rpietila (OP)

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

March 09, 2013, 07:49:13 PM |

|

In my work as precious metals dealer since 2006, I have got to know a variety of customers.

Now one of them revealed to me his plan of going all-in in bitcoin. I would like to follow your concerns to him.

As far as I know, this man (34) owns a house worth about € 400,000 and has a mortgage to about half that value. He also operates a business that does not have significant assets if realized, but is a specialist niche field and generates about € 100,000 profit per year. His wife is also a professional with high income but is 3 months pregnant to their 1st child. Their investments are in mostly in metals and also BTC, valued at least € 500,000 (this is hardest for me to estimate exactly).

He said that he thinks bitcoin will in all probability succeed and make them tremendously wealthy. Because nothing else is giving good returns just now, he thinks that there is no reason to keep money in other investments. Their financial situation is solid and both are able to generate income. They have their own house and live rather modest life as all Finns do. The investment is long term, there is no plan to use leverage or trade. Just go all-in and buy at least 15,000 BTC. I don't know what he wants to do with them when they are worth millions.

The argument that I just cannot refute is: "What is the point in having other investments that underperform, and what is the point in having cash, since BTC can be cashed when needed?"

|

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|

|

|

Whoever mines the block which ends up containing your transaction will get its fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

jwzguy

|

|

March 09, 2013, 07:55:00 PM |

|

This is the first time I've heard the term "cold-bloodedly" used in a positive way.

Traditional wisdom will say to diversify, however, he has a solid point. If everything else is losing value, it's pretty tempting to go all in with Bitcoin.

I hope he truly understands the fundamentals.

|

|

|

|

|

|

mccorvic

|

|

March 09, 2013, 07:55:54 PM |

|

The argument that I just cannot refute is: "What is the point in having other investments that underperform, and what is the point in having cash, since BTC can be cashed when needed?"

Besides "you should always diversify" none really. He sounds like he has a decent knowledge of investing, so if you haven't convinced him yet then you probably won't. If he knows the risks and wants to, then sure, why not. |

|

|

|

cbeast

Donator

Legendary

Offline Offline

Activity: 1736

Merit: 1006

Let's talk governance, lipstick, and pigs.

|

|

March 09, 2013, 08:01:58 PM |

|

Absolutely. As an experienced precious metals dealer, you of all people know a good thing when you see it. In fact, I am surprised that you are also not considering switching your business to becoming a Bitcoin dealer rather than dealing with all those diverse metals. What a great post. You sir, are a true visionary. My advice is to lead by example and go all-in yourself as well since you don't see any reason against your client doing so.

|

Any significantly advanced cryptocurrency is indistinguishable from Ponzi Tulips.

|

|

|

|

1Pakis

|

|

March 09, 2013, 08:03:55 PM |

|

And what if it goes to zero?

|

Tips are welcome at this address 18DVZkpSwmejPjekX3QMKvRRtR8Bfx65LN.

|

|

|

pretendo

Member

Offline Offline

Activity: 112

Merit: 10

|

|

March 09, 2013, 08:10:23 PM |

|

Isn't this kind of stuff disallowed from the forum? Sounds like pump and dump

|

|

|

|

|

cbeast

Donator

Legendary

Offline Offline

Activity: 1736

Merit: 1006

Let's talk governance, lipstick, and pigs.

|

|

March 09, 2013, 08:13:29 PM |

|

Isn't this kind of stuff disallowed from the forum? Sounds like pump and dump

Ya think? |

Any significantly advanced cryptocurrency is indistinguishable from Ponzi Tulips.

|

|

|

|

blablahblah

|

|

March 09, 2013, 08:25:17 PM |

|

...a house worth about € 400,000 and has a mortgage to about half that value....

How's that one performing? Any positive returns on the mortgage yet? |

|

|

|

|

sunnankar

Legendary

Offline Offline

Activity: 1031

Merit: 1000

|

|

March 09, 2013, 10:23:00 PM |

|

The argument that I just cannot refute is: "What is the point in having other investments that underperform, and what is the point in having cash, since BTC can be cashed when needed?"

