Show Posts Show Posts

|

|

Pages: « 1 [2]

|

How can I join your aidrop?

Hey, The Genesis IRO will end in 3 days. To make things more exciting, we have decided to extend the 50% rebate airdrop till the end of the IRO and there will be no upper limit to the amount of KNIGHT token you can earn from today Tuesday, March 15, 2022 8:00 AM at the price of $0.05/token You need to contribute a minimum of $50,000 USDC in order to qualify for the airdrop and it will be claimable upon the successful completion of the IRO. In the event the IRO do not meet the softcap, the airdrop will be reduced to 10% (instead of 50% of your USDC contribution) and you will be able to claim back your full amount of USDC contribution. The contribution amount is cumulative, i.e. if you contributed $25k during the first day of IRO, you only need to top up $25k USDC today in order to qualify for the full 50% rebate! Or if you contributed >$50k before today, all you need to do is to contribute additional $1 between now till the end of IRO to qualify! Summary 1. You will get 50% of your USDC dollar contribution back in KNIGHT tokens with no CAP when you contribute from today Tuesday, March 15, 2022 8:00 AM with a minimum cumulative of $50,000 USDC 2. The 50% reward airdrop will be given out upon the successful completion of the IRO. If the IRO fails, the reward airdrop will be reduced to 10% of your USDC contribution and you will be able to claim back your full amount of USDC contribution. This is our final sprint to meet the IRO soft cap. Please share the news with your friends and WAGMI!! Do join our Discord for updates! |

