Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3843

|

|

June 30, 2022, 08:42:42 PM |

|

What do people think contributed most to Golds 20 year bear market ?

Disinflation due to digitization, cheap China (at that time) labor force, computer "revolution" (straight deflation in the prices of computers and components). Same for TVs. check out computer prices: https://www.usatoday.com/story/tech/2018/06/22/cost-of-a-computer-the-year-you-were-born/36156373/I remember a colleague in the early 90ies buying pre-Jobs Mac for $3.5-4K. Not limited to macs, see the reference. Memory had CRAZY prices too. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Whoever mines the block which ends up containing your transaction will get its fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

June 30, 2022, 08:43:32 PM |

|

What do people think contributed most to Golds 20 year bear market ?

If not 10 years of over-speculation to the upside, It could have been re-installed faith in fiat currencies, despite the fact they were still effectively worthless, but doesn't look that way. The fact that the S&P made a new high in 1980 after an 8 year bear market can't be a coincidence though. Money better placed elsewhere? GOLD vs SPX back then:  You opine in total abject ignorance of all of the many political and economic happenings in the 1970s–80s, many of which affected the gold market in various directions. You reduce it to searching for magical lines on a chart, which you declare “can’t be a coincidence”. Yes, I'm saying that investors went for S&P that had recovered from an 8 year bear market, selling off Gold that was completely overbought and had made investors considerable profits by then. Is it a coincidence that investors bought something that had started a new uptrrend, as opposed to buying something that had started a downtrend? Do you seriously think investors make choices based on their emotions, or what's currently trending to the upside, based on risk vs reward? You think the price of Gold vs S&P is a magical line? It's called a price comparison. It's not magical, it's simply based on investors buying and selling two different assets. There is no magic involved I assure you. The equation is: [Gold] divided by [S&P] = "Magical line". Let me guess, you think all price charts are magical lines, so it's nothing more than a comparison of magical lines? Need to stop wasting my time with such degenerate clowns  Whaddya think about the London gold cartel and paper manipulation ?

Not much. Price went down didn't it? |

|

|

|

|

empowering

Legendary

Offline Offline

Activity: 1078

Merit: 1441

|

|

June 30, 2022, 08:43:43 PM

Last edit: June 30, 2022, 09:01:05 PM by empowering Merited by fillippone (3) |

|

When BTC was created ... no one in a regulatory position, knew what it was. Now, there is some consensus that it is not a security.... good stuff I agree.... well done clap clap... did they come to that conclusion after a few (lazy) hours of consideration... have a fucking medal. Now there is this conversation about "altcoins" or certain altcoins, and if they are "securities" HOT fucking take.... they are not the same as securities in my opinion..... and attempting to force these new tokens/technologies, into the same bracket as "securities" is a desperate attempt to maintain a status quo. A status quo, that is old, and outdated , as per status quos. Proposition: regulators, take their lazy thumbs out of their fat lazy asses and do some fucking work, and create a new framework that takes into account the new technology and what it is and stop trying to cram it into their neat little control box. SAME for BTC really, it does not fit into any of their neat little old antiquated control mechanisms boxes. Actually, I find it kinda pathetic how both regulators, and maxis, try and make it so. BURN IT ALL FUCKING DOWN.... get up to speed, the legacy system is antiquated trash, walled garden, control mechanisms, and I wish it all to die. Wake up, it is a brave new day. What is good for the goose is good for the gander. Watching people use the "ewwww only BTC is not a security and all altcoins are securities" reeks to me of old, power hungry stinky old bastards.  |

|

|

|

|

empowering

Legendary

Offline Offline

Activity: 1078

Merit: 1441

|

|

June 30, 2022, 08:49:02 PM |

|

I need a nap. Get cranky wen no nap.  |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3843

|

|

June 30, 2022, 08:53:42 PM

Last edit: June 30, 2022, 09:10:44 PM by Biodom |

|

The equation is: [Gold] divided by [S&P] = "Magical line".

