuan because success of the digital Yuan is part of a global strategy to break the US's hold over the world financial system. All the rogue nations are likely to adopt the digital Yuan when it is available because it can't be blocked by US sanctions, which will serve as a double-edged victory for China- it boosts reliance on the Chinese economy and it weakens the US at the same time. |

|

|

|

|

463

|

Economy / Economics / Re: April 15th Price Drop, Hash Rate Drops As Blackouts Instituted In China

|

on: April 22, 2021, 04:46:54 PM

|

A thread was posted on this topic in the bitcoin discussion section days ago. It only received a handful of replies. Many are still wondering what caused the drop. Posting this in the hope it helps answer questions.

It should be acknowledged that china has been a prime mover in many of bitcoin's largest price drops throughout history. The big drop around the time of the 1st silk road closing and Ross Ulbricht's arrest could partly be attributed to china banning banks from trading bitcoin in 2013.

It is even possible that china fabricates fake news to negatively influence bitcoin's price. As occurred with false stories of binance offices in shanghai being raided back in 2019.

China may be assuming a softer public tone to minimize negative public backlash associated with their numerous attempts to kill bitcoin's value over the past 10 years. I don't know if they need worry. Most appear to have forgotten china was ever involved.

This is entirely giving China too much credit for price crashes. First, how is silk road closing partly attributable to China banning banks from trading Bitcoin? You'll have to explain that one for me because I don't see the connection. Second, no, China is not fabricating news to negatively influence Bitcoin's price. Every time the price falls, it's not because of a conspiracy. Third, why would the hash rate falling affect the price of bitcoin? It doesn't seem likely to be a cause and effect relationship. The hashrate falling could only possibly affect supply for a maximum of 2 weeks before the difficulty is readjusted, and even then would only result in slightly less Bitcoins being produced than it would have otherwise, and it and I don't see why falling hash rate would affect demand. Seems like these are only correlated by happenstance and not cause. |

|

|

|

|

464

|

Economy / Economics / Re: FINALLY ALL MONETARY AUTHORITIES IN THE WORLD WILL ADOPT BITCOIN

|

on: April 22, 2021, 04:38:46 PM

|

This is wishful thinking.

This. Also, I think these types of posts are typical of someone who has little Bitcoin. So, he likes to think more about how wonderful the future will be if he keeps holding than the present. Someone on the other hand who is a millionaire today thanks to having been holding for many years, may think about the great future that still remains for Bitcoin but I think he enjoys more the present moment and what is happening now. The institutional adoption is to celebrate it and what happens with the authorities in 20 years we will see, those of us who will still hopefully be alive by then. Further, institutional adoption has zero interest in it as a currency. It's being spurred by store of value usage. The odds of bitcoin becoming a functional currency when the only major appeal to it is store of value is virtually zero. There are many other cryptos that beat the pants off bitcoin at being an actual currency. Bitcoin is slow, expensive, and can handle very few transactions at scale. Even a joke coin like Doge is better at being a currency than Bitcoin is. |

|

|

|

|

465

|

Economy / Economics / Re: Charlie Munger: "Bitcoin is an artificial substitute for Gold"

|

on: April 21, 2021, 12:26:41 PM

|

It's always compared to gold years ago and the first one was digital gold or new gold in this age. And for those old successful investors, they really won't be able to catch up with the tech stocks because they're living traditionally and don't understand what's in it.

I guess after just a few years from now, with all of those negative statements from these popular and successful investors who have said negatively about bitcoin, they'll change.

Exactly, they are just putting in action what they are saying, don't invest in something that you don't understand, honestly, we don't really need to hear their opinions about bitcoin because it is going to be the same old thing that they are going to say and I don't think that they will change that and if you are following them then you should probably stop investing because you don't think for yourself and you always seek other's validation. We don't need their opinions but it's always the media that are publishing every word they say even if it's a nonsense thing. The media is the one to blame because they know that it will get their attention if they're going to do that against the bitcoin community. Also, they are public people who'll have media to cover their words everywhere they go at any time. That's plain silly. The media reports what they say because it's newsworthy because of who the are and what they've done. Their opinions aren't nonsense because you disagree with them. I don't know why this community gets themselves so worked up over Buffet and Munger not being fans of bitcoin. Y'all gotta let it go, it doesn't even matter. I think sometimes the news seems to deviate from reality for some purpose. and of course, with the news it will affect the psychology of traders. therefore it depends on us personally in filtering out the news that really happened No part of this is the news deviating from reality. Munger and Buffet expressed negative sentiments about bitcoin, the news reported it, a bunch of people on these boards threw tantrums over it. That all happened. My point is only that people need to stop working themselves up into a tizzy over what Buffet and Munger say because it doesn't matter. |

