somac.

Legendary

Offline Offline

Activity: 2046

Merit: 1181

Never selling

|

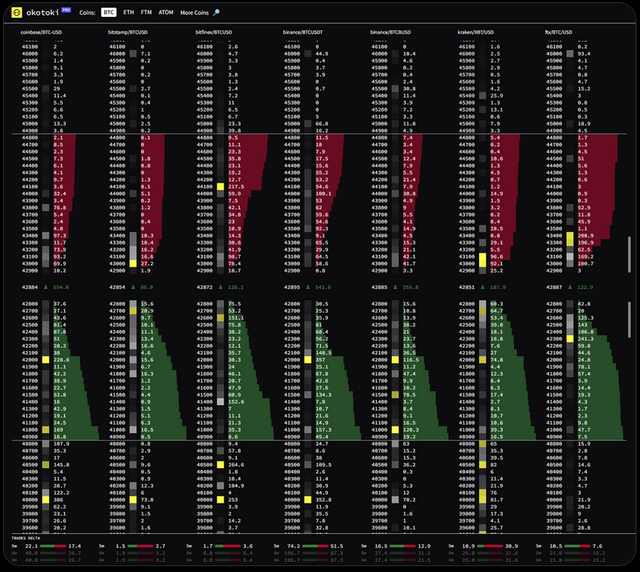

https://twitter.com/ByzGeneral/status/1479063644117864452This is starting to feel very similar to the 30k range now. The imbalance between bid & ask side is getting crazy. Spot bids keep getting filled with new orders showing up, meanwhile ask side fails to repopulate in any meaningful capacity.  You have to understand that there's an active (market orders) and a passive (limit orders) flow. The passive flow is what we see in these books. So the reason price goes down despite orderbook delta looking green that the active flow is selling. The active flow is the dominant flow (always, naturally) and it's what guides us. But it bumps into resistance in either direction. If the opposing passive side refuses to give out and keeps offering resistance the active flow will eventually just get exhausted. So sellers get exhausted and all the hands that want to fold already folded and they fail to break the bid side and there's not enough ammo anymore to repopulate the ask side. At this point it's a waiting game... Because price is sitting on top of a thick bid side and the active (sell) flow has given up. So we just kind of float around (with a slight slope downwards because of mining there's always some natural sell pressure, ranges on BTC almost always slope down) until... until bids get impatient. Some game theory comes into play here. Eventually some asshole is gonna get impatient and pull his limit bids and set them higher. Someone else catches on and decides to pull his limits and market buys! All of a sudden the active flow has turned into buying and the ask side is fragile because folding hands used up all their dry powder! Add to that a bit of open interest that can get used for squeezing purposes and suddenly you're slicing through the book like it's butter.  This is the feeling I got at the 30k range and I'm getting it again. Maybe there's a little less buying juice left in the tank than before, but I still think this range is probably accumulation and not re-distribution. "BUT MUH FUNDING ISNT NEGATIVE THE ENTIRE TIME". I know I would also prefer consistent neg funding rates, however there has been a consistent spot premium. Also... I heard bears are pussy ass bitches. /end

|

|

|

|

|

|

|

|

|

|

|

|

According to NIST and ECRYPT II, the cryptographic algorithms used in

Bitcoin are expected to be strong until at least 2030. (After that, it

will not be too difficult to transition to different algorithms.)

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Shamm

Sr. Member

Offline Offline

Activity: 1064

Merit: 343

Hhampuz is the best manager

|

|

January 06, 2022, 12:51:44 PM |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 01:01:32 PM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 06, 2022, 01:17:13 PM |

|

Playing pickup sticks on my chart 42.5-42.8 is the next place bulls make a stand...

Ugh.  That said, we will have a lot of support in this range if we end up in it...  |

|

|

|

|

somac.

