ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 26, 2022, 10:01:25 PM |

|

|

|

|

|

|

|

|

|

|

|

The forum strives to allow free discussion of any ideas. All policies are built around this principle. This doesn't mean you can post garbage, though: posts should actually contain ideas, and these ideas should be argued reasonably.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 26, 2022, 11:01:24 PM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 26, 2022, 11:17:19 PM |

|

For some reason I have started arguing with Kurt Wuckert. It's amazingly circular and pointless. I wonder how much that guy gets paid... man, And I just rep the truth for free!  |

|

|

|

|

AverageGlabella

Legendary

Offline Offline

Activity: 1232

Merit: 1080

|

|

January 26, 2022, 11:40:51 PM Merited by JayJuanGee (1) |

|

Found something really interesting. Everytime BTC goes below 1 Week 50 MA, it retested 1 Week 200 MA.Not saying it has to do this again but something to look at.   I can not say whether you are right in what you are talking about but I will accept it in any case since it fits with my narrative. Your way of discussing several of the matters and your trade offs does cause me a decent amount of concern - especially in terms of your ability to HODL through potential tough times.

For sure, there is a lot of empirical evidence to show that lump sum investing has tended to pay off even better than DCA - especially when the buying was upon dips.. but we can never really know the extent to which a dip is over.. so there tends to be some value in having some strategies besides lump sum, such as an ability to continue to buy on further dips... otherwise you just have to HODL through the whole dip period, if it ends up coming and taking a long time to resolve...and hopefully you would not end up panicing in the meantime.

Personally, since you did a pretty decent lump sum investment, maybe you should plan to carry out a DCA plan at any time that the BTC price get's close to your buy-in price.. even if your DCA amount is ONLY $10 per week (maybe $100 per week would be better?).. it might give you some peace of mind if we ever go below your average buy price.

Usually the plan for having at least a 4-year plan would be that if you bought at the top of the cycle then you would still have pretty decent chances of at least being profitable after 4 years.. maybe not extremely profitable, but at least not in the red.. and there are no guarantees of that, either, even though BTC's investment thesis does seem to be quite a bit stronger now than it was 7-8 years ago.

Regarding cashing out, sure of course you might want to attempt to time tops somewhat, but you still gotta be careful about cashing out too much because where you going to put it that is better than BTC? You could consider cashing out more incrementally such as quarterly, yearly or some timeline variation that is comfortable, but you might need to be careful that you might end up taking out at the wrong times.. but sure if you cash out a quarter or a years worth of expected expenses, then that would likely be reasonable.

You know about the 4% per year theory regarding cashing out too, right? That has traditionally been the guidance for traditional investments, even though I do believe with BTC you could get away with larger percentages depending on how you value your holdings. Also, if you are planning not to cash out any BTC for 5 years, you do have 5 years to figure out those kinds of matters, but you could attempt to project out values and cash out plans in terms of best case scenarios, worse case scenarios and even medium case scenarios.. and for sure there is value to give some serious considerations to the worse case scenarios, even though if they are not really very likely it is better to have a way of keeping in mind a range of scenarios while focusing more of your attention on more likely scenarios and perhaps revisiting the projections from time to time to see if you might need to tweak them.

Regarding your cold storage, you should check them a few times a year to make sure that you understand your access and your recovery and if you might have back up ways to recover.. and once you go through the process a few times, you might be able to just do it once a year.. depending on how complicated that you have made it for yourself.. ..but for sure both complication and too much simplicity could be enemies.. so some kind of balance is going to be preferred.

