|

Monero is a cryptocurrency who really cares about privacy. I believe in the long term that it will be much more valuable than the present. It's the right time to buy Monero.

|

|

|

|

Despite repeated warnings from the central bank of Indonesia about the supposed risks of cryptocurrency trading, everyday people keep turning to bitcoin in this highly populated Asian country. In fact, soon there will be more traders on just one crypto platform than there are on the local stock exchanges established over a 100 years before it. Bitcoin Is More Popular Than StocksSoon There Will Be More Bitcoin Investors Than Stock Traders in IndonesiaThe Indonesia Digital Asset Exchange (Indodax), founded in 2014 as Bitcoin.co.id, has 1,147,430 members already on board, according to its website. That is just a bit shy of the Indonesia Stock Exchange, which opened in 1912, with only about 1.18 million registered participants according to data from the Indonesia Central Securities Depository. In fact, as the Indodax is the biggest in the country, but not the only venue to trade cryptocurrency for rupiah, it is possible that there are already more bitcoin investors than stock traders in Indonesia. The Indodax is expected to have 1.5 million members by the end of the year, according to Chief Executive Officer Oscar Darmawan. We are seeing almost 3,000 new members signing up everyday. Most people are trading in bitcoins though transactions in ethereum has increased significantly of late. The cryptocurrency trading platform is targeting daily volume to double from an average 100 billion rupiah ($7.3 million) a day currently, Darmawan said. Defying Bank IndonesiaThe countrys central bank, Bank Indonesia, has in the past repeatedly issued warnings to the public regarding what it sees as the dangers of cryptocurrencies, although it has not gone as far as forcing closure of exchanges. Its crackdown has caused Indonesian bitcoin payment processors to cease operations and hurt local tourism businesses in the island of Bali. The latest figures show that there are a great deal of people willing to defy the central banks word among the countrys 261 million citizens. And Indonesia is not the only emerging market known to see bitcoin trading becoming more popular than traditional securities. Earlier this year we reported that there are already more than twice as many people invested in bitcoin as those who trade stocks in Latin Americas largest economy, Brazil. Source: https://news.bitcoin.com/soon-will-bitcoin-investors-stock-traders-indonesia/ |

|

|

|

Floridadanın Citrus Bölümünden bir kamu çalışanı, kripto para kazanmak için kurum bilgisayarını kullanarak madencilik yaptığı gerekçesiyle tutuklandı. Floridadanın Citrus Bölümünden bir kamu çalışanı, kripto para kazanmak için kurum bilgisayarını kullanarak madencilik yaptığı gerekçesiyle tutuklandı.Tampa Bay Timesa göre, Florida Eyaleti Ceza İnfaz Departmanı (FDLE), Floridanın narenciye endüstrisini denetleyen bir devlet kurumu olan BTnin yöneticisi Matthew McDermottı hapse attı. McDermottun hala sanık olarak tutulduğu ve kefaretinin 5 bin USD olduğu bildirildi. FDLEnin tutuklama gerekçesi raporda; McDermottun kurum bilgisayarında Bitcoin ve Litecoin madenciliği yapması ve görevi kötüye kullanması olarak tanımlandı. Ayrıca raporda, şubenin elektrik faturasının, Ekim 2017 yılından Ocak 2018 yılına kadar %40 oranında arttığı ve bunun da madenciliğin yüksek enerji kullanımı gerektirmesiyle açıklandığı belirtildi. Yine FDLEnin raporuna göre, McDermott 24 adet grafik işlem birimi satın alıp bunları ofisin hesaplarından ödedi. Toplam tutarı 22,000$ olan bu cihazlar genellikle kripto para madenciliği yaparken kullanılanlardandı. Yani standart bir bilgisayarın hız kapasitesini artırıp çok daha hızlı işlem yapabilmesini sağlamakta kullanılan çiplerdi. Bu haber ABDde resmi bir çalışanın kamu kurumunun kaynaklarını kripto madenciliği yapmak için kullanmasına örnek teşkil eden bir haber niteliğinde. Geçtiğimiz hafta ABDnin Louisiana eyaleti eski çalışanlarının madencilik yapıp yapmadıklarıyla ilgili bir araştırma başlatılmıştı. Yine 2017nin Ocak ayında Federal Rezerv Müfettişliği Ofisi, 2012 ve 2014 yılları arasında Merkez Bankasının sahip olduğu bir sunucudan Bitcoin madenciliği yapıldığının tespitinin ardından 5000 dolar para cezası uygulanmıştı. Bu yılın ilerleyen zamanlarında ise New York Eğitim Bakanlığı, Mart ve Nisan 2014 döneminde, iş bilgisayarından Bitcoin madenciliği yapıldığını onaylamıştı. Kaynak: https://coin-turk.com/florida-eyalet-calisani-kripto-madenciligi-yaptigi-iddiasiyla-tutuklandi |

