shahzadafzal

Copper Member

Legendary

Offline Offline

Activity: 1526

Merit: 2890

|

|

December 05, 2021, 10:19:27 AM |

|

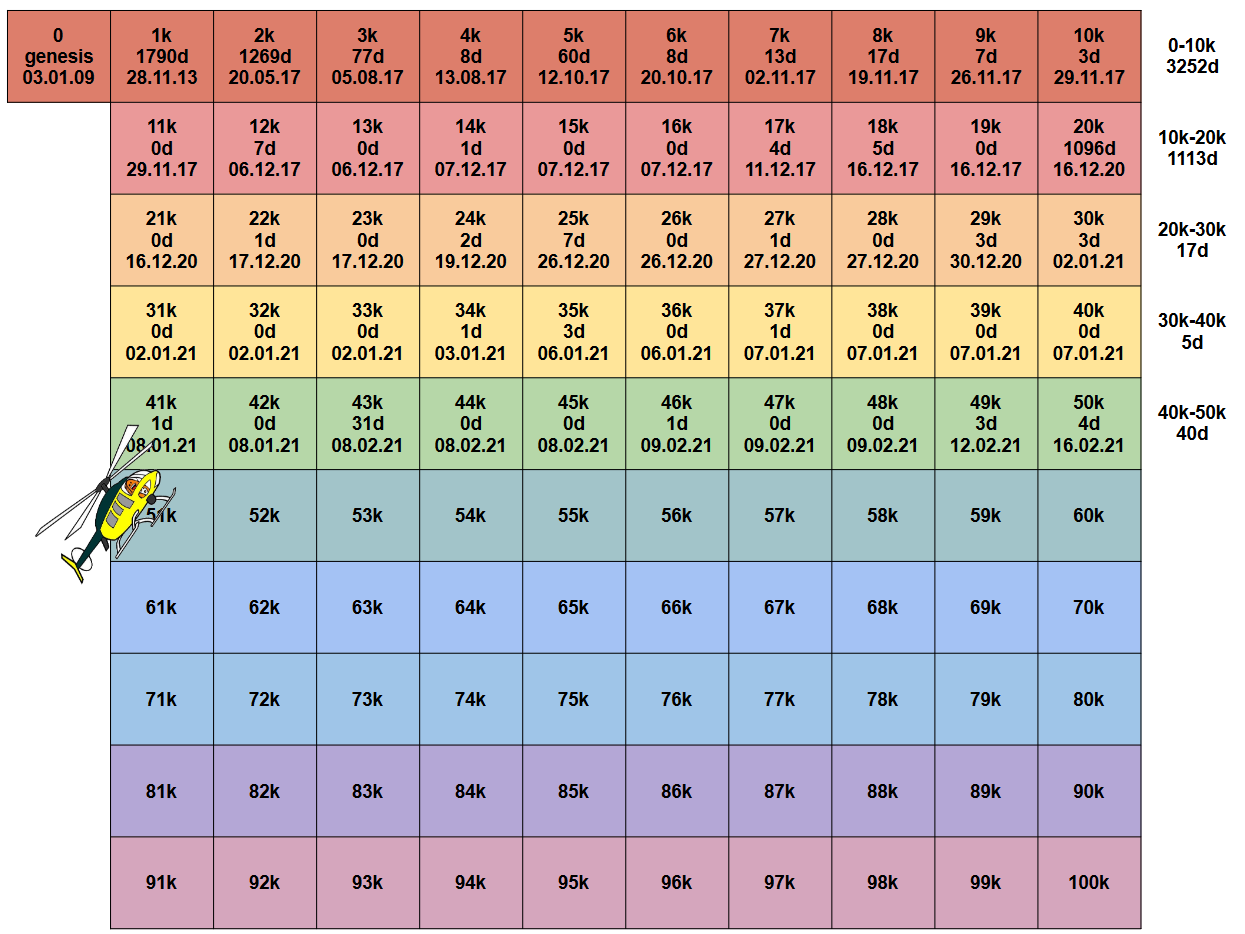

Days since ATH:  Well we are about to touch $50k yet again, remember 16-Feb-2021 was the day first time we crossed $50k and Chopper was introduced for the first time. we did it! half way done!  |

|

|

|

|

|

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

aysg76

Legendary

Offline Offline

Activity: 1960

Merit: 2124

|

|

December 05, 2021, 10:25:16 AM |

|

Where did you get this IRL photo of mine?  From the parallel world where i also look like you  |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 05, 2021, 11:01:26 AM |

|

|

|

|

|

|

somac.

