Feel free to post positive news about bitcoin in this topic, to help people stay positive.

Bitcoin in Brief Thursday: Big Money Wears Big Horns, Claws Are In the ClosetIn today’s Bitcoin in Brief we’re talking about big money and big expectations. While the ratio between bulls and bears is constantly changing in the crypto market arena, experts working with venture capital investments and large crypto trades report positive trends and share optimistic sentiments. On that backdrop, “Why is our digital society still using a yellow metal to store value?” is a good question.

Bitcoin to Reach $90k in Two Years, Potentially $700kThe future of Bitcoin was one of the hot topics at this year’s Sohn Investment Conference. The leading cryptocurrency is the first viable candidate to replace gold according to John Pfeffer, hedge fund manager at Pfeffer Capital. Bitcoin could rise to no less than $90,000 in the next couple of years, and potentially as high as $700,000, Pfeffer predicted during the annual event.

“We should think of crypto assets as a venture capital investment. They can go to 0, but there is a chance that they could be worth much more. In the case of bitcoin, it would be worth $90,000 if it became equal to private gold bullion holdings, about $1.6 trillion of total value compared to $150 billion or thereabouts today. It’s a bet, it’s a risk that I’ll be willing to take”, the investor told CNBC.

Click here to read more.

Be Positive

Markets Update: Cryptocurrencies Bring Bullish Gains This Spring

The top ten cryptocurrency positions on April 24, 2018.

Cryptocurrencies are breaking new price levels this week as markets are seeing gains across the board during the last two weeks of April. Yesterday’s trading sessions saw bitcoin cash touch a high of $1,560 per BCH as the currency has been on a relentless run over the past week. BCH prices are hovering around $1,477 at press time. Bitcoin core (BTC) prices touched a high of $9,410 but prices have dipped to the $9,340 range since reaching that vantage point. Overall there are quite a few digital assets seeing more significant gains than BTC as the spring trading season starts to melt the ‘crypto winter’ blues that recently plagued the community.

The Top Cryptocurrency Market PerformancesCryptocurrencies, in general, have done well over the last two weeks and the current momentum continues. BTC markets have seen a daily volume increase of $8.8Bn and a $157Bn market capitalization. However many other digital currencies have seen much bigger gains and BTC dominance is down to the 37 percent threshold today. Ethereum (ETH) markets are doing considerably well this week and are up 35 percent over the last seven days. One ETH is averaging around $695 per coin during the April 24 trading sessions. The third largest cryptocurrency valuation held by ripple (XRP) has seen seven-day gains around 37 percent. The market value of XRP today is $0.91 cents and markets command a $1.2Bn 24-hour trade volume. The cryptocurrency EOS has taken over the fifth top market capitalization as its markets have increased significantly this week. One EOS is hovering around $13.42 per token today with a $1.9Bn daily trade volume.

The Verdict: Crypto-Optimism is in the AirOverall cryptocurrency market participants are extremely pleased with the past week’s runups in value. However, some traders are still skeptical that we are out of the bear market range as there have been a lot of false positive rallies over the last four months. So far the verdict is many traders and digital asset enthusiasts are confident 2018 will be just as spectacular as last year.

Read more

here.

Be Positive

PR: Bitcoin of America Opening New BTMs in 5 Major U.S. CitiesThis is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.Chicago, IL: Bitcoin of America is happy to announce that they will be expanding their services in five major U.S. cities during the next four months. The company, which is headquartered in Chicago, IL, will be opening new Bitcoin Teller Machines — also known as BTMs, Bitcoin Kiosks, and Bitcoin ATMs — in Cleveland, Los Angeles, New Orleans, Philadelphia, and Washington D.C. The new machines will be in addition to currently available BTMs in Cleveland and Los Angeles. BTMs are designed to allow regular people to buy and sell digital currencies like Bitcoin without the need for an intermediary. Bitcoin of America already operates 32 BTMs in St. Louis, Los Angeles, Indianapolis, Detroit, Columbus, Cleveland, Chicago, and Baltimore.

While BTMs resemble traditional ATMs (Automated Teller Machines), they serve a very different purpose. Instead of providing you with access to your bank accounts, they can be used to buy and sell Bitcoin and other virtual currencies. With these machines, buying and selling Bitcoin is easy and convenient for the end user. A potential buyer can use cash or the Bitcoin Wallet app on their phone to buy Bitcoin without a bank account or debit/credit card.

Bitcoin is widely considered to be the first cryptocurrency, or digital currency. While there were earlier concepts for virtual currency, but they were never fully developed. The core idea behind these virtual currencies is to create a freely exchangeable form of money that is entirely digital and secured by encryption.

Interestingly, when Bitcoins first became available to the public in 2009, they could not be bought or sold like it is today. Instead, the virtual coins had to be “mined” and collected. As they were virtually worthless at the time, they system was thought of as a simple novelty by many. Over a year after the introduction of Bitcoin, they were used for their first ever “real-world” purchase when a Florida programmer bought two Papa John’s pizzas with 10,000 Bitcoins. Today, those 10,000 Bitcoins would be worth in excess of $67 million.

Read more

here.

Be Positive

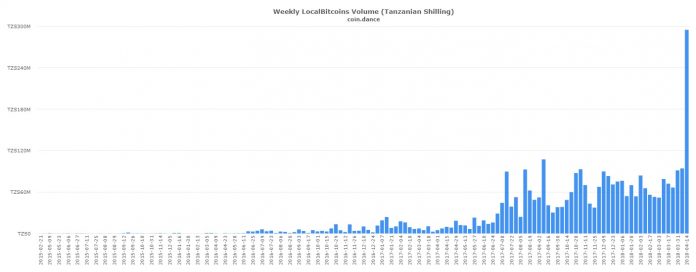

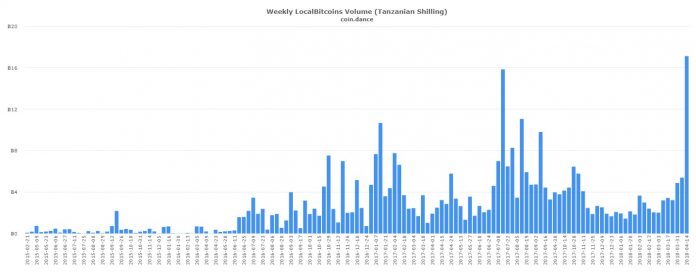

Tanzanian, Venezuelan, and Peru’s P2P Bitcoin Markets Witness Record VolumeThe trading volume for Tanzanian bitcoin pairings on Localbitcoins has spiked to establish a new record high this week. The sudden spike in volume has occurred after several months of increasing warnings regarding virtual currencies from Tanzania’s central bank. Certain South American markets have also seen spikes in trading activity, with Peru and Vietnam also seeing record trading volume this past week.

