Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

February 11, 2020, 10:09:44 PM |

|

Excellent points made.

There is a fair chance that Halvening 3 (tm) will be the precursor for the next moonshot. Masterluc may prove too cautious, perhaps because of the attention his earlier predictions received over time, leading to a kind of cult status. Personally, I dig that position, but I am also fully aware that every light is turning green again.

This may become The Big One.

|

|

|

|

|

|

|

|

|

The forum strives to allow free discussion of any ideas. All policies are built around this principle. This doesn't mean you can post garbage, though: posts should actually contain ideas, and these ideas should be argued reasonably.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

keystroke

|

|

February 12, 2020, 03:10:07 AM |

|

This may become The Big One.

It went up infinity percent already, what's another 10x?  |

"The difference between a castle and a prison is only a question of who holds the keys."

|

|

|

|

Millionero

|

|

February 12, 2020, 04:29:09 AM |

|

This may become The Big One.

It went up infinity percent already, what's another 10x?  Well, you can't divide by zero now, can you? I put the actual figure at about four or five million percent.    |

|

|

|

|

StarenseN

Legendary

Offline Offline

Activity: 2478

Merit: 1362

|

|

February 12, 2020, 06:28:01 AM |

|

J0E008 ?

|

|

|

|

|

Bossian

Member

Offline Offline

Activity: 450

Merit: 59

|

|

February 20, 2020, 12:38:20 PM |

|

A few things.

The market was already bullish before the two previous halvings. Therefore, there could be absolutely no correlation.

This time, in 2020 the market is not bullish yet, it is at a critical point right now but it won't be bullish before we break above 10.5k and so far it has proved to be a very strong resistance. If Bitcoin price retraces to 8k area, then we are still in a bear market. And if we are still in a bear market before the halvening occurs, we cannot predict the future based on what happened during the two previous halvenings as the trend and context are different (bearish).

Last thing: every time the herd says something, doing the opposite is likely to generate profits.

Right now the herd says we will see a new ATH because of the recent golden cross + incoming halvening.

Make your own conclusions.

|

1uo2hAbLvmvhvw5WzQ6c3Lsc45zmewrWe

|

|

|

Globb0

Legendary

Offline Offline

Activity: 2674

Merit: 2053

Free spirit

|

|

February 20, 2020, 03:51:25 PM |

|

aha but what if everyone is trying to do the opposite?

|

|

|

|

|

drays

Legendary

Offline Offline

Activity: 2520

Merit: 1073

|

|

February 20, 2020, 04:46:03 PM |

|

A few things.

The market was already bullish before the two previous halvings. Therefore, there could be absolutely no correlation.

This time, in 2020 the market is not bullish yet, it is at a critical point right now but it won't be bullish before we break above 10.5k and so far it has proved to be a very strong resistance. If Bitcoin price retraces to 8k area, then we are still in a bear market. And if we are still in a bear market before the halvening occurs, we cannot predict the future based on what happened during the two previous halvenings as the trend and context are different (bearish).

Last thing: every time the herd says something, doing the opposite is likely to generate profits.

Right now the herd says we will see a new ATH because of the recent golden cross + incoming halvening.

Make your own conclusions.

Heh  Do you have a special 'certified herd place' where you unmistakably read the herd's opinion? Or do you have an access to user opinion statistics to find out what 'herd' really thinks? People say lots of different things - and depending on where you prefer to look for opinions, you could get completely different views on what 'herd' says. In general, you are right, doing the opposite of what herd says, is likely to generate profits. But 'who is the part of the herd, and who isn't' - is the real question. From what I have seen, everyone thinks he is the genius, and the rest are the herd. |

... this space is not for rent ... |

|

|

|

kellrobinson

|

|

February 20, 2020, 05:55:47 PM |

|

everyone thinks he is the genius, and the rest are the herd.

I resemble that remark! |

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

February 21, 2020, 12:41:45 AM |

|

A few things.

The market was already bullish before the two previous halvings. Therefore, there could be absolutely no correlation.

This time, in 2020 the market is not bullish yet, it is at a critical point right now but it won't be bullish before we break above 10.5k and so far it has proved to be a very strong resistance. If Bitcoin price retraces to 8k area, then we are still in a bear market. And if we are still in a bear market before the halvening occurs, we cannot predict the future based on what happened during the two previous halvenings as the trend and context are different (bearish).

Last thing: every time the herd says something, doing the opposite is likely to generate profits.

Right now the herd says we will see a new ATH because of the recent golden cross + incoming halvening.

