|

241

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 29, 2015, 10:34:41 PM

|

Once the hardware is sold, the new owners of said hardware can mine whatever blocks they want. They can include or exclude any transactions as they see fit. Why the current owners can't do it? What's the difference? Sorry, I should have defined the difference between "new owners" and "current owners"... - what I mean is that the "current owners" are incentivized by profit, hence their incentive to sell. The "new owners" in this scenario, would be individuals or state-level actors that are not incentivized by profit. (Indeed, who would run unprofitable hardware except some "otherwise-incentivized" participant?) These "new owners" would have no profit margin, no scenario in which they could turn a profit, thus their only motive now is to attack the network. Their only incentive for running this specialized hardware at a loss would be to harm the network. Makes sense? |

|

|

|

|

242

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 29, 2015, 09:59:24 PM

|

Let miners leave. Let difficulty fall. Others will step up and fill that gap.

I think you might underestimate the amount of sha-256 horse-power that might be leveraged against the network once mining becomes unprofitable. If mining is no longer profitable, mining hardware will be sold at clearance prices. It all contributes to diminishing the security of the immutable ledger. Could you eleborate on that scenario? At a certain point in time, a group of mining pools decides they earn too little for letting their computers run. So what option do they have? 1. Shutdown and leave. Like others did when the price fell below 300. 2. They introduce a new 'fork' which gives them more money and turn their hashing powers towards that fork. When this fork happens my guess is that it will be so obvious to the whole world that it's just to enrich the miners, it won't happen. How? Maybe by that time everyone has a small '21' asics in their home powered up. Governments who don't want to lose money will create laws against hijacking earth's currency. I'm just thinking out loud, but I'm confident a solution will arise. // about the laws thing; ideally bitcoin becomes resilient that it's not necessary. Sadly I share this world with people who like to abuse everything and anything. So yeah, we probably need laws against those people. "Could you eleborate on that scenario?" Sure. "At a certain point in time, a group of mining pools decides they earn too little for letting their computers run. So what option do they have? " As a profit-mined miner myself, I would expect that the best option is to sell non-profitable hardware to the highest bidder. Once the hardware is sold, the new owners of said hardware can mine whatever blocks they want. They can include or exclude any transactions as they see fit. Are you beginning to see the problem? "So yeah, we probably need laws against those people." "laws" that can't be enforced are useless. If you are expecting to rely on force of government and enforcement of "laws" , you're gonna have a bad time... |

|

|

|

|

244

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 29, 2015, 09:21:53 PM

|

Let miners leave. Let difficulty fall. Others will step up and fill that gap.

I think you might underestimate the amount of sha-256 horse-power that might be leveraged against the network once mining becomes unprofitable. If mining is no longer profitable, mining hardware will be sold at clearance prices. It all contributes to diminishing the security of the immutable ledger. |

|

|

|

|

245

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 29, 2015, 09:08:27 PM

|

What if they simply set the target at 50% of the 20%-80% of the votes and tell you people NOW STFU? Some idiots will probably attack it on that still, not realizing what they are doing. Scrapping the top and the bottom makes me think that's probably what's initially intended. I remember a time when forum participants like Mr. Mucus were considered trolls. Mr Mucus, I must tip my hat, you've nailed it on the head, directly. This illusion of "voting" and "mattering" is just that, an illusion. The only votes that matter are cast by the ones that control the mining of the blocks, they run the show, but they only run as far as the incentives will lead. As soon as the reward incentives paid per block are reduced to less than the potential reward for attacking the network, the security agreement will end. Miners have no incentive to be loyal. They have no incentive to secure your record of transactions without sufficient monetary compensation.The question I leave for electric mucus, (and anyone else who'd like to respond - excepting BJA, I've grown tired of his lack of intelligence) is: How do you propose that the miners are incentivized to protect the security of the blockchain if there is no scarcity enforced on the size of the Blockchain? |

|

|

|

|

246

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 28, 2015, 02:33:10 AM

|

Ok Bitfinex apparently was migrating to a new multisig wallet. When the Withdrawals started working again they did a double send, one from the old and one from the new. So I received duplicate Bitcoin transactions and double the Bitcoin at my destination address. Confirmed with another Bitfinex user.

A few hours later, once they figured it their blunder they deducted the respective amount from the current USD deposits.

Shakes my confidence in Bitfinex.

