|

xxjs (OP)

|

|

February 04, 2013, 01:11:48 AM |

|

Use gold as in private coinage, coins used in day to day trade, free exhange, free import and export.

Which country would use gold, if the dollar tanks?

Which country will use gold, when the dollar tanks?

My guesses:

1 India, since gold is already widely distributed amongst the population.

2 South africa, as they have gold mines and already have krugerrand as legal tender.

3 Australia, because they have lots of gold mines.

4 Argentina, because they have problems right now.

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Stephen Gornick

Legendary

Offline Offline

Activity: 2506

Merit: 1010

|

|

February 04, 2013, 01:56:56 AM |

|

Which country would use gold

From another thread: It took decades but finally the government of Kelantan (a state in Malaysia - They have a federal system like the USA) last year listened and introduced Gold and Silver currency which is legal tender in that state. They are even paying civil servants using it.

Another Malaysian state (Perak) has now introduced its own Gold Dinar and Silver Dirham coins. Kelantan was first, in August of 2010. - http://constitutionaltender.blogspot.com/2011/03/another-state-in-malaysia-introduces.html |

|

|

|

Stephen Gornick

Legendary

Offline Offline

Activity: 2506

Merit: 1010

|

|

February 04, 2013, 02:28:24 AM |

|

1 India, since gold is already widely distributed amongst the population.

Also interesting are these plans from the RBI (India's central bank): It wants banks to encourage products linked to accepting physical gold as deposits and investing public money in gold related products, and extend loans against gold as collateral.

Indians own about 20,000 tonnes of gold, or three times the holdings of the U.S. Federal Reserve, in jewellery, bars and coins.

- http://in.reuters.com/article/2013/02/01/gold-india-idINDEE91009U20130201 |

|

|

|

Phinnaeus Gage

Legendary

Offline Offline

Activity: 1918

Merit: 1570

Bitcoin: An Idea Worth Spending

|

|

February 04, 2013, 02:55:07 AM |

|

1 India, since gold is already widely distributed amongst the population.

Also interesting are these plans from the RBI (India's central bank): It wants banks to encourage products linked to accepting physical gold as deposits and investing public money in gold related products, and extend loans against gold as collateral.

Indians own about 20,000 tonnes of gold, or three times the holdings of the U.S. Federal Reserve, in jewellery, bars and coins.

- http://in.reuters.com/article/2013/02/01/gold-india-idINDEE91009U20130201That equates to roughly $66,800,000,000. Divide that by 1B people and they'll have $66 each, and that's only if all the women in India surrender their gold jewelry. Highly unlikely one would, let alone half a billion plus of them. I don't know how much the average woman in India has in gold, but my ex-wife owned about three pounds of the stuff in only the form of jewelry, and she was barely middle class. Here's an interesting read: https://docs.google.com/viewer?a=v&q=cache:FDcG1zORUdAJ:www.abwic.org/Proceedings/2007/ABW07-203.doc+&hl=en&gl=us&pid=bl&srcid=ADGEESjW4Wy8_96ct4frbuduvpcjHP7x8mGvchZxXu5DZRJ11ZxpTWxFxHFqopjodUea0G_OVQAZgx4wURNTRPYe78rn5JnVKqUYdXtKlZ6CQCNpZfTDLAxxgSFcvZ13A5M3F7Ev_sEq&sig=AHIEtbTH-KMv76FzqsZZ-eA20_c7x9BqjQBTW, I'm talking about my real ex-wife, and not Maria. Which reminds me. Where is my sweetheart? |

|

|

|

|

John (John K.)

Global Troll-buster and

Legendary

Offline Offline

Activity: 1288

Merit: 1225

Away on an extended break

|

|

February 04, 2013, 04:28:52 AM |

|

Which country would use gold

From another thread: It took decades but finally the government of Kelantan (a state in Malaysia - They have a federal system like the USA) last year listened and introduced Gold and Silver currency which is legal tender in that state. They are even paying civil servants using it.

