Qoheleth (OP)

Legendary

Offline Offline

Activity: 960

Merit: 1028

Spurn wild goose chases. Seek that which endures.

|

|

March 26, 2013, 01:06:25 AM |

|

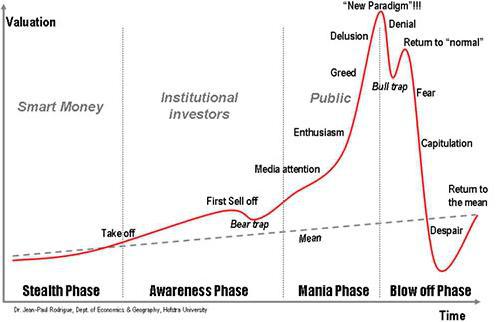

From two months ago, in a thread about bubbles:  I'm thinking somewhere between "greed" and "delusion".... In the end, it seems clear that this read was incorrect; at the time, the price of one bitcoin was something like $20. However, (please don't laugh!) fool that I am, I suspect that the chart has finally begun to apply. Recently, people have pointed out that there are many, many new accounts being created at the major exchanges. Bitstamp account IDs have tripled in the past month. Mt. Gox made a post discussing their increased volume. And with the Cyprus haircuts (or scalpings, if you prefer), many major news organizations are reporting on Bitcoin as a currency of flight for panicked Europeans. That's "Media Attention" - the beginning of the public investment (mania) phase of a bubble. Does this mean I predict a price crash tomorrow? Of course not! After all, even if my read is correct (a long shot, to be sure), it only puts the bubble at preliminary levels, far below the peak. If the chart holds, we'll see prices in the hundreds before the spaceship comes crashing down, and the crash isn't even guaranteed to break through $10/coin. But I feel as though the conditions that create a textbook bubble have finally begun to emerge. Just one foolish forum member's thoughts. Take them however you will. |

If there is something that will make Bitcoin succeed, it is growth of utility - greater quantity and variety of goods and services offered for BTC. If there is something that will make Bitcoin fail, it is the prevalence of users convinced that BTC is a magic box that will turn them into millionaires, and of the con-artists who have followed them here to devour them.

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

March 26, 2013, 01:11:11 AM |

|

I agree.

31 was the first sellof

2 was the bear trap

something between 78 and infinity will be new paradigm

and finally

despair will go below 1.

|

|

|

|

|

|

zoinky

|

|

March 26, 2013, 01:14:44 AM |

|

ohlawdythespeculationiskillinme.

|

|

|

|

|

thezerg

Legendary

Offline Offline

Activity: 1246

Merit: 1010

|

|

March 26, 2013, 01:52:05 AM |

|

Unlike tulips, the internet stocks were a bubble but somehow the internet has completely transformed everyone's lives and made a lot of people a lot of money.

Add this bubble chart to a decade+ long term "S" curve (we are still in the very beginning so it is not distinguishable from exponential) and you'll have what I think bitcoin will do.

|

|

|

|

|

Qoheleth (OP)

Legendary

Offline Offline

Activity: 960

Merit: 1028

Spurn wild goose chases. Seek that which endures.

|

|

March 26, 2013, 01:56:02 AM |

|

I agree.

31 was the first sellof

2 was the bear trap

something between 78 and infinity will be new paradigm

and finally

despair will go below 1.

That's an unusually long view of the data. I'm skeptical of it, for two reasons: - We spent months at $5. A months-long stable price is hardly expected behavior for the middle of a bubble.

- If $33->$2 was a mere bear trap, the main event is going to be, what, three orders of magnitude? Sub-$1 to super-$1000? Such multipliers would be a first in recorded history - not even tulip bulbs saw that sort of inflation.

Unlike tulips, the internet stocks were a bubble but somehow the internet has completely transformed everyone's lives and made a lot of people a lot of money.

Add this bubble chart to a decade+ long term "S" curve (we are still in the very beginning so it is not distinguishable from exponential) and you'll have what I think bitcoin will do. Also a valid interpretation. Personally, I'm still pretty confident that the blockchain technology is the future of asset transfer, though I'm not 100% convinced that Bitcoin will be the implementation that wins. |

If there is something that will make Bitcoin succeed, it is growth of utility - greater quantity and variety of goods and services offered for BTC. If there is something that will make Bitcoin fail, it is the prevalence of users convinced that BTC is a magic box that will turn them into millionaires, and of the con-artists who have followed them here to devour them.

|

|

|

Spaceman_Spiff

Legendary

Offline Offline

Activity: 1638

Merit: 1001

₪``Campaign Manager´´₪

|

|

March 26, 2013, 02:00:35 AM |

|

I agree.

31 was the first sellof

2 was the bear trap

something between 78 and infinity will be new paradigm

Personally, I see $2 as the despair of bubble nr. 1, but its not that big a difference I guess. and finally

despair will go below 1.

