|

KS

|

|

May 05, 2013, 10:09:09 PM |

|

meh... if you look at capital expenditure (CAPEX) and operating expenditure (OPEX), ASICs are way better than GPUs.

For the same 2500USD spent, you'd now get a PC with 4x 7970 GPUs, giving you about 2.8GH/s for a total of 0.11 BTC/day (according to the table above, as of May 11th) and using up about 1400-1500W of energy.

Compare that to a 2500USD 50GH/s machine in August that will give you 0.40 BTC/day at 100W.

Even at 10.000USD per 50GH/s, serious miners won't loose money with respect to the current situation (if the table is correct)...

Sooo, my humble guess is... not much will happen.

|

|

|

|

|

|

|

|

The grue lurks in the darkest places of the earth. Its favorite diet is adventurers, but its insatiable appetite is tempered by its fear of light. No grue has ever been seen by the light of day, and few have survived its fearsome jaws to tell the tale.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

organofcorti (OP)

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

May 05, 2013, 11:06:34 PM |

|

meh... if you look at capital expenditure (CAPEX) and operating expenditure (OPEX), ASICs are way better than GPUs.

For the same 2500USD spent, you'd now get a PC with 4x 7970 GPUs, giving you about 2.8GH/s for a total of 0.11 BTC/day (according to the table above, as of May 11th) and using up about 1400-1500W of energy.

Compare that to a 2500USD 50GH/s machine in August that will give you 0.40 BTC/day at 100W.

Even at 10.000USD per 50GH/s, serious miners won't loose money with respect to the current situation (if the table is correct)...

Sooo, my humble guess is... not much will happen.

I'm not following you. What post are you referring to? |

|

|

|

|

KS

|

|

May 06, 2013, 09:08:11 AM |

|

@organofcorti: I was referring to "your" numbers table.

Long story short: I think ASIC mining will be where GPU mining now is, profit-wise, after the "ASIC-wall" hits.

The GH/s power required will simply have multiplied by a factor more or less equivalent to the price reduction in equipment of similar GH/s power. So, you will still invest the same amount for the same or slightly lower BTC return but you will also have cut your electricity costs.

The money-making window is NOW for those lucky few with a shiny new ASIC and it will close when the masses can finally get their hands on them too. Your bet is as good as mine as to when that will happen (given BFL should have shipped in 2012 already...).

Hope this clarifies the previous post a bit.

|

|

|

|

|

organofcorti (OP)

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

May 06, 2013, 09:14:38 AM |

|

@organofcorti: I was referring to "your" numbers table.

Long story short: I think ASIC mining will be where GPU mining now is, profit-wise, after the "ASIC-wall" hits.

The GH/s power required will simply have multiplied by a factor more or less equivalent to the price reduction in equipment of similar GH/s power. So, you will still invest the same amount for the same or slightly lower BTC return but you will also have cut your electricity costs.

The money-making window is NOW for those lucky few with a shiny new ASIC and it will close when the masses can finally get their hands on them too. Your bet is as good as mine as to when that will happen (given BFL should have shipped in 2012 already...).

Hope this clarifies the previous post a bit.

Ignoring electricity costs (which hopefully wont be an issue for a while unless we hit the petahash mark soon), is this what you mean:  |

|

|

|

|

KS

|

|

May 06, 2013, 10:26:28 AM |

|

I would look at BTC/GH/s per $ invested. As your projections show, BTC/GH/s is falling rapidly (nice blog BTW) but when you factor in CAPEX, the numbers look more mundane. Now, to know whether you'll be making money in $ terms is another issue (as always, it depends on the market). My guesstimate is that the BTC should hover in the 50-70 USD range when all the crazyness has dissipated but things are very much in flux right now so I wouldn't bet on it  At 50 USD/BTC, you're looking at a profit of circa 20 USD/day in August for 50GH/s (0.008 BTC/GH/s per day), not factoring power consumption. If you paid 50K for your ASIC (and got it in August), you just lost a ton of money. If you paid 2.5K, you'll get the same ROI as ppl used to get on GPUs when spending the same 2.5K on a PC. I would plug in some CAPEX numbers in the tables/graphs to have a guesstimate as to how much one can invest and when, if one wants to make money (but it looks like you're doing it much better already :p). |

|

|

|

|

organofcorti (OP)

