|

721

|

Alternate cryptocurrencies / Speculation (Altcoins) / Re: [HFT] Hashflow Speculation

|

on: February 20, 2023, 10:05:38 AM

|

a new star is born in crypto, Hashflow is the next big thing.

Already pumped 3x in 40 days. Would be nice to wait for a decent correction but yea it can pump far higher from current price because of CEX FUD, crosschain swaps and growing popularity. The few things that bother me is that: 1- only 20% of supply is in circulation 2- only ~15 mln $ daily volume compared to 230 mln$ on pancakeswap. If we do a volume/marketcap calulation CAKE looks more than twice better. |

|

|

|

|

722

|

Economy / Speculation / Re: Bitcoin Leverage Liquidity Map: Shorts dominating leverage trading

|

on: February 20, 2023, 09:49:32 AM

|

Bitfinex is less than 0.15% of all derivative trading.

That's exacly what I wanted to post after reading Wapfika post. Bitfinex charts have zero analytical value and are super easy to manipulate. Bottom line: Traders remain uber bearish right now. Despite bears claiming that the market is too bullish, clearly leverage traders are overtly bearish right now around current prices.

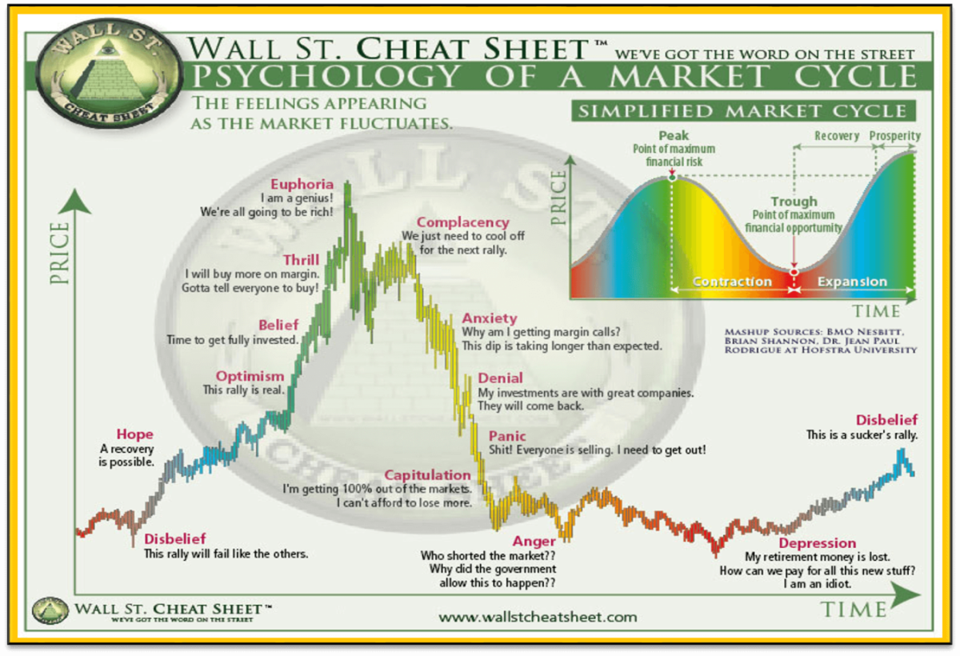

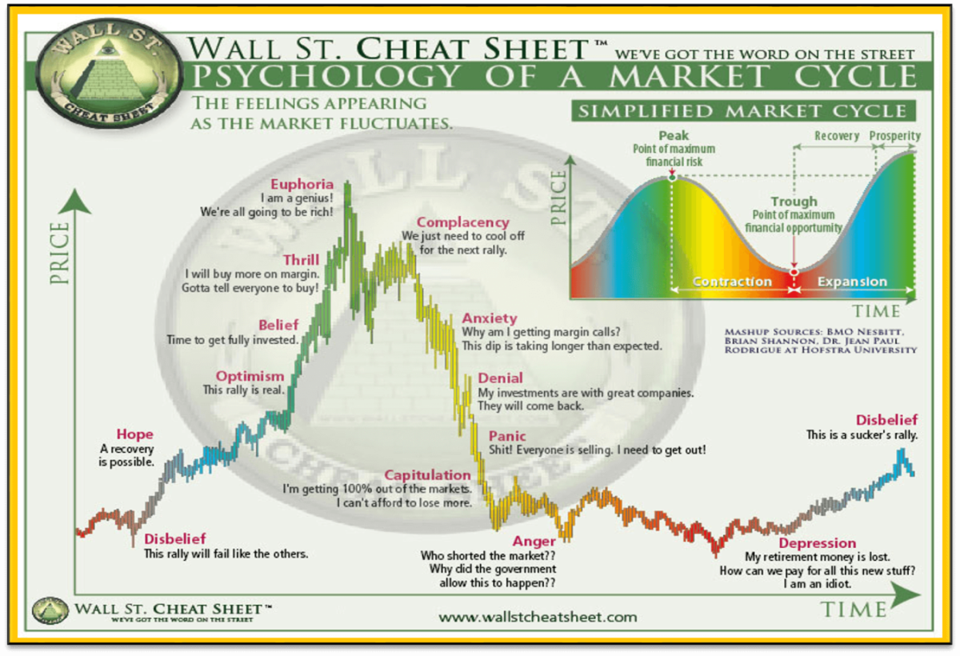

Fit best in a "suckers' Rally" narrative also called "disbelief":  People don't trust this pump. 500 days in bear market made them forget how bull run looks like. Just like in APR 2019. This is a very great setup for a short squeez. |

|

|

|

|

723

|

Other / Archival / Re: Bitcoin vs. Inflation

|

on: February 20, 2023, 08:21:13 AM

|

And they can sell a good number of units only if mining stays profitable. Else the mining businesses will certainly not invest into new hardware... At least this is how I see the things. The Intel miners (ASIC chips or full devices, whatever) are a novelty, but I doubt people (and businesses!) will only buy them as collectibles  But all this intel discussin is to prove that bitcoin can't go down because big company can't be wrong by investing in mining chip technology. But history is full of such mistakes. Like KODAK or NOKIA. Nvidia also made many mistakes trying to fulfill ETH miners needs during ICO bubble in 2017. This math is actually not too bad. But this means the next pump will go 2-3x from the last ATH (if no recession or bigger war). And this contradicts the initial statement that in the next decade (meaning 10 years) the price stays in the 20k-60k range.

