|

1721

|

Economy / Trading Discussion / Re: huge arbitrage opportunity

|

on: June 29, 2011, 06:24:55 PM

|

|

All the Bitcoin exchanges pay out cash rather slowly. So you can't sell on exchange A, move your cash quickly, buy on exchange B, and repeat, using the same capital. That cycle takes days, rather than minutes. This limits arbitrage.

|

|

|

|

|

1722

|

Economy / Trading Discussion / Re: Low volume -- herd behavior?

|

on: June 29, 2011, 06:18:08 PM

|

|

That's inherent in a system that's mostly limit orders - if the price isn't moving, trading stops.

What's really interesting is how many "buy" orders are outstanding on Mt. Gox. There are over a million dollars of limit orders displayed below the current price. Each of those supposedly has a cash deposit behind it. Who's putting up all that cash? And why are they keeping it in Mt. Gox?

|

|

|

|

|

1724

|

Bitcoin / Bitcoin Discussion / Re: MemoryDealers

|

on: June 29, 2011, 03:16:46 AM

|

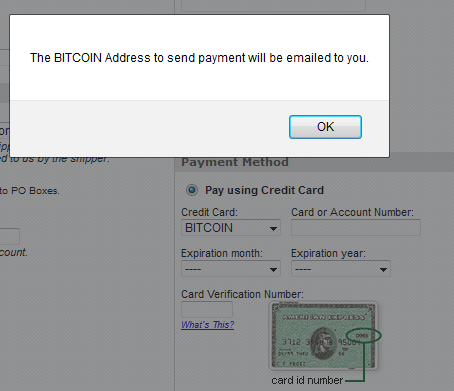

My current yahoo shopping cart system DOES accept bitcoin orders, and I have already contacted Yahoo Store directly, asking them to allow all their users to easily accept bitcoins. The checkout page mentions Bitcoins, but then you have to do manual email stuff.  |

|

|

|

|

1725

|

Bitcoin / Bitcoin Discussion / Re: Watching amateur finance types flail

|

on: June 29, 2011, 01:25:43 AM

|

You can buy anything on Amazon.com with bitcoins.

This is news. How? Without first converting to USD? There's a few middlemen - you send them BTC and a wishlist, they buy it and (I'm guessing) sell the BTC. Amazon doesn't accept BTC directly. There are importing businesses which work like that - you send them a wishlist and money, and they buy stuff for you in some foreign country and have it shipped over. That's useful because they can deal with sellers in another language, consolidate shipments into containers to save on shipping, deal with customs documentation, and physically get the stuff moved. Going through some intermediary just to get a currency conversion isn't worth much. And it really complicates returns. |

|

|

|

|

1726

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Laws Imminent

|

on: June 28, 2011, 08:04:23 PM

|

Exchangers will be the very first, pools second, big miners third. Exchanges are the big problem right now. Mt. Gox would be legal if it registered with the Japan Financial Services Agency as a money transfer service and complied with their regulations. Japan's regulations for money transfer services are quite flexible, and were specifically intended to encourage new Internet-based forms of money transfer. The regulators do insist on audits, will check that the customers' money really is there and is held in accounts separate from the business's own funds. For the amount of money Mt. Gox is handling, those requirements are quite reasonable. |

|

|

|

|

1727

|

Bitcoin / Bitcoin Discussion / Re: A Bitcoin Solution to Spam?

|

on: June 28, 2011, 06:08:04 PM

|

|

It's not a new idea. It does have some potential, though, because Bitcoins are transferable. One could have a spam filter that bounced messages from new senders unless they sent a fraction of a Bitcoin. The recipient gets to keep the money and can use it to send. It's not a tax or fee, but a deal between sender and recipient. There might be convention that if the receiver replies to the sender, the sender normally gets their coin back.

