Show Posts Show Posts

|

|

Pages: [1] 2 3 4 »

|

AnonymousCoder"Quarterly reversal time unit is one quarter. Gold rallied before the quarter was over and no other signal in the opposite direction was available to indicate change of direction.The time span is 1 to 3 units in time so the quarterly bearish reversal had 1 to 3 quarters before time was up. Armstrong wrote on his private blog on the first of March our quarterly level of the model generated a bullish reversal at the end of the year reversing its short position and going long. This also signaled that gold would rally from the $1060 area and should test the next bullish reversal at the $1347 level." Not sure if you are aware or not but you are losing this discussion.  Just for fun I went back and reread my gold report from 2016 (part 1) in which MA stated that he thought that the gold rally was a "Bull Trap" (implying lower lows to come) due to the fact that the gold/silver ratio was rising which exactly contradicts what Gumbi said above. Alot of folks also got burned on this (including myself) but honestly I should also thank MA at the same time because without that negative experience I may never have created my own system which makes the calls to be in/out blatantly clear. |

|

|

|

Oh, and Simons has an enormous edge in that he wins more often than he loses.

It's a bit nit picky but the key to Simons system (or any system for that matter) is not that he wins more than he loses but that his net win/loss amounts are positive (ie he makes lots of money doing it). I know it's counter intuitive but I looked at a few trading systems that had losing averages (ie lost alot more times than they won percentage-wise) but that actually made money because the many small losses were significantly less than the few huge wins that were generated (vice versa and obviously your account blows up pretty quickly). |

|

|

|

I disagree that it is exceptional- Martin Armstrong has so many ways of being right that it becomes useless. I call it the Gann fallacy: https://images.exchangerates.org.uk/uploads/012319gas.png So many ways to be right isn't a good thing. He also hyped some date last year and then when nothing happened, he talked about some insignificant corruption that happened in Malaysia, which has never been a big player on the world stage. I didn't say MA is exceptional, I only said it would be exceptional if you had reliable timing for events/moves (either up or down).......we are not in disagreement at all. Yes I have seen him countless times come in after the fact and stating all sorts of reasons why he was still correct. His ECM and arrays stand alone so if they work then it should produce an event on that date, if not then obviously it doesn't work. |

|

|

|

Spot on anonymous

Notice heís Quoting the 30k figure so he can come out and say itís a low if it keeps going and if it pulls back he wonít bring up the 30k figure heíll just go on about how good Socrates is and his ECM date

Each way bet in a 2 horse field

I don't care if it is a high, a low or even a change in slope, just being able to time a market event/move would be exceptional (you can use other means to figure out what that move might be if you have timing right). So to me if the cycles do work then something should be occurring on that timing without exception (tons of exceptions means your rules don't work). So again if it actually works you should be able to see something on that date, if not, then probability says we are likely talking about a broken clock being right twice a day. |

|

|

|

The most disgusting post I have seen for a while. He is ambiguous as ever: He can see when his is wrong with his predictions. Then he switches sides and claims he has never been wrong.    I'm sure he would just claim that humans are biased but his computer has both sides covered so that's why he doesn't ever admit he's wrong........yes, it's twisted, I know. |

|

|

|

I've done alot of empirical testing on it against real market data you may have done your testing on inaccurate array data. You can forget about the arrays from Feb. 2019 - August 2019 on ask-socrates.com. I'm sure they were completely faulty during that time. This is part of the problem. Even if the Socrates system did work, the roll out was quite unprofessional because the subscribers were basically the guinea pigs. Then later if someone says they traded with the system you get some legal nonsense stating the system if for educational purposes only. It's like Telsa's auto pilot that requires 2 hands on the wheel at all times (hint: that's not really auto pilot). |

|

|

|

Please try to understand the following:

The forecast array has 12 columns. For the sake of argument, if each column had a turning point, what would the predictive value of it?

Zero.

If on the other hand, a forecast array had only a single turning point in it, then that would be something. But it would still be of a low value because it can be interpreted as both a low or a high.

The fact is that forecast arrays typically have more than one turning point, in fact many turning points, so the predictive value is low due to the resulting ambiguity.