Legendary

Offline Offline

Activity: 2046

Merit: 1181

Never selling

|

|

December 05, 2021, 11:04:53 AM |

|

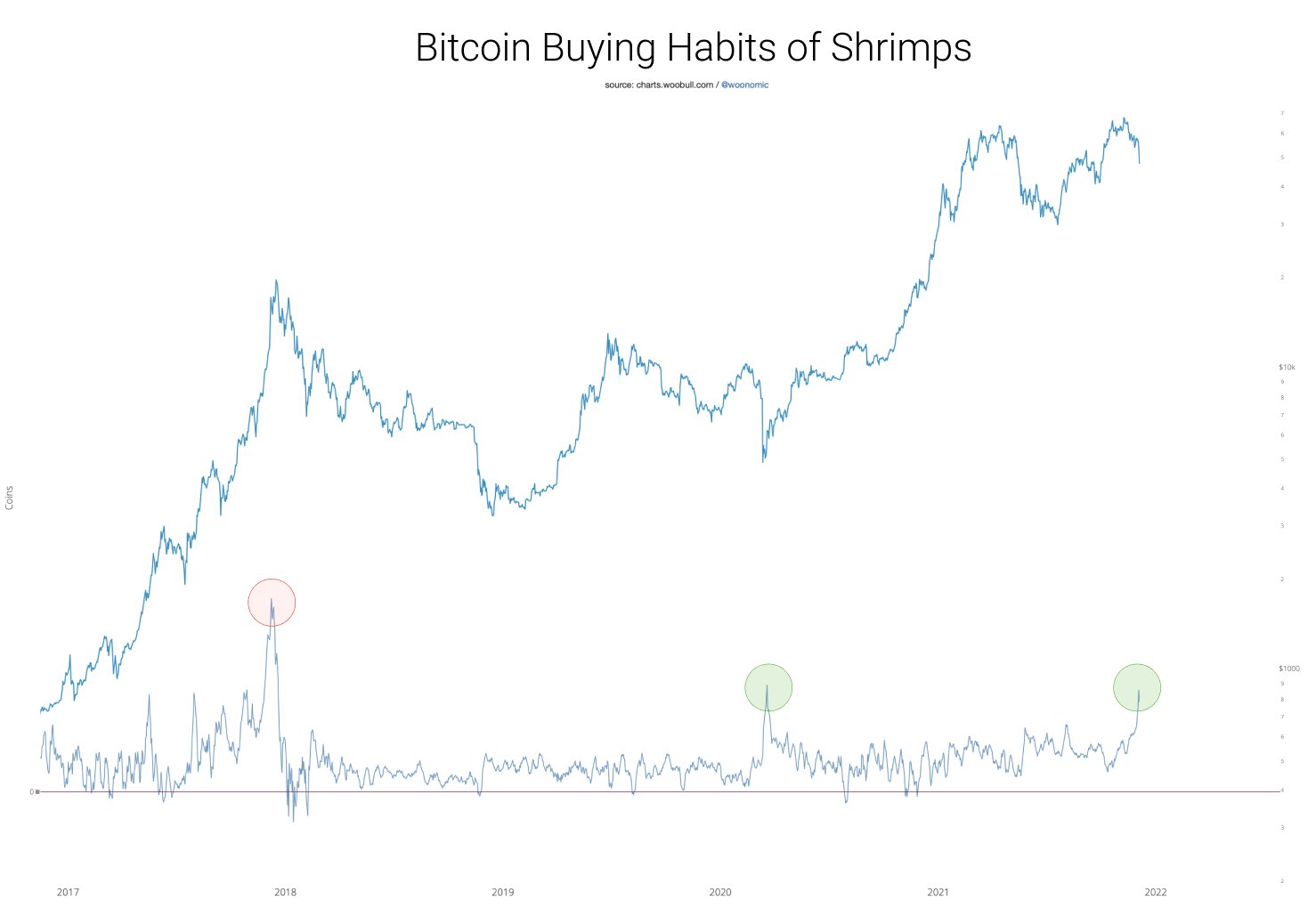

Shitcoins have come back very strong, good portion of them have completely elimanted their weekend losses and are up on the week. Bitcoin looks very tired and heavy in comparison.

To me this could mean 2 things. 1) no significant retail buying is happening with BTC anymore. or 2) BTC investors know something that the shitcoins don't, which is most likely more dumps on Monday. Or I guess both.

Don't like any of those options honestly.

