cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 29, 2011, 04:17:31 PM

Last edit: July 29, 2011, 07:51:16 PM by cypherdoc |

|

what to do?

BUY BITCOIN!

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 29, 2011, 07:17:21 PM |

|

debt/GDP is now 100%.

read Reinhart and Rogoff as to what this means.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 29, 2011, 07:34:10 PM |

|

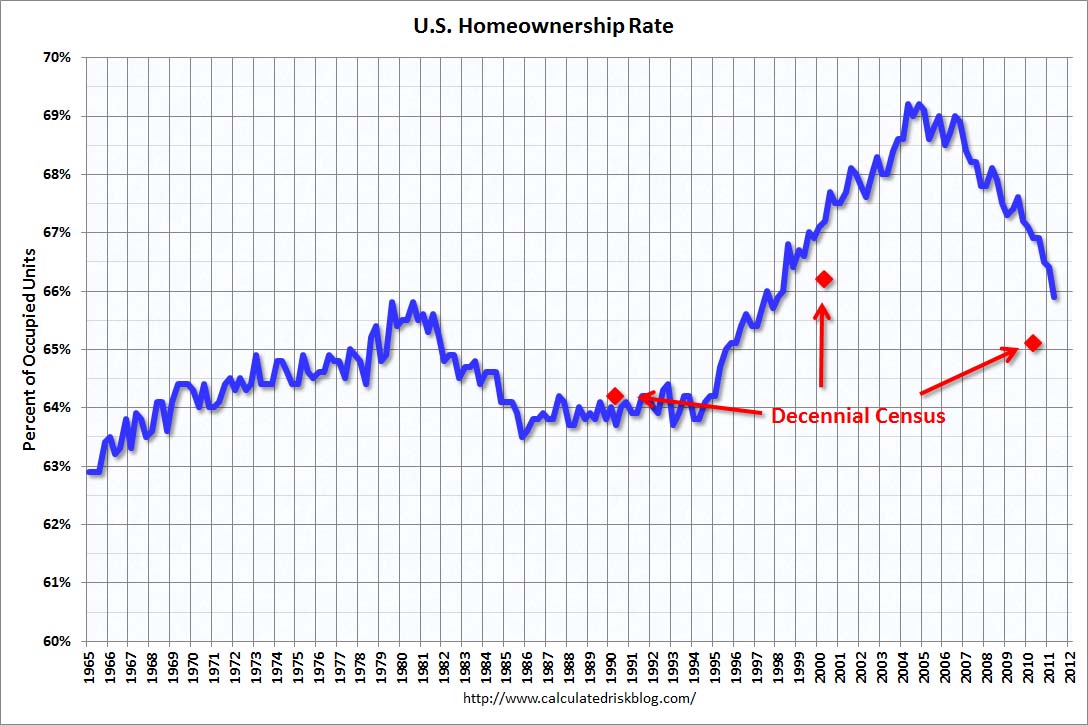

who here remembers Bush bragging about the high home ownership rate of Americans? they've impoverished us.  |

|

|

|

|

Johnny Pizza

Newbie

Offline Offline

Activity: 28

Merit: 0

|

|

July 29, 2011, 07:39:22 PM |

|

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 29, 2011, 08:12:13 PM |

|

very subtle but meaningful clues today; the threads Subject held true throughout the day.

|

|

|

|

|

|

evolve

|

|

July 29, 2011, 08:30:34 PM |

|

my stocks are still doing fine  .... btc market isnt moving enough for me to make money right now (and my bot is down)....soooo im holding steady on all my investment positions...if i buy anything right now, itll be stocks. |

|

|

|

|

TraderTimm

Legendary

Offline Offline

Activity: 2408

Merit: 1121

|

|

July 30, 2011, 02:02:22 AM |

|

I wouldn't touch equity markets with a 10-QE pole. Going to get real interesting once interest rates start to ratchet up. Good luck rolling over that short-term debt, America.

|

fortitudinem multis - catenum regit omnia

|

|

|

tvbcof

Legendary

Online Online

Activity: 4578

Merit: 1276

|

|

July 30, 2011, 02:45:23 AM |

|

who here remembers Bush bragging about the high home ownership rate of Americans? they've impoverished us.

