kurious

Legendary

Offline Offline

Activity: 2590

Merit: 1643

|

|

August 01, 2019, 09:21:53 PM |

|

And meanwhile Bitcoin

Spikes up nicely to ten four

That is much better

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4861

Doomed to see the future and unable to prevent it

|

|

August 01, 2019, 09:23:48 PM |

|

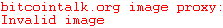

source: howmanyconfs.com FYI, this is a worthless metric. Could you elaborate more on this? I strongly disagree as the security implied in Bitcoin (ledger costliness) is one of the main value proposition for bitcoin imho. Who would Store Value on an insecure blockchain? This does not correctly represent the relative relationship of the security chains. Which is not to say I disagree with your statement. I'll try to find a link for you later after I catch up a bit. |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4861

Doomed to see the future and unable to prevent it

|

|

August 01, 2019, 09:29:53 PM |

|

Just put everyone on ignore. You'll get to the last page much more quickly  Shit half the time I can scroll a whole page practically thats ignored!  btw, i'm way the fuck behind again.  You need to take a hint from "every"one else to either employ the services of a team, a bot and/or a sex doll. We are no longer in the 90s..... get with the program....    Ohh shit man you killed me with this one!!!!! I'm am literally laughing out like a lunatic by myself right now! I never actually laugh out loud, its a rare thing.  Nobody quote homer please.

Thanks!

Ohh crap, too late!  It doesn't need to be tested, it is just among the possibilities. Unless the price stays under the 200DMA for a considerable amount of time, it will be bullish. See that chart: https://www.tradingview.com/chart/DL4HQwBW/As long as the orrange line looks upwards, we are fine. (sideways is fine too but i would start to worry at that point) edit: I just realized i can't share tradingview links that way. Just see this pic then:  I like this chart.  |

|

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 01, 2019, 09:37:44 PM

Last edit: May 16, 2023, 07:25:16 AM by fillippone |

|

source: howmanyconfs.com FYI, this is a worthless metric. Could you elaborate more on this? I strongly disagree as the security implied in Bitcoin (ledger costliness) is one of the main value proposition for bitcoin imho. Who would Store Value on an insecure blockchain? This does not correctly represent the relative relationship of the security chains. I'll try to find a link for you later after I catch up a bit. Thank you. This is how I discovered this website. https://twitter.com/lopp/status/1122850107685310464 I don't want to fall into the " appeal to authority" (one of the most common logical fallacy), but I think Jameson Lopp knows how these things work. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

August 01, 2019, 09:40:14 PM |

|

Don't get why people just don't put Roach on /ignore.

Roach is happy he does not have to deal with me.

We have already formed consensus without you.  |

|

|

|

|

Raja_MBZ

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

August 01, 2019, 09:40:46 PM |

|

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 01, 2019, 09:42:32 PM

Last edit: May 16, 2023, 07:25:09 AM by fillippone |

|

This is impressive. I mean: what will happen after May 2020 when the supply of Bitcoin will be halved overnight? Back of the envelope Calculations: Average Bitcoin price during lat 90 days = 7,500 USD Mined Bitcoin during last 90 days= 12.5*90*24*6=162,000 Cashapp Sales = 150,000,000 USD so, Cashapp Sales in BTC = 150,000,000/ 7,500 = 20,000 Basically Cashapp bought more than 12% of total Bitcoin supply. CashApp only. After the halving 6% will turn into 24% because of the supply reduction. This with a flat growth in the next 4 quarters. Not bad, really not bad. |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

August 01, 2019, 09:50:39 PM |

|

what will happen after May 2020 when the supply of Bitcoin will be halved overnight?

It's almost as if you're describing a Ponzi scheme. |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4861

Doomed to see the future and unable to prevent it

|

|

August 01, 2019, 09:53:16 PM |

|

I researched it back then and think I even saw where the author said it was a poor metric but I can't remember right now. Security is comprised of a litany of metrics and they are not really linear across algorithms as well. BTW,, I am a fan of Lopp's posting and data correlationals and as you can see he is using it to compare apples to apples by only showing the sha-256 coins. the next 30 days direction probability of btc price action, I think is split 50-50 between going up around 11,000 or down to the 9000 area.

I just put a chunk of my btc holdings into celsius.network to earn interest, so I want it to go up to get better interest.

The interest is paid in btc, but I'm gonna sell for fiat the interest payments as I receive them.

The suspense is building.

Wait, so according to this your going to get 478.50 per BTC per year for letting them have your coins? I think you are too trusting. https://celsius.network/earn-interest-on-your-crypto/ |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

August 01, 2019, 09:53:54 PM |

|

My leveraged DCA that I started a month ago has flipped into the green.