Record Trading Volume in TanzaniaThe Tanzanian peer-to-peer (P2P) markets on Localbitcoins have exploded this past week, with the markets producing record trading volume approximately three times that of its preceding fiat-valued volume record.

During the week of the 14th of April 2018, Tanzania’s P2P markets witnessed roughly 295,000,000 Tanzanian shillings (TZS), approximately $130,000 USD, worth of bitcoin change hands. The Tanzanian markets also set a record for the number of bitcoins traded in a single week (17) – with more bitcoin being exchanged in seven days than during the preceding four weeks.

Thirsty Whale or Response to Regulatory Concerns?

Thirsty Whale or Response to Regulatory Concerns?The spike appears to have occurred without a specific news catalyst, as no major events appear to have occurred with regards to Tanzania’s cryptocurrency sector in the last week. Tanzania’s central bank has, however, issued a number of statements regarding cryptocurrencies in recent months.

Last month, the Bank of Tanzania (BOT)’s director of national payment systems, Bernard Dadi, indicated that the central bank is currently researching different potential legislative models for the regulation of cryptocurrencies. “Bot is currently studying internet currencies with a view to finding a permanent regulatory solution […] The bank of Tanzania is, in the meantime, taking a cautious approach by warning members of the public on the risks associated with internet currencies,” Mr. Dadi said. “There is no mechanism to prevent the public from accessing cryptocurrencies outside Tanzania’s jurisdiction without blocking public access to the Internet,” he added.

In January, the Bank of Tanzania also described bitcoin as comprising a potential threat to the East African Community (EAC)’s plans to develop a regional currency.

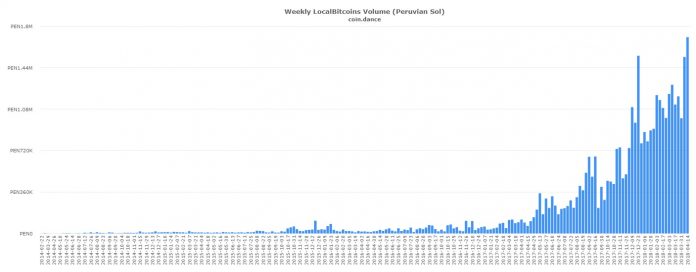

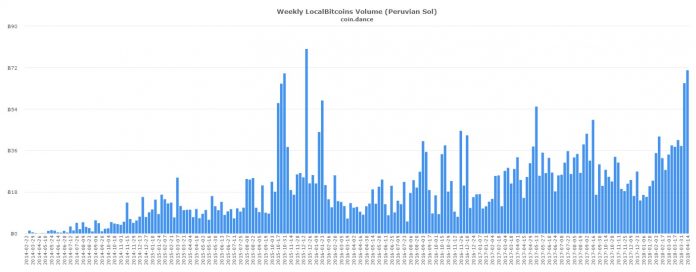

P2P Markets of Peru and Venezuela Witness Record VolumeTrading between the Peruvian Sol (PEN) and bitcoin on Localbitcoins spiked to set a record of 1,704,657 PEN (approximately $530,000 USD) this past week.

The spike saw roughly 71 bitcoins exchange hands – which is the second highest number of bitcoin traded for PEN in a single week on Localbitcoins. The record was set during December 2015, when 80 bitcoins were traded for PEN – then equating to just $36,800 worth of trade.

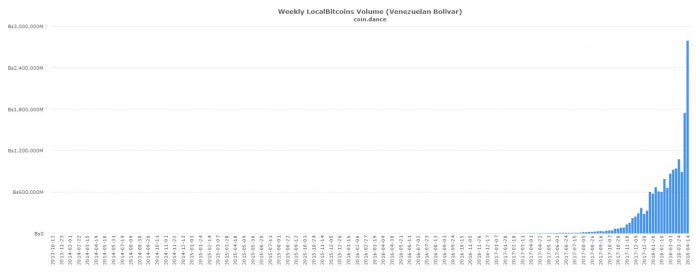

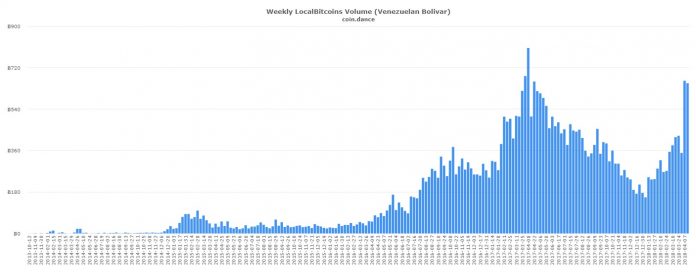

Venezuela’s P2P bitcoin markets have continued to produce accelerated momentum, establishing a new record for weekly trading volume for the sixth time in seven weeks when measured in Venezuelan Bolivars (VEF). 2,789,991,957,138 VEF was traded this past week, dwarfing the preceding week’s record of 1,744,669,576,098 VEF.

Venezuelan Volume Records Representative of Bolivar Hyperinflation

Venezuelan Volume Records Representative of Bolivar HyperinflationIn many instances, Venezuela’s recent P2P trading volume highs (when measured against VEF) have been more indicative of the extremity of the hyperinflation besieging the nation than it has surging demand for bitcoin.

