jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4309

diamond-handed zealot

|

|

October 09, 2018, 05:05:54 PM Merited by BobLawblaw (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"The nature of Bitcoin is such that once version 0.1 was released, the

core design was set in stone for the rest of its lifetime." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

becoin

Legendary

Offline Offline

Activity: 3431

Merit: 1233

|

|

October 09, 2018, 05:08:23 PM |

|

Industry bellwether Bitcoin had seen its daily transaction volumes fall from an average of around 360,000 a day in late 2017 to just 230,000 in September 2018. Bitcoin market is flourishing and growing every day. Market is just moving out of regulated exchanges. Why? Because those exchanges are more and more regulated. Bitcoin is safe without government control. It can exist on markets without any government regulation! |

|

|

|

|

|

|

|

|

El duderino_

Legendary

Online Online

Activity: 2492

Merit: 11997

BTC + Crossfit, living life.

|

|

October 09, 2018, 06:23:42 PM |

|

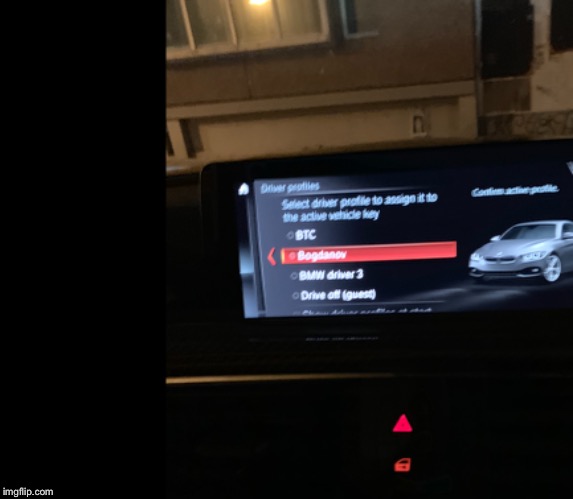

via Imgflip Meme Generator via Imgflip Meme Generator Hahahaha lol lmao , my friend Turks on his M4 and the dashboard selection ....  What a Guy  |

|

|

|

|

|

|

EatonABooger

Member

Offline Offline

Activity: 151

Merit: 36

|

|

October 09, 2018, 07:57:15 PM Merited by JayJuanGee (1) |

|

whoa !!!! french fries with steak  ?? you do not see that combination in north america (well maybe Canada). Makes me want to go to a steak restaurant and ask for fries with my steak and see what reaction I get... Canada was the first place I experienced french fries with chili and cheese poured on top of them. I think they called them chili fries. |

|

|

|

|

|

kirreev070

|

|

October 09, 2018, 08:19:56 PM |

|

I got the impression about you that you only do what you go to restaurants, eat there and drink. And also have fun. I would have liked it too. |

|

|

|

|

RejectedBanana

Sr. Member

Offline Offline

Activity: 406

Merit: 551

I am a banana.

|

|

October 09, 2018, 08:35:40 PM |

|

Do they know about segwit transactions? :-)

Maybe they don't even know about the forks/airdrops that forced everyone to move ALL their coins to claim them nor many other factors that were happening during that time (spam, ridiculous FOMO, etc).... Or they do and they just don't care because the only thing that matters is the dramatic headline. Do they know about wash trading? Do they know that mining difficulty is actually rising, not falling? Do they know that exchanges are in bed with mega miners? Do they know that all exchanges would dump literally every shitcoin they have (to drum up extra money) before they'd start selling their precious bitcoin? Do they know that *we* know that when they start printing the really doom & gloom articles, the bottom is likely in? Hit the nail on the head: Institutional Investors Are Using Back Door for Crypto Buys (1 Oct 2018)https://www.bloomberg.com/news/articles/2018-10-01/institutional-investors-are-using-back-door-for-crypto-purchasesBig Institutional Investors are Buying Large Amounts of Bitcoin in OTC Market (3 Oct 2018)https://www.newsbtc.com/2018/10/03/big-institutional-investors-are-buying-large-amounts-of-bitcoin-in-otc-market/Bitcoin is now a rich man's game. 2018 marks the transition from small-time retail hype to the beginning of savvy institutional/money-bags hype. Exchanges are becoming less and less relevant as larger transactions are moving off-exchange at a premium to current exchange prices. When the next big bull run does happen, small time retail buyers may be shut out due to a lack of supply or basic transaction access. What little may be available on-exchange during a bull-run will likely fetch a hefty premium. The next generation of HODLers will be laughing all the way to the exchange OTC. IMHO, we are in the midst of large-scale coordinated institutional manipulation leading up the next halving/ETF/choose your own hype spark: 1. First rule of Institutional Bitcoin: you don't talk about Institutional Bitcoin. 2. Quietly buy up all the mining supply via OTC back channels or in-house Bitcoin brokers. [Optional: Fund bogus studies, ban ads, ban credit card & retail bank sales, and fling FUD near and wide to throw your competition off scent. JP Morgan, Chase, Juniper Research, Google, Twitter, etc.] 3. HODL and wait for the next hype-fueled bull run. 4. SHORT futures like mad and then SODL at the peak. 5. Rinse and repeat. According to Cho, high net-worth individuals and institutions are using the OTC market to process trades that exceed $100,000, which based on the current price of Bitcoin at $6,500 is around 15.38 BTC.