|

|

|

|

466

|

Economy / Economics / Re: The Coinbase CEO sold 749999 shares of COIN on the first day of the offering

|

on: April 21, 2021, 12:22:18 PM

|

There's an extra digit in the title that's bothering me. OP title says 749,999 shares, but the post says 74,999 shares. Huge difference.

It's 749,999 and not 74,999. Brian Armstrong sold shares worth $292 million at an average price of $389 per share. Still the number of shares sold is a small fraction of his overall holding in Coinbase. As per the 8-K filing made to the SEC, Armstrong holds a total of 2,753,924 Class A shares and 36,851,833 class B shares of Coinbase. Marc Andreessen owns 5,516,037 Class A and 23,961,498 Class B, while Fred Ehrsam and Fred Wilson owns more than 10 million shares. Thanks for the correction. In that case, the first post is missing a digit in the number of shares sold and it's bothering me. OP title correctly says 749,999 shares but the first post says 74,999 shares. Huge difference. |

|

|

|

|

467

|

Economy / Economics / Re: Markets taking profit

|

on: April 21, 2021, 12:19:59 PM

|

|

Anyone who cares what the price has done over a 1 week period has invested more than they should have. If it's so much of a concern, you're over exposed. Price movements over a daily, weekly, or even monthly period are meaningless over the long term.

|

|

|

|

|

468

|

Economy / Economics / Re: Is master card giving us the go ahead to keep buying coins

|

on: April 21, 2021, 12:16:37 PM

|

If this happens our banking system would be forced to do major transaction in crypto currency or else the might just have to suffer deflation on the long run. Considering the fact most companies now transact in crypto currency and pay workers in crypto currency as well

This is false. The banking system definitely wouldn't be forced to do anything. One company allowing for crypto transactions isn't going to anything consequential to the overall banking system, and 99.99% of Mastercard's own transactions are still going to be denominated in USD. |