When measuring Localbitcoins trade volume in BTC, one can see that the 652 bitcoins traded comprised a slight decline from 663 bitcoins traded during the prior week of the 7th of April. Whilst the price of bitcoin has increased by approximately 22.3% since April 7th, such does not account for the approximately 60% increase in trade volume when measured against VEF.

SourceBe Positive

SourceBe Positive

16 Government-Approved Crypto Exchanges Have Formed Self-Regulatory Group in JapanA new association has been registered in Japan consisting of 16 government-approved cryptocurrency exchanges. The group will focus on establishing self-regulatory rules and will have the authority to investigate and sanction members that do not comply with self-regulation.

New Japanese Crypto AssociationA new cryptocurrency organization has been registered with the Japanese Financial Services Agency (FSA), consisting of 16 crypto exchanges that have been approved by the agency, according to local media.

The Japan Virtual Currency Exchange Association recently held a general meeting, during which a director was chosen, Jiji Press reported.

The group plans to “elect Taizen Okuyama, President of Money Partners as Chairman” at the next Board of Directors meeting which will be held on April 23. The association will be formally launched on that date.

The news outlet quoted the new group explaining that they aim to establish rules for their member exchanges, and as an organization, will have the “authority to investigate and banish member companies.”

Founding MembersThe Japan Virtual Currency Exchange Association’s founding members are the 16 fully licensed exchanges operating in Japan. They are Bitflyer, Money Partners, Bitbank, Bitpoint, Quoine, SBI Virtual Currencies, Fisco Virtual Currency, Btcbox, Zaif, GMO Coin, Bittrade, Tokyo Bitcoin Exchange (DMM Bitcoin), Bitarg Exchange Tokyo, FTT Corporation, Xtheta Corporation, and Bitocean.

Japan already has two existing associations in the crypto space: the Japan Blockchain Association (JBA) and the Japan Cryptocurrency Business Association (JCBA). The former is headed by Bitflyer CEO Yuzo Kano and the latter by the president of Money Partners Group.

The new association will be a member of both the JBA and the JCBA, both of which will continue to operate, according to the news outlet. Some crypto exchanges are members of both associations, such as GMO Coin and Coincheck.

While all members of the new association are FSA-approved exchanges, members of the JBA and the JCBA also include “deemed dealers,” which are exchanges the agency allows to operate while their registrations are under review. Coincheck, which was hacked in January, falls into this category.

The FSA is currently strengthening its rules for deemed dealers. Masashi Nakajima, Professor at Reitaku University, who participates in the agency’s research group, pointed out that most users did not know that Coincheck was unlicensed, Sankeibiz conveyed. “I ask for a mechanism that is easy to recognize at a glance” to indicate that an exchange is still unlicensed such as a posting on the exchange’s website, he was quoted.

SourceBe Positive

Australia Introduces AML/CTF Requirements for Cryptocurrency ExchangesAustralia’s new legislative guidelines for the operation of cryptocurrency exchanges were introduced on the 3rd of April 2018. From now on, Australian digital currency exchange businesses will be required to register and comply with anti-money laundering/counter-terrorism financing (AML/CTF) laws.

Australia’s new regulative apparatus pertaining to cryptocurrencies has formally been adopted as law, mandating that digital currency exchange businesses comply with the country’s AML/CTF requirements.

Cryptocurrency exchanges must now register and report to the Australian Transaction Reports and Analysis Centre (AUSTRAC). AUSTRAC has issued a document outlining the primary obligations of digital currency exchanges under the new guidelines.

In addition to “adopting and maintaining an AML/CTF program to identify, mitigate and manage money laundering and terrorism financing risks,” Australian virtual currency exchanges must “identify” and “verify” the “identities of their customers,” keep “certain records for seven years,” and report “suspicious matters” and “transactions involving physical currency of $10,000 or more” to AUSTRAC.

Transitional Registration Arrangements in Place for Existing ExchangesAUSTRAC states that “A ‘policy principles’ period of six months will be in place from 3 April 2018” – during which “the AUSTRAC CEO can only take enforcement action if a DCE business fails to take ‘reasonable steps’ to comply.”

The six month period will also see “Transitional registration arrangements” made available to “existing businesses to allow them to continue providing services while their registration application being considered.” Existing digital currency exchange businesses will need to register for the transitional registration arrangements by May 14th. AUSTRAC warns that the unregistered provision of digital currency exchange services will suffer “criminal offense and civil penalty consequences.”

Last week, the Australian Taxation Office (ATO) announced that it is seeking public consultation from citizens regarding how the ATO should “approach specific tax events.” The ATO, which has been drafting legislation for the taxation of cryptocurrencies, stated that it has “launched a community consultation to help us understand practical issues experienced when complying with cryptocurrency tax obligations.”

SourceBe Positive

THE BITCOIN PRICE IS GAININGBitcoin Approaches $7,500 Again Thanks to Surprising Positive TrendIt is rather strange to see all cryptocurrency markets in the green as of right now. Given the negative market sentiment throughout the past few weeks, it has become evident there may not be any major gains on the horizon. Even so, all markets are recovering slowly. With the Bitcoin price heading to $7.500 again, things will undoubtedly get very interesting.

Everyone should be aware of how the Bitcoin value determines all prices in the world of cryptocurrency. If the Bitcoin price drops, all altcoins will suffer. When the Bitcoin value goes up, altcoins will benefit as well, albeit usually in less spectacular fashion. As such, the market needs a healthy Bitcoin price increase before all of the cryptocurrencies can effectively see a proper bullish trend.

Even so, the Bitcoin price is currently heading in the right direction. With a small push, one might even see a value of $7,500 again later today. This is in stark contrast to the Bitcoin price of nearly $6,400 just a few days ago. Industry experts know this bearish trend is only temporary and the market will reverse course eventually. Whether or not this is happening already, is difficult to predict at this point.

