piramida

Legendary

Offline Offline

Activity: 1176

Merit: 1010

Borsche

|

|

December 03, 2013, 06:54:50 PM |

|

14,000,000,000 % INCREASE.

there's your division by zero - considering that in 2008, bitcoin value was zero, now we literally look at an infinite rise  |

i am satoshi

|

|

|

|

|

|

|

|

"Bitcoin: mining our own business since 2009" -- Pieter Wuille

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

NewLiberty

Legendary

Offline Offline

Activity: 1204

Merit: 1002

Gresham's Lawyer

|

|

December 03, 2013, 08:01:30 PM |

|

This progression happens in every starting endeavor.

It begins with nothing, and progresses.

Why the hyperbole?

Bitcoin is in beta, (I remind myself of this every time I re-balance my meager portfolio to keep no asset above 5%.)

It is still the early days, though Bitcoin is getting a bit overextended with all the current attention.

Its all good though, just yet another test which makes us stronger in an antifragile way.

|

|

|

|

rpietila (OP)

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

December 03, 2013, 08:08:13 PM |

|

14,000,000,000 % INCREASE.

there's your division by zero - considering that in 2008, bitcoin value was zero, now we literally look at an infinite rise  Incorrect. Bitcoin did not exist in 2008. What Sirius sold in 2009 for $5 was exactly the same thing that, if kept, would now be worth $5M. The market cap and the 14B% is of course a publicity stunt, but the 1M% increase is very much real. He told this to me in person. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|

Equilux

|

|

December 03, 2013, 08:47:23 PM |

|

Can we get an update on the graph in the OP?  |

|

|

|

tonico

Newbie

Offline Offline

Activity: 39

Merit: 0

|

|

December 04, 2013, 03:19:11 PM |

|

|

|

|

|

|

NewLiberty

Legendary

Offline Offline

Activity: 1204

Merit: 1002

Gresham's Lawyer

|

|

December 04, 2013, 05:28:35 PM |

|

So... sell at US$1K until April?

No... you...

|

|

|

|

|

kdrop22

|

|

December 04, 2013, 09:44:01 PM |

|

So... sell at US$1K until April?

No... you...

The target price for December is somewhere around $420 (if I can see clearly from the chart) So, the price of $1100 is 2.6X trend. Which is in orange territory(not red yet). Maybe sell a small portion if needed, I do not recommend selling all as the trend catch up pretty quickly at 20% a month. |