Wait a minute, they sent you double bitcoin? I'm going to assume you weren't the only person this happened to. So what happens if they sent you double and you had no fiat or bitcoin left on account? These kind of mistakes do not inspire confidence, I must agree. (Gives new twist to "double spend" though  ) |

|

|

|

|

248

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 28, 2015, 01:55:28 AM

|

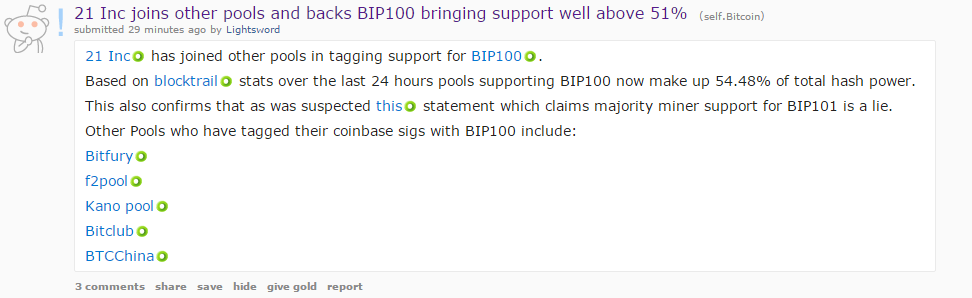

... sounds like consensus to me, tally-ho game on. Me as well, I like the fact that it was a quicke. Gives inordinate power to miners. Although I don't mine my own blocks, I can choose which pool to direct my hash rate. As demonstrated by fake nodes, the only voting that can not be faked is either voting by mining blocks (proof of work) or voting by signing messages with private keys that prove how much bitcoin you have control over (proof of stake). The process of mining is what makes the Blockchain secure. The security is what gives it value. Bip100 =>> http://gtf.org/garzik/bitcoin/BIP100-blocksizechangeproposal.pdfIt's quite ambitious actually, and not quite ready yet? (I think there's a compatibility problem with the headers first thing, but I need to look closer) - but I'm fine with the miners deciding the blocksize. There is a symbiotic balance between the miners and the nodes, but do not kid yourselves, it is the miners that are running the show. You cannot force the miners to do anything. The best you can hope for is coercion. Meanwhile, if the miners choose one direction and the nodes disagree, the nodes are stuck, they cannot make transactions without mining. (Unless of course they all just switch to proof of stake :-/ could happen, who knows?) |

|

|

|

|

250

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 24, 2015, 04:39:10 AM

|

intentionally throttling the network to collect more fees is like strangling the golden goose to get more eggs.

Or like jumping out of a certain wooden sculpture when the walls of Troy first come into view? Or like trying to charge money for an infinite resource? Bip 101 timescale: Year. Size. Reward. blockchain size (rough estimate) 2016 8MB. 12.5. 40GB 2020 32MB 6.25. 3.4TB 2024. 128MB 3.125. 16.8TB 2028. 512MB 1.5625. 70.56TB 2032 2048MB 0.78125. 285.6TB 2036 8192MB 0.390625. 1145TB How many individuals do you think will be incentivized to store more than a petabyte of data with no compensation? The good news is that Gavin's plan is preposterous and will never gain traction, so fortunately there's nothing to worry about.  |

|

|

|

|

252

|

Bitcoin / Bitcoin Discussion / Re: Decentralized decision making, hashing toward a better bitcoin

|

on: August 24, 2015, 03:14:06 AM

|

By making it easier for nodes to "express their acceptance of a block" (e.g., for blocks larger than 1 MB), we are making it easier for the network to come to consensus according to the original design of Bitcoin. Thus Adam's proposal is simply Bitcoin playing out the way it was designed.

(There is no mention of a block size limit in the Bitcoin white paper.)