|

|

|

|

469

|

Economy / Economics / Re: World risk - global

|

on: April 20, 2021, 10:18:51 PM

|

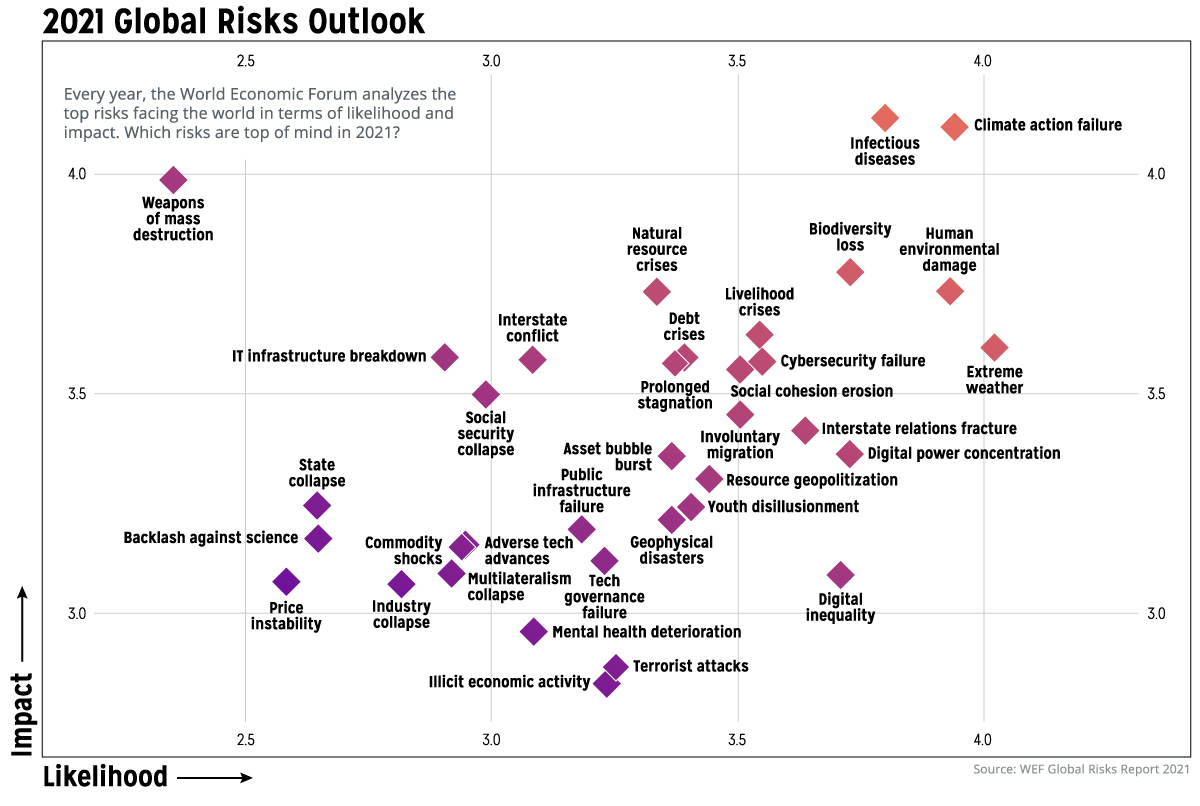

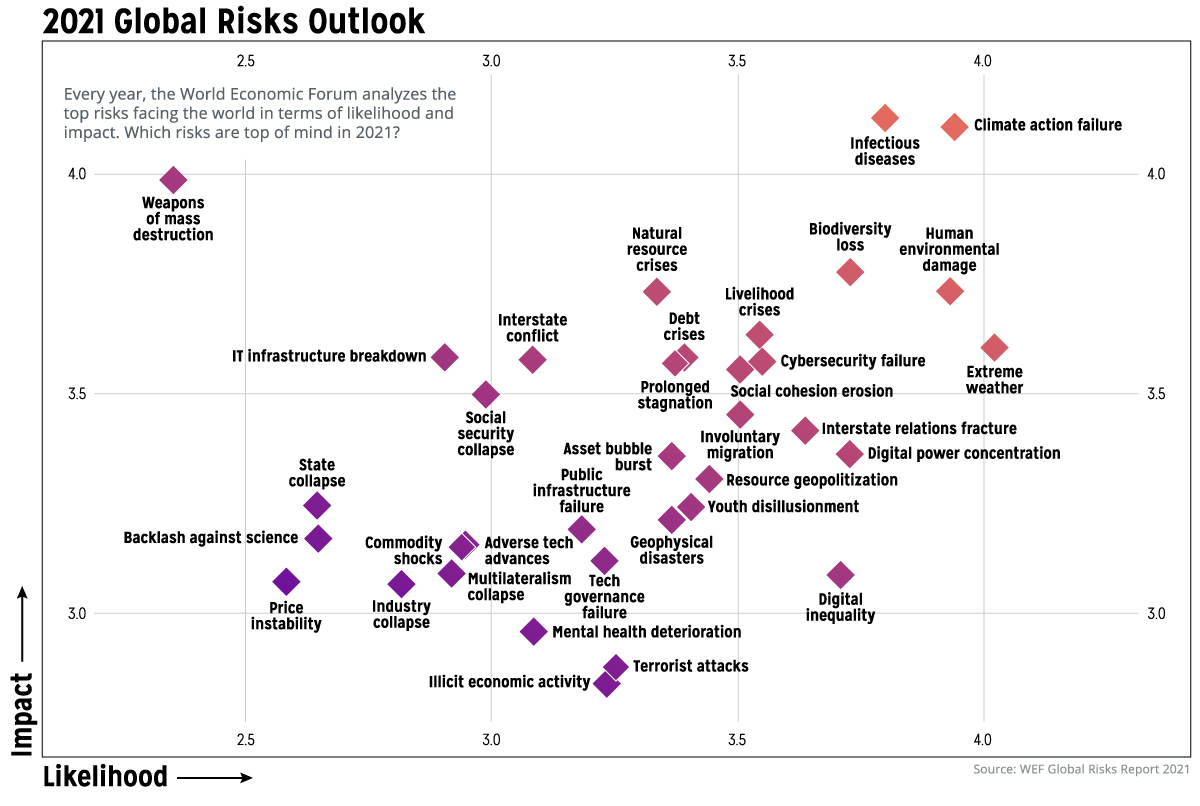

For those unfamiliarised, this is a risk quadrant depicting the world level risks. How important the risk is is based on how likely is to materialise (likelyhood or frequency) and how bad is it (impact or severity). For example something that is likely to happen and is disastrous will be on the top right corner. Risks that are unusual but terrible would be top left. In the inforgraphics you can see how climate change is quite likely and has severe consequences whereas weapons of mass destruction are less likely and even just equally as bad. Now, where would you place the risk of a bitcoin hack o network problem in your finances and in the world finances?  First, the axis is cut off so the graph is truncated and skewed to the upper right as displayed. That said, I'd place breaking the Bitcoin encryption very low likelihood axis and moderately low on the impact axis. It would be low enough on both that it wouldn't show on this graph, down in the lower left corner of an expanded graph. On a global scale, the impact would be fairly minimal at this point, but the likelihood would be far lower due to the calculations how how much computing power it would take to crack the encryption and how many years it would take. |

|

|

|

|

470

|

Economy / Economics / Re: How is it supposed to be alt coin season after bitcoin falls?

|

on: April 20, 2021, 09:58:24 PM

|

I hear everyone talking about how it's going to be alt coin season when bitcoin season is over. But how? Whenever bitcoin falls, for some whack reason alt coins follow suit. Even those coins whos projects have nothing to do with bitcoin like Vechain.

I really feel like we've hit the market cycle top earlier than expected tbh

It's because so much of altcoin market cap is made up of bitcoin pair trading, so a significant portion of the market cap is denominated in bitcoin and translated into USD equivalent. Therefore, when bitcoin falls all alts tend to follow suit if they have a significant portion of their trades done in bitcoin. 99% of altcoins are pure trash anyway, I'm not sold on the concept of "alt coin season" even being a thing. If you're buying them, you're probably making your portfolio worse in the vast majority of cases. |