Which is distressing if the trend holds because my purchase tomorrow will start to push the average entry point up!

I’ve never been so sad to have Bitcoin gains.

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 01, 2019, 09:56:27 PM |

|

what will happen after May 2020 when the supply of Bitcoin will be halved overnight?

It's almost as if you're describing a Ponzi scheme. This is a cheap objection and you are too smart not to understand why. I won't indulge in this anymore. |

|

|

|

|

Raja_MBZ

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

what will happen after May 2020 when the supply of Bitcoin will be halved overnight?

It's almost as if you're describing a Ponzi scheme.  |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

August 01, 2019, 10:02:39 PM |

|

what will happen after May 2020 when the supply of Bitcoin will be halved overnight?

It's almost as if you're describing a Ponzi scheme. This is a cheap objection and you are too smart not to understand why. I won't indulge in this anymore. No, it is not a cheap objection. Anything based on artificial scarcity is a Keynesian scam. Always has been. Always will be. |

|

|

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

August 01, 2019, 10:07:17 PM |

|

Guess what happens when the gold price spikes - there is a flood of new supply. As I have been repeatedly saying over the past 5 years, there are a ton of gold mines on care and maintenance waiting for this exact moment. https://www.afr.com/companies/mining/gamechanger-price-spike-powers-new-gold-rush-20190729-p52bw9Gamechanger': Price spike powers new gold rushPeter Ker

From Orange in New South Wales to Bendigo in Victoria and Kalgoorlie in Western Australia, the gold sector is forecast to pull a record $22 billion worth of yellow metal out of the ground in fiscal 2020.

''These old mines may have shut down when the gold price was $300 for example, it is now above $2000, they would have bypassed a lot of gold in those underground mines because it would have been uneconomic at the time,'' Olsen says.

As a store of value and subject of speculation, the forces driving gold prices are opaque, but it is safe to say the recent rally has been sparked by a deteriorating US economy and geopolitical concerns about the US relationship with Iran, North Korea and China.

Rising gold prices have buoyed miners in all nations, but Australian miners have received an extra boost in the form of a weaker local currency, which has ensured their Australian-denominated costs have become a smaller proportion of the US dollars they receive for their gold.

Monetary easing from central banks has seen investors turn to gold.

The US dollar's role in setting global gold prices means Australian-denominated gold prices are strong when the greenback is strong against the Australian dollar.

New York based VanEck Securities is the world's largest gold equity manager, and the firm's portfolio manager Joe Foster said an interest rate cut in the US this week could be followed by a recession if history is any guide.

He says that would be a recipe for even higher gold prices.

''If you look historically, after the first rate cut in 2008 we went into a recession three months later. When they cut rates in 2000 we went into a recession two months later, so we could very well see economic weakness over the next six to 12 months, maybe even a recession,'' he tells The Australian Financial Review.

''If we go into a downturn, that increases the risk to the financial system that would probably drive gold much higher.

''We are near the end of a cycle, this is the longest expansion on record, it is the longest stock bull market on record and these things don't last forever.''

While most pundits expect a US rate cut will be good for US-denominated gold prices, Shaw and Partners analyst Peter O'Connor notes that the impact on Australian-denominated gold prices is less clear.

The Australian dollar has dropped in recent days below the 70c threshold.

He points out that gold prices may rise in US dollar terms in response to a rate cut, but may fall in Australian dollar terms if the US currency weakens significantly.

''The outlook depends not just on the fed cut but on the commentary, and probably the minutes released next month,'' he said.

''The short answer is we are getting closer to an Australian-denominated gold price peak, but not a US-denominated gold price peak.''

The situation could change again if, as expected, the Reserve Bank of Australia makes further interest rate cuts later this year, with further cuts likely to support Australian-denominated gold prices.

Gold-rush towns always get a boost when the local mine resumes production, but in Stawell's case the impact on the local economy will be unusually strong and refreshingly traceable, with the mine set to host a multimillion dollar particle physics laboratory.

Scientists studying ''dark matter'' require a laboratory free of background radiation, and deep underground is one of the few suitable places for such research.

Plans to build such a laboratory in a chamber of the Stawell mine were dashed when the mine closed in 2016, denying the laboratory of the ventilation and other support systems required to safely work underground.

But the revival of the mine has enabled a revival of the laboratory project, with state and federal governments contributing $10 million to build the scientists a chamber about 1000 metres down the mine.

