|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

TPTB_need_war

|

|

August 27, 2015, 04:33:14 PM

Last edit: August 27, 2015, 04:48:14 PM by TPTB_need_war |

|

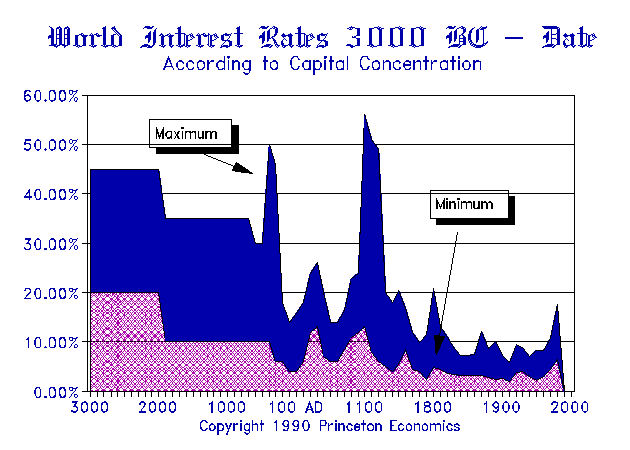

CoinCube afaics you always repeat the same mistake (same myopia despite your obvious expertise in logic, math, etc). Annealing only occurs at a fine grained level, not at the macro level. Entropy and time are not reversible. That which is more efficient (anneals better) destroys that which doesn't (that which doesn't needs a crutch such as government theft). I leave it to you to work through how that disproves your statement. Remember debt isn't concerned with performance, only with return of capital. You can refer to my refutation of your mathematical limit proof for clues. Once this light bulb goes on, I think you will finally understand that I won all the debates about anarchy vs. top-down governance. The world is about to undergo a radical change in social organization. We will not be going back. The NWO will fight to survive by any means of totalitarianism. But it will lose, or make the human race extinct (e.g. nuclear winter). There is no middle ground because of the economics I explained recently. http://www.armstrongeconomics.com/archives/36568 We are at effectively reaching a 5,000-year low in interest rates. It cannot get more bearish than this for government. What we face is monumental. P.S. once the epiphany slams you in the face, you will realize that what we face is much more severe than any hopes you've had for a calm or slow resolution to the current crisis. See this post. You now see Armstrong was correct yet again about October 1 being the start of the BIG BANG global sovereign debt crisis. Don't lose valuable time sitting on the fence. What is your game plan? I think you are crazy if you don't take a $5000 rider on a Bitcoin killer. But I don't need you. I just think you are crazy for not doing it. No need to answer me publicly. |

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 27, 2015, 06:54:38 PM

Last edit: August 27, 2015, 10:04:33 PM by CoinCube |

|

This back an forth is uninteresting and can be simplified mathematically to the following. F(x)=  CoinCube: For any finite value of x the function is not 0

TPTB_need_war: The answer is 0

CoinCube: For a finite value of x the function is greater than zero

TPTB_need_war: Why do I have to repeat myself the answer is zero

You have a blind spot when it comes to economics. If the opportunity cost of not joining the Knowledge Age is say 10 - 100X greater than remaining in the financed NWO morass, the profit margins of the financed world go negative (in fact this has already happened in China in the export manufacturing sector!) because you have too many competing for the same small bounded value (relative to the Knowledge Age value and the unbounded opportunities for growth). Thus collapse to 0. That collapsed financed NWO system will try to survive by TOTALITARIANISM and eugenics. Q.E.D. You are arguing that the profit margins from finance will go negative and this will accelerate the trend towards a future knowledge age and the eventual elimination of finance. Are you making the case that the profit margins will go negative over the near to medium term due to an artificial bubble in finance created by current market conditions? If that is the case then I would agree with you. Or are you arguing that the profit margins from finance will go negative for the rest of human history? If so than you have yet to make your case to my satisfaction. There will always be a human desire and market to push forward consumption and a potential profit to lenders who can satisfy this demand. Since I have no reason to think that the current bubble in finance will continue indefinitly the profit margins of meeting this demand should eventually turn positive once more. Perhaps future profits from finance will follow a damped sine wave model?   |

