|

theonewhowaskazu (OP)

|

|

October 28, 2013, 08:09:17 PM |

|

Like, a majority of the US Population. Obviously, this would lessen the value of the dollar by a huge margin. What's to stop the Federal Reserve for citing such inflation to demand huge interest, saying it'll need to do so to curb delfation, which would in turn force congress to come up with a large amount of Federal Reserve Notes, which would cause huge taxation, payable only in legal tender, thus meaning people would need it, not Bitcoin.

Are we trapped?

|

|

|

|

|

|

|

|

|

|

|

|

|

In order to get the maximum amount of activity points possible, you just need to post once per day on average. Skipping days is OK as long as you maintain the average.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

MAbtc

|

|

October 29, 2013, 06:05:59 PM |

|

As long as they denominate our income in dollars and enforce taxes payable only in dollars, we are trapped.  |

|

|

|

|

linuxnewbie

Member

Offline Offline

Activity: 92

Merit: 10

|

|

October 29, 2013, 06:22:07 PM |

|

They pay their enforcers in dollars.

|

|

|

|

|

|

theonewhowaskazu (OP)

|

|

October 29, 2013, 06:30:20 PM |

|

As long as they denominate our income in dollars and enforce taxes payable only in dollars, we are trapped.  They don't force us to denominate our income in dollars. However, they do enforce that our taxes are payable only in dollars. Although, its very easy to dodge income tax when using Bitcoin. The issue would be things like property tax that wouldnt' be easy to dodge, which is primarily at the local level. Do you think states would be liable to switch in such a situation? For example, I'm pretty sure gold is legal tender in Indiana. |

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

October 29, 2013, 06:38:05 PM |

|

If we honestly value bitcoin more than dollars, the scheme would not cause an actual disturbance, since it is already in effect.

|

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|

theonewhowaskazu (OP)

|

|

October 29, 2013, 06:50:48 PM |

|

If we honestly value bitcoin more than dollars, the scheme would not cause an actual disturbance, since it is already in effect.

Exactly, it would prevent Bitcoin from causing a disturbance, and perpetuate that status quo, would it not? |

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

October 29, 2013, 06:59:17 PM |

|

If we honestly value bitcoin more than dollars, the scheme would not cause an actual disturbance, since it is already in effect.

Exactly, it would prevent Bitcoin from causing a disturbance, and perpetuate that status quo, would it not? I disagree with you; As long as bitcoins are easily exchangeable for dollars, I don't think the scheme would matter. "They" have been able to suppress silver's use as medium of exchange, and even gold's, but I have always paid all taxes due and never had more than 5% of balance in fiat. To pay taxes you don't need to have much balance in that currency, you just save up from the cash flows in the days preceding the due date, or dip to your savings and exchange. There are all sorts of insidious capital controls possible, but in today's world the result is massively more misery than good. The more people are harassed financially, the higher bitcoin rises. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

October 30, 2013, 05:39:01 AM |

|

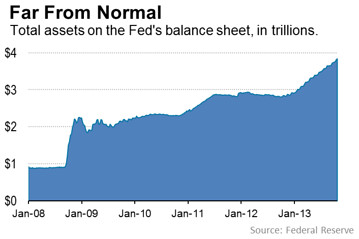

... au contraire, it is they who are trapped  - they can't raise interest rates or their whole rotten system falls apart. At present, interest rates are practically zero (for money center banks) AND they are printing $85 billion per month just to keep them propped up. It is in a terminal phase of exponential monetary blow-off, even minor competition like bitcoin is a threat, gold unfortunately has been severely manipulated and thrashed into uselessness as an alternate store of value by way of illegal derivatives dealings and other schemes by the same actors and vested interests. This is movie that has been replayed many times before and what Volker did in 1980 to restore the dollar will not work again. In 1980 the Federal Reserve Dollar system had only been officially defaulting on their gold obligations for ~10 years, now it is over 40 and the rot has gone far and wide throughout the monetary system, and indeed the whole academic infrastructure that has built up around the tissue of economic lies that support the fiat currency fraud. Nation states should never have shouldered the burden of reserve currency with a fiat unit tied to their economic outputs, it will be looked back upon with curiosity, disdain and probably eventually horror. Gold and silver were assets that formed independent units from the State economies that could have worked and maybe still will as components of currencies comprised of baskets of commodities. But the experiment with floating fiat units tied to taxation and national economic outputs has been a complete disaster for financial stability and a terrible burden on the lower classes. Raise interest rates, raise taxes, whatever they want to try, they are screwed. It needs to be discarded into the bin of history for a more equitable system of efforts and rewards and the sooner and smoother we do that the better. |

|

|

|

DeathAndTaxes

Donator

Legendary

Offline Offline

Activity: 1218

Merit: 1079

Gerald Davis

|

|

October 30, 2013, 05:50:23 AM |

|

Nothing in the OP is how the federal reserve works.

If the federal reserve feels there is a risk of deflation they simply expand the money supply. Literally they make money out of thin air. *

If the federal reserve feels there is a risk of high inflation they simply shrink the money supply. Literally they destroy money into nothing. *

They don't need to (and never do) ask Congress for money.

