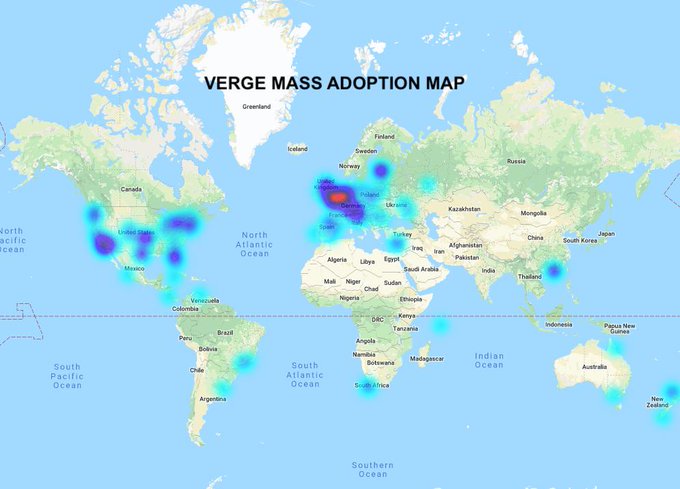

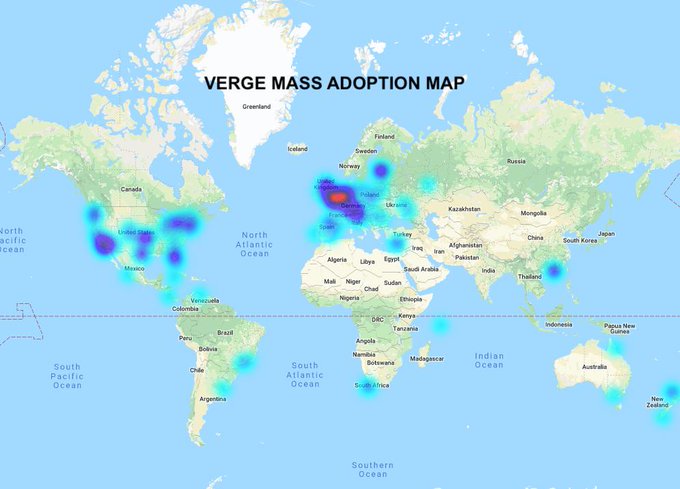

Here we can see Verge is big in The Netherlands. You'd think that for a coin whose main selling point is privacy, this data would not exist… |

|

|

|

hmmmm....not impressed...have had LISK since the ICO...

looking a lot like I may just dump, not really sure that a javascript coin for apps even makes sense anymore

with Bitcoin having atomic swaps now next release

I mean, who even does javascript anymore?

Will have to ponder this some

Brad

Javascript is a bad coding language, look at IOST a platform for javascript dapps but it lacks community support. Java is pretty god. Utherwise it wouldn't be so popular Java and Javascript are two very different things. |

|

|

|

why is the xhv scam still goin?

explain me please why are you categorizing XHV as a scam project? we can have an open discussion here its just troll talk after all the FUD a couple of months back. of course it is  , this is a modus how to get them shut up their mouth I would like to read some constructive reasons why they think that way.... I will wait forever  Good analysis.

Sketchy "stablecoins" are, at best, a stop gap product...

Also, a shitcoin with a 7 figure cap cannot be "stable"...

Looking at you KRB devs who are legit, but have taken the XHV nonsense to the next degree.

The Haven Protocol is like having a "big spec miner with very heavy bags and 150K Twitter followers in your back packet".

