MalReynolds

Legendary

Offline Offline

Activity: 938

Merit: 1000

|

|

June 13, 2017, 07:39:15 PM |

|

So in summary:

• 20% of your investment went into capitalising the asset you now hold

• 80% of your investment went into capitalising a private company in which you didn't get any shares

Like I say, that's just my understanding of the current equity balance of the ICO. I'm happy to be corrected if wrong.

I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. |

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

Shahrul09

|

|

June 13, 2017, 07:39:30 PM |

|

Goodluck

|

|

|

|

|

Angel Di

Sr. Member

Offline Offline

Activity: 588

Merit: 251

EVOS

|

|

June 13, 2017, 07:44:34 PM |

|

I very much hope that the project will develop well and the team will succeed to implement the plans. I bought myself a little coin, very happy about it. Please tell me when my coin will be available in your purse so that I could move them on a stock exchange or another purse?

|

|

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

June 13, 2017, 07:51:15 PM

Last edit: June 13, 2017, 08:04:20 PM by toknormal |

|

Just as I thought. What you initially stated is patently false: "Well, 20% of your funds bought into it. The other 80% goes to capitalising the balance sheet of Bitcoin Suisse AG of which you receive no share, at least as far as I understand. Happy to be corrected on that if wrong." It isn't false. Money doesn't just disappear into thin air. It's "owned" at all times. If you currently own 20% of the book value of your investment (notwithstanding the correction made below), then somebody else "owns" the other 80%. It is therefore currently sitting on the balance sheet of a private corporate entity which I presume to be the ICO issuer. I'm also assuming it's manifesting as an asset, not a liability, otherwise you'd be waving share certificates at me in your response instead of empty rebuttals. I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. Could well be that I have the aggregate ratios wrong. Thanks for the clarification ! |

|

|

|

|

|

paulmaritz

|

|

June 13, 2017, 07:55:01 PM |

|

Just as I thought. What you initially stated is patently false: "Well, 20% of your funds bought into it. The other 80% goes to capitalising the balance sheet of Bitcoin Suisse AG of which you receive no share, at least as far as I understand. Happy to be corrected on that if wrong." It isn't false. Money doesn't just disappear into thin air. It's "owned" at all times. If you currently own 20% of the book value of your investment, then somebody else "owns" the other 80%. It is therefore currently sitting on the balance sheet of a private corporate entity which I presume to be the ICO issuer. I'm also assuming it's manifesting as an asset, not a liability, otherwise you'd be waving share certificates at me in your response instead of empty rebuttals. I am not going to repeat myself. Folks can read and make up their own minds. |

|

|

|

|

Zechis966

Sr. Member

Offline Offline

Activity: 350

Merit: 250

http://cointedtoken.com/

|

|

June 13, 2017, 08:06:46 PM |

|

Just as I thought. What you initially stated is patently false: "Well, 20% of your funds bought into it. The other 80% goes to capitalising the balance sheet of Bitcoin Suisse AG of which you receive no share, at least as far as I understand. Happy to be corrected on that if wrong." It isn't false. Money doesn't just disappear into thin air. It's "owned" at all times. If you currently own 20% of the book value of your investment (notwithstanding the correction made below), then somebody else "owns" the other 80%. It is therefore currently sitting on the balance sheet of a private corporate entity which I presume to be the ICO issuer. I'm also assuming it's manifesting as an asset, not a liability, otherwise you'd be waving share certificates at me in your response instead of empty rebuttals. I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. Could well be that I have the aggregate ratios wrong. Thanks for the clarification ! Cryptos aren't money though legally at least most places they're classified as commodities and SOME commodities DO disappear into thin air...just ask Oil |

|

|

|

toknormal

Legendary

Offline Offline

Activity: 3066

Merit: 1188

|

|

June 13, 2017, 08:20:55 PM |

|

Cryptos aren't money though legally at least most places they're classified as commodities and SOME commodities DO disappear into thin air...just ask Oil I think in the case of an ICO, it's the investor's view that's significant. In that regard I assume each person who buys into an ICO considers their purchase as having been made with "money". Similarly, the ICO issuer wouldn't be requiring payment in something that wasn't "money" to them. My point is, that when it's a corporate entity receiving the funds there's a potentially conflict of interest that is quite different from classic investment models. In the latter you're not "giving anything away". You pay, say $10,000 and you receive $10,000 worth of equity based on some agree valuation basis. 100% of the book value of your investment is accounted for. However in the case of these ICO it's all fly by your pants stuff. You pay 100% book value funds and get something back that isn't 100%, 30%, maybe 70%. The balance of your investment - as I've stated earlier - goes towards jacking up the equity value of the ICO issuer. Ok you could say that the investors valued the total asset at a premium over book value (happens all the time) but even then you're not getting it all going into your equity slice. The ICO issuers are not just executors of your money, they are now owners of it as well with not even a contract over what they are required to do with it. In fact the valuation wasn't even known until the ICO closed, it's a case of "we'll take as much cash as you can throw at us". I'm not saying it won't necessarily work out for everyone in the end, but you're now at the mercy of markets to recover the loss on the book value of the investment. I doubt people are going to be able to get away with this for very long with the amounts that are being thrown around in these ICOs now. |