|

|

|

|

471

|

Economy / Economics / Re: The Coinbase CEO sold 749999 shares of COIN on the first day of the offering

|

on: April 20, 2021, 09:54:07 PM

|

Yeah well, most insiders of privately-held companies just can't wait to cash out once they go public--so this news isn't exactly shocking. The same thing happens after a lot of IPOs, and there's nothing particularly sinister about it (or newsworthy, for that matter).  Looking at the above chart, the CEO was fortunate to sell at the prices he did--but who knows what the stock is going to do in the future. From my brokerage's analysis page, COIN appears to have a P/E of 208, so I'd say the stock is seriously overvalued. If Coinbase were a company that was growing like crazy, that P/E might be acceptable to some investors, but I'm not sure how much they're actually growing their business. I betcha COIN will see much lower prices in the coming months. No one is pricing a company like COIN based on the present earnings. It's a speculative investment on how much it's going to earn in the future and how big this market can become. In that sense, it's no different from ultra speculative equities like Tesla, which also trades at a valuation that makes zero sense in the present. Also, pretty fitting if you ask me that COIN itself is a speculative investment considering it's built upon buying a speculative asset like crypto. ### There's an extra digit in the title that's bothering me. OP title says 749,999 shares, but the post says 74,999 shares. Huge difference. |

|

|

|

|

472

|

Economy / Economics / Re: What's Next? After Bitcoin Passes The 60K Mark......

|

on: April 20, 2021, 09:47:48 PM

|

Financial "experts" have been predicting over $100k every year since for years now, they've never been right before so there's no real reason to give any weight to these predictions. Bitcoin is as likely to go back to $50k than it is to go to $70k, let alone go to $130k.

