AlcoHoDL

Legendary

Offline Offline

Activity: 2352

Merit: 4134

Addicted to HoDLing!

|

In 2017, a couple of friends asked me how to get into crypto. I told them "not crypto, Bitcoin!" They said it was too expensive, and bought Ripple and Lumen instead. They pumped, my friends ended up with 10x their initial investment. I told them "sell them NOW and buy Bitcoin!" They didn't listen to me. Yesterday, I was chatting with one of them, and casually mentioned that Bitcoin is pumping and we'll soon reach ATH and beyond. He was not so happy. He changed the subject...  |

|

|

|

|

|

|

|

|

|

According to NIST and ECRYPT II, the cryptographic algorithms used in

Bitcoin are expected to be strong until at least 2030. (After that, it

will not be too difficult to transition to different algorithms.)

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2090

Merit: 1461

We choose to go to the moon

|

|

November 16, 2020, 10:31:44 AM |

|

Weather feels a bit pumpy today.

|

|

|

|

|

strawbs

Legendary

Offline Offline

Activity: 868

Merit: 1340

|

|

November 16, 2020, 10:34:29 AM |

|

Maggie the damn block Blijft in uw kot! Minister of health Dude, that's your Minister of Health? Could they have chosen a less suitable looking Health Minister??? And congrats on the 2-0, Eng seemed to have a lot of possession but never really doing too much with it  |

|

|

|

|

strawbs

Legendary

Offline Offline

Activity: 868

Merit: 1340

|

|

November 16, 2020, 10:38:31 AM |

|

In 2017, a couple of friends asked me how to get into crypto. I told them "not crypto, Bitcoin!" They said it was too expensive, and bought Ripple and Lumen instead. They pumped, my friends ended up with 10x their initial investment. I told them "sell them NOW and buy Bitcoin!" They didn't listen to me.

Yesterday, I was chatting with one of them, and casually mentioned that Bitcoin is pumping and we'll soon reach ATH and beyond. He was not so happy. He changed the subject...

I always find "but I don't have enough money to invest in bitcoin, they're over $xxxx each" to be the most common response when I tell folk to avoid shitcoins. At which point, I consider them to be beyond help and change the conversation to something else. |

|

|

|

|

V8s Road Warrior

Member

Offline Offline

Activity: 90

Merit: 44

|

|

November 16, 2020, 10:40:57 AM |

|

Another rigged

football match. England in fact

thrashed the Belgians.

|

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7962

|

|

November 16, 2020, 10:43:59 AM |

|

Blijft in uw kot! ...of gegeten worden, denk ik.

|

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11985

BTC + Crossfit, living life.

|

|

November 16, 2020, 11:11:24 AM |

|

Maggie the damn block Blijft in uw kot! Minister of health Dude, that's your Minister of Health? Could they have chosen a less suitable looking Health Minister??? And congrats on the 2-0, Eng seemed to have a lot of possession but never really doing too much with it  Yeah she’s not looking to well Aaaaand yeah, Belgium let them play along a bit....  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11985

BTC + Crossfit, living life.

|

|

November 16, 2020, 11:12:41 AM |

|

Blijft in uw kot! ...of gegeten worden, denk ik.

First ok after the .... or been eaten, I think. <—  |

|

|

|

|

|

Millionero

|

|

November 16, 2020, 11:25:41 AM |

|

Please do not change the roller guys color  Orange coins matter. |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

November 16, 2020, 12:09:49 PM |

|

Blijft in uw kot! ...of gegeten worden, denk ik.