Thanks to this solid 4.99% gain over the past 24 hours, things are looking up for the Bitcoin price for the first time in a while. Albeit this may only be a temporary reprieve before the bears take control again, it may also herald a more positive trend for cryptocurrency in general. There is no specific reason as to why the Bitcoin price would remain below $7,00 other than through sheer market manipulation.

coinmarketcap.com

It appears the Bitcoin trading volume is also picking up once again. With $5bn worth of trades in the past 24 hours, the demand for Bitcoin has not diminished by any means. However, this is still a long way removed from the Bitcoin trading volume people saw in late 2017. It is possible such high trading volume materializes again at some point, but for now, it remains unknown how things will play out.

The market is dominated by Bitfinex, which still generates most of the trading volume. Its lead over OKEx has shrunk a tiny bit, though, and Binance is not all that far behind either. What is rather unusual is how there is only one South Korean exchange in the top five. Bithumb barely makes the top ten, which seems to indicate that market is still on the fence as far as BTC is concerned.

How all of this will play out in the near future, remains to be determined. It is evident people have grown tired of the ongoing Bitcoin price decline, but the market can negative this positive trend quick quickly. All gains need to be taken in stride, though, and speculators simply have to hope this is the positive development people have been waiting for throughout most of 2018.

SourceBe Positive

Positive news about BTCAbove $7,000: Bitcoin Eyes Gains After Death Cross FailsIn Bitcoin We Trust

Despite having witnessed a so-called "death cross" over the weekend, bitcoin (BTC) is now eyeing gains above the $7,000 mark.

The much-feared technical indicator (bearish crossover between the 50-day moving average (MA) and the 200-day MA) was confirmed over the weekend, but, as anticipated by CoinDesk, the oversold conditions seem to have put a floor under bitcoin prices.

As of writing, CoinDesk's Bitcoin Price Index (BPI) is seen at $7,040, having clocked a 54-day low of $6,443 on Sunday. Meanwhile, the cryptocurrency was last seen changing hands at $7,060 on Bitfinex - up 9.88 percent from the previous day's low of $6,425.

The recovery is pretty much in line with the historical pattern, which shows that bitcoin tends to regain poise every time the relative strength index (RSI) drops to or below 30.00.

Daily chart

As seen on the daily chart prices as per Bitfinex) above, the RSI fell to 30.00 on Friday, signaling oversold conditions. Further, the death cross was confirmed on Saturday, but did not do significant damage to bitcoin's price.

It's worth noting that the death cross looked pretty unconvincing before it occurred, i.e. the 50-day MA turned neutral (flatlined) a week ago and remains neutral after the bearish crossover, validating the argument put forward by the daily RSI that BTC is oversold. A falling 50-day MA pre- and post-crossover could have brought in a lot of technical sellers.

Further, the cryptocurrency has successfully defended the key ascending trendline seen on the weekly chart below.

Weekly chart (linear scale)

Bitcoin avoided a break below the confluence of the ascending trendline and the rising (bullish biased) weekly 50-MA, amid oversold conditions.

So, it appears the cryptocurrency has made a short-term low at $6,425 and could visit $7,500-$7,600 in the next few days, as indicated by the bullish-RSI divergence on the chart below.

4-hour chart

BTC has breached the descending trendline, but only a clear break above $7,100 (channel resistance) would add credence to the bullish RSI divergence and allow a rally to $7,500-$7,600.

That said, further gains are ruled out in the short-term, because the 10-day MA is biased to the bears (sloping downwards).

Daily chart II

In the chart above, the 5-day MA and 10-day MA are bearish, and a sustained rally to $8,000 and beyond is only likely after they have bottomed out.

ViewBTC seems to have made a temporary low at $6,425. A clear break above $7,100 could yield a rally to $7,600.

Further gains cannot be ruled out, but will likely happen only after the 5-day MA and 10-day MA have shed bearish bias.

On the downside, $6,425 is an immediate support, which if breached, would allow a re-test of the February low of $6,000. However, the bears will have a tough time taking out support $6,425, courtesy of short-term oversold conditions.

SourceBe Positive

Ways to Profit in a Crypto Bear MarketBear Markets Are Best Markets

There’s an assumption, among less experienced traders, that once your altbags are underwater, there’s nothing to do but wait it out. Take up fishing; join a gym; kill some time until more favorable conditions return. Not so. Following the giddy euphoria of daily all-time highs, level-headedness returns. Clear thinking prevails when hype has been hustled out of town. While some of the following strategies call for experience, the majority require little more than a willingness to study. Put in the hours now and when the running of the bulls resumes, you’ll be at the head of the pack.

Bitcoin doesn’t need to move up for you to profit – it just needs to move. Any which way is good provided you can identify the trend. The shorter the time frame, the greater the risk of getting liquidated – but the quicker the payday. The likes of Bitmex and Okex offer futures as well as perpetual contracts that are funded every eight hours. Beware of futures trading altcoins such as ripple and litecoin, because bitcoin chooses the tune the rest of the market moves to.

Give Margin Trading a GoMargin trading is basically futures on steroids. Crank up that leverage all the way to 100x if you’re feeling foolhardy or supremely confident. The rewards for mastering margin trading are huge: Bitmex’s top two traders have amassed 7,000 BTC between them. They’re exceptions though. In conventional cryptocurrency trading, you get to keep the coin, even if its BTC value sinks. With margin trading, the margin for error becomes wafer thin the higher you crank that leverage, and the penalty for failure is liquidation.

Brush Up on Technical AnalysisIf there’s one thing a bear market’s good for, it’s homework. While the benefits bestowed by technical analysis (TA) can be debated, no trader in their right mind would consider margin or futures trading without a basic understanding of it. Start with the basics such as moving averages and RSI, and then move on to ichimoku, fibonacci, and all the rest. Bitmex’ testnet is your playground for experimenting with indicators without getting rekt.

