|

621

|

Economy / Economics / Re: Surviving the economy with creative thinking.

|

on: February 14, 2024, 05:03:00 PM

|

|

creative thinking

decades ago people living in villages, countrysides only had local town populations to cater to. so volume of customers was limited.

now with the internet and international postage.. the world is open. you just have to find the right product to sell, even if it only captures 0.001% of the worlds eyes, out of 8 billion that is still 80,000 customers.. and if you only make $2 thats $160k

as for surviving in your own home on a fixed salary income.

being creative can be as easy as upgrading house lighting from 100w incandescent bulbs to 8w LED

do you need the $20 delivered pizza or can you have a $4 store bought pizza

do you need the new top brand 4wheel drive 4ltr engine truck/sports car just to drive around town. or can you do with a small fuel efficient second hand car

just buying your first choice is not a choice nor creative. always look for other choices by thinking creatively about other options. and never go with first choice as thats usually the dreamy want, not the basic need

|

|

|

|

|

622

|

Economy / Economics / Re: Energy Crisis 2.0 in the New World Order era

|

on: February 14, 2024, 04:44:06 PM

|

fuel costs(energy crisis) is relaxing

Energy crisis "relaxes" when two things happen, first is when energy prices come down (eg. oil goes back down to at least $40 which is half its current price) and second is when energy sources become stable and the routes become safe again. Neither of these has happened for the energy crisis to relax. Now about: here in the UK fuel costs went upto £2/litre petrol and now back to £1.36/litre petrol

US went upto $6/gal now back in the $3.20/gal range

Last time petrol was £1.4 ish was in 2020 when the COVID had shut down the economy and oil price was about $20-$30 per barrel. That's the only way true value of petrol can reach £1.4. Today oil price is still $80 ish per barrel and despite deindustrialization, the UK economy hasn't shut down like COVID time. That means the only way price can be £1.4 ish today is if the government is artificially keeping it down by injecting lots of money into it. That money is taken out of every citizens pocket which means it has worse economic consequences down the line even if things seem good in short term. So as I said, things regarding "Energy Crisis" have gotten slightly better (that is for example oil is no longer $100-$120 per barrel) but we are far from things actually relaxing and something like petrol really reaching £1.4 per liter. first of all the oil cost crash of 2020 was the fluke due to futures trades that couldnt facilitate delivery. so people were literally paying refineries to take the contracts.. dont confuse short events of critical events.. with norm expectations as for you thinking oil should go down to $40 as "norm" pfft.. yet the average of last 20 years is higher then $40.. average is more like $60($50-$70).. and oil has been seen to be $70 in february.. and not been near the $110 peak for a while(May 2022) the petrol prices in the UK lingered around the £1.20-£1.40 from 2011.. so the expectant back to reality compared to the highs of £2 peak is getting back to the below £1.40 range .. i drove passed 4 petrol stations today. all priced £1.369, which is about the same price average i seen 2011-2019

if you think oil and UK petrol should go down to pre 2008 levels (under $40 and under £1 respectively) as norms.. sorry but no, just no. ,, side note. since 2004(20 years) the only times oil went as low as $40. was 5 months(nov2015-march2016) and then the futures oil deal crisis of 2020 $40 is not the expected norm. its the temp crash periods

separate debate: the reason fossil fuel costs have come down but the electrification of fossil power plants and renewables are still high. is because governments are charging carbon credits to fossil energy companies which sell on and average out over the grid to make even regions highly involved in renewable higher price because the grid spreads the carbon costs to an average per resident even if its green energy. |

|

|

|

|

623

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Spot ETFs hit $10 Billion milestone just one month after approval

|

on: February 14, 2024, 04:20:42 PM

|

While that is true one important fact is that if a single entity holds a large amount of BTC it gives them direct power to manipulate the market.