First ok after the .... or been eaten, I think. <—  Blijft in uw kot! => Old fashioned (or belgian) way of saying "Stay in your raggedy-ass house!" |

|

|

|

|

V8s Road Warrior

Member

Offline Offline

Activity: 90

Merit: 44

|

|

November 16, 2020, 12:10:30 PM |

|

another day another vaccine

there's too much bloody choice in this world

in my day blah blah blah even heard of consumerism

blah blah by our own bootstraps

blah blah the price of everything and the value of nothing

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 16, 2020, 01:02:54 PM

Last edit: May 16, 2023, 01:03:42 AM by fillippone Merited by vapourminer (1) |

|

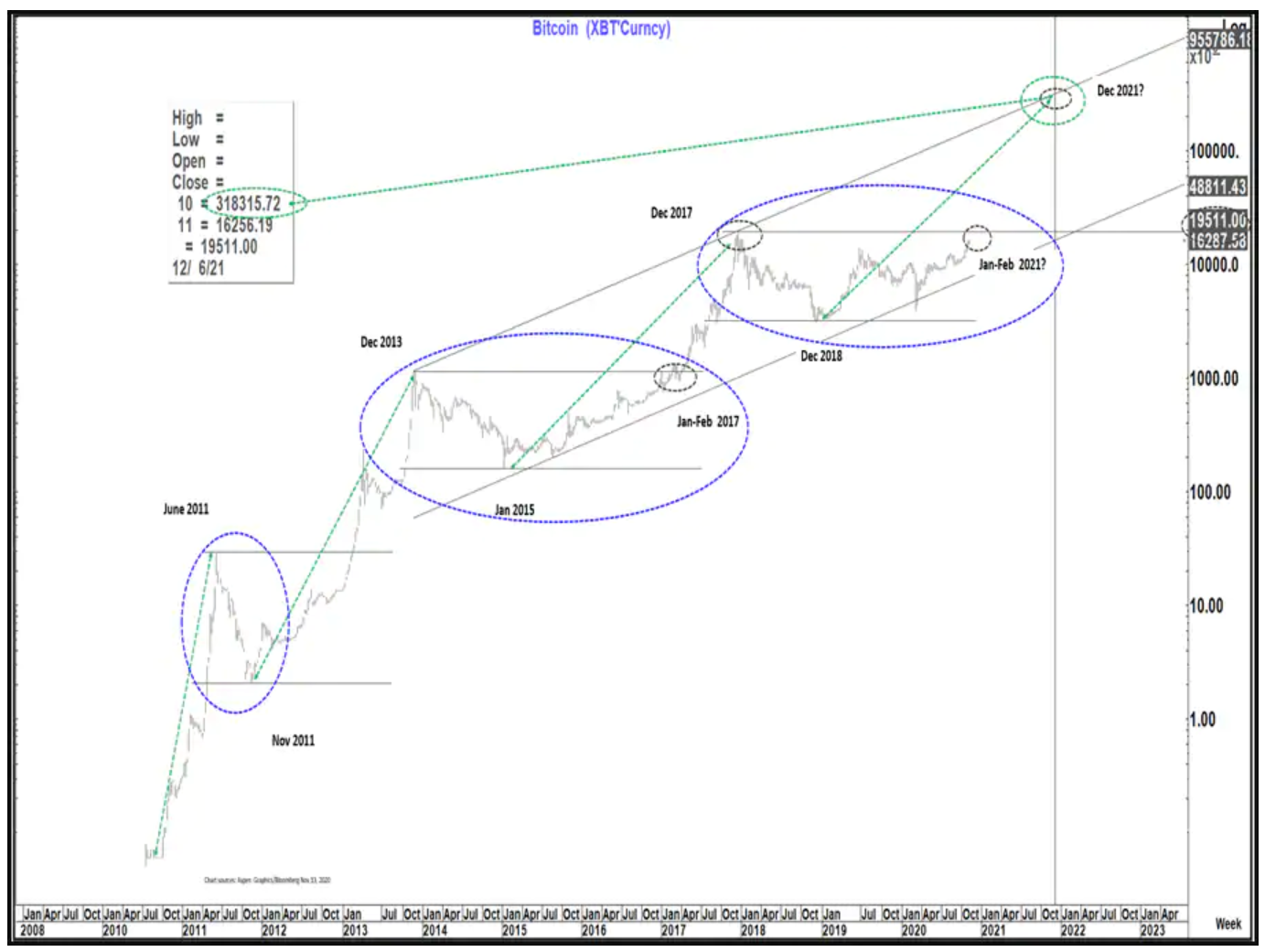

TLDR: Citibank now reads WO and is filling their bags. Here you have the full report. Bitcoin: 21st Century GoldBy Tom FitzPatrick - The whole existence of Bitcoin has been characterised by unthinkable rallies followed by painful corrections (The type

of pattern that sustains a long term trend.)