Haha made me smile! Last time "significant retail buying" of BTC happened back in December 2017! Does that mean we're still in a bear? We're not observing shitcoins here. The fact that some of that crap "came back very strong" doesn't mean a shit. All shitcoins are doomed (well, most of them).  I've noticed that there are times like this after a dump where BTC doesn't come back as strong as the shitcoins and this often preceeds another dump, at least back to the recent move's lows. The movement of shitcoins are absolutely relevant, just like they were in early 2018 when they were going strong but BTC was not. BTC retail buying will of course come back, but that is not when shitcoins are pumping. I don't think we are in a bear market, on-chain shows nothing of the sort at the moment, but I don't think its all up from here, though I hope I'm wrong. Even if that means my buy order at the recent lows is not hit. |

|

|

|

|

shahzadafzal

Copper Member

Legendary

Offline Offline

Activity: 1526

Merit: 2890

|

|

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1850

Merit: 2829

All good things to those who wait

|

Shitcoins have come back very strong, good portion of them have completely elimanted their weekend losses and are up on the week. Bitcoin looks very tired and heavy in comparison.

To me this could mean 2 things. 1) no significant retail buying is happening with BTC anymore. or 2) BTC investors know something that the shitcoins don't, which is most likely more dumps on Monday. Or I guess both.

Don't like any of those options honestly.

For me the problem is not the lack of a retail interest. The problem is that anytime the price increases, immediately it is pulled back by the bots of Binance traders. And the reason for this is that probably too many monkeys are fighting for one banana, i.e. too many are trying with a leverage from 10x to 100x to make some profit. Hence the increased number of long positions - since the first big crash in May, they tried to compensate by investing again at prices which were looking stable - around 59K. And because the bots of all exchanges are using Binance price, the role of short and long positions there has become crucial, like Bitmex in the past. The only difference is that Bitmex manipulators used Bitstamp and Kraken as low volume exchanges to bring down the price, while now Binance longers are selling on each miniscule price increase on Binance to get some profit. The effect is the same. They failed once again, losing all their investment. Before the crash on Binance there were 2.7 bil longs. After the crash only 1.5 bil survived. The quiestion now is when the gravity of this always losing game will be overcome and the price starts to climb again. Hopefully the effect will be felt as early as the next week and it will continue until the n00bs take loans and open another 100x leveraged longs somewhere between 120K and 200K. It is funny how the new ATH's make everybody happy, but only the hodlers can realize profits. Definitely not the naiive wet-dreaming long gamblers aka nocoiners, who end up with red eyes and empty pockets... ALWAYS. I think proudhon is one of them, once having thousands of bitcoins, which were lost on stupid shorts and still waiting for the price to falls to 100$. Now, this is the definition of pathetic    |

|

|

|

|

somac.

Legendary

Offline Offline

Activity: 2046

Merit: 1181

Never selling

|

|

December 05, 2021, 11:43:17 AM |

|

Shitcoins have come back very strong, good portion of them have completely elimanted their weekend losses and are up on the week. Bitcoin looks very tired and heavy in comparison.

To me this could mean 2 things. 1) no significant retail buying is happening with BTC anymore. or 2) BTC investors know something that the shitcoins don't, which is most likely more dumps on Monday. Or I guess both.

Don't like any of those options honestly.

For me the problem is not the lack of a retail interest. The problem is that anytime the price increases, immediately it is pulled back by the bots of Binance traders. And the reason for this is that probably too many monkeys are fighting for one banana, i.e. too many are trying with a leverage from 10x to 100x to make some profit. Hence the increased number of long positions - since the first big crash in May, they tried to compensate by investing again at prices which were looking stable - around 59K. And because the bots of all exchanges are using Binance price, the role of short and long positions there has become crucial, like Bitmex in the past. The only difference is that Bitmex manipulators used Bitstamp and Kraken as low volume exchanges to bring down the price, while now Binance longers are selling on each miniscule price increase on Binance to get some profit. The effect is the same. They failed once again, losing all their investment. Before the crash on Binance there were 2.7 bil longs. After the crash only 1.5 bil survived. The quiestion now is when the gravity of this always losing game will be overcome and the price starts to climb again. Hopefully the effect will be felt as early as the next week and it will continue until the n00bs take loans and open another 100x leveraged longs somewhere between 120K and 200K. It is funny how the new ATH's make everybody happy, but only the hodlers can realize profits. Definitely not the naiive wet-dreaming long gamblers aka nocoiners, who end up with red eyes and empty pockets... ALWAYS. I think proudhon is one of them, once having thousands of bitcoins, which were lost on stupid shorts and still waiting for the price to falls to 100$. Now, this is the definition of pathetic    Yes the influence Binance has over this market is disturbing and I felt the same way about bitmex. I wonder with these exchanges though, are they also doing the dodgy themselves, are they manipulating the price. Let's face exchanges are a black box, they get up to all sorts of shit, Binance has always avoided regulatory scrutiny where it can and I don't think it's because they are libertarians. What do you think? could Binance be manipulating the situtation in anyway? |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 05, 2021, 12:01:34 PM |