Another Malaysian state (Perak) has now introduced its own Gold Dinar and Silver Dirham coins. Kelantan was first, in August of 2010. - http://constitutionaltender.blogspot.com/2011/03/another-state-in-malaysia-introduces.htmlYep, apparently the Islamic laws requires Gold and Silver as a form of 'zakat' and legal currency. The states above have a majority of Islamic civilians, and thus the proliferation of gold and silver. |

|

|

|

|

|

EndTheFed321

|

|

February 04, 2013, 05:12:05 AM |

|

but,but gold is not money  Uncle Ben told Senator Ron Paul! |

|

|

|

|

|

|

aceking

|

|

February 04, 2013, 07:58:44 AM |

|

|

|

|

|

|

|

|

franky1

Legendary

Online Online

Activity: 4200

Merit: 4435

|

|

February 04, 2013, 11:19:56 AM |

|

gold for daily to day trading?

i hope you don't mean to buy a pint of milk. because the size of a coin that has a value of a loaf of bread or a pint of milk is smaller then . <- that dot. for "private coinage" to use on daily bases.

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

phelix

Legendary

Offline Offline

Activity: 1708

Merit: 1019

|

|

February 04, 2013, 01:04:52 PM |

|

Which country would use gold

From another thread: It took decades but finally the government of Kelantan (a state in Malaysia - They have a federal system like the USA) last year listened and introduced Gold and Silver currency which is legal tender in that state. They are even paying civil servants using it.

Another Malaysian state (Perak) has now introduced its own Gold Dinar and Silver Dirham coins. Kelantan was first, in August of 2010. - http://constitutionaltender.blogspot.com/2011/03/another-state-in-malaysia-introduces.htmlYep, apparently the Islamic laws requires Gold and Silver as a form of 'zakat' and legal currency. The states above have a majority of Islamic civilians, and thus the proliferation of gold and silver. Have been to Malaysia last year and visited both Perak and Kelantan. Very nice. Did not see any gold coins, though. |

|

|

|

|

|

xxjs (OP)

|

|

February 04, 2013, 01:13:03 PM |

|

gold for daily to day trading?

i hope you don't mean to buy a pint of milk. because the size of a coin that has a value of a loaf of bread or a pint of milk is smaller then . <- that dot. for "private coinage" to use on daily bases.

I think there exists somewhere a plastic coin with a gold nugget cast in. |

|

|

|

|

|

Seth Otterstad

|

|

February 04, 2013, 03:33:28 PM |

|

Gold is a really bad form of money for everyday transactions, just better than any other commodity. Representative forms of it are far superior. Bitcoin crushes both gold and its representations as a form of money.

|

|

|

|

|

CurbsideProphet

|

|

February 04, 2013, 07:45:40 PM |

|

Use gold as in private coinage, coins used in day to day trade, free exhange, free import and export. I don't ever see this happening. A return to the gold standard I can see but using physical gold as a medium of exchange isn't feasible on a a large scale. |

1ProphetnvP8ju2SxxRvVvyzCtTXDgLPJV

|

|

|

|

robamichael

|

|

February 04, 2013, 11:12:42 PM |

|

You don't need to trade the actual gold to have a currency based on gold (or silver or any other hard asset). The alternative would be certificates that represent gold, and I don't mean the fractional reserve type that lead to bank runs either. I mean you have a right to the actual metal. Peter Schiff has already started something like this, though it is not available in the USA. http://www.youtube.com/watch?v=goI8rAAJKtE#t=9m33s |

|

|

|

|

CurbsideProphet

|

|

February 05, 2013, 01:46:16 AM |

|

You don't need to trade the actual gold to have a currency based on gold (or silver or any other hard asset). The alternative would be certificates that represent gold, and I don't mean the fractional reserve type that lead to bank runs either. I mean you have a right to the actual metal. Peter Schiff has already started something like this, though it is not available in the USA. http://www.youtube.com/watch?v=goI8rAAJKtE#t=9m33sI was responding to the OP. Use gold as in private coinage, coins used in day to day trade, free exhange, free import and export. I took this to mean the use of actual gold coins. |