Legendary

Offline Offline

Activity: 2046

Merit: 1181

Never selling

|

|

January 06, 2022, 01:21:18 PM |

|

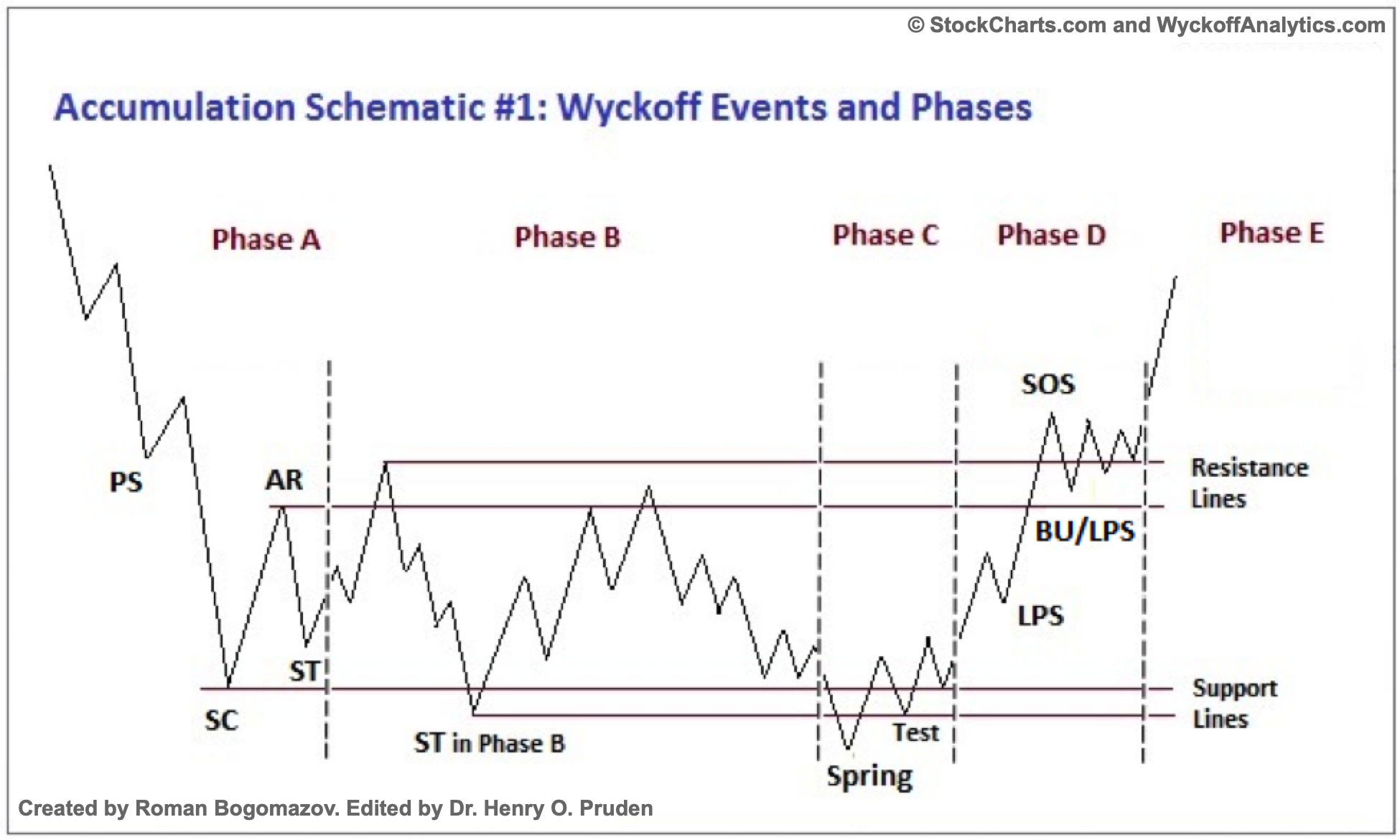

Remember all those wyckoff accumulation charts we saw in last year's mid year dip. It proved to be correct, I haven't seen any such analysis getting around now but things look similar. Has anybody seen any of that analysis done on this dip?

|

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2477

|

|

January 06, 2022, 01:24:51 PM |

|

BTC expectation for January 2022Waitress, please give me and my high class whore a lobster each, with the caviar starter and a bottle of your finest champagne. In fact triple it up and you can join us too, I will pay for your salary for the rest of the year if you join us.  BTC reality for January 2022 BTC reality for January 2022Weiwei, geez us a single Big Mac meal, hold the extra large as I can't afford it today.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 02:01:28 PM |

|

|

|

|

|

|

Arriemoller

Legendary

Offline Offline

Activity: 2282

Merit: 1767

Cлaвa Укpaїнi!

|

|

January 06, 2022, 02:06:00 PM |

|

Remember all those wyckoff accumulation charts we saw in last year's mid year dip. It proved to be correct, I haven't seen any such analysis getting around now but things look similar. Has anybody seen any of that analysis done on this dip?

