South Korean authorities are divided whether bitcoins from criminal proceeds should be confiscated. In a criminal case involving 216 bitcoins, the court previously ruled that the digital currency cannot be confiscated. However, the prosecutor is now appealing to the court to overturn that decision and allow the forfeiture of the bitcoins, now worth billions of won. Prosecutor Seeks to Confiscate BitcoinsFollowing the ruling in September by South Korea’s Suwon District Court that found the confiscation of bitcoins in a criminal case to be inappropriate, the case prosecutor has appealed to the court to overturn that decision, SBS reported this week. The prosecutor believes that all criminal proceeds should be forfeited. The case began when a web developer was indicted in April for allegedly distributing 235,000 instances of illegal pornographic material on adult websites over three years, as news.Bitcoin.com previously reported. Ahn, 33, operated adult websites with 1.2 million customers. The prosecutor seized his cash in the amount of 1.46 billion won as well as 216 bitcoins held in a wallet at an exchange. Since Ahn’s arrest, the 500 million won worth of bitcoins have appreciated to 4.25 billion won (about $4 million). Court Previously Ruled – Inappropriate to Confiscate BitcoinsDuring the trial held in September, the prosecutor filed a lawsuit against Ahn and his family for 1.46 billion won in cash and the forfeiture of his 216 bitcoins. The Suwon District Court sentenced Ahn to one year and six months in prison. However, the judge decided to only collect 340 million won out of the 1.46 billion cash and threw out the confiscated bitcoins. He believes that 340 million won is the extent of the direct profits generated from Ahn’s pornography operation. As for the digital currency, the publication conveyed the judge’s decision: "Not only is it difficult to do this, but it is [also] not appropriate to confiscate bitcoins because they are in the form of electronic files without physical entities, unlike cash." The news outlet explained that the ruling which states that bitcoin is “not appropriate for confiscation” was based on Article 10 of the Concealed Revenue Regulation Act. If the prosecutor is successful at keeping Ahn’s bitcoins, they will be transferred to the state treasury and will be auctioned, the publication detailed, adding that “the second sentencing [for this case is] scheduled for January 8th.” https://news.bitcoin.com/south-korean-prosecutor-confiscate-bitcoins-criminal-proceeds/ |

|

|

|

Bitcoin was huge in 2017 as Bitcoin Google searches came in at number two on Google Trend’s list for global news. No matter how you slice it, 2017 was the year of Bitcoin and cryptocurrency in general. As the daddy of all crypto began to shoot up in value, people began to take notice. Headlines were made again and again as another price barrier was broken. So, how hot was the virtual currency in 2017? Google Trends released their list of the top trending topics for 2017, and Bitcoin Google searches came in at number two on their global news list. PEOPLE INTERESTED IN BITCOIN It seemed that every time you turned around, people and media were talking about Bitcoin. On the economic front, many financial institutions were very negative towards cryptocurrency, even though they were intrigued by the possibilities and applications of blockchain technology. Yet as the year wore on, more and more banks, investment companies, and Wall Street firms began to become an active part of the crypto world. It appears that the main driver of interest in Bitcoin was its increasing jump in price. Looking at the Google Trends page for the cryptocurrency, you can see (image shown below) that searches were mostly steady throughout the year but began to climb in August when the price began to really go up. Then searches exploded in late November as Bitcoin went from $8,000 to $10,000 and then much, much higher. WE’RE NUMBER TWO! WAIT…WHO’S NUMBER ONE? Bitcoin came in at an extremely respectable number two on the Google Trends global news list. It beat out topics like the solar eclipse, North Korea, and the horrific Las Vegas shooting that left 58 innocent people dead and a staggering 546 injured. So what beat out Bitcoin for the top spot for global news in 2017? The answer to that is Hurricane Irma. This makes perfect sense as the Category 5 hurricane wreaked so much havoc, inflicting $66.77 billion in damages and killing 134 people. Places like Puerto Rico, Cuba, Florida, and Saint Martin lost power for weeks (and Puerto Rico is still recovering). Personally, I was hit by the hurricane and lost power for over a week. As we stagger towards the end of the year, Bitcoin continues to make the news on a daily basis. The new narrative is that the cryptocurrency is in hot water due to its recent slump, which is nonsense as Bitcoin has always had a recovery after a major drop as the market corrects itself. Then there are stories about people forgetting their keys to their wallets, causing them to take desperate measures, such as hypnotism. Plus, it seems each week brings another exchange getting hacked or some government or business being saddled with ransomware demands for bitcoins. It’ll be fascinating to see what lies ahead for Bitcoin in the coming year. http://bitcoinist.com/bitcoin-google-searches-are-number-two-for-2017-global-news/ |