It becomes easier for an entity to manipulate the price if it holds huge amount of that asset.

unlocking coin from custody(to day-trade coin) is a situation of needing to undo share purchases to have unallocated shares, to then request to dissolve unallocated shares and unlock said coin.. these institutions are not going to use coins locked into ETF to day-trade spot. many securities laws and custody policy doesnt make it easy however they may have extra coin not locked. which they can play on the spot market .. much like whales had coins locked in futures contracts, but used a separate stash on the spot market to keep the prices down so their futures contracts fulfilled |

|

|

|

|

624

|

Bitcoin / Bitcoin Discussion / Re: What is the Bitcoin bull market?

|

on: February 14, 2024, 04:16:53 PM

|

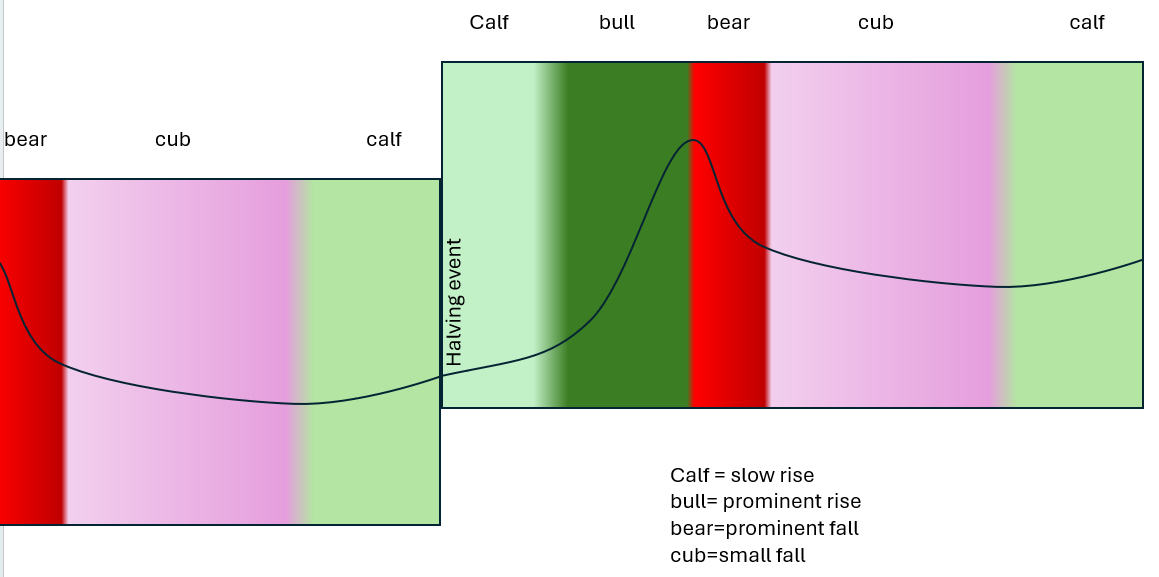

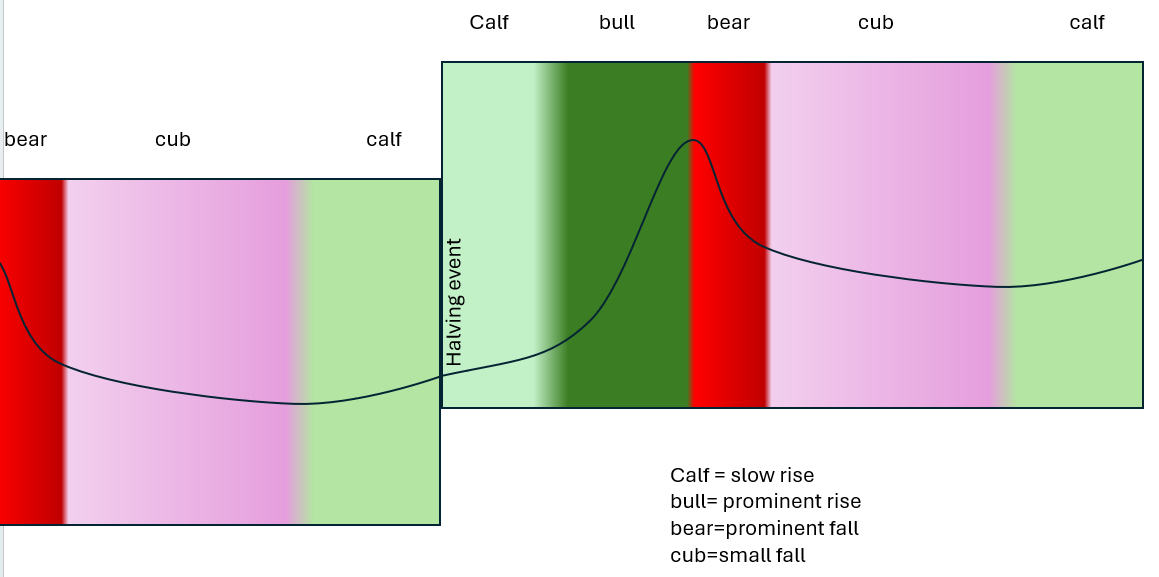

alot of people think any and all ups are bull and all downs are bears.. which makes people confused as to when there is true bull and bear.. this quick doodle may help  dont treat all ups and downs as bulls and bears. call the small fluctuations as something else like cubs and calves. the bulls and bears are the significant changes leading upto a ATH(bull) and after a ATH(bear) |