I seem to remember someone posting about it some days ago, basically saying that it looks good. |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7762

'The right to privacy matters'

|

BTC expectation for January 2022Waitress, please give me and my high class whore a lobster each, with the caviar starter and a bottle of your finest champagne. In fact triple it up and you can join us too, I will pay for your salary for the rest of the year if you join us.  BTC reality for January 2022 BTC reality for January 2022Weiwei, geez us a single Big Mac meal, hold the extra large as I can't afford it today.  The McDonalds girl is cuter then the lobster 🦞 lady. The big opportunity for btc buys is here. Grab some dip guys. I have a $50 a day set in place. |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

January 06, 2022, 02:24:40 PM |

|

I just don't see how they can actually raise them .. they seem to have really painted their lil selfies in a corner...

It's jawboning. Thing is lets say they raise rates, the economy will still need to be supported otherwise deflation will come in. So what they take with one hand they will give with another. And if they don't, and things crash, you watch how quickly they reverse. It would make The Flash jealous. The Fed is the whale in control of the stonk market. Their jawboning is literally spoofing the market to affect the behavior they want, instead of actually having to change rates. |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7762

'The right to privacy matters'

|

|

January 06, 2022, 02:28:56 PM |

|

I just don't see how they can actually raise them .. they seem to have really painted their lil selfies in a corner...

It's jawboning. Thing is lets say they raise rates, the economy will still need to be supported otherwise deflation will come in. So what they take with one hand they will give with another. And if they don't, and things crash, you watch how quickly they reverse. It would make The Flash jealous. The Fed is the whale in control of the stonk market. Their jawboning is literally spoofing the market to affect the behavior they want, instead of actually having to change rates. many times i think the feds and or two or three large counties created btc as a tool to bail us out of the 2008-2009 fiat crash. I then think Btc worked to well and now they do not quite know what to do with it. |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

January 06, 2022, 02:57:57 PM

Last edit: January 06, 2022, 03:08:14 PM by dragonvslinux Merited by JayJuanGee (1) |

|

Remember all those wyckoff accumulation charts we saw in last year's mid year dip. It proved to be correct, I haven't seen any such analysis getting around now but things look similar. Has anybody seen any of that analysis done on this dip?

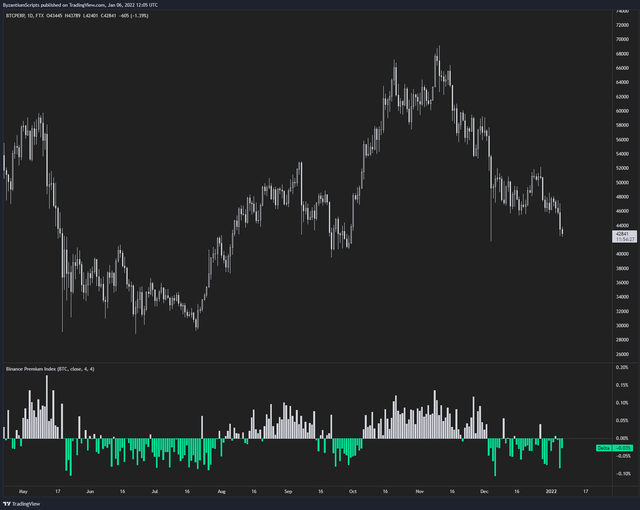

I seem to remember someone posting about it some days ago, basically saying that it looks good. I was posting about it before when it looked like wyckoff accumulation on the 4hr chart, though unconfirmed, but this structure has now been broken with the recent drop: Posting this again for some New Year Hopium. Recent bounce from $46K still looking like a "spring" for Wyckoff accumulation, even more so after creating new closing low on 4hr:  Based on the current price structure, it doesn't look like wyckoff to me, at least not on a line chart. On a candle chart, we'd be in Phase B at best, prior to creating a lower low:  As for current outlook, I'm personally not seeing $40K-$46K range as providing much support given the volume gap, even if a dead cat bounce could occur from here at any moment:  The $42.5K level is merely a "last line in the sand" before lower lows, similarly to how $46K acted as such after failing to find support and getting rejected by $48K MA support. The 0.236 fib retracement around $38K where volume lies and previous VPVR point of control around $33K-35K is more likely where a macro higher low would form imo, while taking more weeks to get there. Daily RSI is bearish, but not even oversold yet (like back in May) for reference sake, the Weekly RSI hasn't even turned bearish yet, as food for thought. There's plenty for room to the downside if price strength continues to weaken basically. Ultimately price closed below the 50 Week MA again and the bears followed through, breaking both support trend-lines, as well as MA support. Doesn't look great to me anymore to put it simply. At least the on-chain data still looks good, but price structure looks pretty f**ked now. Truth is, Bitcoin has never been continually traded below the 50 Week MA within a bull market, so best to hope for in the mid-term would be further consolidation at higher levels. Still not seeing any argument for $20K-$25K levels, even if entirely possible now (70% drop from high to low), but otherwise not seeing any buyers at current prices either. Ideally price drops hard and we get the crash over and done with as quickly as possible, somewhat regardless of how low it goes, rather than f**king around in no mans land. Just my opinion anyway. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 03:01:36 PM |