|

|

|

|

|

BitDreams

|

|

December 06, 2013, 12:08:16 AM |

|

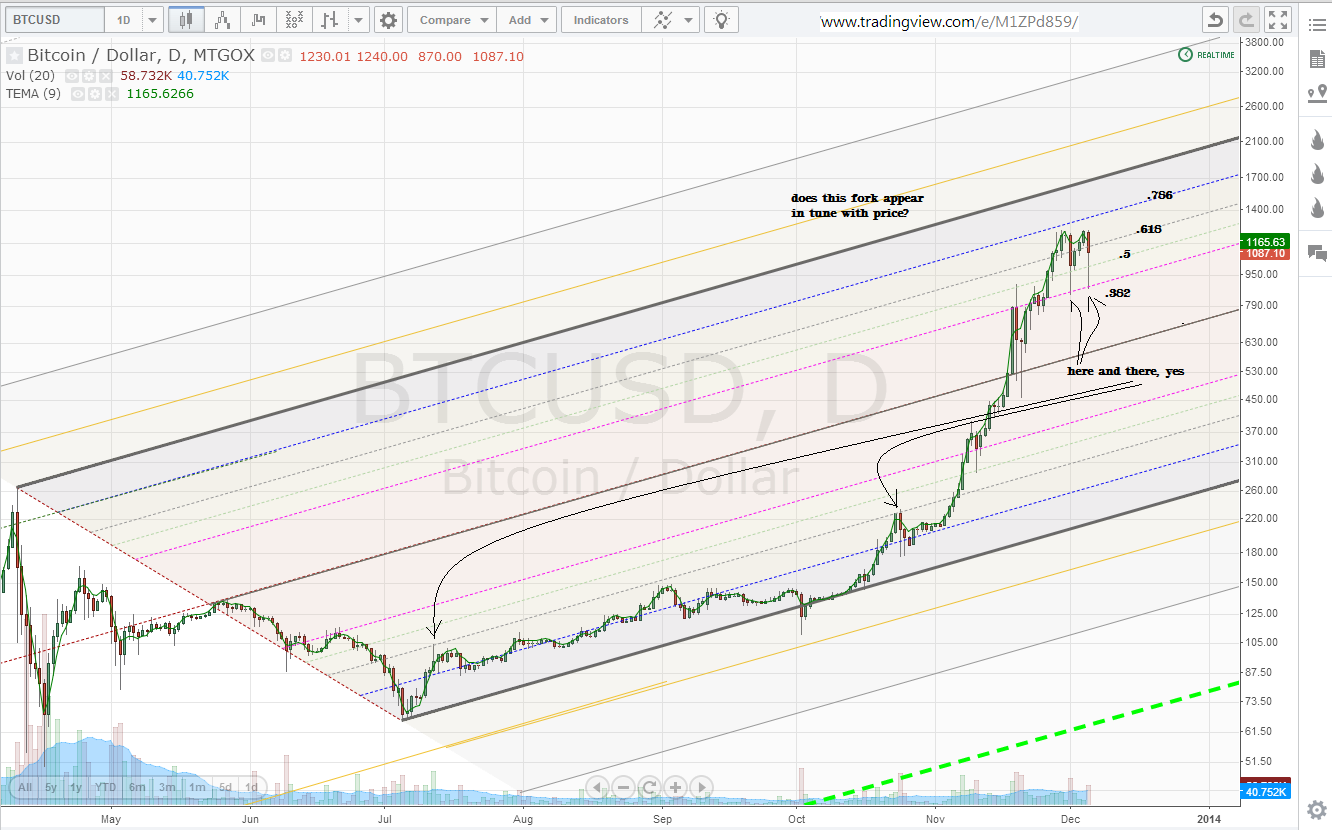

chart, I have not found a reason to adjust the plots of this Andrews Pitchfork and more reasons to leave it on.  |

|

|

|

|

BitChick

Legendary

Offline Offline

Activity: 1148

Merit: 1001

|

|

December 07, 2013, 09:50:08 PM |

|

So I guess the "crash" has just moved us back to more "normal" growth at this point?

I guess the good thing is that each rise shows us that we are on our way to those new highs. It should give us some confidence of where Bitcoin is going anyways.

|

1BitcHiCK1iRa6YVY6qDqC6M594RBYLNPo

|

|

|

mladen00

Legendary

Offline Offline

Activity: 2124

Merit: 1013

K-ing®

|

|

December 09, 2013, 10:21:28 AM |

|

we are back +1000$  |

IOTA

|

|

|

rpietila (OP)

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

December 09, 2013, 11:17:50 AM |

|

So I guess the "crash" has just moved us back to more "normal" growth at this point?

I guess the good thing is that each rise shows us that we are on our way to those new highs. It should give us some confidence of where Bitcoin is going anyways.

The problem is that the "crash" so far has not come even close the trendline. So either it was not a crash at all, or we will be visiting the trendline soon (down), or there is a new paradigm in bitcoin price (such as the one of growth spurts without deep crashes in 7/2010-6/2011). It quacks like a crash. So my bets are hedged whether to visit the trend or continue higher in a sense that invalidates the trend. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

|

bitrider

|

|

December 09, 2013, 06:44:22 PM |

|

So I guess the "crash" has just moved us back to more "normal" growth at this point?

I guess the good thing is that each rise shows us that we are on our way to those new highs. It should give us some confidence of where Bitcoin is going anyways.