|

|

|

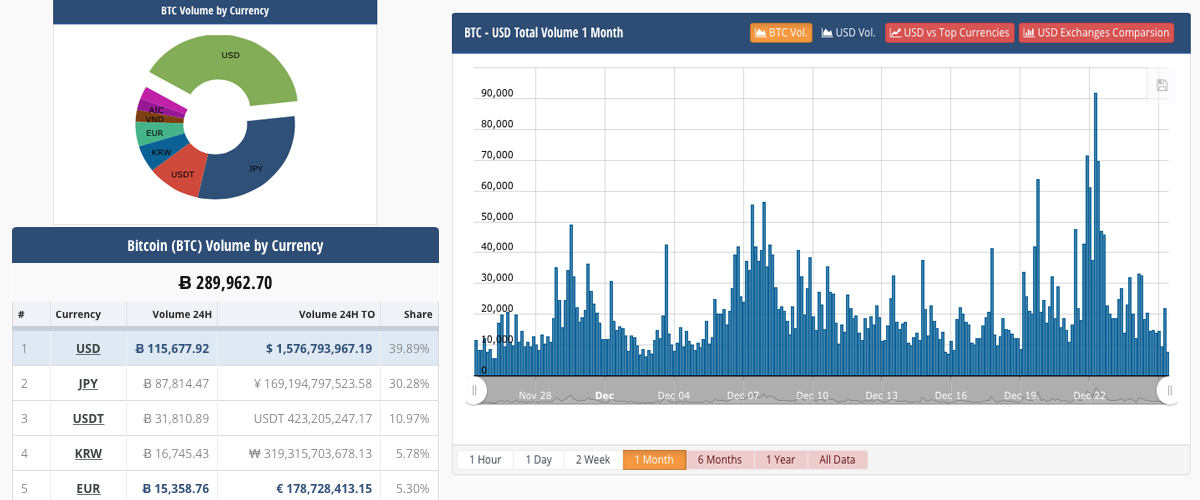

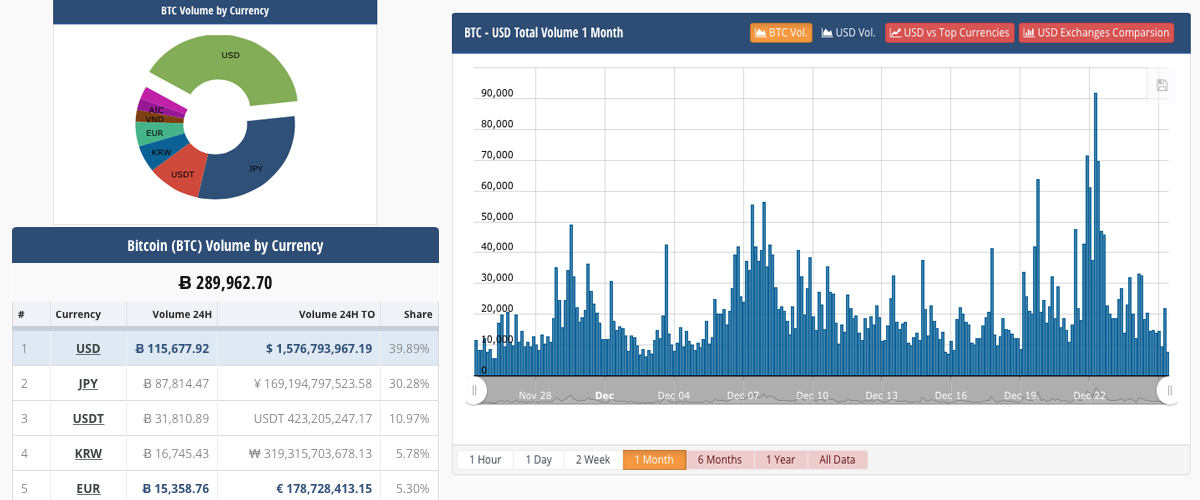

The price of bitcoin has dropped considerably since it touched its all-time high of $19,600 per BTC on December 17. Since then markets have been quite bearish across the board, leading to lows in the $11K zone on December 22. Bitcoin markets have rebounded since then, and the price per BTC across global exchanges has been moving sideways for the past 72 hours. Moving Sideways Over the Holidays After the Big DipBitcoin markets have been extremely bearish leading up to Christmas day on December 25, 2017. At the moment the price of bitcoin core (BTC) is hovering between $14,000-14,300 on many trading platforms worldwide. However, there has been some significant price spreads between a few exchanges leading people to try and obtain some arbitrage. For instance the price per BTC on GDAX is currently $14,400, and at times the price has been $200-400 higher over the past three days. Bitcoin trade volume worldwide for a holiday is pretty decent as $10Bn worth of BTC has been swapped in the past 24-hours. Visiting a few Telegram channels like the Whale Pool, or the Whale Club people can see that traders are still very active during the holidays.  The top five exchanges trading the most BTC include Bitfinex, Bithumb, Binance, GDAX, and Okex. Right now the USD is the dominating currency traded with bitcoin core, and leads by 39 percent. The U.S. dollar’s lead is followed by the Japanese yen, tether (USDT), the won, and the euro. Bitcoin core is also representing over 47 percent of the bitcoin cash (BCH) trades today, and BCH/BTC trades are the top pairs on Shapeshift. BTC dominance is very low right now hovering around 42 percent with a market capitalization of around $234Bn. Continue reading > https://news.bitcoin.com/markets-update-bitcoin-price-moves-sideways-during-the-holiday-lull/ |

|

|

|

"Be fearful when others are greedy and be greedy when others are fearful." —Warren Buffett Until Dec. 22, the world of cryptocurrency felt positively 'to the moon.' It seemed like everywhere you looked, your favorite cryptocurrency was hitting new all-time highs with ease, breaking any barrier set before it. In fact, according to data from OnChainFX (reported by Coindesk): in the past four days, all of the top-20 cryptocurrencies have hit all-time highs. But yesterday, a steep drop-off in Bitcoin—falling as low as $12.5K—precipitated a drop off among essentially all other major cryptocurrencies. Testament to the power of Bitcoin, this amounted to more than a 20 percent decrease in the entire global cryptocurrency market cap (currently operating at $478B, down from $611B). Through the night we've seen signs of a possible upswing—but many are left wondering what could have caused such a massive drop. Only time will tell, but in the meantime, here are 6 possible explanations for the day's dip. 1. 'Tis The Season To Be SpendingIt might seem comical when you first hear it, but with major holidays like Christmas, Hanukkah, Kwanzaa, and New Year's planted right in the same month stretch—the end of the year is a notoriously bad time for savings accounts and investments, as many seek to withdraw yearly gains. Setting aside speculation and the general (deserved) fervor around blockchain technology, few cryptocurrencies currently serve a purpose that benefits the average consumer more than cash does. With a few exceptions, cryptocurrencies are more difficult to use for everyday transactions, meaning many in the market are there for speculative investment. Speculative buyers do not necessarily equate to market stability—as many will seek to cash out on early gains rather than 'hodl' through the waves of market volatility. The end of the year marks the time when these investors would be most likely to convert their winnings to cash, and yesterday—conveniently just a few days before Christmas—might have been the day that experienced the greatest impact of this behavior.

