|

Publictalk792

|

|

December 21, 2023, 04:33:57 AM Merited by JayJuanGee (1) |

|

Sometimes based on personal circumstances, cash flow circumstances or just getting caught up in the BTC (FOMO) hype, people will end up investing more into BTC (in kind of lump sum ways) at certain times, so there could be cases in which a person invested way more into BTC at the top of BTC prices in 2021, so then that person may well end up still being in the negative because they are having to make up for their having had front loaded their BTC investment at times that ended up being higher prices than they are currently. Those kinds of mistakes do sometimes end up happening, and maybe some of those kinds of persons might end up DCA investing into bitcoin 3-4 years (or even more) before they finally start getting into profits. Of course, no matter what there are not any guarantees that your BTC portfolio will end up in profits, even though many of us have certain levels of confidence that bitcoin is amongst the best of investments currently available, if not the best investment, and because of our assessment of bitcoin, we continue to buy into it, even if it might take a while for our holdings to get into profits (an might not ever get into profits if something ends up negativing bitcoin's positive investment thesis).

Mistakes like these can happen and it may take several years or more for someone to start seeing profits from their BTC investment. It is crucial to acknowledge that there are no guarantees in the market even though many of us have confidence in Bitcoin as a long-term investment. Despite our positive assessment it's possible that external factors could negatively impact Bitcoin's investment thesis. But if we believe in Bitcoin so definitely we will be happy after a certain. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

|

|

|

|

TalkImg was created especially for hosting images on bitcointalk.org: try it next time you want to post an image

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

promise444c5

Full Member

Offline Offline

Activity: 280

Merit: 139

Keep Promises !

|

|

December 21, 2023, 07:41:05 AM Merited by JayJuanGee (1) |

|

But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes . Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start now |

|

|

|

|

Miles2006

Full Member

Offline Offline

Activity: 238

Merit: 151

Cashback 15%

|

|

December 21, 2023, 10:28:24 AM Merited by fillippone (1) |

|

Sometimes based on personal circumstances, cash flow circumstances or just getting caught up in the BTC (FOMO) hype, people will end up investing more into BTC (in kind of lump sum ways) at certain times, so there could be cases in which a person invested way more into BTC at the top of BTC prices in 2021, so then that person may well end up still being in the negative because they are having to make up for their having had front loaded their BTC investment at times that ended up being higher prices than they are currently. Those kinds of mistakes do sometimes end up happening, and maybe some of those kinds of persons might end up DCA investing into bitcoin 3-4 years (or even more) before they finally start getting into profits. Of course, no matter what there are not any guarantees that your BTC portfolio will end up in profits, even though many of us have certain levels of confidence that bitcoin is amongst the best of investments currently available, if not the best investment, and because of our assessment of bitcoin, we continue to buy into it, even if it might take a while for our holdings to get into profits (an might not ever get into profits if something ends up negativing bitcoin's positive investment thesis).

Mistakes like these can happen and it may take several years or more for someone to start seeing profits from their BTC investment. It is crucial to acknowledge that there are no guarantees in the market even though many of us have confidence in Bitcoin as a long-term investment. Despite our positive assessment it's possible that external factors could negatively impact Bitcoin's investment thesis. But if we believe in Bitcoin so definitely we will be happy after a certain. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again. The fear of missing out has cause a lot of investors to regret, I will say this act is commonly done by new comers who doesn't know anything about the market but due to the hype alot of them decide to buy with huge sum and end up with high expectations from the market, concerning the hype what will make a newbie to follow the hype they have heard something about bitcoin before they made such decision, the hype about bitcoin is just too much and anyone who can't control their emotions they should just stay out from investing. Investors who find themself in this circumstances some can't even wait for 2_3 years before the next ATH that's why they choose to follow the hype, when it comes to FOMO this kind investment choice is never right not only bitcoin investment other investment too, for example a newbie who doesn't know how the market works how can that person make a proper investment. I will go with the opinion to continue using the DCA strategy not minding the hype cause during this season a lot of investors take high risk spending more. |

|

|

|

|

adultcrypto

|

Sometimes based on personal circumstances, cash flow circumstances or just getting caught up in the BTC (FOMO) hype, people will end up investing more into BTC (in kind of lump sum ways) at certain times, so there could be cases in which a person invested way more into BTC at the top of BTC prices in 2021, so then that person may well end up still being in the negative because they are having to make up for their having had front loaded their BTC investment at times that ended up being higher prices than they are currently. Those kinds of mistakes do sometimes end up happening, and maybe some of those kinds of persons might end up DCA investing into bitcoin 3-4 years (or even more) before they finally start getting into profits. Of course, no matter what there are not any guarantees that your BTC portfolio will end up in profits, even though many of us have certain levels of confidence that bitcoin is amongst the best of investments currently available, if not the best investment, and because of our assessment of bitcoin, we continue to buy into it, even if it might take a while for our holdings to get into profits (an might not ever get into profits if something ends up negativing bitcoin's positive investment thesis).