thanks to you for being concerned enough with regards to me to offer this extraordinary guidance. I figure I will take your recommendation and do a DCA plan as you say. I think taking out $100 consistently that the value stays a little % underneath my target is smart to prevent me from getting hurt assuming it never arrives at the target I am focusing on. I am going to try to avoid accessing my cold storage and I will only be checking that the recovery paper I have is in good condition and has not deteriorated. My process was the normal process and should not be hard to check 1 a year. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 12:01:33 AM |

|

|

|

|

|

|

AverageGlabella

Legendary

Offline Offline

Activity: 1232

Merit: 1080

|

|

January 27, 2022, 12:17:39 AM Merited by JayJuanGee (1) |

|

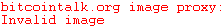

Makes me feel good about my decisions  |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 01:01:24 AM |

|

|

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

January 27, 2022, 01:15:17 AM |

|

By the way, I sent the above image to someone via text in real life, and at the time of sending the pic, I pretty much said: "You need to be more like me," and the person told me that I needed to explain the picture MOAR better because the picture does not make sense, and I refused to explain the picture. I said that the picture is self-explanatory.. and should be studied more closely in order to understand it. One of the problems of peeps in real life.. sometimes, and in that regard, I guess I am a meanie in real life, too.. because I refuse to explain more than what is already shown in the picture. Down here, be like me Dip like piña colada Badass JJG #haiku |

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

January 27, 2022, 01:15:53 AM Merited by fillippone (3) |

|

For some reason I have started arguing with Kurt Wuckert.

I just ended up blocking him. His "I'm rich with a loving family and friends" bullshit was the weakest of sauce when really getting savage with him. The guy probably cries himself to sleep every night. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 02:01:25 AM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 27, 2022, 02:08:24 AM |

|

For some reason I have started arguing with Kurt Wuckert.

I just ended up blocking him. His "I'm rich with a loving family and friends" bullshit was the weakest of sauce when really getting savage with him. The guy probably cries himself to sleep every night. What the hell is wrong with him? I wonder if he kept all the payments made to him as BSV? I do feel like he is losing his mojo a little... |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 03:01:32 AM |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 04:01:25 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10147

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 27, 2022, 04:15:18 AM |

|

By the way, I sent the above image to someone via text in real life, and at the time of sending the pic, I pretty much said: "You need to be more like me," and the person told me that I needed to explain the picture MOAR better because the picture does not make sense, and I refused to explain the picture. I said that the picture is self-explanatory.. and should be studied more closely in order to understand it. One of the problems of peeps in real life.. sometimes, and in that regard, I guess I am a meanie in real life, too.. because I refuse to explain more than what is already shown in the picture. That is kinda mean Mr. JJG. You've gotten your friends, acquaintances and enemies alike used to a certain standard of communication and then you pull the rug out from under them with a simple picture? I can see what you are saying. It was venturing on the more shocking way of communicating for someone who seems to be failing/refusing to appreciate certain kinds of creative ways that I attempt to communicate about attempting to see the bright side of a seemingly negative situation... I will clarify, however, I did not share such picture with one of my family members in which I attempt to maintain more formal communications.. it was someone with whom I thought that various kinds of informalities would be acceptable. The reaction caused me to conclude that I might have to be a bit more sparing and less daring with those ways of communicating with that person... Really? "I don't get it." "I don't get it." is just telling me that such person does not want to "get it." A picture may paint a thousand words but it can't hold a candle to you, sir.

Well? You may have a point. Such person had recently been telling me that there would be a preference that I communicate with more pictures, memes and graphs... yet I have not yet been successful.. and so I am thinking that I should just be sticking to my core competencies, even if such person does not seem to understand such core competencies. I suggest you apologize to that "someone" and strive to maintain excellence in all further communications. Pfft... a picture.  I cannot recall whether I have ever apologized in my whole life, except when my teachers in grade school would force such words to come out of my mouth. For sure, there are firsts for everything.. I may have to consider the context of the matter, and perhaps for a moment, put myself in my second-grader shoes.. if that might seem the best path forward, given the level of mess that I have so far created for my lil selfie. And I am also going to sell my house for the dip.