Umm, no. You are overlooking the fact that bitcoin has a very nice 'mean' trendline going on, so in absence of fundamentally really bad news, I doubt we'll ever see $1 again (and I have my doubts if we'll ever see single digits again, my money is on no) In the long run, we are just starting to see institutional investors starting to dip their toes in (though in this case, maybe the public might like bitcoin faster than institutions? dunno). |

|

|

|

|

Dargo

Legendary

Offline Offline

Activity: 1820

Merit: 1000

|

|

March 26, 2013, 02:34:22 AM |

|

As spiff points out, there can be more than one bubble, and the crash can just be a return to more moderate growth (rather than an Enron-type crash to zero). Also, it's not clear what "public investing" means for Bitcoin. We obviously have a lot of public investing now, but in terms of the chart, if public investing comes after institutional investing, this might mean people investing in a Bitcoin ETF (or something like that) which can be traded on standard exchanges, and with Apple-esque public awareness and confidence. My retail investor friends are too scared and suspicious to invest in Bitcoin, and I think it will take something like availability on a main-stream exchange before they will give it a go. So, maybe we are just starting to exit the stealth phase. Yeah, I know, this is an overly optimistic thought - more likely the model just doesn't fit Bitcoin very well. But it's fun to speculate.  |

|

|

|

|

BitPirate

Full Member

Offline Offline

Activity: 238

Merit: 100

RMBTB.com: The secure BTC:CNY exchange. 0% fee!

|

|

March 26, 2013, 02:58:00 AM |

|

Absolute minimum floor right now is $50. Even self-confessed bears will be buying at $50 or above. Remember that BTC is a currency, not a stock.

I think most would be happy to just hold on to $50 too. Those who don't -- no big loss.

|

|

|

|

|

Sage

|

|

March 26, 2013, 03:22:11 AM |

|

Wait! Wait! This time it's different... right? Bitcoin is immune from human nature  |

|

|

|

|

BitPirate

Full Member

Offline Offline

Activity: 238

Merit: 100

RMBTB.com: The secure BTC:CNY exchange. 0% fee!

|

|

March 26, 2013, 03:23:42 AM |

|

Wait! Wait! This time it's different... right? Bitcoin is immune from human nature  Haha -- It's not different at all. We all see the hourly/daily crazy fluctuations in price. Doesn't mean this is the top of a bubble though... |

|

|

|

|

Sage

|

|

March 26, 2013, 03:32:20 AM |

|

Wait! Wait! This time it's different... right? Bitcoin is immune from human nature  Haha -- It's not different at all. We all see the hourly/daily crazy fluctuations in price. Doesn't mean this is the top of a bubble though... Perhaps you didn't get my sarcasm... |

|

|

|

|

Dargo

Legendary

Offline Offline

Activity: 1820

Merit: 1000

|

|

March 26, 2013, 03:33:27 AM |

|

Wait! Wait! This time it's different... right? Bitcoin is immune from human nature  Yes, because it's a new paradigm!  |

|

|

|

|

BitPirate

Full Member

Offline Offline

Activity: 238

Merit: 100

RMBTB.com: The secure BTC:CNY exchange. 0% fee!

|

|

March 26, 2013, 03:40:34 AM |

|

Wait! Wait! This time it's different... right? Bitcoin is immune from human nature  Haha -- It's not different at all. We all see the hourly/daily crazy fluctuations in price. Doesn't mean this is the top of a bubble though... Perhaps you didn't get my sarcasm... No way, really? I just add 'haha' to the beginning of everything I write  |

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

March 26, 2013, 01:54:09 PM |

|

I agree.

31 was the first sellof

2 was the bear trap

something between 78 and infinity will be new paradigm

and finally

despair will go below 1.

That's an unusually long view of the data. I'm skeptical of it, for two reasons: - We spent months at $5. A months-long stable price is hardly expected behavior for the middle of a bubble.

- If $33->$2 was a mere bear trap, the main event is going to be, what, three orders of magnitude? Sub-$1 to super-$1000? Such multipliers would be a first in recorded history - not even tulip bulbs saw that sort of inflation.

$5 was the end of the bear trap. In the template is something like a 1:3 relation between first selloff and new paradigm. That would leave us with a peak of roughly USD 100. It doesn't have to stick to those figures, what is important is that the general relationships apply and they certainly do when looking on the all time chart. After all the slope of the initial runup was kind of steep. So it would still hold even if the top were something like ~500. I'm not saying bitcoin must adhere to the template, but I really think that if it does the all time chart is the most applicable. |

|

|

|

|

Qoheleth (OP)

Legendary

Offline Offline

Activity: 960

Merit: 1028

Spurn wild goose chases. Seek that which endures.

|

|

March 26, 2013, 04:40:45 PM |

|

$5 was the end of the bear trap.