|

|

|

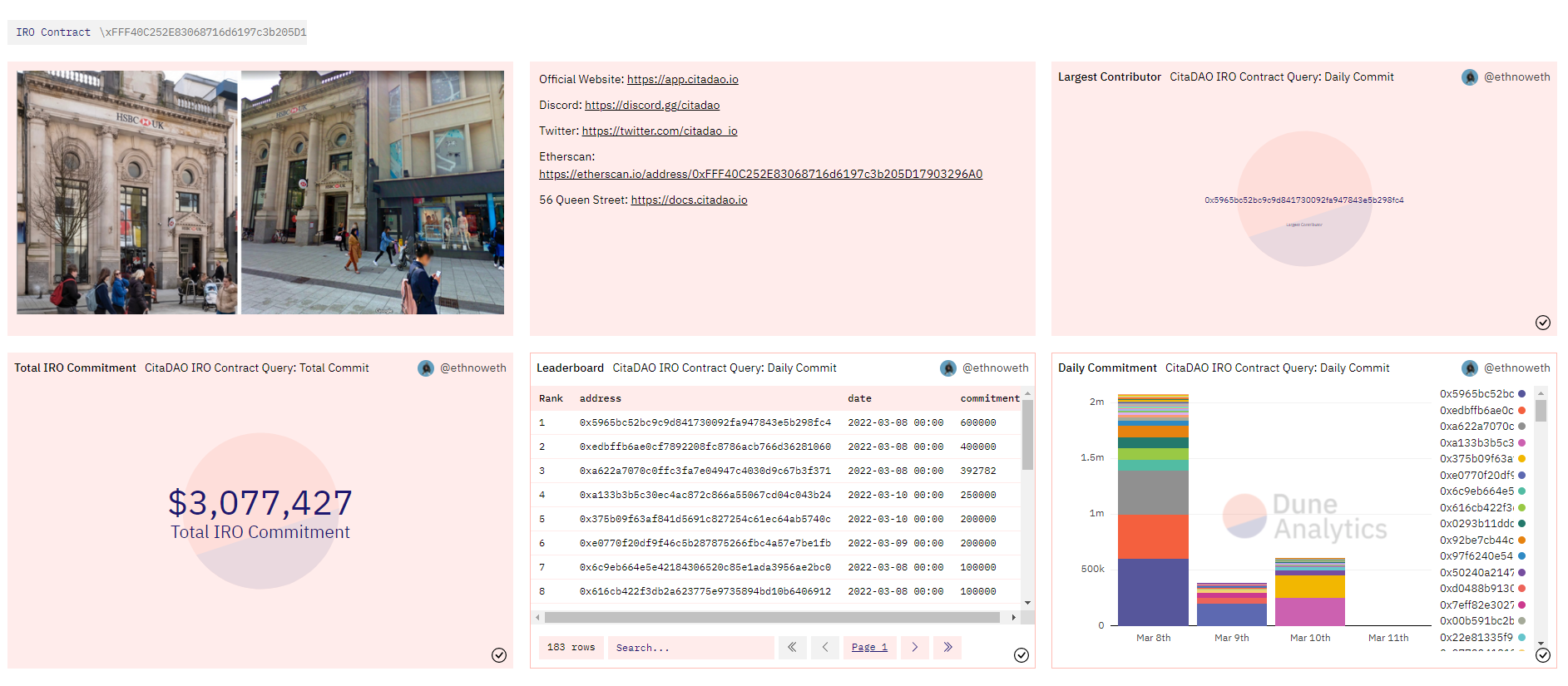

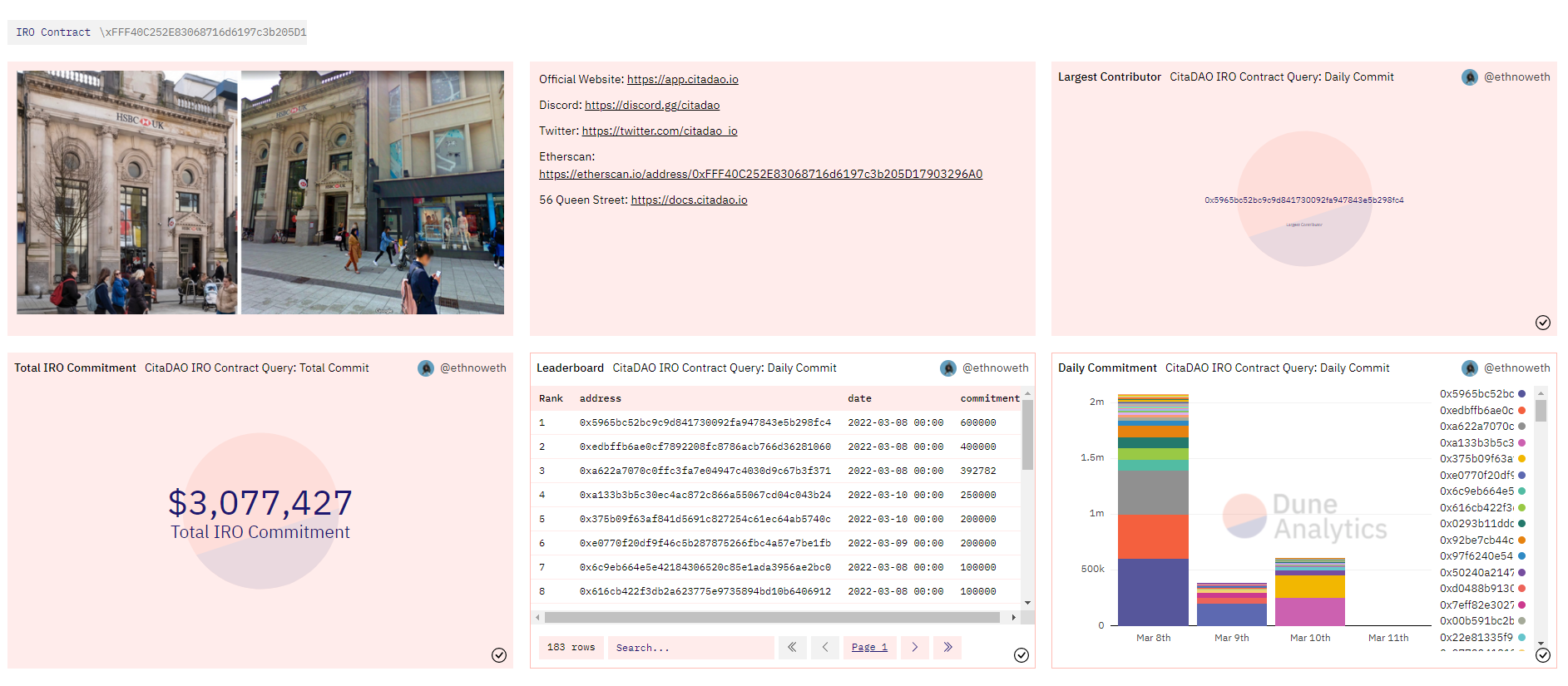

Genesis IROCitaDAO recently launched its Genesis IRO on 8th March 2022 UTC 00:00 with the goal of buying a Bank building worth US$20,690,000. Address: 56 Queen Street, Cardiff, CF10 2PX, UK Address: 56 Queen Street, Cardiff, CF10 2PX, UK

IRO value: $20,690,000 | IRO duration: 10 days | IRO reward: $1,000,000 | APY Floor: 176%

The Real Estate Listing features an extravagant heritage building valued at US$20,690,000. Participants who contribute their Stablecoin USDC to the IRO can expect a floor APY of 176% on their contribution. Moreover, eye-catching airdrops in the form of CitaDAO's governance token, KNIGHT, are being given to IRO participants. All these rewards come in addition to the Real Estate Tokens that participants will receive anyway if the IRO is successful.

Joel Lin, a contributor at CitaDAO remarked, "For the first time in history, crypto anons will be able to collect rents from rent-seekers. The first IRO for CitaDAO will be a building leased to TradFi in Wales. If we want to bring legitimacy to web3, this is our opportunity and Real Estate will play a crucial role, this is the way."

As of now, the commitment amount to the IRO has exceeded US$2 million and will end on 18th March 2022 UTC 00:00. Don't miss out on this amazing opportunity, join us at app.citadao.io!

What is the minimum Investment I can make? Hi, the minimum USDC you can commit to the IRO is 1! |

|

|

|

Project has very good potential. I want to know more about your project.I hope citadao will be a successful project.

Hi, do refer to the first post to find out more about CitaDAO. Feel free to ask any questions here or join our Discord where we have Weekly Project Calls! |

|

|

|

Are you planning to list on any exchange soon?

Hey, as mentioned above, CitaDAO's governance token, KNIGHT, is listed on the Uniswap DEX. We have partnered with MEXC Global, a CEX, and will be listing KNIGHT there, the date is TBA. |

|

|

|

When you are going to list in exchange?

Hey, CitaDAO's governance token, KNIGHT, is listed on the Uniswap DEX. We have partnered with MEXC Global, a CEX, and will be listing KNIGHT there, the date is TBA. |

|

|

|

Citadao Seems really good project.How can I know more about your project. Can you send me your whitepaper link.Thanks

Hi, you can check out our Litepaper as well as our Documentation for more information on CitaDAO. Hope that helps! |

|

|

|

why there would be two prices for the same asset on chain and off chain? Don't you think there will be a problem if the same real estate have two price then the buyers and the sellers face problem to transact it?