I totally agree with you, from what I've had explained thus far (both at a WEC and from other supposed gurus on the subject) of MA's array rules and how to use them those arrays don't have any value as is IMHO. Everyone says only the reversals are for trading (even more useless IMHO). What I am saying is that if you disregard all that and just look at the long-term row there may be some accuracy to whatever he's using to create it. I've done alot of empirical testing on it against real market data and there appears to be some weak correlation but that's all I can postulate at this point. Could it all be just circumstance, sure but the reverse could be true as well. It's not after the fact because that array was around well before being used so we can at least rule that out. Do we have any idea how he actually creates the arrays? |

|

|

|

I have to laugh. Why?

Look at these arrays. There are 12 columns in every array, right?

In this one, it has 6 extremes to pick from, right? 3 highs and 3 lows. 6 out of 12 that is 50%. Please note that in Armstrong speak, there is no difference between high and low, right?

So we have a probability of roughly 50% already that any attempt to fit any curve to this in the way that our Charlatan in Chief advises us to do, will actually be successful. Then you have the variation that these arrays are actually dynamic, so the highs and lows are not fixed while time moves on.

What does this mean? It means that for a curve fitting exercise (in hindsight) you can choose perhaps out of 4 different arrays the one that suits you best. At the end of the day, your success will always be 100%.

Now you think: hey, I have fitted the past with a great deal of cherry-picking, and therefore, the future will cooperate and follow the path of the array into the future? That is pure bullshit. Many people have tried this before. It never worked.

I did a ton of testing on Socrates when it came out and all of it was basically junk but for some reason the arrays on his private system were significantly different and appeared to have some accuracy to them (I don't know why). I have no idea what you mean about with extremes/highs/lows, post up a drawing like I did so we know what you're talking about. I don't use any of MA's rules at all when looking at the arrays (as I said I don't think he understands his own stuff). There's some dynamic stuff in the array for sure but if you look at the long-term row there's always some sort of static cycle in there because you see it on every array. |

|

|

|

Do the same thing over many samples and report back, thanks. Cooincidence and confirmation bias is all it is.

That's the trouble, you can't do many samples because those arrays aren't available via Socrates......I ran into the same issue back in 2016. Only way to get those are to wait for him to post them online in his blog or take them out of a report. Find me more current ones and I'll be happy to run tests galore. |

|

|

|

I posted this way back on page 319 and tried to use one of MA's arrays to predict a change in the GBPUSD pair as a way to see if there was anything worthwhile. I don't think it's conclusive by any means, but to me there appears to be more than just a coincidence that it did in fact show something (note the white lines I drew in using the info on the array) in both major direction changes on the currency. The presumption now from the array is that it will continue down at least until the end of the time frame shown. Now again this was just my interpretation not MA at all (personally I don't think he even knows how to read his own stuff). Anyway I thought I would share since it appears there might be something worth pursuing at least from a cycle perspective.  |

|

|

|

There is nobody left to blame but yourself now that Socrates has been fully released with all the reversals and arrays. Armstrong barely posts anymore on his private blog because there is no real need. I'm pretty sure you were not on Princeton economics website which actually had the GMW from daily to monthly in 2015 for free. The GMW was like pure gold at that time since we didn't have much to work with then. the only thing you are referring to is his public blog and he can only go so far and reveal so much there. Do yourself a favor and read the private blog posts starting from 2016 going into at least 2017/2018 and all will be revealed regarding the metals and the indices. Have a look and see what reversals were given and see for yourself whether they worked or not. Its right there a record of everything Armstrong posted on his private blog. You will have to discover the truth on your own I cannot do it for you... And of course AnonymousCoder has never gone through the private blog and is still stuck on the gold play that ended in early 2016 for him, that is a real sad state of affairs how many calls Armstrong has made after the fact on his private blog and he is hung up on one trade from the hundreds of trades given on his private blog he clings to one as proof of his assertion. I cannot continue to post because this forum has been taken over by the mob that is AnonymousCoder and he is doing everything in his power to silence me, it clearly has become personal. Private Blogs: I have all private blogs and these do NOT contain anything contradicting our message. You did have the chance to quote any relevant private blog messages but you failed to do so.