Make your own conclusions.

Until we breach the December 2018 lows, we could be in a larger bull market. Until we breach the June 2019 highs, we could be in a larger bear market. This can only be known after the fact, in hindsight. Returning to $8K seems like an arbitrary measure. It could just be a retracement in a bull market, like this:  |

|

|

|

|

fabiorem

|

|

February 21, 2020, 01:37:01 AM |

|

I dont believe there will be a ATH this year. Maybe in 2021.

This year might end with a price between 15k and 18k. And I'm being optimistic.

Experience tells me overhyped things do not work.

Expectations over the halving are too high. They remind me of futures and BAKKT hypes.

|

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

February 21, 2020, 06:00:53 AM |

|

Experience tells me overhyped things do not work.

Expectations over the halving are too high. They remind me of futures and BAKKT hypes.

Bears keep saying that, but I keep seeing the opposite: people saying the halving is already priced in, the stock-to-flow model is dead, etc. I would say sentiment is mixed at best. The market doesn't feel greedy, not yet anyway. The Fear & Greed Index unsurprisingly stands at 44 (Fear). We've got a long ways to go before the market is over-hyped or exuberant. https://alternative.me/crypto/fear-and-greed-index/ |

|

|

|

windjc

Legendary

Offline Offline

Activity: 2156

Merit: 1070

|

|

February 21, 2020, 06:56:33 PM |

|

I dont believe there will be a ATH this year. Maybe in 2021.

This year might end with a price between 15k and 18k. And I'm being optimistic.

Experience tells me overhyped things do not work.

Expectations over the halving are too high. They remind me of futures and BAKKT hypes.

Let me guess. You joined crypto after 2015? Right? |

|

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

|

February 21, 2020, 08:45:20 PM |

|

Nah he is right, every halvening is less important then the previous. Any greater movement will come in the year or two after the block reward is halved and thats happened in the past. The rise before the event is anticipation but the actual effect of the block reward falling is in action only afterwards and increases over time by reducing supply of new BTC but the alteration we make in 2020 is far less then previous changes , its a diminishing effect.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

February 21, 2020, 09:40:03 PM |

|

Nah he is right, every halvening is less important then the previous. LOL, there has only been 2 halvings so far. With this small of a data set, we're speaking in the realm of coincidence, not reliable patterns. In hindsight, we may find this entire first decade of price discovery was essentially noise before the vertical swing of an S-curve. I would be weary of assuming the past cycles will automatically extrapolate into the future. The trend could reverse, or the magnitude could increase (or decrease) even by orders of magnitude.  The people planning to sell at $60K-$100K because they insist BTC must follow the past logarithmic trend (with diminishing gains) may end up selling way too early. |

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3008

Welt Am Draht

|

|

February 22, 2020, 01:00:20 AM |

|

Nah he is right, every halvening is less important then the previous. Any greater movement will come in the year or two after the block reward is halved and thats happened in the past. The rise before the event is anticipation but the actual effect of the block reward falling is in action only afterwards and increases over time by reducing supply of new BTC but the alteration we make in 2020 is far less then previous changes , its a diminishing effect.

I agree with the principle but I think this one will be the biggest of all and it'll start to roll gently downhill in impact from the next one in 2024 onwards. It's happening just as more building blocks are falling into place, it's being taken seriously by more people than ever and in a way it hasn't up until recent times and the inflation rate will be lower than the average fiat currency just as it steps up into a new phase of legitimacy. At the same time it's going to properly dawn on people that there really aren't that many fresh ones left to arrive. That was a factor barely worth considering with both previous halvings. There were still millions of coins to come. Now it's just over 10% for the rest of eternity. That's a variety of factors aligning around this one that are unique and will never be repeated. Guess we'll see soon enough. Expectations over the halving are too high. They remind me of futures and BAKKT hypes.