|

|

|

|

625

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Spot ETF Tracker

|

on: February 14, 2024, 02:34:03 PM

|

Random thought: I'm reminded that there were people, I believe even on this site and that I saw elsewhere on the internet, who claimed that ETFs would be a flop because anyone in the US who wanted a Bitcoin ETF would have already gotten into the Canadian ETFs that were approved a few years ago. lol, those people are sorely disappointed.

canada has its own stock/shares market.?.?. never heard of it! (satire) NASDAQ, hard to avoid it american employers invest their employees pension in american shares of american markets... simple as that |

|

|

|

|

626

|

Economy / Economics / Re: Energy Crisis 2.0 in the New World Order era

|

on: February 14, 2024, 01:51:02 PM

|

Are big Gold countries actually selling right now?

... when golds easy to access at the citizen level.. it means the institutional level is not in a hoarding season when its available via vending machines instead of jewellers/collectors. they are literally trying to throw it at people like snacks https://www.walmart.com/browse/jewelry/gold-bars/3891_4718514_3708899_8655615(able to buy gold in walmart of all places, speaks for itself as to how open the market is) Your point is good BUT Walmart is not a good example, they are not selling gold on their site, but rather 3rd party vendors, and gold vending machines are more for bragging rights. its more about when the gold hoarders are selling to the working-lower class consumers of walmart demograph, and not doing private trade at the rolex/lambo crowd. you soon spot how much they want to get rid of gold again gold is at its near ATH of ALL history.. so not a buying time, especially when the causes of the ATH have passed.. expect a correction ....

as for energy.. fuel costs are coming down to normal levels. which mean production, mining, and construction becomes reasonable again. because facts show the main costs of construction, production, mining is the energy cost. not labour

labour cost is more of a concern in the consumer market of retail

Don't know where in the world you are located, but in most parts energy prices are at some of their lowest point in years. Not getting there, not coming down, but there. im in the UK but i also see the views of other places here in the UK fuel costs went upto £2/litre petrol and now back to £1.36/litre petrol US went upto $6/gal now back in the $3.20/gal range |

|

|

|

|

627

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Spot ETF Tracker

|

on: February 14, 2024, 12:02:33 PM

|

|

today blackrock hit 105,000btc.. a 10kcoin rise from last update yesterday

yesterday had 95k which was a 7.5k increase from the weekend

gaining more coins per day than its usual queue in the line, biting at the grayscale(outflow) pie

seems this week ETF's are getting hungrier and grayscales depletion schedule is not enough

|

|

|

|

|

628

|

Economy / Economics / Re: Is increase in minimum wage a good method to fight inflation?

|

on: February 14, 2024, 10:54:25 AM

|

|

decades ago in previous inflation's. employers didnt want to move the market rate of labour by increasing minimum wages.. which then impacted costs of goods

what they did instead(especially in america) was incentivise recruits/employees with hidden benefits, such as dental care, healthcare and pension matching

this meant the post tax cost of labour stayed low and employers got tax incentives/rebates by offering the benefits. which helped keep the employers costs down thus kept the price of goods down

employees then got free healthcare/dental which cut down their post tax medical costs. so they had more cash to spend on other things...

.. and thats the story of the evolution of the industrialisation of the medical system

|

|

|

|

|

629

|

Economy / Economics / Re: saving vs investing - minimalism vs frugality

|

on: February 14, 2024, 10:31:27 AM

|

To be honest, minimalism and savings appear to be nearly identical; they allow us to save for things we want more than we need, although simplicity can provide us with so-called financial freedom. .by conserving money and avoiding unnecessary expenses.

