|

Walsoraj

|

|

August 18, 2013, 08:26:57 PM |

|

i dont know what you are saying, but i know i won this argument and the discussion is now over

thanks for your participation

|

|

|

|

|

|

|

|

|

|

You get merit points when someone likes your post enough to give you some. And for every 2 merit points you receive, you can send 1 merit point to someone else!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

NamelessOne

Legendary

Offline Offline

Activity: 840

Merit: 1000

|

|

August 18, 2013, 08:32:38 PM |

|

i dont know what you are saying, but i know i won this argument and the discussion is now over

thanks for your participation

LOL HAHAHAH, I just laughed out loud for real.  |

|

|

|

|

S3052 (OP)

Legendary

Offline Offline

Activity: 2100

Merit: 1000

|

|

August 18, 2013, 08:34:43 PM |

|

i dont know what you are saying, but i know i won this argument and the discussion is now over

thanks for your participation

thats too easy... come on

Personally, I believe that BTC will outperform most assets in the next 12 months. Is this clear enough? |

|

|

|

RationalSpeculator

Sr. Member

Offline Offline

Activity: 294

Merit: 250

This bull will try to shake you off. Hold tight!

|

|

August 18, 2013, 09:16:01 PM |

|

So many people have predicted that bitcoin is in a bubble and is doomed to death.

There are most often the same people who push stocks up into bubble territory.

Now let's get to the bottom of this:

1) Is Bitcoin in a bubble?

Look at that longterm chart. Where is the bubble? I can't see it.

The uptrend is healthy.

2) What are REAL bubbles?

The NASDAQ bubble has already popped 13 years ago

There are some new bubble stocks in there that either have already popped or will do soon (LNKD, PCLN, etc.)

these are the real bubbles

how do other see that?

I think chances are high that bitcoin will find a low around $60 the coming months. If this materializes that means a drop of -40% from the current $100 on bitstamp. That's called a crash in traditional markets. So I think one can say bitcoin is still in a bubble today. However, I agree that price will likely be higher than the current $100 in 1 year and have surpassed the all time high of $266 in 2 years. In a traditional market it takes decades for bubbles that deflated to reach new all time highs so from that perspective bitcoin is not in a bubble today. I agree that gov bond market is likely close to default. Before that however interest rates of gov bonds should go up strongly, just like in Greece happened. Like in Greece stocks and to a lesser extend real estate will go down in such event. Gold may, in contrast to 2008, not go down and just like in Greece go to a strong premium as people flee banks and gov bonds. But agreed, chances are 50/50 gold will first go down too. However waiting for the above event to buy bitcoin seems unwise to me since it can take years before it starts unfolding, as Japan proved, and in such time bitcoin has easily 10 times more users and a 10 times higher price, in contrast to gold. So I would say biggest bubble is gov bonds, then stocks, then real estate in many areas, and although gold is certainly priced on the higher end historically, it will likely be the next great bubble the coming years. What seems most undervalued to me today is bitcoin considering it's market cap is still only $1 billion. |

|

|

|

|

S3052 (OP)

Legendary

Offline Offline

Activity: 2100

Merit: 1000

|

|

August 19, 2013, 06:25:41 PM |

|

So I would say biggest bubble is gov bonds, then stocks, then real estate in many areas, and although gold is certainly priced on the higher end historically, it will likely be the next great bubble the coming years. What seems most undervalued to me today is bitcoin considering it's market cap is still only $1 billion.

this makes a lot of sense |

|

|

|

RationalSpeculator

Sr. Member

Offline Offline

Activity: 294

Merit: 250

This bull will try to shake you off. Hold tight!

|

|

August 19, 2013, 07:55:28 PM |

|

So I would say biggest bubble is gov bonds, then stocks, then real estate in many areas, and although gold is certainly priced on the higher end historically, it will likely be the next great bubble the coming years. What seems most undervalued to me today is bitcoin considering it's market cap is still only $1 billion.

this makes a lot of sensethanks  Great question too  |

|

|

|

|

NewLiberty

Legendary

Offline Offline

Activity: 1204

Merit: 1002

Gresham's Lawyer

|

|

August 20, 2013, 02:23:42 AM |

|

there are two effects with different impacts:

1) the overall deflation of all assets which can also impact BTC as you suggested above

2) bitcoins infancy with still huge potential. just imagine every citizen of the world would have 0.001 BTC...