Mistakes like these can happen and it may take several years or more for someone to start seeing profits from their BTC investment. It is crucial to acknowledge that there are no guarantees in the market even though many of us have confidence in Bitcoin as a long-term investment. Despite our positive assessment it's possible that external factors could negatively impact Bitcoin's investment thesis. But if we believe in Bitcoin so definitely we will be happy after a certain. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again. The fear of missing out has cause a lot of investors to regret, I will say this act is commonly done by new comers who doesn't know anything about the market but due to the hype alot of them decide to buy with huge sum and end up with high expectations from the market, concerning the hype what will make a newbie to follow the hype they have heard something about bitcoin before they made such decision, the hype about bitcoin is just too much and anyone who can't control their emotions they should just stay out from investing. Investors who find themself in this circumstances some can't even wait for 2_3 years before the next ATH that's why they choose to follow the hype, when it comes to FOMO this kind investment choice is never right not only bitcoin investment other investment too, for example a newbie who doesn't know how the market works how can that person make a proper investment. I will go with the opinion to continue using the DCA strategy not minding the hype cause during this season a lot of investors take high risk spending more. There is a saying that "beauty catches the eyes while personality keeps the heart". This statement is applicable to even Bitcoin because the hype is like the beautiful things people see in Bitcoin that actually attract them. So, the hype is good for Bitcoin, it is just for those of us who have been there to guide them properly. We have to convince them not to be carried away by the hype but follow a well-defined approach like the DCA method. Remember that most of us here actually joined Bitcoin following previous hypes, which has become part and parcel of Bitcoin. Just imagine how the market responds to news, this shows how humans responds to hypes and fear. Even though FOMO is bad in the long run, I feel it is an energy that should be properly managed. Like I said before, those coming into Bitcoin due to the hype should receive help from those of us that have been there. We need to tell them how to go about managing their expectations so they are not carried away into taking wrong decisions. |

|

|

|

|

Taskford

|

|

December 21, 2023, 02:11:55 PM Merited by fillippone (1) |

|

Sometimes based on personal circumstances, cash flow circumstances or just getting caught up in the BTC (FOMO) hype, people will end up investing more into BTC (in kind of lump sum ways) at certain times, so there could be cases in which a person invested way more into BTC at the top of BTC prices in 2021, so then that person may well end up still being in the negative because they are having to make up for their having had front loaded their BTC investment at times that ended up being higher prices than they are currently. Those kinds of mistakes do sometimes end up happening, and maybe some of those kinds of persons might end up DCA investing into bitcoin 3-4 years (or even more) before they finally start getting into profits. Of course, no matter what there are not any guarantees that your BTC portfolio will end up in profits, even though many of us have certain levels of confidence that bitcoin is amongst the best of investments currently available, if not the best investment, and because of our assessment of bitcoin, we continue to buy into it, even if it might take a while for our holdings to get into profits (an might not ever get into profits if something ends up negativing bitcoin's positive investment thesis).

Mistakes like these can happen and it may take several years or more for someone to start seeing profits from their BTC investment. It is crucial to acknowledge that there are no guarantees in the market even though many of us have confidence in Bitcoin as a long-term investment. Despite our positive assessment it's possible that external factors could negatively impact Bitcoin's investment thesis. But if we believe in Bitcoin so definitely we will be happy after a certain. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again. The fear of missing out has cause a lot of investors to regret, I will say this act is commonly done by new comers who doesn't know anything about the market but due to the hype alot of them decide to buy with huge sum and end up with high expectations from the market, concerning the hype what will make a newbie to follow the hype they have heard something about bitcoin before they made such decision, the hype about bitcoin is just too much and anyone who can't control their emotions they should just stay out from investing. Investors who find themself in this circumstances some can't even wait for 2_3 years before the next ATH that's why they choose to follow the hype, when it comes to FOMO this kind investment choice is never right not only bitcoin investment other investment too, for example a newbie who doesn't know how the market works how can that person make a proper investment. I will go with the opinion to continue using the DCA strategy not minding the hype cause during this season a lot of investors take high risk spending more. So to avoid coming up with wrong conclusion regarding on this situation much better if we could learn from experience of other that made a mistake regarding how they take those FOMO situation. For sure we can learn a lot from stories of other people showing their regrets towards taking rush decision while the market is currently reaching its new high. That's the importance of analyzing the market since from that we can get an idea that its not really good to buy at that situation but rather we can wait for some correction to happen since this is actually the best time for us to accumulate back again. The hype of bitcoin is to much especially when people talk about bull run to happen since many think that the same what happen on history they can earn a lot of money from it but they didn't realize that they also need to gather knowledge about it on what they would like to do to their investment either they want to HODL or to do DCA. if they choose one of it then its cool since all will matter on how those people will execute or handle the pressure it self since market is so volatile and we cannot control anything what might happen to it that's why at least we have a knowledge about it so we will not regret some decision we make. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10233

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 21, 2023, 04:08:17 PM |

|

Sometimes based on personal circumstances, cash flow circumstances or just getting caught up in the BTC (FOMO) hype, people will end up investing more into BTC (in kind of lump sum ways) at certain times, so there could be cases in which a person invested way more into BTC at the top of BTC prices in 2021, so then that person may well end up still being in the negative because they are having to make up for their having had front loaded their BTC investment at times that ended up being higher prices than they are currently. Those kinds of mistakes do sometimes end up happening, and maybe some of those kinds of persons might end up DCA investing into bitcoin 3-4 years (or even more) before they finally start getting into profits. Of course, no matter what there are not any guarantees that your BTC portfolio will end up in profits, even though many of us have certain levels of confidence that bitcoin is amongst the best of investments currently available, if not the best investment, and because of our assessment of bitcoin, we continue to buy into it, even if it might take a while for our holdings to get into profits (an might not ever get into profits if something ends up negativing bitcoin's positive investment thesis).