So, what are our financial goals or targets? Short- or long-term investment? So, what do we do with the money? Saver or spender?

nosavings is not about saving for things we want.. savings should be for the things you need. both saving and minimalism is about purposefully adjusting your views to concentrate on the things you NEED that is not to say people need to live without a vacation.. its more about concentrating on the fact that for sanity sake when you NEED a vacation to rest and rejuvenate and break the insanity spiral of non-stop work you make the best judgements. not waste it on things that dont bring you long term happiness, recovery of energy and sanity if you are just going on vacation because you want to for one week a quarter, try to organise vacation for when you need to 2week each 6month. make the most of time off to help you rejuvenate and have great experiences or the opposite. if you dont want 1 week per quarter/2week per 6month. but NEED a extended weekend break to recover from stressful work every couple months. then plan what you need still have your extended breaks/vacation just choose wiser about expense, experience and time utilisation for instance out of all vacations/extended weekends you have ever had, which one gave you the best memory and rejuvenated you, freshened your energy levels to make you feel happy to go back to work after the vacation.. vs which vacation was a huge waste (where after going to vagas losing on the slots), you came back to work more stressed, feel guilty about spending and upset about what happened on vacation most people then work out the most cost effective experience, within budget that does not leave them feeling guilty of spending after and has rejuvenated them But in this discussion We can build a financial strategy that is consistent with our ideals. Let us merely remember that we can modify these concepts to match our own problems.

people that purposefully budget. stop relying on 6 credit cards and instead start developing a savings pot for emergencies so they can cut up the credit cards. they also look at the most expensive devices/gadgets/appliances in their homes and look at the warranties/expected life span of appliances. and then budget that too EG a #400 computer lasts maybe 5 years so they budget an amount of #7 a month (#7*60month=#420) thus getting a computer upgrade when old one fails is not a sudden #400 emergency. but an unnoticeable #7 planned expense that eventually will be needed thus saves you needing a credit card or 'pay later' retail loan thus saves you needing to sell investments at a bad time at a loss to pay for the computer |

|

|

|

|

630

|

Economy / Economics / Re: Energy Crisis 2.0 in the New World Order era

|

on: February 14, 2024, 09:55:51 AM

|

|

they gave negative trust rating because your clown army you support(doomad hosted) cried to them with victim tears.

as for your research.

you dont read code or blockdata or find real statistics or data. your research is asking someone their opinion on things and then you copy their opinion.

you are defined as a spoonfed consumer sucking up anything handed to you. not a researcher.

from looking at your opinions they all sound like copy and pastes from social/mainstream media.

when you dont sound like doomad, stompix, you sound like fox news

even your insults are a copy and paste

as for your incessant overuse of the word gaslight.. you need to see who's fueling your flames and causing you to get burnt. the vapour that comes to you is piped in from idiots. if your getting burned by it.. change your fuel source..

because you have become as useful as a gas flaring chimney. not utility gas

..

the main debates i had with gregmaxwell was about how segwit allows junk data to get into blockchain unvalidated due to backward compatibilities lack of need for network readiness/activation of understanding, having rules new formats of transactions... and ordinals proves the exploit

even your mentor doomad now knows i was right, but still hates that i even dare challenge/scrutinise the beloved gods you idolise and trust

as for chinas gold buy.. such wow. they increased their hoard by 'meh' 10%... and are now offering out gold to help incentivise the unfinished real estate projects to be bought up at market rate by offering buyers a gold brick..

.. instead of discounting the real estate, which would ripple market price decline for other finished housing

EG if a gold brick is $75k and average apartment price is $300k

instead of offering unfinished real estate at $225k to spark buy-ups. they still offer real estate at $300k but give the buyer a $75k gold brick

thus the real estate market stays on paper at the $300k rate and not decline by 25%

get it yet

its the same trick employers do(but opposite to keep salaries low). instead of pay rises which spark inflation, they offer employee's other benefits like pre-tax pensions and healthcare schemes. so that they can keep the salary market competitive(low)

..

as for energy.. fuel costs are coming down to normal levels. which mean production, mining, and construction becomes reasonable again. because facts show the main costs of construction, production, mining is the energy cost. not labour

labour cost is more of a concern in the consumer market of retail

|

|

|

|

|

631

|

Bitcoin / Bitcoin Discussion / Re: BTC to Bitcoin ETFs - The ownership are shifting to centralized ownership

|

on: February 14, 2024, 09:04:31 AM

|

No, it is 51% of the hash rate that are needed to mine bitcoins. When you achieve that, you would in theory be able to double spend for a short while, but the cost of doing that... out weigh the benefit of doing that.