The problem is that the "crash" so far has not come even close the trendline. So either it was not a crash at all, or we will be visiting the trendline soon (down), or there is a new paradigm in bitcoin price (such as the one of growth spurts without deep crashes in 7/2010-6/2011). It quacks like a crash. So my bets are hedged whether to visit the trend or continue higher in a sense that invalidates the trend. I'm personally leaning toward the "revert to the trend" scenario, but suspect that it will get there mostly through time - rather than much greater price drops. Of course we could be seeing an acceleration of the trend with all the breakthrough acceptance BTC has achieved in the last month. If so I will be sad to let go of the current trend chart (even in exchange for a more aggressive line), as it has been very comforting to have next to my desk. But BTC keeps blowing my mind - and that is the name of the game - so I guess no reason to stop now. |

|

|

|

|

BitChick

Legendary

Offline Offline

Activity: 1148

Merit: 1001

|

|

December 09, 2013, 09:00:29 PM |

|

So I guess the "crash" has just moved us back to more "normal" growth at this point?

I guess the good thing is that each rise shows us that we are on our way to those new highs. It should give us some confidence of where Bitcoin is going anyways.

The problem is that the "crash" so far has not come even close the trendline. So either it was not a crash at all, or we will be visiting the trendline soon (down), or there is a new paradigm in bitcoin price (such as the one of growth spurts without deep crashes in 7/2010-6/2011). It quacks like a crash. So my bets are hedged whether to visit the trend or continue higher in a sense that invalidates the trend. New paradigm? Sounds interesting.  If we have to adjust the trendline does that just mean that we are going to have an even higher or faster growth then we even expected based on the older charts? I enjoy looking at the charts but I am in no way capable of making one. If anyone wants to play with the numbers and throw up a new one with an adjusted growth rate based on this month's data it would be cool to look at. But of course, it just might get my hopes up too much!  |

1BitcHiCK1iRa6YVY6qDqC6M594RBYLNPo

|

|

|

BitChick

Legendary

Offline Offline

Activity: 1148

Merit: 1001

|

|

December 09, 2013, 09:02:51 PM |

|

So I guess the "crash" has just moved us back to more "normal" growth at this point?

I guess the good thing is that each rise shows us that we are on our way to those new highs. It should give us some confidence of where Bitcoin is going anyways.

The problem is that the "crash" so far has not come even close the trendline. So either it was not a crash at all, or we will be visiting the trendline soon (down), or there is a new paradigm in bitcoin price (such as the one of growth spurts without deep crashes in 7/2010-6/2011). It quacks like a crash. So my bets are hedged whether to visit the trend or continue higher in a sense that invalidates the trend. I'm personally leaning toward the "revert to the trend" scenario, but suspect that it will get there mostly through time - rather than much greater price drops. Of course we could be seeing an acceleration of the trend with all the breakthrough acceptance BTC has achieved in the last month. If so I will be sad to let go of the current trend chart (even in exchange for a more aggressive line), as it has been very comforting to have next to my desk. But BTC keeps blowing my mind - and that is the name of the game - so I guess no reason to stop now. You just need a new and improved chart next to your desk showing growth to $1,000,000 next year.  Hey, it is probably more accurate then the $1300 potential value for BTC that Bank of America somehow came up with last week! |

1BitcHiCK1iRa6YVY6qDqC6M594RBYLNPo

|

|

|

|

BitchicksHusband

|

|

December 09, 2013, 09:14:50 PM |

|

If we truly are going to the "more vertical" part of the S-curve, there's a possibility that the growth is so fast that it goes toward parabolic rather than logarithmic. So we may be seeing that uptick OR we may be WAY ahead of where we should be still (although $500 seems VERY firm at this point).

|

1BitcHiCK1iRa6YVY6qDqC6M594RBYLNPo

|

|

|

godislove

Member

Offline Offline

Activity: 74

Merit: 10

Devout Atheist

|

|

December 09, 2013, 10:39:34 PM |

|

Using all data from MtGox from bitcoincharts, the trend is 1 doubling every 120 days, 8x in a year, or 0.571% per day. Also, the current expected value from the trend is $250. In an equation this gives:

$ = 250*1.00571days from today

$ = 250*1.186months from now

$ = 250*8years from now

Only 8 x 250 = $2000 next December. But I think the complete change in trust the past few month is a 1-time bonus that shifts the trend up without affecting the long-term growth rate. If $900 is fair right now, then the equation is

$ = 900*1.00571days from today

$ = 900*1.186months from now

$ = 900*8years from now

or 8x900 = $5,600 next December.