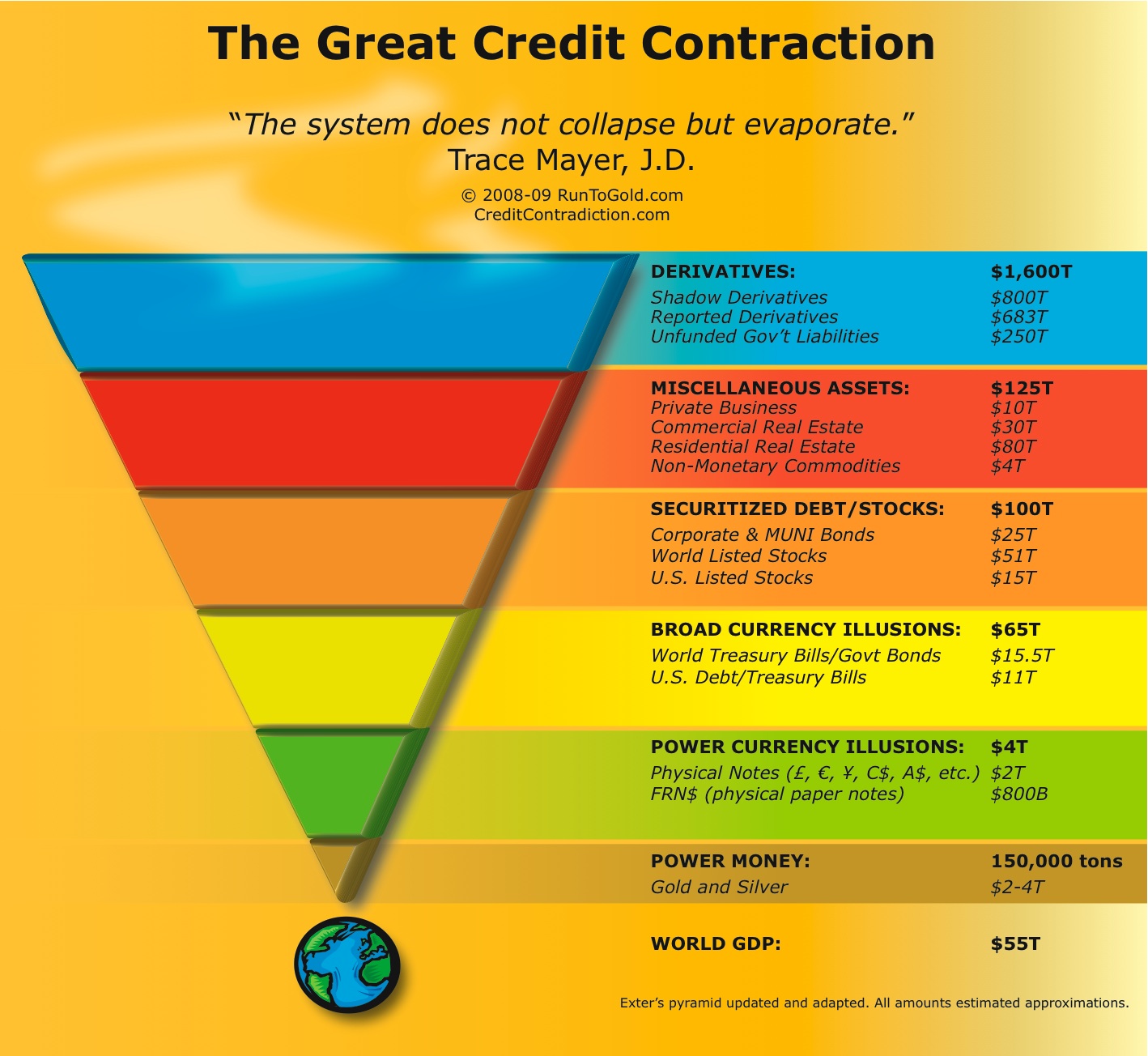

That is getting to be an increasingly more difficult question to answer because of the depth in the exchanges. As The Great Credit Contraction continues the safety and liquidity value proposition Bitcoin offers will get increasingly more attention as capital burrows down the liquidity pyramid into safer and more liquid assets.  This info graphic of potential bitcoin prices makes the case in favor of allocating capital towards bitcoin.  I think 100x makes several very good points in the case against allocating capital towards bitcoin. Every individual has their own risk tolerance. |

|

|

|

randrace

Sr. Member

Offline Offline

Activity: 329

Merit: 250

LTC -> BTC -> Silver!