update* you almost sound upset to see me go AnonymousCoder  You never wanted to talk about anything other than the gold report in 2015 and early 2016 March that is the time period and the blog posts you were fixated on and there was no way to move ahead to other trades. And you have not read a single private blog post from 2017 going into 2019 because you have been fixated on one trade where the only conclusion is to believe Armstrong lied or failed to let clients know in time. I am done with trying to explain anything to you I do not care what you believe or have to say about Armstrong or Socrates, who are you at the end of the day? just a disgruntled owner of the 2015 gold report who lost out on one trade, ultimately your opinion means nothing. Good luck guys hope you find success with your trading with or without Socrates.  Gumbi, sorry but much of what you're saying here just flat isn't true at all. Armstrong completely blew the turn in commodities in late 2015 and for whatever reason he continually called for new lows the entire time. This wasn't just one trade, this went on for most of 2016 and into 2017. The 2015 WEC forum was just full of chatter about it. Coming out of the 2015 WEC I will say he did get it right to short Deutsche Bank but just about everyone saw the EU as a dirt torpedo so not a particularly hard call IMHO. I was on Socrates when it first came out in early 2016 and nobody seemed to understand how to make it work, not the GMW (public or private), not the arrays, reversals, energy indicators , etc. Everyone took a crack at it and offered their explanations, they all took tries to trade from it and often you'd hear of some 3rd party that knew how to use it and make serious money in futures/stocks/etc but not a single person I ever came across was able to back this up at all. Slowly we started to notice the arrays on Socrates we were using and the arrays MA posted were quite different. Then after a few months of trying to use the system we were told don't trade on it because the coding still had bugs that needed to be worked out. Seriously?! I have absolutely no bias for or against Armstrong but I do deal in facts and I'm sorry but the reality is that he continually called for a bottom on PM's right through that entire rally. Why are people so pissed off about that? Well maybe it's because PM stocks went up 3-10X during that time! That's a huge missed call and if the computer didn't show you that move then how the heck can you trust it on more subtle market moves? He also said governments would move to ban crypto currencies (we'll see how that one plays out too, but nothing yet). Honestly I should be thanking him for what happened because without it I would not have created my own system which does work remarkably well for me. Now I'm not prepared to say all of MA's stuff is fraudulent or garbage but to sell the idea that the computer is never wrong is certainly misleading even under the best circumstances. |