|

|

|

Bitcoin's price nearly hit $9,000 on Thursday, a move that came hours after the cryptocurrency briefly went back above $10,000. According to CoinDesk's Bitcoin Price Index (BPI), the price hit a low of $9,075.87 before recovering. At press time, the cryptocurrency's value is hovering around $9,287.00. The development is a notable one, coming roughly a day after the market saw a $1,000-plus drop during afternoon trading.  Observers attributed Wednesday's move to several factors, including issues at cryptocurrency exchange Binance, a warning from the U.S. Securities and Exchange Commission about exchange compliance and a report from the trustee of Mt Gox revealing that some $400 million in bitcoin and bitcoin cash had been liquidated over a several-month period. It's less clear what drove today's market move. Indeed, some speculators on social media suggested that the price could test lower levels, with some predicting a slide to as low as $7,000. Should bitcoin's price fall below $9,000, it would represent the lowest level since Valentine's Day on February 14, market data shows. Additional information published by cryptocurrency information provider OnChainFX shows that all of the top-10 cryptocurrencies by market capitalization are down today. Of those, cardano and bitcoin cash have dropped the most in the past 24-hours, falling by 8.59 percent and 6.95 percent, respectively. Source: https://www.coindesk.com/800-in-1-hour-bitcoin-price-drops-big-to-near-9k/ |

|

|

|

A subcommittee of the U.S. House of Representatives Financial Services Committee is set to hold a hearing next week on cryptocurrencies and initial coin offerings (ICOs). A notice posted on the committee's website states that the Capital Markets, Securities, and Investment Subcommittee hearing - entitled "Examining the Cryptocurrencies and ICO Markets" - is scheduled for March 14 at 10 a.m. EST. Speaking to CoinDesk on the sidelines of this week's DC Blockchain Summit, U.S. Representative Tom Emmer - a member of the subcommittee - suggested that the hearing would largely be educational in nature, aimed at providing members with more information about the market for cryptocurrencies and token sales. He also indicated that, amongst Financial Services Committee members, there's a growing interest in learning more about the subject and the implications of the tech's use in areas like remittances. The hearing represents the latest Congressional foray into the world of cryptocurrencies, coming more than a month after the Senate Committee on Banking, Housing and Urban Affairs held a major hearing on the topic that included testimony from Securities and Exchange Commission (SEC) chairman Jay Clayton and Commodity Futures Trading Commission (CFTC) chairman J. Christopher Giancarlo. At that hearing, the two notably indicated that their respective agencies could ultimately seek additional oversight powers over the market. As of press time, no further details have been published regarding the hearing. An agenda outlining the scope of the hearing, as well as who is set to appear as witnesses, is forthcoming, officials said. Source: https://www.coindesk.com/us-congress-discuss-icos-hearing-next-week/ |

|

|

|

Potentially bullish news from China: A high-ranking official has called for a national digital asset trading platform to be established. Chinese Peoples Political Consultative Conference (CPPCC) member Wang Penjie made the statements earlier this week. The move would follow strict guidelines, with assets undergoing a vigorous approval system and users of the platform would also have to undergo a vetting process, confirming real identities. As well as opening the platform, Penjie suggested providing greater investor education regarding blockchain technology. The official report states: [A]fter sound domestic laws and regulations, under the unified cooperation of the Central Bank and the CSRC, a regulated, efficient and clean blockchain digital asset trading platform will be set up for enterprises to raise funds [and trade digital assets. Whilst Penjies suggestion is not an official statement of intent by Chinese authorities, it does represent a noticeable change in perceptions of blockchain technology by officials. It follows a full-page article on the benefits of blockchain technology in Chinas official news outlet, The Peoples Daily from last week. The piece was extremely bullish, referring to the technology as highly ingenious and next internet. These developments may be indications of a changing policy towards blockchain and cryptocurrency in China. Whilst official sanctioning of the technology is not yet a reality, there is certainly a highly positive sentiment emanating from many circles in Chinese society. An article from Sohu yesterday is one example. It brought together the opinions of over twenty Chinese business leaders, innovators, and regulatory officials and almost all of them had only positive statements to make regarding developing distributed legend technologies, including cryptocurrencies. Prominent Zeng Ming, chairman of the Academic Committee of Alibaba Group, which reported revenue of $23.82 billion last year, said the blockchain is a revolution in the relations of production and will inevitably bring about major changes in productivity and a true supply-side revolution This sentiment was shared by Yao Jinbo, founder of 58.com, Chinas largest classified site and with a personal valuation of $1.2 billion. we take the initiative to embrace, to explore the blockchain. Blockchain has the decentralization and deintermediation characteristics, which may be as great as the Internet, which may be a [bigger] historical opportunity than artificial intelligence Others were equally enthusiastic. Cai Wenshseng, Chairman of technology giant Meitu spoke of blockchain technology as both a technological and cognitive revolution. Meanwhile Xu Xiaoping, founder of True Fund, issued a literal call to arms, imploring CEOs to join him all in on blockchain. His words could not have been more confident: Do not doubt the blockchain, do not hesitate, immediately mobilize all staff to embrace the blockchain. The statements from big industry players in China are not just hot air. This month it was announced that a subsidiary of the consumer giant Alibaba had successfully implemented blockchain technology to handle logistics data. At the time of writing over 30,000 imported goods, ranging from Shanghai to Shenzen had been logged with the system. It appears that China will enthusiastically adopt blockchain technology across industries, with a broad range of use cases. However, there has been some distinction between decentralized virtual currencies, including Bitcoin and Ethereum. China has already banned foreign cryptocurrency trading platforms, blocking access to sites using its national firewall. Many observers have interpreted developments in the nation as damning for decentralized currencies but todays announcement that a national trading platform could be launched may be a turnaround. Whilst there has not been official confirmation the project will go ahead, and it is also unclear whether Bitcoin, Ethereum, and other decentralized currencies would be included, todays news marks a ray of hope. Thats because Pengjies suggestion did not explicitly rule out decentralized currencies from being included. The reopening of Chinese markets would be hugely bullish for cryptocurrency prices at the time of the closure of exchanges, Chinese traders represented some 40% of total market share. We would likely see a huge flood of investors looking to get involved. Whether this will come to pass is currently speculative, but with enthusiasm for blockchain technology growing significantly, we may not have to wait long to find out. Source: https://www.ccn.com/official-blockchain-trading-platform-suggested-by-chinese-politician/ |