- The first major rally on this chart as Bitcoin came into the mainstream was the exponential move from 2010 into the 2011 high

followed by a deep correction. This is interesting for 3 reasons

- That surge, as it came into the mainstream, was very reminiscent of what happened with Gold as it was allowed to

float in the early 1970’s after 50 years of trading in a $20-$35 range. - That period with regard to the Gold price was a structural change in the modern day monetary regime as it broke

the orthodox relationship between FIAT currencies and Gold ushering in a World of fiscal indiscipline, deficits and

inflation. - The Bitcoin move happened in the aftermath of the Great Financial crisis which saw a new change in the monetary

regime as we went to ZERO per cent interest rates (negative in some countries) and massive QE.

- Are we on the cusp of another such structural development? A number of things come to mind in that respect

- With the onset of a new crisis (Covid) Fiscal Orthodoxy has gone out the window (and likely rightly so for now). The

unprecedented societal crisis that we are seeing today leaves little if any room around the World for Fiscal

austerity. - The Fed (The Central Bank of the World) has given 2 pieces of very clear guidance in recent years about how

monetary policy is being reshaped, in possibly the most dramatic fashion since the floating of Gold in the 1970’s,

even more so than the introduction of QE in the last cycle. - The first guidance was before the Pandemic hit and was an assessment of the actions taken during the Financial

crisis. If I remember the phrase correctly it was something like “better a dime today than a Dollar tomorrow”. In

essence the conclusion was that it was better if a crisis developed to hit it hard and early rather than piecemeal

over time- the “big bazooka” effectively. True to their word that is exactly what they did as the Pandemic roiled

financial markets in Feb-March this year. - The second and (in my view) more “monumental” guidance was the indication that as the economy/inflation

and employment pick up they will not look to constrain monetary policy in the same fashion they have in the whole

post Volcker era. This change in monetary policy and simultaneous opening up in fiscal policy is (despite

protestations to the contrary) MMT in all but name and a clear intention of debasing FIAT currency.

- Historically this has been good for Gold and likely will again. However, Gold has some restrictions that also need to be noted.

Physical Gold needs to be stored, is not readily portable across borders, has paper equivalents on exchanges that may or may

not fully reflect the actual move in Gold and could possibly be called “yesterday’s news” in terms of a financial hedge.

- Bitcoin is the new Gold- It is an asset with limited supply. It is digital (This is the 21st century- Gold is a 20th century asset).

It moves across borders easily and ownership is opaque. That last point is, I believe, very relevant. The huge Fiscal deterioration

of today has a cost in the future, either directly or indirectly. Directly it is that at some point the “bills have to be paid” which

means at some time in the future the money needs to be found. While Bitcoin may become subject to more regulatory

constraints going forward it is a natural store of “money” to avoid this. Indirectly the argument can be the debasement of FIAT

currencies by creating high nominal growth and inflation (effectively a soft default- I do not believe hard default, particularly in

the World’s reserve currency is a real concern. However in lesser currencies it could well be)

- Central Banks are increasingly discussing digitisation of currencies: This is a double edged sword. On one side it creates a

much more effective mechanism for distributing stimulus (particularly fiscal) but on the other side it also makes capital

confiscation easier (eg negative interest rates). Both these scenarios would look to me to be positive Bitcoin and in the 21st

Century give us the digital equivalent (Bitcoin versus FIAT digital) of what we saw in the 20th century when the financial regime

changed (Gold versus FIAT paper)