1ProphetnvP8ju2SxxRvVvyzCtTXDgLPJV

|

|

|

|

|

|

xxjs (OP)

|

|

February 05, 2013, 08:07:27 AM |

|

You don't need to trade the actual gold to have a currency based on gold (or silver or any other hard asset). The alternative would be certificates that represent gold, and I don't mean the fractional reserve type that lead to bank runs either. I mean you have a right to the actual metal. Peter Schiff has already started something like this, though it is not available in the USA. http://www.youtube.com/watch?v=goI8rAAJKtE#t=9m33sI was responding to the OP. Use gold as in private coinage, coins used in day to day trade, free exhange, free import and export. Yes I was thinking about using actual gold, except for smaller coins, because histori has shown that gold backing only lasts until it doesn't last any more. Just speculating here, but I think it is possible, and it will be triggered by some fiat crisis. I took this to mean the use of actual gold coins. |

|

|

|

|

hashman

Legendary

Offline Offline

Activity: 1264

Merit: 1008

|

|

February 05, 2013, 05:19:11 PM |

|

I'll guess Ur. Or perhaps Lemuria.

|

|

|

|

|

|

stochastic

|

|

February 05, 2013, 11:20:03 PM |

|

You don't need to trade the actual gold to have a currency based on gold (or silver or any other hard asset). The alternative would be certificates that represent gold, and I don't mean the fractional reserve type that lead to bank runs either. I mean you have a right to the actual metal. Peter Schiff has already started something like this, though it is not available in the USA. http://www.youtube.com/watch?v=goI8rAAJKtE#t=9m33sThe Liberty Dollar tried this and the founder is [going to be] sitting in federal prison because: Attorney for the Western District of North Carolina, Anne M. Tompkins, described the Liberty Dollar as "a unique form of domestic terrorism" that is trying "to undermine the legitimate currency of this country".[28] The Justice Department press release quotes her as saying: "While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country. |

Introducing constraints to the economy only serves to limit what can be economical.

|

|

|

|

robamichael

|

|

February 06, 2013, 02:44:09 AM

Last edit: February 07, 2013, 02:23:57 AM by robamichael |

|

You don't need to trade the actual gold to have a currency based on gold (or silver or any other hard asset). The alternative would be certificates that represent gold, and I don't mean the fractional reserve type that lead to bank runs either. I mean you have a right to the actual metal. Peter Schiff has already started something like this, though it is not available in the USA. http://www.youtube.com/watch?v=goI8rAAJKtE#t=9m33sThe Liberty Dollar tried this and the founder is [going to be] sitting in federal prison because: Attorney for the Western District of North Carolina, Anne M. Tompkins, described the Liberty Dollar as "a unique form of domestic terrorism" that is trying "to undermine the legitimate currency of this country".[28] The Justice Department press release quotes her as saying: "While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country. As I recall though, the actual legal ground was based on the word "dollar" being used - this is how they claimed the operation to be counterfeiting. Of course, the word dollar is not originally nor uniquely American. |

|

|

|

|

Seth Otterstad

|

|

February 06, 2013, 08:13:02 AM |

|

It is perfectly legal to use alternate currencies in the US. You just can't try to pass them off as dollars, as that idiot did with Liberty Dollars.

Gold-backed currencies don't work anymore. The representation of the gold always winds up getting debased. You know how these gold ETFs like SPDR refuse independent audits? That's because the gold is not all there. You have to actually use the physical gold to transact to avoid this problem, and transacting in physical gold is ridiculously bad. Bitcoin fixes this.

|

|

|

|

|

robamichael

|

|

February 07, 2013, 02:35:09 AM |

|

It is perfectly legal to use alternate currencies in the US. You just can't try to pass them off as dollars, as that idiot did with Liberty Dollars.