Most crypto traders have lives away from the soft glow of dual Tradingview monitors, and it’s unlikely you’ll have the time and skill to become a TA pro. Getting a feel for the basics will help you time your entries and exits better, however, and when the markets turn green, you’ll stand a better chance of selling near the top instead of falling for the hodl meme and suffering another 70% retracement.

Scalp Your Way to Profit

When the markets are capricious, there’s money to be made in creaming profits off small price movements. Scalping is a smash-and-grab job that requires little other than free time and a willingness to grind it out through frequent buying and selling. Like all trading strategies, scalping is not without its risks. All it takes is one major fail for your hard day’s haul to be undone.

Dig for Hidden Gems

Everything’s cheap in a bear market, but just because a coin’s cheap doesn’t mean it has value. Thanks to the low volumes and depressed prices, there’s no need to rush into trades. Instead, take your time to research projects that are undervalued and have the potential to 10x or greater when the market rebounds. Examining coins that have dropped 70% or more from their all-time high will reveal, amidst all the dross, a handful that have been unfairly hammered.

Most crypto traders are impatient, and sometimes a coin is languishing simply because the crowd has lost interest while the platform is under development. Monitor the social feeds and Github repositories of projects you like to learn when their mainnet is due to launch.

Play ICO Detective

Market shakeouts are great for separating the wheat from the chaff, especially when it comes to ICOs. In early January, any piece of vaporware was guaranteed to hit its cap. With many tokens trading at a loss the moment they hit an exchange, investors now have to be savvy. Instead of FOMOing into some 5/10 crowdsale that’s ending tomorrow, save your ether and put your time into investigating projects whose sale is still months away. Read their technical documentation, Google the team, and pore over their token use cases. Just as experienced traders can spot a bear trap when they see one, experienced ICO researchers can spot a winner long before the crowds have caught on.

Get a Job

If crypto trading’s stopped paying the bills, perhaps it’s time you got a job. No, not a McJob – a crypto job. There are still loads of companies hiring because they, like the bulk of the crypto community, are confident that these bearish conditions are only temporary. The best thing about working in crypto, even if the job’s not particularly glamorous, is you’re likely to get paid in crypto. Then, when bulls come out to play again – whaddya know – suddenly that cryptocurrency you’ve earned is worth a whole lot.

SourceBe Positive

Despite Bitcoin's 'Sell-Off' The Cryptocurrency Space Continues To Attract Investors Bitcoin's price evolution shown over the past one year to February 2, 2018. Having soared to around $19,000 in mid December last year, the price of the digital currency had declined to around $7,000 by the start of this April. (Source: Bloomberg).

Bitcoin's price evolution shown over the past one year to February 2, 2018. Having soared to around $19,000 in mid December last year, the price of the digital currency had declined to around $7,000 by the start of this April. (Source: Bloomberg).Volatility, volatility, volatility. Traders certainly love it. But the volatility witnessed of late among many leading cryptocurrencies - including the ‘Big Daddy’ of them all in the shape of Bitcoin as well as Ethereum - has been a "double-edged sword" according to some pundits. Price swings can occur dramatically and result in big profits, should you catch it right.

Equally, significant losses can be sustained should your timing be all awry, there is negative newsflow around the crypto space and/or particular digital currencies.

Bitcoin’s Halcyon Days?One might say you pays your money and takes your chances in the “Wild West” of crypto land. More succinctly, caveat emptor (buyer beware). And, according to Jordan Hiscott, chief trader at ayondo markets, a brokerage in The City of London, in a note from last week (March 27) said: “Certainly the halcyon days of performance gains [for Bitcoin] from 2017 seem long gone.”

Bitcoin moved lower early last week on Tuesday and was trading at around the $7,900 mark. However, this was in stark contrast to the level of $13,275 at the start of 2018. Hiscott’s view expressed at the time in late March was that the situation around the current soggy price level could persist for “at least six months.”

He added: “My theory is based around the situation regarding the liquidation of the Mt Gox Exchange, and the appointed trustee to handle the bankruptcy. Colloquially, this individual is known at the "Tokyo Whale", and having already sold around $400 million worth of both Bitcoin and Bitcoin Cash, he is likely the main catalyst for this year’s move down.”

Interestingly, there still remains around three times that amount of Bitcoin to potentially to hit the market. “With this kind of volume yet to surface, in my view, prices on Bitcoin will remain depressed until this situation has been resolved,” ayondo’s Hiscott posited.

New InvestorsThe wild run on the crypto scene starting from late last year may have created a few sob stories for new investors, as those who bought in during the all-time highs are likely to have incurred losses due to February’s massive correction. Some might even be ruing the day they ever decided to dive in and invest.

In fact, recent statistics indicate that most people who got into bed with and invested in Bitcoin did so at a significantly higher price than the current market price, which is now well below the $10,000 market. This is a remarkable turnaround.

Having reached just slightly north of $19,000 a pop on December 17, 2017, in a something of a feeding frenzy from the month before (seeing the currency’s value almost quadruple from $5,857.32 on 12 November), Bitcoin’s price retreated and has fallen back to around $6,500 as of today (April 1) - and that’s no joke. Since the peak it equates to a decline of 65% in a matter of fifteen weeks.

Bitcoin was not alone in seeing a price a substantial correction from its peak.

Ethereum’s price, which was standing at around $366 as April 1 is down from over $1,330 - the currency's peak - reached on January 14 this year, while it’s a similar picture declining prices from their highs for Bitcoin Cash, Litecoin and Ripple.

Source: CoinDesk Inc. Prices in US dollars as of April 1, 2018, 15.20 UTC.

There were stories that many had invested using their credit cards. And, some plucky investors even re-mortgaged their homes. What they are thinking now is anyone’s guess. But if you play high risk markets then there is also the possibility of getting burned big time.

And, if there is one lesson from all this, it is not to believe in all the hype that surrounded cryptocurrencies when the prices were getting pretty frothy and frankly some people were getting ahead of themselves.