|

|

March 09, 2013, 10:25:52 PM |

|

Tell him to pay off his house first.

|

|

|

|

|

Gabi

Legendary

Offline Offline

Activity: 1148

Merit: 1008

If you want to walk on water, get out of the boat

|

|

March 09, 2013, 10:57:40 PM |

|

Bitcoin is still a high risk thing. We do not know what will happen in the next months or years. Yes, probably its price will skyrocket, but maybe not, who know? since BTC can be cashed when needed? Yeah sure, but if you sell BTC when it is worth 1$ and you bought it at 45$, well not a good thing. |

|

|

|

sunnankar

Legendary

Offline Offline

Activity: 1031

Merit: 1000

|

|

March 09, 2013, 11:01:41 PM |

|

I am not saying he shouldn't allocate capital towards BTC

Not saying you did. I think one should analyze the case for and against and then make a decision. The great thing about Bitcoin is it helps people take responsibility for themselves. As the Great Credit Contraction grinds on; on the other side the people with the wealth will be those who deserve it. |

|

|

|

|

oakpacific

|

|

March 10, 2013, 12:50:56 AM |

|

To be considered pump and dump one has to spread falsely positive information, now, there is no way I can find out if the OP tells the truth(I give him benefit of the doubt), but there is hardly any false "inside" information you can spread about bitcoin itself, everything is there for everyone to know.

|

|

|

|

cbeast

Donator

Legendary

Offline Offline

Activity: 1736

Merit: 1006

Let's talk governance, lipstick, and pigs.

|

|

March 10, 2013, 01:53:03 AM |

|

To be considered pump and dump one has to spread falsely positive information, now, there is no way I can find out if the OP tells the truth(I give him benefit of the doubt), but there is hardly any false "inside" information you can spread about bitcoin itself, everything is there for everyone to know.

I'm not sure what to make of this. Okay, I fold. I was anyway thinking of increasing my BTC stash by about $50000. Then came the correction and I was salivating at the idea of being able to buy at $30-$35. I didn't sleep at night, just waiting and waiting and spreading FUD... Then it started going back up from $45. If you look at the daily chart, there is no correction. Just going up and up. Of course there will be dips and some day there will be crash for sure. The dips, such as the one two nights ago, will take us back maybe 3 days' worth of gains. The crash will nullify the gains of maybe latest 1-2 months (like the one in 2011 did). If you know what we all know, it makes pretty little sense to do anything except all in (leave enough in silver that you can live comfortably if BTC goes to 0, of course). I am planning to do just that in the coming weeks and I still hope for $30-$35. Today was the deciding factor - up until today I thought there is some coins in the bears' hand that they can sell. Today I realized that the number of bears increased just because more and more people that speculatively sold already, and USD is now burning in their hands. BTC is going up long term for sure. The bears will buy back or be forgotten. Sorry fella bears that I put the buy orders there. My friend told that I will hurt the ability to buy, if you show it, but I don't know how to use bots  Sorry also for the mini runup. I was panicking  |

Any significantly advanced cryptocurrency is indistinguishable from Ponzi Tulips.

|

|

|

|

oakpacific

|

|

March 10, 2013, 02:02:05 AM |

|

To be considered pump and dump one has to spread falsely positive information, now, there is no way I can find out if the OP tells the truth(I give him benefit of the doubt), but there is hardly any false "inside" information you can spread about bitcoin itself, everything is there for everyone to know.

I'm not sure what to make of this. Okay, I fold. I was anyway thinking of increasing my BTC stash by about $50000. Then came the correction and I was salivating at the idea of being able to buy at $30-$35. I didn't sleep at night, just waiting and waiting and spreading FUD... Then it started going back up from $45. If you look at the daily chart, there is no correction. Just going up and up. Of course there will be dips and some day there will be crash for sure. The dips, such as the one two nights ago, will take us back maybe 3 days' worth of gains. The crash will nullify the gains of maybe latest 1-2 months (like the one in 2011 did). If you know what we all know, it makes pretty little sense to do anything except all in (leave enough in silver that you can live comfortably if BTC goes to 0, of course). I am planning to do just that in the coming weeks and I still hope for $30-$35. Today was the deciding factor - up until today I thought there is some coins in the bears' hand that they can sell. Today I realized that the number of bears increased just because more and more people that speculatively sold already, and USD is now burning in their hands. BTC is going up long term for sure. The bears will buy back or be forgotten. Sorry fella bears that I put the buy orders there. My friend told that I will hurt the ability to buy, if you show it, but I don't know how to use bots  Sorry also for the mini runup. I was panicking  First my focus is in the later part about bitcoin itself, I don't know why you can't see it. Second on this subforum someone could just talk bullshit and tell plain lies and later get away with it like nothing has happened, no need to do repentance and self-disclosure like this guy did, we have plenty of these people around and I am sure you know them.  |