- So let us go back to the chart. After the high was posted in 2011 we saw Bitcoin retrace 93% over 5 months (not for the faint

hearted). That was followed by a 9 year period that has been much more symmetric as Bitcoin as an asset became more visible

and increasingly more mainstream

- It rallied for 2 years from 2011-2013 (multiplying by an incredible 555 times)

- It fell from Dec 2013 to Jan 2015 (13 months) by 86%

- It rallied from Jan 2015 to Dec 2017 (2 years and 11 months) multiplying by 121 times

- It fell from December 2017 to Dec 2018 (12 months) by 84%

- It rallied from December 2018 to? by ? %

- If you look at the chart below and the price action to date you could argue 2 things

- Timeframes for the rally are getting longer (10 months, 2 years, 3 years and next 4 years? So end of 2022.) Of course in

doing that you likely argue even higher levels as a consequence.

- You look at price action being much more symmetrical over the past 7 years or so (while still huge numbers) forming

what looks like a very well defined channel giving us an up move of similar timeframe to the last rally. Such an argument

would suggest that this move could potentially peak in December 2021, at the high of the channel, suggesting a move as

high as $318k. Improbable though that seems it would only be a low to high rally of 102 times (the weakest rally so far in

percentage terms) at a point where the arguments in favour of Bitcoin could well be at their most persuasive ever.

- Time will tell if we end up seeing such lofty levels but the backdrop and the price action we are looking at clearly

suggest the potential for a major move higher nonetheless in the next 12-24 months.

I don't know about the prediction, but I like the reasoning about bitcoin put down by the guy. It is almost the reason why I am long bitcoin. |

|

|

|

|

Wilhelm

Legendary

Offline Offline

Activity: 1652

Merit: 1265

|

|

November 16, 2020, 01:31:38 PM |

|

TLDR: Citibank now reads WO and is filling their bags. Here you have the full report. - The whole existence of Bitcoin has been characterised by unthinkable rallies followed by painful corrections (The type

of pattern that sustains a long term trend.)

- The first major rally on this chart as Bitcoin came into the mainstream was the exponential move from 2010 into the 2011 high

followed by a deep correction. This is interesting for 3 reasons

- That surge, as it came into the mainstream, was very reminiscent of what happened with Gold as it was allowed to

float in the early 1970’s after 50 years of trading in a $20-$35 range. - That period with regard to the Gold price was a structural change in the modern day monetary regime as it broke

the orthodox relationship between FIAT currencies and Gold ushering in a World of fiscal indiscipline, deficits and

inflation. - The Bitcoin move happened in the aftermath of the Great Financial crisis which saw a new change in the monetary

regime as we went to ZERO per cent interest rates (negative in some countries) and massive QE.

- Are we on the cusp of another such structural development? A number of things come to mind in that respect

- With the onset of a new crisis (Covid) Fiscal Orthodoxy has gone out the window (and likely rightly so for now). The

unprecedented societal crisis that we are seeing today leaves little if any room around the World for Fiscal

austerity. - The Fed (The Central Bank of the World) has given 2 pieces of very clear guidance in recent years about how

monetary policy is being reshaped, in possibly the most dramatic fashion since the floating of Gold in the 1970’s,

even more so than the introduction of QE in the last cycle. - The first guidance was before the Pandemic hit and was an assessment of the actions taken during the Financial

crisis. If I remember the phrase correctly it was something like “better a dime today than a Dollar tomorrow”. In

essence the conclusion was that it was better if a crisis developed to hit it hard and early rather than piecemeal

over time- the “big bazooka” effectively. True to their word that is exactly what they did as the Pandemic roiled

financial markets in Feb-March this year. - The second and (in my view) more “monumental” guidance was the indication that as the economy/inflation

and employment pick up they will not look to constrain monetary policy in the same fashion they have in the whole

post Volcker era. This change in monetary policy and simultaneous opening up in fiscal policy is (despite

protestations to the contrary) MMT in all but name and a clear intention of debasing FIAT currency.

- Historically this has been good for Gold and likely will again. However, Gold has some restrictions that also need to be noted.