I remember reading somewhere (Prechter? lol) that gold always comes back to be about 1:1 with the Dow. The last time it happened was in 1980. Gold and Dow both at 15K at some point? It's possible, I guess, but it would be a somewhat dysfunctional world, imho. Dow and bitcoin at the same price point? Very possible in the midterm. My expectation after a real bottom is a rally to 50week MA, currently around maybe 43K, but declining. From where? it is a big question and you provided excellent possibilities. Gold went to ~300, then back to ~500. Bitcoin "should" bounce harder. |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

|

June 30, 2022, 08:55:59 PM |

|

If bitcoin keeps falling soon it won't be enough to just hold BTC. Every holder will have to buy a miner and make it work at home. Because falling under $ 17 000 will force many miners to turn off their equipment. Those who mine with S17 and pay $0.1 per kilowatt lose $1.2 every day if 1 BTC costs $ 20 000.

Oh my God... I just had this terrible thought... This could lead to a sort of negative feedback loop! Ahh, what could we call it... an "abysmal spinning down". No too clunky. Umm, a "deceasement loop"... nah deceasement is not a word, is it? I don't know... someone could come up with a good name for it. How have we never thought of this before? ...death spiral ? When people started talking about a death spiral in 2018 the bottom was in. This is from December 3, 2018. It's by a University professor of finance "expert". https://www.ccn.com/worthless-bitcoin-has-entered-death-spiral-finance-professor/Silly professor Only if there was some kind of automatic procedure to change the hardness of the puzzle every two weeks or so depending on the supply/demand for mining  Lots of gamblers selling BTC, lots of people buying BTC meh world moves on. Fill up your bags and hunker down in about 638days all global miners will work for 10min for just BTC3.125 if my math is right about 50kg of gold is mined every 10min globally or about $3MM worth The grizzled investors mentioned in that article got it right by following your strategy and buying at $3k. with an eye on the bitcoin price and an eye on the calendar, grizzled investors can offer a brief reply: “We’ll see.” |

|

|

|

|

empowering

Legendary

Offline Offline

Activity: 1078

Merit: 1441

|

|

June 30, 2022, 08:57:14 PM |

|

Whaddya think about the London gold cartel and paper manipulation ?

Not much. Price went down didn't it? That was the idea methinks |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 30, 2022, 09:04:58 PM |

|

|

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 30, 2022, 09:05:18 PM |

|

I laugh at TA, and I declare that Bitcoin is good as gold. See my prior posts on gold’s worst bear market. Good, hopefully you will stop losing money by over-leveraging yourself long in a bear market like a clown then. Not going to look at your previous posts no, that's what the scrolling function is for. I think that you saw my prior posts just fine. I started drawing an analogy to the gold market 11–12 days before I see you just did, in numerous posts here. To the best of my knowledge, I originated that comparison in the context to this crash. I was certainly the first to raise it in WO. Credit where due. Don’t pretend you didn’t see it. Clearly you think most people read all your posts, clearly you are very wrong as per usual. I would have you on ignore if it weren't for JJG replying to you with massive block quotes which would make it ineffective. If I could ignore you and anyone who respond to you (in this case myself included, apologies WO folk), I would very happily do so. Congratulations to you if you were the first to raise the alarm though, seriously. An idea was recently, repeatedly published by me in a venue that you regularly read. It evoked some discussion from others—some of whom quoted various parts at length. This has been ongoing sporadically for about 12 days. It was not even one little post that could plausibly be missed by someone reading WO in this time period. In the past, you have expressed an irrational personal dislike for me. Now, you claim not to have seen what I wrote after you poorly aped its substance. That is not credible.Yes, I am calling you a liar. Not surprising: I first heard of you when you were shilling for the DeepOnion scam. Today, I see that your paid signature advertises Wasabi Wallet—the new version enhanced with spying and censorship. You are a known dishonest character. I didn’t start by risking 100%. I started with a reasonable risk, then walked myself down the garden path to a catastrophic risk. This has already been discussed—especially with Jay. I obviously made some terrific mistakes, but you do yourself no favours by misrepresenting me as a clueless degen who suddenly threw all of his money into a leveraged long. I don’t expect for you to read all the stuff about my personal finances— that, I understand may be uninteresting to many people. But if you wish to opine on the subject, it would behoove you first to review the prior discussion. If you opine without first informing yourself, that itself reflects poorly on you. If you don’t want to spend time reading all those posts, then do not offer an opinion. Oh dear, you're making the same mistake over and over again it seems, thinking that TA astrology guarantees future results.

