|

521

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 06, 2023, 12:04:28 AM

|

https://bitcoinmagazine.com/business/blackrock-ceo-larry-fink-says-bitcoin-is-an-international-assetBlackRock’s CEO, Larry Fink, has made an appearance on Fox Business where he stated that the role of bitcoin and crypto is “digitizing gold.”

“Instead of investing in gold as a hedge against inflation … or the devaluation of your currency … [bitcoin] can represent an asset that people can play as an alternative,” Fink stated. The description reinforces the perception of bitcoin as a store of value, akin to the role gold has traditionally played in investment portfolios. By likening bitcoin to gold, Fink acknowledges the international nature of the digital asset, highlighting its potential as a global store of wealth — and indeed, during his news appearance, Fink further emphasized that, "Bitcoin is an international asset."

The televised statement underscores the conviction Fink, and likely BlackRock, have in bitcoin and its potential role in the future. Fink's recognition of bitcoin's international appeal further bolsters the case for increased institutional interest and investment. Here is an excerpt from the video of Larry Fink speaking:: https://twitter.com/WatcherGuru/status/1676685754922151941So, BTC is not anymore money laudering? Now it's an international asset  Has everyone here bought enough? It looks like the rocket is going to start going up very soon    ? I doubt it. |

|

|

|

|

522

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 05, 2023, 11:41:03 PM

|

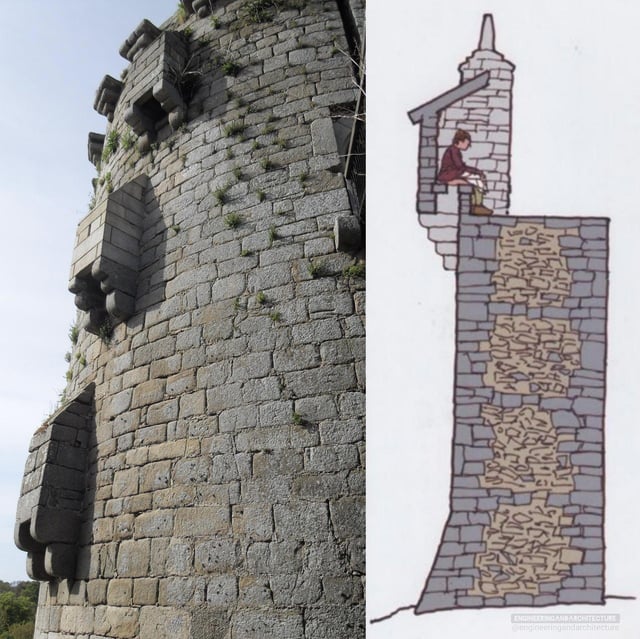

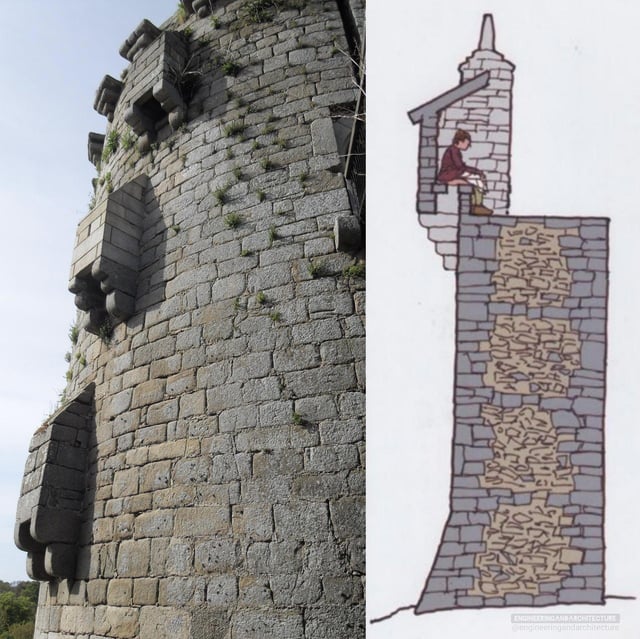

I warned Torque about the castle toilets. ...

Secrets of Great British Castles (a little dark at times, but great if you like cool Castle history)

...

Don't stand below these things on castle walls. They're the toilets.  Sure, thanks for the reminder..you've got the "priority" afaiac. I am getting to where almost everything is "news", haha |

|

|

|

|

524

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 03, 2023, 09:47:32 PM

|

...