|

|

|

|

|

jhenfelipe

|

|

June 13, 2017, 09:00:49 PM |

|

Social Media Bounty is now Closed. And it seems that those who submitted their weekly report later than June 12 will not get paid. As the Campaign Manager replied to the comments, the report needs to be submitted not sooner than a week started on the day the participant signed up (see screenshot of my application below)  As the image shown above, I applied 8 days ago (June 5 forum time), so my first report should not be submitted sooner than June 12. Since on June 12, their site wasn't accessible (app.bancor.network/), participants like me who supposedly submitting the reports haven't had the chance to submit (screenshot of another user with the same problem below):  I've seen one of the reply from the manager (stated about post later than June 12 - meaning will not get paid):  I don't think it should be like this. The manager was accepting participants until 3 days ago today (so it was June 10 forum time), and mentioned about weekly report (see screenshot below):  If he knew that it will end on June 12, why still accept? and why not post a new discussion on the bounty site to inform the participants? Tweets and other actions should be checked (the date) and pay those who qualified. Some just posted it late because of the Weekly report rule & inaccessible site during the time of submitting a report, but did finish the task ahead of time. Want to clarify it on the bounty site but it didn't allow me to sign in using telegram account (which I used before to sign up there), that's why I posted here. Thank you! PS. All screenshots was taken today No. Manager wont know when the campaign gonna stop. The rules posted, since day one stated that the campaign will end at 30th june or when ico end, which ever that come first. So no, he didnt know if it will end one 12th june or not. But its fair what he did. Closed it at ico according the rule And its already mention by manager when you all signup in beginning that you will be paid weekly, not daily.Like the last picture there you post. Its clearly say there. 'reports are submitted weekly. sicne everyon signed up on different dates, unfortunately some people will not be elidgable to submit their next report if the fundraiser has ended before their next weeks report is due' P/s : and i saw that you already got your reward after argue with manager

Post all the rules that he mention also in your comment.For your PS. No, I wasn't paid and I didn't argue with the manager. I wasn't able to log in so I don't have a power to reply to the manager. I think you're referring to user @bobo012 on the screenshot. It was clearly not me, as you can see in the first screenshot, bitcoingeek is my username.

@jhenfelipe lol, you are banned from their telegram ?? is it true ?

I don't think I'm banned since it's not only me who can't sign in. https://bitcointalk.org/index.php?topic=1789222.msg19538625#msg19538625https://bitcointalk.org/index.php?topic=1789222.msg19538672#msg19538672and @Shahrul09 gave an answer: https://bitcointalk.org/index.php?topic=1789222.msg19538730#msg19538730 |

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

June 13, 2017, 09:13:42 PM |

|

So in summary:

• 20% of your investment went into capitalising the asset you now hold

• 80% of your investment went into capitalising a private company in which you didn't get any shares

Like I say, that's just my understanding of the current equity balance of the ICO. I'm happy to be corrected if wrong.

I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. Bancor blog clearly states that 20% of raised ETH goes into reserve, which is ~80K. They crowd sold only 50% of BNT (~40M), the other 40M they gave to themselves. In the end, 80M of BNT is backed by 80K of ETH. At a price of 100 BNT per 1 ETH this means 10% reserve ratio. People, at lest learn times table before you invest into something. |

.