Well atleast their prediction isn't really far off considering many these so called financial experts have predicted bitcoin to go as far as $100K from when the price of bitcoin was below $10K and we're already more than halfway to go here. It's not like their prediction should be very accurate right? there's always some miss ~ I agree. Bitcoin price, after crashing from $19k, was staying below $10k for more than a year, then it went up above $10k in the end of June 2019, reached $13k for a second in July, and started crashing from there(only with one outlier in the mid February 2020, when it reached $10k+, again, just for a moment), and it descended to as low as $5,173 in March 2020. Knowing all that, it wasn't that easy to predict that BTC would go from $10k not towards $5k again, but towards $100k. I personally couldn't predict that, and I respect those who could. The point is there's no accountability for the predictions. You never keep track of all the times someone is wrong predicting $50k, you only remember the 1 out 100 times they were right. Nobody issuing price predictions has a track record worthy of paying attention to their track records is my point. Btw, totally called going back to $50k after it hit $60k. Maybe I am the expert.  |

|

|

|

|

473

|

Economy / Economics / Re: Diversifying with REITs - buy a prison :)

|

on: April 18, 2021, 05:11:48 AM

|

I like real estate as an asset class, and I have a lot of REIT investments because of the tax advantages of owning them. That said, I can't think of a more morally objectionable real estate class than prison REITs. Private prisons shouldn't even be a thing. Data centers are a growing and much more palatable REIT investment in my book.

It is objectionable indeed but then again the whole Government and the centralized system is corrupted and objectionable itself. Itís a governmentís job to police and run the penal system. Itís too important to delegate to a company whose main incentive is profit. We already know that private prison companies lobby for more restrictive laws because it increases inmates and and therefore profit. The only consideration when crafting laws should be what is good for society, not prison profits. |

|

|

|

|

474

|

Economy / Economics / Re: Russian vs foreign companies

|

on: April 18, 2021, 04:59:36 AM

|

It's obviously bad for consumers. If Russian software was any good and desired by consumers, they wouldn't need the government to force it onto devices in the country. Russia is an authoritarian country like China, and it's not surprising to see them attempting to prop up their uncompetitive businesses artificially through strongarm tactics like this.

It is not about whether the software is good or bad. Russian firms are being denied a level playing field elsewhere. Even in case of the vaccination against CoVID 19, the American regime forced many countries not to order the Sputnik V vaccine. The Nord Stream 2 pipeline is hit by sanctions from the US, although the German government is firmly in favor of its completion. When this is the case, why should the Russian government allow Western corporations to make profit in their jurisdiction? None of that addresses the facts. Russian corporations are propped up by the Russian government because their products are inferior and not competitive in the global market. Nobody expects a level playing field in Russia. At the end of the day, Russia gonna Russia. |

|

|

|

|

475

|

Economy / Economics / Re: Out of Reach

|

on: April 18, 2021, 04:57:29 AM

|

Small investors such as myself find it hard to purchase bitcoin during a bull market. Yes, everyone here aspires to acquire atleast 1 bitcoin. It was attainable then since the price is only at a thousand dollars, but with the current price which is at 50k atleast, acquiring 1 bitcoin will be difficult, especially for those that are not so wealthy. However, those that have HODL bitcoin from the very start, those of which who have purchased it at a low price will definitely gain more than what they have given.

Must it be at least 1 Bitcoin? I believe everyone should start removing that kind of mentality, and begin counting their coins in the smallest possible denomination. In Satoshis, or Bits. With a Bitcoin price above 60,000 USD it seems nearly impossible for a beginner in the crypto world to go directly for 1 BTC. Its just too much money. Even if you had such kind of funds available right now I wouldn't recommend to put it all in Bitcoins. The risk of owning only one crypto coin is quite high with these prices. In my opinion it would be better to split your funds among 4-6 different crypto coins, with only 50% put into Bitcoins. As a long term goal owning 1 BTC is still a viable in my opinion. Honestly, with how many coins are completely useless, owning other coins seems like a much bigger risk than just owning bitcoin. The only reason most people try to buy other coins is in hope to pumps like bitcoin did, but that lightning isnít going to strike twice. |

|

|

|

|

476

|

Economy / Economics / Re: Bitcoin are playing with the big boys and cleaning their energy footprint

|

on: April 18, 2021, 04:49:59 AM

|

It is also a trend for Fiat shills (competition) to complain about the high energy consumption that are needed to mine coins (tokens) and to run the Bitcoin Blockchain. Now, "Gryphon Digital Mining has raised $14 million to establish renewable energy-driven bitcoin mining operations in the United States."