Don't do it. All we need is another homeless WO participant.. bad enough that so many in these here parts have been considering that they are being creative merely by adding chicken bones to their ramen. The scary bit is we seem to be experiencing a good deal of catastrophe... ;/

Speak for yourself. I would not call bouncing between $32k and $69k in the past 3 months as being really that bad of a thing, and even if you extrapolate for the whole of the last 12 months from the end of January to the end of January, we are not really that bad even for the whole year.. The 52-week moving average shows the average price for the past year, and even though somewhat flat is still at about $48k. If you consider that we spent most of 2018, 2019, and 2020 below $10k.. If you look at that 52-week moving average during that time, it had gotten up to nearly $9k by the end of 2018, but then took another 2 years to get up to $9k.. You can see it in this chart (but the certificate for the website is not renewed so maybe you don't want to look)... https://bitcoincharts.com/charts/bitstampUSD#igWeeklyzczsg2018-02-01zeg2020-10-06ztgMza1gSMAzm1g52za2gSMAzm2g208zvAnyhow, the 52-week moving average has been going up ever since about mid-2019 when it got down to about the $5,500 territory... even though 52-week moving average seems to currently be flattening out in the upper $40ks.. . but still does not seem to be a bad thing....and I suppose the near term BTC price is going to tell us if that 52-week moving average is going to continue to go up, go sideways or go down.. and surely I am thinking that it still has good chances to go up.. even though for sure, I like to simultaneously maintain the "you never know" perspective. |

|

|

|

|

shahzadafzal

Copper Member

Legendary

Offline Offline

Activity: 1526

Merit: 2890

|

|

January 27, 2022, 04:44:50 AM |

|

The news we were rooting for:  Showing a giant middle finger to IMF’s crooks. Game over IMF!  |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 05:01:24 AM |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 06:01:32 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10147

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 27, 2022, 06:31:58 AM Merited by OutOfMemory (1) |

|

Halving 1:

8300% Up after First Halving - Took 335 Days

80% Down in 426 days

Halving 2:

2300% Up after Second Halving - Took 487 Days

75% Down in 396 days

Halving 3:

570% Up after Third Halving - Took 487 Days

Prediction: 70% Down in 426 days

Are you sure we have hit the peak of this bull run? There are much more hodlers this cycle, at least if you trust onchain data analysis. So i doubt a retrace in the 70% ranges. I am also not so sure that we have hit this cycles peak yet. Framing the top for this cycle as a certainty is likely to lead to problematic conclusions.... especially when at best maybe you could argue greater than 50% odds that the top is in, and I personally do not believe that it is greater than 50% odds that the top is in, even though I do understand that others could come to such a conclusion.. and perhaps even somewhat reasonable persons... hahahahahaha On about December 16, the last time that I really went through an attempt at measuring whether the top was in, I got around 45% odds (and sure there is a bit of SOMA in that), and maybe I would be willing to tweak my numbers a wee bit since then.. but from my ongoing attempt to understand what is going on, there does not seem to be enough information to tip us over a 50% reading that the top is in... ..and maybe the most persuasive part would be that we are spending so much time in a kind of 45%-50% correction zone.. which causes it to become harder to believe that BTC prices are going to just double to get us back to our November 9 ATH.. It just feels like fantasy thinking, even though many of us know that BTC is quite capable of such - especially once the UPpity momentum gets going, it becomes harder to keep honey badger down in those kinds of circumstances of previous seemingly outrageous suppression.... So, yeah, maybe at best a reasonable person might come up with reasons to assign slightly higher than 50% odds to the top already being in.. but nothing close to treating it as a certainty seems reasonable.. at least not based on current data and logic in front of those of us who can see it. Sane reasoning there, J. I am a poker player, so i always try to expect the unexpected, even if against the odds. We might be speaking past each other a bit because it seems that I am somewhat focused on suggesting that whatever drop in BTC price that we have had so far, maybe nearly 53%, if we are referring to $32,951 as our low of the correction, so far. When focusing on whether the top is in, I am still considering that the odds have not really changed that much.. maybe they came down a few percentage points... from 55% to nearly 50%, and maybe we could even go a bit greater than that... So I was not even attempting to address the variety of other scenarios.. just focusing on whether the top is in or not. So, if you are assigning different odds or you are focusing on some other question, then we might be getting into a kind of preparing for something that is low odds. Also, the guy who assigns near certainty to the top already being in seems to be engaging in risky gambling scenario to me, even though s/he might end up being correct that is at best in the 50/50 arena. Since Bitcoin didn't do this (tumbling because of bans and politics) before, this cycle, could as well be longer than those in the past. The odds that Bitcoin will persist are above 99,9% though, just because it's great and fits that narrow gap which fiat can't close, as it is.