This was especially so just prior to Bitcoin futures being traded on the Chicago derivative exchanges, the CBOT and CME. Between the point when it was announced late last October that futures in the cryptocurrency would commence during the fourth quarter 2017 - until Bitcoin’s peak in December - the price had surged by 211%. And, now for Bitcoin we are broadly back at those levels seen when the announcement was made first disseminated to the market by the CME.

Looking back it was unrealistic and unsustainable to expect Bitcoin and other leading cryptocurrencies to continue their explosive runs - ever upwards. And, while not wishing to say I told you so, it is something I had pointed out in some of my previous posts on Forbes. Namely that it didn’t exactly look too healthy or sustainable. Some out there think though there will be correction upwards to where it was before and well beyond, given the recent trading lows over the last 50-day trading period.

Now there has been a tightening of regulations. One of the latest examples being from the European Securities and Markets Authority (ESMA), the Paris-based financial regulator, with its communique on 26 March concerning leverage on derivative products related to cryptocurrencies amongst other financial products. Regulators in South Korea and China have also weighed in with pronouncements on bans for Initial Coin Offerings (ICOs) and other crypto prohibitions over recent months.

It was fortunate perhaps that the latest G20 meeting in Argentina did not bear down on the crypto space as they could have, which had been flagged up as a distinct possibility by French and German central bankers along with Mark Carney, Governor of the Bank of England and head of the Basle-based Financial Stability Board (FSB).

Investor Appetite?All of this, however, does not appear to have dampened investors’ drive to be part of the crypto space. Hundreds of millions of dollars in tokens continue to be traded on exchanges. ICOs also continue to rake in the big bucks. Indeed, just three months into 2018 and $4.8 billion in funding has already been raised through various token sales so far.

Blockchain is widely considered to be the next disruptive technology. As such, many believe that the crypto space is a high-potential growth area that could provide massive returns of investment. For early adopters of coins like Bitcoin and Ether, it most definitely has. Although for later ones the jury is out.

As pointed out above, if you bought when the mania gripped at the end of last year you will be nursing a hefty loss. Of course, one might see this as ripe time to buy back in and average out your crypto holdings.

Even established companies are making their respective plays in crypto investing. Trading platform eToro recently secured $100 million in a Series E funding round to support its global expansion and further support of crypto and blockchain. The platform already supports major tokens including Bitcoin, Ether, Litecoin and Ripple.

But the funding round hints at the adoption of blockchain technology for its own use. Crypto exchange Poloniex was also recently bought by Circle, a fintech firm backed by Goldman Sachs, which underscores how traditional institutions acknowledge crypto’s impact.

Such developments only help inspire investor confidence, or so some pundits argue. And, even if coins remain far from their all-time highs, backers continue to stake in blockchain and crypto.

And, in that vein here are five reasons as to why the crypto space still continues to encourage more investors to participate.

1. The Promise of BlockchainIt’s tough to argue against blockchain as a technology since there is value in the immutable and transparent record keeping that it provides. But it should be pointed out that Blockchain projects and their protagonists have had a nasty habit of over promising and underdelivering. And, the number of ICOs that failed to deliver in 2017 isn't exactly something to shout about.

Several projects though have already made headway in the areas of finance, healthcare and security. Blockchain’s distributed nature also helps mitigate security and reliability issues that plague other technologies.

Blockchain’s appeal is even bolstered by the emergence of smart contracts and cross-chain interoperability. The possibilities for developing new applications based on blockchain now seem boundless according to the view of some. Because of this, there is no shortage of new and promising ventures building their projects on blockchain.

And, I for one can certainly vouch that hardly a day passes when I do not receive a slew of press release ICO launches in the crypto space. It seems never ending.

Traditional institutions and large enterprises are also committed to adopting the technology. Even banks are forming consortia that would enable them to use blockchain for their various services. Due to this demand, IT providers like IBM and Microsoft are even compelled to offer blockchain-related products and services and blockchain-as-a-service.

2. Unicorn PotentialThis next wave of tech companies is attempting to bring disruption to a variety of verticals. New projects have now extended beyond blockchain’s typical use cases and have found their way even in sectors like social networks, media and gaming - all of which are billion-dollar industries.

Casting a wider net could help these ventures catch bigger fish. And, for investors, backing such companies early on could deliver significant returns down the line.

Some may be labeling this boom a bubble, in much the same way as happened with a whole host of dotcom ventures back in the naughtiest (2000’s). While this may be true in some regard, one should not dismiss the likelihood that winners can emerge - even if the bubble bursts.

And, in hindsight, who would not have wanted access to Google or Amazon stocks at pre-IPO or at IPO prices? There is always a chance that this slate of crypto-based projects may include future unicorns.

3. Early “In”Clearly, not everyone is a venture capitalist (VC) or an angel investor who could find early “ins” to startups. This typically requires a certain amount of clout and reputation in the business community as well as significant wealth in the war chest. The only way ordinary people were able to invest in new companies was to wait for a public offering.

Today, ICOs have allowed just about anyone to invest early in new projects. ICOs now generates 3.5 times more capital than VC funding. This is largely due to how ordinary investors could invest even relatively small amounts right at the start, based on the promise of returns once the token hits exchanges or when the venture eventually flies.

4. Fundamentals Start to MatterMore investors are also realizing that they should not be rash in spending their money on any ICO that comes their way. It does take disciplined due diligence to spot potential unicorns. But even a good idea does not necessarily come to fruition until the service goes live and the market takes to it.

Fortunately, more investors are learning to look into a project’s fundamentals. The uniqueness and value of the concept, the token economy, the potential for target verticals to be disrupted by the technology, the strength of teams behind the projects, and other factors are now being considered by investors.

This rising focus on fundamentals can eventually help minimize speculation and the market’s volatility and even encourage traditional investors to participate.

5. Global ReachTraditional investing has largely been geographically limited due to the regulatory constraints. ICOs, however, have opened up the game, allowing investors from all over the world to participate. This is also becoming increasingly easy given how established platforms are supporting more cryptocurrencies.