So, KRB are basically trying the same thing XHV does, am I getting that right? You know, I could just move on and don't even care about XHVs doomed efforts, but I think this is extremely symptomatic for the current state of crypto and altcoins. It is not that I think they are malicious or scammers or something like that. I think they started of genuinely believing that they'd find a solution for the problems at hand eventually. And now they are so deep in it that they can't really turn around and basically say "yeah, it's probably not gonna work the way we thought it would", because they'd have a bunch of angry, tikitorches and pitforks swinging "investors" looking for them then. But the fact of the matter is that not only doesn't the whole thing add up, I have yet to see or hear anything more than *crickets* regarding the issues. Like, if you apply a simple example, you'll find that XHV is way too dependent on certain conditions to actually do what it's supposed to. Let me state here that I think XHVD can work quite well for some time, given the right market conditions. Which sctually makes the whole thing even worse, because these types of systems tend not to give warning signals or anything, they just at some point flat out will stop working and people will be holding the bag. This is not a XHV specific problem, but can be seen all over the industry. How else can a sane brain rationalize the steps needed to go from BTCs approach to EOS's 21 validators? It's people getting into the market who don't realized and/or understand what Bitcoin was created for, which is, by western standarts, an absolute edge case. We are not surrounded by fiat money crashing left, right and center and for most of us, the banking system and Paypal work quite well. Bitcoin(and other blockchain projects) is primarily not supposed to be a better Paypal (fuck you, Roger), it is a system that is more resilient against catastrophic failure. And catastrophic failure is not a daily occurence, which is why people forget that it's a possibility. I could point towards parallels between this line of thought and the thought process of anti-vaxxers, but I digress. Let's look at a simple example: Let's say, XHV spikes to a marketcap of 100,000,000$. At this pricepoint, 2,000,000$ worth of XHV is offshored and 2,000,000 worth of XHVD are created. Now, the marketcap falls for whatever reason. Let's say, it drops to 10,000,000$. There is still sitting 2,000,000$ worth of XHVD offshore, but instead of being 2% of the XHV supply, they now represent 20%. If they would be onshored and XHV would be created, you'd have to deal with an instant inflation of 20%, add to that the fact that there is no way that the orderbooks on exchanges are as thick as they were at a marketcap of 100,000,000. So, there are 2,000,000$ worth of XHV going into the market, completely crashing the price. A counter argument could be that miners could not allow these 2,000,000$ to be onshored. This would effectively mean that they are not unconditionally backed with XHV, so one XHVD will not be worth one dollar, even if XHVD can be traded as its own asset. This creates another question: What exactly is the price of one XHV? Are you going with the spot price, or are you taking orderbook size into account? I guess this wouldn't work, because this would effectively mean that the more XHVD is onshored, the more XHV per XHVD needs to be created to allow the holder to cash out. Some may say that this is not how rational human beings act, that no one i their right mind would onshore their XHVD, then immediately sell their XHV in a thin market, losing money. Well, but what if they have to, maybe thy got sick and need the money right now, or something like that? Not only that, this is absolutely against the core premise of money itself: that the owner can do whatever the fuck they want with it. If you tie the value of money to a set of conditions that need to be met, this will be priced in. And this is something that is extremely dangerous when it comes to crypto in general: you can't count on the predictability of human behavior, especially in a scenario in which you have to count constantly on humans behaving rationally or predictably. Because it only needs one moment, one unexpected turn to screw this thing up big time. And at that point, you'll have a bunch of panicking holders running to the exit, either onshoring their XHVD to XHV, inflating the supply even more, or selling their XHVD at completely low, "desperate to get out" discounts. All this is amplified by the fact that XHVD is XHVs main selling point. If no one uses this mechanism, it just another Monero clone with not much else to show for it. And if a lot of people use it, it just creates a ticking time bomb. You might not even need a big swing in marketcap to make this a problem; a significant amount of XHV being offshored and then being onshored again might do the trick all by its own. Look, I'm trying hard not to come off as a hater or fudster or anything nad I probably spent way too much thought on this project. But in all honesty, too much of crypt reminds me of the underpants gnomes from South Park( https://www.youtube.com/watch?v=3zc4bGkU05o) and this is, sadly, a prime example. |

|

|

|

I've tried for the first time to store UBQ on my Ledger wallet, but after having clicked on Connect to Ledger Wallet on pyrus.ubiqsmart.com, nothing happens. Windows doesn't pop up. I've read instructions here: https://support.ledgerwallet.com/hc/en-us/articles/115005459725-Ubiq-UBQ-but they don't work for me I'm having 1.4.2 Firmware on Ledger and the Ubiq app installed through Ledger Live is 1.1.7. Inside Ubiq app the settings don't have any "browser support" option, BTW. What now? Two possible problems I can think of: Using Ledger with a browser apparently only works with Chrome and chromebased browsers (i.e. Chromium, I haven't tried Brave yet). Firefox does not work. I never tried Internet Explorer/Edge, so no idea whether they'd work. Do you use Linux? I had a bit of struggle with Ledger on Linux, because you need some library(Btchip something, via Python) to get it to work. But considering that you have Ledger Live and it connects to the device, I'd imagine missing dependencies are not such a big issue…? |

|

|

|

(…)

Sincere apologies if I was to impolite.