2. Altcoin OverloadAs mentioned above, following the initial surge in Bitcoin, most of the major gains we've seen in cryptocurrency this month have been in altcoins like Cardano, Qtum, Ripple, TRON, and Verge. This has undoubtedly felt amazing to the investors motivated to leave the safe haven of Coinbase for the further reaches of the other exchanges—one might even say too good to be true. In the process of diverting funds from BTC, enthusiastic crypto traders may have also temporarily destabilized the Bitcoin market. If Bitcoin were just another coin, that would be all well and good, but Bitcoin is the "gold" of the cryptocurrency world—the standard by which all other coins are measured. So whether we like it or not, every altcoin is hedged (in some way) along Bitcoin's success—or at a minimum for the foreseeable future, its maintenance.

3. Bitcoin Cash Confusion on CoinbaseOn Tuesday, Coinbase announced it would support buying, selling, and trading Bitcoin Cash (BCH) on its platform. Since the August fork, there has been major community in-fighting among the BCH and BTC camps regarding which is the "true" Bitcoin. Point being: energy is high around this discussion. Many have speculated that BCH would end up on Coinbase, but even conservative estimates in crypto circles were January 2018. So it's no surprise that the noticeable and seemingly out-of-the-blue gains made in BCH in the days and hours leading up to the announcement caused some on social media to cry "insider trading." This resulted in Coinbase shutting down BCH trading within minutes to launch an internal probe into the possibility that insider trading occurred. By the next afternoon, BCH was in full force again on Coinbase. But the impact might have been deeper felt than we initially realized. Many have at best a passing understanding of the differences between BTC and BCH, and seeing BTC prices drop so sharply when BCH jumped onto the scene—as well as BCH's perceived volatility—might have left a larger stain in their minds on the broader concept of cryptocurrency. And even for those who didn't pay too much attention to the hullabaloo, it might have just amounted to extra, unwanted confusion to keep them from participating further. 4. Market ManipulationWe also have to entertain the possibility that foul play is afoot. What would that look like? A recent report in Bloomberg revealed that a group of 1000 investors own 40 percent of all Bitcoin. This means that—if even some among that number were acting in concert, they would have the potential to manipulate the market to their whim. These "whales"—investors, hedge funds, and otherwise with enough stake in the crypto market to tip the scale—could easily have engaged in "painting the tape" (creating the appearance of high transaction volume by simply selling and re-selling back-and-forth on small margins) to inflate the value of Bitcoin. Why would they do that? So that they could sell off at the highest possible price before inducing a crash by selling off mass amounts of their Bitcoin stock. Of course, this can only work so far unless others begin to take notice and sell their own Bitcoin off; that's where the influx of new traders comes into play. By essentially scaring fair-weather fans with FUD ("fear, uncertainty, and doubt) who started buying in on the crypto hype without much study of the market, whales stand to make off like bandits. How? By selling off at record highs, dropping the market to record lows, then buying back in. This is made even more appealing with the launch of bitcoin futures trading on Cboe and CME, which sets these players up to short the market. 5. Hacking & RegulationEarlier this month the SEC halted PlexCoin on charges of being an ICO scam, and this week it reportedly suspended trading in The Crypto Company over "concerns regarding the accuracy and adequacy of information" and stock manipulation. Meanwhile, Youbit, the popular South Korean exchange, announced its closure on Dec. 20 after being hacked (purportedly by North Korea), losing 17 percent of all assets. As an added note, the 'insane' energy costs associated with Bitcoin mining continue to garner negative press as we move into the new year. There is a chance that the general concern created in these developments has scared off potential investors and even caused existing participants to cut their losses. 6. The Bubble Was Real & Crypto Winter Is ComingOf course, there could be some truth to all of the above, and together are amassing to the bubble pop that many have been warning users about for months. The argument against this being a sign of crypto winter is that we've seen this degree of volatility in Bitcoin all throughout 2017 (and even prior). The difference now is that the sheer volume of players is a full exponent greater than it's ever been—and many new participants have no experience navigating these types of markets, making them more sensitive to the down moments. If we are entering the crypto winter, the past eight years of Bitcoin has revealed two things: 1) that Bitcoin always bounces back—and with it, a whole roster of cryptocurrencies (with inevitable casualties along the way), and 2) the demand for decentralized currency and blockchain technology is here to stay. Some might urge you to cut your losses now before the supposed winter blusters in harder. Others might say it's just another hump in the road. Editor’s Note & Disclosure: The author participates in cryptocurrency markets. Neither the author nor Forbes endorses participation in any token sale or cryptocurrency investment, all of which have significant inherent risk. Seek advice from a financial advisor as well as do your own due diligence before considering investment. https://www.forbes.com/sites/jessedamiani/2017/12/22/6-possible-explanations-why-bitcoin-and-cryptocurrency-prices-dropped-so-low-yesterday/2/#21d45ce74f68 |

|

|

|

Summary - As a currency, bitcoin faces major problems with its transaction speed, which if left unaddressed can limit bitcoin's potential. - The Lightning Network will address bitcoin's scalability issues, allowing for instant payments with low fees. - A successful implementation improves the long term outlook of bitcoin's valuation. Bitcoin's Scalability ProblemsMany people believe that bitcoin is the future of our financial system. But there is a big issue standing in the way of this goal, and that is scalability. Currently, bitcoin's network can only process a maximum of 10 transactions per second. In reality, the network only handles around 4 to 5 transactions per second, as 10 transactions per second is only a theoretical maximum under optimal conditions. Compare bitcoin's limitations to VISA or PayPal. Visa handles on average around 2,000 transactions per second, with a daily peak rate of 4,000 transactions per second. VISA has a peak capacity of 56,000 transactions per second; however they never actually use more than a third of this even during peak shopping periods. PayPal handles on average 10 million transactions per day for an average of 115 transactions per second. As a result of bitcoin's relatively low maximum transaction speed, bitcoin keeps a large backlog of unconfirmed transactions, leading to a multitude of problems, including long transaction confirmation times and high transaction fees. Clearly the main blockchain isn't very scalable. But as it turns out, it doesn't have to be. The community has come up with a new technique called the Lightning Network to solve the scalability issues. The key idea is that small and everyday transactions don't have to be stored on the main blockchain. This bypasses the 10 transaction per second limit and is also called the off-chain approach. Lightning NetworkThe Lightning Network is a proposed solution to the bitcoin scalability problem. The network would use an off-chain protocol and is currently under development. It would feature a P2P system for making micropayments of digital cryptocurrency through a scale-free network of bidirectional payment channels without delegating custody of funds or trust to third parties. Continue reading >> https://seekingalpha.com/article/4133695-lightning-network-means-future-bitcoin |