|

|

|

|

tehMoonwalker

|

|

June 13, 2017, 09:15:26 PM |

|

I will just start boldly. The Bancor business model is pretty close to a scam. I am sure you will not take my word for it, because this is my first post. In fact, I made this account because I find it bizarre that no one is talking about this. Let's be honest, which one of you truly tried to comprehend their mathematical proof? Not a single person who invested at least, because otherwise they would not have wasted their money. I will try to explain a little. They collected pretty close to 400k ether. Essentially what they do, is keep .8*400k ETH = 320k ETH to themselves, and call the remaining 80k reserves. They will express this 80k in a different coin, called BNT. They assign 100 BNT to 1ETH that they received. That means there is 500BNT for every 1ETH in the reserves. Essentially, if everyone would want to convert their BNT back to ETH, they would get 1/500 ETH per BNT. Wait you say, in the white paper it says that the starting price of 100BNT will equal 1 ETH! This is true, this is where the mathematics uses a trick to hide what is going on. Their pricing formula, P=R/(S*F) ensures that the first BNT sold will be sold at a 'fair' value, namely equal to the amount of ETH you spent to buy it in the first place. After the first sell, things get worse rather quickly. Let's illustrate this by a little example: Lets say that 10% of people who own BNT sell it back to ETH via the smart contract. For the initial price we get: P = 80k/(40m*.2) = 0.01. All looks fair. Then after the sell we get 40m*10%*0.01 = 40k, P = 80k-40k/((40m-4m)*0.20) = 0,00556. Ouch, the price almost dropped to half value from the 10% sell-off (this is different if there are many small transactions but I will get to that later). If people buy the same amount of BNT, this is what happens: P = 120k/(44m*0.20) = 0.01364. The increase in price is not nearly as interesting for the next person. But again, this will be lower for many small transactions. I created a plot assuming transactions are made in small batches of BNT coins. We find that the BNT value drop VERY quickly when people start selling, and does not rise nearly as fast. Essentially this just makes BNT an undesirable coin. Another weird thing about their system is that it does not consider convexity. This means that big transactions will get very different prices than many small ones. This just does not make sense, but they don't care as they simply took your money. http://imgur.com/a/f9yLyIf you are still not convinced, consider this. They literally admit to taking 80% of your money. All they give back is some mathematical trick based on 20% of the ether that you gave them. Do you really believe they just generated x5 value out of thin air? Sorry, but math does not work that way. I would recommend getting rid of your BNT asap, or you end up all the way on the left side of the graph. I am sorry that this news comes a bit late for some of you... I didn't read their methodology until last night Sad Maybe now you can start to add up why the ICO was strange in various ways. As final words, don't just believe whatever I say. Think about it for yourself. I gain nothing by convincing you of whatever I write here, I am simply sharing thoughts. We bought into BNT not ETH. If we wanted to buy into ETH, we would have simply kept our money in ETH. It is no secret that 80% of the ETH will go towards the BNT project’s development and 20% will be kept as a reserve to ensure a minimum value per BNT. This doesn’t automatically make BNT worthless or the business model a scam, because we’re buying into Bancor’s potential (good or bad). "Essentially, if everyone would want to convert their BNT back to ETH" - Why would we all want to convert our BNT back into ETH, especially at this stage? i dont need complicated formulas, i payed 1 eth that is around 350 euro for 100 bnt, so i need 1 bnt to have a worth of 3.50 to breakeven, everything above is my profit, this coin will go to 10$ faster than you can say money so im all good plus its a revulotionary project that i SUPPORT plus i make profit. some people think theyre so smart but they dont see the obvious |

|

|

|

|

|

memberx

|

|

June 13, 2017, 09:35:44 PM |

|

By the way, what is the official exchange code for this Atlc.? BNT is shown as Babtan already, or will it be reused? And when will it be listed first?

Thx

|

|

|

|

|

Mrrr

|

|

June 13, 2017, 09:49:33 PM |

|

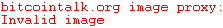

|

burp...

|

|

|

MalReynolds

Legendary

Offline Offline

Activity: 938

Merit: 1000

|

|

June 13, 2017, 10:41:43 PM

Last edit: June 13, 2017, 10:57:23 PM by MalReynolds |

|

So in summary:

• 20% of your investment went into capitalising the asset you now hold

• 80% of your investment went into capitalising a private company in which you didn't get any shares

Like I say, that's just my understanding of the current equity balance of the ICO. I'm happy to be corrected if wrong.

I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. Bancor blog clearly states that 20% of raised ETH goes into reserve, which is ~80K. They crowd sold only 50% of BNT (~40M), the other 40M they gave to themselves. In the end, 80M of BNT is backed by 80K of ETH. At a price of 100 BNT per 1 ETH this means 10% reserve ratio. People, at lest learn times table before you invest into something. OK, let me zero in a little more considering your logic. They intended to take in 250K ETH, they ended up with 397K ETH. As you say, 20% of all ETH goes into reserve so we've got three pots now. In rounded numbers, (a) 0.2 * 397 = 79K ETH for the reserve; (b) 0.8 * 250 = 200K that actually "paid for" 39M BNT distributed to the public; and (c) 0.8 * (397-250) = 118K ETH that goes into an unexpected "post ex facto" fund to buy back public tokens at ICO price and give them to Bancor Network. So the proportion of your donation that actually bought BNT tokens for your own wallet was 200 / 397 = 50.4%. The other 49.6% of your donation went to buy tokens for the Bancor Network - some now in the reserve pool, the rest over the next 2 years during buyback. Final approximate ICO cost for a single purchased BNT token assuming $400 per ETH is thus 200,000 *400 / 39,000,000 = $2.05 per BNT. Bancor's loss of control on how and when to stop the ICO resulted in the percent of your donation actually purchasing tokens FOR YOU slip from the promised 80% to an actual 50.4%. Not a very well run ICO. |