''That is an unusual spin-off from an old gold mine opening up again,'' said local mayor Kevin Erwin.

''That side of it will be a real game changer for Stawell. We will have international professors in town and it will raise the bar for local kids in terms of aspirations for what their future careers can be.

"We are on the cusp of a wave and it is just starting to roll.

''We have got a bit of a shortage in housing at the moment so we are just trying to address that very quickly, bucking the trend of a lot of rural communities.

''We have quite a few hundred jobs coming online in the next few years and we need families and we need housing."

Olsen says Arete is looking for other opportunities to invest in old mines that might have been unloved by their former owners.

Hugh Morgan's private equity fund has made its first acquisition in Victorian gold.

Some of those opportunities are in Victoria, where interest in gold mining has rebounded since bonanza gold grades were found in the "Swan Zone" beneath the then marginal Fosterville mine near Bendigo in 2015.

Foster travelled from New York to see Fosterville with his own eyes in 2015, and says the Swan Zone is the best gold discovery he has seen anywhere in the world in the past two decades.

Fosterville, which is owned by Kirkland Lake Gold, has since become one of Australia's most lucrative gold mines, and its success has spawned bullish talk of a broader ''renaissance'' of the Victorian gold sector.

''There is certainly a lot more interest since Fosterville went down below 600 metres and basically broke into Aladdin's Cave,'' said Olsen.

Statistics suggest interest in Victorian gold has improved, but the state remains a very small player in the Australian gold industry.

Spending on exploration in Victoria has quadrupled over the past four years, but at $24.5 million in the March quarter, the state had less than 5 per cent of the national exploration spend for the quarter, according to figures published by the Australian Bureau of Statistics.

Kirkland Lake has listed on the ASX.

For comparison, $353 million was spent on exploration in WA in the March quarter, while NSW ($61.3 million) and Queensland ($75.2 million) also attracted much higher rates of spending.

The Victorian government this year announced it would charge a royalty on gold production for the first time, but the government expects the royalty will generate just $56 million over a four year period.

Victoria's gold sector has boomed in the past four years.

That pales in comparison to the $1.16 billion the WA government expects to raise from gold royalties over the same period.

Compared to the gold rushes of the 1850s, which made Melbourne one of the world's wealthiest cities, Ballarat gold mine general manager Stephen Jeffers says it's a stretch to call the past few years a genuine renaissance.

"It is a long bow,'' he said.

''We have noticed that since Fosterville really hit their straps, explorers are coming around and having a good sniff, for sure, but unless something comes up, they will get bored real quick."

Fosterville's success has triggered a 70 per cent increase in the number of exploration licences granted in the state between fiscal 2015 and fiscal 2018, but the "renaissance" has to date delivered no new "greenfield" mines in Victoria.

''The low hanging fruit in the 'renaissance' will be the reopening of old mines that have existing infrastructure and have a fairly low social impact, if you like, and there are a number of those,'' said Olsen.

''We are looking at those, we are active and keen to invest if the environment allows it.

"But having said that, those mines that are closed down require a huge investment with dewatering and refurbishing, getting all the access and all the power re-established, it can take years and you still need permission to do it.

''There is nothing free about gold mining I can tell you, it has got to be one of the most capital intensive, high-risk industries there is.''

Foster bets on gold discoveries for a living, and he was not exactly optimistic that Fosterville's success will be repeated elsewhere in Victoria.

"It is always possible, but those mines in that area have been around a long time, they have had a lot of work and a lot of drilling, so I would not bet on others discovering another Swan Zone,'' he said.

''They are so few and far between, the probability of discovering another one is low at Fosterville, and it is even lower on other properties where the geology is not quite as well known." |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

A little development on the LedgerX saga: <SNIP all the previous updates> Latest Development: Very US solution: SUE https://messari.io/article/ledgerx-clashes-with-cftc-over-planned-launch-of-bitcoin-futures-platformFollowing yesterdays announcement that LedgerX had launched a retail platform allowing for the first physically settled bitcoin ($BTC) futures in the U.S. it remains unclear if contracts are live for trading or will be live any time soon. Earlier today The Block reported that there was no sign of approved contracts on the CFTC website and no listed market volumes.

