HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 16, 2018, 12:27:46 AM |

|

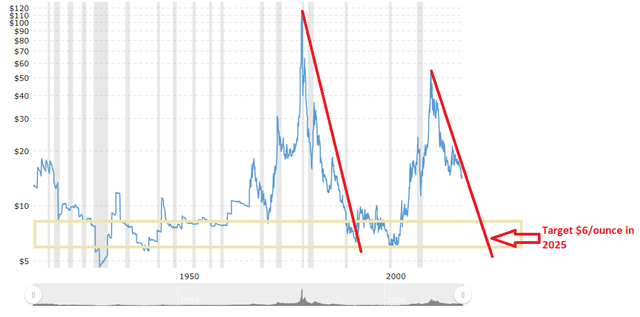

Silver bubble continues to break downwards...Edit: Good support at $5 / ounce so price due to fall another 66% then stabilize

Who could have possibly guessed the zionist kike in the thread would *gasp* tell lies to try and trick the goyim from acquiring real money at the floor and instead attempt to persuade them into buying imaginary, valueless digital tokens instead? They are pretty much out of room for further metals manipulation to the downside in the long view, but short term, unsustainable tricks are always possible:  Good job #1 cutting the prices off your chart and #2 not adjusting for inflation over 80 year period. |

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

bitserve

Legendary

Offline Offline

Activity: 1820

Merit: 1464

Self made HODLER ✓

|

|

December 16, 2018, 12:29:18 AM |

|

Also... *40* fucking years cup and handle? WTF?!

|

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 12:32:03 AM |

|

If Bitmain and Bitfinex go belly up,(which I hope they do) some other manipulative, greedy slimebags will fill in the niche.

It's hard to tell if Bitmain will blow up or not. They're selling their Antminer T15 for $840 right now. How much money do you think they actually need to sell that for to make a profit (also factoring in all R&D, failed chip tapeouts and everything else)? What if they make profit on every unit sold for over $100-200 or something retardedly low? Yea, they lost their shirts on Bcash, but if their cost of production for these stupid ASICs is something miniscule, it seems like it would be hard to go bankrupt. I also believe a lot of their company budget is spent attempting to try and rig the bitcoin price upwards, and they probably do experience some losses doing that, so that also factors in. |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4308

diamond-handed zealot

|

|

December 16, 2018, 12:35:25 AM |

|

there is no hopium like silver hopium

I was addicted to that shit for years man

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 16, 2018, 12:36:30 AM |

|

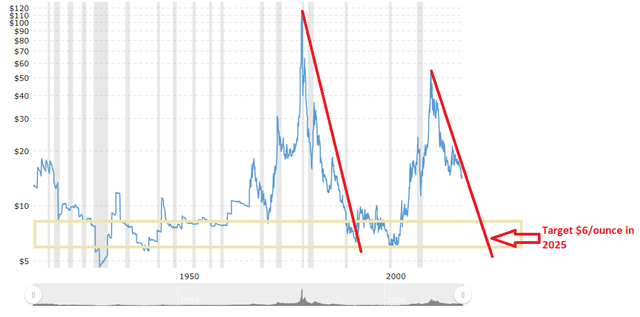

Here is a proper chart adjusted for inflation and showing prices, seeing as Roach is too afraid to show actual numbers. Incidentally that's a lower high on the multi-century time frame but let's not worry too much about that. Ain't nobody got time for that.  |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 12:38:10 AM |

|

Good job #1 cutting the prices off your chart and #2 not adjusting for inflation over 80 year period.

It's still a cup and handle on the adjusted for inflation version. Also... *40* fucking years cup and handle? WTF?!

Short term TA trends towards being random noise while longer term TA holds much more weight. So a 40 year cup and handle is not something you can hand wave away like one of HairyJewLarry's 15 minute charts. |

|

|

|

|

bitserve

Legendary

Offline Offline

Activity: 1820

Merit: 1464

Self made HODLER ✓

|

|

December 16, 2018, 12:41:51 AM |

|

Even if your theory about Bitfinex and Bitmain rigging the price might make some sense, you exaggerate your "analysis" to fit your narrative.

First, Bitmain started selling vast amounts of their BTC reserves in August 2017. Most of the parabolic BTC pump came later than that... while they were burning BTC to increase their BCH stash up to a ridiculous 1.5M+ coins. So no, it wasn't Bitmain. Maybe on the contrary.

Bitfinex? Well, we have theorised many times about the relevance of Tether in the pump and subsequent dump. We haven't been able to reach a convincing conclusion.

Will Bitmain going belly up have a negative impact on price? Most probably, at least in the short term. Same goes with Bitfinex.

But in either case I don't think the impact will be critical for Bitcoin and unless you have some way to quantify it, it is all mere speculation.