|

|

|

|

chesthing

Legendary

Offline Offline

Activity: 1414

Merit: 1000

|

|

June 13, 2017, 10:59:06 PM |

|

Blah blah blah from people who didn't have the nuts to buy into the ico.

|

|

|

|

|

|

beyinsi

|

|

June 13, 2017, 11:28:27 PM |

|

....Not a very well run ICO....

Okey MalReynolds, now go back your iconomi topic and discuss cofound.it crowdsale. Thanks. |

|

|

|

|

burner2015

Full Member

Offline Offline

Activity: 238

Merit: 100

Co founder & CMO SocialX

|

|

June 13, 2017, 11:41:02 PM |

|

Many people couldn't invest. I don't see this going down  |

|

|

|

MalReynolds

Legendary

Offline Offline

Activity: 938

Merit: 1000

|

|

June 13, 2017, 11:48:24 PM |

|

Many people couldn't invest. I don't see this going down  I don't see it going down, either. I am analyzing this from the standpoint of investing after it hits the exchanges since I didn't have my capital lined up to donate in The Golden Hour. Could be a very good buy with a lot of future upside potential. |

|

|

|

|

|

Mrrr

|

|

June 13, 2017, 11:54:28 PM |

|

So in summary:

• 20% of your investment went into capitalising the asset you now hold

• 80% of your investment went into capitalising a private company in which you didn't get any shares

Like I say, that's just my understanding of the current equity balance of the ICO. I'm happy to be corrected if wrong.

I think the 20/80 rules only apply to the last 147K ETH that poured into the ICO that was above their intended 250K ETH cap. So I think the correct way to look at it is that (250+0.2*147)/397 = 70% of your donation went into capitalizing an asset you now hold. The remaining 30% went to an unplanned, "ex post facto" fund whose assets you now have no claim over. For the next 2 years this new fund will purchase tokens (at a price that gives zero profit to the public sellers) and give those tokens back to the Bancor Network that issued them. Bancor blog clearly states that 20% of raised ETH goes into reserve, which is ~80K. They crowd sold only 50% of BNT (~40M), the other 40M they gave to themselves. In the end, 80M of BNT is backed by 80K of ETH. At a price of 100 BNT per 1 ETH this means 10% reserve ratio. People, at lest learn times table before you invest into something. OK, let me zero in a little more considering your logic. They intended to take in 250K ETH, they ended up with 397K ETH. As you say, 20% of all ETH goes into reserve so we've got three pots now. In rounded numbers, (a) 0.2 * 397 = 79K ETH for the reserve; (b) 0.8 * 250 = 200K that actually "paid for" 39M BNT distributed to the public; and (c) 0.8 * (397-250) = 118K ETH that goes into an unexpected "post ex facto" fund to buy back public tokens at ICO price and give them to Bancor Network. So the proportion of your donation that actually bought BNT tokens for your own wallet was 200 / 397 = 50.4%. The other 49.6% of your donation went to buy tokens for the Bancor Network - some now in the reserve pool, the rest over the next 2 years during buyback. Final approximate ICO cost for a single purchased BNT token assuming $400 per ETH is thus 200,000 *400 / 39,000,000 = $2.05 per BNT. Bancor's loss of control on how and when to stop the ICO resulted in the percent of your donation actually purchasing tokens FOR YOU slip from the promised 80% to an actual 50.4%. Not a very well run ICO. Somebody give this guy a medal.... |

burp...

|

|

|

|

beyinsi

|

|

June 14, 2017, 12:48:59 AM |

|

Many people couldn't invest. I don't see this going down   |

|

|

|

|

Zechis966

Sr. Member

Offline Offline

Activity: 350

Merit: 250

http://cointedtoken.com/

|

|

June 14, 2017, 01:01:32 AM |

|

Somebody give this guy a medal....

lol I love Mal he/she is legit as hell...no one can necessarily be right or wrong in something like this market...but Mal is pretty close as one can get to being right. I definitely always think a bit about what Mal posts and the fact they're a ZH reader just sealed the deal for me even further! |

|

|

|

|