|

|

|

After hitting levels above $20,000 per coin just last week, Bitcoin saw a massive sell-off as fears of a bubble began to loom large. The price reached an all time high of $20,078 on December 17, but saw an approximate 40% drop in just three days, once dipping to as low as $11,833 on December 22. However, in spite of fears, the market has rebounded again, and is now stabilizing above $14,000. At press time, Bitcoin was trading at an average of $15,147, according to Coinmarketcap. The recovery so far seems to have justified the approach of HODLers (‘Hold On for Dear Life’) who refuse to sell in times of market fear. Varying responses Nevertheless, the drop-off saw hedge-fund manager Mike Novogratz delay the issuing of his hedge-fund, citing the substantial swings in the market as well as potential conflicts of interest as the cause. On the contrary, however, Kain Warwick, Founder and CEO of Havven, an asset-backed cryptocurrency, made it clear that the rebound should have been expected, telling Cointelegraph: “Bitcoin rebounded because there is significant support at psychological levels like 10k, so once the price stopped falling people came in to buy the dip.” https://cointelegraph.com/news/after-losing-40-of-value-bitcoin-bounces-above-14000 |

|

|

|

Do you sleep easy at night, knowing how many thieves would love to steal your bitcoin? At this very moment, hackers are probing your cryptocurrency exchange for weaknesses. They’re gathering information about you – where you live, your pet’s name, your favorite football team – with a view to social engineering. They’re crafting malware laden emails with your name on and prepping to port your phone number to a different handset while you sleep. Concerned about the security of your bitcoins? Sounds like you need a storage solution for the ultra-paranoid. Keep Calm and Lock It DownProvided your bitcoin is stored in a wallet that you – and you only – hold the private keys to, your coins are safe from all online attack vectors. The one thing this setup can’t protect you from is real world risks: threats from thieves, brandishing a gun to your head, threats from fire and flood damage, and threats from yourself. The biggest cause of lost coins isn’t third parties – it’s you. The tales of lost hardware wallets, overwritten hard drives, and forgotten seeds don’t need retelling. Just as human error – usually stolen or weak passwords – is the cause of most successful cyber attacks, it’s the same when it comes to lost or stolen bitcoins. Any private key-based solution needs to address the risk of human error. Otherwise, even the fanciest of hardware wallets and strongest of safes can be rendered redundant. For individuals in possession of life-changing amounts of bitcoin – or who believe that their coins will one day be worth a life-changing amount – the following methods guarantee a good night’s sleep. There are downsides to resorting to such extremities of course: in the event of a major bitcoin crash, the rest of the world will have cashed out while you’re still taping together strips of paper wallets. If you’re contemplating drastic measures to safeguard your cryptocurrency holdings, however, you presumably have faith in bitcoin’s long-term prospects. Create a TimelockFor long-term investors, entering bitcoins into a time-locked wallet is a surefire way to ensure they can’t be accessed anytime soon. With smart contract protocol Ivy providing a framework for utilizing the Bitcoin Script assembly language, it will soon be a lot easier to create time-locked wallets. Set the date far enough in the future and you needn’t concern yourself with the wallet being prematurely opened – by you or anyone else. For now, implementing timelocks is a feature best left to the experts. Coinb.in is one such service. As the site explains: “Use OP_CHECKLOCKTIMEVERIFY (OP_HODL) to create a time locked address where the funds are unspendable until a set date and time has passed”. All of the site’s code can be audited on Github and the site doesn’t hold your private keys. Use MultisigTimelocks are all well and good, but what if you would like to access your bitcoins at some point in the future, you’re just not sure when? Multisig is the preferred solution for enterprises in charge of substantial bitcoin holdings. Because the private keys of two of three individuals is generally required, multisig makes it impossible for a rogue employee to drain the wallet. For personal use, a multisig wallet could involve one of the keys being entrusted to an attorney or other trusted entity. Don’t mandate that every signatory’s key must be used to unlock the wallet though, as if one person loses their key you’re screwed. Coinb.in, once again, is an option: it will allow you to specify as many as 15 keyholders per wallet, and to state how many keys should be required to unlock it. Other providers of multisig wallets include Armory, Electrum, Coinbase, and Bitgo.

Use a Cryptocurrency Custodial VaultA number of companies have launched ultra-secure cold storage solutions. You’ll need to have at least $100,000 in digital assets to enter into Coinbase’s, for instance, and it’ll cost you a premium. Still, for those who would sleep easier offloading responsibility for their coins to a fully insured third party, a custodial vault is about as good as it gets. Swiss ones cut into a mountainside are particularly well regarded. Xapo’s is a decommissioned Swiss military bunker that can survive a nuclear blast. In its core lies a “cold room”, protected by steel slabs that act as a Faraday cage to repel electromagnetic pulse attacks. Set Up Your Own VaultWhy pay over the odds for someone else to slap a bitcoin logo on their bank vault when you could visit your local bank and put your private key in a safety deposit box? Better still, store your key at several banks, just to be sure. While there’s nothing to stop you from storing your wallet seed in a safe in your own house, this runs the risk of criminals forcing you to open it. Far better to let a bank deal with the danger. Split Your Paper Wallet Into PartsA variation of number four, this technique calls for cutting your private key into parts and then storing them in numerous vaults, including at least two copies of each pars to ensure redundancy. Using multiple paper wallets is essentially multisig for people who don’t trust other people. If you’re worried that the paper itself could be damaged and rendered illegible, have your keys etched into metal. That’s a job you’ll want to do yourself or outsource to multiple etchers, to ensure that no one gets to read your entire private key. If the foregoing options aren’t robust enough for your liking, there’s nothing to stop you from combining them all. A time-locked multisig paper wallet split into sections and distributed in banks across multiple continents? Now that’s just getting silly. In reality, a paper or hardware wallet with the private key backed up in a safe place off-site should be enough for most people. Still, if the safety of your cryptocurrency holdings is causing you worry, up your opsec and start sleeping easy. https://news.bitcoin.com/five-ways-ultra-paranoid-store-bitcoin/ |