Mistakes like these can happen and it may take several years or more for someone to start seeing profits from their BTC investment. It is crucial to acknowledge that there are no guarantees in the market even though many of us have confidence in Bitcoin as a long-term investment. Despite our positive assessment it's possible that external factors could negatively impact Bitcoin's investment thesis. But if we believe in Bitcoin so definitely we will be happy after a certain. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again. Maybe we can try to explore different kinds of investors in regards to ways that they might accumulate BTC and perhaps we don't even need to go too far down the path of comparing BTC accumulators to traders. The most that a person who is ONLY buying (and not using leverage and/or trading) can screw up is to have an average BTC price at the top of the market, so just by definition, if someone buys at the top and continues to buy, his average cost per BTC is going to ultimately end up coming down, and in order to be profitable - in terms of the average, then the price that BTC needs to reach will continue to go down as more buys are made, so profitability will come into existence quite long before reaching the ATH again. Of course, the purchase that was made at the top will not get into profits until after reaching the ATH again, and so there can be some variance in terms of whether someone might measure whether they are in profits in terms of transaction by transaction or if they also might consider their average price per BTC, and there should be no reason not to be able to engage in both kinds of practices in order to better understand how to manage the BTC that you have accumulated in terms of how profitable it is - while at the same time, there are some folks who are not very detailed in their keeping track of their BTC, so they might ONLY have ballpark ideas regarding the extent to which their BTC holdings might be profitable or not. Of course, someone who bought at the top and then did not buy any more BTC will be stuck waiting for the BTC price to get back above the ATH in order to get into profits. There could be other ways in which a person continues to buy, but the cost per BTC does not continue to go down, and that would come after a person were to keep buying and to lower his cost per BTC from $69k to let's say $30k or $40k, but then after the BTC price is above $30k or $40k, then he keeps buying BTC, so his average cost per BTC is no longer getting lower upon each purchase, and there likely is nothing wrong with your average cost per BTC increasing, as long as you might be meeting other goals, which might be just wanting to increase your BTC stash and/or continuing to appreciate that BTC remains a good place to store value, even if the price might fluctuate quite a bit and sometimes your BTC stash is not in profits, but there is a bit of speculation (perhaps based on an understanding of BTC being sound money and scarce) that a person holding BTC is likely going to have more financial options in the future as compared with someone who chooses not to hold BTC. Maybe it could be worth it to briefly contrast what the trader does? Instead of continuing to buy BTC on a regular basis and continuing to go long, the trader engages in practices to try to lower his cost per BTC, but if he ends up NOT being successful, he could end up raising his cost per BTC, even when he is fucking around with his trades at prices that are way lower than the ATH, or even lower than his average cost per BTC... so a person engaging in trading may well end up having to make up for his trading mistakes by hoping that the BTC price goes higher than the previous ATH or even if he is able to bring down his cost per BTC, he may well might not have had been able t bring down his cost per BTC as much as the person who is strictly buying BTC on a regular basis, so the trader might have been trying to engage in short-cuts to lower his average cost per BTC in a faster way than the person who is merely buying BTC on a regular basis, but the end effect is that his cost per BTC might not lower as quickly and there could even end up being circumstances in which he unduly causes his cost per BTC to raise, even higher than the ATH. Of course, there are different intensities in which a person might trade, gamble or even to employ leverage, and there could likely be some prudent ways to trade, gamble and employ leverage to increase likelihood for better results as compared with the person who merely buys BTC on a regular basis... yet we are not talking about those matters in this thread, and we should expect and understand that the techniques for trading, gambling and leveraging are more complicated than the ones for buying persistently, consistently, ongoingly, regularly and in accordance with one's own financial/psychological circumstances including the considerations of cashflows and expenses. But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes. If you are ONLY buying BTC after buying at the ATH, then it is guaranteed that you will be in profits when the next ATH comes (if it comes). Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work

It is not guaranteed that a person will ONLY buy and it is not guaranteed that an ATH will come again... yeah, if someone screws around with buying and selling or otherwise engaging in gambling or leverage then he could well end up raising his costs per BTC rather than lowering them. Lower costs per BTC is guaranteed to happen as long as you are buying below your average costs per BTC, yet at the same time, sometimes people are sloppy in their ways of keeping track of these kinds of matters including keeping track of the costs and quantities of their buys, and if they end up trading then they can really end up screwing up their accounting - especially if they might already be engaging in sloppy accounting practices. as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start now

That sounds correct in regards to the best time to get involved in bitcoin was yesterday, and since you cannot go back in time, then the second best time would be to get involved today. In other words, gets started as soon as possible and make some kind of a plan and start to follow the plan and then tweak the plan along the way as you are learning more about your own financial/psychological circumstances (including accounting for the 9 factors that I mentioned in this post) in order to employ a personally tailored approach. [edited out]

The fear of missing out has cause a lot of investors to regret, I will say this act is commonly done by new comers who doesn't know anything about the market but due to the hype alot of them decide to buy with huge sum and end up with high expectations from the market, concerning the hype what will make a newbie to follow the hype they have heard something about bitcoin before they made such decision, the hype about bitcoin is just too much and anyone who can't control their emotions they should just stay out from investing.Investors who find themself in this circumstances some can't even wait for 2_3 years before the next ATH that's why they choose to follow the hype, when it comes to FOMO this kind investment choice is never right not only bitcoin investment other investment too, for example a newbie who doesn't know how the market works how can that person make a proper investment. I will go with the opinion to continue using the DCA strategy not minding the hype cause during this season a lot of investors take high risk spending more. Ways to control your emotions is by establishing techniques that deal with moderating and managing position size. I don't see any reason that anyone should stay out of bitcoin, and in fact everyone should get into bitcoin by at least getting off zero, so even if that is only a 1% allocation or something modest. So getting out and staying out, does not seem to be the solution for most people, and of course, if a person does not have any discretionary income, then he is not able to invest into bitcoin or anything else, so there are needs to sort out a persons discretionary income in order to make sure that he is able to invest and that he is not going to need the money.. which again brings us back to moderating emotions by moderating and managing position size, which is not necessarily zero..and actually probably should not be considered to be zero.. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

jcojci

|

|

December 21, 2023, 04:30:43 PM |

|

But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes . Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start nowThat is if the person can continue to hold the bitcoin even though the price is still below the purchase price. Most people will panic and sell their bitcoins quickly, even if they bear the loss. Not many people can continue to hold their bitcoin in a loss condition. By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him. |

|

|

|

|

|

MusaPk

|

|

December 21, 2023, 04:32:50 PM |

|

If you understand the investment in this way, maybe the newbies can clearly understand and learn about the investment.