51% mining is mitigated mostly by not accepting low confirms as 'settled' for large amount an adversarial pool would attempt a re-org. (they wont buy/rent billions of dollars of miners to 51% for just a coffee, but to undo a 200,000btc they might) a 51% attacks most annoying trick would be to purposefully "empty block" to cause congestion 51% attack cant really change the code, protocol of the network. not without also offering people on the network a new node with altered code .. owning any % 5-20-50-90% does not affect the blocks, or code protocol directly, coin ownership does not cause issues.. however psychologically economic nodes(merchant services) that still want coin, would probably sway to the whims of proposals of such high yielding coin owners desire in exchange for some of that coin IF rich owner(s) did then say they only use a certain node that communicates transactions in a certain way of certain format.. then economic nodes may sway their node branding to follow the majority coin owner(s) meaning if it changes code protocol by following the different brand, it can mandate mining pools nodes to also follow this brand or have blocks rejected by not processing a format certain high yield coin owners desire |

|

|

|

|

632

|

Economy / Economics / Re: saving vs investing - minimalism vs frugality

|

on: February 14, 2024, 03:39:06 AM

|

While I agree that savings is a must, I don't think savings is only designed for the rainy days. Savings could actually be the necessary start for investment. To many people, investment is a luxury they cannot afford. But they can actually regularly save little by little until it gets significant enough to be invested on a small business or whatever.

Also, saving has become a short-term thing because we have a kind of money that is not worth keeping across time. The current monetary system makes long-term saving pointless. However, it could be possible with a different currency. Bitcoin, for example, might make saving even inter-generational.

I'm with you on the minimalist lifestyle.

savings infers the word to save(rescue).. so only think of savings as the rescue fund. not the wealth creation fund. then it allows you to then treat savings as the small pot of money for rescue, and when you have that rescue buffer to save you in dire times. you can then stop funding the rescue fund and start investing the income excess excess as for starting a business. no one on low income should jump big. always start low, test the waters and grow with prosperity EG if you want to cook food and serve it. dont envision needing $200k to buy a restaurant. start small, test recipes, see if the local populous even demands what you have to offer. offer food delivery from a "ghost kitchen"(your own home that links to uber eats for delivery only) have a food stand at a country market or street market. gain a loyal customer base then expand using the profits to many have the luxury maximalist mindset of wanting to open a 5 star restaurant as first foot into the industry truly plan your money. the minimalist way first. do you really need a fully furnished $200k restaurant lease before you have even let anyone taste your food to test your recipes. or could you start small.. perfect your offering. then expand |

|

|

|

|

633

|

Bitcoin / Bitcoin Discussion / Re: When will Bitcoin catch up with Gold in capitalization?

|

on: February 14, 2024, 03:24:36 AM

|

https://companiesmarketcap.com/assets-by-market-cap/Total market cap of gold is more than 13 times higher than Bitcoin market cap. If Bitcoin can have x2 for each halving, it will need about 6 to 7 more halvings to catch gold market cap in 2024. With this humble expectation (x2 for each halving), it will be achieve in a year of 2064. If you increase this price expectation from x2 to like x3 in average for future halvings, a target year will be sooner than 2064. 1B(1btc=$50k)x2=2B(1btc=$100k) 2Bx2=4B 4Bx2=8B 8Bx2=16B 4 halvings 2024 2028 2032 2036 .. now lets use the 4 ATH of 2025 2029 2033 2037 2.8b(1btc of $140k) in 2025 2.8bx2=5.6b in 2029 5.6bbx2=11.2b in 2033 11.2bx2=22.4b in 2037 |

|

|

|

|

634

|

Bitcoin / Bitcoin Discussion / Re: BTC to Bitcoin ETFs - The ownership are shifting to centralized ownership

|

on: February 14, 2024, 03:14:10 AM

|

right now ETF are not gobbling up much new coin

most of the coin that go into things like fidelity/blackrock/ark came from... wait for it.. [drum roll] grayscale