|

|

|

An official from one of Chinas top financial regulatory agencies said that he believes blockchains function more effectively when they are built on a centralized system. Zhang Ye, director of the China Securities Regulatory Commissions (CSRC) information center, said on Sunday that the government should devote great attention to the development of blockchain technology. However, Zhang who made these comments at the Two Sessions conference in Beijing during an interview with state media outlet Securities Times tempered his enthusiasm for this nascent technology by stating that more research needs to be devoted to building a decentralized blockchain on top of a centralized foundation. [F]rom a technical point of view, the absolute decentralization of the blockchain is not valid because the blockchain itself is a software and the software must be centralized, he said, according to a rough translation. Therefore, how to build a decentralized system based on a centralized structure needs further study. The regulatory official did acknowledge that some blockchain applications may require decentralization, but he said that these scenarios should be limited and he did not go into detail about what applications should and should not be centralized. Admittedly, some application scenarios need to be decentralized, but whether all scenarios need to be decentralized requires careful consideration, he said. Zhangs comments are the latest evidence that China is grappling with whether and how it can reap the benefits of blockchain technology while retaining complete control of the systems underlying infrastructure. Last month, the Peoples Daily a state-sponsored media outlet published an article praising blockchain technology, even as the government has taken measures to snuff out what little volume remains in the countrys once vibrant cryptocurrency trading industry. Notably, though high-ranking official has also reportedly called for the government to establish a state-controlled digital asset trading platform, sparking speculation that the government could ease prohibitions on cryptocurrency trading, as long as the markets are directly controlled by the government. Source: https://www.ccn.com/blockchains-must-have-centralized-foundation-chinese-regulator/ |

|

|

|

|

I think countries in the world can't control Bitcoin. Therefore, no matter how much btc prohibited, Bitcoin will much to be valued.

|

|

|

|

|

I think most alts will die because they are useless. People just buy them to make money. After Bitcoin's transfer rate has improved, the alts have not had much of a boost.

|

|

|

|

Ethereumum yeni geliştirdiği blockchain alternatifi sunan Casper protokolünün güvenli olup olmadığı tartışılıyor. Curacaoda düzenlenen Financial Cryptography 2018 etkinliğinde dağıtık sistemler uzmanı Dahlia Malkhi, ethereum Casperı eleştirdi.

Malkhi açılış konuşmasında bilgisayar bilimi yardımıyla blockchainin nasıl çalıştığını aktardı. Ardından dikkatleri Caspera çekti ve Casperın blockchaine iyi yönde bir ivme kazandıracağını ve çevre dostu olduğunu vaat ettiğini belirtti. Bitcoin madenciliği işlem bloklarını oluşturabilmek için elektriği kullanıyor. Madencilik sistemi işlemin yapıldığını kanıtlayan göstergelerle çalışıyor. Ancak Casper sistemi daha sanal bir madencilik sunuyor; gerçek madenlerde olduğu gibi coinler hazırda bulunuyor ve işlem bekliyorlar. Teorik olarak Casperın sistemi daha faydalı görünüyor. Hali hazırdaki madencilik modelinin harcadığı enerji ve çevreye verdiği zararın azaltılabileceği savunuluyor. Öte yandan Malkhi, geliştirilen Casper sistemini eleştiren ilk bilgisayar bilimleri araştırmacısı oldu. Malkhi Casperı sert eleştirdi ve şöyle konuştu: Casper sisteminin temelde zayıf olduğunu düşünüyorum. Bir grup insana karar verme hakkı tanıyor. Bence bu sistem, daha çok gücün zenginlerin elinde toplanmasına yardım edebilir. Dağıtık sistemler üzerine yıllardır çalışan Malkhinin Casper hakkında iki büyük endişesi var; biri güvenlik diğeri ise canlılık. Blockchain sistemi işlemlerin doğru bir şekilde yapılmasını zamanla birlikte ileriye giderek sağlıyor. Bu şekilde sistem canlı kalmış oluyor. Casper her ne kadar çevre dostu olsa da pek canlı görünmüyor. Yine de Malkhi konuşmasının devamında eleştirilerini yumuşattı ve Casperın ilginç olduğunu ifade etti. Hiçbir blockchain sisteminin kusursuz olmadığını belirtti ve Casperın blockchain araştırmacıları tarafından ilgi görebilecek bir yenilik olduğunun altını çizdi. Türkçe kaynak: https://coin-turk.com/ethereum-casper-blockchaini-ileri-goturebilir-mi