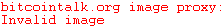

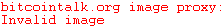

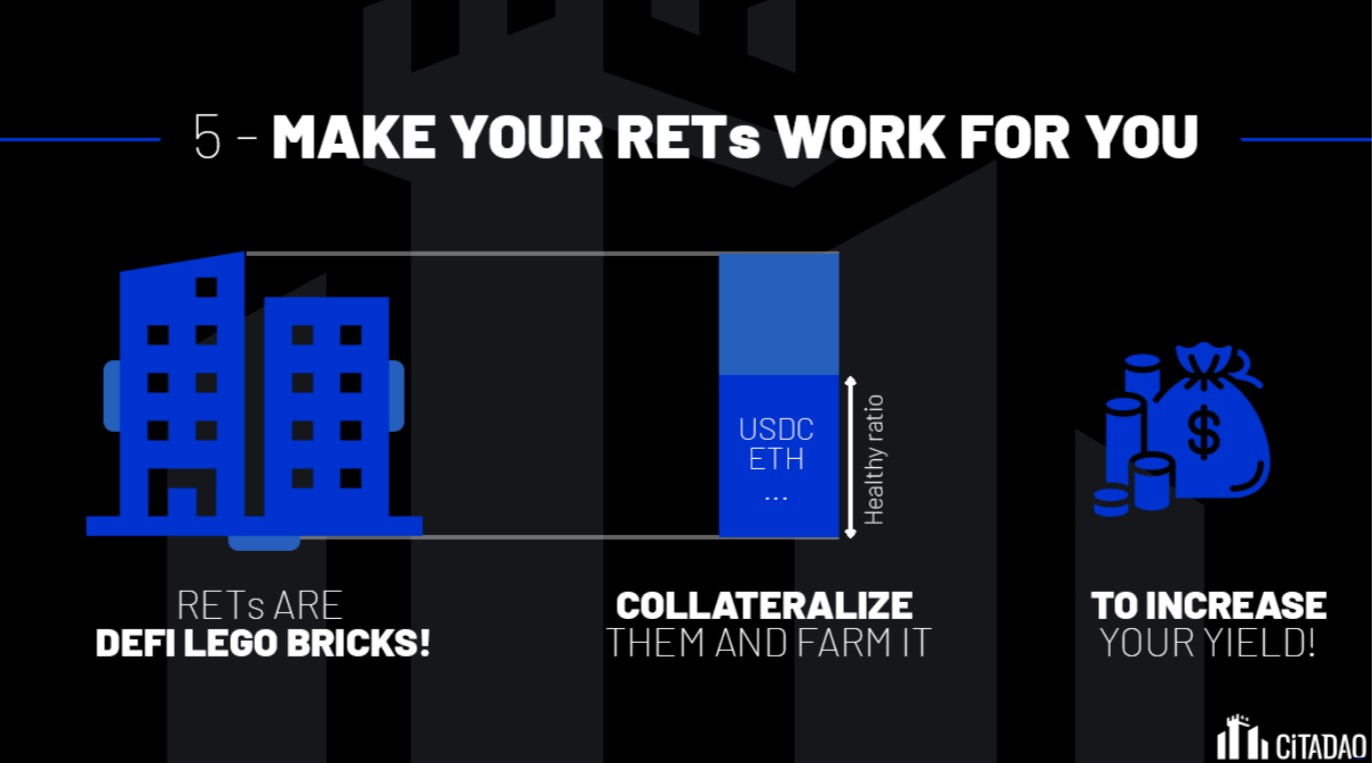

Hi, as mentioned above we believe that with CitaDAO, there will be 2 different prices for the same piece of Real Estate: the price of Real Estate On-chain and Off-chain. We believe that the value of Real Estate on-chain will be higher than value of the same Real Estate off-chain. This is simply because with CitaDAO, on-chain Real Estate has more use cases compared to off-chain Real Estate (similar to the iPhone App Store increasing the value of an iPhone because of multiple use cases provided by the App Store). Real Estate Token holders will find that there is more that they can do with their RET compared to having the physical piece of Real Estate. Such examples would be pairing the RET with USDC to yield farm, taking out collateralized loans with RET, RET Index Funds, Futures and other Primitives. Because of these use cases that you would normally not have or have difficulty attaining in the real world, we believe that the RET will be worth more than the Real estate in the Real World since there would be greater demand for the RET. As for your 2nd question, buyers and sellers will only be able to buy and sell RET via our Automated Market Maker. If a buyer wants to buyout the entire Real Estate, they will have to go through our buyout process This means that if anyone wants to buy the property, they will have to go through our platform where the price is based on the On-chain price. The Off-chain price simply acts as a floor price for the On-chain RET. Hope that answers your questions! |

|

|

|

Genesis IROCitaDAO recently launched its Genesis IRO on 8th March 2022 UTC 00:00 with the goal of buying a Bank building worth US$20,690,000. Address: 56 Queen Street, Cardiff, CF10 2PX, UK Address: 56 Queen Street, Cardiff, CF10 2PX, UK

IRO value: $20,690,000 | IRO duration: 10 days | IRO reward: $1,000,000 | APY Floor: 176%

The Real Estate Listing features an extravagant heritage building valued at US$20,690,000. Participants who contribute their Stablecoin USDC to the IRO can expect a floor APY of 176% on their contribution. Moreover, eye-catching airdrops in the form of CitaDAO's governance token, KNIGHT, are being given to IRO participants. All these rewards come in addition to the Real Estate Tokens that participants will receive anyway if the IRO is successful.

Joel Lin, a contributor at CitaDAO remarked, "For the first time in history, crypto anons will be able to collect rents from rent-seekers. The first IRO for CitaDAO will be a building leased to TradFi in Wales. If we want to bring legitimacy to web3, this is our opportunity and Real Estate will play a crucial role, this is the way."

As of now, the commitment amount to the IRO has exceeded US$2 million and will end on 18th March 2022 UTC 00:00. Don't miss out on this amazing opportunity, join us at app.citadao.io!

Genesis IRO UpdateCitaDAO is proud to announce that as of 11th March 2022 UTC 03:00, an approximate total of US$3,070,000 has been contributed.

We are 3 days in and our first ever Introducing Real Estate On-chain (IRO) is going strong!

To celebrate this amazing milestone, we will be extending our Community Airdrop to our Partner DAOs till the 14th of March 2022 UTC 00:00.

Contribute to our Genesis IRO and earn back 50% of your contribution in CitaDAO's governance tokens, KNIGHT.

(I.e. Contribute 1000 USDC and receive an airdrop of 500 USDC worth of KNIGHT tokens.)

Here are the details to the Community Airdrop:

1️⃣ Contribute to IRO at https://app.citadao.io/

2️⃣ Reply to this tweet and tag 2 friends in your response: https://twitter.com/citadao_io/status/1501428988110991363

3️⃣ Submit the twitter link of the reply in our Discord at our #genesis-iro channel by using the /twitter-submit command

4️⃣ Wait for the airdrop to be updated in https://claim.citadao.io/

If you have any questions, join us at our Discord!

If Any landlord get listed on Citadao then what kind of benefit they will get? Is there any chance it it can be 2or 3 times from tradition revenue?

Hi, Landlords have access to 1. Greater liquidity (according to DeFi Pulse, the DeFi space has a TVL of over $70 Billion) 2. Competitive fees (CitaDAO has a 2% Listing Fee) 3. Underwriting (Landlords can underwrite a fraction of their Real Estate and tokenize the rest). As for revenue, Landlords get to decide on the pricing of their Commercial Real Estate to be listed but whether or not the listing goes through is dependent on the demand from the Community. Hope that answers your questions, find out more at our Docs! [moderator's note: consecutive posts merged] |

|

|

|

ok, so if i buy a fraction of a real estate then how will i get the profit, and which basis. Is this coming from the rent or after selling the property?

Hi, rental yield is used to buy and burn the Real Estate Tokens, driving the price up. Your yield can be realised by selling the RET when it is at a higher price. |

|

|

|

Genesis IROCitaDAO recently launched its Genesis IRO on 8th March 2022 UTC 00:00 with the goal of buying a Bank building worth US$20,690,000. Address: 56 Queen Street, Cardiff, CF10 2PX, UK Address: 56 Queen Street, Cardiff, CF10 2PX, UK

IRO value: $20,690,000 | IRO duration: 10 days | IRO reward: $1,000,000 | APY Floor: 176%

The Real Estate Listing features an extravagant heritage building valued at US$20,690,000. Participants who contribute their Stablecoin USDC to the IRO can expect a floor APY of 176% on their contribution. Moreover, eye-catching airdrops in the form of CitaDAO's governance token, KNIGHT, are being given to IRO participants. All these rewards come in addition to the Real Estate Tokens that participants will receive anyway if the IRO is successful.

