RyNinDaCleM

Legendary

Offline Offline

Activity: 2408

Merit: 1009

Legen -wait for it- dary

|

|

April 23, 2015, 11:10:54 AM |

|

Gold h&s

sorry, can someone explain the implications should it play out? Is head and shoulders a continuation pattern or bearish or what? I sent this one for silver to my dad. Maybe it will explain better.  Those pink vertical lines are the same height but this is log scale. The point of neckline break is approximated so it may be sooner or later than I have drawn. Edit: The problem with H&S is they don't confirm until they complete. There could be a false break below the neckline and it could break back above on the retest. |

|

|

|

|

|

|

|

|

|

|

|

|

Be very wary of relying on JavaScript for security on crypto sites. The site can change the JavaScript at any time unless you take unusual precautions, and browsers are not generally known for their airtight security.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

oda.krell

Legendary

Offline Offline

Activity: 1470

Merit: 1007

|

|

April 24, 2015, 10:57:39 AM |

|

ITT people see what they want see...

I'm leaning towards 'more downside' as well (expecting to see sub-200 again, for example), but you'll note that luc didn't say "New lower low incoming", but rather "Further price collapse is possible, but not required".

Also, prices an order of magnitude lower than current price (i.e. ryn's myself chart) are pretty unlikely in my opinion, unless catastrophic protocol failure or "global crypto ban" happens. It took more than a year for price to deflate 75% (as measured by a 20 day average), and we're already showing signs of selling exhaustion, so I wouldn't bet much on pre-2013 prices.

a) 208 not hit (yet?). Keep the salivation reflex in control  b) Even then, still missing what luc's main point was. Relevant parts again: 1. Further price collapse is possible, but not required, and 2. Very fucking long "silence phase" (after final collapse) |

Not sure which Bitcoin wallet you should use? Get Electrum!Electrum is an open-source lightweight client: fast, user friendly, and 100% secure. Download the source or executables for Windows/OSX/Linux/Android from, and only from, the official Electrum homepage.

|

|

|

|

h3speros

|

|

April 24, 2015, 12:13:57 PM |

|

ITT people see what they want see...

I'm leaning towards 'more downside' as well (expecting to see sub-200 again, for example), but you'll note that luc didn't say "New lower low incoming", but rather "Further price collapse is possible, but not required".

Also, prices an order of magnitude lower than current price (i.e. ryn's myself chart) are pretty unlikely in my opinion, unless catastrophic protocol failure or "global crypto ban" happens. It took more than a year for price to deflate 75% (as measured by a 20 day average), and we're already showing signs of selling exhaustion, so I wouldn't bet much on pre-2013 prices.

a) 208 not hit (yet?). Keep the salivation reflex in control  b) Even then, still missing what luc's main point was. Relevant parts again: 1. Further price collapse is possible, but not required, and 2. Very fucking long "silence phase" (after final collapse) My reply was for the bolded parts of your reply. Imo you read luc posts with a bit too strong bull classes. Luc could comment, but my interpretation from example H&S pattern that luc has showed also, is that luc thinks that new LL <166 is likely. We could see capitulation <100 then upper weekly BB then "very fucking long silent phase" at middle weekly BB. |

|

|

|

|

Bassica

|

|

April 24, 2015, 01:32:13 PM |

|

Luc, i'm wondering, since I've seen charts from gold as well, do you also analyze the major indices? DJX SPX?

If so, what are your thoughts on the current conditions?

|

|

|

|

|

damiano

Legendary

Offline Offline

Activity: 1246

Merit: 1000

103 days, 21 hours and 10 minutes.

|

|

April 24, 2015, 02:23:02 PM |

|

ITT people see what they want see...

I'm leaning towards 'more downside' as well (expecting to see sub-200 again, for example), but you'll note that luc didn't say "New lower low incoming", but rather "Further price collapse is possible, but not required".

Also, prices an order of magnitude lower than current price (i.e. ryn's myself chart) are pretty unlikely in my opinion, unless catastrophic protocol failure or "global crypto ban" happens. It took more than a year for price to deflate 75% (as measured by a 20 day average), and we're already showing signs of selling exhaustion, so I wouldn't bet much on pre-2013 prices.

a) 208 not hit (yet?). Keep the salivation reflex in control  b) Even then, still missing what luc's main point was. Relevant parts again: 1. Further price collapse is possible, but not required, and 2. Very fucking long "silence phase" (after final collapse) I'm not worried about the collapse, but the silence phase will be painful / depressing / boring. |

|

|

|

|

|

lunarboy

|

|

April 24, 2015, 02:55:50 PM |

|

I'm not worried about the collapse, but the silence phase will be painful / depressing / boring.

