|

102

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 22, 2023, 06:15:51 PM

|

I'm not worried. Not at all. I'm just a little bored if I'm honest, and echo LFC's sentiment. That's really what my original post was about.

tl;dr: Just be patient and HoDL/DCA for 1-2 more years.

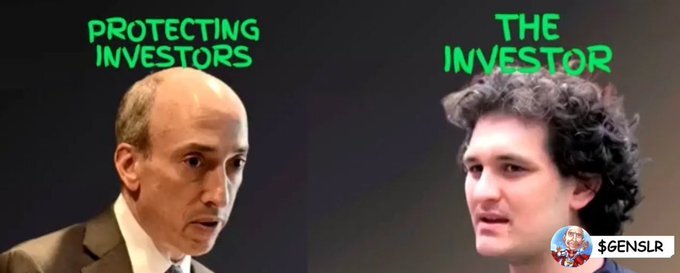

I don’t think 4 year cycles will be a thing forever. <Snip>The 2028 halving will see the block reward at 1.5625 BTC and I would expect maybe that to be the final 4 year cycle. From the 2032 halving the block reward drops below 1 BTC so maybe bitcoin will behave like a more mature asset from then, less volatility and a more stable price. Until then though we will be seeing lots of uppity as our friend JJG would say. Quick prediction time - 2025 cycle high (year after halving) - $180,000 to $250,000 2029 cycle high (year after halving) - $500,000 to $750,000 While agreeing that it could happen, I am not sure that it would. Here is my reasoning: last cycle was "abnormally" timid (only a 3.45X swing over the previous ATH). Why? There could be two possibilities: one would be externalities, like China mining ban+ shenanigans of Celsius+Blockfi+FTX, plus exorbitant share printing by DCG; on the other hand, it could be just mechanics of the cycles, where each cycle causes less and less upward swing. Therefore, next cycle would be an interesting test and @LFC numbers suggest resumption of the 'strong' swings: 250K would be re-acceleration or rather continuation of the swing strength and 180K just a small decline to 2.6X. The current history of "swings" (from lows to highs) order goes like this: First halving-from $2 cycle low to $1160 high(580X); Second-from $175 low to $20K high (114X); Third-from $3.2K low to $69K high (21.5X); Fourth-from supposed $15.7 low to ? high. Unfortunately, if the "swing" reduction factor from prior cycle to the next would be the same, the next number in the sequence is roughly 4-5X, which is ONLY 63K-78.5K, which is terrible. I, myself, don't believe that we would be "dealt" such cruel cards, but whatever 'acceleration' mechanism could be in play, it is still to reveal itself. Personally, I think that the acceleration that makes @LFC numbers is possible, but would occur via realization of the potential in the realm of inscriptions. Imagine this: each sat could have some informational packet attached. This opens up virtually unlimited potential in the future. Heck, every single Apple share could be inscribed on 157 bitcoins maximum (only 0.00074% of all bitcoin while Apple is, by itself, corresponds to 7.4% of US total stock market cap). There is plenty of room in bitcoin for ALL property plus future asteroids, planets, etc, etc...and that is even without going to sub-sats. Think about this. The last cycle was characterized by many factors that are worth recalling. 1. The Covid panic of March 2020 crashed the price to 4K. A year or so later, it was already 65K. That's 16x growth! 2. The 65K price was not the result of speculation or euphoria, but of increased demand worldwide. It should be noted the price stayed in this range for months, which we did not have before. 3. Elon's tweets did serious damage and the first big drop to 30K was shocking to newbies. 4. However, within a few months due to the news of the futures ETF, the price surpassed the old ATH and reached 69K. Somewhere in there, the Chinese started panicking and spreading FUD news to hammer the price. By tradition, this gave result. Meanwhile, a huge percentage of bought bitcoins turned out to be FTX paper junk, which also had a negative effect. A whole bunch of institutions were dragged down like dominoes and the price hit the bottom of 15600. The question is, how far could Bitcoin have gone if it weren't for all this bad news. I think there would have been a peak of over 100K, with a cycle bottom in the 25-35K range. The next question is how far Bitcoin can go in 2025. In the worst case scenario - no ETF, with a ban from the US and China, the old ATH will be still easily overtaken. That means a peak above 100K most likely. Basically, there will be potential for 200K, but it's very likely that hypocrites like Gary, Warren and the fat banker will do everything to stop the growth. They are terrified of Bitcoin because it threatens their banking system, which rests solely on false trust. If people knew the truth the feds are hiding, they would immediately withdraw their money and buy bitcoins. But the common people like to be lied to with empty promises. On that note, I suspect puppet Garry's strings are being pulled by Warren and the fat one. So it is very likely that SEC will not give approval for the spot ETF. Whether this will lead to a return of the bear market remains to be seen. Nothing should be excluded. But there is still a long time until 2025, so I hope that the damage from these scavengers will be erased by then and we will enjoy new ATHs. |

