jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 12:00:24 AM |

|

Well I mostly disgaree with the OP for reasons others have already stated.

But good job for at least presenting some arguments of the other side of

the debate (I'm for bigger blocks). At least you didn't list "decentralization"

which is a highly dubious argument when one is also advocating to push transactions off

the main chain and into the hands of a trusted party.

The thing about the so called "dusty junk" -- how do you know whats junk

and whats legit? Maybe I want to send 25 cents to a gambling site,

or maybe I want to tip someone 20 cents on Facebook for an awesome comment.

What's the difference? Who's to say? Who's to judge?

Why even limit things at all unless we have to?

|

|

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Linuld

|

|

September 09, 2015, 12:11:53 AM |

|

increasing block size is not the solution. even at 1 TB you cannot fit all of the day to day transactions for billions of people + IoT + all of the financial stuff build ton top + micro transactions + unknown unknowns. Lightning network is the best solution that i see so far.

This is a great argument which clearly shows that some people don't care about bitcoin but instead about some altcoin that they claim is better suited. What does this have to do with bitcoin? Nothing anymore. We need to make bitcoin better. And that only can be reached with making bitcoin fit for the future. Nobody awaits bitcoin having as many transactions as visa suddenly. But we know that the bitcoin usage is slowly rising and me need to be prepared for that. All this fear spread... it would be funny when it wouldn't be sad. |

|

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 12:28:29 AM |

|

1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.

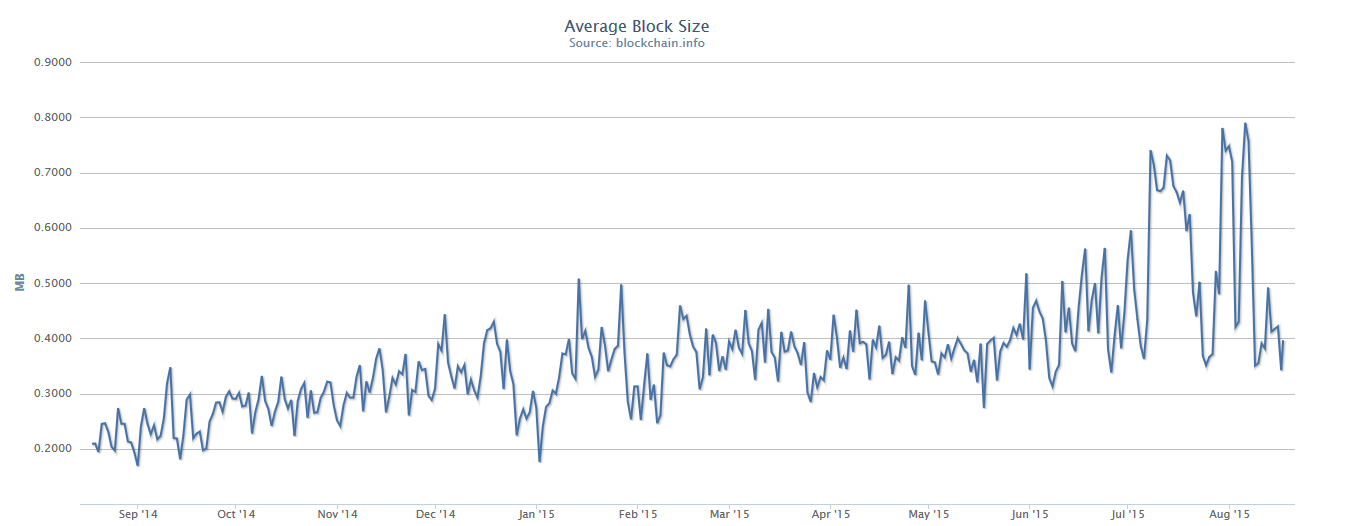

why not let more TX pre block so that a block can have a lot of small 5 cent or less fees TX pay for the network? 2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.  its werid everytime i go see https://blockchain.info/ i always see a few full blocks on the six latest blocks. out of the last 6 blocks the 4 are full blocks right now. 3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions.

would be interesting to get your idea of an want constitute a non-legitimate transaction. 4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise.