“What that’s showing you is the professionalization that’s happening across the board in this space. The Wild West days of crypto are really turning the corner,” Cho said, speaking to Bloomberg.

“We’ve seen triple-digit growth enrolling in our OTC business," said Jeremy Allaire, chief executive office of Boston-based Circle Internet Financial. “That’s a big growth area."

Cho explained that the stability in the price of Bitcoin and the valuation of the crypto market can be attributed to the entrance of institutional investors and high profile traders into the space, which has corresponded with the strengthening of market infrastructure.

“One of the biggest criticisms of crypto by institutional investors has been the volatility. Over the last four to six months, the market has been trading in a very tight range, and that’s seems to be corresponding with traditional financial institutions becoming more comfortable diving into the space,” Cho said.

Cumberland’s parent company, DRW Holdings, disclosed that more than 33 percent of the company’s OTC market trades were processed during Asia hours, suggesting that large miners like Bitmain’s Antpool and BTC.com are regularly liquidating Bitcoin generated from their mining operations.

"If they are liquidating [coins], they are liquidating them via OTC," said Tom Flake, founder of Bcause, a provider of mining facilities whose customers are institutional miners with hundreds to thousands of machines. The largest miners also sell their coins to sellers directly or through brokers.

One of the biggest reasons to buy coins outside of exchanges, though, is that there are often not as many coins offered for sale as the institutional buyers would like to buy, according to Sam Doctor, managing director and head of data science research at Fundstrat Global Advisers.

“At this point in time, because more and more institutions are beginning to enter the market, there’s more of an imbalance,” Doctor said. That’s why brokerage firms are springing up to help institutional buyers find inventory, he said.

What’s more, miners can offer something unique: brand-new, “virgin” coins, which some investors covet. Such coins command a premium of up to 20 percent, according to Travis Kling, founder of the hedge fund Ikigai. It’s easier to prove they’ve not been involved in money-laundering operations, he said. |

|

|

|

|

Icygreen

Legendary

Offline Offline

Activity: 1463

Merit: 1135

|

|

October 09, 2018, 08:37:30 PM |

|

whoa !!!! french fries with steak  ?? you do not see that combination in north america (well maybe Canada). Makes me want to go to a steak restaurant and ask for fries with my steak and see what reaction I get... Canada was the first place I experienced french fries with chili and cheese poured on top of them. I think they called them chili fries. Eh, WTF? chili fries, watch it bud  Its called Poutine and its fun to say. |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

October 09, 2018, 09:12:26 PM

Last edit: October 09, 2018, 10:12:31 PM by d_eddie Merited by Torque (1), RejectedBanana (1) |

|

Indeed. 1. First rule of Institutional Bitcoin: you don't talk about Institutional Bitcoin.

Or publicly keep a skeptical attitude about fancy internet money, or even spread FUD. Until your bank is found red-handed. At that point, just keep a publicly skepical attitude. Or even disseminate some doubt-generating mud. 4. SHORT futures like mad and then SODL at the peak.

The only problem I have with this point is: do you close the mad shorts (buy btc) or do you take a loss? According to Cho, high net-worth individuals and institutions are using the OTC market to process trades that exceed $100,000, which based on the current price of Bitcoin at $6,500 is around 15.38 BTC.