Characterizing the criticism as coming from ďfiat shillsĒ is disingenuous at best. Bitcoin is never going to replace fiat, itís just not a viable currency. So people donít need to tear down bitcoin because itís not a threat to fiat. The criticism about energy consumption is legitimate, and it has nothing to do with fiat. Youíre projecting your own insecurities about bitcoin way too hard. |

|

|

|

|

477

|

Economy / Economics / Re: Venezuela Planning New 100,000-Bolivar Bills Worth Just $0.23

|

on: April 18, 2021, 04:43:52 AM

|

There won't be any because Bitcoin is not at all suitable as a currency for everyday use. There is no country in the world where you go to the bakery in the morning and pay with gold. Moreover, a country would give up its sovereignty over money. No politician would do that.

You are absolutely spot on. Bitcoin can be used as a payment, but it is not suitable for making day to day payments. The confirmation tome can vary from 5 minutes to 1 hour. Who is going to wait for this much time, to get his payment confirmed? Another issue is with the extremely high transaction fee. It's on the rise once again, and yesterday everyone was paying an average fee of around $20. Imagine paying this much as the fee for a coffee or burger, which itself costs just $3. Itís efficient for transferring large values but not at all suitable for small transactions, which is why it isnít suitable as a currency. Cross border transactions are are good use for speed and cost, but that doesnít make it a good currency. |

|

|

|

|

478

|

Economy / Economics / Re: Charlie Munger: "Bitcoin is an artificial substitute for Gold"

|

on: April 18, 2021, 02:46:57 AM

|

It's always compared to gold years ago and the first one was digital gold or new gold in this age. And for those old successful investors, they really won't be able to catch up with the tech stocks because they're living traditionally and don't understand what's in it.

I guess after just a few years from now, with all of those negative statements from these popular and successful investors who have said negatively about bitcoin, they'll change.

Exactly, they are just putting in action what they are saying, don't invest in something that you don't understand, honestly, we don't really need to hear their opinions about bitcoin because it is going to be the same old thing that they are going to say and I don't think that they will change that and if you are following them then you should probably stop investing because you don't think for yourself and you always seek other's validation. We don't need their opinions but it's always the media that are publishing every word they say even if it's a nonsense thing. The media is the one to blame because they know that it will get their attention if they're going to do that against the bitcoin community. Also, they are public people who'll have media to cover their words everywhere they go at any time. That's plain silly. The media reports what they say because it's newsworthy because of who the are and what they've done. Their opinions aren't nonsense because you disagree with them. I don't know why this community gets themselves so worked up over Buffet and Munger not being fans of bitcoin. Y'all gotta let it go, it doesn't even matter. |

|

|

|

|

479

|

Economy / Economics / Re: Can the government hijack Bitcoin?

|

on: April 17, 2021, 10:21:52 PM

|

Bitcoin is known as to be the biggest cryptocurrency. in some countries it can be used to purchase goods and services and some see cryptocurrency as a threat.

if Bitcoin comes to be number one currency in the world today, can it be hijack by the government?

No, that's kind of the point. It's decentralized, there's no one point where you can control it. The only way to control it is to have a significant majority of the hashpower which at this point would be nearly impossible, or to break the encryption that secures the blockchain, which with the present level of technology is also nearly impossible. |

|

|

|

|

480

|

Economy / Economics / Re: Charlie Munger: "Bitcoin is an artificial substitute for Gold"

|

on: April 17, 2021, 10:14:48 PM

|

The clip over at Youtube: https://www.youtube.com/watch?v=2Zh_9cBQSYUWhile I have great respect for Charlie Munger and Warren Buffett, it feels like they have missed the boat on Bitcoin - leaving a lot of money on the table as it were. They have famously avoided tech stocks until investing in Apple relatively late and it seems they have gotten increasingly risk adverse in their old age. Personally I think that Bitcoin is an artificial substitute for gold and that is actually a good thing. Having some gold coins myself during Covid, I have sold them face-to-face in the past but most businesses were closed during this time and it simply doesn't feel safe sending such high value items through the post - Bitcoin does not face such a problem. Of course Gold has practical physical world uses as well, but the majority is kept in the form of jewelry or investment grade forms. I find it funny that Charlie seems to have mellowed a bit on it, I'm sure he has labelled it evil in the past.. They haven't missed the boat because they were never going to get on the boat. They don't invest in assets that don't produce income like gold and bitcoin, they've never been interested in that and it's never been part of their investment universe. They invest in companies that generate cashflow and profit, because that's what they know how to value. |

|

|

|

|