So what I've missed or where we don't understand each other?

Its not from ATH but from halving date price. So if we will have halving @ 30k, its possible to bounce from last ATH. That's correct. Still, the history has shown for now that the difficulty went down only for rather short periods of time and this trend seems to still be strong. For how long? I don't know, but, again, it breaks that 20k-60k range prediction.

Agree. Predicting a reversal of a strong 10 year trend is most often a mistake. But its also worth to mention that bitcoin was created in 2009 (after GFC) and existed only during a decade of booming economy and globalization. I'm not so sure we are booming now and will be in next few years. Nothing is certain. There are only probabilities. |

|

|

|

|

724

|

Local / Polski / Re: Binance vs FTX

|

on: February 19, 2023, 08:32:16 AM

|

Oczywiście Bianance będzie musiał albo:

- zastąpić Paxosa innym emitentem (albo emitować BUSD samemu)

- znależć dodatkowego emitenta, zostawiając Paxosowi obsługę już istniejących BUSD, jeśli NYDFS nie również tego nie zakaże. Ale to mogłoby być mocno skomplikowane.

- zastąpić BUSD innym stablecoinem.

Upadek BUSD jest prawdopodobly ale nie tyle w sensie krachu wartości, ale po prostu zwinięcia tego projektu i wypłaceniu użytkownikom równowartości w fiatach albo innych stablecoinach.

Spadek poniżej 1$ szacujesz zatem na bardzo małe ryzyko, jeśli nawet nie zerowe tak? A jak z drugą stroną pytania? Pompa na 2$ albo i wyżej bo nic nie broni kursu przed wzrostami, bo nie da się tworzyć nowych jednostek? Na przykład scenariusz w którym bitcoin robi szybką korektę, odpalają się zlecenia stoploss i magincall na parach walutowych do BUSD, kapitał dynamicznie przelewa się z bitcoina na stablecoiny. Wszystkie mają płynność, a busd nie. Sam swoje stopy na BTC/BUSD ściągnąłem dopiero wczoraj. |

|

|

|

|

725

|

Other / Archival / Re: Bitcoin vs. Inflation

|

on: February 19, 2023, 08:26:25 AM

|

Intel has entered the game and I think that they've made a much more comprehensive research than you and me.