Yabancı kaynak: https://www.coindesk.com/fundamentally-vulnerable-ethereums-casper-tech-takes-criticism-curacao/

|

|

|

|

Kripto para piyasası sıradan bir gözlemci için heyecan verici, korkutucu ve gizemli olabilir. Bilindiği gibi, bu piyasasının öncüsü olan Bitcoin, geçtiğimiz Aralık ayında hızlı bir şekilde arttı ve son aylarda keskin bir şekilde düştü. Bu fiyat değişimlerinin yanında ICOlar da her geçen gün artarak karşımıza çıkıyor. Kripto para piyasası sıradan bir gözlemci için heyecan verici, korkutucu ve gizemli olabilir. Bilindiği gibi, bu piyasasının öncüsü olan Bitcoin, geçtiğimiz Aralık ayında hızlı bir şekilde arttı ve son aylarda keskin bir şekilde düştü. Bu fiyat değişimlerinin yanında ICOlar da her geçen gün artarak karşımıza çıkıyor.Kripto para piyasasına bazı finansal danışmanların şüpheyle yaklaşmasının yanında, piyasaya büyük miktarda yatırılan paraları da görmezden gelmek imkansız. Teknoloji eğilimlerini inceleyen ve öngören iki önde gelen fütürist olan Thomas Frey ve James Canton kripto paraların geleceği ve finansal sistemdeki rolü hakkında Time dergisiyle bir röportaj yaptılar. İşte o röportajdan dikkat çeken cümleleri sizlerle paylaşmak istiyoruz. DaVinci Enstitüsünde yazar olarak çalışan Thomas Frey, gelecek tahminleriyle tanınan biri. Thomas Fery, kripto piyasasının geleceği hakkında şu tahminlerde bulunmuş: Kripto paralar, hayatımızda kalacak. 2030 yılına kadar ulusal para birimlerinin kabaca %25ini yerinden oynatacağına inanıyorum. Kripto paralar daha verimli çalışıyorlar. Kripto para birimleri, merkez bankaları ve uluslararası bankacılık alanlarının yerini alabilir. Bitcoin, gayrimenkul satmak gibi bir şey. Yani Bitcoin satmak, mülk sahipliğini değiştirdiğinizde başkasına dijital bir parçanızdan verdiğiniz anlamına geliyor. Visa ve diğer şirketlerin, Bitcoini düzenli işlemler için kullanması kolay. Ancak, kripto paralar hala süpermarkette harcayabileceğiniz bir şey değil. Bitcoin ve kripto piyasası var olmaya devam edecektir. Global Futures Enstitüsünden Dr. James Canton ise şunları ifade ediyor: Kripto paralar geleneksel küresel ekonominin yanında ortaya çıkan yeni bir varlık sınıfıdır. Elbette bu piyasada para kayıpları olabilir. Fakat zengin olmakta mümkün. Kripto para yatırımlarını hisse senetleri ve geleneksel yatırım yöntemleri ile benzer şekilde görüyorum. Sadece kripto paralarda daha fazla dalgalanma var. İnsanların yatırım portföylerini gerçekten dikkatli bir şekilde oluşturmaları gerekiyor. Türkçe kaynak: https://coin-turk.com/2030-yillina-kadar-kripto-paralar-dunya-piyasasinin-%25ini-kapsayacak

İngilizce kaynak: https://www.ccn.com/cryptos-to-overtake-25-of-fiat-money-by-2030-says-futurist/ |

|

|

|

Hollandada her yıl olduğu gibi, 1 Mart itibariyle vergi iadesine varlık bildirimi yapılmaya başlandı. Bu sene geçen yıllardan farklı olarak, vergi iadesi için kripto paraların da bildirimi yapılacak. Hollanda Vergi ve Gümrük İdaresi, dijital para birimlerini tıpkı altın veya başka bir para birimindeki para birikimi gibi gördüklerini ve bu yüzden vergiye tabii tutulması gerektiğini belirtiyorlar.Hollandada vergi bildirimi, genellikle internet üzerinde e-devlet gibi bir sistemle bildiriliyor. Hollanda Vergi ve Gümrük İdaresi, Bitcoin ve diğer kripto birimlerinin vergilendirmesinin yapılabilmesi için, bu sistemde, birikimlerininiz ikonu altına Bitcoin ve sanal ödeme yöntemi seçeneği ekledi. Bu seçenek ile birlikte, kripto para varlığı olan Hollanda vatandaşları bu imgeyi seçerek varlık bildirimi yapabilecekler. Hollanda Vergi ve Gümrük İdaresi, 2013den 1 Ocak 2017 tarihine kadar, Bitcoin ve diğer kripto paralara yatırım yapmış ve kazanç sağlamış olan yatırımcılardan kripto para varlıklarını bildirmelerini istiyor. Tabi ki bu durum bu yıl için geçerli. Gelecek yıl 2017 bildirimi de yapılacaktır. Peki Hollandada kimler kripto para kazancından, yüzde kaç vergi ödeyecek? Bunun için belirlenen kriterler şu şekilde: Bekar ve toplam varlığı 25.000 Eurodan az kişiler ile, evli veya resmiyette birlikte yaşanılan bir partner ile toplam varlık 50.000 Eurodan az olan kişiler bu sene kripto para vergi ödemesi yapmayacak. Vergi dilimleri ise şu şekilde belirlenmiş: 75 bin Euroya kadar %0.86, 75.000 ila 975.000 Euroya kadar %1.38, 975.000den yukarısı ise %1.61 oranlarından vergilendirilecek. Pazar araştırmacısı Kantar TNSe göre, 580.000den fazla Hollandalının kripto parası var. Hollandalıların büyük çoğunluğu ise geçen yıl kripto paraları keşfetti. Bu nedenle gelecek yılki vergilendirme dönemi kripto para yatırımcıları için bir hayli yoğun geçebilir. Source: https://coin-turk.com/hollandalilar-kripto-para-varliklari-icin-vergi-odeyecek