Well you seem to be raising two questions here. One question relates to the top not being in, and so therefore, the cycle dragging out longer.. which surely seems like a reasonable outcome, and the other more extreme you are asserting that bitcoin is not going to go to zero... Yeah.. of course, that is more or less a given and not really being discussed.. but if you want to talk about a more realistic scenario, then we might talk about whether lows are going to go further than $32,951, or whether we will get back into the $20ks and will we break below $28,600, will we reach the lower $20ks and will we break below $20k.. those would be more urgent questions rather than something that you are assigning 99.9% odds of not happening... Why go to such extremes when it is hardly even an immediate question in front of us? [edited out]

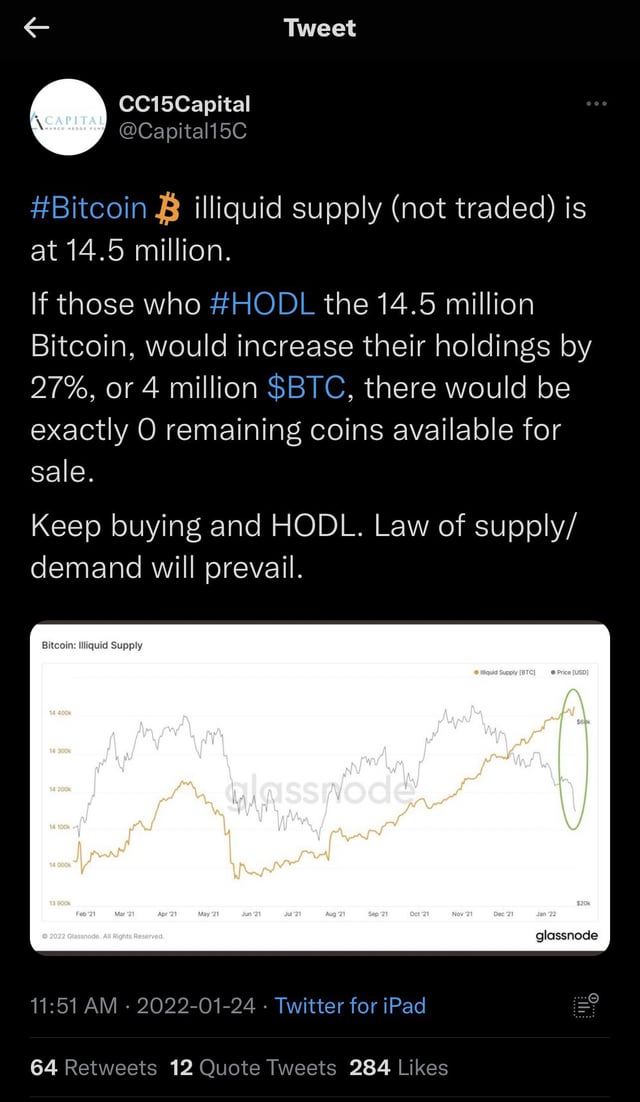

I think the first simple indicator we need to see to determine a top is in is a simple lower low. Which depending on your interpretation would be somewhere between 29313 and 30k.  O.k.. fair enough that the end of this cycle could be determined by a lower low.. I doubt that would be enough to convince me, but staying below the 104-week moving average for a significant amount of time., such as one to two weeks would likely convince me that the cycle has good chances of being over... currently the 104-week moving average is around $31k. I think, unfortunately this is DEFINITELY a non-zero chance scenario. :/

Sure, bitcoin prices can move 10% to 20% pretty quickly in either direction.. and surely it is helpful to be at least 20% above any price that you are in fear of reaching... and if any of us is contemplating whether a bottom is in, then it is nice to get at least 20% to 40% above that feared "bottom price" before becoming too smug about any assertions that the bottom is "in" In fact... if we do not see a turnaround from where we are it's a fair certainty.