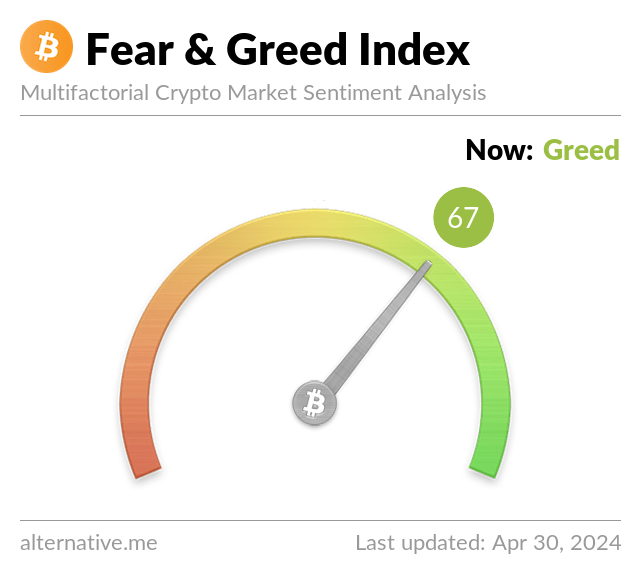

No matter how much you study or gather knowledge prior to investing, you learn investment only when you jump with real cash. Techniques like paper trading can help you a bit but they are no way a replacement of real money investment. Everyone want to buy Bitcoin when its up and not much pay attention to bitcoin when price is down. There is no harm in buying Bitcoin when it goes up but buying with intention that price is going up so I may buy Bitcoin to get profit is wrong approach. In fact this is what we are discussing here that there must be a strategy that must be span over a period of time (4 or more years) before you start seeing the real profit. Now price is up and many people are buying, as evident from Bitcoin fear and greed index. Same ratio of buyers is not seen when price is down.  https://alternative.me/crypto/fear-and-greed-index/ https://alternative.me/crypto/fear-and-greed-index/ |

|

|

|

promise444c5

Full Member

Offline Offline

Activity: 280

Merit: 139

Keep Promises !

|

|

December 21, 2023, 04:54:18 PM

Last edit: December 21, 2023, 06:25:08 PM by promise444c5 |

|

By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him.

Well I guess JJG mentioned this as Gambling your way into profit in Bitcoin not really gambling  its a simple way of gradual opt-in of Btc trade with consideration of HODLing for a long period of time, well it depends on the movements  . I really need to go through this there're many alot of things I need to understand and I could really make use of it too. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10233

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 21, 2023, 05:42:23 PM |

|

By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him.

Well I guess JJG mentioned this as Gambling your way into profit in Bitcoin not really gambling  its a simple way of opt-in and out of Btc trade without considering HODLing for a long period of time, well it depends on the movements  . Your way of framing your response is strange though. Because DCA is a kind of ongoing buying that likely is better used for longer term investing rather than planning to get out of bitcoin in a shorter period merely based on profits, so when you are suggesting Opting in and out, you seem to be talking about both trying to time the market and trading, but really a DCA approach would likely end up identifying the investment that you want to get into, which in this case is bitcoin, and then once you identify the investment, then you figure out your own budget regarding how much to invest into bitcoin on a regular basis, and so then the better that you know yourself and the 9 factors that I mentioned, then the more aggressive that you could afford to be with your bitcoin investment and still not necessarily feel stressed out about your investment into bitcoin because you realize that you are drawing from discretionary money rather than money that you need to cover your expenses in the next month to six months... so yeah, you could well have an emergency fund that covers 3-6 months of your expenses (salary) and helps you to feel comfortable that you have enough money in such emergency fund in the case you might be able to be more aggressive in your bitcoin investment and also to have the emergency fund available in case you overdo it... which might sometimes end up happening, and it should be minimized that you are counting on your emergency fund, yet after you maintain an emergency fund for a long enough period of time and you get used to maintaining an emergency fund, then you should come to realize how to use it and the creation of your own personal boundaries for when and how to use it.. I really need to go through this there're many alot of things I need to understand and I could really make use of it too. As I mention in that linked post, it can take a while for guys to figure out each of their particulars in regards to the 9 factors to consider... so there is no need to rush such process, but as you get your various factors in order then you have a checklist of each of the kinds of things that you should be considering when making your investment into bitcoin and how to maybe tailor your investment into bitcoin from time to time in accordance with the 9 factors (which surely sometimes will also change and help to warrant, from time to time, various changes to your BTC accumulation/maintenance and/or liquidation stages). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Litzki1990

|

|

December 21, 2023, 06:20:23 PM |

|

But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes . Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start nowThat is if the person can continue to hold the bitcoin even though the price is still below the purchase price. Most people will panic and sell their bitcoins quickly, even if they bear the loss. Not many people can continue to hold their bitcoin in a loss condition. By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him. Not all investors sell their investments at a loss, but those who have a pre-planned investment hold their investments even in bad times. When the Bitcoin market moved above $60,000 and those who bought Bitcoin at that time and who have held onto that investment until now are real patient investors. Patience is a very necessary aspect of a human being. He who has no patience loses everything. I got real proof of how important patience is for a man. I went to the bank for one of my needs to deposit money and while depositing that money I faced this real experience. Money was being collected from three counters and there were enough customers in three counters to catch up. I was regularly monitoring the movement of a person who was first in our line but as our line was a bit crowded he went to counter number three and a person at counter number three deposited a lot of money due to which there was a lot of delay. Due to the delay from counter number three he returned to our serial again though two more new persons entered our serial after he left. Our line grew a bit as two new people joined a serial due to which he impatiently went to another counter to deposit money and when the man was very close to depositing money the bank official left the counter for one of his needs. As he left the counter he came into our line again and he fell far behind. Seeing his restlessness, I was able to understand that it is not right to be in such a hurry in all work and one should be patient. If the person was patient, he could have deposited money long before our line, but because of changing counters multiple times, he ended up depositing last of all. We should not be too hasty or too impatient to invest. When the market goes down, we have to take it naturally. Naturally one must wait for good times, if the investor waits for good times then good times will surely come for him. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

promise444c5

Full Member

Offline Offline

Activity: 280

Merit: 139

Keep Promises !

|

|

December 21, 2023, 06:21:25 PM |

|

Your way of framing your response is strange though.