Larger blocks do not make it easier to come to consensus, they make it harder. An 8MB block will take longer to propagate, making it more likely that small forks and orphans occur. Also since you are now locked into exponential growth, in two years my well connected mine in northern Europe can mine and quickly propagate 16MB blocks which will take longer for the Chinese miners to download and validate, giving me an advantage (which isn't necessarily a bad thing) and also an incentive to pack blocks full of junk transactions (which is necessarily a bad thing) - if the nodes are all following the rules of bip101 they have to accept my garbage filled 16MB blocks, as they are perfectly valid. By allowing these much larger blocks to be created, you increase the effectiveness of selfish mining and thus, increase the incentive to act in a malicious manner. Satoshi might not have realized a block size limit was necessary when he was drafting the white paper, but it sure didn't take him long to implement one once the network was up and running. For anyone who is still struggling to understand why bigger blocks might not be such a good idea, I thought this was a nice, succinct, and humorous explanation of XT from a rather unlikely source. http://www.zerohedge.com/news/2015-08-23/what-bitcoin-xt-primer-everyoneEnjoy.  |

|

|

|

|

253

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 24, 2015, 02:29:33 AM

|

I wonder how much money and time it would take to add enough XT hashing power to trigger the switch assuming no more existing nodes defected. I'm guessing it could easily be done for less than $500M. The problem is that the cripplecoiners would only need to add one Terahash/second for every 3 Terahashes/sec new nodes to prevent it from happening.

I'm pretty sure 21.co's chips will be mining XT. Microtransactions will not be practical once the network approaches capacity. At capacity, they won't even be possible.

Cripplecoiners consider small transactions "spam", but microtransactions will prevent spam if, for example, email requires 0.1 milibit postage. or even 0.01 mBit. A lightning network adds a layer of complexity to a system that is already too complex for mainstream use. Trusted third parties may make it simple and easy, but that defeats the whole purpose of a peer to peer network.

Did you make some bad bets Mr decentral banker? You seem awfully bitter as of late. |

|

|

|

|

254

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 24, 2015, 02:24:56 AM

|

Like Dostoevsky's Grand Inquisitor, I bear the burden of being reviled by all, so that the weak may bare the living.

Wait, where does that leave me? Am I useless then? I hope not professor, looks like there's not a lot of money lying around for useless eaters. http://www.bloomberg.com/news/articles/2015-08-21/brazil-has-yet-another-big-mess-on-its-hands-after-state-default"The state (Rio Grande do Sul), proportionally the most-indebted in Brazil, is in such distress that it didnít pay salaries to public workers in July." I hope professors don't rely on public money in Brazil, though I'm sure you've seen this all before and you'll be fine. After all, government fiat money is good, bitcoin bad, right? |

|

|

|

|

255

|

Bitcoin / Bitcoin Discussion / Re: Decentralized decision making, hashing toward a better bitcoin

|

on: August 24, 2015, 01:02:53 AM

|

How is this appreciably different than the way it already works today? If 90% of the miners want to do whatever, no one's stopping them.

Bitcoin is not a democracy. It is a system of voluntary consensus. Miners are financially motivated to follow the rules and also to enforce those rules upon everyone else that wishes to participate.

You are free to go ahead and fork your own democraticoin at any time. No one can stop you; just as no one can force a change upon the bitcoin network against the will of the participants.

And how this voluntary consensus is different from democracy? Because I can't see much difference. In democracy people do what they want or what they think is good because it will gain them profit or better government or something, miners are doing exactly the same they seek profit. The only difference that live democracy is fiction because not everyone vote, therefore we have something like votes 30% of whole nation, and from that 30% of people who voted option with 51% votes wins. With bitcoin everyone MUST choose. The difference is simple: stupid people don't get to have everyone in society shoulder the weight of their stupidity. How do we (we = Bitcoin Community) come to "consensus"? I wouldn't say it's a democracy in the sense that every person loosely attached to Bitcoin has precisely "one vote"--that's not how Bitcoin works. But it's not that different either. In reality, each person has a vote that carries a weight in proportion to their influence. If influence accrues to those who are wiser, then the decision of the "influence-weighted majority" will be the best decision IMO. I would thus argue that the best approach to reaching consensus is to give the people the necessary tools to make expressing their free choice (e.g., BIP101 vs BIP100 vs no increase) as easy as possible. As long as their free choice does not change the fundamental rules that the consensus network agrees on, they can run whatever client they like. XT, core, electrum, armory, etc... but when it comes to making a change to the fundamental rules of consensus, I would argue the best approach is to make this process as hard as possible. Making a change like bip 101 that involves ballooning the block size to 8MB and eventually to 8GB is reckless and can bring about problems and attack vectors that we can't know or predict. They (Gavin and Hearn) are spreading fear and panic and preying on your fear of what might happen if we don't change [1] while they pay no heed to all to the consequences and real danger that could occur from such a drastic change to the fundamental rules that balance incentives and keep bitcoin secure. [1]even though we've seen from the spam attacks that it's not a problem and bitcoin deals with full blocks just fine... In fact, it may even be desirable to be in a constant state of full blocks so that a fee market can emerge. Remember that the miners must continue to get paid as the reward continues to diminish) |

|

|

|

|

256

|

Alternate cryptocurrencies / Altcoin Discussion / Re: If somthing bad happend to bitcoin what cryptocurrency will you use ?

|

on: August 24, 2015, 12:41:44 AM

|

Monero without a doubt, for the privacy aspect, and automatic block size adjustment as features that are already better than bitcoin.