|

|

|

|

|

|

|

Copetech

|

So I'm watching as the price keeps bouncing off the $42.5k support level. When things are going the other way and repeatedly bouncing off a resistance level, it means to sell at that resistance expecting to buy lower because it's very likely to break through and leave you holding less.

Am I reading this wrong in thinking I should hold off a bit longer to buy a dippier dip? My DCA isn't due until tomorrow anyway, so kinda asking for support for resisting a reverse FOMO buy. (I have occasionally pulled the trigger on DCA buys a day early beat out a weekend pump) I'm just not used to Downs yet as I'm still a bit new at this.

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

January 06, 2022, 03:30:17 PM Merited by JayJuanGee (1) |

|

Goodbye stimulus, goodbye welfare....and the Fed wants to taper and raise rates this year too? Good luck with that, Fed.  |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

So I'm watching as the price keeps bouncing off the $42.5k support level. When things are going the other way and repeatedly bouncing off a resistance level, it means to sell at that resistance expecting to buy lower because it's very likely to break through and leave you holding less. There are generally two schools of thought with the repeated tests of support or resistance. The first being the more you test a level the weaker it becomes, the latter being the more you test a level the stronger it becomes. Personally I think the price structure is more relevant to answer this. Is price creating lower highs/lows while doing so, and therefore price is getting weaker, or higher lows/highs with price getting stronger? I think more relevant in this case, given you talk of DCA, is to ignore the lower time-frames here, as they are not relevant to the longer term trend. Ideally ignore price all together when you DCA, stick to time-based analysis. Price could be up significantly by the end of the week, it could also be lower by next week. Likewise price could be lower by tomorrow and significantly higher by the end of the week. Am I reading this wrong in thinking I should hold off a bit longer to buy a dippier dip? My DCA isn't due until tomorrow anyway, so kinda asking for support for resisting a reverse FOMO buy. (I have occasionally pulled the trigger on DCA buys a day early beat out a weekend pump) I'm just not used to Downs yet as I'm still a bit new at this.

If your DCA is due tomorrow, not today, then I'd recommend buying tomorrow - because that's when your DCA is due. Rushing in to buy falling knives is always very risky move. This will also help to maintain your disciple with DCA. If you start buying early, you're also likely to be buying late, therefore trying to trade price instead of time. I imagine JJG will otherwise give you all the relevant info on dollar cost averaging... |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2477

|

|

January 06, 2022, 03:39:47 PM |

|

Goodbye stimulus, goodbye welfare....and the Fed wants to taper and raise rates this year too? Good luck with that, Fed.  I guess the Build Back Better campaign for increased inflation around the world have another crisis waiting in the wings to replace the pandemic spend? I'm surprised Biden hasn't (yet) called it Build bLack Better at some point.  |

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

January 06, 2022, 03:48:05 PM |

|

2022 is gonna be Year of the Crab, Goddamnit.

I can feel it in muh plums.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 04:01:28 PM |

|

|

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2477

|

|

January 06, 2022, 04:17:21 PM |

|

USA, what happened to you guys? How can you let a bunch of utter cunts; Joe Biden, Chuck Schumer, Nancy Pelosi, Kamala Harris talk this much shite for a year? Truly astonished.  Jan 6 2021 as bad as 9/11 or Pearl Harbour? They have absolutely no shame at all. Ridiculous comparisons. I'd much rather have central political buildings burn rather than my local high street. To me it is in fact quite understandable why people are angry with these complete and utter cunts in charge. Even so, not much happened, and whatever did was most likely partially engineered. What a circus and a bunch of clowns fronting this nonsense. |

|

|

|

|

|

Poll

Poll