ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 01:03:28 AM |

|

|

|

|

|

|

|

|

|

|

|

"Governments are good at cutting off the heads of a centrally

controlled

networks like Napster, but pure P2P networks like Gnutella and Tor seem

to be holding their own." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

June 29, 2022, 01:07:46 AM |

|

Almost every little 'shithead' on youtube/twitter/tradingview keeps blabbering about 10K-14K bottom.

To me it says that it won't be THAT.

My preference (and it looks like the WO on average) is that the bottom was "already", but the whole cycle is messed up so much that it is difficult to be certain.

One thing is for sure: I believe in btc as a medium of exchange much more than the 'store of value' story at this point. It could change, though.

The fact that there will only ever be 21 million makes this pretty much a forgone conclusion that over time BTC is and will be a store of value it could be, eventually, but it does not feel this way if you consider the period since late 2017. No value stored vs inflation whatsoever, objectively. A negative 20% (vs inflation) vs gold's +25% vs inflation, and I dislike gold. imho, the involvement of financial institutions 'messed' bitcoin up, albeit maybe only temporarily. If financial types could pledge bitcoin en masse (and they did), then the 'store of value' and "clean collateral" stories could be affected. TL;DR a new 'story' for bitcoin is needed (or it could be the "old" story of the medium of exchange). The 'store of value' story is in deep hibernation for now. but gold is subject to vast dilution of value with discovery of new deposits of it. https://www.mining.com/web/uganda-says-exploration-results-show-it-has-31-million-tonnes-of-gold-ore/"Muyita said an estimated 320,158 tonnes of refined gold could be extracted from the 31 million tonnes of ore." quote from link If true that is more than the 205,000 mined ever see below. https://www.gold.org/goldhub/data/how-much-goldand the 2016 estimate of gold mined and in the ground was "About 244,000 metric tons of gold has been discovered to date (187,000 metric tons historically produced plus current underground reserves of 57,000 metric tons). Most of that gold has come from just three countries: China, Australia, and South Africa. The United States ranked fourth in gold production in 2016." google quote above, so the 244,000 world total mined and not mined yet total to go to over 500,000 mined and not mined yet. Which means about a 50% dilution of value for gold. How about that find and a second find in Africa and the asteroid they are looking at all come true in under 20 years. gold could move from a 244,000 grand total estimate to 1,000,000 total in the next ten years to twenty years. I consider gold to have more risk than BTC or Silver. Reason for silver is there is more of it so find a lot more is less likely. 1,600,000 tons of silver has been mined already. I am thinking finding 1,600,000 more tons of silver is less likely . than finding 320,000 tons of gold (just been found) so I fear gold's staying power. Do silver and BTC. But I am only talking about what I like to do. yes, sure, I am aware, good points. Perhaps this discovery being "priced in" resulted in almost no rise significantly despite the 5X increase in M1 since 2020. https://fred.stlouisfed.org/series/M1SLbecause of what you posted, I am reluctant to buy gold, but was just saying that it did better than btc since 2017, but worse than btc since covid crash. |

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 29, 2022, 01:15:28 AM |

|

Almost every little 'shithead' on youtube/twitter/tradingview keeps blabbering about 10K-14K bottom.

To me it says that it won't be THAT.

My preference (and it looks like the WO on average) is that the bottom was "already", but the whole cycle is messed up so much that it is difficult to be certain.

One thing is for sure: I believe in btc as a medium of exchange much more than the 'store of value' story at this point. It could change, though.