If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever.

one very cool thing about bitcoin is it made possible miro transaction, 10cent fee might not seem like much, but it's 10% of a 1$ payment. so much for bitcoin TX being free. 5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily.

only if a significant % of miners not only not upgrade but start to massively attack the new chain with a lot of hashing power is it dangerous. at this point you are in a increasingly small minority when you say you want to keep the 1MB limit. 6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers.

no comment. |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 12:31:00 AM

Last edit: September 09, 2015, 12:48:27 AM by adamstgBit |

|

increasing block size is not the solution. even at 1 TB you cannot fit all of the day to day transactions for billions of people + IoT + all of the financial stuff build ton top + micro transactions + unknown unknowns. Lightning network is the best solution that i see so far.

thats weird other day someone said a ~256MB block would allow for about the same amount of TX VISA processes pre day. ... ~300million TX pre day is VISA which = 3472TPS we need ~300bytes pre TX, so that ~1MB pre second worth of TX so ~600MB blocks should do it. not bad, maybe miners can "zip" the blocks when trying to send them to other nodes so that might cut down the actual bandwidth needed dramatically. BTW 3472TPS @ 0.0001BTC fee pre TX is about 208BTC in fees pre block, enoght to keep minners happy?? I think so!  |

|

|

|

teukon

Legendary

Offline Offline

Activity: 1246

Merit: 1002

|

|

September 09, 2015, 12:49:41 AM |

|

1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.

(emphasis mine)Oft-cited, rarely questioned, and never satisfactorily argued. This is a myth. |

|

|

|

|

jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 02:02:28 AM |

|

I think there's a fundamental misunderstanding of what happens with transaction fees when the block limit is increased. All transactions can be sent for free if there is any empty space in the block. We need blocks to be filled completely to force a rise in transaction fees. Without this effect, in the scenario we increase block size, the network will be insecure in the future since miners will receive negligible payment. They will focus their efforts on something else which actually pays them.

Miners decide what to include. You're not making sense saying 'they can be sent for free'. They can only be sent free if the miner allows it. I've disussed some of the complexities in this thread. https://bitcointalk.org/index.php?topic=1162684.msg12361309#msg12361309 |

|

|

|

RoooooR

Legendary

Offline Offline

Activity: 1008

Merit: 1000

GigTricks.io | A CRYPTO ECOSYSTEM FOR ON-DEMAND EC

|

|

September 09, 2015, 02:05:13 AM |

|

increasing block size could actually destroy Bitcoin, rather than help it!

|

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 02:08:02 AM |

|

I think there's a fundamental misunderstanding of what happens with transaction fees when the block limit is increased. All transactions can be sent for free if there is any empty space in the block. We need blocks to be filled completely to force a rise in transaction fees. Without this effect, in the scenario we increase block size, the network will be insecure in the future since miners will receive negligible payment. They will focus their efforts on something else which actually pays them.

fact, for years bitcoin has been well below block limit and for years most poeple put a fee along with their TX... fact, 1million TX per block with avg fee of about 1cent is a hell of reward every 10mins. fact, 1000 TX per block with avg fee of about 1dollar is 10 times less of a reward. conclusion, small block with high fees, will make bitcoin less useful and less secure in the future  |

|

|

|

jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 03:21:54 AM |

|

I think there's a fundamental misunderstanding of what happens with transaction fees when the block limit is increased. All transactions can be sent for free if there is any empty space in the block. We need blocks to be filled completely to force a rise in transaction fees. Without this effect, in the scenario we increase block size, the network will be insecure in the future since miners will receive negligible payment. They will focus their efforts on something else which actually pays them.

Miners decide what to include. You're not making sense saying 'they can be sent for free'. They can only be sent free if the miner allows it. I've disussed some of the complexities in this thread. https://bitcointalk.org/index.php?topic=1162684.msg12361309#msg12361309Any transaction can be sent for free as it is now, that's proof enough. Some people say more transactions = more fees for miners, but that's untrue since 0 X any # of transactions is still 0. As I said before people fundamentally misunderstand how transaction fees work in the real world. That's obviously true, but its a completely different context than the one where a blocksize cap can help raise fees (that context is far in the future when subsidies are greatlly diminished)...So It is puzzling why you're talking about them in the same paragraph, almost the same thought, when they are unrelated. |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 04:19:39 AM |

|

I think there's a fundamental misunderstanding of what happens with transaction fees when the block limit is increased. All transactions can be sent for free if there is any empty space in the block. We need blocks to be filled completely to force a rise in transaction fees. Without this effect, in the scenario we increase block size, the network will be insecure in the future since miners will receive negligible payment. They will focus their efforts on something else which actually pays them.