Some question how "legal" alternative currencies really are, and whether this man was being made an example. Besides the "dollar" -http://en.wikipedia.org/wiki/Dollar - is "the official currency or a banknote of many countries, territories and dependencies, including Australia, Belize, Canada, Hong Kong, New Zealand, Singapore, Taiwan, Brunei and the United States." "Counterfeit money is imitation currency produced without the legal sanction of the state or government." I'd be interested if anybody knew the details of that case, I admit I am have not studied it well. How exactly his Liberty Dollar was "without legal sanction" should settle the debate. |

|

|

|

DeathAndTaxes

Donator

Legendary

Offline Offline

Activity: 1218

Merit: 1079

Gerald Davis

|

|

February 07, 2013, 02:58:00 AM |

|

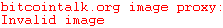

The liberty dollar case is a poor one to draw a larger legal view on alternative currencies. Liberty dollar was about counterfeiting. Based on both the actual coins, the defendants own internal docs, and testimony of affiliates the goal was to pass the coins off as legal tender. It as highly profitable to confuse the public into accepting the coins as US legal tender when making change. Why was it profitable? Because the coins were sold to merchants at below face value (sometimes as little as 50% off face value) who then profited everytime a consumer accepting one even in confusion. Ever heard of a currency you can buy "on sale" from the issuer? Wait why would they sell the coins below face value especially since they were backed by precious metals? Well depending on when the coin was minted they generally had only 30% to 60% of the face value in precious metals at the time of minting. i.e. a $10 coin might only have $3 in silver. The mint marked it up to say $5 to the merchant who then passed it off on a consumer as a $10 in value. Everyone wins except the consumer who ended up paying $10 for non legal tender worth about $3 spot unless they could find a sucker willing to give them more.  Honestly what is your first reaction when you see these coins. Imagine someone just handed one to you with your other change or offered a silver ten dollar (ommiting the word liberty) instead of a paper ten dollar. Names of states, "lady liberty", "in god we trust", BTW here is a "Liberty Dollar" issued by US Mint in 1922. Look strangely familiar.  There have been many alternative currencies which didn't face legal challenge. Ithaca Hours for has printed millions of dollars in notes for over twenty years without legal challenge. Then again nobody would confuse this ....  with this ...  |

|

|

|

|

BCB

CTG

VIP

Legendary

Offline Offline

Activity: 1078

Merit: 1002

BCJ

|

|

February 07, 2013, 02:59:17 AM |

|

Greece.

|

|

|

|

|

|

robamichael

|

|

February 07, 2013, 03:07:07 AM |

|

"Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation." -Wikipedia Of course he tried to peddle these things as legal tender. What logical, law-abiding currency would not? The question is whether he was actually trying to imitate U.S.A. minted coins. Yes, I see the resemblance to the Liberty Dollars of long ago, but the ultimate likeness is debatable. It's subjective. No where does it state "United States of America" which WAS included on the original US minted Liberty Dollar. Here is a pic that was left out:  Well that looks strangely different. |