so basically its one institution shuffling to another institution

However, the warning signs are there for what might occur in the future of bitcoin. If enough of these high networth individuals buy the bitcoin spot ETF, I reckon Blackrock and the others can own much of the supply and have a gated market where people can only invest in bitcoin through their ETFs. This will not be right for the real purpose of bitcoin as peer to peer cash. However, this is not the fault of the people. Similar to what has been argued before, this might be the fault of bitcoin's monetary policy. my view, and from whats already happening. is as such looking at the institutions.. we have things like DCG and river financial looking at their funders we can see kingway capital all of which have invested in core devs and many bitcoin services. they have invested ALOT of money into things that incentivise making bitcoin network annoying whilst promoting subnetworks for middlemen hoarding/routing. so yes the path being set is to make bitcoiners lives more burdensome and making a path to ETF easier.. its not a new game back in the days of creating the commodity markets of things like wheat. the commodity offering institutions got regulators to help them kill off the family farms and replace it with commercial farms. whereby they begun to control the wheat markets. we should not be stroked and hugged and kissed with loving whispers into accepting the only way forward is to abandon the bitcoin network and move to commercialised subnetworks. we should not be ego stroked into accepting bitcoin should only be the reserve currency rail for the elites, while having our funds syphoned in commercial services of middlemen, via fees, account renting and wallet premium subscriptions of on offchain services |

|

|

|

|

635

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Spot ETF Tracker

|

on: February 14, 2024, 02:47:05 AM

|

|

my view

grayscale has already lost 28% of its pre-launch holdings in one month.

so lets fast forward 3months time.. other ETF will then be having to majority buy from spot open exchanges and/or miners

meaning less supply/more demand on spot markets

ETF's are not looking for a scheme that lasts 6 months, they have business plans set for the next 5-10 years. and so forward-looking, the impacts on spot will come forth. its still the "early adopter" stage for them

pension plans only diversify/adjust portfolio/divest(from trad-fi) every quarter on average, so yet to see many pension plans buy into bitcoin etf shares. thus the buckets of coins needed now, compared to later years is a big difference.

things will shift to greener pastures. but not this month

as for your thoughts that these ETF institutions will use the coin to manipulate spot via day trading.

when locking coin into custody, there are contracts involved when assigning shares pegged. these cant simply be released as easy as you think, nor can the institutions fractionally reserve double trade their collateral. SEC has rules to prevent this

EG

the deals to move out grayscales 28% so far are not made same-day. they are plans made pre launch where grayscale had a queue and a daily limit.

|

|

|

|

|

636

|

Bitcoin / Bitcoin Discussion / Re: BTC to Bitcoin ETFs - The ownership are shifting to centralized ownership

|

on: February 14, 2024, 02:36:07 AM

|

ETF this, ETF that, I think that people are now reasoning better, this is unlike how it was so lousy before the approval. Even then, I wonder what difference the ETF would make in the crypto space if not for Bitcoin shifting hands from one means to another, and from personal storage to company storage.

many people pre etf launch expecting grayscale to hold onto its hoard. and not shuffle it over to other ETF. they thought ETF's would buy their own coin from the open market.. however january shown just a institutional shuffle from one etf to the others. however there is only so much coin Grayscale has.. (72%) left. meaning 28% lost in one month eventually other ETF's are going to syphon coins from the open spot market instead of shuffling. and these large basket purchases will directly affect spot price.. as for the effect on the other ecosystems such as merchant use and services offered.. well gold is not used in retail purchases of goods or services, so not much positive impact on merchant use due to being seen as an investment asset.. what bitcoiners need to do is not wait for ETF investments to spark some commercial investment into fixing bitcoin utility annoyances, because so far those commercial investments have produced unfinished sandbox subnetworks used as workaround of work around of work around to the annoyances that prevent bitcoin utility, all of which have not helped bitcoin utility, but just promoted people should use bitcoin less.. so no positive impact there we need a fresh set of eyes, a fresh set of devs to go back to scratch and propose different strategies to solve bitcoin scaling/utility. that actually benefits bitcoiners. ETF businesses have put a stake in the ground to say they see bitcoin as something that will be around for years. but now we have to get on and actually start proposing proper proposals to make bitcoin easy, cheaper to use for the benefit of bitcoiners instead of waiting for commercialised flawed sandboxes to solve things for us |

|

|

|

|

637

|

Bitcoin / Bitcoin Discussion / Re: BTC to Bitcoin ETFs - The ownership are shifting to centralized ownership

|

on: February 14, 2024, 02:15:49 AM

|

|

there are no issues in how people want to use bitcoin, but we should atleast strive to point out the risks and not just play promotion platitude ass kissing