They are a hardwere producers not a miners. So they care to sell x amount of units not about how profitable they are. Am I wrong here? You're right about the far future, but we're not there yet. The amount obtained from tx fees is still small compared to the block reward. And will still be so after the next halving.

You are right that example I posted shows very far future. My point was to show the end-game that we are heading too. How negligible the last halving will be. So the good question is where are we now? We know that first halving (reduce inflation from 25% to 12%) had huge impact on price and was fallowed by a 100x pump. Second one (from 9% to 4,5%) was fallowed by a 40x pump. Third halving (from 4% to 2%) and a 6x pump. 4th halving will reduce inflation from 1.5% to 0.7% and its possible that we will do only a 2-3x pump or not if markets will be disturbed by recession or WW3. 5th halving and we will cut inflation from 0.6% to 0.3%. Does it matter? Especially if we evaluate bitcoin in a currency that inflation changes by 1% in a month/month basis. I know the narrative, that miners wont sell at loss so price have to go up. But price will go up only if we assume that demand is constant. Which is not. It can go down as well and those miners that did not sell at loss wont have cash to pay for bills and will go bust reducing difficulty for others. Other miners will mine cheaper bitcoins that they will sell at profit even lower. Difficulty doesn't have to go up all the time. I'm not saying that bitcoin will not reach new ATH. I'm saying that all 3 scenarios posted above are possible and the fact that we will have halving in next year doesn't change that. |

|

|

|

|

726

|

Local / Polski / Re: Binance vs FTX

|

on: February 18, 2023, 09:37:27 AM

|

Możliwe, ale raczej nie. Duże firmy nie miałyby raczej problemu w szybkim stworzeniu i zrekrutowaniu dedykowanego działu ekspertów, czy skorzystaniu z usług zewnętrznych ekspertów.

[...]

Audyty finansowe są prawnie wymagane, co wiąże się z bardzo dużymi regulacjami i przepisami zmniejszającymi konflikt interesów (np nakaz zmiany autytora co kilka lat itp). W razie dużej wpadki mogliby stracić licencję.

Więc może brak odgórnych przepisów? Brak norm postępowania, których przestrzeganie miałoby być weryfikowane? Swoją drogą to jak oceniacie prawdopodobieństwo upadku BUSD (spadek poniżej 1$) w wyniku niewypłacalności PAXOS i braku poczucia odpowiedzialności przez Binance i nie zrobienie bailouta w razie konieczności? Bo z technicznego punktu widzenia PAXOS i Binance pilnują by kurs nie spadł poniżej 1$. Nikt natomiast nie broni BUSD przed pompą do 2$, bo nie da się generować nowych jednostek ... busd jest trzymany sztywno tylko w 1 stronę. |

|

|

|

|

727

|

Local / Polski / Re: Atak na tethera

|

on: February 18, 2023, 09:17:40 AM

|

Są jeszcze jakieś inne stable wypuszczone przez Paxos, jeżeli tak, to jakie?

Ich własny stable coin USDP, dawniej Paxos Standard (PAX). Kiedyś było jeszcze USDC, ale przeszło do circle. No i jest jeszcze PAXG, czyli stable coin zabezpieczony złotem. Nie wiem jak z nim, ale wygląda na to, że firma z twojej sygnaturki ma 1 dużego konkurenta z głowy. |

|

|

|

|

728

|

Other / Archival / Re: Bitcoin vs. Inflation

|

on: February 18, 2023, 08:41:59 AM

|

While for short term I cannot argue, I don't think that it'll go too high this year (and whether the high point will be in May or later I don't know), on long term (decade) you seem to have missed the halvings and the ever increasing difficulty; this cannot be sustained for 10 years only with max 60k price (and usually lower).