Physical Gold needs to be stored, is not readily portable across borders, has paper equivalents on exchanges that may or may

not fully reflect the actual move in Gold and could possibly be called “yesterday’s news” in terms of a financial hedge.

- Bitcoin is the new Gold- It is an asset with limited supply. It is digital (This is the 21st century- Gold is a 20th century asset).

It moves across borders easily and ownership is opaque. That last point is, I believe, very relevant. The huge Fiscal deterioration

of today has a cost in the future, either directly or indirectly. Directly it is that at some point the “bills have to be paid” which

means at some time in the future the money needs to be found. While Bitcoin may become subject to more regulatory

constraints going forward it is a natural store of “money” to avoid this. Indirectly the argument can be the debasement of FIAT

currencies by creating high nominal growth and inflation (effectively a soft default- I do not believe hard default, particularly in

the World’s reserve currency is a real concern. However in lesser currencies it could well be)

- Central Banks are increasingly discussing digitisation of currencies: This is a double edged sword. On one side it creates a

much more effective mechanism for distributing stimulus (particularly fiscal) but on the other side it also makes capital

confiscation easier (eg negative interest rates). Both these scenarios would look to me to be positive Bitcoin and in the 21st

Century give us the digital equivalent (Bitcoin versus FIAT digital) of what we saw in the 20th century when the financial regime

changed (Gold versus FIAT paper)

- So let us go back to the chart. After the high was posted in 2011 we saw Bitcoin retrace 93% over 5 months (not for the faint

hearted). That was followed by a 9 year period that has been much more symmetric as Bitcoin as an asset became more visible

and increasingly more mainstream

- It rallied for 2 years from 2011-2013 (multiplying by an incredible 555 times)

- It fell from Dec 2013 to Jan 2015 (13 months) by 86%

- It rallied from Jan 2015 to Dec 2017 (2 years and 11 months) multiplying by 121 times

- It fell from December 2017 to Dec 2018 (12 months) by 84%

- It rallied from December 2018 to? by ? %

- If you look at the chart below and the price action to date you could argue 2 things

- Timeframes for the rally are getting longer (10 months, 2 years, 3 years and next 4 years? So end of 2022.) Of course in

doing that you likely argue even higher levels as a consequence.

- You look at price action being much more symmetrical over the past 7 years or so (while still huge numbers) forming

what looks like a very well defined channel giving us an up move of similar timeframe to the last rally. Such an argument

would suggest that this move could potentially peak in December 2021, at the high of the channel, suggesting a move as

high as $318k. Improbable though that seems it would only be a low to high rally of 102 times (the weakest rally so far in

percentage terms) at a point where the arguments in favour of Bitcoin could well be at their most persuasive ever.

- Time will tell if we end up seeing such lofty levels but the backdrop and the price action we are looking at clearly

suggest the potential for a major move higher nonetheless in the next 12-24 months.

I don't know about the prediction, but I like the reasoning about bitcoin put down by the guy. It is almost the reason why I am long bitcoin. I hope he's right but I don't see this happening. IMO $70k-$100k max.... |

|

|

|

|

lightfoot

Legendary

Offline Offline

Activity: 3094

Merit: 2239

I fix broken miners. And make holes in teeth :-)

|

|

November 16, 2020, 01:37:13 PM |

|

And back to 16,300 territory. Nice to see there is a bit of support at these levels, so when it gets to 18k will people be posting double vegattas?