While it's hard to retrofit it to email, it has potential for a forum system. Someone might develop a WordPress plug-in for this.

|

|

|

|

|

1728

|

Bitcoin / Bitcoin Discussion / MemoryDealers

|

on: June 28, 2011, 05:55:33 PM

|

MemoryDealers.com They're not new. They've been on the Bitcom.org wiki page for some time. They accept Bitcoins because they're selling gear for Bitcoin miners. And their shopping cart system (which is Yahoo Store) doesn't accept Bitcoins. Now if Yahoo Store accepted Bitcoins and converted them for the merchant, that would be big news. But no. |

|

|

|

|

1729

|

Bitcoin / Bitcoin Discussion / Re: There might be another virtual currency following BTC

|

on: June 28, 2011, 05:50:44 PM

|

Oh man, it would suck so hard if every major corporation like Amazon or whatever started using their own virtual currency...

Like these:     There's hundreds of those things, and they don't interchange between merchants. And those are just the ones denominated in dollars. There are "rewards cards", denominated in "points"  and phone cards, denominated in "minutes".  Those really are a sort of currency, since they have their own unit. In the US, stored value cards usually don't interchange between vendors. Hong Kong, though, has the Octopus card.  Works for transit, vending machines, fast food, etc. So there are already a lot of corporate currency-like things out there. |

|

|

|

|

1731

|

Bitcoin / Mining support / Re: How to build your own power supply?

|

on: June 28, 2011, 04:50:16 PM

|

Power supplies that have a UL approval should deliver their rated output continuously without overheating. UL (which is owned by fire insurance companies) tests that. UL also requires that no single component failure can cause a fire. Phony UL approval markings are often seen in products from China. But there's a way to check. UL has a database of approvals. The UL file number on the UL approval sticker must match the manufacturer and the description of the item. Here's what it takes to test a power supply. Hardware Secrets connects the power supply to a load box, loads it up to its rated output, and runs it for hours at 45C while checking the electrical outputs. See their reviews. |

|

|

|

|

1732

|

Economy / Trading Discussion / Re: Do the people running Mt. Gox trade on their own exchange?

|

on: June 28, 2011, 02:55:27 AM

|

Data going through any exchange needs to be transparent (i.e. Public) and independently verified. Is there no way this functionality can be built into the bitcoin client?

A distributed exchange is only possible if the nodes can hold, transmit, and receive at least two tradeable forms of value. So you need a client that understands both Bitcoins and at least one other system. It seems possible to make a distributed exchange work without a trusted intermediary if the client broke up transactions into small amounts (say $1 to $10) and one of the low-cost money transfer systems like Liberty Reserve or Dwolla could do an end to end transaction in seconds. Then you could do a trade where you agreed on a price and quantity with another party, then the client did the trade by sending say $5, waiting for the agreed value in Bitcoins to show up, and repeating until the transaction was complete. Ripoffs are possible but limited to $5, and a reputation system can be used to keep anybody from pulling that more than once. New accounts with no reputation would get maybe $1 at a time until they built up some reputation points. LR charges 1%, minimum $0.01; Dwolla charges $0.25 based on transaction size, so you need units of $25 to get down to 1%. Whether either system is fast enough for this is not clear. |

|

|

|

|

1733

|

Bitcoin / Bitcoin Discussion / Re: The Bitcoin Show on OnlyOneTV.com

|

on: June 28, 2011, 02:25:56 AM

|

WTG guys, at least now you're taking time prepping in advance =)

Right now, they're showing a live feed of their apartment. Nice hardwood floor. Someone walked through carrying a large paper cup and went into the kitchen. There's water dripping and a background whine. Big bowl on the dining table. |

|

|

|

|

1734

|

Economy / Trading Discussion / Re: Warning signs of financial fraud

|

on: June 27, 2011, 09:40:17 PM

|

It does seem fairly simple for Mt. Gox or Tradehill to back-date trades at the low and high for themselves.