Joel Lin, a contributor at CitaDAO remarked, "For the first time in history, crypto anons will be able to collect rents from rent-seekers. The first IRO for CitaDAO will be a building leased to TradFi in Wales. If we want to bring legitimacy to web3, this is our opportunity and Real Estate will play a crucial role, this is the way."

As of now, the commitment amount to the IRO has exceeded US$2 million and will end on 18th March 2022 UTC 00:00. Don't miss out on this amazing opportunity, join us at app.citadao.io!

|

|

|

|

We're proud to announce that we are launched. Our GENESIS Introducing Real Estate On-Chain (IRO) is currently live on app.citadao.io. You can earn USDC reward from participating in the Genesis IRO by committing USDC to the IRO. |

|

|

|

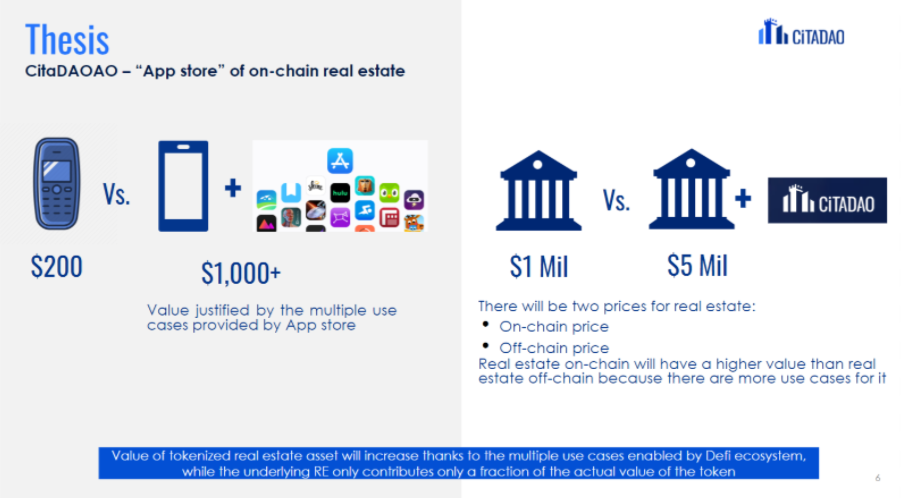

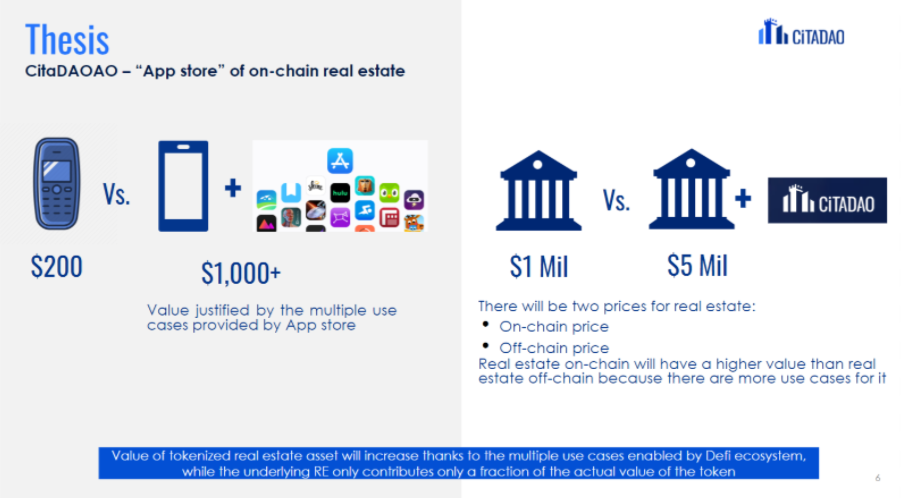

how is this better than realT or Propy?

We have a different approach to the problem. Unlike past real estate tokenization attempts, we are taking a 100% DeFi approach that leverages composability with other projects in DeFi, allowing us to scale users and usecases rapidly. An example include our partnership with XToken to provide concentrated liquidity on UniswapV3: https://twitter.com/xtokenmarket/status/1461716880713039872. The tokenized real estate can potentially be used as collateral for permission-less loans on-chain via our collaboration with Chainlink on price feeds for real estate: https://twitter.com/chainlink/status/1465814283938377729 |

|

|

|

hey guys, long term investor in ETH and lurker of this forum. Iím a big fan of crypto but also in to real estate. Realt has been around for a few years. CityDAO getting backing from Mark Cuban and others. Propy just listed on Coinbase I think. I think there will be growing demand for yield, and real estate tokenized can be a source of sustainable yield. I recently start contributing to a project called CitaDAO as they are doing something completely different and building a holistic Real Estate powered DeFi ecosystem, featuring a two-way asset tokenization bridge, ample liquidity, and bearer asset tokens that are composable with the broader DeFi applications and primitives. Real estate tokens will enable the DeFi community generate sustainable yield through real world productive assets, diversify their portfolio on-chain, AND serve the growing demand for on-chain yield. Unlike past real estate tokenization attempts, we are taking a 100% DeFi approach that leverages composability with other projects in DeFi, allowing us to scale users and usecases rapidly (see recent partnership with XToken to provide concentrated liquidity on UniswapV3: https://twitter.com/xtokenmarket/status/1461716880713039872). Through our platform, Crypto Anons will soon be taking over meatspace real world assets and we shall see the physical world re-made in the likeness of our own Crypto community, and use tokenized real estate as collateral for permission-less loans on-chain via our collaboration with Chainlink on price feeds for real estate: https://twitter.com/chainlink/status/1465814283938377729) Lastly, there is a pipeline of projects to come on-chain via collaboration w a Singapore based family office, and the first property to be tokenized will be a $20m prime real estate located in the heart of Cardiff, Wales, UK - a building currently being leased to a global bank, partly chosen so the crypto anons can rent real estate out to the rent-seeking banks -- and partly for the stable rent 🙂 leave a comment if youíre interested or come checkout our website and join our discord! hopefully can join our growing contributors consisting of defi degen apes, legal, and real estate pros! |

|

|

|

There have few similar project.What special do your products have?

We published our litepaper on our website: https://citadao.io. Feel free to join our discord community https://bit.ly/citadao if you have any questions on the litepaper. We'll be more than happy to answer them there. |

|

|

|

IntroductionAbout $140 trillion is locked up in Real Estate and does not earn any yield. At the same time, Real Estate is incredibly illiquid and is a highly inaccessible asset class to many with its high upfront capital costs. Therefore, CitaDAO aims to leverage on #DeFi to drive demands, unlock capital efficiency, lower the barrier to entry and increase the liquidity of Real Estate.How will CitaDAO enhance the Real Estate Ecosystem?CitaDAO offers a 2-way tokenization bridge between the Real World and the Blockchain. Any landlord within the Commonwealth jurisdiction can list their commercial Real Estate on the platform after ownership verification (KYC). If they pass the KYC, their property will get listed on CitaDAO and undergo a tokenization process called Introducing Real Estate On-Chain (IRO).