Too true. Alot of this is technical mumbo jumbo to me, but can someone explain why the Mid January capitulation to 150 followed by the last 3 months of silence is not exactly this, and that the bottom hasn't already been reached? |

|

|

|

|

|

Wandererfromthenorth

|

|

April 24, 2015, 03:04:13 PM

Last edit: April 24, 2015, 03:15:11 PM by Wandererfromthenorth |

|

I'm not worried about the collapse, but the silence phase will be painful / depressing / boring.

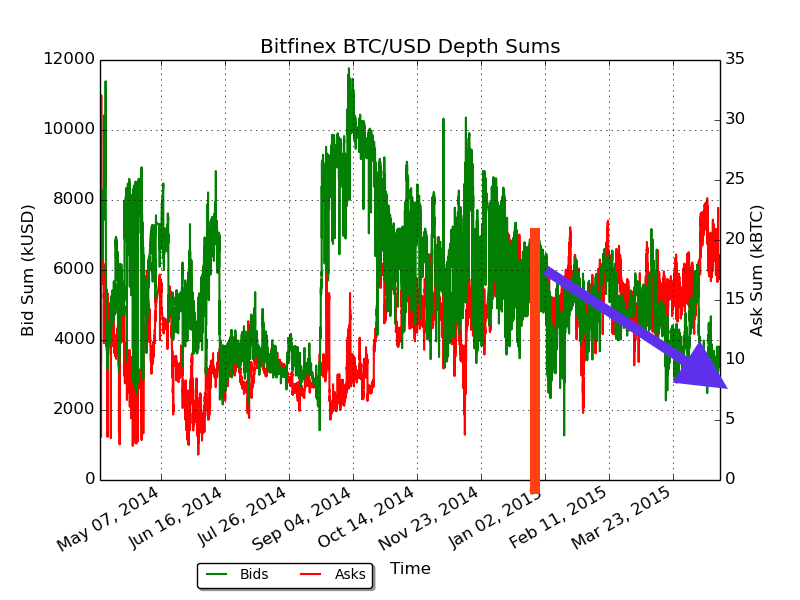

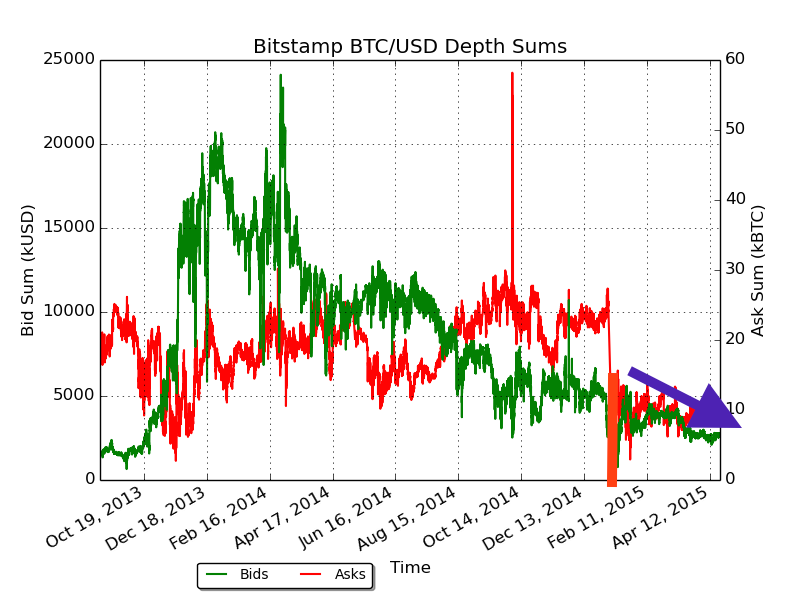

Too true. Alot of this is technical mumbo jumbo to me, but can someone explain why the Mid January capitulation to 150 followed by the last 3 months of silence is not exactly this, and that the bottom hasn't already been reached? It's bid sum still being ridiculously low (and still decreasing, while at the end of the 2013 bear market bid sum went nuts, and price clearly followed for example), it's decreasing volume on all exchanges since January (again, after a real capitulation like in 2013 or 2011, the recovery should be panic buying on progressively increasing volume for the following months), the fact that the actual volume on the $150 bottom wasn't all that amazing (on chinese exchanges they are almost a standard volume bar), the fact that overall volume measured in USD is lower than in the $300-$400 area especially on chinese exchanges, EW analysis, value of daily mined coins, short term (and also long term) support trend lines broken, recent weak price action etc.