(people on this forum have already heard the word bitcoin to have even found this forum. so they do not need the cheerful whispers of utopian promotional recruitment speak, they are now looking for the real, factual information and risks they need to be aware of)

bitcoin in CEX have no insurance. so unlike a bank you do not have the $250k FDIC insurance

use a CEX if you day trade where depositing/withdrawing is a hassle but realise the risks. and note the "you can lose all your investments" slogan

holding long term because you have no intent to sell anytime soon. its best to suggest storing on ones own private key. but note the risks of different wallet, software and what they do or dont offer

..

those taking advantage of ETF share buys. should know although they get tax advantages whilst getting exposure to the spot price. they need to know their broker, ETF trust at their sole discretion can close the share offering. and shares are not claims to any rights to any asset held. you cannot redeem bitcoin spot ETF for actual bitcoin. you only have price exposure at a share ratio to bitcoin price based on the Nav number the ETF trust chooses and can change at their sole discretion without needing to give notice or get votes from share holders

|

|

|

|

|

638

|

Bitcoin / Bitcoin Discussion / Re: When will Bitcoin catch up with Gold in capitalization?

|

on: February 14, 2024, 01:59:52 AM

|

Nothing will change if Bitcoin exceeds gold in terms of market capacity. Some markets are worth more than gold. However, gold will exist, Bitcoin will exist, and the stock market will exist. Bitcoin and gold are two assets that are not related to each other, which means that it is good to invest in Bitcoin and gold to diversify your investment portfolio and Bitcoin will not be a competitor to gold, or if Bitcoin surpasses gold, everyone will abandon gold and invest in Bitcoin.

The assumption that Bitcoin will overtake gold at a price of ~$650k is not correct. With current inflation, the year 2037 will be completely different from 2024, and the value of ~$650k will be completely different from its value in 2037.

gold went from $1.1k range 13 years ago to $2.2k so in next 13 years might be $3.6k-$4.4k at best.. but bitcoin will in 13 years get 4 more halvings ('24, '28, '32, '36) so bitcoins deflation will outpace fiat.. also gold only went high due to fuel going from $3/gal to $6/gal. fuel to mine gold is coming back down to the $3/gal range so gold can correct down below $2k, so dont expect $4.4k/oz of gold to be a low min.. but a max if inflation continued to 2x over the next 13 years gold only 2x in 13 year. bitcoin since 2011 has gone $0.30->$50,000(166,666x) im not suggesting bitcoin is ever going to 166,666x ever again as each halving cycle has seen less and less increments. but bitcoin will healthily outpace inflation even if each bitcoin cycles ATH only peaks at 2x of last EG 2025 ATH=$140k 2029 ATH=$280k 2033 ATH=$560k 2037 ATH=$1.12m the feel of $1.12m will feel like $560k of todays fiat purchasing power(if gold/inflation was to 2x again in next 13 years) |

|

|

|

|

639

|

Other / Meta / Re: The effect the mixer ban has had on the forum.

|

on: February 14, 2024, 01:52:24 AM

|

|

the effect i have noticed is this:

when people had mixer avatars and footers.. alot of their posts were always aimed at privacy, where they would then mention a mixer..

now when i see the same people with betting avatars/footers. their conversations are now gambling related...

when people are using/paid by the merit cycle troll meme.. their posts become more trollish

seems money decides their mindset

|

|

|

|

|

640

|

Bitcoin / Bitcoin Discussion / Re: When will Bitcoin catch up with Gold in capitalization?

|

on: February 14, 2024, 01:31:28 AM

|

|

not sure why anyone cares about market caps

market caps are not a measure of any real money stored as reserve to then pay out every holder at that $amount

market cap is just a measure of a small/decimal amount of an asset multiplied by asset total count

its never been about money held to reciprocate/fulfil all sells at that price.

there is not $13T of money held to fulfillguarantee all gold

there is not $900b of money held to fulfil/guarantee all btc

there is not $3T of money held to fulfil/guarantee all microsoft shares

market caps are just a unit price * total units

where the price and thus cap can change based on buying or selling just one unit.

anyone can right now create an altcoin with a 1trillion token pre-mine..

sell 0.001 token for $0.10

and at a real world cost of $0.10. create a market cap of $1quadrillion

anyone can right now create company with a 1trillion shares. (metaphorically, though securities commission will have rules)

sell 0.001 shares for $0.10

and at a real world cost of $0.10. create a market cap of $1quadrillion

|

|

|

|

|