Introducing Real Estate On-chain (IRO) is the process where the community determines the type of Real Estate to be tokenized. Every Real Estate will need to go through the IRO process, and only properties with sufficient commitment from the community will be tokenized. Think of it like crowdfunding for a project. More about how an IRO works can be found at https://docs.citadao.io/intro/how-iro-works/overview.If an IRO is successful, the NFT representing the right to redeem the title deed would be minted. The NFT will be custodied in a smart contract and fractions of the smart contract, which are ERC-20 tokens or Real Estate tokens (RET), will be distributed to IRO participants. Holders of the RET own the right to buyout the other RET to claim the NFT and redeem the title deed. More on the buyout can be found at https://docs.citadao.io/intro/how-iro-works/buyouts.Why CitaDAO?  With CitaDAO, there will be 2 different prices for the same piece of Real Estate: the price of Real Estate On-chain and Off-chain. With CitaDAO, there will be 2 different prices for the same piece of Real Estate: the price of Real Estate On-chain and Off-chain.

We believe that the value of Real Estate on-chain will be higher than value of the same Real Estate off-chain. This is simply because with CitaDAO, on-chain Real Estate has more use cases compared to off-chain Real Estate (similar to the iPhone App Store increasing the value of an iPhone because of multiple use cases provided by the App Store).

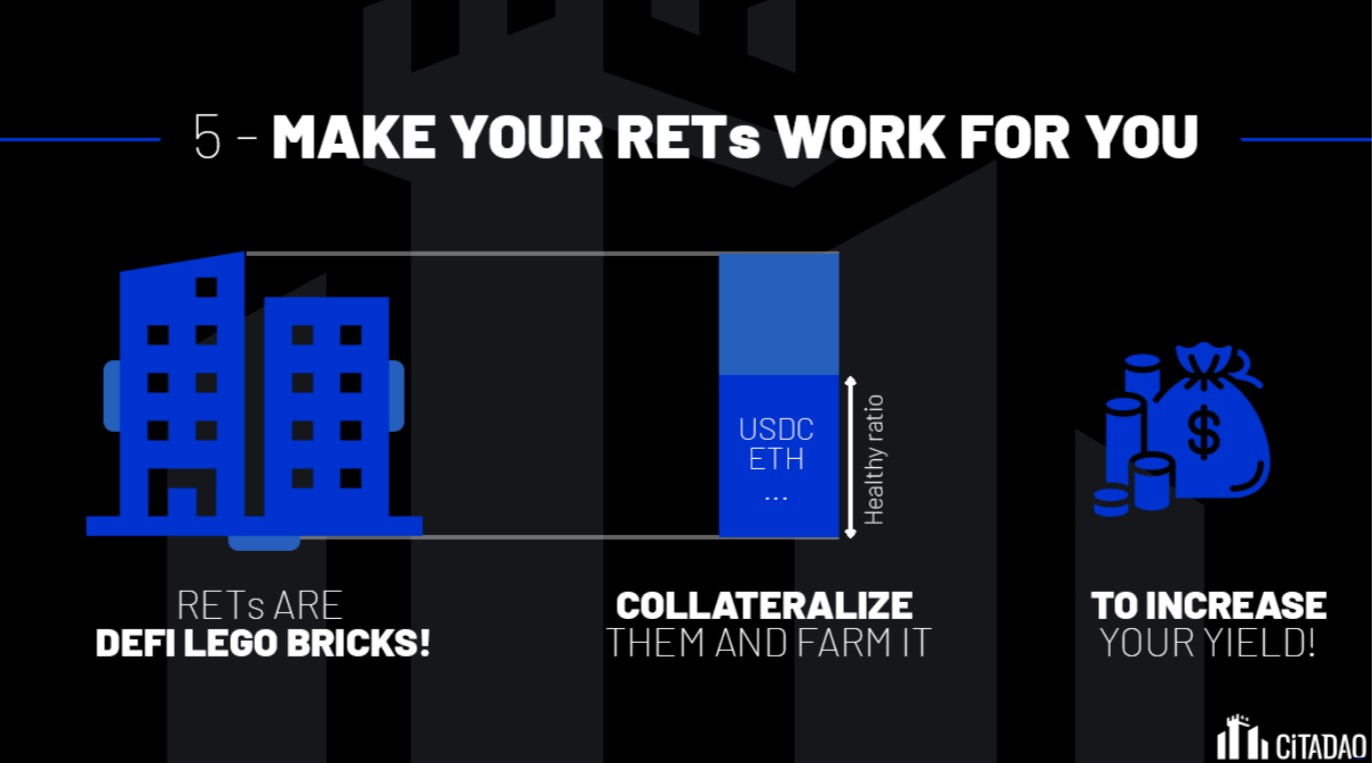

Real Estate Token holders will find that there is more that they can do with their RET compared to having the physical piece of Real Estate. How does CitaDAO compare to other tokenization projects?  How are RET any different from REITS? How are RET any different from REITS? Tokenization Bridge Tokenization Bridge CitaDAO enables a 2 Way Tokenization bridge for IRL (in Real life) Real Estate. This allows for Real Estate assets to be conveniently brought on and off the blockchain. The tokenization bridge works as such: CitaDAO enables a 2 Way Tokenization bridge for IRL (in Real life) Real Estate. This allows for Real Estate assets to be conveniently brought on and off the blockchain. The tokenization bridge works as such:

Landlords list their Real Estate on our platform through Introducing Real Estate On-chain (IRO). A successful IRO will tokenize the property and Real Estate Tokens (RET) will be distributed to the IRO participants, thereby bringing the Real Estate On-chain.