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

December 16, 2018, 12:42:06 AM |

|

Roach you may have just persuaded me to short the fuck out of physical silver. That silver chart is completely broken. Any rally will get crushed by sellers trying to exit their bags. I assume that's why you are here. Trying to flog your bags of shit coins.

|

|

|

|

|

Majormax

Legendary

Offline Offline

Activity: 2534

Merit: 1129

|

|

December 16, 2018, 12:42:42 AM |

|

This is getting very, very reminiscent of the last bear market both price trajectory but also our very own WO thread activity. We’re going back to 2015 levels of posting. It’s totally dying in here which is possibly a good sign to tell you the bottom might be in or at least very close.

On a large scale, the downtrend is flattening... until now. A common error of traders is that they want to catch the very bottom.

You don't NEED that. Actually, unless you're the big whale(or group) that's moving the price you probably won't manage to "catch the falling knife".

Instead of that, near the bottom there's plenty of time to think and make a good decision to buy and make a good profit with lower risk of missing out.

That's way I bought on the way down. There is a good chance the price will go down further but... damn... I even bought when it was 12-13k... now it's time to make decisions! Safest to buy when the price has doubled from the lows, over at least a few months.Then you are with the trend. It will be a bit of a wait now, because we are still in the downtrend. It is psychologically damaging to buy a downtrend, but if you think you can cope, go ahead ! Patience required. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 12:51:02 AM |

|

Here is a proper chart adjusted for inflation and showing prices, seeing as Roach is too afraid to show actual numbers  Your chart is the typical amateur level analysis of metals. It requires moving twice as many tons of dirt now to get one ounce of silver as it did in the early 2000's. There's also 1/4th as much above ground, investment grade silver right now as the year 1980, while there's twice as much above ground gold since then. It's not possible for silver to go down to $6 like you claim. Peak gold and silver has already happened for humans on planet earth with current mining and energy technology. Cost of production ranges from like $13-20+ for various companies. The reason above ground silver stocks have depleted so badly while gold has not is because the majority of gold is recycled while silver was manipulated too artificially low, which caused people to not attempt to conserve it at all. It would be like the govt of Venezeula artifically setting gas to 10 cents a gallon. People will just set it on fire for fun, but it eventually causes things to rubberband back the opposite way. |

|

|

|

|

bones261

Legendary

Offline Offline

Activity: 1806

Merit: 1826

|

|

December 16, 2018, 12:52:57 AM |

|

If Bitmain and Bitfinex go belly up,(which I hope they do) some other manipulative, greedy slimebags will fill in the niche.

It's hard to tell if Bitmain will blow up or not. They're selling their Antminer T15 for $840 right now. How much money do you think they actually need to sell that for to make a profit (also factoring in all R&D, failed chip tapeouts and everything else)? What if they make profit on every unit sold for over $100-200 or something retardedly low? Yea, they lost their shirts on Bcash, but if their cost of production for these stupid ASICs is something miniscule, it seems like it would be hard to go bankrupt. I also believe a lot of their company budget is spent attempting to try and rig the bitcoin price upwards, and they probably do experience some losses doing that, so that also factors in. This article is old, but Jimmy Song estimated that it cost Bitmain $500 per unit to manufacture an S9 and the R&D cost was about 10M. https://medium.com/@jimmysong/just-how-profitable-is-bitmain-a9df82c761aThe development of the 7nm chip was more problematic for them, so probably cost them more in R&D and failed chip tapeouts. Also, the Trump tariffs are adding 25% to the cost of Bitmain ASICS for US customers. This is likely to give any potential US customers some pause before purchasing. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 01:17:47 AM |

|

There's a million other variables to factor in with silver as well, like one of the Pilgrim's Society's main goals was the demonetization of silver in order to hurt the east - places like China & India. But now the world has flipped the exact opposite way and China & India have hoarded most of the gold, while the west has lost all the gold, but entities like JPMorgan have been hoarding silver. So the Pilgrim's Society has no real reason for silver to be their #1 enemy anymore. If anything they will probably flip to pro-silver and anti-gold.

This means in any type of new monetary revaluation, Bretton Woods agreement, or the system being forced back to monetary metals, the western powers are going to highly favor silver over gold percentage gains-wise in order to recapitalize themselves from the debt bubble implosion. Russia seems to have lots of silver as well as gold, and China probably has a decent amount too. So at the end of the day, it will be difficult for them to protest against silver receiving much higher gains when it was obviously far more undervalued than gold was anyway.

|

|

|

|

|

Syke

Legendary

Offline Offline

Activity: 3878

Merit: 1193

|

|

December 16, 2018, 01:21:53 AM |

|

Roach you may have just persuaded me to short the fuck out of physical silver. That silver chart is completely broken. Any rally will get crushed by sellers trying to exit their bags. I assume that's why you are here. Trying to flog your bags of shit coins.