After 5 years living on our property, our tax man reassessed ours based on skyrocketing land values in the area.

Our property value went up ~40%.

Most people would be like "Hell yeah! My house/land value increased ~40% in just 5 years!"

Well so did my yearly property taxes by that same amount. On a property I already for paid in full and plan to never leave.

So no, this fkn sucks. I'd be happier if for the rest of my life they valued my house and land at $0.

It could be worse. Would you rather live here with no property taxes?  I'd bring toilet paper to compliment the food. insufficient information... if gf/wife a "thing"...choice #1 if not...Starlink Internet..choice #2 for "toilet paper' you can: a. quickly rappel down to the ocean bare naked (nobody to see it, right?) b. do a dog-style wipe on the grass...gross, I know, but you need to "fertilize" those plants  c. the winner: use the bidet you thoughtfully installed beforehand. c. the winner: use the bidet you thoughtfully installed beforehand.Do bidets run on water you got from the well? I doubt they are hooked up to the local water grid there. I doubt the gf/wife would be too happy at being forced to do a dog-style wipe on the grass. 1) ESG dictates that I got to use rain water storage for that, hehe 2) yeaaah, I imagined asking mine about it, so a solid "no" ...family style rappelling can still work, lol EDIT: you made me laugh, buddy, so...thanks! |

|

|

|

|

525

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 03, 2023, 09:38:25 PM

|

...

After 5 years living on our property, our tax man reassessed ours based on skyrocketing land values in the area.

Our property value went up ~40%.

Most people would be like "Hell yeah! My house/land value increased ~40% in just 5 years!"

Well so did my yearly property taxes by that same amount. On a property I already for paid in full and plan to never leave.

So no, this fkn sucks. I'd be happier if for the rest of my life they valued my house and land at $0.

It could be worse. Would you rather live here with no property taxes?  I'd bring toilet paper to compliment the food. insufficient information... if gf/wife a "thing"...choice #1 if not...Starlink Internet..choice #2 for "toilet paper' you can: a. quickly rappel down to the ocean bare naked (nobody to see it, right?) b. do a dog-style wipe on the grass...gross, I know, but you need to "fertilize" those plants  c. the winner: use the bidet you thoughtfully installed beforehand. |

|

|

|

|

526

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 03, 2023, 09:25:33 PM

|

And buying 100 btc for 1200 really would have been better.

It is difficult (and maybe not realistic to hypothesize like that) to just pick a lump sum price, and to say that I could have afforded to buy 100 BTC for $12 each and then mostly have had been able to hang onto them for 12 years blah blah blah... when the fact of the matter was that you were shedding BTC for almost all of those last 12 years... except maybe more recently you are trying to figure out how to hang onto more BTC, but you still seem to have an ongoing dollar biasness that makes it difficult for you to hang onto your BTC... That's part of the reason that dollar cost average buying is better for really solidifying a position is that it can end up taking place over a decently long time and will also have better chances of facilitating strong hands and longer term thinking in regards to maintaining the stash ... and don't be trying to sell BTC in order to buy more BTC at cheaper prices. even though surely if you are in a business (the mining business) that causes you to have regular income coming in through BTC, then you are somewhat of a forced seller.. but you still need to figure out your HODL mostly cold storage targets along the way.. so let's say even if you had regularly screwed up and you are kind of continuing to regularly screwing up (maybe you cannot be fixed), but just for the sake of other members who might find themselves in similar situations, there are needs to accumulate and to keep some of that value in cold storage so that you are not tempted to sell it and to try to buy back later.. Sure selling small amounts of BTC on the way up might be o.k... but ONLY small enough amounts that you are not really depleting your principle.. although with more elderly people who are getting into their 60s or even late 60s, they might not really be in any kind of accumulation stage anymore but instead either maintenance or even perhaps quite likely liquidation stages.. so once you get to a more elderly stage, you likely are considering ways to spend your wealth.. but if you are not sure how many years that you might be living then you may well be teetering more between liquidation and maintenance and maybe not even trying to spend too much too quickly. None of us can know the exact solution for anyone else.. even though we may well realize that if we have an investment timeline that is 4-10 years or longer, then we may well be mostly trying to focus on BTC accumulation through the three most common BTC accumulation methods of DCA, buying on dips and lump sum investing.. while at the same time keeping a kind of eye on the prize of making sure that our BTC is mostly growing while we are in the accumulation stages, and if we spend any BTC, then we are doing spend and replace Hopefully replacing with more BTC than the quantity of BTC that we had spent, even if it might cost us a bit more if we don't time some of our spend and replaces very well... and shit does some times happen.. including mistakes sometimes happen along the way too.. maybe the mistakes are in a state of almost inevitable. For sure, I am not even suggesting that I am free from mistakes. I am still making little tweaks here and there to continue to figure out ways to take advantage of my mid-June Binance US windfall in which I ended up with quite a few extra Tether USD.. since within hours (or was it minutes) of the actual windfall, I had pretty much bought back more than 125% of the quantity of the BTC that I had sold, just so that I could at least lock into place that I would not end up with fewer BTC out of the whole situation.. so even if I already feel that I have more BTC than I need, I did not want my mid-June windfall to cause me to have fewer BTC than I had planned to have had - even though I had received a premium price for many of them, and even if I used all of my remaining USDT to buy back more BTC at these here prices, I would be able to buy a decent quantity of BTC --- and part of my point in referring to mistakes is that no matter what any of us might do (or decide to do or to plan) then there are going to be dilemmas and potentially a variety of paths forward and some paths are more obvious than others, and some paths have a variety of tradeoffs that need to account for personal factors. and the various better solutions (since there are probably more than one) are not always clear. Everybody in bitcoin deserves whatever price they got...and sometimes people 'grow' into it. That said, who knew in 2012 the extent of what transpired in 2020, for example. 2008 was just a glimpse, although it is kind of crazy when you start to fully comprehend this. |