I don't know about that. Of course, it is nice if we are able to get some kind of clear bounce off of a bottom, but sometimes there is a gradual rise from the bottom before a distance is made to cause some certainties about the bottom being in. For sure, I am not anywhere close to asserting that this bottom is in or close to being in when the best that we have gotten, so far, is a bounce up to $39k - which is merely an 18% bounce from the bottom and hardly even enough to have confidence that the bottom is in.. Maybe these days we are going to need to look at the $46k to $50k price range before starting to feel some confidence about the bottom being in..so yeah.. we are not even close to that.. so maybe there is a need to flesh out some ideas about how far the down might go.. how long it might stay down and whether any of those down scenarios might negate the possibility of even getting into some kind of price (such as within the $46k to $50k range currently), in which we might be able to develop some confidence that the bottom is in.. I feel like this is the type of thing John Madden (RIP) would say. "For this team to win they are going to need to get the ball down the field, and score!". Well in this case, for Bitcoin not to go further down, it needs to start going up!  Fair enough. Seems to me there are fundamentals that support the go-up scenario... and there are certain events, and some technical reasons we should be prepared for downity as you like to put it.

Either way I will be fine, though I admit, a third push to a new ATH would be a nifty new thing to happen "this cycle".

For sure this cycle is having several differences that seem inevitable etched in already, whether we end up going down from here or up from here.. and yeah, I really doubt that we will go sideways for very long.. but who knows..? I suppose that if we were to make some kind of a SOMA prediction for the next 3 months (end of April), maybe we could say something like from here $36k--- the odds of finishing the 3 months above $46k would be something like 38%, the odds for going finishing below $30k would be something like 33% and the odds for sideways (finishing within the range) would be something like 30%... I suppose that we could come up with all kinds of timelines about where we might finish at the end of the timeline or what might be the highest/lowest price during that timeline. I am not saying that I know, but each of us may well come up with different probability assignments, depending upon how the question is framed and also maybe how strongly we might be influenced by recent BTC price dynamics, too. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 27, 2022, 07:01:24 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10147

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 27, 2022, 07:14:45 AM Merited by fillippone (3) |

|

Low time frame charts getting bouncy jumpy  EDIT: Stopped watching. Looks too fragile to me. Some drama ahead? Grow some balls! Going down after so many bullish news? We're going nowhere but up!  I am quite risk averse. That's why i almost only hodl. Also, this is the shortest answer to JJG's question about why i am mostly trading small ranges with my micro "play money" stash, he asked about one to two weeks ago. Good that i can put a checkmark to that on my todo list as well. I'm generally bullish, in case you didn't notice  I am glad that you pre-emptively struck with your unsolicited explanation regarding why you sold recently (with your parts of parts of your "micro" "play money") hahahahahaha By the way.. my lowest sell amount is currently set for in the $40ks and then $41ks.. and then every thousand up from there.. have not sold anything in a very long time..,. so I believe that my $1k increments continue until the lower $60ks and thereafter they go to either $2,500 and then soonthereafter $3,333-ish.. $1k is too close.. except for the last year we have mostly been stuck in this kind of $29k to $69k range.. so I only barely got into $2,500 and $3,333 increments before having to revert back to $1k increments. I recall in most of 2018, 2019 and 2020 I was in $500 increments.. so surely some graduation had taken place.... little by little, no? Very rarely have I ever heard so many words used to say nothing at all.

TL;DR

We're doing nothing today but might do something soon.

Side Note:

In light of so many words used in saying nothing...

OpSec - I noticed J1G has been completely absent through this press conference and it's run-up.

Should we start using the abbr. J1P???

Just asking...

I watched it too.. and largely I was wondering what he was saying exactly, and even the various reporters were asking questions as if he was actually saying something. Regarding your other point... Sure... have you ever seen Powel and JJG in the same room at the same time? Good question. I am not going to slip any meaningful clues. Mums the word.  Your way of discussing several of the matters and your trade offs does cause me a decent amount of concern - especially in terms of your ability to HODL through potential tough times.