|

|

|

Cryptocurrency Market Rebounds Within 24 Hours, Ethereum, Bitcoin Cash, Litecoin Rally Within merely 24 hours after experiencing a major correction during which every single cryptocurrency in the market plunged in value, the cryptocurrency market has completely recovered. Speedy RecoveryThe market valuation of cryptocurrencies surged from $480 billion to nearly $600 billion, to the point before the correction on December 21. Today, on December 23, all cryptocurrencies in the market from bitcoin to the top 100 cryptocurrency have surged in value. Specifically, Bitcoin Cash recorded the largest gain in the top 20 cryptocurrencies with a 52 percent overnight price increase. Others including bitcoin, Ethereum, Ripple, Litecoin, Cardano, and Dash have all increased by more than 20 percent. On December 22, prior to the recovery, several analysts including Alan Silbert and Robert Reid noted that throughout 2017, the price and market valuation of bitcoin have fallen by more than 30 percent on six occasion. After each correction, bitcoin recorded a significant gain in value. Cryptocurrencies with the biggest daily gains in the top 20 rankings are Verge, Bitcoin Cash, Monero, with 176 percent, 52 percent, and 41 percent increase in value respectively. Max Keiser, a highly regarded financial analyst and bitcoin expert, also noted that with the current momentum, bitcoin will initiate a new rally and surpass through $20,000 with ease in the short-term. Sharing the chart below, which has been an accurate demonstration of the bitcoin price and the value of almost every cryptocurrency in the market to date, Keiser stated, “this is still true. This chart pattern will take us to $100,000 #bitcoin. Fiat currency is a barbarous relic,” expressing his optimism in regards to both the short-term and long-term price trend of bitcoin. Where Does Cryptocurrency Market Go From HereFor many months, analysts have expected the price of bitcoin and the valuation of the cryptocurrency market to surge during the holiday season, around Christmas and new years. With Christmas Eve approaching, analysts believe that the price of cryptocurrencies will increase rapidly as new relatives, friends, and family members become introduced to bitcoin and a new asset class in cryptocurrencies. Already, with less than 24 hours left to Christmas Eve, the cryptocurrency market has demonstrated a speedy recovery and a rapid surge in valuation. From December 25 to January 1, analysts see the valuation of cryptocurrencies rising further. In several leading markets such as Japan and South Korea, investors have already started to invest in cryptocurrencies with high premiums. On Bithumb, South Korea’s leading cryptocurrency exchange, bitcoin price is at $17,600 and the price of Bitcoin Cash is nearing $4,000. In the upcoming days, the cryptocurrency market will likely demonstrate optimistic signs of growth and recovery, as the demand for bitcoin and other leading cryptocurrencies continue to surge rapidly. Fundstrat’s Tom Lee stated: “We are buyers of bitcoin on this pullback. The intrinsic/fundamental value of bitcoin has risen in the past month given the surge of new wallets and hence, explains the rise in our short-term target price.” https://www.ccn.com/cryptocurrency-market-rebounds-within-24-hours-ethereum-bitcoin-cash-litecoin-rally/ |

|

|

|

With Bitcoin and its smaller siblings gaining so much momentum in 2017, governments and central banks now have little choice but to acknowledge that cryptocurrencies are here to stay. Volatility is still a major setback, especially with Bitcoin, which has swung by $8,000 in just seven days. Of banks and cryptocurrency, Peter Smith, CEO of Blockchain, told CNBC in an interview last week: "This year will be the first year we start to see central banks start to hold digital currencies as part of their balance sheet." Smith stated that central banks would likely buy Bitcoin and Ethereum as part of their reserves, just as they do with gold and foreign currency. The rise of Bitcoin as an asset would mean that some major financial institutions would have to start holding it. Smith went on to say: "Bitcoin is already a top 30 currency by supply, and this trend, and pressure to hold digital currency as part of reserves will only accelerate as the price rises." DIGITAL GOLD There is growing opinion among bankers that cryptocurrencies will be held by central banks in order to be better prepared for shocks to the markets. According to Eugene Etsebeth, a former central banker with the South African Reserve Bank: "In 2018, G-7 central banks will witness bitcoin and other cryptocurrencies becoming the biggest international currency by market capitalization. This event, together with the global nature of cryptocurrencies with 24/7 trading access, will make it intuitive to own cryptocurrencies as they become a de-facto investment as part of a central bank’s investment tranche." He added that digital currencies would also facilitate international trade. STATE COINS It has also been widely suggested that nations would have to consider issuing their own digital state coins, or stablecoins, which would be pegged to local currency. A number of central banks have already started to investigate the possibility of a state-issued cryptocurrency. Banks in the United Arab Emirates and Saudi Arabia announced a partnership to issue a cryptocurrency for cross-border trade last week. The People’s Bank of China also hinted that it would be launching a new state virtual currency in the near future. European Central Bank President Mario Draghi remains skeptical and said cryptocurrencies are not “mature” enough to be considered for regulation yet. He went on to say: "With anything that’s new, people have great expectations and also great uncertainty. Right now we think that especially as far as bitcoins and cryptocurrencies are concerned, we don’t think the technology is mature for our consideration." However it is only a matter of time before cryptocurrencies are considered mature enough by bankers and governments alike. http://bitcoinist.com/central-banks-hold-cryptocurrencies-2018/ |