Any RET holder can buyout the RET of other RET holders. A successful buyout will allow the RET holder to claim the title deed of the Real Estate, making them the sole owner of the property, thereby taking the Real Estate Off-chain.TokenomicsCitaDAO Protocol & TokenomicsToken Address: 0x3541A5C1b04AdABA0B83F161747815cd7B1516bC

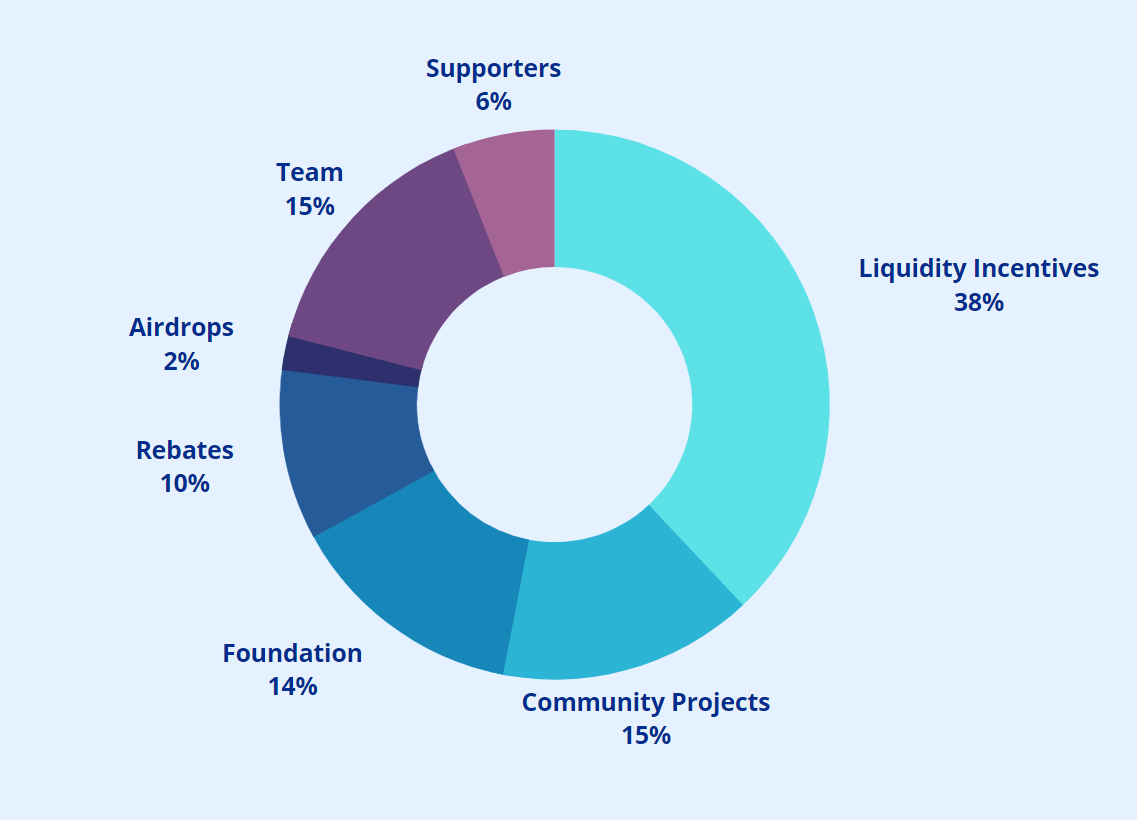

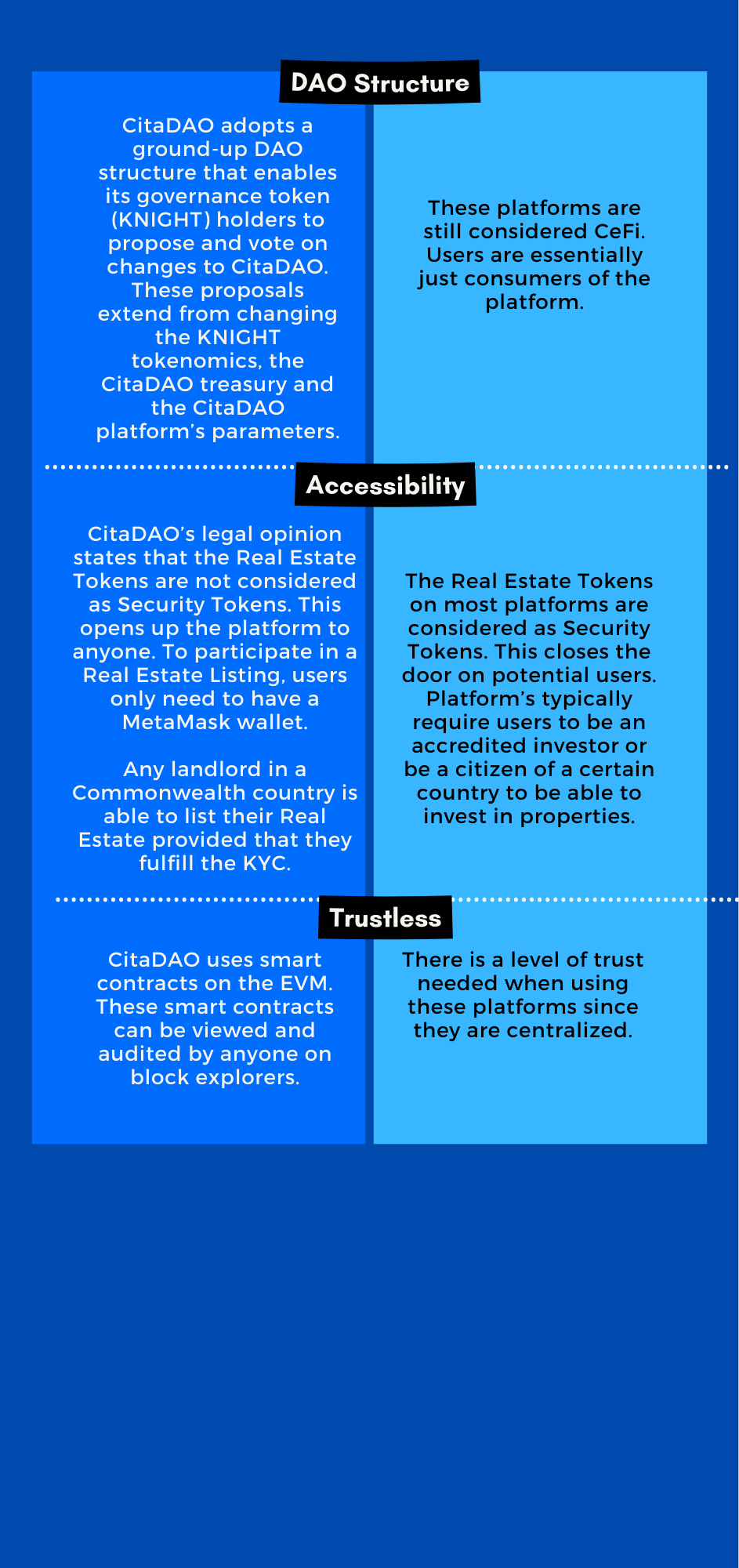

Token Supply: KNIGHT tokens will have a hard cap of 10,000,000,000 tokens (10B).