|

|

|

|

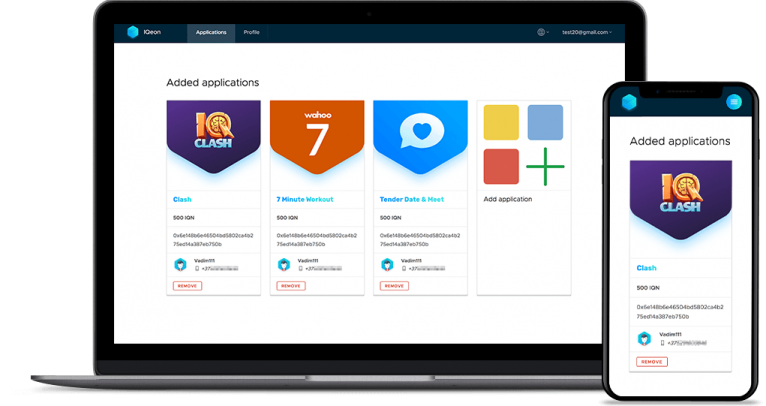

Merkezsiz PvP oyun platformu IQeonun ICOsu tüm hızıyla sürüyor. Cointürk okurlarına daha önce birçok kez duyurduğumuz platformun katılımcıları yalnızca oyun oynayarak gelir sağlayabilir. IQeon şu ana kadar 2 milyon doların üzerinde fon toplamayı başardı. Merkezsiz PvP oyun platformu IQeonun ICOsu tüm hızıyla sürüyor. Cointürk okurlarına daha önce birçok kez duyurduğumuz platformun katılımcıları yalnızca oyun oynayarak gelir sağlayabilir. IQeon şu ana kadar 2 milyon doların üzerinde fon toplamayı başardı.Zeka oyunları piyasasının belki de en büyük sorunu oyuncuların yalnızca %3ünün oyunlardaki başarısını paraya çevirebilmesi. Ne kadar başarılı olursa olsun; oyuncuların %97si başarısını para ödülüyle taçlandıramıyor. Özetle, 4.9 milyar dolarlık bu piyasada para kazanan kişi sayısı oldukça az. Piyasanın bu açığını yakalayan IQeon oyunculara hak ettiği paraları kazandırmak için kuruldu. Şimdi IQeon platformunun özelliklerine ve getirdiği avantajlara göz atalım..  Kullanıcılar açısından IQeon IQeon ekosistemi. Oyunlarda kazanılan IQeon tokenleri kullanıcılar tarafından diğer oyunlarda kullanılabilir. IQeondaki potansiyel değer artışı. Üçüncü parti geliştiricilerin IQeon ekosistemine katılması ve IQeon ürünlerinin hizmet vermeye başlamasının ardından kullanıcı sayısının ve IQeon tokenine talebin patlama yapacağı tahmin ediliyor. Diğer kripto paralarla değiş-tokuş. Birçok borsada listelenecek IQeon tokenleri bitcoin, litecoin ve ethereum gibi birçok kripto parayla değiş tokuş edilebilir. Dolandırıcılığa karşı tam koruma. Platformun altyapısında kullanılan blockchain ve smart contracts teknolojisi platformun güvenliğini ve kazanan kişilere ödemelerin sorunsuz bir şekilde transfer edilmesini sağlar. Debit karta transfer. IQeon tokenleri itibari paralara çevrilebilir. Çevrilen para platformun cüzdanı üzerinden debit karta gönderilebilir. Gizlilik. IQeon platformunda oyuncular tamamen gizli kalabilir. Geliştiriciler açısından IQeon Çok sayıda oyun seyircisi. Geliştiricilerin geliştirdiği oyunları platform içinden ve dışından çok sayıda oyun tutkunu takip eder. Para çekim ücretlerinde indirim. Geliştiricilere Google Playde %30, Apple Storeda %10 indirim yapılır. API. Kulllanışlı API sayesinde geliştiriciler kendi oyunlarını kolayca IQeon ekosistemine entegre edebilir. Yasallık. IQeon tokenleri App Store Değerlendirme İlkeleri ve Google Play Geliştirici Politikasına tam uyumluluk gösterir. Ethereum blockchain. Platformun altyapısında kullanılan ethereum blockchaini sayesinde IQeon ekosistemindeki tüm ödeme işlemleri gizlilikle ve güvenle yapılır. Kullanıma hazır ürün. Platformun beta sürümüne http://demo.iqeon.io/ adresinden erişilebilir. Token alıcıları açısından IQeon IQClash API. Platform dahilinde geliştirilen IQClash isimli orijinal oyun App Store ve Google Playden indirilebilir. Düşük riskli token alım fırsatı. IQeon platformunun kurumsal olarak token satın alanlardan biri de ABA Marketing Group Inc. Bunun yanı sıra platform ICO rating sitelerinden oldukça yüksek puanlar alıyor. Profesyonel proje ekibi. Platformun Estonya, Letonya ve Belarustaki ofislerinde 40dan fazla personel çalışıyor. Ortaklık anlaşmaları. Çok sayıda oyun ve uygulama geliştiricisiyle yapılan ortaklık anlaşmaları platformun geleceğine dair olumlu sinyaller veriyor. Benzersiz kazanç fırsatı. IQeon token satın alanlara ve zeka oyunu oyuncularına yalnızca oyun oynayarak para kazanma fırsatı tanıyan ilk platform. Proje ekibinin yanı sıra IQeon platformunun danışma kurulu da kendini kanıtlamış kişilerden oluşuyor. Kurula son katılan isim başarılı girişimci Jason Hung. Hung mobil uygulamalar sektörüne getirdiği yeniliklerle tanınıyor. Hung ve ekibinin ortaklaşa geliştirip patentini aldığı 9 benzersiz teknoloji ürünü halihazırda 2 binin üzerinde mobil uygulama tarafından kullanılıyor. Dijital marketing, yapay zeka, kurumsal kaynak planlaması ve blockchain gibi alanlarda engin bir bilgi birikimi ve tecrübeye sahip Hung şu ana kadar üç şirket kurdu: Treascovery, Chidopi ve Timebox. Deneyimli danışman bunun yanı sıra BitRewards, BlockLancer, Datarius, ICONIC, AIDA, EZPOZ, Suchapp, USAT ve SafeCrypt başta olmak üzere 15in üzerinde ICO projesine bilgi ve tecrübesiyle katkıda bulundu. Yüksek potansiyelli IQeon platformunun ICOsunu kaçırmayın. ICO bittikten hemen sonra, IQeon kripto para GetBTC, YoBit, Bankera ve Etherdeltada işlem görmeye başlayacak. Platforma ve ICOya dair daha fazla bilgi almak için resmi siteyi ziyaret etmenizi öneriyoruz.  Source: https://coin-turk.com/iqeon-icosu-tum-hiziyla-suruyor |