|

|

|

New cryptocurrency laws are expected to be introduced for official consideration to the Russia's national legislature on Dec. 28, according to a senior government official. Russian media sources RIA and TASS cited comments from lawmaker Anatoly Aksakov, who chairs the State Duma's financial markets committee, that the new rules – which will reportedly formalize rules around the creation and exchange of cryptocurrencies like bitcoin – are likely to be cleared by early next year. "I expect that the adoption of the draft law on [cryptocurrencies] will be in March... The problem is that we already have a lot of people who acquire [cryptocurrencies] and they are deceived, we need to give people the opportunity to work legally with it, to protect them as much as possible," Aksakov was quoted as saying by RIA. The comments all but confirm that Russia won't finalize the bill by the end of the year, as Aksakov had previously suggested. In September, the senior lawmaker said he believed the work could be wrapped up before winter. The measure has faced a series of delays due, in part, to conflicting visions over the scope of the proposed laws. The expected move to submit the bill also comes months after Russian President Vladimir Putin ordered new regulations to be developed around cryptocurrencies and blockchain, including rules specifically aimed at initial coin offerings (ICOs). As quoted by TASS, Aksakov cited Putin's directives when speaking about the work that is expected to play out over the coming weeks and months. "We have a deadline designated by the president, and after a week there will be a presentation of the bill that will start to be debated," he told reporters. https://www.coindesk.com/official-russia-to-introduce-cryptocurrency-regulation-bill-next-week/ |

|

|

|

The Year of Bitcoin continues to get more interesting, as reports surfaced today that legacy bank Goldman Sachs will open a cryptocurrency trading desk by mid 2018. It’s a momentous occasion for many reasons, but not least of which is the influence the bank carries in terms of respect within the industry.

Goldman Sachs Sees Summer of Bitcoin 2018Bloomberg reports that banking institution Goldman Sachs is set to launch a cryptocurrency trading desk by July of next year. Goldman is mainstream within the mainstream, topped off with some extra mainstream in case anyone was wondering about its mainstream cred. It just doesn’t get any more American banking than the one 150 year old institution. It’s an integral part of any US weighted financial average, including the Dow Jones Industrial Average (DJIA) and the S&P 100 and 500 components. It boasts over 35 billion USD in revenue and has enough employees to nearly sell out a professional baseball stadium. Take a job at Goldman and there’s a chance you just might end up running Europe’s central bank (Mario Draghi), landing the printing press at the US Treasury (Steven Mnuchin), heading the Bank of England (Mark Carney), or become the prime minister of Australia (Malcolm Turnbull). And should Goldman ever have financial trouble, not to worry: taxpayers will float a cool ten billion dollars in relief just as usual because, well, it’s Goldman! According to the report, Goldman is “still trying to work out security issues as well as how it would hold, or custody, the assets.” Goldman Had Been HintingBitcoin has been an increasing topic of conversation at the firm. This month alone, the company hosted a Talks at GS program, and the panel resolution read: “The Evolution of Bitcoin.” The talk included Coin Center’s Jerry Brito and the CEO of 21 Inc, Balaji Srinivasan. They discussed “public policy issues for digital currency, [and] the evolution of Bitcoin and its long-term potential.” And more recently its podcast, Exchanges at Goldman Sachs, episode 80, carried the title: “Tax Reform, Bitcoin, and the Year Ahead for Financials.” Goldman “is now assembling a team in New York,” Bloomberg continued. “While the bank hasn’t made a decision where to house the desk, one possibility is that it will operate within the fixed-income, currencies and commodities unit’s systematic trading function, which conducts transactions electronically,” the report paraphrases two unnamed sources as having said. Its CEO, Lloyd Blankfein, has played possum with bitcoin for months now. He first tweeted a mild defense of the world’s most popular cryptocurrency back in October, but of late has been heaping skepticism on bitcoin’s long-term viability. His leadership team also put heavy restrictions on clearing bitcoin futures as CME and Cboe made contract markets. Whatever the case, 2018, with Nasdaq entering the bitcoin futures market along with Cantor Fitzgerald, and now Goldman open to the decentralized currency, might just make this next year as interesting as 2017 for enthusiasts. https://news.bitcoin.com/goldman-sachs-goes-crypto/ |

|

|

|

The European Commission – the executive arm of the European Union – is keeping a close eye on bitcoin markets and is reportedly urging EU banking and markets watchdogs to issue risk warnings to investors. In statements at a news conference on Wednesday, European Commission vice president Valdis Dombrovskis expressed a ‘concerned’ take on the volatility in bitcoin prices. The official – effectively the European Union’s financial regulation chief as VP in charge of financial stability, financial services and capital markets union, – revealed bitcoin had the authority’s undivided attention. In remarks reported by Reuters, he stated: "In recent weeks, bitcoin has our heightened attention. There are clear risks for investors and consumers associated with price volatility, including the risk of complete loss of investment, operational and security failures, market manipulation and liability gaps." A report by the Financial Times reveals the official doing more than offering remarks on a public forum, pointing to a letter written to banking and markets watchdogs in the European Union urging them to warn bitcoin adopters of the risks in investing in the cryptocurrencies. Specifically, Dombrovskis’ letter was sent to the heads of EU’s three supervisory agencies, namely: the European Banking Authority (EBA); the European Insurance and Occupational Pensions Authority (EIOPA) and; the European Securities and Markets Authority (ESMA). In further remarks to reporters, Dombrovskis added: "Let me remind you, the value of bitcoin is not guaranteed by any country or issuer… Investors should realise that it can drop at any moment. And virtual currencies like bitcoin are not really currencies." As reported previously, the European Commission first proposed strict rules for the use of cryptocurrencies in July 2016, driving legislation to include digital currency exchanges and wallet providers under the purview of the purview of the Anti-Money Laundering Directive (AMLD). The executive body also proposed a centralized database to store bitcoin and cryptocurrency adopters’ identities. https://www.ccn.com/bitcoin-heightened-attention-european-commission/ |