FTFY. The metaphor is sound. I have pointed out before that professional astrologers make numerous accurate predictions, then rationalize failures. Blaming believers for believing is one means of such rationalization. By contrast to your tier of TA, which is just pitching the woo, quantitative finance is sound in theory. A large part of quantitative finance is the quantification of probabilities that predictions will fail. When you make a prediction with your crude lines on a chart, exactly what numerical % probability do you assign to that? A quant always has such a number, which is necessary to calculate hedges and stop-losses—and in many cases, to manage a portfolio with some monstrously complex equation derived from the Kelly Criterion. In a prior post, I drew the analogy that TA is to astrology as quantitative finance is to astronomy.Do I seem vehement? Excessive belief in TA could cause a Bitcoin death spiral. One by one, TA bottoms fail: The 200 WMA, the prior cycle top... The failure is what causes loss of confidence. Those who disbelieve TA are now the ones with the most confidence that Bitcoin is fine. I am vehement, because one thing that can hurt Bitcoin is more bad predictions, which can be true only if lucky. If unlucky, the result is another round of panic. That is bad for Bitcoin. Actually, I think I did a decent job at pointing out how the whole "death spiral" theory is relative nonsense. I'm sure there were many who thought Gold would drop to $100, $10, even $1 in the 80s, based on TA, once it's decade long bull market ended. Clearly, they were all wrong, because the fundamental inflationary aspect of Gold remained strong.. You don’t know the difference between inflation and deflation, yet you wish to opine on the market?  Seriously? Next you'll be telling me Bitcoin is deflationary when it clearly is inflationary (at present). DYOR  Don’t strawman me. In the above context, which I deliberately did not snip, “deflationary” is sensible—“inflationary” is not. You conflated the two words. If you are an illiterate fool who proudly claims to scroll by the cogent presentation of excellent insights (but later rips them off), that is not my loss.

Yawn. TL:DR seriously. Snipped to a Tweet-sized portion, so as to fit into your brain. |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

June 30, 2022, 09:12:29 PM |

|

The equation is: [Gold] divided by [S&P] = "Magical line".

I remember reading somewhere (Prechter? lol) that gold always come back to be about 1:1 with the Dow. The last time it happened was in 1980. Gold and Dow both at 15K at some point? It's possible, I guess, but it would be a somewhat dysfunctional world, imho. Dow and bitcoin at the same price point? Very possible in the midterm. I see what you're getting at Gold/Dow, but really that ratio above 0.5 looks like a fake-out not much else. I only really see lower lows and lower highs, though more upside than downside at present.  Dow & Bitcoin returning to 1:1? Looks possible, but I personally wouldn't look too much into it, as too short a time-frame for these type of value comparisons. My expectation after a real bottom is a rally to 50week MA, currently around maybe 43K, but declining.

From where? it is a big question and you provided excellent possibilities. Gold went to ~300, then back to ~500.

Bitcoin "should" bounce harder.

I'm personally not looking at the 50 Week MA when it comes to a dead cat bounce. In 2019 this was at $5.5K and price cut through it with ease. After initial support followed by anticipagted rejection, it has never acted as strong resisance for any bear market bounce. It's only really been useful for confirming a bear market, as opposed to maintaining it. You can do your own DYOR, but you'll see what I mean, all the way back to 2012. Bitcoin is simply just too volatile to be respectful of the 50 Week MA when it comes to a bear market dead cat bounce, or continuation of a bull market. Personally, based on 2019 bear market dead cat bounce, the 0.618 fib retracement @ $13.4K acted as perfect resistance level. Currently with a low of $17.5K this gives an equivalent target of $49K. Even if price drops to $12K, this still targets $47K, as the percentages don't vary so much. Most people will think these prices are unlikely in a bear market, just as many thought $14K was unrealistic back in 2019. |

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 30, 2022, 09:23:31 PM |

|

I mean.... ya should not be getting REKT, LEVERAGE or NO LEVERAGE , given effective analysis, bank roll management, AND risk management.....