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

May 06, 2013, 10:38:25 AM |

|

I would look at BTC/GH/s per $ invested. As your projections show, BTC/GH/s is falling rapidly (nice blog BTW) but when you factor in CAPEX, the numbers look more mundane. Now, to know whether you'll be making money in $ terms is another issue (as always, it depends on the market). My guesstimate is that the BTC should hover in the 50-70 USD range when all the crazyness has dissipated but things are very much in flux right now so I wouldn't bet on it  At 50 USD/BTC, you're looking at a profit of circa 20 USD/day in August for 50GH/s (0.008 BTC/GH/s per day), not factoring power consumption. If you paid 50K for your ASIC (and got it in August), you just lost a ton of money. If you paid 2.5K, you'll get the same ROI as ppl used to get on GPUs when spending the same 2.5K on a PC. I would plug in some CAPEX numbers in the tables/graphs to have a guesstimate as to how much one can invest and when, if one wants to make money (but it looks like you're doing it much better already :p). I've included exchange rate in previous posts in the series, and produced tile plots of exchange rate / ROI with days to ROI as the tile colour. It's interesting, but at the moment everyone seems to want their estimates based in BTC, and no one seemed to know how to interpret the charts. I agree it's an important factor, but back in January I'd only included exchange rates up to $40 and even then people though I was being optimistic. Point is, BTC market is too volatile to use an estimate - you have to produce a large number of estimates for a very wide range. If readers want that back, I'll bring it back next time. |

|

|

|

|

KS

|

|

May 06, 2013, 11:12:40 AM |

|

Right, a projection on how fast they need to retire their GPUs. I don't know how anyone could do that right now, given we have no clue how many ASICs are being put online and how many more are to come and when. I should go and see a psychic, then I will let you know  |

|

|

|

|

|

GodHatesFigs

|

|

May 07, 2013, 12:35:10 AM |

|

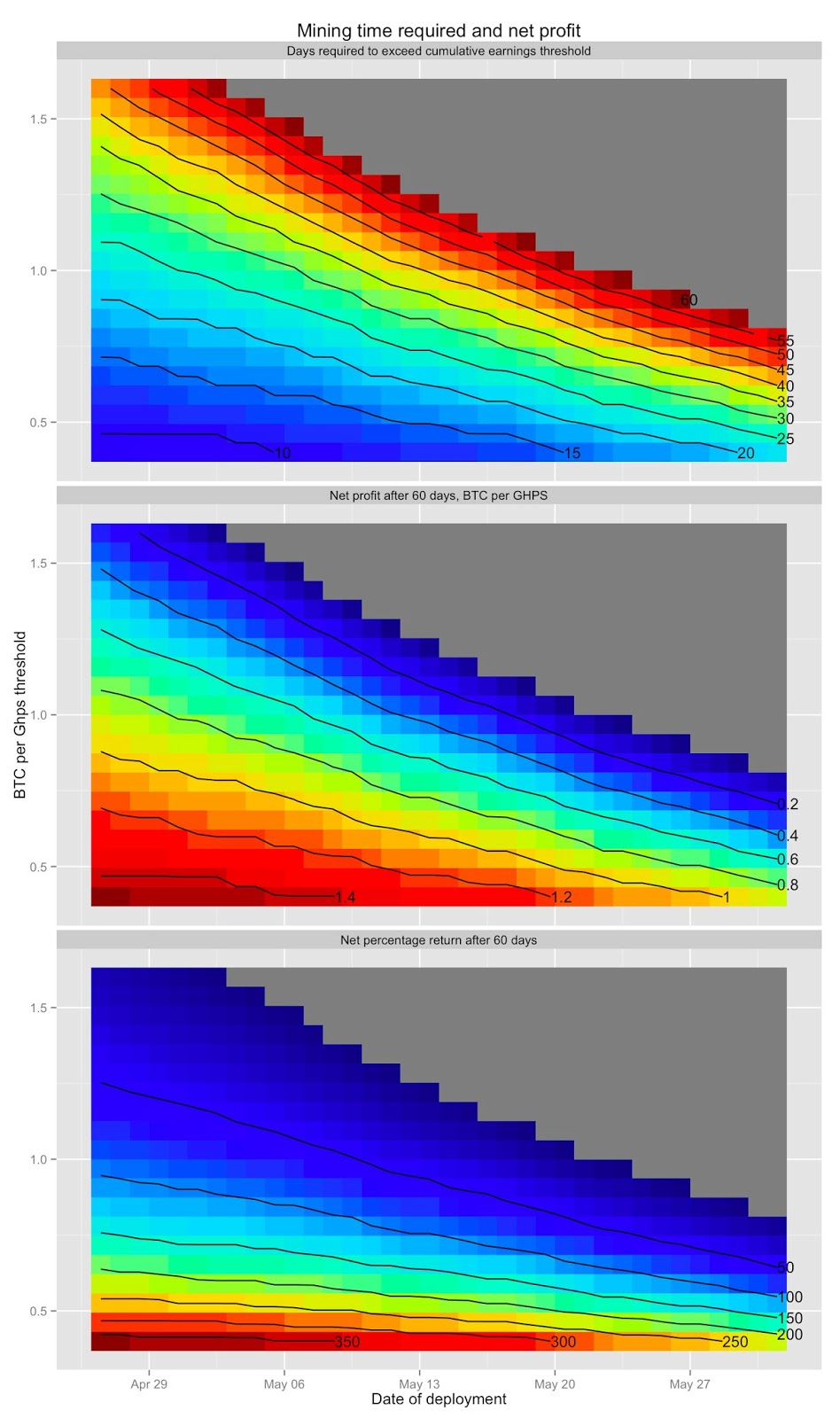

I can't make heads or tails of those graphs - can you explain what they show please?