… alright, just for you I'll write another post here: no apologies needed, this was not addressed at you. As for the monetary reward and costs, there is hardly any of that in Byeball, the role of a witness is very different and it is much more about trustworthyness, reputation. In fact the point is, they are only witnesses because they are reputable and to continue to be recognized as such, they should not have any other interest in the ecosystem other then that. Very different from the interests of miners in a PoW-scenario. Bitcoins base premise is that you don't have to trust the miners because the system as a whole is built in a way that makes bad behavior expensive and ultimately not worth it. Anyone, regardless of reputation, is able to mine and you as a user should not need to care who confirmed your transaction. I can see how soe people might feel uncomfortable with this. What if the block was mined by a state-sponsored mining facility in North Korea (to my knowledge not happening right now, but a possible scenario)? Having real world entities who keep the system running may be the preferable choice for some. Now, this may sound silly, but can you imagine being one of twelve witnesses on a system with the marketcap and transaction throughput of Bitcoin, or even more? I would be terrified. What if there was a bug and I messed something up and someone lost a big amount of money? What if someone knocked on my door and asked me politely but "convincingly" not to confirm transactions on a certain branch of the DAG or something? We were talking about scaling in a different sense, but maybe thinking about scaling in that direction would be worth a thought or two. if history teaches us anything, we just need to use new tech to publish porn in order to make a project succeed. Oh god, does that mean the real future of crypto is Verge? I think we can both agree on that not being a good thing  Ok, now that's it I think. |

|

|

|

Oh, good, we finally arrived on the verge of ad hominems. Questioning my intelligence and all that. Great. It's funny how no one really talks about Byteball, but rather about Bitcoin… (…)

Only a different consensus mechanism then one purely based on monetary gain can solve this, otherwise the process towards total centralization is automatic.

I strongly disagree with this. If you have no built-in reward, the ones running the system will eventually make damn sure that they get rewarded in some other way. I stongly disagree with that statement too! I said purely monetary. It is not a first time by ttookk for not understanding the whole sentence, he jumped to my "not comparable" too, ignoring that i said "not DIRECTLY comparable". Attention span nowadays  But could be language issue too, don't know. Could be. Also, I'd like to hear if he/she or someone else disagrees with the more interesting part of that statement, namely that basing a consensus mechanism purely on monetary reward will automatically lead to total centralization. Just like totally free (unregulated) capitalism in a market will automatically lead to a monopoly. Yeah, maybe I was skimming over that part a bit quickly, but "purely monetary" in the strict sense doesn't exist; there is always other factors associated with it. Do you have to run hardware 24/7, do you have to stake coins/tokens etc. To answer your question, I can see the danger of centralization in Bitcoin, yes, but I think it is largely mitigated by a strong division of the different interest groups (miners, devs, users, etc.) and the gametheoretical underpinnings that give cooperation on a protocol layer little to no advantage. Let me try to rephrase the whole question I have: As tarmo888 has so condescendingly stated, Byteball operates on a very different basis than Bitcoin, so why aren't you guys looking for more comparable real-world projects? I brought up the witness voting mechanism to DPoS comparison multiple times, because I think it is far more comparable than Byteball/BTC. If you want to see how a future system that is based on voting can look like, there are a lot of DPoS systems out there in which on-chain voting as part of the consensus mechanism is a thing and their behavior can be studied. Lisk, EOS, Ark, Tron, Shift, just to name a few. …Oh, and by the way, here is something no one in the altcoin space wants to hear: technology is absolutely overrated. Things don't have to work optimally with tons of headroom, they have to work good enough. Almost all Bitcoin clones were trying the "better than BTC" narrative, be it faster blocktimes, bigger blocks, more GPU-friendly mining algos etc. Where are they now? Currently, we are seeing the same phenomenon with ETH and its competitors. If tech would actually matter as much as so many people think it does, at least Ethereum would have been dethroned by now. In the end, it doesn't matter if something is theoretically better than the competition, if no one uses it. History is full of better versions of the things that became mainstream, where simply the circumstances, like the network effect, helped decide the race. Bitcoin is more decentralized than all the other projects out there (maybe except for Ethereum in some fields), including Byteball. Bitcoin is the most secure blockchain/distributed ledger. Maybe there are implementations out there which are theoretically more secure, if they had the userbase, the development base, the miner base and all the other metrics of Bitcoin, but they don't. In the end, users will not (and should not) give two shits about whether the system they use to pay their coffee or whatever uses a blockchain or a DAG, PoW, PoS or a different consensus mechanism. Alright, but now I guess this turns too much into incoherent rambling from my side, plus, I don't like to be insulted, so that's it from my side. You have fun playing with your Byteballs. |