|

|

|

Bitcoinpro

Legendary

Offline Offline

Activity: 1344

Merit: 1000

|

|

March 10, 2013, 02:02:20 AM |

|

the banks can call in his mortgage at anytime and will do so as soon as he buys the bitcoins  |

WWW.FACEBOOK.COM

CRYPTOCURRENCY CENTRAL BANK

LTC: LP7bcFENVL9vdmUVea1M6FMyjSmUfsMVYf

|

|

|

Anon136

Legendary

Offline Offline

Activity: 1722

Merit: 1217

|

|

March 10, 2013, 02:22:48 AM |

|

Depends on what he wants out of life. ask him if offered the choice between having a 50% chance of becoming a billionare and a 50% chance of dieing of a heart attack or a 100% chance of living the rest of his life in mediocrity and a 0% chance of dieing of a heart attack what would he chose? If the former than by all means go all in on bitcoin. However if he is buying bitcoins under the impression that bitcoins are in any way a safe asset he is dangerously mistaken.

|

Rep Thread: https://bitcointalk.org/index.php?topic=381041If one can not confer upon another a right which he does not himself first possess, by what means does the state derive the right to engage in behaviors from which the public is prohibited? |

|

|

|

oakpacific

|

|

March 10, 2013, 07:25:32 AM |

|

This is the first time I've heard the term "cold-bloodedly" used in a positive way.

I just wanted to make the distinction between doing something in a premeditated, calculating way, as opposed to arriving in the conclusion without the necessary time to think, and thorough analysis. No, it's because in Finland, cold is like....cool.  |

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 10, 2013, 08:17:21 AM |

|

I did the same thing a year ago. Dont regret it for a second  |

Bro, do you even blockchain?

-E Voorhees

|

|

|

|

1Pakis

|

|

March 10, 2013, 08:37:06 AM |

|

All in, is a poker term. Diversify. Buy also LTC  Also buy hardware and mine some cryptocoins. |

Tips are welcome at this address 18DVZkpSwmejPjekX3QMKvRRtR8Bfx65LN.

|

|

|

|

oakpacific

|

|

March 10, 2013, 08:52:26 AM |

|

I did the same thing a year ago. Dont regret it for a second  How "all in" were you? Mind some disclosure? |

|

|

|

KTE

Member

Offline Offline

Activity: 69

Merit: 10

|

|

March 10, 2013, 08:56:50 AM |

|

The argument that I just cannot refute is: "What is the point in having other investments that underperform, and what is the point in having cash, since BTC can be cashed when needed?"

If you want to ever consider yourself as a professional investor giving valuable advice to your clients, I strongly recommend learning about risk management if you are not able to refute this argument. Even if you're of a gambling sort and like to encourage people to get on the BTC train, you should at least be familiar with the basics. |

|

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 10, 2013, 09:14:57 AM |

|

I did the same thing a year ago. Dont regret it for a second  How "all in" were you? Mind some disclosure? Not going to get into numbers, but it was about 80% of my total assets. |

Bro, do you even blockchain?