While some countries have already put up stringent regulations to limit and even ban crypto investing, many countries still only advise their citizens to be cautious when investing in crypto. Investors from these certain countries are otherwise unbridled to trade cryptocurrencies.

Risks and RewardsAt the end of the day, investing as a financial activity entails risks and rewards. While crypto investing seems to carry more risk due to the technology and space’s infancy, the rewards can also be significant.

Fortunately, the crypto space appears to be headed - some believe - towards normalcy as regulation and a focus on fundamentals are helping lessen speculation. Increasing support by traditional trading platforms and the participation of other established organizations also helps bring legitimacy to crypto activities, which ultimately should inspire investor confidence.

Add to all this, the space continues to make significant money. And, as long as this is the case, it will continue to attract enterprising parties from all over. But watch this space.

SourceBe Positive

Bitcoin Price Prediction 2018: Can cryptocurrency hit $50,000 this year? -Bitcoin News Today – Sun Apr 1Can Bitcoin hit $ 50,000 this year? While most of the cryptocurrencies are much below their earlier highs but there are newer and newer predictions coming up for cryptocurrencies. One such prediction is that Bitcoin can rise to as high as $ 50,000 in the calendar year 2018.

A cryptocurrency portfolio manager by the name of Jeet Singh, stated at World Economic Forum in Davos, that the current volatility is completely normal when it comes to the cryptocurrencies space. He also stated that it is normal for cryptocurrencies to fluctuate by 70% to 80%. This is one of the main reasons why the current volatility does not worry him at all.

He compared cryptocurrencies to the current bellwether companies like

Microsoft as well as Apple. Initially,

their stocks were also pretty volatile. However, as the companies develop their business model, the stocks not only rose but they become much more stable as well.

However, many of the investors are actually currently worried due to the high volatility in cryptocurrencies. According to him, however, long-term investors need not fear the volatility at all. Since they are here to stay for a longer period of time, they would have no problem at all in holding the cryptocurrencies for a longer period of time as well.

He further added that Bitcoin would reach as high as $ 50,000 this year. If indeed that happens, the current price of Bitcoin being around just $ 10,000, that would be a fivefold increase once again.

Whether the portfolio manager is right or wrong, only time would be able to tell. The truth is that currently, many of the investors are worried about putting new money into Bitcoins. Only once they are sure that the volatility would end and the Bitcoin resumes its uptrend you can be sure that most of the investors would actually get ready to invest in this cryptocurrency.

For now, however, most of the investors are keeping away from the cryptocurrency boom. Many of the investors are just holding their holdings patiently in order to find out whether the cryptocurrencies resume their uptrend or not. It is still too uncertain for most of the investors to take a call. On the other hand, institutions are increasing their presence in the cryptocurrencies pace as well which is sure to benefit the cryptocurrencies space and would add value and credibility to the cryptocurrencies in the future as well. This is one of the main reasons why it is not seeing further fall after creating a bottom few weeks back. Also, once the regulatory hurdles are sorted, you can be sure that the value of cryptocurrencies would again more.

tags: bitcoin price prediction today usd, bitcoin forecast 2018, bitcoin price prediction chart, bitcoin forecast 2020, bitcoin forecast 2017, bitcoin price prediction 2019

Surely, Bitcoin is headed up – John McAfeeJohn McAfee, Bitcoin supporter and founder of the popular McAfee antivirus software, is being very positive about Bitcoin. He predicted that Bitcoin price will hit $1 million by 2020 following last year’s prediction of $7000 which was well surpassed.

Bitcoin Price Prediction Tracker portal, Bircoin.top, did the maths and explain that Bitcoin needs to grow daily at 0.4840957034310259% per day.to meet McAfee’s prediction. Currently, Bitcoin is around $ 8,207 compared to $ 7,171. Cool right? However, to hit McAfee’s target, BTC would end the year just over $29k.

“BTC has accelerated much faster than my model assumptions. I now predict Bitcoin at $1 million by the end of 2020. I will still eat my d**k if wrong” – John McAfee

Apart from the economics behind the limited supply of Bitcoin, his prediction considered the factors like the increased adoption of Bitcoin and blockchain as well as a total cryptocurrency’s market cap around $162 billion which gives large room for growth.

“I think Bitcoin will be worth a tiny fraction of what it is now if we’re headed out 10 years from now…I would see $100 as being a lot more likely than $100,000.” – Kenneth Rogoff

Rogoff’s prediction is based on his long-held belief that governments will rise against anonymous virtual currencies like Bitcoin. Government regulations, according to Rogoff, will pop the Bitcoin bubble but a Bitcoin pioneer on Wall Street thinks along very different lines.

“We expect bitcoin’s major low to be $9,000, and we would be aggressive buyers around that level,” – Tom Lee

Though Bitcoin went below Lee’s base of $9,000 (nearing $6,000), it has bounced out reaching in March $11,000. It will take a ride similar to the one we witnessed last year for Bitcoin to reach this mark. To make this happen, Lee is counting on more institutional investors taking on Bitcoin and a steady increase in Bitcoin user base. Lee’s target may be half the mark according to fellow crypto-believer.

Volatile Bitcoin to touch $50,000 – Jeet Singh (cryptocurrency portfolio manager)Speaking in January at the World Economic Forum in Davos, experienced cryptocurrency fund manager, Jeet Singh predicted that the price of Bitcoin will go as high as $50,000. He warned of heavy price fluctuations which he believes is only normal for a Bitcoin market that is still maturing.

Bitcoin could definitely see $50,000 in 2018…We will probably go through a suffering period of volatility around the time of Bitcoin’s next $10,000 landmark.” – Jeet Singh

Just like Lee, Singh expects Bitcoin to be adopted not just in the black market but by institutions and entire countries. If 50k seems too optimistic, how about 100k from the “Nostradamus of Markets”?