(snip) An enlightening read. IMO your analysis is spot on, as it often happens. |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

October 09, 2018, 09:26:09 PM |

|

Here's an excerpt from the second link provided by mfort a few posts above. Big Institutional Investors are Buying Large Amounts of Bitcoin in OTC Market (3 Oct 2018)https://www.newsbtc.com/2018/10/03/big-institutional-investors-are-buying-large-amounts-of-bitcoin-in-otc-market/When Will it Show on Bitcoin Price?

If institutional investors are acquiring large amounts of Bitcoin in the OTC market, it should have a noticeable impact on the cryptocurrency exchange market and the price movement of major digital asssets.

However, over the past two months, the cryptocurrency market has demonstrated stability and struggled to initiate large movements on the upside.

As Circle, Coinbase, BitGo, Goldman Sachs, Citigroup, Morgan Stanley, and other major financial institutions that either have already launched crypto-focused custodian solutions or plan to offer crypto custody in the short-term begin to serve an increasing number of institutional investors in the months to come, investors expect the value of cryptocurrencies to increase accordingly.

The question in the subtitle has been left unanswered in the article, but my reasonable guess is "probably well before the halvening". |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

October 09, 2018, 09:34:18 PM |

|

|

|

|

|

|

leetlezee

Member

Offline Offline

Activity: 232

Merit: 38

|

|

October 09, 2018, 09:45:27 PM |

|

Here's an excerpt from the second link provided by mfort a few posts above. Big Institutional Investors are Buying Large Amounts of Bitcoin in OTC Market (3 Oct 2018)https://www.newsbtc.com/2018/10/03/big-institutional-investors-are-buying-large-amounts-of-bitcoin-in-otc-market/When Will it Show on Bitcoin Price?

If institutional investors are acquiring large amounts of Bitcoin in the OTC market, it should have a noticeable impact on the cryptocurrency exchange market and the price movement of major digital asssets.

However, over the past two months, the cryptocurrency market has demonstrated stability and struggled to initiate large movements on the upside.

As Circle, Coinbase, BitGo, Goldman Sachs, Citigroup, Morgan Stanley, and other major financial institutions that either have already launched crypto-focused custodian solutions or plan to offer crypto custody in the short-term begin to serve an increasing number of institutional investors in the months to come, investors expect the value of cryptocurrencies to increase accordingly.

The question in the subtitle has been left unanswered in the article, but my reasonable guess is "probably well before the halvening". Essentially the point is that institutional investors want to buy up large quantities of Bitcoin without moving the price. So if they are only buying OTC from Bitmain and other large miners, and the "halvening" happens in 589 days... then I would agree that could easily be where the increase in price comes. But we should remember that institutional investors also suffer from greed and FOMO, and if there's investors wanting to buy more than the amount of BTC currently being available to purchase OTC is where we will see their purchases encroaching on the traditional markets, and then we will see the increase in price. So when will this happen? ::shrug:: Maybe we should ask Jamie Dimon. I bet he has a pretty good idea of when that might be. |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

October 09, 2018, 09:52:25 PM Merited by JayJuanGee (1) |

|

If we can hold the $6k floor through to the end of January, then it’s on like Donkey Kong.

|

|

|

|

|

afbitcoins

Legendary

Offline Offline

Activity: 2100

Merit: 1061

|

|

October 09, 2018, 09:52:42 PM |

|

wasnt it a 6510 in the VIC20. it had added some dedicated i/o pins vs the 6502 or something IIRC.

or maybe that was just the C64.. i had both.

fun times but i got more into the TRS-80 line with CP/M and such after.

The 6510 was in the C64. I remember doing a fair bit of assembly and FORTH on the Vic-20, it could do a good bit with what you had. First computer was a TRS80 Model 1 Level 1. I still remember the game "Termites" followed by the game "Introduction to programming". Wonder about first computers for people here. i think a nintendo or something..... but my first computer i really use ... is from when i got my first BTC's so as you see and know i come from very very VERY far and still have an extreme far way to go when it comes to computers  but i got good guy's around me last years  My cousin got a ZX81 it had 1K memory. 1 K!!! We typed in the code to run games on it from magazines. It didn't have sound, or colours. Good times though. Showing my age. Ha. My first was the Acorn Electron. I wanted a C64 but my parents thought the Electron would be more educational. It was a pretty cool computer in its way though. I grew to be a fan. Programming on that as a hobby eventually morphed into my profession |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

October 09, 2018, 09:57:52 PM Merited by JayJuanGee (1) |

|

Any sound investment should plan to budget in such a way that prepares for the down...