I'm not an expert on Elliott Wave Theory (I don't know anything about it actually), but all the EW chartists on this forum are bearish right now. They probably can give you a more specific answer regarding EW. As a summary I would say: -Bearish current price structure (and weak price action) -Decreasing Bid Sum -Decreasing volume (since the January bottom) |

|

|

|

|

|

Wandererfromthenorth

|

|

April 24, 2015, 03:06:46 PM

Last edit: April 24, 2015, 03:24:06 PM by Wandererfromthenorth |

|

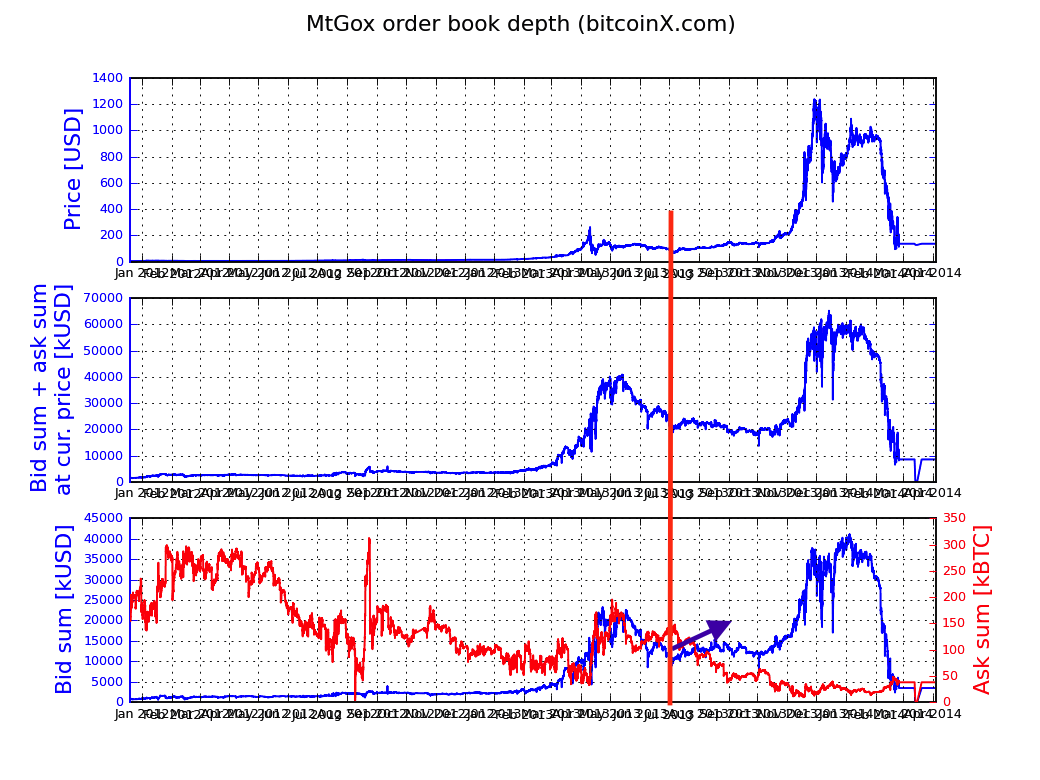

Volume:

2011: Increasing Volume  2013: Increasing volume 2015: Decreasing volume  Bid Sum: Bid Sum:

2013: Increasing Bid Sum  2015: Decreasing Bid Sum:   Unfortunately I can't find info on the increasing/decreasing Bid Sum in 2011 on gox  The depth charts I found don't show data before 2012

|

|

|

|

|

|

lunarboy

|

|

April 24, 2015, 03:15:58 PM |

|

In short, If it was the actual bottom EW predicts an subsequent increase in trading volume, which hasn't transpired. Thanks.  |

|

|

|

|

oda.krell

Legendary

Offline Offline

Activity: 1470

Merit: 1007

|

|

April 24, 2015, 04:47:35 PM |

|

Solid analysis of volume+bid/ask, Wandererfromthenorth. My reply was for the bolded parts of your reply.