|

|

|

|

|

|

Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

December 05, 2021, 12:11:01 PM |

|

WillyBot is back......you have been warned.  Looks like one of them NFT's  |

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1850

Merit: 2829

All good things to those who wait

|

|

December 05, 2021, 12:59:57 PM |

|

Shitcoins have come back very strong, good portion of them have completely elimanted their weekend losses and are up on the week. Bitcoin looks very tired and heavy in comparison.

To me this could mean 2 things. 1) no significant retail buying is happening with BTC anymore. or 2) BTC investors know something that the shitcoins don't, which is most likely more dumps on Monday. Or I guess both.

Don't like any of those options honestly.

For me the problem is not the lack of a retail interest. The problem is that anytime the price increases, immediately it is pulled back by the bots of Binance traders. And the reason for this is that probably too many monkeys are fighting for one banana, i.e. too many are trying with a leverage from 10x to 100x to make some profit. Hence the increased number of long positions - since the first big crash in May, they tried to compensate by investing again at prices which were looking stable - around 59K. And because the bots of all exchanges are using Binance price, the role of short and long positions there has become crucial, like Bitmex in the past. The only difference is that Bitmex manipulators used Bitstamp and Kraken as low volume exchanges to bring down the price, while now Binance longers are selling on each miniscule price increase on Binance to get some profit. The effect is the same. They failed once again, losing all their investment. Before the crash on Binance there were 2.7 bil longs. After the crash only 1.5 bil survived. The quiestion now is when the gravity of this always losing game will be overcome and the price starts to climb again. Hopefully the effect will be felt as early as the next week and it will continue until the n00bs take loans and open another 100x leveraged longs somewhere between 120K and 200K. It is funny how the new ATH's make everybody happy, but only the hodlers can realize profits. Definitely not the naiive wet-dreaming long gamblers aka nocoiners, who end up with red eyes and empty pockets... ALWAYS. I think proudhon is one of them, once having thousands of bitcoins, which were lost on stupid shorts and still waiting for the price to falls to 100$. Now, this is the definition of pathetic    Yes the influence Binance has over this market is disturbing and I felt the same way about bitmex. I wonder with these exchanges though, are they also doing the dodgy themselves, are they manipulating the price. Let's face exchanges are a black box, they get up to all sorts of shit, Binance has always avoided regulatory scrutiny where it can and I don't think it's because they are libertarians. What do you think? could Binance be manipulating the situtation in anyway? There is one major difference between Bitmex and Binance. Bitmex owners are well known scammers, who were often accused of foul play against their customers. I haven't read anything similar for Binance owners, which doesn't mean they are alright, of course. Surely there are all kinds of manupulations on most of the exchanges. But I think that the main force which is restraining the prices and causing sporadic dips and crashes is the irrational volume of long liquidations in Binance. I've been watching the liquidation data closely and each time there is a 2-3% dip there are 5-10x more long liquidations, compared to short liquidations during a 2-3% price increase. This shows that the shorters are more cautios this year, while the longers are quite reckless. In general, what happens in derivate exchanges stays there. But Binance is an exception - it is simultaneously a derivate and a spot exchange. So what happens there has a real impact on the price. The volume above 40K bitcoins each day is beyond the power of a single whale. And the liquidation data confirms that there are millions of longers losing ~100$. It is like a new Tortuga attracting all kind of wastrels and seekers of treasure. They refuse to invest and hope to get lucky, not caring about Bitcoin or the odds of winning. And if they claim here the odds are good, then they are surely applying proudhon's math and science  . |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11985

BTC + Crossfit, living life.

|

|

December 05, 2021, 01:00:08 PM Merited by JayJuanGee (1) |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 05, 2021, 01:01:30 PM |

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

December 05, 2021, 01:06:26 PM

Last edit: December 05, 2021, 01:17:14 PM by Torque |

|

This tweet brings up the idea that time is money, and money is time. Most Average Joe sheeple think that every fiat dollar they earn is an honest unit of work expended into the global GDP. But if your salary and the salary of every other person around you is paid in money that is printed by the FED for free (to the tune of $120B/month), does that mean your time-spent work truly has any lasting value? Nope. And that's the rub. We're now living in a zombie-corp run world, with global work solely propped up with freely-printed monopoly money. And they want its spending value to melt as fast as cotton candy in a rain storm. Look for CBDCs in the future to have an expiration date. |

|

|

|

|

somac.