Think about this for a second. The federal reserve can instantly and at will create or destroy any amount of money. Why would they "ask" Congress for money?

NOTE: The "federal" reserve is a private cartel of banks, it is about as "federal" as Federal Express.

If the federal government runs a deficit the treasury will borrow money, it does that by selling bonds. In a high inflation environment this means creditors will demand higher rates. Somewhat ironically this has been more of a restraint on federal spending then any action by Congress critters. In low inflation (or deflation) environments like what OP indicates interest rates would be LOWER not higher.

* By itself the fed creating or destroying money would have no effect however when creating money they then lend this newly created money to banks who then lend it to people, companies, etc who depositor their lent money and via the magic of fractional reserve system the money supply grows. However this has nothing to do with Congress or taxes.

|

|

|

|

|

|

Pente

|

|

October 30, 2013, 07:18:24 AM |

|

Like, a majority of the US Population. Obviously, this would lessen the value of the dollar by a huge margin. What's to stop the Federal Reserve for citing such inflation to demand huge interest, saying it'll need to do so to curb delfation, which would in turn force congress to come up with a large amount of Federal Reserve Notes, which would cause huge taxation, payable only in legal tender, thus meaning people would need it, not Bitcoin.

Are we trapped?

During the Weimer Germany Inflation era, taxes became irrelevant. You stall in paying them till the last minute, allowing hyperinflation to make the value of the tax insignificant. Normally, you would trade some foreign currency (which was illegal at the time) or some other item of value for a bit of worthless currency to pay the tax. I think it would be the same if most people in USA were using bitcoin. We would just use bitcoin for our normal stuff, then convert some to the worthless currency that was being madly printed and given to all the government employees and welfare addicts. |

|

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

October 30, 2013, 04:47:57 PM |

|

If the federal reserve feels there is a risk of deflation they simply expand the money supply. Literally they make money out of thin air. *

If the federal reserve feels there is a risk of high inflation they simply shrink the money supply. Literally they destroy money into nothing. *

They don't need to (and never do) ask Congress for money.

I wanted to expand on this a little, as the way the Fed creates money is less nefarious than what "out of thin air" may imply to some readers. The Fed creates money by buying assets. Historically, the asset of choice was US Government debt, but assets now include agency debt as well as some more creative stuff, IIRC. Consider a purchase of US Government debt: the Fed literally credits the Treasury's bank account with $1,000,000 of new USD [that previously never existed]; but remember, in exchange for these new dollars, the Fed now holds on its balance sheet an asset of supposedly* equal value [the US Gov promises to pay those million dollars back in the future]. The Fed can destroy money by doing the opposite: sell some of its assets in exchange for USD [thus sucking USD out of the money supply]. The point I wanted to make is that the Fed's balance sheet is always....balanced. |

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

October 30, 2013, 07:50:29 PM |

|

And the government owes more money than exists. And any new money created must be paid back with interest. This system necessitates infinite debt growth.

|

|

|

|

DeathAndTaxes

Donator

Legendary

Offline Offline

Activity: 1218

Merit: 1079

Gerald Davis

|

|

October 30, 2013, 08:00:05 PM |

|

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Well that is an interesting way to look at it. It isn't balance against anything except money it created out of thin air. So yes they create money from nothing and then use that to buy stuff. Not sure how the buying stuff from money they created on a whim suddenly makes it better. They create money from nothing, trade if to for assets and now there is more money in the economy. More supply, same demand, the purchasing power of your money declines.  I would love it if I could create as much money as I want when I want. Don't worry I promise to buy lots of stuff with the money I create. How many D&T dollars would you like and what asset do you want to trade for it. |

|

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

October 30, 2013, 08:44:34 PM |

|

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Well that is an interesting way to look at it. It isn't balance against anything except money it created out of thin air. We share the same sentiment, D&T.....just pointing out for posterity that the process is not as brazen as creating a trillion dollars willy-nilly or each month monetizing one doll from Janet Yellen's Beenie Baby collection for 85 billion dollars. |

|

|

|

|

theonewhowaskazu (OP)

|

|

October 30, 2013, 08:52:28 PM |

|

I wanted to expand on this a little, as the way the Fed creates money is less nefarious than what "out of thin air" may imply to some readers.

The Fed creates money by buying assets. Historically, the asset of choice was US Government debt, but assets now include agency debt as well as some more creative stuff, IIRC. Consider a purchase of US Government debt: the Fed literally credits the Treasury's bank account with $1,000,000 of new USD [that previously never existed]; but remember, in exchange for these new dollars, the Fed now holds on its balance sheet an asset of supposedly* equal value [the US Gov promises to pay those million dollars back in the future]. The Fed can destroy money by doing the opposite: sell some of its assets in exchange for USD [thus sucking USD out of the money supply].