Jus my two cents.

Ya will not be getting REKT, if ya keep your coins in your wallet where they belong, exclusively controlled by your own private keys. I wrecked myself by not following the advice that I had previously given others. I was right all along. I told me so.If I had followed my own advice, then I would now be smiling just like I was in previous crashes. It is not my first time around the block here—it is my first time losing money in a cryptocurrency bear market. That said: As I have told Jay, I do recognize that there exist trading scenarios where properly risk-managed leverage makes sense. I have given some examples of what I see as such a scenario. They are completely beyond the abilities of any newbie—which is why I have made such a big deal of the don’t use margin message. Indeed, it was an obvious part of my original motive for my first post here in May. What else would sufficiently justify embarrassing myself by exposing my losses?  Atop that, a place to grieve without further burdening my friends is just gravy. |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

June 30, 2022, 09:34:28 PM |

|

An idea was recently, repeatedly published by me in a venue that you regularly read. It evoked some discussion from others—some of whom quoted various parts at length. This has been ongoing sporadically for about 12 days. It was not even one little post that could plausibly be missed by someone reading WO in this time period. As I said, if could put you on ignore and those that respond to you (discussions with yourself) then I would have. This should really tell you something here; I'm really not that interested. Following WO is different from reading it. I very rarely read all of WO, especially long-winded discussions, usually I'm scrolling for graphics and charts and don't bother reading into various boring discussions, especially yours. In the past, you have expressed an irrational personal dislike for me. Care to reference this? I once enquired to others about putting you on ignore. This doesn't mean I dislike you, only that I'd prefer to ignore you. Not convinced I ever expressed dislike for you... Yes, I am calling you a liar Honestly, I really couldn't care less whether you beleive that I read all your nonsense or those that reply to you. Your ego clearly prevents you from understanding that not everyone is interested in what you have to say. If you were making references to Gold's bear market, as I said, good for you. I did so purely in the context of Yearly MAs, so unless this is what you did, I clearly didn't rip you off what-so-ever, even if i did read what you had to say (which I didn't). If you also think you're the first person to reference this, you're clearly very naive and more arrogant than I thought. It's been referenced for years already, by myself as well as many others. If you are an illiterate fool who proudly claims to scroll by the cogent presentation of excellent insights (but later rips them off), that is not my loss.

Snipped to a Tweet-sized portion, so as to fit into your brain. Thanks for simplifying that. I'm almost certain none of your insights are based on excellence, so there is no loss here. |

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4312

Merit: 3506

what is this "brake pedal" you speak of?

|

|

June 30, 2022, 09:57:18 PM |

|

jeez...sub $20k corn...what a blessing. I knew there had to be some positive news out there after a few days into hiking...I fell off a cliff and broke my leg. LOL. I am an idiot sometimes...

Anyways....been recovering this last month and a half....ankle is a bloody wreck..ripped most of the tendons and ligiments along with the fractures.....great.

sorry to hear that. keep healing man. at the rate us WOers are taking damage we will need to have homer make us some wheelchair avatars. |

|

|

|

|

empowering

Legendary

Offline Offline

Activity: 1078

Merit: 1441

|

|

June 30, 2022, 09:59:18 PM

Last edit: June 30, 2022, 10:18:41 PM by empowering Merited by JayJuanGee (1) |

|

I mean.... ya should not be getting REKT, LEVERAGE or NO LEVERAGE , given effective analysis, bank roll management, AND risk management.....

Jus my two cents.