|

|

|

|

TPTB_need_war

|

|

August 27, 2015, 09:02:03 PM |

|

Or are you arguing that the profit margins from finance will go negative for the rest of human history? If so than you have yet to make your case to my satisfaction. There will always be a human desire and market to push forward consumption and a potential profit to lenders who can satisfy this demand. Since I have no reason to think that the current bubble in finance will continue indefinitly the profit margins of meeting this demeand should eventually turn positive once more. Perhaps future profits from finance will follow a damped sine wave model?   As you correctly argue they can go 'positive' over short periods of time but they are fighting against the trend they are not really positive (and increasingly not so) and just pushing forward demand. Thus your rough model on cursory glance appears to be reasonable. Good point! You taught me something[1]  [1] And it isn't first time. Remember your astute private argument that collapse in the USA could not come before 2017. That was before we had clarified Armstrong's model on that point. Kudos on being able to pull that model out of your hat so quickly. That is what an applied math degree can do. |

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 28, 2015, 02:09:42 AM |

|

A couple of quotes that apply to us all.  Once you stop learning, you start dying In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists |

|

|

|

HeroBit

Newbie

Offline Offline

Activity: 3

Merit: 0

|

|

August 29, 2015, 12:25:42 AM |

|

Yes central banking was needed to maintain confidence because the large concentration of monetary capital required for production in the Industrial Age, but in the fledgling Knowledge Age knowledge capital can not so centralized and thus we no longer will need a central bank to prevent runs on confidence.

The problem is not leverage. Rather root of the problem has been that capital enslaved labor until (just recently) knowledge became the predominant component of production startup costs. Think it out[1] and you will see the generative essence of the issues you are raising are all due to the fact that capital enslaved labor and this actually supported (and required![2]) the large collectivization of society. |

|

|

|

|

|

RealBitcoin

|

|

August 29, 2015, 07:38:49 AM

Last edit: August 29, 2015, 08:04:47 AM by RealBitcoin |

|

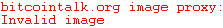

Pardon me but isnt that graph having a low term interest rate due to the debt the world holds, and the money printing available. Currency counterfeiting is an 5000 year business, from the Babylonian treasurer mixing silver coins with nickel, to the Roman coins being mixed with iron and led, to the modern banking scam of just pure toilet paper printing. I see the interest rates have spiked in the 1100 when massive wars created huge inflation (soldiers paid with scam coins because taxes are never enough to pay the war costs), then its going low now.

REMEMBER THERE WERENT CENTRAL BANKS BEFORE 1664 AD. , SO THE INTEREST RATES BEFORE THAT WERE GENUINE AND FREE MARKET BASED!But not because the money printing stopped, but because it's more efficient than ever, and that the keynesian inflation doesnt leak into the economy, rather it gets soaked up by massive derivatives, stock,bond, estate, precious stones, and luxury items bubbles. BECAUSE OF THAT CENTRAL BANKS CAN EASILY RIG THE INTEREST RATES, IN THEIR MONEY PRINTING SCAM'S FAVOUR.THEY JUST NEED TO BLOW AIR INTO THE BUBBLE, TO AVOID THE AVALANCHE OF INFLATION THAT IS CONTAINED THERE Of course if this "dam" breaks, you will see hyperinflation, and I don't know but to clean up this shit, you will probably need 10,000% interest rates or bigger.

The world is about to undergo a radical change in social organization. We will not be going back. The NWO will fight to survive by any means of totalitarianism. But it will lose, or make the human race extinct (e.g. nuclear winter). There is no middle ground because of the economics I explained recently.

It's funny that you suddenly agree with me, last time I talked with you you made me look like an idiot, but with little evidence. I don't think the nuclear winter is probable, as I told in earlier posts, these are the options on the table:

So basically 3 futures can exist:

1) 1-2% of the population with IQ over 140, and the wealthiest, will provide the goods & services in the more and more complex economy, the manual labour will be achieved by robots, and the rest of the people 98%, will be on permanent welfare like some freeloaders, in a massive socialist economy

2) The elite will do eugenics, and will wipe out the low IQ people with war,plague or else, and reduce the world population to a very very small level, and only keep the high IQ people alive.

3) The economy will be reset, everybody loses all their money, and we start over, but soon enough the high IQ people will again emerge wealthy even with equal opportunities, and the same shit starts again.