|

|

|

DeathAndTaxes

Donator

Legendary

Offline Offline

Activity: 1218

Merit: 1079

Gerald Davis

|

|

February 07, 2013, 03:14:07 AM |

|

Of course he tried to peddle these things as legal tender. What self-respecting currency would not? Um. Not sure if your are serious? In the US legal tender is established by legal statute. United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues. Foreign gold or silver coins are not legal tender for debts. http://www.law.cornell.edu/uscode/text/31/5103This isn't a matter for debate. It is an absolute fact. Gold isn't legal tender, silver isn't legal tender, Disney dollars aren't legal tender, Bitcoin isn't legal tender. Lying (even by omission) about the legal tender status of something which isn't legal tender can in any way be lawful. The very definition of the word LEGAL tender meaning established by LAW. You can't pass something off as legal tender. It is either legal tender because the law makes it so by decree or it isn't. Legal tender =/= currency. Bitcoin could become insanely popular, maybe the most popular alternative currency in the world but that wouldn't make it legal tender in the United States unless Congress (and only Congress) passed laws declaring it so. One can advocate for alternative currencies taking a right turn into legal dead end. It does nobody any good to lie or pretend Bitcoin is somehow legal tender. It absolutely isn't (and probably never will be, at least not in the US). Yes, I see the resemblance to the Liberty Dollars of long ago, but the ultimate likeness is debatable. Of course it is debatable. It was debated in court and he lost. A jury believed it was his intent not establish an alternative currency but to counterfeit US currency. The lesson to take from that (combined with the lack of legal challenges for Ithica dollars or say facebook credits) is to make damn sure you currency won't be mistaken for US currency AND certainly don't do something stupid like pretend it is legal tender when it isn't. |

|

|

|

|

|

robamichael

|

|

February 07, 2013, 04:01:30 AM |

|

Um. Not sure if your are serious? In the US legal tender is established by legal statute.

United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues. Foreign gold or silver coins are not legal tender for debts. You are referring to the Coinage Act of 1965, which some might call an unconstitutional act. The Constitution delegates the following money powers: Article 1. ... Section. 8. ... To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; ... Section. 10. No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility. So looking to this: This isn't a matter for debate. It is an absolute fact. Gold isn't legal tender, silver isn't legal tender, Disney dollars aren't legal tender, Bitcoin isn't legal tender. I would have to disagree. This is a lively debate, lending many fresh facts. Gold and silver can be the ONLY forms of tender, constitutionally. Even then, it must be the states that dictate the law here. Still, I see nothing that limits an individual's ability to mint coins, and market these as tender for private debts. The only restriction is that States can only accept gold and silver as payment for THEIR debt. And the federal government can only coin money, not restrict its form! Lying (even by omission) about the legal tender status of something which isn't legal tender can in any way be lawful. The very definition of the word LEGAL tender meaning established by LAW. You can't pass something off as legal tender. It is either legal tender because the law makes it so by decree or it isn't.

Legal tender =/= currency. After reading this part of your post is when it occurred to me that we are delving into the murky waters of a semantics battle. I thought this was an interesting article: http://mises.org/daily/4546I will concede that in some respects you are correct on this point - but please review that article, and let me know what you think as far the opinion that the strict term "legal tender" cannot be applied to the US in a constitutional sense. There are no rights given by the Constitution to the Federal government or the States that allow "legal tender" laws which force the acceptance of debts between individual parties. Bitcoin could become insanely popular, maybe the most popular alternative currency in the world but that wouldn't make it legal tender in the United States unless Congress (and only Congress) passed laws declaring it so. One can advocate for alternative currencies taking a right turn into legal dead end. It does nobody any good to lie or pretend Bitcoin is somehow legal tender. It absolutely isn't (and probably never will be, at least not in the US).

So as I discussed above, yes I agree. But with the caveat of pointing out that there is no such ability for the US to grant "legal tender." Yes, I see the resemblance to the Liberty Dollars of long ago, but the ultimate likeness is debatable. Of course it is debatable. It was debated in court and he lost. A jury believed it was his intent not establish an alternative currency but to counterfeit US currency. The lesson to take from that (combined with the lack of legal challenges for Ithica dollars or say facebook credits) is to make damn sure you currency won't be mistaken for US currency AND certainly don't do something stupid like pretend it is legal tender when it isn't. The decision of a jury has never decided the constitutionality of a law - it never has and never can. The Constitution is law supreme. Again, I don't know the nitty gritty of how his currency was considered a counterfeit. From far away, I guess I could confuse the two, but I haven't seen any sources showing his intent to actually pass these off as the same coin. I get the sense he was advocating this as an alternative currency, but I could be wrong (It happens a lot). |