Do people with any significant holdings actually hold physical silver? Or is it just paper-silver? |

|

|

|

|

bitserve

Legendary

Offline Offline

Activity: 1820

Merit: 1464

Self made HODLER ✓

|

|

December 16, 2018, 01:22:23 AM |

|

Silver bubble continues to break downwards from blow off top in 2011 (when Roach bought the top because he’s dumb and greedy). Edit: Good support at $5 / ounce so price due to fall another 66% then stabilize  Maybe you just want to piss r0ach... but you are completely ignoring the support and potential trend reversal at $10. $5 would be THE ultimate bottom. Not gonna happen, and even if it does, it would take 10-15 years to reach that low. |

|

|

|

|

bitserve

Legendary

Offline Offline

Activity: 1820

Merit: 1464

Self made HODLER ✓

|

|

December 16, 2018, 01:33:48 AM |

|

Roach you may have just persuaded me to short the fuck out of physical silver. That silver chart is completely broken. Any rally will get crushed by sellers trying to exit their bags. I assume that's why you are here. Trying to flog your bags of shit coins.

Do people with any significant holdings actually hold physical silver? Or is it just paper-silver? That's a very interesting question I once asked to r0ach. I was arguing about the poor value/weight relationship of silver. Storing a single million $ would weight around 2 fucking metric tonnes! He then started arguing about the absurdity of my example, and that it was because silver was so fucking cheap at this time and blah blah blah.... so I let it go. The FACT is that you can not reasonably use physical silver to store a sizeable amount of money. Not to even mention about mobility..... |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 01:38:10 AM |

|

Maybe you just want to piss r0ach...

Of course his post was complete nonsense, but the real gamechanger at play really is nothing what either of us mentioned so far. It's what the unit of account is for world energy prices. You're currently living in a completely delusional, nonsensical, unsustainable world because the unit of account for oil is dollars. This means you can print something imaginary to conjure something real out of thin air - or better explained, it's real purpose is to steal resources from other countries. The dollar is a mechanism for stealing, both from other countires and it's own people. International banking has Jewish roots, so nobody is spared from the theft. On a finite planet, it's not really possible for a scheme like this to last for long. Eventually something finite and linked to physical reality has to be linked to something else finite to be the unit of account. So then you have a situation of someone claiming "oh, the cost of production for gold is like $1100 and $15 for silver with the majority of it's price being derived from things like diesel fuel". Now, answer me what is the cost of production for gold and silver if purchasing the oil that makes up the majority of it's cost of production price has to be paid with gold and silver instead of dollars? |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4308

diamond-handed zealot

|

|

December 16, 2018, 01:39:52 AM |

|

gold, guns, ammo, booze, transceivers

everything good is too heavy for a bug out bag

I need a bug out B-17

|

|

|

|

|

bones261

Legendary

Offline Offline

Activity: 1806

Merit: 1826

|

|

December 16, 2018, 01:45:03 AM |

|

When it comes to gold and silver, all I have to say is bring it on.  "Pikes Peak or bust." |

|

|

|

|

bitserve

Legendary

Offline Offline

Activity: 1820

Merit: 1464

Self made HODLER ✓

|

|

December 16, 2018, 01:55:02 AM |

|

Of course his post was complete nonsense, but the real gamechanger at play really is nothing what either of us mentioned so far. It's what the unit of account is for world energy prices. You're currently living in a completely delusional, nonsensical, unsustainable world because the unit of account for oil is dollars. This means you can print something imaginary to conjure something real out of thin air - or better explained, it's real purpose is to steal resources from other countries.

The dollar is a mechanism for stealing, both from other countires and it's own people. International banking has Jewish roots, so nobody is spared from the theft. On a finite planet, it's not really possible for a scheme like this to last for long. Eventually something finite and linked to physical reality has to be linked to something else finite to be the unit of account. So then you have a situation of someone claiming "oh, the cost of production for gold is like $1100 and $15 for silver with the majority of it's price being derived from things like diesel fuel".

Now, answer me what is the cost of production for gold and silver if purchasing the oil that makes up the majority of it's cost of production price has to be paid with gold and silver instead of dollars?

I don't know why would someone have to pay oil with gold and silver instead of dollars... But, since you insist that the cost of production is what marks the price bottom and also that oil is the most important factor of that cost of production I will tell you "the real gamechanger at play really is nothing what either of us mentioned so far": OIL PRICES ARE GONNA DUMP HARD IN THE NEXT DECADES. FUCKING HARD. MORE THAN YOU CAN EVEN IMAGINE. So there's that. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

December 16, 2018, 01:59:41 AM

Last edit: December 16, 2018, 03:16:33 AM by realr0ach |

|

When it comes to gold and silver, all I have to say is bring it on.  "Pikes Peak or bust." One reason why financial armageddon is taking so long, besides the fact they want people to be stuck in fiat dollar enslavement forever, is the fact most of these people are psychopathic control freaks. Many of them want only gold to have value and be the unit of account, others are for a bi-metallic solution, others want only gold to have value but they also know it's completely impossible to stop the rise of silver with it having much higher percentage gains. Some are just going senile and don't even understand attempting to force only a gold standard is pointless when places like India hold so much gold, so going mono-metallic instead of bi or tri-metallic is completely pointless and just gives way too much power to 3rd world nations like India over everyone else. So no matter how much kicking and screaming they do, the most likely outcome is not a gold only standard, but more likely tri-metalic just like the old days with gold, silver, and even copper all seeing significant use. |

|

|

|

|

|

Poll

Poll