Big red flags with Mt. Gox are 1) delays and difficulty in getting money (not Bitcoins) out, and 2) complaints about limit orders not being executed. 1) is an indicator that the money might not be there, and 2) is an indicator that there may be front-running (where the insiders get to queue trades ahead of others, after seeing the queue, thus betting on a sure thing). As I've said before, get your cash out of Mt. Gox. If they're legit, it won't hurt them; they make their money on transaction fees. If they're not, last ones to get out lose. You can always deposit cash later if you need to buy Bitcoins. |

|

|

|

|

1736

|

Economy / Trading Discussion / Warning signs of financial fraud

|

on: June 27, 2011, 09:08:04 PM

|

A standard list of warning signs of financial fraud, as applied to Bitcoin exchanges. - (1) Sales Appeal: The hook designed to lure you in is get rich quick without risk or hard work. Above market returns, guarantees, low or no risk, and no effort required are all hallmarks of investment fraud. Investment fraud intentionally appeals to the basic human emotions of fear, greed, and wanting something for nothing so that you will make an irrational decision. Be wary of any salesman who draws out your emotions as part of the sales process. Due diligence is how you remove the emotion and base your decision on facts.

- (2) Obfuscation and Misinformation: Fancy words and successful images are designed to win your trust by creating a fašade of sophistication. Techno-babble is designed to intimidate you into not looking behind the facade. Multiple postings on the internet under various aliases are designed to create the appearance of many people involved. Professional images are designed to create trust. Always ask, "Where is the beef?" Never trust the fašade, but instead look deeper to find real substance. Due diligence is how you look behind the veneer of obfuscation and misinformation to see if there is any real meat.

- (3) Unverifiable Claims: Secrets of the rich, technological breakthroughs, patent pending formulas, government conspiracy theories, and inside information are all examples of things that are either hard to verify or not verifiable at all. Never invest based on hollow words alone. Verify all statements and claims with independent third party information. Assume nothing is true until confirmed through due diligence.

- (4) Manipulative Sales Practices: Intimidation, inadequate disclosures, non-traditional payment choices, inadequate diversification or improper asset allocation, encouraging you to invest based on trust, or rushing you into a decision with high pressure sales tactics are all examples of manipulative investment sales practices that deviate from proven professional standards of conduct. Never rush a decision or invest based on emotion. Due diligence will slow the sales process sufficiently to offset manipulative practices.

- (5) Lack Of Transparency: All investment accounts should be registered separately in your name with an independent, third-party custodian, and all transactions in your investment accounts should be fully visible to you on a daily basis either through independent account statements or the custodian's web site. Avoid commingled, pooled funds where the manager has custody and possession and/or account activity statements are generated only by the manager and not by an independent third-party.

|

|

|

|

|

1738

|

Economy / Trading Discussion / Do the people running Mt. Gox trade on their own exchange?

|

on: June 27, 2011, 08:05:20 PM

|

|

Do the people running Mt. Gox trade on their own exchange?

It's striking how different the trading pattern was when Mt. Gox was offline. Tradehill settled down around 15, got some market depth, and Bitcoins started acting like a stable currency. Once Mt. Gox came back up, the volatility went way up. That's backwards. A bigger exchange should be less volatile.

Something funny may be going on behind the scenes here.

Watch for limit orders not being executed when they should be, or delays before trade execution. That's an indication of front-running.

|

|

|

|

|

1739

|

Bitcoin / Bitcoin Discussion / Re: Watching amateur finance types flail

|

on: June 27, 2011, 07:42:26 PM

|

Yet they're acting as depository institutions for sizable funds belonging to others. They are not a depository institution. Mt Gox has custodial relationship with account holders. The funds _are_ held in a depository institution, namely Sumitomo Mitsui Banking Corp. That's an interesting legal point. Whether funds held by a Bitcoin exchange are debts of the exchange or a shared interest in a custodial account isn't clear. This matters a lot when an exchange goes out of business. For a bank, a deposit is a debt of the bank. For a brokerage, a deposit not invested in some security is funds held in custody. This really matters when a brokerage firm goes under. (I've had that happen, with L. F. Rothschild. Founded in 1899, went bust in 1989. Getting all my assets out took a few weeks of daily phone calls and threats, but I didn't lose anything.) For a money transfer firm in Japan, which Mt. Gox is, a custodial account is required. Mt. Gox isn't registered as a money transfer firm, although they should be. So we have only rumors that they have all their customer's funds. |

|

|

|

|