This is correct if we assume some variables are constant. 1- mining efficiency thanks to Moore's law. Its no longer double each 2 years but its still an exponential grow. We can have slowly growing hashrate without price going up. Mining efficiency is not constant. 2- demand stays the same so price have to go up when supply goes down. But demand is not a constant and supply goes down a little % of a whole supply. Its not like during first/second halving: 1st halving reduced monetary inflation from 25% to 12%. Second halving reduced monetary inflation from 9% to 4,5%. Now we are getting closer and closer to the 4th halving that will reduce bitcoin monetary inflation from 1.5% to 0.7%. Both numbers are negligible compared to 8% official CPI in US, 10% in EU or 80% in countries like Turkey. Halvings fundamental impact on bitcoin price is getting lower and lower with every next halving in oppose to macro data, FED decisions, interest rates, recessions and of course ADOPTION.

My point is that each halving has lower fundamental impact. In about 100 years we will cut mining rewards from 2 sats/block to 1 sat/block (the very last halving). I don't think that price will double thanks to this only because miners rewards are getting cut by half (from 0.00105 BTC/ year to 0.000525 BTC/ year while whole supply is 21M). At that day no one will care about halvings. I thinks we have 0-3 halvings left that will have any impact on price. Although i know its not very popular statement in crypto community. 3- the fact that hasrate has to go up. In fact it dosn't. We can be at the top of first hashrate cycle and now a decade going sideways. |

|

|

|

|

729

|

Other / Archival / Re: Bitcoin vs. Inflation

|

on: February 17, 2023, 08:54:33 AM

|

Interesting. And what you think Bitcoin price will do in this equation? Will it follow the other assets and will go down again big time?

Not every asset acted the same. So far everyone is looking at inflation, interest rates and sp500/nasdaq as next bitcoin move indicator so I used SP500 in above post. But interesting thing happened to gold during "The Great Inflation" 1965–1982. In 1971 Richard Nixon depeg USD from gold and gold had the biggest pump ever. From 35$ to 900$ in a decade (while stocks were going sideways). If the same would happened again and bitcoin would fallow gold we could see a pump to 1 mln $ (x30 from now). But to be honest i don't think its the most likely scenario. More likely one is that we will be stuck for a decade in 20-60k consolidation. Something in between seams to be the most likely one. In short term I expect everything to be bullish until inflation hit short term bottom (next few months). Somewhere around CPI=2-4%. Is 2-4% possible? In my opinion it is. And inflation bottom (before new wave to new inflation ATH) should be around JUN and market high in APR/JUN. "sell in May and go away" should be a good strategy this year.  https://www.statista.com/statistics/216037/monthly-percentage-of-change-in-the-cpi-u-in-the-us/ https://www.statista.com/statistics/216037/monthly-percentage-of-change-in-the-cpi-u-in-the-us/Annual inflation is close to sum of all candles. So we can see that each next month big candle goes away and new small one comes in. So to see official CPI increase in next months we need to have >.6% M/M change in FEB. >.8% in next month etc. So its likely to see an official CPI going down for at least next 3 months. 1 month flat and 2 more months down (if we will not see covid 2.0, nuclear war etc.). |

|

|

|

|

730

|

Economy / Speculation / Re: All of the World’s Money and Markets in One Visualization

|

on: February 17, 2023, 08:06:11 AM

|

If Bitcoin was to achieve a price of $1 million per coin, the market cap would be $19.3 trillion. Doable?

"If you dreamed of making the white picket fence a reality, a new house would've cost approximately $6,296" "A fresh set of wheels varies depending on the make and model, but a Chevrolet in the 1920s cost $525" https://www.countryliving.com/life/g33398396/what-things-cost-100-years-ago/Would you say in 1920, that your house value will pump to 200 000$ from 6300$? Would you say in 1920, that to own new Chevrolet right from factory you have to have 100 times more "money" (60 000$). Is 19.3 trillion doable? If history is about to repeat itself (dollar will lose >97% of purchasing power in 100 years) than after 100 years we will hit this number and bitcoin wont even pump. It will only remain current purchasing power (~30 000$). |

|

|

|

|

731

|

Other / Archival / Re: Bitcoin vs. Inflation

|

on: February 17, 2023, 07:50:24 AM

|

Can it be maybe also the fact that the inflation slowing down can be a sign that the recession was - at least for now - avoided and everybody starts putting to work the liquidity they may have been keeping at hand for the dark days?

Plus, the trend is pretty clear now, which can increase the appetite of the investors.