|

|

|

It's funny how no one really talks about Byteball, but rather about Bitcoin… (…)

Only a different consensus mechanism then one purely based on monetary gain can solve this, otherwise the process towards total centralization is automatic.

I strongly disagree with this. If you have no built-in reward, the ones running the system will eventually make damn sure that they get rewarded in some other way. |

|

|

|

You are right about incentives. But there is something else. PoW mining is an economic activity. You have capex, you have opex, almost all your profits are burned in your huge costs, and you have to care about efficiency in order to stay in the game. And in any economic activity, you have economy of scale. As your mining farm gets bigger, it becomes more efficient and stands better against the competition. You get volume discounts for miners, you will be the first in line for the new generation of miners, you can get cheaper electricity when you buy wholesale, it becomes worthwhile to relocate to a more favorable location, and you can hire the best talent in the industry. It doesn't matter if the PoW algorithm is ASICable or not, the economy of scale is universal. It might be not very important in the growing market when everyone, even a smaller and weaker miner, gets a portion of the growing pie, but nothing lasts forever and as the market matures and gets more competitive, the weaker players are darwinized, and the hash power gets concentrated in the hands of a few bigger miners. Miners, not mining pools. This looks like an end-game of any PoW based blockchain, because it has a heavy "hook" into the economy, and the economy favors scale. You can call it emergent centralization. Incidentally, Byteball moves in the opposite direction.

...Incidentally, Byteball moves in the opposite direction. Can you explain what you mean by that? I can't see how this statement is accurate. I understood it as Bitcoin becomes more and more centralized as bigger miners get more powerful. You don't know when it is happening because these few people are decentralizing their mining operations, so it would not be too obvious that they have the most power. Sounds nuts, but hashrate of Bitcoin network is steadily going up. Who are they, we don't know, but I doubt they are Venezuelans or Iranians who don't have enough money even for food, let alone buying ASICs. https://news.8btc.com/bitcoin-hashrate-increases-in-a-bear-market-investors-are-still-optimistic-in-the-long-term Byteball on the other hand, becomes more decentralized as more witness candidates and better witness candidates will join and since they are public, they can't be the same rich person. Think of this way, you kind of know who are the rich guys today, but you can't do anything about it, they rule the world and the banks and the real-estate and the companies. You can't even vote them off from lobbying to the government because they will lobby to whoever is currently in parliament. Just check what's happening in EU with upload filters, that's Facebook and Google lobbying result. With Bitcoin, you don't know who the rich guys are and you don't know how many rich guys are there, there could be 10, but there could also be only 1. And you can't do anything about it, you could fork and make their hardware useless, but you probably don't get the miners because the rich guys are becoming the majority of the miners. Byteball moves in the opposite direction, eventually there will be so many witness candidates that if they breach your trust, you replace them and if enough people feel the same, better witness gets elected. If one day, all Byteball current witnesses are replaced then your only hope that Bitcoin is more decentralized is because you think that the big miners are not the same people, but you can't be sure. Also, if some of those people become so powerful that they could pull off 51% attack, your hope is that they will not do it because it will destroy the value of their holdings, but you don't know how much they hold BTC by that time, they could have been planning for exit or fork for very long time. Hmm, dPOS actually totally makes sense. I am not saying don't invest into BTC, it will still for sure have nice returns, but it will not be nr1 forever. Ok, so still talking about Bitcoin rather than Byteball. What's up with that? Hmm, dPOS actually totally makes sense. DPoS is one of the most broken consensus mechanisms out there. |

|

|

|

There is no inherent incentive to work together as miners, and if there is, a group of miners has no in-system way to punish miners who do not behave as the group wants them to.