I`d prefer 3) but i think 1) is the most likely outcome unfortunately. I also think that if 1) will become true then it's only a matter of time until the elite will become fed up with so many freeloaders so 1) will become 2) in a matter of years.

|

|

|

|

|

RealBitcoin

|

|

August 29, 2015, 08:11:01 AM |

|

Normally the interest rates now should be around 10-15%, to massively restructure the economy from a speculator/spender one, to a savings/producer one, It might hurt and cause a bit of recession, but mixed with regulation elimination and tax decreases, it should work. However the clock is ticking: http://www.nationaldebtclocks.org/It's impossible to increase the interest rates anymore due to the amount of debt that has been created by it. So to illlustrate:  The dam is under so big pressure, that if you stop pushing "water" into the dam's left side, then the water will just smash through and the hyperinflation will be so big that alot of catastrophes could happen in the meantime. If you dont increase interest rates then the dam will eventually crack and hyperinflation will still come.

There is a 500 year financial pressure buildup we are talking about, and in our lifetimes the dam will break!

HYPERINFLATION IS INEVITABLE NOW, NO MATTER WHAT THE CENTRAL BANKS DO, THEY CAN ONLY STALL IT, BUT THEY CANT STOP IT! |

|

|

|

smooth

Legendary

Offline Offline

Activity: 2968

Merit: 1198

|

|

August 29, 2015, 09:32:00 AM |

|

There is a 500 year financial pressure buildup we are talking about, and in our lifetimes the dam will break!

How do you know it will happen in our lifetimes? Because it is "unsustainable"? That was just as true 100 or 200 years ago. What is the trigger that is certain to burst the dam at this time, and not just prompt pouring more concrete to create a bigger dam? |

|

|

|

|

|

RealBitcoin

|

|

August 29, 2015, 10:42:28 AM |

|

There is a 500 year financial pressure buildup we are talking about, and in our lifetimes the dam will break!

How do you know it will happen in our lifetimes? Because it is "unsustainable"? That was just as true 100 or 200 years ago. What is the trigger that is certain to burst the dam at this time, and not just prompt pouring more concrete to create a bigger dam? This time its different, because it's not just the surface problems that is caused by this massive disallocation of resources, but the economy is also fundamentally distorted. In an average depression, many jobs get lost, business go bankrupt, for the same fact that they are not belonging to that economy, so they have no place there to exist. But now its over 50% of the GDP that is comprised of financial services/banking & corporate business, and not just the jobs that will be lost, but the capital. 1) If they put more concrete, a.k.a. print money and buy all bubbles up, then eventually the leaked inflation becomes so big that the real earnings of the populus will be detrimentally hurt. If the inflation increases more than your earnings, and drastically more, then eventually you will starve to death as you cannot even buy the food in the stores, despite the food supply being constant. And of course this hurts the economy even more, imagine if 99% of the GDP is got from banks, who will produce anything? And each time they print money, the GDP gets distorted more, if the financial sector is 50% of the GDP and the bust sets in then consider a 49% GDP decrease depression, because about 49% out of 50% does not belong there. But the hyperinflation will probably wash away the rest too, so my guess is about 80-90% depression, and alot of unemployed people (+robotics caused unemployment). By the next decade we can easily see 50% unemployment of able bodied people. 2) If they dont print money then obviously speculators will pull out their money, and it will cause a bust spiral that will bust the entire economy, starting from the 1:1000 leveraged firms , down to the small vendor who has a little mortgage. The amount of financial devastation pending will be big, and it will cause civil unrest probably. |

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 29, 2015, 06:56:08 PM

Last edit: August 30, 2015, 12:57:31 AM by CoinCube |

|

There is a 500 year financial pressure buildup we are talking about, and in our lifetimes the dam will break!

How do you know it will happen in our lifetimes? ... This time its different... 1) If they put more concrete, a.k.a. print money and buy all bubbles up, then eventually the leaked inflation becomes so big that the real earnings of the populus will be detrimentally hurt. If the inflation increases more than your earnings, and drastically more, then eventually you will starve to death as you cannot even buy the food in the stores, despite the food supply being constant. RealBitcoin you are not accounting for the predictable government response to spill over inflation. I agree with you when you say there will be spill over inflation which combined with technological progress will progressively undercut the real earnings of the majority. Government response to this is will not be to let the system collapse but instead to "put down more concrete". As earnings are eroded governments will simply move on a worldwide basis to supplement the incomes of the newly impoverished masses via redistribution and welfare programs. A small part of this redistribution will occur in the form of significantly higher taxes. However, the lions share will come from increased government debt. As governments become insolvent they will find markets unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's). This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to surrender sovereignty. I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state. |