The fact that there will only ever be 21 million makes this pretty much a forgone conclusion that over time BTC is and will be a store of value it could be, eventually, but it does not feel this way if you consider the period since late 2017. No value stored vs inflation whatsoever, objectively. A negative 20% (vs inflation) vs gold's +25% vs inflation, and I dislike gold.imho, the involvement of financial institutions 'messed' bitcoin up, albeit maybe only temporarily. If financial types could pledge bitcoin en masse (and they did), then the 'store of value' and "clean collateral" stories could be affected. TL;DR a new 'story' for bitcoin is needed (or it could be the "old" story of the medium of exchange). The 'store of value' story is in deep hibernation for now. LOL, you are making an inferior imitation of me ten days later. I called the death of the “Bitcoin narrative” with BTC around $18k—but I meant something very different. I identified the problem, I diagnosed the cause, and I offered a solution. My superior wisdom received no appreciation from thoughtless cheerleaders who are accustomed to sneering at gold—a bad habit that I always detested. Anyone who dislikes gold is a fool: I say that as a lifelong goldbug at heart, who came to Bitcoin for the same reasons. Now, Biodom, your complaint about Bitcoin is classic weak-hands. This is why I pointed out, as quoted below, that gold had an extreme bear market. If gold could have an extreme and irrational bear-market, in which it did not seem to be acting as a store of value, then so can Bitcoin. Bitcoin’s “story” about a store of value is fine. Only the narratives of faith-based TA astrology need to die—to begone ASAP. I will quote myself instead of wasting time repeating myself, when I am backed up on other posts drafted and not finished. Aside: What retard ignored the message on the “report to moderator” page, and reported a fair shot I took at Biodom’s nonsense? My post broke no forum rules, generally—let alone WO special rules. The image source was linked on Wikimedia, as seen in the archive. Not asking if a few of the staff here have exceedingly poor judgment. Asking which retard thinks it’s funny to report WO posts that don’t break any rules.Economically, the Bitcoin narrative is dead. It is already.* That does not mean that Bitcoin is dead (LOL), but only that savvier Bitcoiners need to get out in front of foreseeable developments—lest they be perceived as deluding themselves with a Reality Distortion Field.

Some parts of the Bitcoin economic narrative are best discarded. (I never believed in PlanB; and I always took four-year cycle theories with a grain of salt, beyond the obvious supply-side effect of the Halvings.) Others are sound in the abstract, but need concrete discussions adjusted to fit reality. For only one example, Bitcoin as a store of wealth is fundamentally sound—if and only if Bitcoin is treated as money, and we burn to the ground every foolish notion that treats Bitcoin as “like a stock”. I have been saying for years that we need to get decoupled from stocks, and coupled to PMs ASAP. (“I told you so.”) That is largely a matter of narratives, and of making the narratives fit reality rather than living in fantasyland: Bitcoin’s nature is not to be a stock. Treating a fundamentally non-stock-like thing as “like a stock” must bring disastrous results, both for individual investors and for the whole Bitcoin market!

People obviously are not generally using Bitcoin as a hedge against inflation. Because they see dollars as “money”, and Bitcoin as a stock-like thing that you trade for money. Anyone who wants to brand me overly theoretical or idealistic: I am the realistic one! Your ideas have been demolished by reality.*

Now, I need to ask you: Do you believe in your heart of hearts that you hodl something desirable?

Gold had a two-decade extreme bear market. Anyone who bought gold at the wrong time had to wait an awful lot longer than four years to be not underwater. I also think that was a politically motivated economic attack, though I don’t want to get into off-topic discussion here that will derail into other matters. (I have mentioned this in some prior post, a few weeks ago... Something about gold-producing countries under international sanctions.)

Only fools declared gold dead. Smart people bought gold as low as ~$260, not so very long ago.

In gold’s extreme, extended bear market, after it started crashing, was it smart to sell at $800? $700? $600? Selling for $600 and later re-buying for $300, you could have doubled your gold holding.

...$500? $300? $260? Whoops! Selling for ~$260 (IIRC*) would have been mindrusting gold.