You are right about incentives. But there is something else. PoW mining is an economic activity. You have capex, you have opex, almost all your profits are burned in your huge costs, and you have to care about efficiency in order to stay in the game. And in any economic activity, you have economy of scale. As your mining farm gets bigger, it becomes more efficient and stands better against the competition. You get volume discounts for miners, you will be the first in line for the new generation of miners, you can get cheaper electricity when you buy wholesale, it becomes worthwhile to relocate to a more favorable location, and you can hire the best talent in the industry. It doesn't matter if the PoW algorithm is ASICable or not, the economy of scale is universal. It might be not very important in the growing market when everyone, even a smaller and weaker miner, gets a portion of the growing pie, but nothing lasts forever and as the market matures and gets more competitive, the weaker players are darwinized, and the hash power gets concentrated in the hands of a few bigger miners. Miners, not mining pools. This looks like an end-game of any PoW based blockchain, because it has a heavy "hook" into the economy, and the economy favors scale. You can call it emergent centralization. Incidentally, Byteball moves in the opposite direction. Yes, economy of scale is a thing. But why are you so focussed on talking about Bitcoin? I mean, as the inventor of Byteball (if that is the appropriate term), I would be much more interested in your views regarding Byteballs inherent problems, not Bitcoins. Like the DPoS comparison I made in the post. Do you have any thoughts on that, especially with Lisk and EOS as rather gloomy outlooks? I mean, I realize they are not comparable on a 1:1 basis, but there are similarities, don't you think? ...Incidentally, Byteball moves in the opposite direction. Can you explain what you mean by that? I can't see how this statement is accurate.

Of course, you can slice their head, and you have sucessfully decentralized a witness.

Looks like you are still trying to make fun of the phrase "decentralized witness". Maybe not the best way to say it, "independent witness" would sound better but I bet you understood it anyway. Yes, "independent witness" is way better. "Decentralized witness" is misleading. |

|

|

|

(…)

… Byteball will be more decentralized than Bitcoin because …

(…)

Byteball consensus is not directly comparable with other blockchain consensuses because Byteball is not just another Bitcoin fork.

*compares Byteball with Bitcoin* --> "Byteball isn't directly comparable with other blockchains" This doesn't add up, does it. Btw., this whole "it's more decentralized than Bitcoin" is factually wrong. I am not interested in theories about the future, but in facts. Currently, Byteball is more centralized and I doubt that spreading the 12 witnesses geographically and over different entities will not change that much. But since you seem to like theories, let's talk about that: The way Byteball selects witnesses, as well as their functions, is roughly comparable to DPoS systems. I mentioned that before, but I'll state it again. So, if you want to take a look into Byteballs future, you can take a look at DPoS projects, such as Lisk, EOS, Tron, Ark and so on. DPoS has a pretty big problem: due to its structure, it is a) not as permissionless as mining is (and to a lesser degree staking in traditional PoS; both obviously have financial barriers) and b) it invites collusion (see EOS and Lisk for prime examples), while PoW invites competition. What that means in practice is that is way more profitable for delegates/witnesses to work together and vote for each other than it is for miners, because miners are basically stuck in a big prisoners dillemma. There is no inherent incentive to work together as miners, and if there is, a group of miners has no in-system way to punish miners who do not behave as the group wants them to. Which sounds good at first glance ("they are working together, great!") is a huge problem for a trustless and permissionless system. In a trustless system, you don't want people to work together; in fact, it should not play a role whether people work together or not, at least on a protocol level that is. If the protocol layer itself cares about people working together (or not), it most likely means this layer is not as trustless/permissionless as it claims to be. |

|

|

|

(…)

Decentralized? He looks pretty "in-one-piece-ish" to me...