|

|

|

bu yeni moda güzel oldu. zamanında fbi calınan bitcoinleri btc-e'de bulduğu için btc-e'nin kafasına binmişti. böyle haberler güzel , en azından birilerinin çalınan coinleri bulabiliyor olması blockchain alemine güven sağlar

Bu şekilde devletler göz diktiği kriptoparayı kendi beyaz hackerlerine çaldırıp daha sonrasında ise o kriptoparalara el koyabilir. Bu devletler için bir gelir kapısı olursa ne olacak? Şahsen devlet desteksiz hiçbir hackerin direkt olarak borsayı hackleyebileceğine inanmıyorum. Bunun için büyük bir ekip ve içeriden birileri gerekiyor. |

|

|

|

|

Sepetinizin içerisinde bir miktar bitcoin bulundurmadığınız sürece altcoinler düştüğünde dayak yemiş gibi olursunuz bundan dolayı sepetinizin en az %40'ını direkt olarak bitcoin'den oluşturun. Bitcoin bu piyasanın yapı taşıdır eğer bitcoin yükselmezse hiçbiri yükselmez, çok yükselirse yine altlar yükselmez, düşerse altlar düşer kısacası güvenli liman arıyorsanız sadece bitcoin..

|

|

|

|

Commissioner for Financial Stability, Financial Services and Capital Markets Union, Valdis Dombrovskis of the European Union (EU), is urging a broader regulatory regime upon cryptocurrencies, and is threatening an EU move especially if there appears to be no global consensus on how to address the decentralized currency phenomenon. Also read: Bitcoin Futures Regulator Allows Employees to Trade CryptoEU Financial Commissioner Urges Global Crypto Regulationaldis Dombrovskis, Vice-President of the European Commission, warned, [Bitcoin] is a global phenomenon and its important there is an international follow-up at the global level. We do not exclude the possibility to move ahead (by regulating cryptocurrencies) at the EU level if we see, for example, risks emerging but no clear international response emerging. Mr. Dombrovskis remarks were delivered this week in Brussels at a an EU Commission meeting termed Roundtable on cryptocurrencies. The agency aims to ensure investor protection, market integrity and financial stability while taking full advantage of the new technological developments, according to its website. EU Losing Patience: Bitcoin Needs Global Regulation Valdis Dombrovskis Participants in the Cryptocurrencies Opportunities and Risks, exchanged views on how the EU institutions, supervisors and Member States should respond to the challenges posed by fast technological developments, and seize the opportunities they offer. So-called cryptocurrencies (virtual currencies) and their underlying blockchain technology are affecting many sectors of the economy, including finance, the site explained. The Commission plans to use the discussion at Brussels to inform broader policy as they head into the G20 meetings later in Argentina. The discussion was organised around three themes: cryptocurrencies and their implications for financial markets, investor protection and market integrity in relation to cryptocurrencies as an emerging asset class, and the potential and challenges posed by initial coin offerings, they detailed. Clear, Frequent, and Across All JurisdictionsFor his part, Mr. Dombrovskis urged the roundtable to follow up on an existing Franco-German letter concerned with crypto regulation. Crypto-asset markets are global, with worldwide transactions between investors, consumers and intermediaries, he said. On its own, Europe represents only a small share of global cryptocurrency trading, so we need to work together with our partners in the G20 and international standard-setters.  After applauding blockchain technology, the Vice President outlined issues he felt were previously unaddressed: Cryptocurrencies which are not currencies in the traditional sense, and whose value is not guaranteed, have become subject of considerable speculation. This exposes consumers and investors to substantial risk including the risk to lose their investment. This is why our third conclusion is that warnings about these risks to consumers and investors are important: these must be clear, frequent, and across all jurisdictions. For good measure, he was careful not to miss initial coin offerings (ICOs), which he termed an opportunity but ultimately there are also problems that expose investors to substantial risk, such as the lack of transparency regarding the identity of the issuers and underlying business plans. Perhaps the most ominous of his remarks were saved for the very end, as he pounded home the point crypto-assets present risks relating to money laundering and the financing of illicit activities. That is why the Commission proposed that virtual currency exchanges and wallet providers should be subject to the Anti-Money Laundering Directive. The co-legislators reached an agreement in December, and we invite Member States to prepare for a speedy transposition of this legislation. To sum up, the Commission will continue to monitor these markets together with other stakeholders, at EU and international level, including in the G20. We stand ready to take action based on an assessment of risks and opportunities, he insisted. |