|

|

|

|

527

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 03, 2023, 06:58:19 PM

|

1992 rate was 7.875% 30 years

We paid it off in 7 years. I quit smoking in 1996 so at that time 25 a week for smokes went to pay mortgage down. Homes were cheap in 1992 compared to now.

The mortgage was not too high. So 125 a month x 12 = 1500 a year extra for the mortgage. NJ lets you pay it down without penalty. Our house is over 500k now a nice jump from 144k in 1992.

No that's not nice, its a cost of living increase that is insidious as you pay more in taxes yet if you sell you cannot go anywhere else cheaper. Its a massive scam nationwide to fleece the middle class. Whats worse is its our tax money that was used to buy all our property values up for the benefit of the hedge funds. Sometimes a house is just mostly a living space and that's how I rationalize it. Somehow, I never thought about it as an investment, but I understand many people are thinking otherwise. Texas is not great in appreciation..I calculate just about 3% per year in the last 23 years vs Phil's 4.25% a year (from his numbers, assuming, arbitrarily, $520K for current as 'above 500'). Of course, 'bitchy' Texas RE taxes of almost 2% are not in the calculation. I probably paid a bit more than 200 grand for RE tax+HOA fees over the duration. There goes the appreciation "idea". |

|

|

|

|

528

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 03, 2023, 04:58:39 PM

|

...funny, 2000 is a year I bought my first house using the stock market proceeds for the down-payment...family liked it. Interest rates were 8.5% in a booming market/economy. The total number of $$ that i was supposed to pay over the life of the original loan was shocking, something like 3X of the mortgage value. ....of course, I refinanced a few times with much lower %. @philipma1957...I wonder when you bought yours? |

|

|

|

|

530

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 02, 2023, 05:02:14 PM

|

OT: Did Elon just effectively shut down Twitter? I can't reach any of the tweets I want to see. Is this somehow France-related?

Alternatively, if he wants to make it a closed little pond, good riddance.

Elon Musk said Saturday that Twitter users will only be able to read a certain number of posts per day due to “extreme levels of data scraping” and “system manipulation” on the platform.

Many users who tried to access or post content on Twitter’s website or mobile app Saturday were met with a “Rate limit exceeded” or “Cannot retrieve tweets” error message.

As of 11 a.m. ET, more than 7,300 people reported issues with Twitter to the website Downdetector. -> https://www.cnbc.com/2023/07/01/thousands-of-users-report-problems-accessing-twitter.htmlThough in all fairness it seems you have already 'viewed' 600 tweets in 24 hrs, with all due respect may I suggest to take a break and go out for a walk  thanks, bud, it is exaaactly what I am doing in a few  |

|

|

|

|

531

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 02, 2023, 05:00:26 PM

|

OT: Did Elon just effectively shut down Twitter? I can't reach any of the tweets I want to see. Is this somehow France-related?