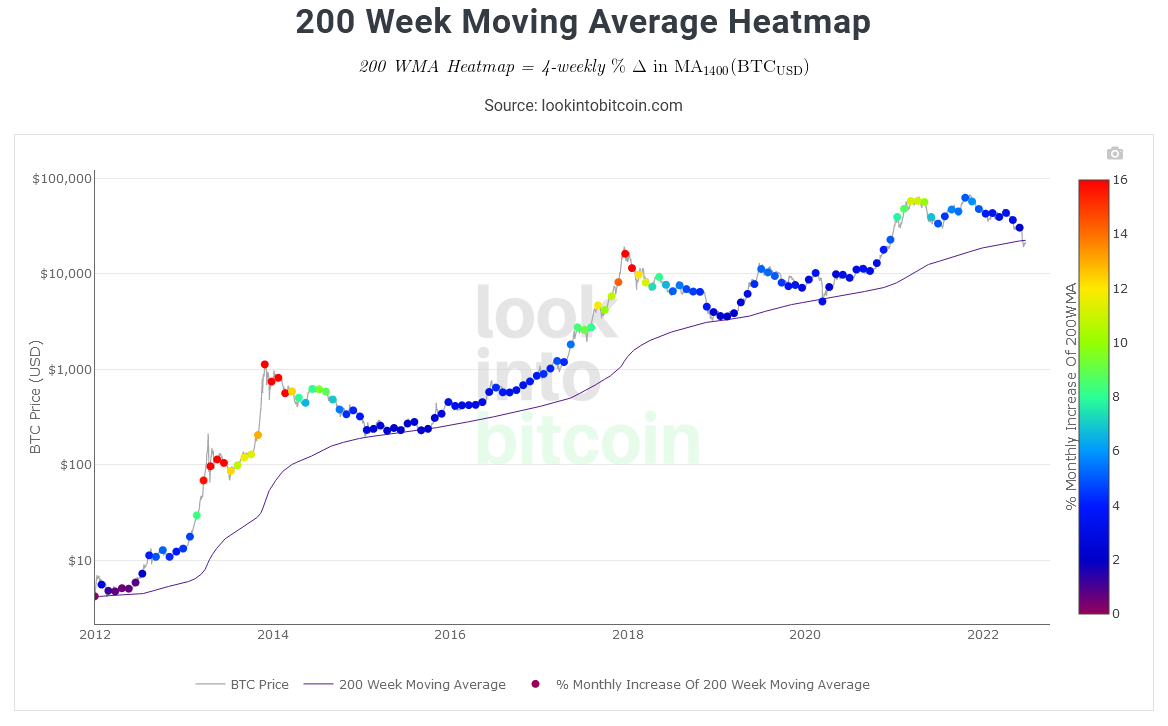

I do think we can declare TA dead. Declare 200 WMA dead as a reliable Bitcoin Bottom. [...]

That’s better for Bitcoin, in the long run. Let’s stop with the juju, and refocus on long-term value fundamentals.

Do we call this “digital gold”? Well, let’s treat it as “like gold”!

Thereupon, I do NOT urge to “HODL as an act of pure faith”. No way!

Some of my recent posts have mentioned refocusing on Bitcoin’s fundamental value. In lieu of an in-depth exploration, here are a few points of cold realism, not “pure faith”:

[...substantial summary of some long-term Bitcoin value fundamentals...]

Echo... echo... About a week ago, when Bitcoin was struggling around $18k–$19k, I showed my posts here to the shark who told me to deleverage at $35k. (Who also freaking told me not to rely on 200 WMA as a bottom—LOL.) He took a glance through WO, and told me to stop wasting my time hanging out with the weak hands here. “Why are people so scared? This is fine. The price is fine. The market is fine. Bitcoin is fine. Stop worrying.”

Don’t get too upset about short term price movements. 1BTC = 1BTC, if you have a time preference longer than 2 years you will be fine.

That’s the spirit! Bitcoin is fine. Only weak hands and leveraged longs will wind up in a world of hurt. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

June 29, 2022, 01:43:43 AM |

|

some peeps simply don't have time for a 20 year long bear market.

besides, 260/850 or more properly 260/650 (because gold was above $650 flat top only for about 7 days) is JUST 69.5 or 60% correction (with at least two bear rallies to ~77% of the flat peak, an equivalent of about 53K in btc). Super long bear with multiple 2X rallies is preferable to 80% down in just half a year (well, we only went -70% so far, to be more precise).

institutional involvement did not pan out as a value stabilizer; this, at least, is clear.

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 02:01:21 AM |

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

June 29, 2022, 02:10:46 AM |

|

"The stimmy checks created such a boon in spending!" "The economy is strong!" https://fred.stlouisfed.org/series/M2V(Focus the graph in between 2020 and now)  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10143

Self-Custody is a right. Say no to"Non-custodial"

|

Almost every little 'bobblehead' on youtube/twitter/tradingview keeps blabbering about 10K-14K bottom.

To me it says that it won't be THAT.

My preference (and it looks like the WO on average) is that the bottom was "already", but the whole cycle is messed up so much that it is difficult to be certain.

One thing is for sure: I believe in btc as a medium of exchange much more than the 'store of value' story at this point. It could change, though.

I did not really feel comfortable with presuming that the bottom is in either, but our current bottom of $17,593 on June 18 is still a pretty damned low low, and about 21% below the 200-week moving average at that time. The 200-week moving average continues to move up $20-ish per day, so yeah still bouncing below the 200-week moving average but recovered (for now) from the low)... The current BTC price placement is showing some level of calamity for our current predicament, but we cannot really tell if the whole severity of the predicament is already priced in or not... so many naked swimmers have already been exposed.. but I am still thinking that there might be some more naked swimmers that need to be exposed, and it's not the cute ones either.... I surely would prefer for the bottom to be in.. at least reck a few shorts before going down further - but if it is really difficult to know which is the easier path forward and whether enough reckless folks have received their proper and sufficient reckening. There are a lot of overly leveraged folks out there, and we should be able to imagine some potential easy pickings so long as the BTC price can be kept down for a wee bit longer.. I hate to say it.. I hate to say it... Regarding your comment about storage of value.. that is nearly pure nonsense and I heard that there were some peeps that just want to jump through their computers to batslappening you for that comment. In other words, zoom out ur lil selfie a wee bit. Almost every little 'shithead' on youtube/twitter/tradingview keeps blabbering about 10K-14K bottom.