|

|

|

North Korea may have made over $200 million USD from cryptocurrency transactions last year, according to a former NSA official. DPRK is believed to have obtained at least 11,000 bitcoins through mining or hacking in 2017. Pyongyang continues to exploit the benefits of using cryptos and the cyber security weaknesses of its adversaries, recent reports suggest. Also read: Intelligence: Pyongyang Trying to Steal Cryptos before Pyeongchang Olympics $200 Million Stashed in BitcoinStruggling to overcome effects from international political isolation and economic sanctions, the Democratic Peoples Republic of Korea has been turning to cryptocurrency in recent years. Multiple reports have indicated that Pyongyang is actively engaged in attempts to acquire cryptos through any means possible.North Korea Obtained 11,000 bitcoins in 2017, Expert Says The North has obtained at least 11,000 bitcoins last year, according to a former NSA official, quoted by Radio Free Asia. Priscilla Moriuchi, who has been in charge of cyber security in the Asia-Pacific region at the U.S. National Security Agency, believes the cryptocurrency has been acquired through mining or hacking in 2017. The value of the stashed coins is estimated at $210 million USD, as of December last year, when the price of bitcoin was at its peak, Moriuchi said. She is currently working at the U.S. based cyber threat intelligence provider Recorded Future. If the hermit states regime still had the bitcoins in January, their value would have been around $120 million, the South Korean Yonhap news agency reported. Taking Advantage of Cryptos and WeaknessesNorth Korea has been trying to benefit from the opportunities cryptocurrencies offer, in terms of freedom and anonymity of transactions. The international financial system is largely unavailable to Pyongyang, as its access is severely limited. Multilateral sanctions over its nuclear and missile programs have been imposed. North Korean interest in cryptos has been confirmed by reports indicating that Pyongyang University is offering courses on cryptocurrencies. The Alma Mater is considered to be the breeding ground for North Korean hackers. DPRK has reportedly made multiple attempts to exploit cyber security weaknesses in the crypto ecosphere of its enemies. Mining malware infections and ransomware attacks have been blamed on North Koreans. Last year hackers from the notorious Lazarus Group, believed to be linked to the communist state, were implicated in attacks on South Korean cryptocurrency exchanges. North Korea Obtained 11,000 bitcoins in 2017, Expert Says According to the South Korean intelligence agency, the North is involved in the hack of Bithumb, the countrys largest cryptocurrency exchange. Personal data of more than 30,000 of its users was stolen by hackers. Authorities in the Republic of Korea have fined Bithumbs operator for leaking private information. Cryptos worth billions of won were stolen by DPRK hackers last year, the National Intelligence Service said. A report by Recorded Future claimed that North Korean government actors, including the Lazarus Group, continued to target South Korean exchanges and their users in late 2017. South Korean intelligence has informed lawmakers during a parliamentary hearing in Seoul that the North has never stopped trying to hack crypto exchanges in the country. The assessment came in a period of relative warming of relations on the Korean peninsula, which recently hosted the Winter Olympic Games in Pyeongchang. Source: https://news.bitcoin.com/north-korea-obtained-11000-bitcoins-2017-expert-says/ |

|

|

|

The Bitcoin price continued to flirt with the $11,000 threshold on Friday, even as other top cryptocurrencies experienced minor declines. Meanwhile, another former top 10-cryptocurrency is eyeing a return to this exclusive list.  Altogether, the cryptocurrency market cap rose by approximately $11 billion on Friday — a single-day increase of two percent — and is currently valued at $462.6 billion. Bitcoin Price Flirts with $11,000The Bitcoin price posted the best single-day performance among large-cap coins with an index-matching two percent increase. At present, the flagship cryptocurrency is trading at $10,932, representing a slight pullback from the intraday peak of $11,189 it hit earlier this morning. Bitcoin now has a $185.1 billion market cap, and its share of the total cryptocurrency market cap has shot up to 40.7 percent.  Ethereum Price Posts Minor Decline Ethereum Price Posts Minor DeclineThe Ethereum price, meanwhile, posted a minor decline for the day, falling one percent to a present value of $861. Ethereum currently has an $84.3 billion market cap, which translates into an 18.6 percent share of the index.  Top-Tier Altcoins See Minor Declines, But a Former Member Eyes a Comeback Top-Tier Altcoins See Minor Declines, But a Former Member Eyes a ComebackTop-tier altcoins posted a comprehensive pullback against the US dollar, although these losses were minor. Outside the top 10, however, prices saw much more action, and one former member is knocking on the top 10-club’s door.  The Ripple price, Bitcoin Cash price, and Litecoin price each posted one percent declines and are currently trading at $0.89, $1,274, and $206, respectively. EOS, NEO, and Cardano, meanwhile, made single-day retreats of about three percent, forcing their prices down to respective values of $8.18, $125, and $0.28. Stellar posted a top 10-worst four percent decline, while IOTA rounded out the top 10 with a two percent dip to $1.93. However, IOTA may not hold that position for much longer. Privacy-centric cryptocurrency Monero achieved a seven percent gain for the day — better than any top 10-coin — and it currently sits in 11th with a $5 billion market cap, meaning it needs just an eight percent increase relative to IOTA to reclaim a spot in the top 10. Source: https://www.ccn.com/bitcoin-price-flirts-11000-top-coins-retreat/ |