|

|

|

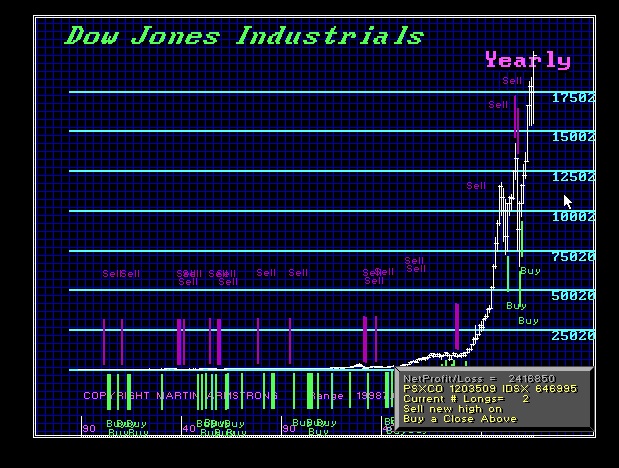

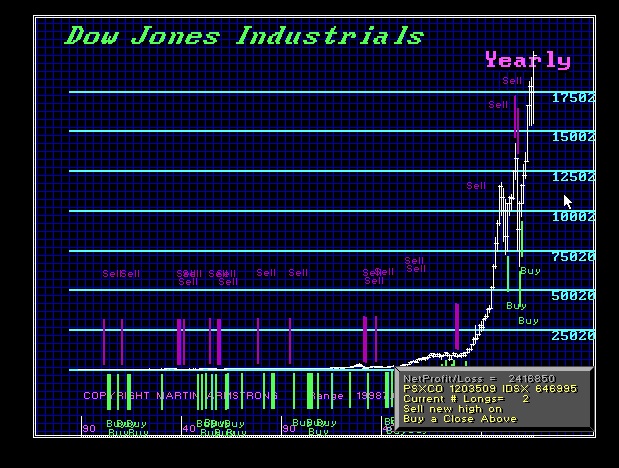

@MTL4 The Socrates premium analysis does go long or short hypothetically a number of positions based on the election of reversals from the daily to the monthly time level which I believe is the same as the chart you posted for example the Dow premium analysis monthly commentary says "we are currently hypothetically long 4 positions at this particular moment on the monthly level" Armstrong mentioned that phase II of Socrates will add a backtesting feature to see what Socrates wrote on any given day. https://www.armstrongeconomics.com/products_services/socrates/progress-report-on-socrates-deployment/I think at this time we just don't have access to the chart which would be very helpful but there is still many other features that need to be added to the pro service Gumbi, this is the issue I have with what you are saying. If you are really using this system to trade you need to know exactly when you are in/out of a position even if you are occasionally wrong (it is quite possible to be wrong over 50% of the time and still have a winning strategy). All successful trading systems I'm aware of have very strict rules for exactly this reason and they must be followed at all times for it to work. As a trader I don't want to read some verbose consulting report every day which may say "we are currently hypothetically long 4 positions at this particular moment on the monthly level". Trading takes hard work and hours during each day are very limited so why would some $100 million system waste our time like that? Typing in questions and speaking to it like Siri/Alexa is a novelty that visual folks used to reading charts won't care about one iota. You are given tons of technical BS with Socrates but the issue is you are still being left to decipher it (I have yet to see anyone do this successfully on a consistent basis). If the system is that good then have it (computer is the expert, right?) interpret the info for us and display it in a table or chart. That way there's no room for error and everyone wins. I really don't see why this is even remotely hard to do even with my relatively low computer programming skills. You'd think that would be priority #1 when designing a system for financial folks to use. |

|

|

|

Again this is incorrect the period in time is defined by the reversal in question, the period has always been a unit of 3.

The election of a reversal normally indicates that the expected high or low that should unfold in as short a time span as 1 to 3 units of time, be it daily, weekly, monthly or quarterly

The next monthly bearish reversal was 1.749% away what in the hell are you talking about? Did you think it was going to take until the end of May to test it?

"We recommend to align Reversals with Forecast Arrays to further strengthen your research, identifying potential convergence of time and price." (Socrates user manual)

You don't understand the energy model, you don't understand the array, and you don't understand the reversal systemÖ Period.

Gumbi, riddle me this........if the system is so intelligent and straight forward then why doesn't MA just have Socrates do all the analysis for you?  I mean real traders need clear signals so why be so vague and complicated, we know he has posted these charts several times, why is this not available? |

|

|

|

The call by Armstrong is for the Dow to make a high In January 2020 in line with the ECM, a high this week with a low the week of 12/02 will confirm this, with a drop back going into 2021(2nd quarter)

This will be a pretty critical call for MA's model because on the ECM 2015.75 should have been a transition high but really it turned out to be a low so now 2020.05 should invert the next transition low into a high. The currency arrays also said the same thing so we'll have to see if this actually works out or not. The markets are due for a correction on my charts as well but the central banks have yet to take their foot off the accelerator just yet. |

|

|

|

That looks surprisingly like Tesla's business model. |

|

|

|

So, this forum has turned into a desperate effort of few ignorant fools trying to debunk Martin Armstrong. Can not comment on Socrates and such, but MA is by far the best economists. Noone has come even close to his understanding of the economy. And I'm so grateful that he is sharing portion of his knowledge publicly. Good luck debunking MA, fools.

I'm still waiting to see how this turns out......lots of changes on the GBP/BREXIT front, the January time frame has some serious potential, we'll see if it was correct or not. Here's another overlay for an array that MA posted not long ago so I'm curious to see if any of it actually has any merit. I put the white lines in where I would expected to see something happen on the array (but hindsight obviously doesn't count) so let's see if the beginning of the year actually does anything for the GBP or not. My white lines are based on the long-term cycle he shows on his arrays. Since the cycles are ramping up then the peaks should fall right at the end of each.  |

|

|

|

Here's another overlay for an array that MA posted not long ago so I'm curious to see if any of it actually has any merit. I put the white lines in where I would expected to see something happen on the array (but hindsight obviously doesn't count) so let's see if the beginning of the year actually does anything for the GBP or not. My white lines are based on the long-term cycle he shows on his arrays. Since the cycles are ramping up then the peaks should fall right at the end of each.  |

|

|

|

no, it's not exclusively about that. It's what you and a few other people have made out of this thread.

This thread is also for people who believe to already know that Socrates works. Just leave them their opinion.

It is also possible to discuss small aspects of a topic without constantly taking the whole thing into question.