Inflation is slowing down because we are in recession and due to bull whip effect. Definitely not because of " soft landing" 1970-1980 was very similar. Thats how asset prices (SPX) reacted to inflation back then.  in 1970 we had first inflation peak (market hit bottom 2 months later) in 1972 we had inflation short term bottom (market reach new ATH 3 months later) in 1974 we had new CPI peak above 12% (market created new low eacly in the month of CPI peak) Than, >1975 market just stop gamble inflation data and ignored next inflation peak but pumped like crazy as it was going back down. Exactly the same we have now. Inflation is going up, assets are going down, people predict the worst-case scenarios. Inflation goes down, assets pump people wait for FED pivot not buying the bottom. Inflation reach short term bottom, FED do pivot, retail buy the local top. Inflation goes up, assets goes down, retails are broke. |

|

|

|

|

732

|

Local / Polski / Re: Binance vs FTX

|

on: February 17, 2023, 07:27:21 AM

|

I tu możemy mieć mały paradoks, gdzie Binance (czy inne giełdy) nawet chcąc zrobić pełny audyt (który chyba muszą mieć robiony), mogą mieć problemy ze znalezieniem firmy z czołówki która by sie tego podjęła. Zgaduje że dla dla audytorów z tzw Big 4, krypto to wciąż zbyt śliski temat i zbyt duże ryzyko reputacyjne gdyby coś poszło nie tak.

Albo zbyt mało wiedzy jak to zrobić skutecznie. Brak odpowiednich, opracowanych wcześniej i sprawdzonych schematów działania. W Big Short chodziło o agencje ratingowe a nie o audytorów, o ile mnie pamięć nie myli.

Zgadzam się, ale chyba schemat działania jest podobny. konflikt interesów wynikający z faktu, że podmiot twojej "obiektywnej" oceny jest jednocześnie twoim klientem a "klient ma zawsze rację". |

|

|

|

|

733

|

Local / Polski / Re: Atak na tethera

|

on: February 16, 2023, 06:02:34 PM

|

No to jak funds są safu, to ja tak dla pewności wymieniłem wszystkie BUSD na USDC  Kibicuje Binance i dobrze zeby BUSD zostało na rynku, ale SBF puszczał podobne Tweety, kiedy padał FTX  Tak. To dobry moment by ograniczyć ryzyko. Kapitalizacja BUSD spadła już (od ath) z $23B do $13.8B czyli o ponad 40%. Jeżeli mieli jakiś lewar to pewnie to niedługo wyjdzie. Chyba, że binance jest gotowy na ewentualny bailout by zachować twarz. Pytanie tylko czemu od razu rezygnują zamiast napisać, że zwrócą się do centre (firmy która prowadzi USDC). Chyba, że coinbase ma wyłącznąść ... Albo czemu nie otworzyć w innej jurysdykcji? Albo binance już jest 4 kroki do przodu i wie, że tego i tak nie wygra? |

|

|

|

|

734

|

Alternate cryptocurrencies / Altcoin Discussion / Re: The Future: Trustless Decentralized Identity

|

on: February 15, 2023, 05:33:15 PM

|

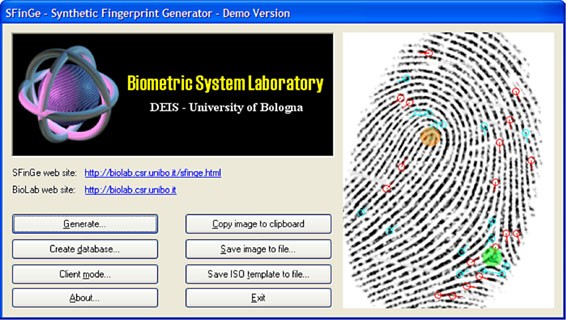

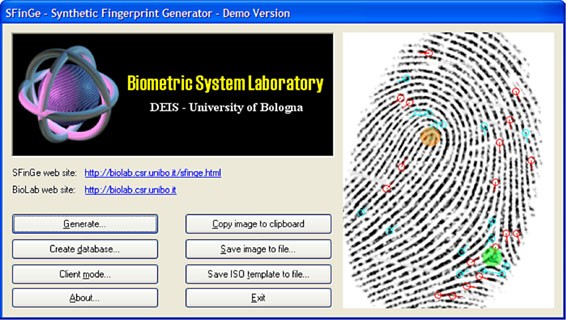

The algorithm checks the blockchain to make sure there is no match. Of course this depends on how many fingers are set up to generate a decentralized identity. If 3DPass get's the algorithm and conditions right for generating a new decentralized identity then it would be 1 per person. Of course people can be very creative and I joked earlier that people will start scanning their toes  Nonetheless there would be a strong limitation on the amount of digital identity per real human being with the goal being 1. As I posted above there are ready to use tools that generates infinite amount of fake fingerprints. Even if they are not perfect to cheat this system ... if big money will come in ... people will find a way. I think this is harsh and I hope you can be open minded on the project.