In the template is something like a 1:3 relation between first selloff and new paradigm. That would leave us with a peak of roughly USD 100. It doesn't have to stick to those figures, what is important is that the general relationships apply and they certainly do when looking on the all time chart. After all the slope of the initial runup was kind of steep. So it would still hold even if the top were something like ~500.

I'm not saying bitcoin must adhere to the template, but I really think that if it does the all time chart is the most applicable.

You're proposing an eighteen month bear trap in the bubble pattern of an asset that's only existed for four years. You're proposing a bear trap that constitutes 60% of the asset's all-time trade history. Isn't there something weird about that assertion? |

If there is something that will make Bitcoin succeed, it is growth of utility - greater quantity and variety of goods and services offered for BTC. If there is something that will make Bitcoin fail, it is the prevalence of users convinced that BTC is a magic box that will turn them into millionaires, and of the con-artists who have followed them here to devour them.

|

|

|

Vandroiy

Legendary

Offline Offline

Activity: 1036

Merit: 1002

|

|

March 26, 2013, 05:00:13 PM |

|

$5 was the end of the bear trap.

In the template is something like a 1:3 relation between first selloff and new paradigm. That would leave us with a peak of roughly USD 100. It doesn't have to stick to those figures, what is important is that the general relationships apply and they certainly do when looking on the all time chart. After all the slope of the initial runup was kind of steep. So it would still hold even if the top were something like ~500.

I'm not saying bitcoin must adhere to the template, but I really think that if it does the all time chart is the most applicable.

You're proposing an eighteen month bear trap in the bubble pattern of an asset that's only existed for four years. You're proposing a bear trap that constitutes 60% of the asset's all-time trade history. Isn't there something weird about that assertion? I think it's a lot less weird than most of the other things written on here. Why not? Human psychology and the spread of information doesn't care much about how old the thing at hand is. If Bitcoin had existed in the shadows for longer, that wouldn't change much about the current situation. Economic bubbles have typical life-spans of a few years, so in terms of the time-span it's not a long shot. Everyone holding mid-term made profits so far. If people make a rule out of that, we're bound to get bubbles with a life-span of years, not just months. These people will tend to hold independent of fundamentals or market valuation, stating "doesn't matter if it went wrong, in a year or two I'll have a profit anyway". It does become a problem eventually, though nobody knows when as long as the user base is growing. It's quite simple: statements that use price trends to predict price indicate bubble-type activity, no matter the time-scale. If this is a dominating factor, it becomes a problem. It certainly is a problem right now. |

|

|

|

|

|

Peter Lambert

|

|

March 26, 2013, 05:14:27 PM |

|

Absolute minimum floor right now is $50. Even self-confessed bears will be buying at $50 or above. Remember that BTC is a currency, not a stock.

I think most would be happy to just hold on to $50 too. Those who don't -- no big loss.

I would say the absolute floor is more like 12 USD. |

Use CoinBR to trade bitcoin stocks: CoinBR.comThe best place for betting with bitcoin: BitBet.us |

|

|

|

chriswen

|

|

March 26, 2013, 05:22:02 PM |

|

People who don't think this picture applies. That is because you haven't felt the fear/despair yet.

|

|

|

|

|

Odalv

Legendary

Offline Offline

Activity: 1400

Merit: 1000

|

|

March 26, 2013, 05:45:56 PM |

|

$5 was the end of the bear trap.

In the template is something like a 1:3 relation between first selloff and new paradigm. That would leave us with a peak of roughly USD 100. It doesn't have to stick to those figures, what is important is that the general relationships apply and they certainly do when looking on the all time chart. After all the slope of the initial runup was kind of steep. So it would still hold even if the top were something like ~500.

I'm not saying bitcoin must adhere to the template, but I really think that if it does the all time chart is the most applicable.

You're proposing an eighteen month bear trap in the bubble pattern of an asset that's only existed for four years. You're proposing a bear trap that constitutes 60% of the asset's all-time trade history. Isn't there something weird about that assertion? If you want to speculate then it is easy, "buy and hold". If you panic sold then don't cry because you already made your money. The bigger market cap the more people can use Bitcoin for shopping. Somebody must take risk invests his money and give Bitcoin a VALUE. If you still do not understand then learn fundamentals WHAT IS BITCOIN. :-) |

|

|

|

|

|

aurora

|

|

March 26, 2013, 08:15:19 PM |

|

Absolute minimum floor right now is $50. Even self-confessed bears will be buying at $50 or above. Remember that BTC is a currency, not a stock.

I think most would be happy to just hold on to $50 too. Those who don't -- no big loss.

I would say the absolute floor is more like 12 USD. according to history it stops where it started |

Dym.gameDouble your money. Use Martingale/anti strategies. 1 to 1 odds

|

|

|

|