The theoretical limit is $1 million per coin based on the world money supply.

Imagine the influx if some banks want to hold it as an asset. All that Fed money buying up toxic assets has got to go somewhere. It has not been going to M2 which has been stable. They're just shoring up and dumping their toxic waste. The bank crime against taxpayers is on going, and people act confused as to why inflation is not higher. Banks are keeping it, not distributing it.

|

|

|

|

|

rpietila (OP)

Donator

Legendary

Offline Offline

Activity: 1722

Merit: 1036

|

|

December 09, 2013, 10:43:12 PM |

|

If we truly are going to the "more vertical" part of the S-curve, there's a possibility that the growth is so fast that it goes toward parabolic rather than logarithmic. So we may be seeing that uptick OR we may be WAY ahead of where we should be still (although $500 seems VERY firm at this point).

Where were we 30 days ago? Oh yes, $290, and just had crossed the ATH and everybody felt so good. Now, $912 seems "cheap" to them who would like it go to the moon before Christmas. There is still so much air in the bubble. Hard to know, which outcome I would like most, ch00 ch00 or orderly reversion to the trend. |

HIM TVA Dragon, AOK-GM, Emperor of the Earth, Creator of the World, King of Crypto Kingdom, Lord of Malla, AOD-GEN, SA-GEN5, Ministry of Plenty (Join NOW!), Professor of Economics and Theology, Ph.D, AM, Chairman, Treasurer, Founder, CEO, 3*MG-2, 82*OHK, NKP, WTF, FFF, etc(x3)

|

|

|

BitChick

Legendary

Offline Offline

Activity: 1148

Merit: 1001

|

|

December 09, 2013, 11:28:37 PM |

|

If we truly are going to the "more vertical" part of the S-curve, there's a possibility that the growth is so fast that it goes toward parabolic rather than logarithmic. So we may be seeing that uptick OR we may be WAY ahead of where we should be still (although $500 seems VERY firm at this point).

Where were we 30 days ago? Oh yes, $290, and just had crossed the ATH and everybody felt so good. Now, $912 seems "cheap" to them who would like it go to the moon before Christmas. There is still so much air in the bubble. Hard to know, which outcome I would like most, ch00 ch00 or orderly reversion to the trend. An orderly trend is just way too boring!  I guess boring is predictable though and there is some comfort to be had in that for sure. Strange as it might sound, most people would probably prefer a more orderly progression. Unpredictability is hard for most to stomach. |

1BitcHiCK1iRa6YVY6qDqC6M594RBYLNPo

|

|

|

Zangelbert Bingledack

Legendary

Offline Offline

Activity: 1036

Merit: 1000

|

|

December 09, 2013, 11:54:17 PM |

|

Not exactly a new paradigm, but if China had never exploded (in its own much faster exponential move) we would still expect the exponential trendline to hold. But China did explode and is now a major player. Unless we expect China to go back to where it was 8 months ago (x4 for slower exponential gain on the main trendline), shouldn't we count China's jump-in as a one-time bump to the trendline? Perhaps 30% up? That would mean we're still less than 2x the trend and could go much higher in this bubble.

|

|

|

|

|

Zangelbert Bingledack

Legendary

Offline Offline

Activity: 1036

Merit: 1000

|

|

December 10, 2013, 12:01:34 AM |

|

If we truly are going to the "more vertical" part of the S-curve,

The accelerating part of the S-curve is only ever exponential growth. It just starts to feel "vertical" to us humans at some point. It doesn't ever go faster than exponential growth (in the ideal curve). The first half is exponential growth and the second half is logarithmic leveling off. |

|

|

|

|

|