I couldn't believe what I typed after reading  I really need to remove autocompletion and auto correct  |

|

|

|

|

Makus

Full Member

Offline Offline

Activity: 322

Merit: 217

Bitcoin!!

|

|

December 21, 2023, 06:55:48 PM Merited by JayJuanGee (1) |

|

so yeah, you could well have an emergency fund that covers 3-6 months of your expenses (salary) and helps you to feel comfortable that you have enough money in such emergency fund in the case you might be able to be more aggressive in your bitcoin investment and also to have the emergency fund available in case you overdo it... which might sometimes end up happening, and it should be minimized that you are counting on your emergency fund, yet after you maintain an emergency fund for a long enough period of time and you get used to maintaining an emergency fund, then you should come to realize how to use it and the creation of your own personal boundaries for when and how to use it..

Well spoken Mr JJG, emergency funds are very important for every Bitcoin investor who is into long term holding. Emergency funds are the basic things any Bitcoin investor should set aside before going into investment. Just as you said most times we get too tempted to overdo our investment due to the market movement, especially now that we are close to the halving and would be experience th bull run thereafter. Most times I sit back and wonder if I'm out of my mind for making some aggressive decision in accumulating Bitcoin, but then I realize that every decision concerning Bitcoin is worth the risk, and that is how move on. After stumbling on those 9 factor and examining my condition, I think I need to work on number 8 because, my application of accumulating strategy isn't flexible and I need to update myself time to time. However it's not all that necessary, especially for newbies. I think the category of person worthy of trying this strategy are those above the newbie stage, newbies in Bitcoin holding are advised to stick with DCA until you seem comfortable of holding without hitting the sell button, then you can go ahead in exploring other strategies. I am still applying buy the dip with DCA and this is the best I have seen so far, don't know if there are other strategy better than this for now, but I think I am comfortable enough to make some changes. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10233

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 21, 2023, 07:55:19 PM |

|

so yeah, you could well have an emergency fund that covers 3-6 months of your expenses (salary) and helps you to feel comfortable that you have enough money in such emergency fund in the case you might be able to be more aggressive in your bitcoin investment and also to have the emergency fund available in case you overdo it... which might sometimes end up happening, and it should be minimized that you are counting on your emergency fund, yet after you maintain an emergency fund for a long enough period of time and you get used to maintaining an emergency fund, then you should come to realize how to use it and the creation of your own personal boundaries for when and how to use it..

Well spoken Mr JJG, emergency funds are very important for every Bitcoin investor who is into long term holding. Emergency funds are the basic things any Bitcoin investor should set aside before going into investment. Just as you said most times we get too tempted to overdo our investment due to the market movement, especially now that we are close to the halving and would be experience th bull run thereafter. Most times I sit back and wonder if I'm out of my mind for making some aggressive decision in accumulating Bitcoin, but then I realize that every decision concerning Bitcoin is worth the risk, and that is how move on. After stumbling on those 9 factor and examining my condition, I think I need to work on number 8 because, my application of accumulating strategy isn't flexible and I need to update myself time to time. "8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. Surely another BIG factor is that if you spend a decent amount of time either building up your bitcoin stash, or even getting your emergency fund in place (when maybe you did not have one previously, or maybe your emergency fund was quite inadequate), so once your emergency fund is in a good place, then you can also tweak your strategy... .. Also, we are not stagnant creatures, we are frequently learning about things or maybe some other kinds of obligations come up in our lives in such a way that we are less able to spend time with figuring out bitcoin or our finances, and so we end up having to spend time, money and energies on some things that were not initially related to our investment plan, so maybe we have an income of $4k per month, and we decide we want to and we are able to be aggressive in our bitcoin investment, and we are able in invest $1k per month into bitcoin (which would be 25% and pretty aggressive), but some things change, and we realize that we have to downsize our investment to ONLY $400 per month (which would be 10% of our income). As you indicated, we might not always be keeping very good track of where we are at, and if we need to relook at what we are doing every month, or once a quarter, or maybe only once or twice a year, but sometimes there will be value in reevaluating where we are at and the kinds of strategies that we are employing in regards to our bitcoin. However it's not all that necessary, especially for newbies. I think the category of person worthy of trying this strategy are those above the newbie stage, newbies in Bitcoin holding are advised to stick with DCA until you seem comfortable of holding without hitting the sell button, then you can go ahead in exploring other strategies. I am still applying buy the dip with DCA and this is the best I have seen so far, don't know if there are other strategy better than this for now, but I think I am comfortable enough to make some changes.

You may well be right that a certain strategy might work for you for several years, but if you spent 4 years buying between $100 and $250 per week as in my above example, then you may well end up in having around $20k to $50k invested into bitcoin after 4 years, and then you might want to spend some time looking over the status of what you had already accomplished and to consider if you need to make some changes to your approach,, because as some point you might start to believe that either you have enough BTC or that maybe you want to invest into other things, and I am not necessarily referring to shitcoins, even though some people do end up going down that road... but there are things like equities, properties, bonds, commodities, and cash/cash equivalents that might be relevant in regards to some ways that you might consider reallocating or refocusing some of your BTC exposure as compared with other places that you are holding some of your value. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Frankolala