-E Voorhees

|

|

|

|

oakpacific

|

|

March 10, 2013, 09:18:00 AM |

|

I did the same thing a year ago. Dont regret it for a second  How "all in" were you? Mind some disclosure? Not going to get into numbers, but it was about 80% of my total assets. I am not as "cold-blooded" as you are, only invested 20% of my savings, now whenever I trade it makes me super nervous coz when it's in BTCs it doesn't feel like much, when it's in fiats it feels like moving my whole bank account.  |

|

|

|

crazy_rabbit

Legendary

Offline Offline

Activity: 1204

Merit: 1001

RUM AND CARROTS: A PIRATE LIFE FOR ME

|

|

March 10, 2013, 10:36:50 AM |

|

I did the same thing a year ago. Dont regret it for a second  How "all in" were you? Mind some disclosure? Not going to get into numbers, but it was about 80% of my total assets. I am not as "cold-blooded" as you are, only invested 20% of my savings, now whenever I trade it makes me super nervous coz when it's in BTCs it doesn't feel like much, when it's in fiats it feels like moving my whole bank account.  +1. 10 BTC? Nuthin. $500 USD? Nervous. |

more or less retired.

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

March 10, 2013, 10:39:56 AM |

|

I did the same thing a year ago. Dont regret it for a second  How "all in" were you? Mind some disclosure? Not going to get into numbers, but it was about 80% of my total assets. I am not as "cold-blooded" as you are, only invested 20% of my savings, now whenever I trade it makes me super nervous coz when it's in BTCs it doesn't feel like much, when it's in fiats it feels like moving my whole bank account.  +1. 10 BTC? Nuthin. $500 USD? Nervous. Yeah thats just conditioning, it was the same for me at first. Trust me, that over time it shifts from one side to the other. I absolutely HATE to see my bitcoins decrease while now I have no issue about spending my fiat. |

Bro, do you even blockchain?

-E Voorhees

|

|

|

|

Herodes

|

|

March 10, 2013, 01:13:30 PM |

|

In my work as precious metals dealer since 2006, I have got to know a variety of customers.

Now one of them revealed to me his plan of going all-in in bitcoin. I would like to follow your concerns to him.

As far as I know, this man (34) owns a house worth about € 400,000 and has a mortgage to about half that value. He also operates a business that does not have significant assets if realized, but is a specialist niche field and generates about € 100,000 profit per year. His wife is also a professional with high income but is 3 months pregnant to their 1st child. Their investments are in mostly in metals and also BTC, valued at least € 500,000 (this is hardest for me to estimate exactly).

He said that he thinks bitcoin will in all probability succeed and make them tremendously wealthy. Because nothing else is giving good returns just now, he thinks that there is no reason to keep money in other investments. Their financial situation is solid and both are able to generate income. They have their own house and live rather modest life as all Finns do. The investment is long term, there is no plan to use leverage or trade. Just go all-in and buy at least 15,000 BTC. I don't know what he wants to do with them when they are worth millions.

The argument that I just cannot refute is: "What is the point in having other investments that underperform, and what is the point in having cash, since BTC can be cashed when needed?"

The finns are brave! |

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2384

Viva Ut Vivas

|

|

March 10, 2013, 05:08:58 PM |

|

Tell him to wait. At least until I can buy more BTC. Give me a few more months at least. He should be ok with that right? No need to rush things.  |

First seastead company actually selling sea homes: Ocean Builders https://ocean.builders Of course we accept bitcoin. |

|

|

josiahgarber

Member

Offline Offline

Activity: 82

Merit: 10

|

|

March 10, 2013, 05:59:49 PM |

|

Well why not just invest half or a smaller percentage of his savings in bitcoin? He'll still be ultra wealthy if it succeeds, but he won't have the very real chance of being broke.

Also, I would ask his wife how she would feel about losing all of their savings. I have a feeling she might not be ok with that, but you never know.

|

|

|

|

|

justusranvier

Legendary

Offline Offline

Activity: 1400

Merit: 1009

|

|

March 10, 2013, 06:48:12 PM |

|

Your friend can go all in and still diversify by not sticking to a strictly buy-and-hold strategy.

If he uses some fraction of the bitcoins he buys to invest in Bitcoin startups, or donates to development to make the network more secure and scalable, that spending would serve to help protect the value of his savings.

|

|

|

|

|

Technomage

Legendary

Offline Offline

Activity: 2184

Merit: 1056

Affordable Physical Bitcoins - Denarium.com

|

|

March 10, 2013, 07:06:37 PM |

|

I think that going 80% all in is completely valid as long as one keeps track of what is going on with Bitcoin and its potential competitors. Going 100% all in I wouldn't recommend, it's good to have something to fall back on in case the worst scenario happens (basically a complete technical failure is the only one that applies).