|

|

|

|

minor-transgression

|

|

August 29, 2015, 07:41:48 PM |

|

@Coincube - Wikipedia? Webster's dictionary? Please tell me you got these from Google. (If so I get to ROFL) Would you happily accept a $1,000,000 IOU from a guy who is $5Tn "in the hole" than a $1 IOU from me (I am debt-free)? We are discussing banking, and I'm going with narrow definitions: JP Morgan : "Gold is money and nothing else" Bitcoin, Gold, a Central Bank Note, and an IOU from minor transgression. Of these only Bitcoin and Gold have no counterparty risk, and are money. The others are valued entirely on the creditworthiness of the issuer, and are credit. Where Notes are issued by government or a Central Bank, they create both a credit and a debt. Similarly when you spend with a credit card, you expand the supply of credit, and when you spend with a debit card, the supply of credit decreases. No new bitcoins or gold (real money) are created or destroyed in these transactions. This point is relevant because at one time real money was the "Reserve" in fractional reserve banking. History provides a list of bitter experience where prudent lending limits were exceeded. Fractional Reserve Banking implies a hard limit on the supply of credit. An important consideration is that as the limit is approached, there is a reasonable expectation that rates of interest on loans will rise. This should provide some measure of stability to an otherwise unstable system. In my humble opinion, fractional reserve banking ceased when Nixon took the dollar off the gold standard in 1971, and I harbour some doubts that it was ever effective post 1913. Clinton and Brown buried it in the 2000's via "light touch regulation" and "risk-based regulation". Haldane, "Why Banks Failed the Stress Test" speech [p12], 2009, summing up the beyond-laissez-faire ethos perfectly: "No. There was a much simpler explanation according to one of those present. There was absolutely no incentive for individuals or teams to run severe stress tests and show these to management. First, because if there were such a severe shock, they would likely lose their bonus and possibly their jobs. Second, because in that event the authorities would step-in anyway to save a bank and others suffering a similar plight." http://www.bankofengland.co.uk/publications/speeches/2009/speech374.pdfThese perverse incentives render further discussions moot until we can agree on some basic definitions. Asking me to believe in fractional reserve banking where the "reserve" is conjured up after the fact out of thin air, is asking an awful lot. Once we understand each other we can talk. I will put up a new thread to handle further discussion on this topic. @TPTBNW thanks for the heads-up on whatsapp. Somehow the MSM was able to keep that request for a backdoor well away from the front page. |

|

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 29, 2015, 09:37:08 PM

Last edit: August 30, 2015, 12:56:09 PM by CoinCube |

|

@minor-transgression I more or less agree with most of your post above. You appear to be arguing that our current banking system is not a fractional reserve system because historically traditional fractional reserve banking was done with sound money gold or silver. This seems to be a debate over etymology. Do you feel my actual conclusions are inaccurate? If so put your penny down and state where and state where and why. Edit: I see you started a new thread on this topic so I will reply there. I do think you have a good point we you argue that our current system is fundamentally different then the classic fractional reserve banking of old and thus deserving of its own name. I will link to your post below. https://bitcointalk.org/index.php?topic=1165896.0 |

|

|

|

|

TPTB_need_war

|

|

August 30, 2015, 07:22:35 AM |

|

Yes central banking was needed to maintain confidence because the large concentration of monetary capital required for production in the Industrial Age, but in the fledgling Knowledge Age knowledge capital can not so centralized and thus we no longer will need a central bank to prevent runs on confidence.

The problem is not leverage. Rather root of the problem has been that capital enslaved labor until (just recently) knowledge became the predominant component of production startup costs. Think it out[1] and you will see the generative essence of the issues you are raising are all due to the fact that capital enslaved labor and this actually supported (and required![2]) the large collectivization of society. You repeated almost verbatim what I have written upthread  |

|

|

|

|

RealBitcoin

|

|

August 30, 2015, 08:25:27 AM |

|

Government response to this is will not be to let the system collapse but instead to "put down more concrete". As earnings are eroded governments will simply move on a worldwide basis to supplement the incomes of the newly impoverished masses via redistribution and welfare programs. A small part of this redistribution will occur in the form of significantly higher taxes. However, the lions share will come from increased government debt.