Alternatively, if he wants to make it a closed little pond, good riddance.

It seems good to me. One of my friends from Marseille confirmed it's good for him as well. Maybe it's your ISP? thanks, maybe...but I was writing my post "on the internet". Maybe they are meddling with their APIs and it causes something..I dunno. |

|

|

|

|

534

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 30, 2023, 04:58:24 AM

|

Wow, what a GREEN candle, the size of which almost matches Bob's instrument of pleasure (or pain...)

What's the occasion? Did someone die?

au contraire, something 'dead' apparently came to life. ..."stupid" financiers throwing "good money" at something-something that is 3X in 8-9 days....ridiculous, but irrelevant. This one will pass. Bitcoin had to follow with a "green dildo" of it's own or risk diverting trader's attention. |

|

|

|

|

535

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 30, 2023, 04:47:44 AM

|

There is no urgency on their behalf as they will buy bitcoin as investors would buy shares in ETF. Of course, they probably need to buy relatively small initial position to kick-start the fund. Analogy with GLD (gold ETF): the price of gold slowly rose from $250 (from the lows in 2000) to $400 by 2004. GLD started in around mid November 2004 and then was more or less flat until late Aug 2005 (about 9-9.5 mo) and then went essentially in exponential fashion (with correction in 2008) until Aug 2011 (4X appreciation or 22% per year average for 7 years). Bitcoin's bull numbers are typically much higher, but last shorter time period, but i would not be surprised by a 5-10X rise just on ETF alone (maybe taking half of the time or about 3-4 years). After that, similarly to GLD, an equally long consolidation process (3-4 years), maybe down to 100-150K. Somewhere during those 3-4 years of bull following with 3-4 years of 'secular" bear, halvings would start to have less effect TL;DR next long term peak is maybe in 3-4 years at $150-300K value from ETF alone plus 140-180K value from the halving "squezze"=290-450K in what could be probably called a "supercycle", then a long term bear down to 100-150K, then a reversal to ATH in some time (could be 6 years from the prior ATH at ~300-500K). |

|

|

|

|

536

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 30, 2023, 02:07:20 AM

|

Yes since 2023, it's now taxed in Portugal if you hold for less than 1 year (until 2022 was tax free, even less than 1 year).

Exactly, it's similar as Germany. However Portugal has one more huge advantage : NHR (non habitual resident) tax-scheme. You get this statut for 10years you are tax free on your foreign income (dividends, interests, royalties). Kind of temporary "territorial tax scheme".

Until 2022 private foreign pensions (for retired people) was tax free too under this scheme. Now it's taxed 10% due to other EU countries pressure (for the new applicants).

NHR-Portugal has provided extensive benefits to residents. As of 2009, the "habitual residency" of Portugal residents is a administrative and financial system designed to attract foreigners. Tax efficient pension income for 10 consecutive years benefiting new hopefuls in Portugal. Two categories can benefit from the NHR-regime: # Retirees who receive pension from abroad. # Individuals and investor who can Structure Their affiair to Sync with the Regime.. Details: https://www.libertyrealestate.pt/detail/nhrnonhabitualresidenceresidenceinportugalresidencyinportugal/12264?gclid=Cj0KCQjw1_SkBhDwARIsANbGpFvZr0Q2bAALvlG2wgb6ja8mcNdZDQgp9ozQlfuf7-UHBH3n03gmL7gaAvOnEALw_wcBMainly depending on these two categories (NHR) the organization works and it can work with great benefits and tax free. Portugal is interesting, apart from that 10% tax for pensions (and I assume, social security payments for US citizens). Not too hot of a situation, considering that i would still have to pay 12-whatever % to Uncle Sam. Basically, a double taxation, unless i fundamentally misunderstood the conditions. The only advantage i can see is no tax on crypto locally if held more than a year, albeit US tax would still apply. The only benefit is easy travel within Europe as everything is closer, in comparison with transatlantic flights. Yes i don't know all the specificities as US citizen (as in US you are even taxed based on your citizenship), so maybe not advantageous as for EU citizen or some other countries. I am personally under this tax scheme. Just a quick story. I met a US guy in Lisbon month ago (from SF). He is based now in Portugal trough investment (golden visa = 500K minimum to invest in real estate), and you can get the Portuguese passport in 5 years after your investment. Now it's not possible anymore to invest in Lisbon for the golden visa, you have to choose another place/city in Portugal to apply. Can be interesting as a global citizen strategy with 2/3 passports and the possibility (at a certain point / depend the own situation) to cancel the US citizenship. (my 2cts, for this topic). Thanks. I might like to have some other friendly countries passports, but don't want to pay for them, lol. I looked into Portugal situation (as well as Puerto Rico close to US) and could not figure out what is the real advantage there, apart from, in Portugal case, getting a EU citizenship in 5 years, if someone needs it. US being a country that taxes citizens worldwide does not help as far as collecting other countries passports and also considering that the current cap gains regime is not that bad. I think that if the world would be in a deep recession, many countries might restart these programs, though. I might want a residence somewhere more cold than here (Texas), at least for about half of the year (during summer, which is May-October here if you consider temperatures only). Canada is very attractive in this regard and you can stay up to 180 days on a visitors visa, apparently. |