Maybe indeed I am. 5 years in crypto made me very sceptical about new projects. I believe it is more secure and secured in a different way. More secure in the sense of multiple biometric data plus an additional object which is a crazy level of security. Plus most importantly it will be more user friendly than anything I've seen so far.

Scan two fingerprints plus your favourite sculpture for example. Good luck trying to figure this out for a hacker or forgetting this.

So its a super secured version of private key. Its a nice usecase too. But its not a digital identity because its not sybil attack resistant. And I would not compare it to having multiple passports. You go to jail for a long time if you get caught. Here you generate new fake fingerprint and scan random object and its ready. |

|

|

|

|

735

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: Idena is the first Proof-of-Person Blockchain

|

on: February 15, 2023, 05:23:41 PM

|

there should be a special kind of telegram to offer an invite code so that not a lot of spam throws away their invite code in the official telegram group, I can't predict anything but I think it will be a positive trend ahead of the mainnet later, hoping the price of IDENA can increase  I think there is. At least it was a while ago. But there was not that much traffic so maybe it was closed. You have to ask on main telegram chanel. today's validation is not much different from the previous validation, I'm waiting for the HF mainnet soon hopefully there will be better developments afterwards

I've seen many people on telegram posting that quality of flips improved. So its possible that quality of nodes went up. |

|

|

|

|

736

|

Local / Polski / Re: Atak na tethera

|

on: February 15, 2023, 07:02:11 AM

|

Powiem szczerze że to dobra informacja, wygląda na to że faktycznie USDT ma solidnie zabezpieczone fundusze lub daja rade tak długo zwodzić wszystkich. Nie wiem juz sam, był jakiś audyt w końcu i to przeprowadzony przez jakąs zaufaną instytucje?

"Today, Tether Holdings Limited made available its December 31, 2022 assurance opinion completed by BDO, a top five-ranked global independent public accounting firm" https://tether.to/en/tether-continues-to-demonstrate-strength-of-reserves-reveals-dollar700m-profits-for-q42022-in-latest-attestation-report/"BDO posiada ponad 1658 biur w 167 krajach Europy, Ameryki Północnej i Południowej, Azji, w krajach południowego Pacyfiku, na Bliskim Wschodzie i w Afryce. Zatrudnia ponad 91 000 ekspertów i specjalistów z różnych dziedzin ekonomii, finansów i prawa." https://pl.wikipedia.org/wiki/BDO_InternationalFunkcjonuje od 60 lat. Ale czy można temu ufać? ostatnio BUSD jest na widelcu

Wydaje mi się, że to element zemsty FTX. Podobno powody zakazu od NYDFS są oderwane od rzeczywistości, ale jak binance/paxos nic nie wymyśli, to BUSD jest skończone. Muszą szukać innych jurysdykcji albo smarować urzędnikom. Odpowiedź CZ https://twitter.com/cz_binance/status/1625067484368740353 |

|

|

|

|

737

|

Alternate cryptocurrencies / Altcoin Discussion / Re: The Future: Trustless Decentralized Identity

|

on: February 14, 2023, 05:59:27 PM

|

The only way to check if a given fingerprint belongs to someone real is to meet him in person and verify it by his finger.