|

|

December 21, 2023, 08:17:34 PM |

|

But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes . Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start nowThat is if the person can continue to hold the bitcoin even though the price is still below the purchase price. Most people will panic and sell their bitcoins quickly, even if they bear the loss. Not many people can continue to hold their bitcoin in a loss condition. By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him. Not all investors sell their investments at a loss, but those who have a pre-planned investment hold their investments even in bad times. When the Bitcoin market moved above $60,000 and those who bought Bitcoin at that time and who have held onto that investment until now are real patient investors. Patience is a very necessary aspect of a human being. He who has no patience loses everything. I got real proof of how important patience is for a man. It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior. I also see people that are new into bitcoin who have only little in their bitcoin portfolio, that feels because the price of bitcoin is pumping and for that reason they are over investing aggressively because they want to have enough bitcoin during the bull run as investors that plans to sell in a short-term which is why they are acting that way and if bitcoin price didn't turn out as they expected, they will be disappointed. It is better since you just got started to focus on buying regular with your DCA amount that would be at ease to you since you are on a long term bitcoin accumulation journey because slow and steady will help you plan different strategies which you will be able to use to buy at different market level and there will be funds available at all time to continue increasing your bitcoin portfolio. The longer you invest, the best. Short term investment will only rip off your future profit. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

Publictalk792

|

|

December 22, 2023, 04:32:59 AM |

|

Maybe we can try to explore different kinds of investors in regards to ways that they might accumulate BTC and perhaps we don't even need to go too far down the path of comparing BTC accumulators to traders.

The most that a person who is ONLY buying (and not using leverage and/or trading) can screw up is to have an average BTC price at the top of the market, so just by definition, if someone buys at the top and continues to buy, his average cost per BTC is going to ultimately end up coming down, and in order to be profitable - in terms of the average, then the price that BTC needs to reach will continue to go down as more buys are made, so profitability will come into existence quite long before reaching the ATH again. Of course, the purchase that was made at the top will not get into profits until after reaching the ATH again, and so there can be some variance in terms of whether someone might measure whether they are in profits in terms of transaction by transaction or if they also might consider their average price per BTC, and there should be no reason not to be able to engage in both kinds of practices in order to better understand how to manage the BTC that you have accumulated in terms of how profitable it is - while at the same time, there are some folks who are not very detailed in their keeping track of their BTC, so they might ONLY have ballpark ideas regarding the extent to which their BTC holdings might be profitable or not.

Understanding different types of investors and their strategies for accumulating BTC is interesting. Some investors focus on buying and holding BTC instead of actively trading or using leverage (and I think this is the best strategy).But some of them are those which believe in other strategies and they mently ok.. with it. For these investors ( who hold BTC) the average BTC price at which they make their purchases is important. If someone buys at the top of the market and continues to buy more BTC over time their average cost per BTC will respectively decrease.This means that the BTC price doesn't necessarily need to reach its ATH again for them to be profitable. The more they buy the lower the required price for profitability. However... it is worth noting that the initial purchase made at the top will not be profitable until the BTC price reaches the ATH again.So individuals may measure their profitability differently either by looking at each transaction or considering their average price per BTC. Doing both can help manage accumulated BTC and assess its profitability. Not everyone keeps detailed track of their BTC holdings and some may only have a rough idea of their profitability. It's always good to have a clear understanding of investments but it is understandable that not everyone is meticulous about it. Of course, someone who bought at the top and then did not buy any more BTC will be stuck waiting for the BTC price to get back above the ATH in order to get into profits.

Snip

You bring up a valid point. It's true that if someone bought at the top and didn't continue to buy more BTC, they would indeed have to wait for the price to surpass the ATH in order to see profits. And I have read the example which you have given. I totally agree wthi you. In conclusion if there is anyone, a trader (except those who leveraging) or an investor they need to hold. If there is a trader so he bought BTC on top so he will try average the BTC price. But still if he is in loss so he has to wait for weeks for months or even years to get profit when the value will go above his entry point. In the end, each investor's strategy and goals may differ and it's important to consider multiple factors when assessing the profitability of BTC holdings. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