Anyone who equates a major shift in the fundamentals of the whole thing with a couple of bits of tinsel in one jurisdiction isn't thinking hard enough. |

|

|

|

|

|

kellrobinson

|

|

February 22, 2020, 03:29:05 AM

Last edit: February 22, 2020, 03:54:05 AM by kellrobinson |

|

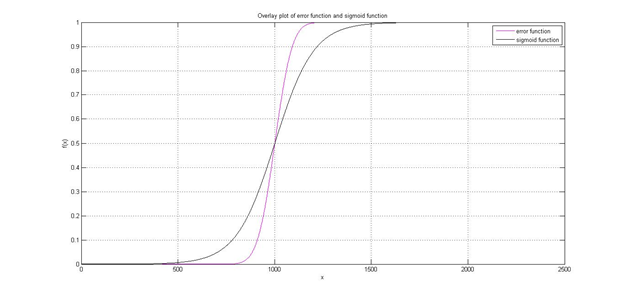

Nah he is right, every halvening is less important then the previous. LOL, there has only been 2 halvings so far. With this small of a data set, we're speaking in the realm of coincidence, not reliable patterns. In hindsight, we may find this entire first decade of price discovery was essentially noise before the vertical swing of an S-curve. I would be weary of assuming the past cycles will automatically extrapolate into the future. The trend could reverse, or the magnitude could increase (or decrease) even by orders of magnitude.  The people planning to sell at $60K-$100K because they insist BTC must follow the past logarithmic trend (with diminishing gains) may end up selling way too early. You are talking about the logistic function, a model of growth which starts as purely exponential and then transitions to a saturation regime. The sigmoid shape appears when you draw the logistic function on a linear graph. A log graph of the logistic function doesn't have an s-shape. The early growth appears as an upward curve on a linear chart (like the one you posted), but looks like a straight line on a log chart. When saturation effects begin damping the growth rate, the linear graph exhibits an inflection point (as on your graph). On a log graph, the transition to a saturation regime appears as a downward bend from the inital straight-line exponential growth, subsequently approaching a horizontal asymptote. The logistic function can be expressed as y=1/(1+e^-x), and here is the log graph https://www.wolframalpha.com/input/?i=y%3Dlog%281%2F%281%2Be%5E%28-x%29%29%29%2C-10%3C%3Dx%3C%3D10%2C-10%3C%3Dy%3C%3D1TLDR: we won't see a sigmoid on the log chart of bitcoin's exchange rate history |

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

Last thing: every time the herd says something, doing the opposite is likely to generate profits.

Right now the herd says we will see a new ATH because of the recent golden cross + incoming halvening.

Make your own conclusions.

I conclude that the herd is wrong also .... btc is going to bull run much further than 2017 or 2013 low:high ratio, and more like 2011 vertical craziness ... begins 3-6 months after the halving peaking around 500k in 1-2Q 2021. |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

February 22, 2020, 04:57:29 AM |

|

You are talking about the logistic function, a model of growth which starts as purely exponential and then transitions to a saturation regime.

The sigmoid shape appears when you draw the logistic function on a linear graph. A log graph of the logistic function doesn't have an s-shape. Sorry if there was confusion, but I was referring to this S-curve, as it relates to the adoption of Bitcoin: https://en.wikipedia.org/wiki/Technology_life_cycle#S-curveThe bell curve probably conveys the idea even better. I contend we have yet to "jump the chasm":  Thus, the strongest wave of adoption is yet to come. Extrapolations based on the past may be unduly limiting. |

|

|

|

|

kellrobinson

|

|

February 22, 2020, 10:50:07 AM

Last edit: February 22, 2020, 11:04:26 AM by kellrobinson |

|

Yeah, I didn't look close enough at your image. The vertical axis is clearly labeled erf(x) The error function is defined as the integral of e^-x^2, i.e. the gaussian normal distribution or "bell curve." The logistic function is the hyperbolic tangent, shifted and scaled to put the asymptotes at 0 and 1. They both have sigmoidal shapes.  Just dropping this for anybody who's interested in sigmoid functions in general. It compares the error function and the logistic function (labeled "sigmoid" in the figure caption). For our purposes, I'm not sure there's much practical difference. But I don't think bitcoin's headed for a quantum leap of adoption and price. It think it's headed for another ordinary bubble, if anything. Nothing to see here, folks. If you filter out the bubbles, the long term trend will be steadily monotonic. That's just my opinion. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11967

BTC + Crossfit, living life.

|

|

February 22, 2020, 11:30:16 AM |

|

Last thing: every time the herd says something, doing the opposite is likely to generate profits.

Right now the herd says we will see a new ATH because of the recent golden cross + incoming halvening.

Make your own conclusions.

I conclude that the herd is wrong also .... btc is going to bull run much further than 2017 or 2013 low:high ratio, and more like 2011 vertical craziness ... begins 3-6 months after the halving peaking around 500k in 1-2Q 2021. A nice noon and a bullish HOPIUM post, what more can the dude ask for  |

XhomerX10 designed my nice avatar HATs!!!!! Thanks Bro

|

|

|

|