|

|

|

The Philippine central bank, Bangko Sentral ng Pilipinas (BSP) and the country’s regulators are planning to create regulatory standards for digital assets like bitcoin. This week the BSP Deputy Governor, Chuchi Fonacier, said the bank is working with the Securities and Exchange Commission in order to create regulatory guidelines for Philippine businesses and exchanges who deal with cryptocurrencies. Due to Recent Developments the Philippines Central Bank is Considering Regulatory Standards for BitcoinThe central bank based in the Philippines is looking to regulate bitcoin according to recent reports from the GMA Network. Chuchi Fonacier, the bank’s Deputy Governor, says the institution has already been working with the SEC concerning ICO’s and digital exchange licensure, but now they are also considering the regulation of bitcoin. “Currently, we are focusing on the exchanges, but who knows — With recent developments, we might consider regulating bitcoin,” explains Fonacier in an interview. "This is in coordination with the SEC, if ever there would be a shift to that – if there is this kind of approach, there is investment already. It would not just be BSP, it’s also a collaboration with the SEC." Only Virtual Currencies Converting to Fiat Will Require OversightThe bank has started to notice the millions of dollars worth of bitcoin traded and converted to national currencies in the Philippines. So far the BSP has been reviewing bitcoin and cryptocurrency exchange applications for licensure in the country. So far 12 businesses applied for the regulatory approval, and just recently five more companies were added to the list of applicants. Two trading platforms have been approved by the BSP: Coins.ph, and Rebittance. This past November BSP Governor, Nestor Espenilla, talked about Initial Coin Offering (ICO) regulation and legalizing bitcoin as a security. “The [BSP] has an open-minded approach to fintech (financial technology). This means that we take a very active role in ensuring that our policies provide opportunities for innovation,” explained Espenilla at the time. The latest drafted regulatory guidelines suggest the bank will only regulate businesses that convert virtual currencies to USD or alternative government-issued currencies. https://news.bitcoin.com/the-philippines-central-bank-considers-regulation-standards-for-bitcoin/ |

|

|

|

The USA Luge team is making history but not in winning Olympic medals. They are the first US Olympic team to accept Bitcoin donations. The 2018 Winter Olympics is almost here. Beginning on February 9th, 2018, hopeful athletes from all over the world will descend upon PyeongChang, South Korea, dreaming of Olympic glory. One such group of athletes is the USA Luge team, who are already making history, but not in the way you think. The Luge team is the first US Olympic team to accept Bitcoin as a donation. GOING FOR THE GOLD WITH A LITTLE HELP FROM BITCOINThe 2018 USA Luge team is composed of ten individuals: seven men and three women. Historically, luge has not been one of the more popular Olympic sports for American viewers. That crown currently belongs to figure skating, with hockey a distant second. This means that the USA Luge team is often in need of funds. While the team does have some sponsors, every little bit counts quite a bit. Which is why the team is turning to Bitcoin for help. Gordy Sheer, the USA Luge marketing director and silver medalist in the 1998 Olympic doubles, sees some parallels between crypto users and lugers. He says: "You know, we hear a lot of jokes about lugers being crazy, and people don’t know why we do it. But luge is something that gets into your blood and transforms your life…and the bitcoiners we’ve met know exactly what it’s like to be all in on something that the world doesn’t appreciate yet. We’ve looked at bitcoin hard, and it is definitely a risk-reward we understand and are eager to take." Continue reading >>> http://bitcoinist.com/usa-luge-team-now-accepting-bitcoin-donations/ |

|

|

|

“Bitcoin” And “Mining” Dominate Google Searches as Ukraine Closes in on Legalisation Keywords like „Бiткойн“ (Bitcoin) and „майнинг“ (mining) have climbed to the top 5 of the “What is…” category in Google Ukraine’s 2017 Zeitgeist report, local media have announced. Queries like “Why did gas go up?” and “Why do we live?” also feature high up in the list – the country has been dogged by economic woes while fighting a bitter civil war since the “Maidan”. And with Ukrainians anxiously awaiting new legislation to regulate/legalize Bitcoin, “I need a spinner” has also made it to the top of the search engine statistics… Fidget spinners, as we know, have a certain nerve-soothing effect. Bitcoin Spins Its Way to the Top of Ukraine’s Search QueriesFreedom is taking a toll on Ukraine, both socially and economically, as Kiev steers the boat towards Western ports with its anchor still buried quite close to Russian shores. The country has been reporting unhealthy inflation since the troubles began in 2013. According to the State Statistics Service, consumer prices have increased by 13.6% year-on-year in November (almost 18% for food). Ukrainian GDP growth rate has averaged -0.09% (yes, that’s a minus) for the past seven years, Ukrstat figures show. Cryptocurrencies present a fresh alternative to the constantly depreciating national currency, the Hryvnia “₴”, as other troubled nations around the world have already discovered. And despite some institutional reluctance, there have been attempts to push through legislation that would legalize and regulate the cryptocurrency ecosphere in Ukraine. Officials hope to attract significant foreign crypto investments to improve the business climate, support the Hryvnia, and increase growth.

Legally, Bitcoin is still in the TwilightWith interest towards cryptocurrencies growing in Ukraine, official Kiev is yet to provide an adequate response to the arising challenges. Currently Bitcoin is neither legal, nor illegal. Its status is still subject to a debate that has been prolonged by the absence of a consolidated government approach. The National Bank of Ukraine has been doing what most central banks in Eastern Europe have – issue strong warnings of the “extremely risky nature” of cryptos that are “definitely not currencies”. Through public statements its representatives have made it clear that Natsbank will follow closely European regulators and the world’s leading central banks to formulate its policy. Ukrainian media have been wondering whether the bank would do something after regulators in the US accepted bitcoin as a commodity and allowed futures trading. But in the meantime their colleagues in Kiev have narrowed down the alternatives: “They’ve already said that cryptocurrencies are neither digital money, nor securities. Commodities have not been mentioned but they’ve talked about financial assets,” technology entrepreneur and cryptographer Pavel Kravchenko said, quoted by 24 Kanal. A couple of months ago, though, Ukraine became the first country in the post-Soviet space to draft dedicated legislation to legalize cryptocurrencies and regulate possession, trade, payments and other transactions. No less than three bills have been making their way through Ukrainian parliament since October, as the official website of the legislature shows. Continue reading > https://news.bitcoin.com/bitcoin-and-mining-dominate-google-searches-as-ukraine-closes-in-on-legalisation/ |