Popkon6

|

|

December 22, 2023, 04:36:59 AM |

|

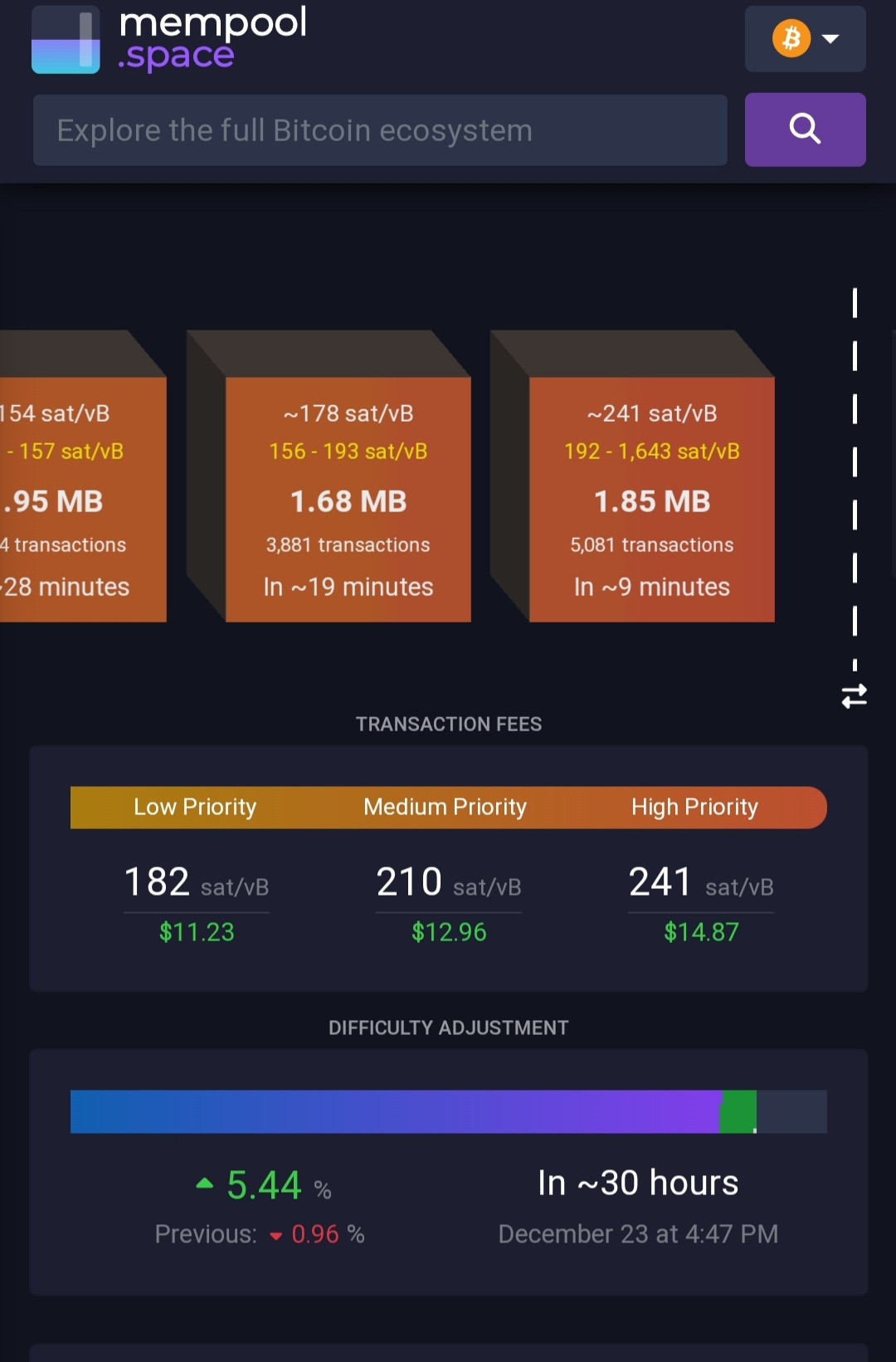

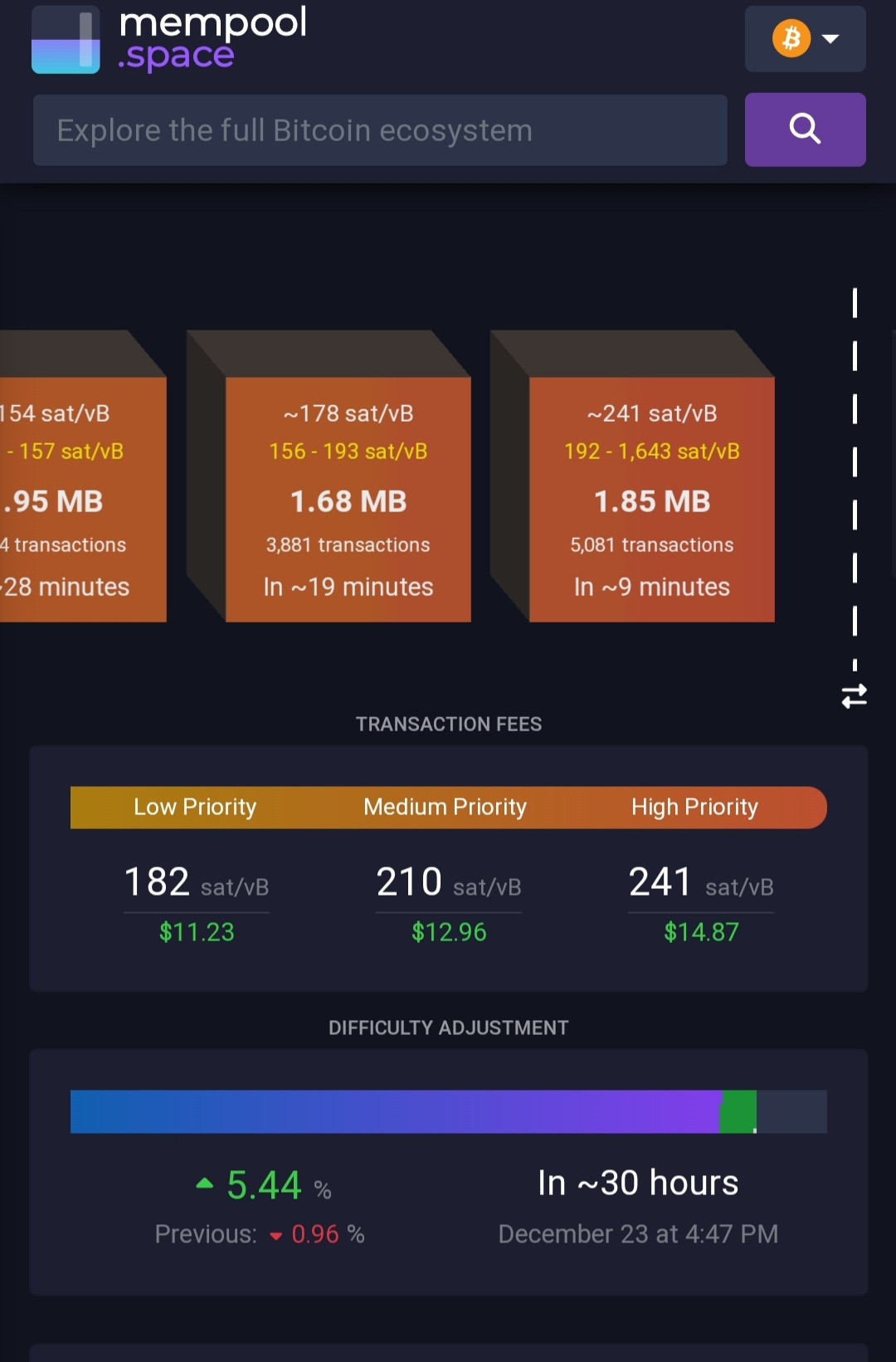

Additional transaction fees have been increasing ever since the price of Bitcoin increased. This transaction fee is currently the biggest hurdle especially for those who are holding Bitcoin with the DCA method of Bitcoin. They incur additional transaction fees to hold bitcoins on a weekly or monthly DCA basis. I myself am under extra stress for Bitcoin transaction fees, because I have to continue investing in the DCA method at high cost. Yet I have not stopped holding bitcoins with the DCA method, continue and will continue to do so in the future no matter how high the transaction fees are. I usually show you a picture of the Bitcoin Mempool.  |