Alex, anyone has the right to have any opinion they want but if I come out and tell everyone that I believe aliens have visited earth, but when asked for proof I tell everyone I don't need to provide proof or tell them to find their own proof then I shouldn't be the least bit surprised that I may be ridiculed for holding that opinion. olegrey, I suggest you restart all of your counts from zero, and post your trades in real-time. On this page 317, you go from successful reversal 5 to 8, without posting ANY real-time trades.

If I make a claim about my magic formula combining moving average and MACD indicators, and simply post like you with some success & failure, but averaging out to be some good stuffs, NOBODY can tell whether I'm faking it or not, even when it is HINDSIGHT based.

I was going to ask the same thing, olegrey the trades should be in tab form so you can see when the call was made, what reversal, what was bought/sold, price paid, etc. People want the ability to go back through the posts and verify the findings using the time stamps (ie you can't go back and edit posts after the fact). Then at the end you can provide a summary like you have been to show the total results it achieved to date. |

|

|

|

Charts are where it's at. Problem is, people don't know how to conduct TA effectively. I remember some time ago I posted some numbers and criteria to trade them intraday for a week in advance when I first discovered a truly amazing technique (on a different forum) and said it would generate no losses. I was being extremely arrogant and off putting in my manner like a child, and so people went at me of course, saying it wasn't possible. But, it worked and people were amazed and salty. I deleted it all and disappeared, but it would have been impossible to replicate in any case, as I had not revealed the important parts of the system, and never have. Secret techniques, magic numbers, and so on are things I would have written off as nonsense. I independently came to the conclusion that it is real, and reverse engineered it. It does lose, but very rarely, with wins and breakevens at 9X%. However, without an objective system, it is just a coin flip. And that's Armstrong's problem. He keeps changing things around and he ignores the losses.

I missed buying the spike down the the LoD today. My system caught it, off 1 point, but I was eating. Rushed to the laptop when I saw it on my phone but the move already happened :/

I did something similar, reverse engineered it and guess what, scary how well it works. Not surprisingly I too had to learn to always check my ego at the door when I test things, now I just let the facts speak for themselves. I love hearing how others are killing it in the markets. Trouble I have right now is getting my system to do the searching for me to find the best setups. I started writing code to do it but I just have too many projects on the go to pull it all off at the moment. I can trade almost anything effectively now but what I want to develop is a way to quickly locate ones that are way offside and have the most potential to move. MA appears to have a pretty back track record on calling major tops/bottoms that aren't done in hindsight but I suppose that would make sense if you wanted to be vague enough to always claim you were correct on every situation. |

|

|

|

Already up 1.5% since I posted. Yes, this is real-time, and not in hindsight like Socrates. Read this blog starting at page 273 to find out more about computerized fraud See https://armstrongecmscam.blogspot.com for a more compact view of major findings posted in this blog Looks like a good bottom call to me (failed breakout to the downside on an upward channel). Top looks to be around 14 unless you get a breakout (major breakout would be holding above 16) then definitely a new upward trend with new highs very likely. Anyone want to start another "Stock Trading" thread under "Economics" for stuff like this because it a big help for other traders to be able to discuss?.....the MA thread is just too easy to lose focus. |

|

|

|

|

You never wanted to talk about anything other than the gold report in 2015 and early 2016 March that is the time period and the blog posts you were fixated on and there was no way to move ahead to other trades. And you have not read a single private blog post from 2017 going into 2019 because you have been fixated on one trade where the only conclusion is to believe Armstrong lied or failed to let clients know in time. I am done with trying to explain anything to you I do not care what you believe or have to say about Armstrong or Socrates, who are you at the end of the day? just a disgruntled owner of the 2015 gold report who lost out on one trade, ultimately your opinion means nothing.

You never wanted to talk about anything other than the gold report in 2015 and early 2016 March that is the time period and the blog posts you were fixated on and there was no way to move ahead to other trades. And you have not read a single private blog post from 2017 going into 2019 because you have been fixated on one trade where the only conclusion is to believe Armstrong lied or failed to let clients know in time. I am done with trying to explain anything to you I do not care what you believe or have to say about Armstrong or Socrates, who are you at the end of the day? just a disgruntled owner of the 2015 gold report who lost out on one trade, ultimately your opinion means nothing.