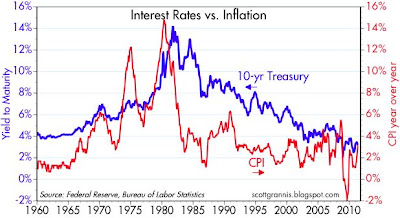

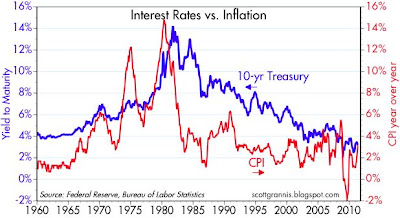

These effects are mostly money-flow based and are not entirely pure of other corresponding price impacts. For example: Bond interest tends to track inflation  Prices that are linked to inflation (hard assets) should rise with the inflation rate. |

|

|

|

S3052 (OP)

Legendary

Offline Offline

Activity: 2100

Merit: 1000

|

|

August 20, 2013, 06:35:03 AM |

|

there are two effects with different impacts:

1) the overall deflation of all assets which can also impact BTC as you suggested above

2) bitcoins infancy with still huge potential. just imagine every citizen of the world would have 0.001 BTC...

These effects are mostly money-flow based and are not entirely pure of other corresponding price impacts. For example: Bond interest tends to track inflation  Prices that are linked to inflation (hard assets) should rise with the inflation rate. yes.. and the should fall with the deflation rate. We are in deflation or soon will be globally. |

|

|

|

polarhei

Sr. Member

Offline Offline

Activity: 462

Merit: 250

Firing it up

|

|

August 20, 2013, 02:28:05 PM |

|

There is currently not enough evidence to point bitcoin is in bubble as there are many buyers, not only the mtgox, but may be dangerous as the market is not fully ready to use mathematical being to count.

I currently notice three major players, two in my place and the btc-e. The btc-e has been doing better than gox at the panic time.

|

|

|

|

|

S3052 (OP)

Legendary

Offline Offline

Activity: 2100

Merit: 1000

|

|

August 20, 2013, 05:39:46 PM |

|

There is currently not enough evidence to point bitcoin is in bubble as there are many buyers, not only the mtgox, but may be dangerous as the market is not fully ready to use mathematical being to count.

I currently notice three major players, two in my place and the btc-e. The btc-e has been doing better than gox at the panic time.

It does not really look like a bubble. |

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

August 20, 2013, 05:47:19 PM |

|

There is currently not enough evidence to point bitcoin is in bubble as there are many buyers, not only the mtgox, but may be dangerous as the market is not fully ready to use mathematical being to count.

I currently notice three major players, two in my place and the btc-e. The btc-e has been doing better than gox at the panic time.

It does not really look like a bubble. You still haven't told us how you think a bubble does look like. |

|

|

|

|

S3052 (OP)

Legendary

Offline Offline

Activity: 2100

Merit: 1000

|

|

August 20, 2013, 09:20:27 PM |

|

There is currently not enough evidence to point bitcoin is in bubble as there are many buyers, not only the mtgox, but may be dangerous as the market is not fully ready to use mathematical being to count.

I currently notice three major players, two in my place and the btc-e. The btc-e has been doing better than gox at the panic time.

It does not really look like a bubble. You still haven't told us how you think a bubble does look like. ok. here we go: Tulip bubble  Japan housing bubble  South sea stock  Basically, a bubble is a irrational, exuberant rise and a crash to where it started. Bitcoin instead started at 0.01-0.06 $ and is still 1,000 - 10,000x higher today. |

|

|

|

|

Walsoraj

|

|

August 20, 2013, 09:38:05 PM |

|

i wonder where bitcoin would be if there were no difficulties extracting fiat from Gox? do you think charts showing the April and 2011 crashes would overlap better?

|

|

|

|

|

ArticMine

Legendary

Offline Offline

Activity: 2282

Merit: 1050

Monero Core Team

|

|

August 20, 2013, 10:45:24 PM |

|

i wonder where bitcoin would be if there were no difficulties extracting fiat from Gox? do you think charts showing the April and 2011 crashes would overlap better?