|

|

|

|

Patrol69

|

|

December 22, 2023, 05:27:07 AM Merited by JayJuanGee (1) |

|

Additional transaction fees have been increasing ever since the price of Bitcoin increased. This transaction fee is currently the biggest hurdle especially for those who are holding Bitcoin with the DCA method of Bitcoin. They incur additional transaction fees to hold bitcoins on a weekly or monthly DCA basis. I myself am under extra stress for Bitcoin transaction fees, because I have to continue investing in the DCA method at high cost. Yet I have not stopped holding bitcoins with the DCA method, continue and will continue to do so in the future no matter how high the transaction fees are. I usually show you a picture of the Bitcoin Mempool.  I don't think the extra transaction fee of Bitcoin should be a deterrent to your investing in DCA method. Now we are regularly noticing extra transaction fees for Bitcoin and you can use a good quality exchange to avoid this extra transaction fee problem. As per the current situation for investing I would suggest you to use Binance Exchange. Since you are investing according to the DCA method, when you feel that you should increase your investment now, you will deposit your country's local currency in Binance and after depositing, you can directly purchase bitcoins through p2p transactions. Or you can buy virtual dollars and later buy bitcoins with those dollars. Additional transaction fees are not a big issue for those who want to hold their investments for a long time and who want to invest in Bitcoin considering the different phases of the Bitcoin market. Our willpower is the most important, if we have the willpower to invest then surely our alternative thoughts will come to our mind. It is now a bit difficult for those investors who transfer their investments from mobile wallets to exchange wallets. In the future when the transaction fees are normalized, an investor can easily transfer his investment from exchange to hardware wallet or software wallet, it is not a difficult task. |

|

|

|

|

|

adultcrypto

|

|

December 22, 2023, 09:11:13 AM Merited by JayJuanGee (1) |

|

Additional transaction fees have been increasing ever since the price of Bitcoin increased. This transaction fee is currently the biggest hurdle especially for those who are holding Bitcoin with the DCA method of Bitcoin. They incur additional transaction fees to hold bitcoins on a weekly or monthly DCA basis. I myself am under extra stress for Bitcoin transaction fees, because I have to continue investing in the DCA method at high cost. Yet I have not stopped holding bitcoins with the DCA method, continue and will continue to do so in the future no matter how high the transaction fees are.

The transaction fee is actually a big problem for those of using the DCA method. I think some adjustments have to be maintain buying the same amount of budgeted funds. Some of those adjustments including changing weekly DCA to bi-weekly DCA or to monthly DCA. In this case, the money can be deposited and Bitcoin bought like it was before the high fees, then keeping withdrawals to once per month as the case may be. Since the fees became too high, I have also adjusted my withdrawal pattern to suit my targets. I don't have to spend huge amount as withdrawal fees as a result of regular withdrawals. While we hope this nightmare will come to an end soon, we have to improvise. The need for withdrawal is because centralized exchanges is not the best place to store your coins to avoid loss of assets due to hack or other sharp practices that is common among CEX. |

|

|

|

Su-asa

Full Member

Offline Offline

Activity: 266

Merit: 201

Can't go home alone.

|

|

December 22, 2023, 11:07:21 AM |

|

Additional transaction fees have been increasing ever since the price of Bitcoin increased. This transaction fee is currently the biggest hurdle especially for those who are holding Bitcoin with the DCA method of Bitcoin. They incur additional transaction fees to hold bitcoins on a weekly or monthly DCA basis. I myself am under extra stress for Bitcoin transaction fees, because I have to continue investing in the DCA method at high cost. Yet I have not stopped holding bitcoins with the DCA method, continue and will continue to do so in the future no matter how high the transaction fees are.

The transaction fee is actually a big problem for those of using the DCA method. I think some adjustments have to be maintain buying the same amount of budgeted funds. Some of those adjustments including changing weekly DCA to bi-weekly DCA or to monthly DCA. In this case, the money can be deposited and Bitcoin bought like it was before the high fees, then keeping withdrawals to once per month as the case may be. Since the fees became too high, I have also adjusted my withdrawal pattern to suit my targets. I don't have to spend huge amount as withdrawal fees as a result of regular withdrawals. While we hope this nightmare will come to an end soon, we have to improvise. The need for withdrawal is because centralized exchanges is not the best place to store your coins to avoid loss of assets due to hack or other sharp practices that is common among CEX. You are absolutely right about the transaction fees, but I have a feeling that that is not a problem. There are many people that are applying the DCAing strategy, so anytime they want to accumulate Bitcoin, they can make use of the lighting network or accelerate the transaction so that it will be confirmed in just a matter of minutes (maybe 30 minutes). However, I haven't used any of them, but with the kind of post and discussion at the technical board, I can tell that they are working perfectly. Although I am still planning to buy more coins next week with the help of the DCAing strategy, and if the transaction isn't confirmed quickly, then I will accelerate it. Before I came across this post, https://bitcointalk.org/index.php?topic=5034315.0 I was thinking of buying the same amount of Ethereum, then when it's confirmed, I will reconvert it back to BTC just because of the transaction, but now, I will not have to do so, I will just buy the BTC from p2p and accelerate it. |

|

|

|

|