Ya will not be getting REKT, if ya keep your coins in your wallet where they belong, exclusively controlled by your own private keys. I wrecked myself by not following the advice that I had previously given others. I was right all along. I told me so.If I had followed my own advice, then I would now be smiling just like I was in previous crashes. It is not my first time around the block here—it is my first time losing money in a cryptocurrency bear market. That said: As I have told Jay, I do recognize that there exist trading scenarios where properly risk-managed leverage makes sense. I have given some examples of what I see as such a scenario. They are completely beyond the abilities of any newbie—which is why I have made such a big deal of the don’t use margin message. Indeed, it was an obvious part of my original motive for my first post here in May. What else would sufficiently justify embarrassing myself by exposing my losses?  Atop that, a place to grieve without further burdening my friends is just gravy. Trading , leverage or no, is like a tool. There are of course considerations, and safety considerations, and risk assessments and at the end of the day , risks no matter how you dice it.... no arguments there, and I am not one of those who claims to have a perfect record... far from it. Education usually costs money. For sure, on top of everything else, counterparty risk, is a bitch... not just exchanges going bust and taking down your stash... been there, done that, MtGox, Bitfinex, twice, Cryptsy, and a few others.... yup I know that road all too well. Buuuuuuuut also, exchanges that, have shoddy engines, have unreliable trade executions, disappearing orders, limit orders that trigger too early , too late, cascading liquidations that fail to trigger your orders and skip right through to the next price points etc etc.. I have seen it all. I had, pre BTC days got absolutely, criminally totally fucked in the ass by eToro... not even funny, for the tune of 27K. I would say this goes hand in hand with risk management and bank roll management though.... you cannot forget about counterparty risk. The safest bet is self custody for sure... However.... I reiterate my position that not all trading is bad, that all TA/QA is not useless, leverage is just a tool (a dangerous tool that will cut your arm off without proper risk management) Tis what it is. Tis not for everyone. Tis not even for the SAME person, a good thing at different times (for example, you are stressed/not in the right mind, under financial stress, not well, not rested, have not thought out what you are doing, have not done extensive training, market conditions are not right... you are drunk etc etc) Tis also, not a great thing at certain points of the market ... longing near potential macro tops, shorting near potential macro bottoms, ie market extremes... or either can be dangerous in sideways volatile chop (options could be yo friend thou) Another often unspoken about factor, is your trade sizing and positioning in relation to your margin ... and your available collateral. Done right, you can, withstanding FUNDING, effectively reduce your liquidation point to basically close to zero... sure that comes with some minimal risks too... what doesn't.... that is what you get paid for at the end of the day, assuming risk. Going long, at macro bottoms, once a retest of support has occurred, and upon confirmation of higher lows and highs, AND WHEN ALL MID TERM AND LONG TERM MOVING AVERAGES ARE POINTED UP... IS a far better idea than when that is not the case, ESPECIALLY WITH LEVERAGE. Combine that with risk management, and sensible trade sizing... and well, one is in a better position than if one did not take all those things into consideration. Trend is your friend.... until the end.... my only friend. Alzo.... TREND + MOMENTUM + VOLATILITY taken together... is a useful way of viewing the market. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 30, 2022, 10:03:28 PM |

|

|

|

|

|

|

|

|

empowering

Legendary

Offline Offline

Activity: 1078

Merit: 1441

|

|

June 30, 2022, 10:14:31 PM |

|

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15376

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 30, 2022, 10:17:59 PM

Last edit: May 15, 2023, 12:12:14 PM by fillippone Merited by BobLawblaw (2), Toxic2040 (1) |

|

I hope bitcoin crashes to $0 and it dies a fiery death. I will consume all of the popcorn that is available in a 100-mile radius from where I live. It will be a glorious event.