As governments become insolvent they will find markets unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's). This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to surrender sovereignty.

I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state.

That could stall the collapse for another 20-30 years however it actually won't. You forget that rich people don't pay taxes, at all. No matter how much you force them (as if you could since they own the politicians), you cannot have the rich taxed because they will just outsource the taxes to his employees or customers. Socialism eliminates the middle class, and the middle class is the only class that pays taxes, as poors only receive poor welfare, and the rich receive corporate welfare, bail-in, bail-out money. So even if the robotization would happen, and people would be left with no jobs, the government cannot give them welfare as there would be nobody left to pay taxes. They cant just print money to give welfare because that would be instant hyperinflation. Could be a slave society with food rationing and slave labour for the poor? Maybe. But i`m more worried that eugenics and population reduction is a more likely outcome unfortunately, since war is not on the table anymore. |

|

|

|

|

TPTB_need_war

|

|

August 30, 2015, 08:25:27 AM |

|

http://www.armstrongeconomics.com/archives/36655 QUESTION: Dear Martin.

Does Socrates think the human race is doomed to be a failed species in the end because of this?

ANSWER: This is what we face about once every 300 years. Society can make it to the next step in our evolution if we at least understand what we are dealing with. Government is collapsing. They will fight fiercely to retain that power. That is what they want everything. This is exactly like Stalin – paranoid. They live in fear of revolution and are preparing for the worst. If we prevail, we can graduate to the next step.Yet so many people keep trying to drag us down condemning us to relive the past unable to see the future.

By no means are we doomed. Yet this is a real struggle. Please everyone email this to Armstrong. His email address is: armstrongeconomics@gmail.comCan't he see what the above chart says? I have written about this extensively in the Economics Devastation thread. This is the end of usury finance and debt. I have explained why in the Economics Devastation thread. This is a momentous change for humanity. Why do you think I am working on anonymous solutions we need in order to cross the chasm! Please support my efforts. It is that damn important.

|

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 30, 2015, 12:44:13 PM

Last edit: August 30, 2015, 03:43:23 PM by CoinCube |

|

Government response to this is will not be to let the system collapse but instead to "put down more concrete". As earnings are eroded governments will simply move on a worldwide basis to supplement the incomes of the newly impoverished masses via redistribution and welfare programs. A small part of this redistribution will occur in the form of significantly higher taxes. However, the lions share will come from increased government debt.

As governments become insolvent they will find markets unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's). This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to surrender sovereignty.

I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state.

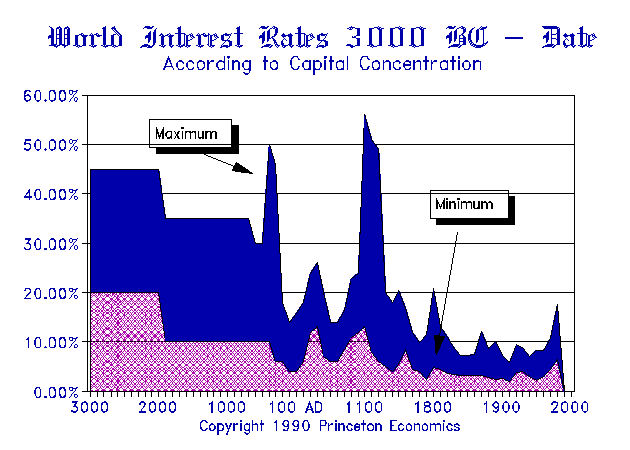

That could stall the collapse for another 20-30 years however it actually won't. You forget that rich people don't pay taxes, at all. No matter how much you force them (as if you could since they own the politicians), you cannot have the rich taxed because they will just outsource the taxes to his employees or customers. Socialism eliminates the middle class, and the middle class is the only class that pays taxes, as poors only receive poor welfare, and the rich receive corporate welfare, bail-in, bail-out money. So even if the robotization would happen, and people would be left with no jobs, the government cannot give them welfare as there would be nobody left to pay taxes. They cant just print money to give welfare because that would be instant hyperinflation. Could be a slave society with food rationing and slave labour for the poor? Maybe. But i`m more worried that eugenics and population reduction is a more likely outcome unfortunately, since war is not on the table anymore. I expect that the rich will be increasingly unable to escape taxation going forward. The wealthy will be tracked and taxed while safe havens and tax shelters are increasingly shut down. Millionaires will be hit hard and even the billionaires take a small hit. As national sovereignty is ceded there will increasingly be no place for them to go. You are correct when you note that this will only stall potential collapse. Down the road we will find ourselves with a massive and inefficient global welfare state that is stagnate and in constant danger of failure. At this point humanity will desperately need a paradigm shift. I believe the knowledge age as outlined by Anonymint in the OP represents such a shift. My exception and hope is that the the current system will survive long enough for the knowledge age to really take off and simply grow us out of the morass. As more people transition themselves from the welfare state to the knowledge age the risk of collapse will decline as the overall size and cost of the welfare state declines to an insignificant portion of the economy. The trend towards future population reduction is already well underway. It seems likely that further population reduction will occur spontaneously as a byproduct of the status quo. http://www.economist.com/news/21589151-crashing-fertility-will-transform-asian-family-baby-boom-bust |