|

|

|

|

106

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 13, 2023, 12:15:21 PM

|

Gensler was asked today in a webinar about Coinbase being at center of ETF filings. He couldn't comment on the filings but went pretty negative on crypto exchanges saying they operate "conflicting services" and have "limited risk monitoring" Here's full quote via @TheBlock__  https://twitter.com/EricBalchunas/status/1679238611407982593 https://twitter.com/EricBalchunas/status/1679238611407982593My reading on this is that Gary is still against a spot ETF, despite the SSA. I'm not a Coinbase lawer, but these accusations are not legit IMO. May be they are true for Binance and other non US exchanges, where wash trading and leverage manipulations are common. It seems that this SSA is just an annoyance for Gary, since it could easily lead to elimination of these practices in the whole US market. And some bankers and feds do not want that. They want to conitue dissing Bitcoin that it is used for illegal activities, thus defending the weakening US banks and USD. Clearly Gary is just a sockpuppet who doesn't have the guts to allow a spot ETF, unless he is forced by the court or more infuential senators or president candidates.  |

|

|

|

|

107

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 12, 2023, 12:07:53 PM

|

The issue of ETFs is important both for the current year and for the next 2-3 years. If there is a rejection this summer, it is very likely that this year's bull market will end and we will return to the bear market until the effect of the halving is felt in 1 year. If accepted, it is possible to approach ATH already this year, i.e. to witness a unique bull cycle starting 1 year before the halving. It's clear that this is exactly why Blackrock wants to get in now, not when Bitcoin goes past 100K after the halving. It is still not clear, whether the SEC is ready to change its mind. The news from yesterday (or the other day) is that Cboe Refiles Spot Bitcoin ETFs Following Surveillance Agreement with Coinbase, i.e. the text "Expected to enter into an SSA" is replaced by such an agreement already entered into. Of course, Blackrock were the first with a ready SSA. https://www.financemagnates.com/cryptocurrency/cboe-refiles-spot-bitcoin-etfs-following-surveillance-agreement-with-coinbase/Henceforth, the SEC has 2 sensible answers and 1 completely illogical one - the result of personal intrigues, political and financial influence, etc.: 1. Direct approval of all spot ETFs. The SEC can now feel victorious that they have brought Coinbase into some form of regulation, so this option is quite likely. 2. Indirect approval, subject to extending the scope of SSA. This means a requirement for the so-called pull actions i.e. the information-sharing agreement, under which the SEC will be able to request the personal data of those suspected of manipulations. I can only speculate here that Blackrock and the others would immediately enter into one, as long as Coinbase didn't object. Given that this will bode well for the stocks and help their future cooperation with the SEC, I believe that Coinbase has no basis for such a refusal. This topic is discussed in one article, but there is no comment from Blackrock et al.: https://finance.yahoo.com/news/blackrock-bitcoin-etf-application-takes-160452048.html3. Denial on grounds of manipulation and that most of the volume is in non-US exchanges. This, of course, is just a front behind which are the nefarious interests of certain high-ranking bankers, feds and politicians who are pulling clown Gary's strings. However, this behavior is becoming increasingly unlikely, especially if the Grayscale wins the case and is joined by Blackrock in the event of a refusal. As Jay Clayton said recently, it is becoming very difficult to sustain the SEC denial. So, the chances for an ETF approval are much higher now, than 2 months ago. And with a possible information-sharing agreement, IMO they would be over 90%. |

|

|

|

|

108

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 11, 2023, 11:18:10 AM

|

It's been like Groundhog Day movie for the last 2 weeks. It's just boring.  You think Groundhog Day movie is boring? Not as boring as any Star Wars movie. In what world did I say Groundhog Day movie was boring? Bill Murray is a great actor! All right, I have some time and explain like to a child/childish old man. His character is bored to live each day the same events watching these poor people doing exact same mistakes. It is obvious that I meant the price action which resembles the plot, not the movie itself. And to say this for Star Wars is just ridicoulous. And what is the connection between these two movies? I don't follow the logic. |