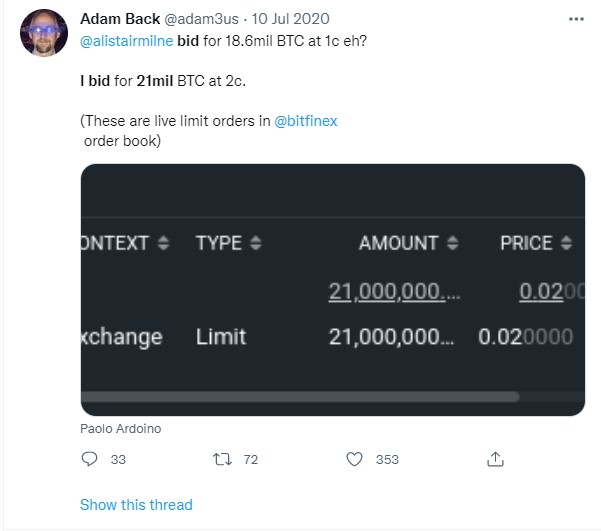

I hope it crashes to $0.01 tomorrow, so I can buy everything the market throws at me. I think Adam Back has an order: 0.02 for 21 millions.  He locked 420K on an exchange so that Bitcoin cannot go to zero. Entities REKT during this bear market;  MOAR Doors coming |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3843

|

|

June 30, 2022, 10:25:21 PM |

|

it feels weird...re the demise of the lending infrastructure.

remember the scary sci-fi movie with Nicholas Cage ("Knowing").

EE...he could not get what it means...finally, he gets it: everyone else

|

|

|

|

|

death_wish

Member

Offline Offline

Activity: 70

Merit: 320

Take profit in BTC. Account PnL in BTC. BTC=money.

|

|

June 30, 2022, 10:30:07 PM |

|

I very rarely read all of WO,

I myself rarely read WO at all. But in the periods when I read any of it, I don’t think that I could plausibly miss a discussion that has on-and-off spanned about 12 days—including a mini-flamewar between Jay and myself. (Jay does not want to see gold mentioned favourably here, even as the basis for a pro-Bitcoin argument.) It seems unlikely: Possible, but improbable. I balance that observation against your prior known credibility. In the past, you have expressed an irrational personal dislike for me. Care to reference this? I once enquired to others about putting you on ignore. This doesn't mean I dislike you, only that I'd prefer to ignore you. Not convinced I ever expressed dislike for you... Simply to answer your question: That is the post to which I referred. In a thread where it is customary to wave around the Almighty Ignore List as a ridiculous threat or insult, it is disingenuous for you to claim that a sarcastic “asking for a friend” post, with no conceivable purpose but to announce to others that you may ignore me, does not show “dislike”. Is it worth putting death_wish on ignore? Asking for a friend...

That, in a gratuitous post all by itself, sufficiently speaks to the question. For some reason, you deeply cared about announcing to others that you may ignore me. I found it amusing.

If you were making references to Gold's bear market, as I said, good for you. I did so purely in the context of Yearly MAs, so unless this is what you did, I clearly didn't rip you off what-so-ever, even if i did read what you had to say (which I didn't).

My essential message is that Bitcoin is fine. I am dismayed and frankly disappointed at some of the alleged strong-hands here, who suddenly started crying in disbelief after we broke the 200 WMA and the previous cycle top. Accordingly, I make war on those magical lines which cause panic when they break—and I point to gold for an extreme example of an irrational bear market for a sound-money asset. At the time, only fools would have said that “gold is dead”. Do we call Bitcoin “digital gold”? Did it matter if gold broke whatever TA lines people may have drawn to attempt predicting the bottom? Viz., whatever lines they drew at the time, to forecast the future. Not whatever you may draw now, with the benefit of 20/20 hindsight. I would link to it, but it was not one post. My essential thesis on this was spread out across a bunch of posts, including replies to others. Yearly MAs are a red herring. That is your angle on a subject that I have been discussing. I'm almost certain none of your insights are based on excellence, so there is no loss here.

Given that you lack the ability to evaluate your own competence, you surely all the worse lack the psychic powers to judge excellence in writings that you have not even read—which you may be unable to read with full comprehension. |

|

|

|

|

|

Poll

Poll