Miners decide what to include. You're not making sense saying 'they can be sent for free'. They can only be sent free if the miner allows it. I've disussed some of the complexities in this thread. https://bitcointalk.org/index.php?topic=1162684.msg12361309#msg12361309Any transaction can be sent for free as it is now, that's proof enough. Some people say more transactions = more fees for miners, but that's untrue since 0 X any # of transactions is still 0. As I said before people fundamentally misunderstand how transaction fees work in the real world. That's obviously true, but its a completely different context than the one where a blocksize cap can help raise fees (that context is far in the future when subsidies are greatlly diminished)...So It is puzzling why you're talking about them in the same paragraph, almost the same thought, when they are unrelated. its not obviously true, its obviously false. back in my day we paid fees for 2 reasons 1) paying a tiny fee to support the network felt good. 2) the bitcoin client was defaulted to pay this fee. altho easy to change the setting, it was simply not cool and you felt bad doing it. blocks were never anywhere near full, yet poeple still paid fees. further more, if miners saw that some % of poeple never payed the tiny fee it would only take 1 miner to refuse to include 0fee TX into his blocks and that would add a big insensitive for everyone to pay this tiny fee to be sure to not let there confirmation time be determined by luck, most likely miners would be smart and include only 10 0 fee TX pre block that they mine, so that free TX in bitcoin are always possible but always much slower to confirm then a paid fee TX. Proof that this "fee market" BS spread by the block-stream 1MBters are spreading are false! :: Fact, miners are profit driven. Fact, majority of miners want to increase block size Conclusion, the idea that block limit will somehow make miners more money is a funny idea. |

|

|

|

jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 04:48:05 AM |

|

Just to be totally clear since there is alot of misinformation in this thread, currently any bitcoin transaction can be sent for free, and this will be true forever if blocksize limit is continuously increased

I think you might be the one who is confused! Your statement here will almost certainly be false when the block subsidies go away. Fees will be the only thing left to support security costs. Commercial miners will need to charge fees to stay in business. The only way it could be true is if all mining is done by volunteers and hobbyists or perhaps by dual purpose ASICS (mining refrigerators, etc) @Adam: You seem a bit confused also. The argument that the small-blockers are making (the ones who know what they're talking about -- see Davout on Reddit), is that unless blockspace is made a scarce resource, the free market price of fees will be too low to provide sufficient security. The idea is similar to price fixing eggs at the supermarkets so the farmers earn enough and continue farming eggs. However, there's a few issues I have with that argument, which I posted in the other thread: What the "cap advocates" are saying is that the free market revenue will provide an insufficient level of security and they would like to boost it by decreasing the supply.

Its a fair argument. But, A) it can't be proven that the free market revenue will necessarily be insufficient, B) it is questionable that decreasing the supply is the only way to boost revenue, and C) it is unclear how much of a boost it would actually be able to accomplish |

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

September 09, 2015, 04:56:21 AM |

|

No one has real data to show that a higher block limit = more fees overall for miners, it is simply a misunderstanding of how transaction fees work in real life.

Here is real data that shows that over the last five years, higher block sizes = more fees overall for miners.  |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 04:57:50 AM |

|

@Adam:

You seem a bit confused also.

The argument that the small-blockers are making (the ones who know what they're talking about --

see Davout on Reddit), is that unless blockspace is made a scarce resource, the free market

price will be too low to provide sufficient security. The idea is similar to price fixing eggs

at the supermarkets so the farmers earn enough and continue farming eggs. However, there's

a few issues I have with that argument, which I posted in the other thread.

there argument is invalid for alot of reasons, but here's one. 1million TX per block with avg fee of about 1cent is a hell of reward every 10mins. 1000 TX per block with avg fee of about 1dollar is 10 times less of a reward. the best is to have as many paying TX's on the network as possible, in that case in the future TX fees going from 1 cent to 3 cents wont mean much the the users but mean 3X more BTC for the minners. |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 05:00:00 AM |

|

No one has real data to show that a higher block limit = more fees overall for miners, it is simply a misunderstanding of how transaction fees work in real life.

Here is real data that shows that over the last five years, higher block sizes = more fees overall for miners.  +1 <sarcasm> I hope to one day see Bitcoin transactions be expensive as hell and still limited to 7TPS </sarcasm> |

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

September 09, 2015, 05:02:16 AM |

|

The argument that the small-blockers are making (the ones who know what they're talking about --

see Davout on Reddit), is that unless blockspace is made a scarce resource, the free market

price of fees will be too low to provide sufficient security. The idea is similar to price fixing eggs

at the supermarkets so the farmers earn enough and continue farming eggs.

It's funny: many small farmers are now locked out the egg market because they can't get a quota. The quota system has actually caused centralization of commercial egg producers here in Canada. Small farmers can't sell their eggs on the commercial markets even though some are more efficient than the large operations! |

|

|

|

jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 05:06:04 AM |

|

@Adam:

You seem a bit confused also.