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7763

'The right to privacy matters'

|

|

November 16, 2020, 01:58:45 PM

Last edit: November 17, 2020, 01:17:35 AM by philipma1957 |

|

Today we are poised to set a new record for btc. edit record set! 2020-11-01 13,762 2020-11-02 13,545 2020-11-03 13,632 2020-11-04 13,908 2020-11-05. 14,937 2020-11-06 15,570 2020-11-07 15,076 2020-11-08 15,255 2020-11-09 15,364 2020-11-10 15,325 2020-11-11 15,562 2020-11-12 15,939 2020-11-13 16,279 2020-11-14 15,982 2020-11-15 15,972 2020-11-16 16,409 if we come in over 13,000 this will be the longest streak above 13,000 from day 1 of a month. here is the old streak which we have already tied as of yesterday. 2018-01-16 11,800. the 16th of jan ended it 2018-01-15 13,875 2018-01-14 13,544 2018-01-13 14,233 2018-01-12 13,652 2018-01-11 13,593 2018-01-10 14,135 2018-01-09 14,703 2018-01-08 15,103 2018-01-07 16,397 2018-01-06 16,670 2018-01-05 15,982 2018-01-04 14,806 2018-01-03 14,960 2018-01-02 14,057 2018-01-01 13,373 we are working on two other streaks note pulled info from here https://bitcointalk.org/index.php?topic=138109 and reworked by me to show this record breaking event (we hope for a close above 16,000 as a crash could fuck It up) |

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

November 16, 2020, 02:32:33 PM Merited by JayJuanGee (1) |

|

Alternatively, even if the various bcashes were to attempt to join forces, which probably such joining of shitcoin forces would be a smarter move if any of them could coordinate well enough to figure out such a force joining strategy.. and then it could be called a unforkening.....

|

|

|

|

|

V8s Road Warrior

Member

Offline Offline

Activity: 90

Merit: 44

|

|

November 16, 2020, 02:44:48 PM Merited by JayJuanGee (1) |

|

https://twitter.com/kerooke/status/1328341089032548352On Friday, Skybridge Capital filed an amendment with the SEC, allowing their $3.6 billion fund to start investing in Bitcoin.

Keep an eye on @Scaramucci 👀 scaramucci has long been a goldfag, so all good now edit: prolly some Trump money in that fund, no?

|

|

|

|

|

rdbase

Legendary

Online Online

Activity: 2856

Merit: 1499

Join the world-leading crypto sportsbook NOW!

|

|

November 16, 2020, 02:52:10 PM |

|

And back to 16,300 territory. Nice to see there is a bit of support at these levels, so when it gets to 18k will people be posting double vegattas?

That was a quick turn around. Bitcoin is back on track to contest $16,700 again just were it left off on Friday night. But then the million maga march interrupted that rally. Although they didn't have a million there.. more like 50k  Michael Moore on The Battle Between So-Called Moderates & Progressives | MSNBC Weekends w/ Alex Witt https://www.youtube.com/watch?v=TT2rF-RPH1IHere is who went to that but without any of their masks on  : https://www.youtube.com/watch?v=lXhI75JoQsY  Da media says whaaa? https://www.youtube.com/watch?v=12O_5m6LR_gRudy updates everybody this morning on how Trump is doing after saying biden won but ends up hanging up before the interview ends.  https://www.youtube.com/watch?v=Y2w1hmPMTns https://www.youtube.com/watch?v=Y2w1hmPMTnsTone Vays says he doesn't give a sh*t and will start traveling NOW and getting out of his bunker (changes background to a penthouse cause of the bitcoin rally perhaps?)  https://www.youtube.com/watch?v=gQEyJ99z09A https://www.youtube.com/watch?v=gQEyJ99z09AJust like those honey badgers, BTC don't give a f**k! |

|

|

|

|

tranthidung

Legendary

Offline Offline

Activity: 2254

Merit: 3972

Farewell o_e_l_e_o

|

|

November 16, 2020, 02:55:09 PM |

|

Hi WO_gang again, The time-series plots (charts) give you enough visual data for daily high price (in 2017, 2018, 2019, 2020) and daily volume. It has around 45 days till the end of 2020 and if history repeats itself, better things not yet to come. But be careful with your trading orders and extremely careful if you are trading with high leverages. You can keep your greediness and wait for higher price in rest days of this year but it is not a most wisely way to take profit. It is not my financial advice. 4 years: 2017 to 2020 In 2017 and 2020 |

|

|

|

|

|

Poll

Poll