To me it says that it won't be THAT.

My preference (and it looks like the WO on average) is that the bottom was "already", but the whole cycle is messed up so much that it is difficult to be certain.

One thing is for sure: I believe in btc as a medium of exchange much more than the 'store of value' story at this point. It could change, though.

The fact that there will only ever be 21 million makes this pretty much a forgone conclusion that over time BTC is and will be a store of value That's what I be talken about... even though you said it first.   [Edited out]

Roughly steps into the dedicated astro camera area would cost me between $2k and $10k, depending on quality. Not the amount i'm used to throw at my hobbies too often. Chump-change. A mere 0.1BTC to 0.5BTC... are we talking ant quantities of monies, here?    Almost every little 'shithead' on youtube/twitter/tradingview keeps blabbering about 10K-14K bottom.

To me it says that it won't be THAT.

My preference (and it looks like the WO on average) is that the bottom was "already", but the whole cycle is messed up so much that it is difficult to be certain.

One thing is for sure: I believe in btc as a medium of exchange much more than the 'store of value' story at this point. It could change, though.

The fact that there will only ever be 21 million makes this pretty much a forgone conclusion that over time BTC is and will be a store of value it could be, eventually, but it does not feel this way if you consider the period since late 2017. Get rid of your feelings. Such feelings are not correct. You will thank me later (or at least you should)No value stored vs inflation whatsoever, objectively. A negative 20% (vs inflation) vs gold's +25% vs inflation, and I dislike gold.

imho, the involvement of financial institutions 'messed' bitcoin up, albeit maybe only temporarily.

Yes.. it is ONLY temporary. Snap out of it. If financial types could pledge bitcoin en masse (and they did), then the 'store of value' and "clean collateral" stories could be affected.

Yes.. you can spin it.. if you are failing refusing to see what is actually happening.. which is the largest wealth transfer in history.. and at the same time passing through a few speed bumbenings along the way. TL;DR a new 'story' for bitcoin is needed (or it could be the "old" story of the medium of exchange). The 'store of value' story is in deep hibernation for now.

No new story is needed. If you want to believe some baloney spin or some dumbass view of the facts, then you are free to fail/refuse to sufficiently/adequately prepare for UPpity. Gresham's law is still going to continue to cause monetized values to flow into bitcoin, and you can choose not to participate or to underparticipate at your own peril. Yeah, of course, there are no guarantees, but it seems to be one of the strongest and most widely available asymmetric bets that ever existed staring at uie pooie in front of your face, and it is up to you whether to act upon such information in terms of being early to the club or just to deny what you are seeing (or fail to see it). Aside: What retard ignored the message on the “report to moderator” page, and reported a fair shot I took at Biodom’s nonsense? My post broke no forum rules, generally—let alone WO special rules. The image source was linked on Wikimedia, as seen in the archive. Not asking if a few of the staff here have exceedingly poor judgment. Asking which retard thinks it’s funny to report WO posts that don’t break any rules. I agree.. that post seemed to have had been a fair pokening for fun... and even arguably artsie fartsie in some kind of way. |

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 29, 2022, 02:31:48 AM |

|

some peeps simply don't have time for a 20 year long bear market.

To be clear: I am not expecting a 20-year bear market for Bitcoin! That was a reductio ad absurdum to show that when corrupt politics and irrational markets are involved, even gold can take a hell of a beating. Historical worst-case extremes. My point: It doesn’t mean that gold isn’t a sound store of value. Nothing is risk-free: Not Bitcoin, not gold, assuredly not dollars. Long-term buy-and-hold for anything is a trade-off. Spend the time value of money sitting on your capital, and embrace long-term systemic risks, to avoid short-term risks and market irrationality. I think that anyone who sold gold low was a fool—mindrusting gold! On a related note, I positively predict that in the long term, starting with almost nothing now, I will probably wind up with more BTC than most of the people who are worried now. besides, 260/850 or more properly 260/650 (because gold was above $650 flat top only for about 7 days) is JUST 69.5 or 60% correction (with at least two bear rallies to ~77% of the flat peak, an equivalent of about 53K in btc). Super long bear with multiple 2X rallies is preferable to 80% down in just half a year (well, we only went -70% so far, to be more precise).