|

|

|

Bank of England Governor Mark Carney does not support a ban on cryptocurrencies, favoring instead what sounds a lot like patchwork regulation. Carney made his largely sanguine remarks on crypto virtually, seemingly on cue, March 2 before students at the inaugural Scottish Economics Conference, an audience who he pointed out may very well own bitcoin, ether or Scotlands digital currency Scotcoin. Speaking on a topic he entitled To Isolate, Regulate or Integrate, Carney decided that isolating society in a jurisdiction from cryptocurrencies could do more harm than good, pointing to China as an example of what not to do. If widely adopted, however, isolation risks foregoing potentially major opportunities from the development of the underlying payments technologies. China was one of the most active countries in the space only to infamously ban exchanges, banks and payment providers from any crypto-related activity. Instead, Carney points to a better path, one that is comprised of regulation for components of the cryptocurrency market to fight fraud and support market integrity and security for the financial system at large. On that note, he wants to hold cryptocurrencies to the same standard as the rest of the financial system, where there is a higher privilege but also greater responsibility. A better path would be to regulate elements of the crypto-asset ecosystem to combat illicit activities, promote market integrity, and protect the safety and soundness of the financial system, he stated. The time has come to hold the crypto-asset ecosystem to the same standards as the rest of the financial system. Being part of the financial system brings enormous privileges, but with them great responsibilities. Early InningsHe discussed the progress that has been made thus far, such as EU and US regulators holding cryptocurrency exchanges up to the same anti-money laundering and anti-terrorism protocols as the more highly regulated banks. More work needs to be done, and regulators are grappling with issues such as how to classify cryptocurrencies to begin. Carney suggests they fall in the securities camp, and regulating them as such would be a step in the right direction. Carney got more specific, calling out initial coin offerings, or ICOs, for circumventing securities laws that are there to protect individual investors by relying on semantics. Carney believes that the US CMEs and CBOEs launch of bitcoin futures has the potential to advance the crypto market toward a higher standard. Carneys remarks are timely, as they come ahead of the Financial Stability Boards report on the financial stability implications of crypto-assets to the G20 summit to be held in Buenos Aires later this month. In his remarks, Carney also took on the role of digital assets as a currency and a store of value. And while he doesnt expect cryptocurrencies to replace fiat money anytime soon, he warned dont cramp their style. Whatever the merits of cryptocurrencies as money, authorities should be careful not to stifle innovations which could in the future improve financial stability; support more innovative, efficient and reliable payment services as well as have wider applications. Carney fittingly quoted American economist Hyman Minsky, saying, Everyone can create money; the problem is to get it accepted. Dont look now but cryptocurrencies appear to be doing just that. Source: https://www.ccn.com/boes-carney-cryptos-pose-no-material-risk-to-financial-stability/ |

|

|

|

Marshall Adaları kendi kripto parasını geliştirmeyi ve bu doğrultuda ICO kampanyası düzenlemeyi planlıyor. Bilginin kaynağı ise oldukça sağlam: Ülke hükümeti. Bloomberge röportaj veren iki hükümet görevlisi ülkenin kripto para planı hakkında konuştu. Görevlilerden biri hükümet sözcüsü ve senatör Kenneth Kedi. Kripto para planının bu hafta parlamentoda kabul edildiğini belirten Kedi geliştirilecek kripto paranın isminin Sovereign (SOV) olacağını ifade etti. Hükümdar, imparator, bağımsız ülke gibi anlamlara sahip Sovereign aynı zamanda artık tedavülde olmayan, basıldığı dönemde bir sterline karşılık gelen ve altından yapılma bir ingiliz madeni parası.Ülkenin resmi para birimi ise Amerikan doları. Sovereignin basıldıktan sonra dolarla birlikte dolaşımda olacağını belirten Kedi, SOVun düzenlenecek ICOyla yatırımcılara dağıtılacağını ekliyor. ICOnun faaliyete geçmeden önce konseyden onay alması gerekecek; ancak Kediye göre konseyden ret kararı çıkma ihtimali düşük. Başkan yardımcısı David Paul ise Bloomberg röportajının diğer aktörü. SOVun 2018 sonuna kadar faaliyete geçeceğini müjdeleyen Paul kripto paranın ülkenin uzun vadeli ihtiyaçlarına yönelik geliştirildiğini vurguladı. Son zamanlarda Venezuelanın geliştirdiği petrol destekli kripto para Petro piyasayı oldukça meşgul ediyor. Öte yandan Türkiye ve İranda da milli kripto paranın geliştirilmesi gündemde. Milli kripto para kervanına Liberlanddan sonra gelen Marshall Adalarının nüfusu 53 bin. Ülke medyasında çıkan haberlerde, ICOdan toplanan paranın sağlık sektöründe; bilhassa ABDnin geçmişte yaptığı nükleer testlerden etkilenen vatandaşlar için harcanacağı belirtiliyor. Kripto para planına dair başkan Hilda Heineın yorumları ise şu şekilde: Kendi paramızı basmak ve dolara ilaveten bu parayı kullanmak ülkemiz için tarihi bir dönüm noktası. Bu, ulusal özgürlük yolunda atacağımız adımlardan bir diğeri. Türkçe kaynak: https://coin-turk.com/milli-kripto-para-furyasina-bir-ulke-daha-katiliyor

Yabancı kaynak: https://cointelegraph.com/news/marshall-islands-plans-to-launch-national-cryptocurrency-and-ico-govt-officials-report |

|

|

|

|