Token Issuance Allocations:

Liquidity Incentives: 38%

Community Projects: 15%

Foundation: 14% towards Future Community Contributors

Landmark Real Estate Supply Rebates: 10%

Airdrop for Active DeFi Community: 2%

Early Team Contributors and Advisors: 15%

Ecosystem Supporters: 6%

Vesting ScheduleThe Ecosystem Supporters' and Early Team Contributors' KNIGHT tokens will be vested according to the following: Vesting ScheduleThe Ecosystem Supporters' and Early Team Contributors' KNIGHT tokens will be vested according to the following:

Tokens from the first strategic rounds to the Ecosystem Supporters will be vested linearly monthly over 12-months after a 6-months cliff from the TGE.

I.e. Tokens will be fully vested on the 18th month from the TGE.

The Early Team Contributors' and Advisors' tokens will be vested over 48-months linearly with a 12-months lock from the TGE.

I.e. 25% of the tokens will be vested on the 12th month from the TGE and will be fully vested on the 48th month from the TGE.The CitaDAO protocol makes use of two different token types:

KNIGHT Token Use Cases:

1. Governance ó KNIGHT tokens can be staked to vote on important decisions such as new platform features, community development, and more. As a Decentralized Autonomous Organization (DAO), CitaDAO is highly dependent on KNIGHT token holders to guide the project into the future.

2. Real Estate Ownership ó 2% of all Real Estate listed via CitaDAO platform will be owned by the DAO itself. Owning KNIGHT is a simple way to gain broad and diversified exposure to Real Estate on-chain.

Real Estate Token Use Cases:

1. Sell RET immediately & earn USDC rewards from IRO

2. Hold RET and let it accrue in value from a rising floor price and the rental yield of the underlying real estate.

RET could be paired up with USDC rewards and deposited into liquidity pools to mine the CitaDAO Knight Token. CitaDAO is proud to be the first launch partner for xTokenís upcoming liquidity incentivization platform, this will ensure a reliable and secure source of liquidity for RET on AMM, called xToken Terminal.

3. WIP: Use RET as collateral to mint other tokens in order for the RET lending pools to be set up, CitaDAO has integrated Chainlink to provide reliable Real Estate valuation data feeds to the DeFi ecosystem. Use RET for Index Funds, Futures and other Primitives.