Hedging with shorts?  You are likely razzing me, because you know that I don't really believe in playing around with margin. Just a little teasing on the surface. I actually think margin trading, used wisely, is a powerful tool. Used unwisely, it's a powerful tool as well, but as with any power tool, you risk your fingers or worse if you don't know your way around it... Even for very smart people, have troubles with the more basic strategies, so I would not recommend playing with margin/or leverage until after the person has developed a decently strong basic game, first. ... however, as with any power tool, there are a bunch of safety rules that can be followed to minimize the risk of injuries while still being able to exploit the power. Imagine cutting logs with a wood axe because that electric saw is just too dangerous. I actually find some form of leveraged trading to be an aid in restraining the inherent gambler inside. Make a plan, work out the best/worst/most likely outcome, play out. No room for clumsy impulse actions once you've set up an involved series of moves. I agree it's not for everyone, though. I don't like welders and their paraphernalia, for example, so I will gladly use the services of a pro whenever I'm in need. And, even in bitcoin, the historical degree of volatility might justify that leveraging and/or margin trading is NOT necessary because the returns can be incredibly stupendous with a mere basic accumulation game that does not involve such additional skills and strategies that may just end up greatly increasing the odds for folks to end up losing in what seems to be an otherwise highly probable winning game.

When the trend is down, if there are no fiat reserves to accumulate moar, there's not much to be done by the accumulate-and-hodl investor. That strategy only pays out in bull markets. This might tickle the inner gambler to "poke his stash with a stick", so to say, which is a dangerous game. On the other hand, a plan with pre-calculated possible gains and losses is a way to grow one's stash even in bear markets, with a limited penalty in case of failure. In the end, and I think we agree on this, it's all about finding a system that works for oneself. |

|

|

|

|

Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

October 09, 2018, 10:02:02 PM |

|

|

|

|

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

Here's an excerpt from the second link provided by mfort a few posts above. Big Institutional Investors are Buying Large Amounts of Bitcoin in OTC Market (3 Oct 2018)https://www.newsbtc.com/2018/10/03/big-institutional-investors-are-buying-large-amounts-of-bitcoin-in-otc-market/When Will it Show on Bitcoin Price?

If institutional investors are acquiring large amounts of Bitcoin in the OTC market, it should have a noticeable impact on the cryptocurrency exchange market and the price movement of major digital asssets.

However, over the past two months, the cryptocurrency market has demonstrated stability and struggled to initiate large movements on the upside.

As Circle, Coinbase, BitGo, Goldman Sachs, Citigroup, Morgan Stanley, and other major financial institutions that either have already launched crypto-focused custodian solutions or plan to offer crypto custody in the short-term begin to serve an increasing number of institutional investors in the months to come, investors expect the value of cryptocurrencies to increase accordingly.

The question in the subtitle has been left unanswered in the article, but my reasonable guess is "probably well before the halvening". Essentially the point is that institutional investors want to buy up large quantities of Bitcoin without moving the price. So if they are only buying OTC from Bitmain and other large miners, and the "halvening" happens in 589 days... then I would agree that could easily be where the increase in price comes. When I said "probably well before the halvening", I was thinking along the following lines. Lately, volume on traditional exchanges has been ridiculously low. I think this might not be tightly connected with shark buyers going OTC; they have been doing things that way for a while already. The issue is small fish losing interest, patience, fiat money, or all of the above. As soon as all these things build back up, exchange prices must inevitably get a push. Any sign of a bull market will likely trigger a wave of small fish FOMO that will impact prices for all to see, including MSM. Which will likely create some feedback loop and we'll be back to late 2017 scenarios. Maybe we should ask Jamie Dimon. I bet he has a pretty good idea of when that might be.

So, who calls him? Will you or should I?  |

|

|

|

|

|

Poll

Poll