|

|

|

|

537

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 30, 2023, 12:55:03 AM

|

Yes since 2023, it's now taxed in Portugal if you hold for less than 1 year (until 2022 was tax free, even less than 1 year).

Exactly, it's similar as Germany. However Portugal has one more huge advantage : NHR (non habitual resident) tax-scheme. You get this statut for 10years you are tax free on your foreign income (dividends, interests, royalties). Kind of temporary "territorial tax scheme".

Until 2022 private foreign pensions (for retired people) was tax free too under this scheme. Now it's taxed 10% due to other EU countries pressure (for the new applicants).

NHR-Portugal has provided extensive benefits to residents. As of 2009, the "habitual residency" of Portugal residents is a administrative and financial system designed to attract foreigners. Tax efficient pension income for 10 consecutive years benefiting new hopefuls in Portugal. Two categories can benefit from the NHR-regime: # Retirees who receive pension from abroad. # Individuals and investor who can Structure Their affiair to Sync with the Regime.. Details: https://www.libertyrealestate.pt/detail/nhrnonhabitualresidenceresidenceinportugalresidencyinportugal/12264?gclid=Cj0KCQjw1_SkBhDwARIsANbGpFvZr0Q2bAALvlG2wgb6ja8mcNdZDQgp9ozQlfuf7-UHBH3n03gmL7gaAvOnEALw_wcBMainly depending on these two categories (NHR) the organization works and it can work with great benefits and tax free. Portugal is interesting, apart from that 10% tax for pensions (and I assume, social security payments for US citizens). Not too hot of a situation, considering that i would still have to pay 12-whatever % to Uncle Sam. Basically, a double taxation, unless i fundamentally misunderstood the conditions. The only advantage i can see is no tax on crypto locally if held more than a year, albeit US tax would still apply. The only benefit is easy travel within Europe as everything is closer, in comparison with transatlantic flights. |

|

|

|

|

538

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 29, 2023, 06:16:11 PM

|

A lot of you guyz on this WO were saying we'd be at $50k or even $100k by now. So much so, you were nearly peeing yur lil' selfies. So. Deal. With. It.  Flat at 30K-it's just one of the possibilities, but I don't think that we would stay at 30K for 12 mo more. We did stay roughly in the $170-315 band for about 10 mo in 2015, starting from January of that year, but if we count 10 mo from the late Nov 2022 low, it should bring us to about the end of August 2023. Plus minus 1-2 mo and there we go. Accordingly, I am focusing on Sept-Nov area to become more active in bitcoin trading, but won't care much if it "runs away" now for a few reasons: 1) i already have some and 2) btc almost always seems to circle back to retest some lows, sometimes many months later. |

|

|

|

|

539

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 28, 2023, 03:27:00 PM

|

|

An alternative scenario:

Due to two-three additional interest rates hikes expected, everything is peaking for the summer, then we have a usual "scary" fiat market dip in September-October.

Then, they find out that inflation is rapidly declining, Wall Street starts whining that Fed is too tight and they switch to easing by November.

Not sure how bitcoin fits in this picture, but I expect total market (indicated by VTI) going to about zero or small gains for the year (which means losing maybe 10-12%) first before some appreciation in Nov-Dec.

EDIT: Microstrategy bought additional 12333 btc at about 28.3K /btc average. Bullish long term.

|

|

|

|

|