The argument that the small-blockers are making (the ones who know what they're talking about --

see Davout on Reddit), is that unless blockspace is made a scarce resource, the free market

price will be too low to provide sufficient security. The idea is similar to price fixing eggs

at the supermarkets so the farmers earn enough and continue farming eggs. However, there's

a few issues I have with that argument, which I posted in the other thread.

there argument is invalid for alot of reasons, but here's one. 1million TX per block with avg fee of about 1cent is a hell of reward every 10mins. 1000 TX per block with avg fee of about 1dollar is 10 times less of a reward. the best is to have as many paying TX's on the network as possible, in that case in the future TX fees going from 1 cent to 3 cents wont mean much the the users but mean 3X more BTC for the minners. Well, yes thats a possible scenario. We have no idea how many transactions there will be decades from now, which makes their line of argument pretty pointless, because we just don't have enough data to formulate a complete scaling strategy (at least as far as the fees go) this far ahead of time. Is it possible the free market revenue of fees with no block rewards will provide low security? Yes, it is. But how likely it is, is anyone's guess because no one really knows how adoption is going to unfold. Therefore, it would be irrational to limit the blocksize based on that, at the current time. |

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 05:11:29 AM |

|

@Adam:

You seem a bit confused also.

The argument that the small-blockers are making (the ones who know what they're talking about --

see Davout on Reddit), is that unless blockspace is made a scarce resource, the free market

price will be too low to provide sufficient security. The idea is similar to price fixing eggs

at the supermarkets so the farmers earn enough and continue farming eggs. However, there's

a few issues I have with that argument, which I posted in the other thread.

there argument is invalid for alot of reasons, but here's one. 1million TX per block with avg fee of about 1cent is a hell of reward every 10mins. 1000 TX per block with avg fee of about 1dollar is 10 times less of a reward. the best is to have as many paying TX's on the network as possible, in that case in the future TX fees going from 1 cent to 3 cents wont mean much the the users but mean 3X more BTC for the minners. Well, yes thats a possible scenario. We have no idea how many transactions there will be decades from now, which makes their line of argument pretty pointless, because we just don't have enough data to formulate a complete scaling strategy (at least as far as the fees go) this far ahead of time.  we can try to use commen sence to go in the right diretions some how limiting bitcoin to <7TPS and stating that this is the only way miners will collect enough fees in the future seems wrong. |

|

|

|

jonald_fyookball

Legendary

Offline Offline

Activity: 1302

Merit: 1004

Core dev leaves me neg feedback #abuse #political

|

|

September 09, 2015, 04:15:43 PM |

|

Actually the break from linearity is on the wrong side to support your theory.

(Should be up above the line, not below it).

Anyway, can you explain why you keep harping about the fees when

it will be several block halvings until fees even coming close the block

rewards, and therefore will be a minority of the security cost for

years or decades?

|

|

|

|

uxgpf

Newbie

Offline Offline

Activity: 42

Merit: 0

|

|

September 09, 2015, 04:19:35 PM

Last edit: September 09, 2015, 05:00:50 PM by uxgpf |

|

Block size has not been changed over the last 5 years, this is what I mean by people fundamentally misunderstand the issue.

Maybe it's you who is totally misunderstanding the issue or just trolling. (I'm beginning to think of latter) Block size has changed as you can see from the graph. The block size limit hasn't changed. So far the gap between actual block size and the limit has been so large that it has had no effect on economy whatsoever. (aside from recent "stress test".) Think of it like the oil market. If block size is increased that's like discovering another Saudi Arabia and will flood supply, directly forcing total transaction fees downward. That makes no sense. Total fees have increased so far with increasing block size (and transfer rate). There is no reason to think that total fees would suddenly drop while transaction volume keeps growing. History shows us that exactly opposite is true. More apt comparison would be that if more oil is transported the transport companies will make more profit in total, even if growing market would drive unit transportation fees down. If you honestly think that limiting block size will profit miners I have a great plan for you. Lets set block size limit to 0 and let miners enjoy huge profits from zero transaction rate. yay logic!  |

|

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

September 09, 2015, 04:19:49 PM |

|

No one has real data to show that a higher block limit = more fees overall for miners, it is simply a misunderstanding of how transaction fees work in real life.

Here is real data that shows that over the last five years, higher block sizes = more fees overall for miners.  Block size has not been changed over the last 5 years, this is what I mean by people fundamentally misunderstand the issue. That shows transaction fees increase as transactions increase with a fixed block limit, but simultaneously shows fees do not have to keep rising since we are not at the limit (when transaction volumes reach the highest levels). That break from linearity at the end might be the stress test too, but that was good proof of my point we're discussing so it's still valid. Think of it like the oil market. If block size is increased that's like discovering another Saudi Arabia and will flood supply, directly forcing total transaction fees downward. the chart shows that total fees ( not the size of each fee ) per block goes up, because there's more TXs 1,000 TX paid 1 dollar fee each or 100,000 TX paid 1 cent each the end result is the same for the miners case #1 bitcoin has a limited TPS and fees are high case #2 bitcoin has unlimited TPS and fees are low how in the world can you argue case #1 is better?  |

|

|

|

|