|

|

|

|

114

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 30, 2023, 02:20:02 PM

|

IMO this surprising decision by the SEC actually means that these proposals will be accepted in the end. A bit of logical analysis is needed here. The main concern is that the SEC is only looking for excuses not to allow spot ETFs. There are plenty of reasons for this. In that case, they would not have done so. They would take their time and re-announce a whole list of problems that cannot be solved. Then it wouldn't matter if Blackrock et al. named the spot exchange and what the details of the surveilance agreement were. The fact that they want these details is something well known to those who write articles and submit to journals. This implies that the article will be accepted if the author corrects the errors and omissions! Logically, this means that if Blackrock et al. provide the necessary information which satisfies the requirements in principle, the proposals will be accepted! I thnk that now the demand for regulated Bitcoin trade via ETF's is so strong in USA, that the time for excuses from the SEC has passed. P.S. It seems that BTCsessions and I are on the same page: Every other ETF: SEC sits on hands and extends deadlines until they must respond, then rejects them. SEC to BlackRock after like 2 mins: "Hey buddy, looks like your application is not quite adequate. Here's some hot tips so that everything goes perfectly for ya!" https://twitter.com/BTCsessions/status/1674782661108445185 |

|

|

|

|

117

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 28, 2023, 02:53:30 PM

|

Intriguing discussion on twitter today: JUST IN: ARK has amended their 19b-4 for spot bitcoin ETF to include a surveillance sharing agreement bt CBOE and a crypto exchange (likely Coinbase), which makes their's like BlackRock's filing now, and puts them in pole position to be approved first bc they filed first. Eric Balchunas @EricBalchunas This adds another twist to the plot bc SEC decision due on this in August, if they delay it is bad sign for approval unless, they delay and then approve BlackRock, which shows favoritism. Grayscale decision announcement also plays into timing of all this. GRAB THE POPCORN. Eric Balchunas @EricBalchunas Nate also brings up another twist: would BlackRock (who doesn't play) even allow Coinbase to enter into a SSE agreement with another that would help another issuer beat them to market? If so ARK would need another crypto exchange to use. Nate Geraci @NateGeraci Have to assume BlackRock was already well aware of ARK's filing... They're not rolling out the red carpet for another issuer. Guessing Coinbase enters into SSA w/ Nasdaq first (and maybe only - at least initially). Nate Geraci @NateGeraci The trick is they have to get the spot exchange to actually enter into a surveillance sharing agreement... Potentially the same exchange that BlackRock already has a partnership with. Eric Balchunas @EricBalchunas Yeah I assumed no issue entering with both but you make a good point, blackrock could use their leverage to force Coinbase to use only them ? https://twitter.com/EricBalchunas/status/1674055780058771463 |

|

|

|

|

118

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 27, 2023, 11:35:21 AM

|

Can someone explain to me why the ETF fanbois think that fourth time's the charm for a Bitcoin ETF? What exactly will the difference be this time?

The question of the benefit of ETFs has been discussed a lot and we can hardly say anything new. But if I have to summarize, the discussion is divided into 2: negative, often overflowing into pure FUD, and positive, often overflowing into unrealistic expectations of matching and even surpassing gold within a few months. To me, the truth is that the benefit of establishing Bitcoin as a stable global financial asset requires spot ETFs. The rise in price will be just the consequence of both FOMO and the scarcity. Let's take just one example, with which I think all of us will agree. People and companies who cannot or do not know how to buy bitcoins, or which exchanges are reliable, will not hesitate to use ETFs. When this ETF is bought for the long term, which is usually done with a spot rather than a futures ETF, the number of real hodlers will increase. The fear that the big companies will have more control over Bitcoin is also understandable, but we can't take at face value the pure FUD that it will kill growth like it did with gold. For enlightened OGs like us, the reasons are clear and need no pointing out. The other question, for me at least, is more interesting and with an unclear answer. Will this next wave of ETFs be stifled by Gary as it was in the past? Basically, there isn't that much of a difference between the previous ETF offerings and Blackrock's, so its approval is far from certain. Although the ratio I think was 575:1, it doesn't really matter that much, in my opinion. From the point of view of using a regulated exchange, there is no change, so there should be no approval. But... With good will from Gary, Blackrock can be given a chance as they have filed for some form of surveillance with Nasdaq. The problem is that this is only a proposal, not an actual agreement. It is not clear if Coinbase will agree and they will enter into one. If that happens this year, given other factors like pressure from senators and presidential candidates, I think Gary will bend and give permission. But everything is in the balance. Blackrock definitely rushed with the clear goal of catching the upcoming bull run after the halving. They also have an extremely strong lobby, so according to some analysts, in order to move forward so sharply, they have some kind of prior approval from Gary. But overall, if one has to estimate the chances, I think the chances of approval are no higher than 40%. However, if a surveillance agreement is announced meanwhile, that probability will become at least 80%. Hence all this buzz and the corresponding wave of ETF offerings, as well as the significant drop in GBTC's negative premium. |

|

|

|

|