There is so much development going on in the Monero sphere that I don't think any other alt comes close.

It's the only other crypto that I own right now. I don't have to wait for the end of the world in bitcoin to invest/hedge in another crypto.

Surprised it took so long to see Monero mentioned. If something "bad" happens to bitcoin it will likely be due to government taking advantage of the transparent and non-fungible nature of bitcoin to attack or co-opt it. In this scenario, Monero is the obvious choice as it would be resilient against such attacks. |

|

|

|

|

257

|

Bitcoin / Bitcoin Discussion / Re: I added Bitcoin to Wikipedia's list of circulating currencies

|

on: August 24, 2015, 12:24:06 AM

|

Well, that was short lived. It's already been removed: https://en.wikipedia.org/wiki/List_of_circulating_currencies#Criteria_for_inclusionIf I continue to add it they'll just block my account, but that doesn't stop someone new from adding it! Here's how you can do it: 1) Go to the link above 2) Create a Wikipedia account to edit pages (it takes seconds; username, password, email, captcha...that's it) 3) Click "edit" next to the "List of circulating currencies by state or territory[edit]" section, which is at the top of the table of currencies 4) Scroll down the code to find the space just before East Timor 5) Enter the following code: |- | {{f|Earth | {{Sort|Bitcoin}} | ฿ | BTC | [[satoshi]] | 100 |- 6) Delete any duplications of "|-" before or after this entry, those serve as breaks in the table and if there are two the formatting might get weird 7) Save changes! I've updated the list one more time, i'm sure they'll delete it again and I doubt I'll get a third opportunity to do this...so, now it's up to the rest of you to keep correcting the list! Cheers. To be accurate, shouldn't that last number be 100,000,000 instead of 100 ? |

|

|

|

|

258

|

Bitcoin / Bitcoin Discussion / Re: Decentralized decision making, hashing toward a better bitcoin

|

on: August 23, 2015, 11:51:10 PM

|

Long has the development of bitcoin been slowed by the devs inability to agree on design decisions, it's time to put in place a system that ensures continued development / evaluation of the code base, in a low friction decentralized manner. Imagine a bitcoin where YOU as a user get a say in every design decision. we can do this today.

There is a design decision to be made, 3 possible implementations, each similar, impossible to say which way is the best way to go. Who ultimately makes the decision on which way to go? It is my belief that satoshi would want the decision to be made by community as a whole. we can achieve this today and use this process to put the block limit debate to rest.

We could have in place a system in which all the different BIP's ( design options ) can be voted on using hashing power. by having different version numbers corresponding to the different proposed implementations. once a version number achieves 90% of hashing power that would be considered the communities will, and that version would be implemented.

what do you think?

How is this appreciably different than the way it already works today? If 90% of the miners want to do whatever, no one's stopping them. Bitcoin is not a democracy. It is a system of voluntary consensus. Miners are financially motivated to follow the rules and also to enforce those rules upon everyone else that wishes to participate.You are free to go ahead and fork your own democraticoin at any time. No one can stop you; just as no one can force a change upon the bitcoin network against the will of the participants. |

|

|

|

|

259

|

Economy / Speculation / Re: Price/Market Movement Discussion ONLY

|

on: August 23, 2015, 10:36:56 PM

|

I expect the price to be within the range from approximately 220 to 300 for the next months, perhaps a year or more, but at least until the end of summer. To say that the price will stay in the range from 8 days (time till the end of summer) to several years is to say nothing  Fine. But I've been saying this since June... [...] Now expecting many months of the sideways...  I'm predicting we'll stay in this range for the rest of the summer at least... Now, as we reach the end of summer, I expect that the price will remain below 330 so long as this whole XT nonsense remains unsettled. Better? |

|

|

|

|

)

)