Imo you read luc posts with a bit too strong bull classes. Luc could comment, but my interpretation from example H&S pattern that luc has showed also, is that luc thinks that new LL <166 is likely.

We could see capitulation <100 then upper weekly BB then "very fucking long silent phase" at middle weekly BB.

Hehe, I'm hardly bullish at the moment. The point I was trying to make was simply that luc's "big picture" analysis was first and foremost about saying "prepare yourself for a long period of stagnation", and less about another crash (so: not ruling that one out, but not stressing it either) - but maybe I misunderstood luc. Anyway, I see it the way like damiano said above: the really painful part could be the stagnation to come, not further sharp price decline. /shrug |

Not sure which Bitcoin wallet you should use? Get Electrum!Electrum is an open-source lightweight client: fast, user friendly, and 100% secure. Download the source or executables for Windows/OSX/Linux/Android from, and only from, the official Electrum homepage.

|

|

|

hdbuck

Legendary

Offline Offline

Activity: 1260

Merit: 1002

|

|

April 24, 2015, 08:19:03 PM |

|

Solid analysis of volume+bid/ask, Wandererfromthenorth. My reply was for the bolded parts of your reply.

Imo you read luc posts with a bit too strong bull classes. Luc could comment, but my interpretation from example H&S pattern that luc has showed also, is that luc thinks that new LL <166 is likely.

We could see capitulation <100 then upper weekly BB then "very fucking long silent phase" at middle weekly BB.

Hehe, I'm hardly bullish at the moment. The point I was trying to make was simply that luc's "big picture" analysis was first and foremost about saying "prepare yourself for a long period of stagnation", and less about another crash (so: not ruling that one out, but not stressing it either) - but maybe I misunderstood luc. Anyway, I see it the way like damiano said above: the really painful part could be the stagnation to come, not further sharp price decline. /shrug medium term stagnation would mechanically imply more dumps tho. patience is not market compatible. especially this one. |

|

|

|

|

lebing

Legendary

Offline Offline

Activity: 1288

Merit: 1000

Enabling the maximal migration

|

|

April 24, 2015, 09:27:46 PM |

|

Unfortunately those graphs are not really very useful anymore due to the increasing fragmentation of exchanges as well as the fact that bitstamp was hacked and is continually losing market share. The only way to draw a meaningful conclusion based on volume would be to aggregate the data from all available sources (and somehow be sure that the chinese data is accurate).

|

Bro, do you even blockchain?

-E Voorhees

|

|

|

afbitcoins

Legendary

Offline Offline

Activity: 2100

Merit: 1061

|

|

April 26, 2015, 11:37:34 PM |

|

Looks to me like a bullish divergence between price and momentum at the moment..  |

|

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

April 27, 2015, 04:44:31 PM |

|

I have to show you a very dangerous channel with bottom now around $30 and falling  The longer term log channel has higher bottom, now is around $110  |

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

April 27, 2015, 04:58:32 PM |

|

Looks to me like a bullish divergence between price and momentum at the moment..

did you discover price reactions in past on such divs? Need confirmation from another oscillator. |

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

April 27, 2015, 04:59:55 PM |

|

I cancel my bids at 170-190 hehe  some shit probably comming |

|

|

|

hdbuck

Legendary

Offline Offline

Activity: 1260

Merit: 1002

|

|

April 27, 2015, 05:18:04 PM |

|

I cancel my bids at 170-190 hehe  some shit probably comming yeay! so did I! thx lucif!  |

|

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

April 27, 2015, 05:21:51 PM |

|

That level must show some resistance, but when I look at the empty space below in chanel - I shit my pants to leave bids there.

|

|

|

|

Odalv

Legendary

Offline Offline

Activity: 1400

Merit: 1000

|

|

April 27, 2015, 08:38:45 PM |

|

I have to show you a very dangerous channel with bottom now around $30 and falling

Profesor bitcorn ? :-) $30 is simply impossible. It can go to zero (if protocol fails) but not to $30. |

|

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

April 27, 2015, 08:43:06 PM |

|

I didn't say it goes to 30, just showed the chanel. Bottom could be anywhere from here down to 110 or even 30. And risk/reward ratio very bad on my 180 bids.

|

|

|

|

|