For sure, there is a lot of empirical evidence to show that lump sum investing has tended to pay off even better than DCA - especially when the buying was upon dips.. but we can never really know the extent to which a dip is over.. so there tends to be some value in having some strategies besides lump sum, such as an ability to continue to buy on further dips... otherwise you just have to HODL through the whole dip period, if it ends up coming and taking a long time to resolve...and hopefully you would not end up panicing in the meantime.

Personally, since you did a pretty decent lump sum investment, maybe you should plan to carry out a DCA plan at any time that the BTC price get's close to your buy-in price.. even if your DCA amount is ONLY $10 per week (maybe $100 per week would be better?).. it might give you some peace of mind if we ever go below your average buy price.

Usually the plan for having at least a 4-year plan would be that if you bought at the top of the cycle then you would still have pretty decent chances of at least being profitable after 4 years.. maybe not extremely profitable, but at least not in the red.. and there are no guarantees of that, either, even though BTC's investment thesis does seem to be quite a bit stronger now than it was 7-8 years ago.

Regarding cashing out, sure of course you might want to attempt to time tops somewhat, but you still gotta be careful about cashing out too much because where you going to put it that is better than BTC? You could consider cashing out more incrementally such as quarterly, yearly or some timeline variation that is comfortable, but you might need to be careful that you might end up taking out at the wrong times.. but sure if you cash out a quarter or a years worth of expected expenses, then that would likely be reasonable.

You know about the 4% per year theory regarding cashing out too, right? That has traditionally been the guidance for traditional investments, even though I do believe with BTC you could get away with larger percentages depending on how you value your holdings. Also, if you are planning not to cash out any BTC for 5 years, you do have 5 years to figure out those kinds of matters, but you could attempt to project out values and cash out plans in terms of best case scenarios, worse case scenarios and even medium case scenarios.. and for sure there is value to give some serious considerations to the worse case scenarios, even though if they are not really very likely it is better to have a way of keeping in mind a range of scenarios while focusing more of your attention on more likely scenarios and perhaps revisiting the projections from time to time to see if you might need to tweak them.

Regarding your cold storage, you should check them a few times a year to make sure that you understand your access and your recovery and if you might have back up ways to recover.. and once you go through the process a few times, you might be able to just do it once a year.. depending on how complicated that you have made it for yourself.. ..but for sure both complication and too much simplicity could be enemies.. so some kind of balance is going to be preferred.

thanks to you for being concerned enough with regards to me to offer this extraordinary guidance. I figure I will take your recommendation and do a DCA plan as you say. I think taking out $100 consistently that the value stays a little % underneath my target is smart to prevent me from getting hurt assuming it never arrives at the target I am focusing on. I am going to try to avoid accessing my cold storage and I will only be checking that the recovery paper I have is in good condition and has not deteriorated. My process was the normal process and should not be hard to check 1 a year. I know that guys here do different things, and several of us have described situations in which we had made our recovery a bit complicated and could have lost our funds due to our creation of complications. I will say that one thing that I do is to divide my recovery seed into three parts and I keep two copies. So sure it is a little bit complicated, but I get worried, for example, if one of the locations is damaged by fire, water or something else and then I would not have a back up... so in that sense I keep some geographical separation. Maybe it is not a very big deal if you were to have only $1k to $10k of value, but historically even that $1k to $10k in value went up 100x.. .so $1K to $10k could have turned into $100k to $1million.. .. I remember having a certainly high amount on one of my hotwallets.. and kind of considered it NOT a Big deal, but between 2015 and 2017, prices went up 78x...so some of those hotwallet values became problematic (on the upside.. so for example, even $100 became $7,800 and even $1,000 became $78k).. luckily nothing happened before I finally did end up pulling those BTC/sats off line and putting the vast majority of those funds in an off-line location. I am not saying that I had those amounts, but still you get the idea that sometimes you might take smaller levels of security and then not really realize how much the value went up and then consider that maybe you need to up your security. Even in this latest run.. we may well have had some guys who got sub $7k coins. and then when the price went up to nearly $70k.. those coins were 10x in value.. at least for a period of time... that was back in the good ole days when guys could more easily buy a whole coin in one shot. |

|

|

|

|

|

Poll

Poll