It's also important to secure the bitcoins really well if one puts a lot of money into them. Especially if others know you have bitcoins. A Bitcoin protocol failure is NOT the only way to lose that money, as we have seen with exchanges so many times.

|

Denarium closing sale discounts now up to 43%! Check out our products from here! |

|

|

KTE

Member

Offline Offline

Activity: 69

Merit: 10

|

|

March 10, 2013, 08:40:23 PM |

|

No one knows for sure what the exact right choice is before it happens. If your friend thinks he can manage his bitcoin investments and understands BTC well enough (or you can work as an intermediary) and is willing to commit to the risk of losing every penny they invest in BTC and really, really wants to take that risk, then I would say it has the possibility of paying off big time.

But the downside is huge, the man really must understand and accept that first. I'm heavily (50%+) invested myself, but I'm prepared to lose it all should it come to it. I wouldn't be if I'd have a mortgage.

|

|

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

March 10, 2013, 09:43:32 PM |

|

Say 10yrs from now there's a 25% chance bitcoin is worth $1500/btc, but a 75% chance it's worth $0. That puts discounted present value at $173/btc (using 8% as the discount rate).

So, if he thinks those probabilities and the timeframe are in the ballpark, then he should be able to answer for himself whether being exposed to that set of outcomes has positive utility for him.

|

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

Odalv

Legendary

Offline Offline

Activity: 1400

Merit: 1000

|

|

March 10, 2013, 09:50:54 PM |

|

Well why not just invest half or a smaller percentage of his savings in bitcoin? He'll still be ultra wealthy if it succeeds, but he won't have the very real chance of being broke.

Also, I would ask his wife how she would feel about losing all of their savings. I have a feeling she might not be ok with that, but you never know.

Yeah, I personally subscribe to the 20-40% argument. Because that is also an unbelievable stash of purchasing power if/when bitcoin succeeds. But this thread is already 34 replies long and there has been only a single argument against the idea presented so far: "There is a very real chance of bitcoin going to zero or otherwise so low that it will decimate any savings that were invested. You should only invest money that you can lose without remorse." My friend replies: "I have a positive cash flow, a house and perhaps we'll keep $50000 or so in silver just in case. The rest (no matter how much it is) I can lose without it affecting our lifestyle, and that part I want to invest in bitcoin." I think, you waste your time with kids who never saw $50. |

|

|

|

|

Melbustus

Legendary

Offline Offline

Activity: 1722

Merit: 1003

|

|

March 10, 2013, 11:46:51 PM |

|

I think bitcoin is cheap at $50, if the present value is $2194.

Hey, my much more conservative PV analysis also says bitcoin is cheap at $50. I'm buying now, but if it hits $173 shortly, I'll sell to you.... :-). Would actually have to be higher than $173, since hitting that would likely entail my estimation of the probabilities becoming more favorable... To be honest, I think the probabilities are better than I outlined anyway, but I always take a more negative view when I do the math to try and account for my own human optimism-bias. |

Bitcoin is the first monetary system to credibly offer perfect information to all economic participants.

|

|

|

aghori

Newbie

Offline Offline

Activity: 28

Merit: 0

|

|

March 10, 2013, 11:49:47 PM |

|

Only slightly off topic re: the pictures on page 1;

The first major money transfer company like western union to integrate bitcoins is going to make a boatload of cash.

|

|

|

|

|

RationalSpeculator

Sr. Member

Offline Offline

Activity: 294

Merit: 250

This bull will try to shake you off. Hold tight!

|

|

March 11, 2013, 03:42:10 PM |

|

But this thread is already 34 replies long and there has been only a single argument against the idea presented so far:

"There is a very real chance of bitcoin going to zero or otherwise so low that it will decimate any savings that were invested. You should only invest money that you can lose without remorse."

My friend replies: "I have a positive cash flow, a house and perhaps we'll keep $50000 or so in silver just in case. The rest (no matter how much it is) I can lose without it affecting our lifestyle, and that part I want to invest in bitcoin."

Your friend is forgetting the primary objective of capital/savings. It is to take care of you when you - cannot - work, due to illness, accident or old age. Speculating with all your capital you risk losing it all and might have nothing to fall back on when you cannot work anymore. I made a new post explaining that argument in more detail. |

|

|

|

|

|