|

|

|

DeathAndTaxes

Donator

Legendary

Offline Offline

Activity: 1218

Merit: 1079

Gerald Davis

|

|

February 07, 2013, 04:40:12 AM

Last edit: February 07, 2013, 04:56:47 AM by DeathAndTaxes |

|

There isn't arguing semantics. Legal tender has a specific definition. One can't have a conversation if for example I think "sky" is the thing above our heads and you think "sky" is an internal organ. Words have meaning and making up random new meaning to established definitions doesn't aid in communication. "Legal tender" has a very specific meaning under the law. Note "money", "currency", and "legal tender" are not the same thing. There really is no point in continuing if you are just going to "mint" your own definitions to already defined terms.

I say everyone knows the statute is minted to ohms law based on the gravitational pull of the buoyancy proletariat. Please provide a counter viewpoint with gates from reputable planks.

|

|

|

|

|

|

robamichael

|

|

February 07, 2013, 04:58:42 AM |

|

Hey now, I was enjoying our discussion.

I already conceded that I had mistaken the commonly used definition of "legal tender."

But after reviewing the Constitution and considering the Mises.org article, I don't believe "legal tender" has any definition that can be applied Constitutionally. It would take an amendment to change this.

The nearest substitute is the tender that is accepted by States as payment of debts, but this is not the same "legal tender' which requires the currency be accepted:

"Coins or banknotes that must be accepted if offered in payment of a debt." -Google

I am still unconvinced either way that this Liberty Dollar had done anything different than that of the other alternative currencies you mentioned. The main difference, it seems, was the magnitude of popularity.

Maybe tomorrow I will look into some of the evidence, and this will clear things up.

|

|

|

|

farlack

Legendary

Offline Offline

Activity: 1311

Merit: 1000

|

|

February 07, 2013, 12:44:21 PM |

|

Zimbabwe will be the first, they already do accept gold. Merchants don't accept their currency because the paper is worth more than the funds written on it all they want is gold. http://www.youtube.com/watch?v=7ubJp6rmUYM |

|

|

|

|

|

Killdozer

|

|

February 09, 2013, 08:52:41 PM |

|

4 Argentina, because they have problems right now. Wouldn't your line of reasoning putting a lot of countries in the list then? Like Argentina is the only country that has problems right now... |

|

|

|

|

Seth Otterstad

|

|

February 09, 2013, 11:58:30 PM |

|

Zimbabwe will be the first, they already do accept gold. Merchants don't accept their currency because the paper is worth more than the funds written on it all they want is gold. http://www.youtube.com/watch?v=7ubJp6rmUYMWhat a waste of human labor to have significant amounts of the world's population digging this stuff out of the ground so it can be put back into the ground in vaults. |

|

|

|

|

xxjs (OP)

|

|

February 10, 2013, 02:12:40 AM |

|

4 Argentina, because they have problems right now. Wouldn't your line of reasoning putting a lot of countries in the list then? Like Argentina is the only country that has problems right now... Hehe, Venezuela next. The question is really what the traders in the different countries believe. It is very possible that a local currency crash will be blamed on something totally irrelevant, and they go for a new inflatable currency. May be they even will think that the currency wasn't inflated enough. That is why I put India high on the list. Record gold import to India nowadays is regarded as a problem for the government, they call it trade deficit (money out, gold in). But if gold is money, the deficit is magically transformed to trade surplus. I suspect the people of India to regard the gold somewhat as money, even if they make jewelry out of it. |

|

|

|

|

|

ShireSilver

|

|

February 10, 2013, 01:50:14 PM |

|

All you folks saying gold can't be used in trade because the coins would be too small please look at this.  Its worth about $4 and you can buy them with bitcoins. Also,  about $8  and for the muslims we have  ,  , and  Yeah, bitcoins are awesome and solve most problems with money, but Shire Silver cards solve the rest. |

|

|

|

|