So 3DPass is not a digital identity because 1 person can have infinite amount of digital identities. In my opinin, correct me if i'm wrong, it lose majority of use cases. 1. As you can see on the picture posted by @3dpass, the HASH ID is created from several pieces of data when together being leveraged as a seed. But each of them represents an authentication factor you can never recover the HASH ID without having all of them: - a fingerprint is something that you are factor, which can identify the person easily (of course, in person); - a piece of stone is something that you have factor. - this combination might be expanded with some additional factors like a password ( something that you know), etc. So 3DPass is only a more secured version of private key. Or maybe not "more secured" but "secured in a different way". Because you can also hash your private key using "something you know" AKA password and part of your best book as "something you have" using simple softwere. 3DPass is nothing more than that. Am I wrong? that your bio has been already compromised (or even public), but the second factor is private and strong enough to protect your keys.

good point. But that doesn't this fact make bio useless in this system? |

|

|

|

|

738

|

Alternate cryptocurrencies / Altcoin Discussion / Re: The Future: Trustless Decentralized Identity

|

on: February 14, 2023, 11:56:51 AM

|

Thanks, I see. Let me clarify my question a little bit. How does the private key identify me as a human being?

It doesn't have to do with me at all, right? So, it can't be treated as a personal identity, cause you'll never know who is the real owner of the private key. That's my point.

Let me give you an example. Imagine, you have 3 person coming over and claiming that each of them is the only owner of an IDENA account. All the three have the private key, which is correctly fit the account. How would you recognize the real one?

Just like with bitcoin wallet, etherum wallet etc. If you are irresponsible to the point that 3 people have access to your private key (which is suppose to be private) ... you are the one who is to blame for losing every asset that is on this wallet nor bitcoin or etherum network. Including digital identity. 3DPass also doesn't prove that digital identity belongs to human being. Identity can be sold or sensitive bio-data can be stole from previous similar projects or malicious apps that needs fingerprint to unlock it or from compromised police office database or from passport issuing office. Just answer this question. How is it possible, in your opinion, that someone has a database of 1 million fingerprints? How 3DPass will deal with fake fingerprint data? I know its impossible to guess my fingerprint. The amount of possibilities are infinite. But creating a random fingerprints should be easy. How will 3DPass sort fake from real preventing 1 person from owning infinite amount of identities? For example this:  |

|

|

|

|

739

|

Alternate cryptocurrencies / Altcoin Discussion / Re: The Future: Trustless Decentralized Identity

|

on: February 13, 2023, 01:30:31 PM

|

let's say I've got an IDENA digital identity (based on solving some CAPTCHAs, please correct me if I'm wrong).

Now, how can I prove it belongs to me (as a real human being)?

Private key is the thing that proves that you own this specyfic digital identity. Just like with every crypto wallet. But that's probably not what you wanted to ask, but how idena deals with the fact that one person has multiple nodes. Its the turing test i was talking about before. Its not a "some CAPTCHAs". Its 6 logic puzzles that you have to solve. This test is performed simultaneously for the entire network and short session last only 2 minutes. So there is no way to validate more than 1 identity. Well you can try with 2-3 but sooner or later you will run out of time and fail valition loosing stake and identity. Based on my experience with idena, 1 node is easy to have, 2 is hard, 3 is super hard and risky. A Decentralized Identity should be both secure and simple.

Idena is very secure but so secure that it makes it difficult for a user in my opinion.

Fair point. But its not as hard as it looks like. I'm the owner of IDENA digital identity for more than 3 years. Just to name a few things invitation codes, first time registration only possible every 18 days, a lot of time needed to solve flips.

you need 10-30 min of your time each validation (~20 days). They tried to aim for a sweet spot. Validation each day is cool because new members can join right away but from the other hand old members needs to spend 30 min each day instead of once every 20 days. My thinking is that Biometric data alone without anything else is OK.

I'm not an expert but to me sharing any data is a red flag. I have no guarantee that this app wont collect my IP address, mobile phone hardware details, information about the browser, about the font size set on the phone, screen resolution, location from GPS. I have no guarantee that it wont be connected with darknet databases from other services that were already compromised. Also if biometric data is all i need for your app ... it means i wont be able to safely use other apps that will one day reach mass adoption if this project will fail because my biometrics can already be compromised. |

|

|

|

|

740

|

Alternate cryptocurrencies / Altcoin Discussion / Re: Some questions about the Polygon (MATIC)

|

on: February 12, 2023, 08:33:04 AM

|

2- When the mining is complete, what is the price of this coin?

Impossible to calculate/estimate. Price is based on supply and demand which is impacted by addoption, project use-cases, project user base, market conditions, short term irrationality of investors, amount and condition of competition and many more. |

|

|

|

|