Bitcoin is the future; Fiat is Past – (Tim Draper, Venture Capitalist)In 2014 with bitcoin at only $413, popular VC, Tim Draper predicted bitcoin to reach $10,000 in three years. This was fulfilled a month earlier than he predicated earning him a reputation among crypto fans. Though he didn’t categorically, predict a $100k Bitcoin in 2018, He said he expected the Bitcoin to continue its growth in an interview with Bloomberg last year. Tim Draper has made successful bets with Tesla, Skype, and Twitter in the past.

Assuming this growth happens at the same pace as the 3-year journey to $10k then we’re in for six digits. Maniacal right? That’s exactly how Draper feels about Bitcoin prospects. Now onto someone who understands a lot about bitcoin’s foundation.

Bitcoin will hit $ 40,000 – Llew Claasen (Executive Director, Bitcoin Foundation)Last month, Llew Classen made a bold statement to reassure Bitcoin believers that the cryptocurrency is on the right track –specifically, on track to reach the $40,000 mark. Though his outlook for some altcoin holders was not very encouraging, he made it clear that as something new, cryptocurrency will be as risky as it is exciting.

Bitcoin to pass $43K by December 2018 – (Survey by Finder.com)Finder.com sought opinions of 13 cryptocurrency experts and concluded that Bitcoin price will witness a 300% growth to land at $43,000 by the end of the year. The site also predicted Bitcoin at over $14K by March 1.

“While we saw the top 10 coins dive by 24 percent last month, our survey shows panelists are expecting this to be a bump in the road as these coins are set to recover.” – Jon Ostler, UK CEO, finder.com

Ostler noted that the predictions were not cast in stone as they can easily be swayed by “outside factors such as regulations, laws, and banking systems”

Bitcoin Will hit $320,000 someday – Cameron Winklevoss (co-founder, Gemini)One of the popular Winkelvoss twins, Cameron Winklevoss recently said that he could easily see the price of BTC go up 40% someday. This year maybe? Not likely. The twin said he and his brother were taking longer outlook, 10 to 20 years.

“Bitcoin is actually fixed in supply so it’s better than scarce … it sort of equals a better gold across the board. We think regardless of the price moves in the last few weeks, it’s still a very underappreciated asset.” – Winklevoss

The fourth wealthiest cryptocurrency investor weighed bitcoin’s prospect against gold and came up with a resounding verdict.

“We believe bitcoin disrupts gold,” He said.

Bitcoin will reach $1million – Bobby Lee (CEO BTCC Exchange)Bobby Lee, CEO of China’s first Bitcoin exchange speaking at the London Blockchain Week went overboard with his prediction. Lee said bitcoin will surpass $1 million but unlike McAfee, he could see this happen in 20 years’ time.

“Bitcoin, I think will get to $1 million per bitcoin…Right now it’s 10,000, it will go 100,000 and then 200,000, 500,000.” – Bobby Lee

IN SUMMARYA good number of analysts have also had their say though very few would be drawn into actual predictions. We observed a general trend in their assessments.

I too believe that bitcoin will hit $50,000.00 by the end of 2018.

Expect Price Fluctuations:At this stage, bitcoin and cryptocurrencies will be greatly affected by speculations. Even small developments in governments, traditional will likely affect prices. Most say the fluctuations are normal and wouldn’t affect the longer term outlook.

SourceBe Positive

Looking Ahead to $20,000 BitcoinIn last week’s Investor Alert, our investment team shared with you a report from Morgan Stanley that says bitcoin’s price decline since December mimics the Nasdaq tech bubble in the late 1990s. This isn’t earth-shattering news in and of itself. The main difference is that the bitcoin rout happened at 15 times the rate as the tech bubble.

Morgan Stanley has some good news for bitcoin bulls, however: The 70 percent decline is “nothing out of the ordinary,” and what’s more, such corrections “have historically preceded rallies.” Just as the Nasdaq gained back much of what it lost in the subsequent years—before the financial crisis pared losses even further—

bitcoin could similarly be ready to stage a strong recovery.One research firm, in fact, believes bitcoin and other digital coins, or “alt-coins,” have likely found a bottom. New York-based Fundstrat, headed by strategist Thomas Lee, issued a statement to investors last week saying that, though a cryptocurrency bull market isn’t necessarily underway, the worst of the pain could be “largely over.”

Take the Long-Term ViewIt’s helpful to compare bitcoin with Nasdaq, as Morgan Stanley did, but what about comparing the current cycle with one from the past?

In June 2011, bitcoin peaked at nearly $30 and found a bottom of $2.02 five months later, in November. It would be an additional 15 months before it returned to its former high. This might seem like a long time to some, but investors who managed to get in at the bottom would have seen their position grow more than 1,300 percent.

But I remain bullish. Cryptocurrencies are still in their very early stages. To return to the comparison with tech stocks, we don’t know at this point which digital coins will be tomorrow’s equivalent of Amazon, Google, Apple and Facebook. A long-term view is key.

Finally, I still believe in the power of Metcalfe’s law, which says that as more and more people adopt a new technology—cell phones, for instance, or Facebook—its value goes up geometrically. A poll conducted in February shows that just under 8 percent of American adults report ever owning or purchasing any cryptocurrencies.

Market penetration, then, hasn’t been as pervasive as some might expect, but as people increasingly become more confident in dipping their toes in the space, demand could rise and, with it, prices.SourceBe Positive

More and more positive news needed now to overcome the price fall because the price keeps falling continiously

That is why I made this topic for us to compile positive News about bitcoin; with this, we can show some light to our community. Some members do not have enough time to read the News, and most of it are negative, which greatly affects our emotions towards bitcoin inability to rise again. Always remember, “Positive thinking leads to positive outcomes”.

If you have any positive news, kindly contribute to this topic.

Positive news so many people trust bitcoin they invest and buy bitcoin even the bitcoin goes down people continue to invest, mining, buying and selling bitcoin. I believe the bitcoin will increase again and in the Philippines, filipinos easily adopt bitcoin at a young age high school or college student buy and invest in bitcoin that is the good news.