Bitcoin has always been orders of magnitude more volatile than gold. When Bitcoin was up, this made some thoughtless Bitcoiners sneer at gold: Look, our gains are so high while gold almost sits still! Now, the shoe is on the other foot. Now that Bitcoin is down, gold’s % performance in extreme gold bear markets looks great. I don’t think that either line of thinking is justified: My proposition is that Bitcoin and gold are complementary assets—both good, both necessary, with some very different strengths. BTC probably has much more upside now, due to being such a young market! Big long-term growth potential. BTC also has the practical advantages of being less difficult to obtain anonymously—and of being oh so much easier to store in your own self-custody. Aside, I find it amusing that two classes of people usually like to sneer at gold: Some (not all) Bitcoiners, and Warren Buffet. Not only Buffet. When the gold market bottomed around 21 years ago, a stock-market professional of my then-acquaintance told me that gold was a bad investment. Hahahah. I didn’t believe him then, and I don’t believe the naysayers about Bitcoin now. institutional involvement did not pan out as a value stabilizer; this, at least, is clear.

With the possible exception of a few particular investors, institutional money was never Bitcoin’s friend. My theory, hereto stated somewhere (not searching now), is that to sustain the onslaught of highly-capitalized institutions who treat BTC merely as an instrument for extracting fiat profits, Bitcoin needs more adoption as money (both s.o.v. and medium of exchange). It is not a new opinion on my part—not at all. Some of the types who are greedy for fast moons get excited about institutional investment, without really thinking this through. I generally see institutional investment as a challenge that Bitcoin must survive and master, just as it has prevailed in the face of other challenges.

For the record, my current personal text: Take profit in BTC. Account PnL in BTC. BTC=money. The problem with institutional investors is that they account PnL in USD (or EUR, ...). Thus whenever they successfully gain profits instead of losing, they extract capital from BTC rather than giving BTC healthy long-term growth. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 03:01:26 AM |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 04:01:20 AM |

|

|

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2352

Merit: 4134

Addicted to HoDLing!

|

|

June 29, 2022, 04:34:00 AM Merited by JayJuanGee (1) |

|

Voted YES in the new poll about reaching the bottom. Also, I don't think the 200-Week MA is "dead". Not yet anyway. Just visit the link, or see the attached screenshot. It has been crossed, but only barely, which has happened a few times in the past. If the price picks up from here, it will just be another deep blue dot touching the 200-WMA on the chart. It all depends on where the price goes next. And even if a deep and long dip eventually "kills" it, it doesn't mean much, really. MA indicators do not contain some high-level intelligence that can tell us something very useful when breached. They are just averages of price data. JMHO.  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10143

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 29, 2022, 04:56:28 AM

Last edit: June 29, 2022, 05:07:51 AM by JayJuanGee |

|

My proposition is that Bitcoin and gold are complementary assets—both good, both necessary, with some very different strengths.

I'll start out by stating that my proposition is: Fuck gold. It's a shitcoin. Stop talking about shitcoins here. My alternate proposition is consider various assets in terms of "what you going to do about it?" What is your allocation to gold? Is your allocation to gold the same as bitcoin? or is the investment thesis for gold a fraction of bitcoin's investment thesis? Such as 10% or maybe more realistically 1% or 2%? Consider the whole matter regarding how much to invest into gold in context.. I am not completely opposed to investing in gold as a hedge, but if you really consider the matter, bitcoin serves the purposes of gold and like 1,000x better than gold, and therefore, Gold should have an allocation in your investment portfolio that is only a fraction of bitcoin's 1% to 10% the size of your bitcoin's allocation at most.. I personally chose 0% into gold, but I could understand some gold bugs or some gold nutjobs wanting to go a wee bit higher.. but still settle down gold bugs (and gold nutjobs), your investment into gold thesis has been replaced/supplanted by a better asset (aka king daddy), and if you want to stick with investing into your funzie lil tingilies - with the sparkles (aka gold), then no more than 1% to 10% the size of your BTC investment is permissible (by yours truly) to be invested in that crap. Here's approximately how my various allocations in various assets have changed through time (from since I got into bitcoin until present.. These are approximate.. and might even be partially (or totally) fictional.. you fucks). Late 2013 (just starting to get into bitcoin - BTFC prices $1,100 -ish - immediately pre-bitcoin)