12 public witnesses, explained in whitepaper Yes, I am aware of that and that's exactly what I was getting at. The witnesses themselves are not decentralized; they are anything but. You have a maximum of 12 very "central" entities securing the network. And while I believe that the witnesses do not have the same amount of power as, say, EOS delegates have, it is at the very least intellectually dishonest to speak of "decentralized witnesses". Now, maybe you could actually decentralize a witness, by making it a group of entities, playing merry-go-round or something. I think this has been discussed before. TL;DR: Calling a single person a "decentralized witness" is misleading. I spare us all an inappropriate joke about certain news items and the decentralization of a human being, for obvious reasons. We could also have 100 or 1000 witnesses but the platform will become less secure if you have more witnesses. A single witness has no power at all and can easily be replaced by users. Users have the real power in the Byteball network, not witnesses. Only when 6 or more witnesses collude they can harm the network, but they still can't change anything in the past. In fact they have very limited options for abuse. This is no answer to my original point, which is "a single witness is not decentralized unless the witness consists of multiple entities". You are trying to make it your point so that you can fire off what you have said earlier, so I'll play along: Users having the real power sounds nice, but has some serious flaws. I'm too lazy to go into this, but very simplified, choosing witnesses is not much different than choosing delegates in a DPoS system. Go take a look at Lisk and EOS to see how that is going. |

|

|

|

(…)

Decentralized? He looks pretty "in-one-piece-ish" to me...

12 public witnesses, explained in whitepaper Yes, I am aware of that and that's exactly what I was getting at. The witnesses themselves are not decentralized; they are anything but. You have a maximum of 12 very "central" entities securing the network. And while I believe that the witnesses do not have the same amount of power as, say, EOS delegates have, it is at the very least intellectually dishonest to speak of "decentralized witnesses". Now, maybe you could actually decentralize a witness, by making it a group of entities, playing merry-go-round or something. I think this has been discussed before. TL;DR: Calling a single person a "decentralized witness" is misleading. I spare us all an inappropriate joke about certain news items and the decentralization of a human being, for obvious reasons. |

|

|

|

Yeah I have ODN. I just now saw that there was an exchange so I guess the I will just lose my ODN. It's a coin I've been holding awhile. Usually the exchanges do the swap for you. That sucks. Apparently the team sucks too..

They'll have to allow for redemptions in perpetuity or their coin will be doomed to fail. You can't expect people to constantly stay updated or lose their tokens... Defeats the entire purpose of typical hodling. I just checked in today for the first time in FOREVER and I see this bullshit. It might be normal and I just haven't read through enough but from the few posts I've just read it seems like we're supposed to be responsible to swap our own tokens in a specific time window.... If so this is absolutely retarded and I'm glad I sold 70% or so when they were near peak high... We will not allow redemptions in perpetuity. It wouldn't make any sense, as it's a different project altogether. It merely took ODN holders as eligible recipients as a way of making up for the failure of the ODN developers, and that's where all ties end. Also, there was no swap. It was merely a limited window where you would prove ownership of ODN, and based on that you would be eligible to receive ODIN. Now, despite the ODN developers completely failing and dropping the Obsidian project, we do still intend to carry on with Obsidian. We are currently looking at ways to get new developers interested, and are already actioning on making other developmental ideas a reality. So, when you say "dropping the project", do you mean that as in "being unable to fulfill their promises", or more like "stop working on it completely"? And what happes with the ICO funds? |

|

|

|

Decentralized? He looks pretty "in-one-piece-ish" to me... |

|

|

|

(...) Sherwood's initiative against the Elite cartel - 7 days laterSherwood pool incentivises breaking up the Elite group by giving a bonus for unvoting their members. Now, 7 days later, I wanna share my little earnings comparison. Within one week I´ve received (rounded) 21 LSK from Sherwood (4 Delegates). During the same period I would have gotten ca. 4.7 LSK from Elite (54 Delegates). This shows once more how much we're being exploited by this group whose main intention is "keeping most of the block rewards for personal gains". The Sherwood initiative is a good opportunity for a change, finally with prospects of success - Elite is clearly moving down. Just consider the latest Delegate Charts for Lisk. And/or learn more at https://medium.com/@4fryn/its-happening-lisk-elite-is-rapidly-falling-7266322a770bBy the way: Lisk reward "halving" (reward reduction from 4 to 3 LSK per new block) is almost here, around two weeks to go: http://www.liskdelegate.io/ After this happening, Sherwood will rise the share rate of their 50% delegates to 60% - which other delegate will do this? Disclaimer: I´m not a Sherwood delegate or connected to them in any way. I just wanna support their initiative, cause imho it´s the best what can happen to change this current, disreputable Lisk DPos "cartel" situation. As someone who followed the project since its ICO days, it is absolutely fascinating to see where it went. As far as I remember, pools weren't even a concept back then and the general idea was to vote for delegates who would use the rewards to fund projects working on top of Lisk. Now, being a pool seems to be downright mandatory. What I find also very interesting is that a lot of the hyped smart contract based projects, such as EOS and Tron, use variants of DPoS as their consensus mechanism, but I haven't seen a mention of Lisk anywhere. I am not completely sure whether Lisk(or Crypti, for that matter) was the first DPoS blockchain, but you'd think as the longest running chain with the biggest marketcap, it would be worth taking a look at it. I don't mean as an investment or something, just as a similar project, to see where the journey is going. |