4. Exercise your right as an RET holder to buyout other RET holders and claim the title deed to the underlying property.

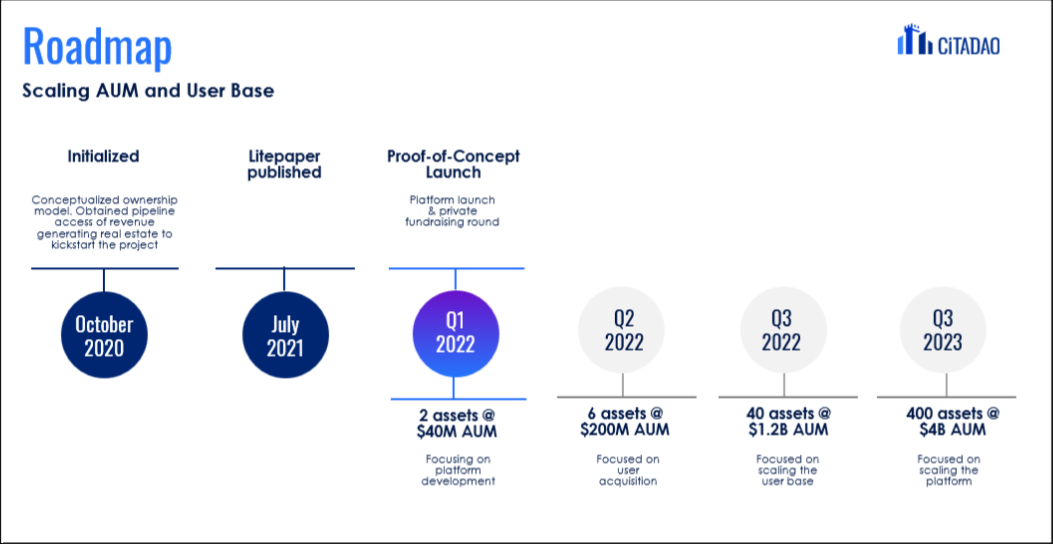

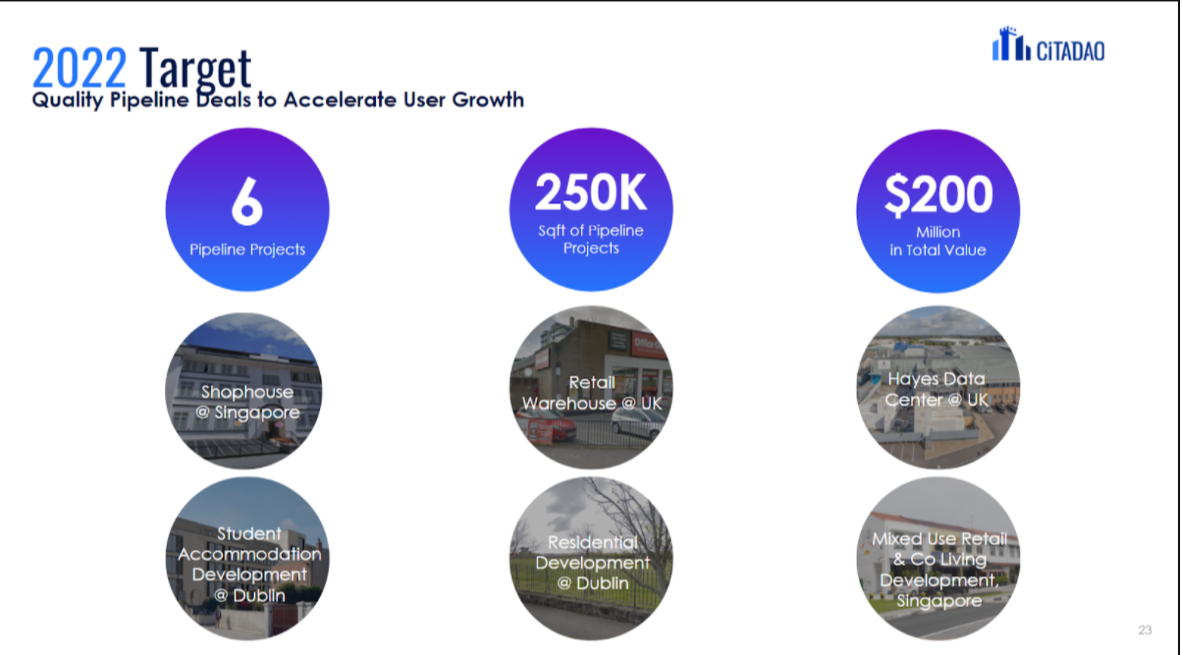

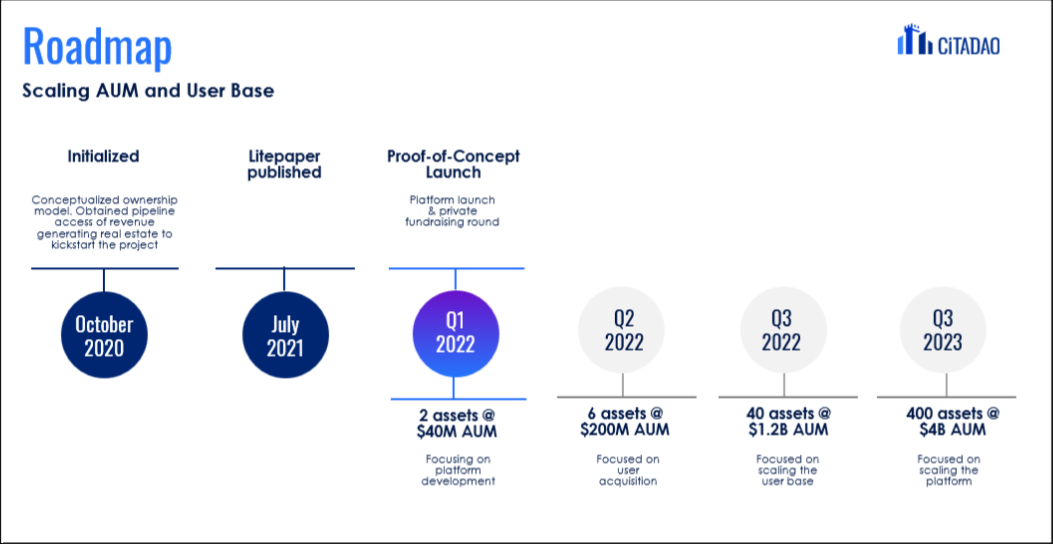

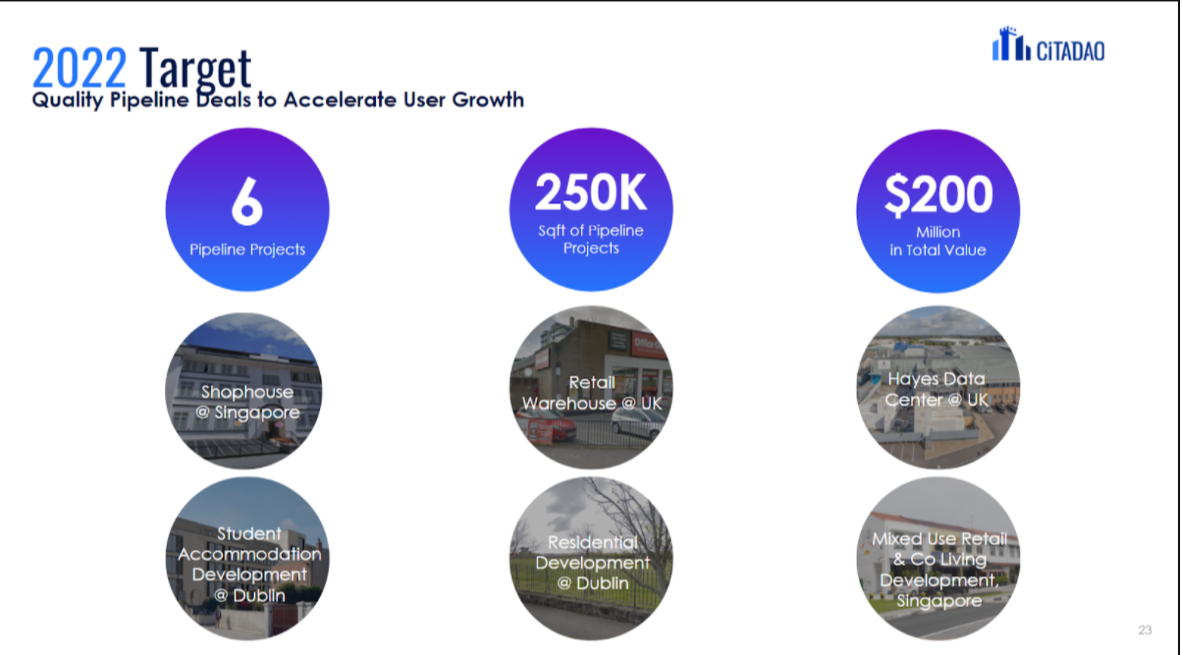

Roadmap Roadmap CitaDAO has a strong pipeline for further IROs to take place in 2022 following its Proof of Concept. By running IROs and offering tokenized Real Estate in multiple countries around the world CitaDAO intends to create a global portfolio of physical properties that is interoperable within the Ethereum ecosystem. CitaDAO Quality Properties in Queue CitaDAO has a strong pipeline for further IROs to take place in 2022 following its Proof of Concept. By running IROs and offering tokenized Real Estate in multiple countries around the world CitaDAO intends to create a global portfolio of physical properties that is interoperable within the Ethereum ecosystem. CitaDAO Quality Properties in Queue  Partnerships Partnerships CitaDAO has formed strategic partnerships with various esteemed partners. With the oracle powered by Chainlink on price feeds for Real Estate, DeFi activities such as tokenized Real Estate used as collateral for permissionless loans on-chain will be a Reality. Partnership with xToken Terminal will bring a game-changer for all the yield farmers out there looking to farm on CitaDAO. We are glad to have BanklessDAO as our partner in building up the next breakthrough in the DeFi space sharing the same vision of bringing 1 billion people onboard. Last but not least, MEXC will be our first CEX listing.BonusFind out how to maximize your yield with CitaDAO below. CitaDAO has formed strategic partnerships with various esteemed partners. With the oracle powered by Chainlink on price feeds for Real Estate, DeFi activities such as tokenized Real Estate used as collateral for permissionless loans on-chain will be a Reality. Partnership with xToken Terminal will bring a game-changer for all the yield farmers out there looking to farm on CitaDAO. We are glad to have BanklessDAO as our partner in building up the next breakthrough in the DeFi space sharing the same vision of bringing 1 billion people onboard. Last but not least, MEXC will be our first CEX listing.BonusFind out how to maximize your yield with CitaDAO below.  Join us in revolutionizing the Real Estate and DeFi world! Join us in revolutionizing the Real Estate and DeFi world! Looking to Stay Updated?

|

|

|

|

|