BTC Stocks Bonds (fixed/govt) Property Business Gold (Pms) Cash Hybrid Income generating funds other0% 17% 6% 5% 5% 0% 6% 59% 2% Late 2014 (nearly met my bitcoin allocation target - which was intended to be 10% - bitcoin prices downwardly sloped all of 2014) 9.5% 13% 5% 4.5% 4.5% 0% 4.5% 57% 2% Late 2015 (over-allocated into bitcoin by about 3.5% more than intended BTC prices - in low territories mostly around $250 for most of 2015) 13.5% 12% 4% 4.25% 4.25% 0% 4% 56.5% 1.5% Late 2017 (my first bitcoin pump up to $20k-ish - bitcoin grew a lot and other allocations grew less)80% 2% 0.25% 0.25% 0.25% 0% 3% 14.2% .05% Late 2018 (my first major bitcoin crash down to $3,124-ish - bitcoin values crashed but not as far as my late 2015 allocation) 42% 6% 1.25% 1.25% 1.25% 0% 2% 45.75% .5% Late 2021 (my second bitcoin pump up to $69k-ish - bitcoin grew a lot and other allocations grew less)89% 1% 0.125% 0.125% 0.125% 0% 3% 6.62% .05% mid 2022 (my second major bitcoin crash down to $17,593-ish - bitcoin values crashed but not as far as my late 2018 crash, so far) 63% 2% 0.5% 0.5% 0.5% 0% 1% 22.35% .15% |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 05:03:27 AM |

|

|

|

|

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 29, 2022, 05:04:46 AM |

|

And even if a deep and long dip eventually "kills" it, it doesn't mean much, really. MA indicators do not contain some high-level intelligence that can tell us something very useful when breached. They are just averages of price data.

That is exactly my point! * Much more succinctly stated. When I declare that the 200 WMA is “dead”, I mean that it’s dead as a predictor of the Bitcoin Bottom. And that’s a good thing. I don’t think that’s bearish, but to the contrary: I repudiate the bearishness of everyone who is worried about being below 200 WMA, who is worried that we have had our worst-ever non-flash-crash break of 200 WMA, and who is worried that we broke 200 WMA and broke the previous cycle top. (The latter has never happened before—not even close!) I am well aware that Bitcoin has previously dipped below 200 WMA. I have discussed this in prior posts. The current break is much worse overall, and the deep dip cannot be excluded as a very brief outlier like the March 2020 panic-crash. My prior posts discussed this at some length. Previous breaks could be rationalized with some squinting and fuzz-factor. Not this. Excessive reliance on TA causes panic when these magical lines fail. Observe that some allegedly strong-hands HODLers went nuts here 11 days ago, gripped by fear and disbelief at $18k and below. They were not newbies, but LTH and WO veterans who have been through multiple previous bear cycles. Magical TA lines backfire. The single most reliable strong-hands HODLer whom I personally know has never ascribed any special predictive significance to 200 WMA. I now understand that that is not a coincidence! I see this as an opportunity to refocus on Bitcoin’s fundamental value. “Past performance does not guarantee future results.” Only long-term value fundamentals can guide rational expectations of long-term future results.

* I myself previously believed in 200 WMA, but only as a Schelling point: A self-fulfilling prophecy of a Bitcoin Bottom, from both the bid side and the ask side. In that sense, I did expect it to have some high-level intelligence—or maybe, high-level human unintelligence. My theory was empirically wrong. When my theories are empirically wrong, I adjust to reality rather than attempting to distort reality to fit my theory. |

|

|

|

|

ImThour

Copper Member

Legendary

Offline Offline

Activity: 1400

Merit: 1512

Bitcoin Bottom was at $15.4k

|

|

June 29, 2022, 05:32:39 AM |

|

BTC/USDT Liquidation ChartOn the right are the shorts, and on the left are the longs. Exchanges move prices to f*ck these retailers.  https://thekingfisher.io/ https://thekingfisher.io/

|

|

|

|

|

cygan

Legendary

Offline Offline

Activity: 3136

Merit: 7681

Cashback 15%

|

|

June 29, 2022, 05:33:57 AM

Last edit: May 15, 2023, 04:34:08 PM by cygan Merited by shahzadafzal (1) |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 29, 2022, 06:03:33 AM |

|

|

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 29, 2022, 07:00:57 AM |

|

* death_wish prepares to smack Buddy. |

|

|

|

|

|

Poll

Poll