|

|

|

|

|

organofcorti (OP)

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

May 07, 2013, 02:03:32 AM |

|

I can't make heads or tails of those graphs - can you explain what they show please?

Sorry I'm at work right now and don't have time, but if you click on the chart the blog post will open which explains it all in detail. |

|

|

|

|

KS

|

|

May 07, 2013, 07:35:20 PM |

|

I can't make heads or tails of those graphs - can you explain what they show please?

Sorry I'm at work right now and don't have time, but if you click on the chart the blog post will open which explains it all in detail. Somehow, I don't think it will clarify things  |

|

|

|

|

|

ecliptic

|

|

May 09, 2013, 11:38:56 PM |

|

Not sure if already discussed (too lazy to read through the whole thread right now, sorry).

How about GPU miners that might move away when profit is close to 0 for them?

edit:

Nice work, an interesting read!

All I can say is that some point we'll lose GPUs and at another we'll lose FPGAs. Many GPUs will probably leave early to mine LTC, FPGAs will mine on until the bitter end. I'm assuming that by the time this happens, 24Thps will be a very small fraction of the network, and probably won't have much of an impact on the forecast accuracy given all the other sources of error (shipping times being the largest source of error). Litecoin has been consistently ~1.3-1.5x more profitable than BTC for GPUs for months now. I expect most GPUs have already moved. (Indeed, a large % of LTC GPU miners were even switching between alt coins because they were more profitable still, but nowhere near as stable as LTC) |

|

|

|

|

600watt

Legendary

Offline Offline

Activity: 2338

Merit: 2106

|

|

May 14, 2013, 09:03:38 AM |

|

if one orders 10 000 avalon chips today and they deliver as they say within 12 weeks they should be shipped around mid august. let´s say getting them mounted on boards and running will take 3 to 4 weeks = mid september that will give you 2800 GH/s with an investment of...(based on current btc rate) (90 k $ for the chips, + 70 k $ for assembly =) 160 k $ this is massive investment in the best available mining hardware. with a difficulty of 80 mio it would generate 530 btc per month. so it would need about 3 months to pay back. send cash, i order !  |

|

|

|

|

|

KS

|

|

May 14, 2013, 11:36:27 AM |

|

if one orders 10 000 avalon chips today and they deliver as they say within 12 weeks they should be shipped around mid august. let´s say getting them mounted on boards and running will take 3 to 4 weeks = mid september that will give you 2800 GH/s with an investment of...(based on current btc rate) (90 k $ for the chips, + 70 k $ for assembly =) 160 k $ this is massive investment in the best available mining hardware. with a difficulty of 80 mio it would generate 530 btc per month. so it would need about 3 months to pay back. send cash, i order !  Time to sell you house  |

|

|

|

|

600watt

Legendary

Offline Offline

Activity: 2338

Merit: 2106

|

|

May 14, 2013, 11:49:05 AM |

|

if one orders 10 000 avalon chips today and they deliver as they say within 12 weeks they should be shipped around mid august. let´s say getting them mounted on boards and running will take 3 to 4 weeks = mid september that will give you 2800 GH/s with an investment of...(based on current btc rate) (90 k $ for the chips, + 70 k $ for assembly =) 160 k $ this is massive investment in the best available mining hardware. with a difficulty of 80 mio it would generate 530 btc per month. so it would need about 3 months to pay back. send cash, i order !  Time to sell you house  my wife wont let me, but i am working on it  |

|

|

|

|

|

KS

|

|

May 14, 2013, 04:21:22 PM |

|

if one orders 10 000 avalon chips today and they deliver as they say within 12 weeks they should be shipped around mid august. let´s say getting them mounted on boards and running will take 3 to 4 weeks = mid september that will give you 2800 GH/s with an investment of...(based on current btc rate) (90 k $ for the chips, + 70 k $ for assembly =) 160 k $ this is massive investment in the best available mining hardware. with a difficulty of 80 mio it would generate 530 btc per month. so it would need about 3 months to pay back. send cash, i order !  Time to sell you house  my wife wont let me, but i am working on it  Sell your wife AND the house! Problem solved  |

|

|

|

|

|