Legendary

Offline Offline

Activity: 2046

Merit: 1181

Never selling

|

|

December 05, 2021, 01:24:49 PM |

|

Shitcoins have come back very strong, good portion of them have completely elimanted their weekend losses and are up on the week. Bitcoin looks very tired and heavy in comparison.

To me this could mean 2 things. 1) no significant retail buying is happening with BTC anymore. or 2) BTC investors know something that the shitcoins don't, which is most likely more dumps on Monday. Or I guess both.

Don't like any of those options honestly.

For me the problem is not the lack of a retail interest. The problem is that anytime the price increases, immediately it is pulled back by the bots of Binance traders. And the reason for this is that probably too many monkeys are fighting for one banana, i.e. too many are trying with a leverage from 10x to 100x to make some profit. Hence the increased number of long positions - since the first big crash in May, they tried to compensate by investing again at prices which were looking stable - around 59K. And because the bots of all exchanges are using Binance price, the role of short and long positions there has become crucial, like Bitmex in the past. The only difference is that Bitmex manipulators used Bitstamp and Kraken as low volume exchanges to bring down the price, while now Binance longers are selling on each miniscule price increase on Binance to get some profit. The effect is the same. They failed once again, losing all their investment. Before the crash on Binance there were 2.7 bil longs. After the crash only 1.5 bil survived. The quiestion now is when the gravity of this always losing game will be overcome and the price starts to climb again. Hopefully the effect will be felt as early as the next week and it will continue until the n00bs take loans and open another 100x leveraged longs somewhere between 120K and 200K. It is funny how the new ATH's make everybody happy, but only the hodlers can realize profits. Definitely not the naiive wet-dreaming long gamblers aka nocoiners, who end up with red eyes and empty pockets... ALWAYS. I think proudhon is one of them, once having thousands of bitcoins, which were lost on stupid shorts and still waiting for the price to falls to 100$. Now, this is the definition of pathetic    Yes the influence Binance has over this market is disturbing and I felt the same way about bitmex. I wonder with these exchanges though, are they also doing the dodgy themselves, are they manipulating the price. Let's face exchanges are a black box, they get up to all sorts of shit, Binance has always avoided regulatory scrutiny where it can and I don't think it's because they are libertarians. What do you think? could Binance be manipulating the situtation in anyway? There is one major difference between Bitmex and Binance. Bitmex owners are well known scammers, who were often accused of foul play against their customers. I haven't read anything similar for Binance owners, which doesn't mean they are alright, of course. Surely there are all kinds of manupulations on most of the exchanges. But I think that the main force which is restraining the prices and causing sporadic dips and crashes is the irrational volume of long liquidations in Binance. I've been watching the liquidation data closely and each time there is a 2-3% dip there are 5-10x more long liquidations, compared to short liquidations during a 2-3% price increase. This shows that the shorters are more cautios this year, while the longers are quite reckless. In general, what happens in derivate exchanges stays there. But Binance is an exception - it is simultaneously a derivate and a spot exchange. So what happens there has a real impact on the price. The volume above 40K bitcoins each day is beyond the power of a single whale. And the liquidation data confirms that there are millions of longers losing ~100$. It is like a new Tortuga attracting all kind of wastrels and seekers of treasure. They refuse to invest and hope to get lucky, not caring about Bitcoin or the odds of winning. And if they claim here the odds are good, then they are surely applying proudhon's math and science  . Ok sounds fair enough, so the longs are using excesive leverage but the shorts are not. At what point does this end though because it is somewhat frustrating (I don't expect an answer)? |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 05, 2021, 02:01:26 PM |

|

|

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7962

|

|

December 05, 2021, 02:13:51 PM |

|

Apparently it creates a lot of bass and distortion as well. |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2064

$120000 in 2024 Confirmed

|

Exellent We have Luca Brecel in the UK snooker final today from 🇧🇪 Will be backing him in honour of the dude  |

|

|

|

|

goldkingcoiner

Legendary

Online Online

Activity: 2030

Merit: 1642

Verified Bitcoin Hodler

|

Coincidence? I very much doubt it. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 05, 2021, 03:01:35 PM |

|

|

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7962

|

|

December 05, 2021, 03:15:13 PM Merited by JayJuanGee (1) |

|

|

|

|

|

|

|

Poll

Poll