|

|

|

Ok, with XHV being listed on Bittrex and the general rise in euphoria, maybe it's time to get this post back to the front, where people can read and respond to it. To be clear, I am genuinely interested in a fruitful discussion regarding the matter and am not trying to fud the project. Any thoughts? Good analysis.

Sketchy "stablecoins" are, at best, a stop gap product...

Also, a shitcoin with a 7 figure cap cannot be "stable"...

Looking at you KRB devs who are legit, but have taken the XHV nonsense to the next degree.

The Haven Protocol is like having a "big spec miner with very heavy bags and 150K Twitter followers in your back packet".

So, KRB are basically trying the same thing XHV does, am I getting that right? You know, I could just move on and don't even care about XHVs doomed efforts, but I think this is extremely symptomatic for the current state of crypto and altcoins. It is not that I think they are malicious or scammers or something like that. I think they started of genuinely believing that they'd find a solution for the problems at hand eventually. And now they are so deep in it that they can't really turn around and basically say "yeah, it's probably not gonna work the way we thought it would", because they'd have a bunch of angry, tikitorches and pitforks swinging "investors" looking for them then. But the fact of the matter is that not only doesn't the whole thing add up, I have yet to see or hear anything more than *crickets* regarding the issues. Like, if you apply a simple example, you'll find that XHV is way too dependent on certain conditions to actually do what it's supposed to. Let me state here that I think XHVD can work quite well for some time, given the right market conditions. Which sctually makes the whole thing even worse, because these types of systems tend not to give warning signals or anything, they just at some point flat out will stop working and people will be holding the bag. This is not a XHV specific problem, but can be seen all over the industry. How else can a sane brain rationalize the steps needed to go from BTCs approach to EOS's 21 validators? It's people getting into the market who don't realized and/or understand what Bitcoin was created for, which is, by western standarts, an absolute edge case. We are not surrounded by fiat money crashing left, right and center and for most of us, the banking system and Paypal work quite well. Bitcoin(and other blockchain projects) is primarily not supposed to be a better Paypal (fuck you, Roger), it is a system that is more resilient against catastrophic failure. And catastrophic failure is not a daily occurence, which is why people forget that it's a possibility. I could point towards parallels between this line of thought and the thought process of anti-vaxxers, but I digress. Let's look at a simple example: Let's say, XHV spikes to a marketcap of 100,000,000$. At this pricepoint, 2,000,000$ worth of XHV is offshored and 2,000,000 worth of XHVD are created. Now, the marketcap falls for whatever reason. Let's say, it drops to 10,000,000$. There is still sitting 2,000,000$ worth of XHVD offshore, but instead of being 2% of the XHV supply, they now represent 20%. If they would be onshored and XHV would be created, you'd have to deal with an instant inflation of 20%, add to that the fact that there is no way that the orderbooks on exchanges are as thick as they were at a marketcap of 100,000,000. So, there are 2,000,000$ worth of XHV going into the market, completely crashing the price. A counter argument could be that miners could not allow these 2,000,000$ to be onshored. This would effectively mean that they are not unconditionally backed with XHV, so one XHVD will not be worth one dollar, even if XHVD can be traded as its own asset. This creates another question: What exactly is the price of one XHV? Are you going with the spot price, or are you taking orderbook size into account? I guess this wouldn't work, because this would effectively mean that the more XHVD is onshored, the more XHV per XHVD needs to be created to allow the holder to cash out. Some may say that this is not how rational human beings act, that no one i their right mind would onshore their XHVD, then immediately sell their XHV in a thin market, losing money. Well, but what if they have to, maybe thy got sick and need the money right now, or something like that? Not only that, this is absolutely against the core premise of money itself: that the owner can do whatever the fuck they want with it. If you tie the value of money to a set of conditions that need to be met, this will be priced in. And this is something that is extremely dangerous when it comes to crypto in general: you can't count on the predictability of human behavior, especially in a scenario in which you have to count constantly on humans behaving rationally or predictably. Because it only needs one moment, one unexpected turn to screw this thing up big time. And at that point, you'll have a bunch of panicking holders running to the exit, either onshoring their XHVD to XHV, inflating the supply even more, or selling their XHVD at completely low, "desperate to get out" discounts. All this is amplified by the fact that XHVD is XHVs main selling point. If no one uses this mechanism, it just another Monero clone with not much else to show for it. And if a lot of people use it, it just creates a ticking time bomb. You might not even need a big swing in marketcap to make this a problem; a significant amount of XHV being offshored and then being onshored again might do the trick all by its own. Look, I'm trying hard not to come off as a hater or fudster or anything nad I probably spent way too much thought on this project. But in all honesty, too much of crypt reminds me of the underpants gnomes from South Park( https://www.youtube.com/watch?v=3zc4bGkU05o) and this is, sadly, a prime example. |