I do indeed remember his 'ownership society' nonsense. Right when he said it I thought to myself that it was the poor saps who bought homes at that time would end up _being_ owned. I don't guess that Bush-II was quite as dumb as people seem to think. Mostly just neurological damaged from cocaine abuse is my guess. I expect that in this case he knew exactly what was going on and that smirk came directly from his heart. I bought a few homes earlier this year. I am pretty sure that I could get a better deal near the end of 2012, but I didn't want to sit on USD until then. I was quite uncomfortable earlier this year when gold and silver were on a tear so I jumped (and missed out on the BTC spike due in part to being busy with that stuff. I would almost certainly be sitting on whatever I had accumulated at that time but I would have gotten in cheaper and probably would have gone mining.) |

sig spam anywhere and self-moderated threads on the pol&soc board are for losers.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 30, 2011, 02:53:34 AM |

|

I bought a few homes earlier this year. I am pretty sure that I could get a better deal near the end of 2012, but I didn't want to sit on USD until then. I was quite uncomfortable earlier this year when gold and silver were on a tear so I jumped (and missed out on the BTC spike due in part to being busy with that stuff. I would almost certainly be sitting on whatever I had accumulated at that time but I would have gotten in cheaper and probably would have gone mining.)

good luck with those homes. hopefully for you we don't go into the 2nd wave of deflation. everyone assumes the Bernank will inflate away their debt. i'm betting against that. |

|

|

|

|

tvbcof

Legendary

Online Online

Activity: 4578

Merit: 1276

|

|

July 30, 2011, 03:35:37 AM |

|

I bought a few homes earlier this year. I am pretty sure that I could get a better deal near the end of 2012, but I didn't want to sit on USD until then. I was quite uncomfortable earlier this year when gold and silver were on a tear so I jumped (and missed out on the BTC spike due in part to being busy with that stuff. I would almost certainly be sitting on whatever I had accumulated at that time but I would have gotten in cheaper and probably would have gone mining.)

good luck with those homes. hopefully for you we don't go into the 2nd wave of deflation. everyone assumes the Bernank will inflate away their debt. i'm betting against that. I was not worried about either inflation or deflation. I wanted to be sitting on just about anything but USD or instruments that I needed the help of a semi-functional financial system to capitalize on. I thought about financing as a hedge if inflation occurred, but in the end the fees and interest made it not make sense to me...and it would have been counter-productive to what I wanted to achieve (e.g., dumping $$$) I figure that a place to live is always worth about 30%-ish of a typical earners potential no matter what the economic conditions. And if TSHTF, I'll likely have some family who could use a place to live anyway. Prices where I bought seemed fair enough even if (both you and) I suspect they very well could be getting even better. |

sig spam anywhere and self-moderated threads on the pol&soc board are for losers.

|

|

|

hugolp

Legendary

Offline Offline

Activity: 1148

Merit: 1001

Radix-The Decentralized Finance Protocol

|

|

July 30, 2011, 07:25:33 AM |

|

I bought a few homes earlier this year. I am pretty sure that I could get a better deal near the end of 2012, but I didn't want to sit on USD until then. I was quite uncomfortable earlier this year when gold and silver were on a tear so I jumped (and missed out on the BTC spike due in part to being busy with that stuff. I would almost certainly be sitting on whatever I had accumulated at that time but I would have gotten in cheaper and probably would have gone mining.)

good luck with those homes. hopefully for you we don't go into the 2nd wave of deflation. everyone assumes the Bernank will inflate away their debt. i'm betting against that. I bet you a couple of bitcoins that Bernanke will keeps monetizing government debt (whether it calls it QE3 or gives it another name is irrelevant). Deal? |

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

July 30, 2011, 07:34:12 AM |

|

I bought a few homes earlier this year. I am pretty sure that I could get a better deal near the end of 2012, but I didn't want to sit on USD until then. I was quite uncomfortable earlier this year when gold and silver were on a tear so I jumped (and missed out on the BTC spike due in part to being busy with that stuff. I would almost certainly be sitting on whatever I had accumulated at that time but I would have gotten in cheaper and probably would have gone mining.)

good luck with those homes. hopefully for you we don't go into the 2nd wave of deflation. everyone assumes the Bernank will inflate away their debt. i'm betting against that. I bet you a couple of bitcoins that Bernanke will keeps monetizing government debt (whether it calls it QE3 or gives it another name is irrelevant). Deal? LOL! only a fool would bet against the fact that he will try. But i will bet you that it doesn't work. we'd have to come up with a timeframe and a measure of success or failure. how about we bet that GDP goes negative by the end of 2012? |

|

|

|

|

|