|

|

|

|

RealBitcoin

|

|

August 30, 2015, 05:21:10 PM |

|

I expect that the rich will be increasingly unable to escape taxation going forward. The wealthy will be tracked and taxed while safe havens and tax shelters are increasingly shut down.

Millionaires will be hit hard and even the billionaires take a small hit. As national sovereignty is ceded there will increasingly be no place for them to go.

But its impossible to tax the rich from a practical standpoint since every new tax you put on them will just simply be outsourced to his employees or customers. The only solution to taxing the rich is to nationalize everything, which will obviously be a catastrophe as we know the government is unable to drive the economy at all. So communism (as in central planning) doesn't work, socialism (currently used) is on the decline. The only possible future is a free capitalist system with self-regulated bodies. There are plenty of clever and innovative people who can build use a better society in the future, but for this we really need to get to a knowledge age so I agree with that. If the collapse hits soon then everybody will go wild and it will be a disaster filled with looting, mobs forming, and total societal breakdown. If it hits gradually then we will have an opportunity to slowly replace it, with a better and well though system. |

|

|

|

CoinCube (OP)

Legendary

Offline Offline

Activity: 1946

Merit: 1055

|

|

August 31, 2015, 10:16:42 PM

Last edit: August 31, 2015, 11:58:08 PM by CoinCube |

|

But its impossible to tax the rich from a practical standpoint since every new tax you put on them will just simply be outsourced to his employees or customers.

The only solution to taxing the rich is to nationalize everything, which will obviously be a catastrophe as we know the government is unable to drive the economy at all.

So communism (as in central planning) doesn't work, socialism (currently used) is on the decline.

It is certainly not impossible to tax the rich just ask any rich person. Businesses are only able to pass on a portion of new taxes to their employees and customers (see link below for why) http://foundationsofecon.blogspot.com/2011/06/businesses-cannot-simply-pass-on-taxes.html?m=1Increasing taxes does lead to increasing centralization and reduced dynamism in the overall economy. Why do you say socialism on the decline? Unsustainable in its current form sure. Far from petering out socialism seems set to grow dramatically over the coming years. |

|

|

|

OROBTC

Legendary

Offline Offline

Activity: 2912

Merit: 1852

|

|

September 01, 2015, 12:55:33 AM |

|

But its impossible to tax the rich from a practical standpoint since every new tax you put on them will just simply be outsourced to his employees or customers.

The only solution to taxing the rich is to nationalize everything, which will obviously be a catastrophe as we know the government is unable to drive the economy at all.

So communism (as in central planning) doesn't work, socialism (currently used) is on the decline.

It is certainly not impossible to tax the rich just ask any rich person. Businesses are only able to pass on a portion of new taxes to their employees and customers (see link below for why) http://foundationsofecon.blogspot.com/2011/06/businesses-cannot-simply-pass-on-taxes.html?m=1Increasing taxes does lead to increasing centralization and reduced dynamism in the overall economy. Why do you say socialism on the decline? Unsustainable in its current form sure. Far from petering out socialism seems set to grow dramatically over the coming years. I suspect taxation will increase for a while as well as Socialism continuing its march to devastation. I agree that it is the productive sector (the active participants in the Knowledge Age) that is the only real solution to our worldwide economic problems. But, intrusive government looks very likely for at least some time. Government dictatorship is one of the very ugliest set of scenarios facing us. I hope TPTB's project is a step on the long & hard road to eventual freedom. |

|

|

|

|

|