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Its far, far more nefarious than creating money "out of thin air". The worst people think of when they think of creating money out of thin air is that the government will cause inflation with their spending of this money on services. But thats not the way it works. The Federal Reserve causes inflation by creating money out of thin air, and then the banks LEND that money to the government, for interest (the supposed assets they bought). The loan is denominated in USD, which they control the supply of, so the USG must take on an increasingly large debt just to perpetuate the same money supply, even if they don't spend a dime of it. This means the banks are, each year, taking an increasingly large percentage share of that money which IS created out of thin air, through one of two methods: 1) The government "repays" some of its old debt, by imposing income tax, which has the effect of shifting the debt onto the people, which causes what is effectively stagflation as people are forced to hoard an inflationary currency just to pay back taxes, or 2) The government creates only new debt each time, by borrowing more money to pay back their old debts, which causes much more inflation with the banks getting the right of "first spend", not to mention an unfair ever-increasing share of the new money being printed. |

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

October 30, 2013, 09:01:49 PM |

|

I wanted to expand on this a little, as the way the Fed creates money is less nefarious than what "out of thin air" may imply to some readers.

The Fed creates money by buying assets. Historically, the asset of choice was US Government debt, but assets now include agency debt as well as some more creative stuff, IIRC. Consider a purchase of US Government debt: the Fed literally credits the Treasury's bank account with $1,000,000 of new USD [that previously never existed]; but remember, in exchange for these new dollars, the Fed now holds on its balance sheet an asset of supposedly* equal value [the US Gov promises to pay those million dollars back in the future]. The Fed can destroy money by doing the opposite: sell some of its assets in exchange for USD [thus sucking USD out of the money supply].

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Its far, far more nefarious than creating money "out of thin air". ne·far·i·ous [ nə férree əss ] evil: utterly immoral or wicked Hmm, you're right. Creating money willy-nilly out of thin air with no accountability would be "brazen," not "nefarious." Perhaps nefarious is a good adjective for the stealthy process of creating money that I described. |

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

November 06, 2013, 04:02:01 AM |

|

I think Silicon Valley has called NY's bluff .... "wtf is going on? what did you do to the money?" ... NY replies, "we haven't got a clue ... it just stopped working (pockets another few billions for them and their pals)"

|

|

|

|

|

theonewhowaskazu (OP)

|

|

November 06, 2013, 05:40:00 AM |

|

I wanted to expand on this a little, as the way the Fed creates money is less nefarious than what "out of thin air" may imply to some readers.

The Fed creates money by buying assets. Historically, the asset of choice was US Government debt, but assets now include agency debt as well as some more creative stuff, IIRC. Consider a purchase of US Government debt: the Fed literally credits the Treasury's bank account with $1,000,000 of new USD [that previously never existed]; but remember, in exchange for these new dollars, the Fed now holds on its balance sheet an asset of supposedly* equal value [the US Gov promises to pay those million dollars back in the future]. The Fed can destroy money by doing the opposite: sell some of its assets in exchange for USD [thus sucking USD out of the money supply].

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Its far, far more nefarious than creating money "out of thin air". ne·far·i·ous [ nə férree əss ] evil: utterly immoral or wicked Hmm, you're right. Creating money willy-nilly out of thin air with no accountability would be "brazen," not "nefarious." Perhaps nefarious is a good adjective for the stealthy process of creating money that I described. How is creating unpayable debt that is effectively enslaving a country not immoral or wicked? |

|

|

|

Peter R

Legendary

Offline Offline

Activity: 1162

Merit: 1007

|

|

November 06, 2013, 07:43:48 AM |

|

I wanted to expand on this a little, as the way the Fed creates money is less nefarious than what "out of thin air" may imply to some readers.

The Fed creates money by buying assets. Historically, the asset of choice was US Government debt, but assets now include agency debt as well as some more creative stuff, IIRC. Consider a purchase of US Government debt: the Fed literally credits the Treasury's bank account with $1,000,000 of new USD [that previously never existed]; but remember, in exchange for these new dollars, the Fed now holds on its balance sheet an asset of supposedly* equal value [the US Gov promises to pay those million dollars back in the future]. The Fed can destroy money by doing the opposite: sell some of its assets in exchange for USD [thus sucking USD out of the money supply].

The point I wanted to make is that the Fed's balance sheet is always....balanced.

Its far, far more nefarious than creating money "out of thin air". ne·far·i·ous [ nə férree əss ] evil: utterly immoral or wicked Hmm, you're right. Creating money willy-nilly out of thin air with no accountability would be "brazen," not "nefarious." Perhaps nefarious is a good adjective for the stealthy process of creating money that I described.How is creating unpayable debt that is effectively enslaving a country not immoral or wicked? Didn't I just agree with you? |

|

|

|

rpietila

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

November 06, 2013, 07:50:07 AM |

|

I think Silicon Valley has called NY's bluff .... "wtf is going on? what did you do to the money?" ... NY replies, "we haven't got a clue ... it just stopped working (pockets another few billions for them and their pals)"

For the first time, silicon valley is financially independent.  Oh what a glorious day when nobody needs the debtcurrency any more! |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|