Which 2011 "crash"? The one from the peak in February 2011 or the one from the peak in June 2011? I actually believe April 2013 chart is a better fit to the February 2011 one. |

|

|

|

|

Walsoraj

|

|

August 20, 2013, 10:48:12 PM |

|

i wonder where bitcoin would be if there were no difficulties extracting fiat from Gox? do you think charts showing the April and 2011 crashes would overlap better?

Which 2011 "crash"? The one from the peak in February 2011 or the one from the peak in June 2011? I actually believe April 2013 chart is a better fit to the February 2011 one. june |

|

|

|

|

ArticMine

Legendary

Offline Offline

Activity: 2282

Merit: 1050

Monero Core Team

|

|

August 20, 2013, 11:28:17 PM

Last edit: August 20, 2013, 11:43:13 PM by ArticMine |

|

i wonder where bitcoin would be if there were no difficulties extracting fiat from Gox? do you think charts showing the April and 2011 crashes would overlap better?

Which 2011 "crash"? The one from the peak in February 2011 or the one from the peak in June 2011? I actually believe April 2013 chart is a better fit to the February 2011 one. june To answer this question lets compare the June 2011 market on MTGox to the April 2013 market on an exchange that is not only not having withdrawal problems but may have some minor deposit issues Virtex in Canada. See this thread https://bitcointalk.org/index.php?topic=273286.0MT Gox May - October 2011: http://bitcoincharts.com/charts/mtgoxUSD#rg60zczsg2011-05-01zeg2011-10-31ztgSzm1g10zm2g25zvVirtex February 22 - August 21 2013: http://bitcoincharts.com/charts/virtexCAD#rg180zczsg2013-02-22zeg2013-08-21ztgSzm1g10zm2g25zvThis market is very different from the aftermath of the 2011 June crash. It may have more in common with the aftermath of the February 2011 crash. As for the impact of the MTGox withdrawal problems it may turn out to temporally depress the price on other exchanges in an otherwise bullish recovery. |

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

August 21, 2013, 12:34:21 AM |

|

Basically, a bubble is a irrational, exuberant rise and a crash to where it started.

Bitcoin instead started at 0.01-0.06 $ and is still 1,000 - 10,000x higher today.

So in your opinion a bubble is only a bubble after it popped? In common sense that's a contradiction. |

|

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

August 21, 2013, 01:31:23 AM |

|

Basically, a bubble is a irrational, exuberant rise and a crash to where it started.

Bitcoin instead started at 0.01-0.06 $ and is still 1,000 - 10,000x higher today.

So in your opinion a bubble is only a bubble after it popped? In common sense that's a contradiction. A bubble is only confirmed to be a bubble after it has popped. Labeling it a bubble before it meets the definition of bubble is premature. |

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

August 21, 2013, 11:48:05 AM |

|

Basically, a bubble is a irrational, exuberant rise and a crash to where it started.

Bitcoin instead started at 0.01-0.06 $ and is still 1,000 - 10,000x higher today.

So in your opinion a bubble is only a bubble after it popped? In common sense that's a contradiction. A bubble is only confirmed to be a bubble after it has popped. Labeling it a bubble before it meets the definition of bubble is premature. Interesting, I guess the pirate ponzi wasn't a ponzi until it collapsed either. |

|

|

|

|

|

xxjs

|

|

August 21, 2013, 02:44:03 PM |

|

Bubbles can easily exist, but on a baseline of an exponential appreciation, based on the sum of the holding preferences of all users. You can't really decide where that baseline is, but you can have some assumption. Then when the speculators get ahead of themselves there is a rise, followed by a slump that can go under the baseline. In the long run, at least before the user base starts to saturate, it will deviate from the baseline only in short lived bubbles (or antibubbles (what is an antibubble)).

|

|

|

|

|

|