|

|

|

Retail and professional cryptocurrency traders can now trade Bitcoin Cash (BCH) on two of the world’s most popular exchanges, Coinbase and Gdax. News of the announcements sent the BCH price to over 3,700 USD as of this writing. Bitcoin Cash is Trading on Coinbase Immediately“We’re excited to announce that customers will be able to buy, sell, send and receive Bitcoin Cash on Coinbase,” came word from the Coinbase blog. BCH is quickly becoming the micropayment alternative to bitcoin core (BTC), and as of this writing is the number three cryptocurrency by market cap at just over 58 billion USD. Its price in the last 24 hours has surged over 70 percent. “Sends and receives are available immediately,” the exchange urged. Coinbase is waiting for “sufficient liquidity” from its Gdax platform before allowing buys and sells. “We anticipate that this will take a few hours.” Bitcoin cash was the result of an August 1st hard fork this year, with miners and enthusiasts signaling for larger block sizes to ease mempool congestion, lagging transaction times, and rising fees on BTC. Coinbase is one of the largest cryptocurrency exchanges in the world, boasting over 13 million users. This year has seen it collect as many as 100,000 new accounts in a single day. The San Francisco-based exchange has been in operation since 2011. Continue reading > https://news.bitcoin.com/bitcoin-cash-jumps-70-as-coinbase-and-gdax-announce-immediate-trading/ |

|

|

|

|

Come on Debitum, you are almost did it. Just 400 000$ left to reach soft cap. So much ridiculous products rise their fund on Ico now, gambling, etc, they do not solve real business problems but almost always got their financing. This situation is unacceptable, Debitum deserves full support, soft cap at least. All will be ok.

|

|

|

|

South Korea’s primary financial regulator and watchdog has ruled out regulating bitcoin trading in the country. In a press conference today, the head of South Korea’s Financial Supervisory Service (FSS) revealed no intention to regulate trading of cryptocurrencies in the country, for now. The primary reason, according to authority’s governor, is the lack of recognition of cryptocurrencies as money substitutes. In statements reported by Reuters, FSS governor Choe Heung-sik stated today: "All we can do is to warn people as we don’t see virtual currencies as actual types of currency, meaning that we cannot step up regulation for now." Curiously, the official went on to add that any regulations from the authority would only spur cryptocurrency trading by giving investors validation of the regulator’s ‘implicit approval’ of their status as a currency. The remarks ring a similar tone to previous statements by the official in November when Choe revealed the regulator would not “directly supervise” cryptocurrency exchanges since cryptocurrencies nor digital tokens aren’t recognized as a “legitimate currency.” As things stand, Korean authorities’ foray into overseeing the local bitcoin and cryptocurrency industry stops with a handful of rules, not regulations, announced last week. Furthermore, South Korea’s National Tax Service (NTS) is currently detailing a framework to enforce taxes on cryptocurrencies wherein adopters are likely to face capital gains taxes from cryptocurrency trading. https://www.ccn.com/bitcoin-isnt-currency-wont-regulated-south-korean-financial-regulator/ |

|

|

|

One of Japan’s largest used car automotive groups has partnered with the country’s largest cryptocurrency exchange Bitflyer to enable bitcoin payments at its dealerships across Japan. Starting with 26 dealerships, the company also plans to add bitcoin payments to 550 additional locations. Car Dealerships Accept Bitcoin Via BitflyerThe Tokyo Stock Exchange-listed Idom Inc. engages in the distribution and sale of used cars. Formerly known as Gulliver International Co. Ltd, the company has been operating a network of stores that buy and sell used cars across Japan since 1994. The company claims to have the largest market share for the domestic used car market, ranking number one in both sales volume and number of purchases. With a subsidiary in the U.S. and New Zealand, the group also holds a 67% stake in Australian new car dealer operator Buick Holdings Pty Ltd. Idom announced last week that its specialty imported used car chain called Liberala will start accepting bitcoin on December 20. The chain specializes in Bentleys, BMWs, and Audis. This is in collaboration with Japan’s largest bitcoin exchange by volume, Bitflyer. The 24 Liberala stores will accept bitcoin payments in amounts up to 100 million yen (~$888,000) per purchase. The stores are located in Hokkaido, Tohoku, Kanto, Chubu, Kansai, Chugoku / Shikoku, and Kyushu. Continue reading > https://news.bitcoin.com/major-japanese-automotive-group-and-dealerships-embracing-bitcoin/ |

|

|

|

CME Group's long-awaited bitcoin futures began trading today with a bullish signal, as the sale price for its Jan. 18 contracts opened above $20,000. Coming months after the Chicago-based derivatives exchange operator first revealed plans for dedicated bitcoin offerings, the launch took place at 6 p.m EST. At that time, the opening price for the January contract was $20,650, $1,150 over the last price on CME's reference rate ($19,500). All told, more than 200 Jan. 2018 contracts were bought during the first hour, CME data reveals. The operator's site shows that one Feb. 2018 contract and one March 2018 contract were sold, along with two scheduled to expire in June. Prices for the latter three are above $20,000 at press time.  Since the opening, contracts have also notably continued trading at a premium against the price of bitcoin, which according to CoinDesk's Bitcoin Price Index (BPI) was $19,400 when CME launched trading of the bitcoin futures. Along with last week's bitcoin futures kick-off from Cboe, the past week has now seen the launch of multiple products aimed at institutional investors. And, as previously reported, other institutional giants including Nasdaq and Wall Street's Cantor Fitzgerald are expected to launch products around bitcoin in 2018. However, CME's launch also showed signs of market fatigue. In a departure from the initially rocky launch for Cboe, which saw its website become briefly inaccessible due to significant traffic, CME's site remained stable after the open. Further, over the course of the first hour, bitcoin saw a sell-off, with the price declining to a low of $18,424. https://www.coindesk.com/cme-groups-first-bitcoin-futures-open-above-20000/ |

|

|

|

|