|

|

|

(…) Hi, thank you for your feedback. I have shared it with the team. Also keep in mind that there are economic incentives in the network. As for some of the new team members they include a Chief Financial Officer and a Business Analyst. More details will be provided in a Medium post. https://medium.com/mysterium-networkWe are exploring various possibilities for our community to make use of the MYST token until Mysterium VPN app goes to market. We are also exploring options for nodes to onboard on various platforms to start receiving MYST tokens. More news on this in the coming weeks, stay tuned. Honestly, if I were in your shoes, I'd think about a good strategy to phase out the MYST token completely and replace it with another, more general currency (i.e. BTC/ETH) without completely screwing over current holders. I'm not sure if such a solution exists, and it will probably give a lot of grief in the short term in any case, but in the long run, I really don't see a way around it. Otherwise, you are coupling the future of your project to a number of unknowns of which you simply don't have any influence and, even worse, which are not directly related to your base project. I mean, even if your token was the best solution (whch I still highly doubt), looking at the overall Ethereum token craze aftermath would lead me to the solution that we'll see a huge drop in interest in that particular field. And then you have to explain to a completely disillusioned and fed up public "yeah, we know most tokens suck, but we are legit, trust us!". They won't listen. And this "exploring various possibilities", come on. You are a VPN project, that's where your focus should lay. Are you seriously trying to shoehorn your token into your system, even if it is a bad fit? What if all the evidence would tell you that it was a bad idea, and commiting to it, no matter what, won't make it a good idea? Also, in addition to hiring economy people, it might be a good idea to get some outside people to take a look at what you're doing. People who don't have to toot the companies horn in order to not lose their job, you know… |

|

|

|

hi guys

does anybody knows if we can mine XVG safely at this time?

I'm awaiting a brand new Dayun Zig Z1 landing today...

I'm trying to figure out what's the best coin/pool to get the highest stable yield.

Thanks for any advice!

/E

No one can tell you if there'll be another hack or not. The thing is that the dev team has been proved untrustworthy in my eyes. What's important though is that there were already a lot of coins which were hacked and probably no one can know for sure if they have been dumped yet or not. If they have not, then the price could plunge any moment. But in either case, would you like to support a coin and a team which was so easily hacked twice? Are you happy with the way they handled it? I had expected them to notice the problem immediately and rollback the blockchain and the hacked coins. So... your choice. I see mate, looks that the only reasonable choice it's to stay away! With my brand new DaYun Zig Z1 I'm currently testing NiceHash and some multi-pools such as Zerg, that still include XVG. Thanks for your worthy point of view! /E Well, I don't know, if it's the most profitable currency to mine, you could mine it and sell it as quickly as possible. XVG is a pretty liquid market and even while the attacks were occuring, it didn't drop by as much as it could have. I just wouldn't let it lie around for too long in the hope of it gaining more value over time. But I think for miners, this is generally good advise, especially when they are not the greatest of traders. I agree that it's a shitcoin with no real substance and if you are ideologically involved in crypto and buy into the whole new paradigm thing, you should stay the hell away from it, but if you're ok with making an extra buck or two and it's the best choice, why not. |

|

|

|

|

, this is a modus how to get them shut up their mouth

, this is a modus how to get them shut up their mouth