The CFTC later stated that LedgerX does not have a designated contract maker (DCM) license required to trade futures, only one from 2017 that allows for the trading of swaps. This statement clashes with the fact that the CFTC had reportedly approved LedgerX's DCM license last month. Following these events Paul Chou, CEO of LedgerX, took to Twitter to announce that he would take action against the CFTC stating:

I've decided to sue the CFTC for anti competitive behavior, breach of duty, going against the regs, etc.

https://www.theblockcrypto.com/2019/08/01/actually-ledgerx-might-not-have-launched-physically-settled-bitcoin-futures-contracts-after-all/Time to call it a day folks. Now Alita the Battle Angel. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11968

BTC + Crossfit, living life.

|

|

August 01, 2019, 10:45:14 PM |

|

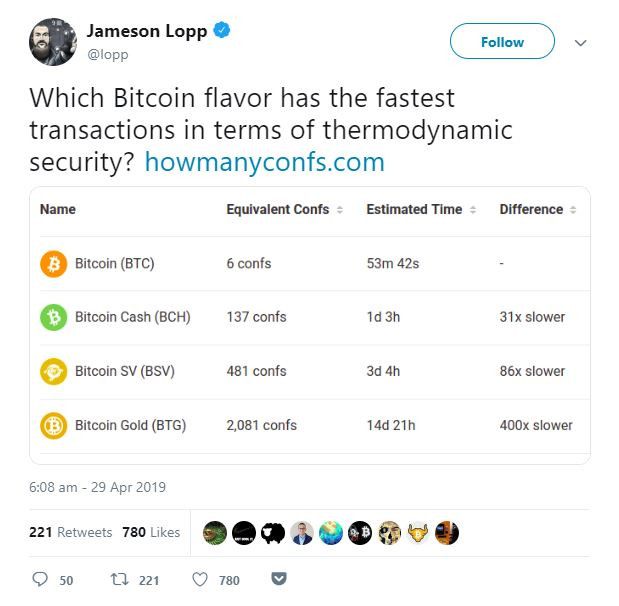

I wonder if difficulty will ever start to just somewhat settle especially with node size getting harder and harder to shrink. This indicator speaks to the impact of mining on Bitcoin's price. As new coins are mined into existence, miners sell some of their mined coins to pay for production costs. This produces bearish price pressure. https://twitter.com/woonomic/status/1156968538742988800?s=21The weakest miners sell more of their coins to remain operational. When it becomes unsustainable, they capitulate, hashing power and network difficulty reduces (ribbon compression), leaving only the strong, who sell less leaving more room for more bullish price action. https://twitter.com/woonomic/status/1156968540940800000?s=21Typically we see this at the end of bear cycles, after miners capitulate, the lack of miner selling pressure allows the price to stabilise and then climb; the classic accumulation bottom.  via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968561404866560?s=21 via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968561404866560?s=21Credit goes to @VinnyLingham who was the first AFAIK to spot this dynamic in his April 2014 article on how Bitcoin finds its price equilibrium. We now have 5 more years of data to back it up. https://twitter.com/woonomic/status/1156968565037137920?s=21Miners capitulate in bears, but also during block reward halvening events when suddenly only half the coins are mined for the same costs and the market price has yet to catch up to pay for it. See the compression after each halvening (marked as vertical lines) as miners die off.  via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968583571730432?s=21 via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968583571730432?s=21As a final note, notice how the 2019 the 2012 bull market have the same structure, we saw severe mining capitulation (ribbon flipped negative) leading to a shorter accumulation band before price breakout. This bull market has resembles 2012 more than 2016 structurally.  via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968606749474816?s=21 via Imgflip Meme Generatorhttps://twitter.com/woonomic/status/1156968606749474816?s=21 |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11968

BTC + Crossfit, living life.

|

|

August 01, 2019, 10:46:56 PM |

|

A little development on the LedgerX saga:

Time to call it a day folks.

Now Alita the Battle Angel.

Boy you’re in for a treat As for me = HODLsleep  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10130

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 01, 2019, 11:12:02 PM |

|

source: howmanyconfs.com FYI, this is a worthless metric. Could you elaborate more on this? I strongly disagree as the security implied in Bitcoin (ledger costliness) is one of the main value proposition for bitcoin imho. Who would Store Value on an insecure blockchain? This does not correctly represent the relative relationship of the security chains. I'll try to find a link for you later after I catch up a bit. Thank you. This is how I discovered this website. https://twitter.com/lopp/status/1122850107685310464 I don't want to fall into the " appeal to authority" (one of the most common logical fallacy), but I think Jameson Lopp knows how these things work. It seems to me that Jameson Lopp probably just engaged in a relative straight-forward calculation that accounts for how much hashrate is dedicated to each coin in terms of the amount of security that is achieved and compared the other forks of bitcoin wannabes in comparison to bitcoin's 6 confirmation. |

|

|

|

|

|

Poll

Poll