Market Crash Post Mortem

The last Market Dump that happened last friday, was particularly interesting in my opinion. As far as We can see, much of the action can be traced back to the derivatives market.

A few insightful Post mortem were released, I will analyse here, tring to sum them up and add my own consideration and other material I found in different places.

All relevant links are reported at the end of this post and clearly referenced when used.

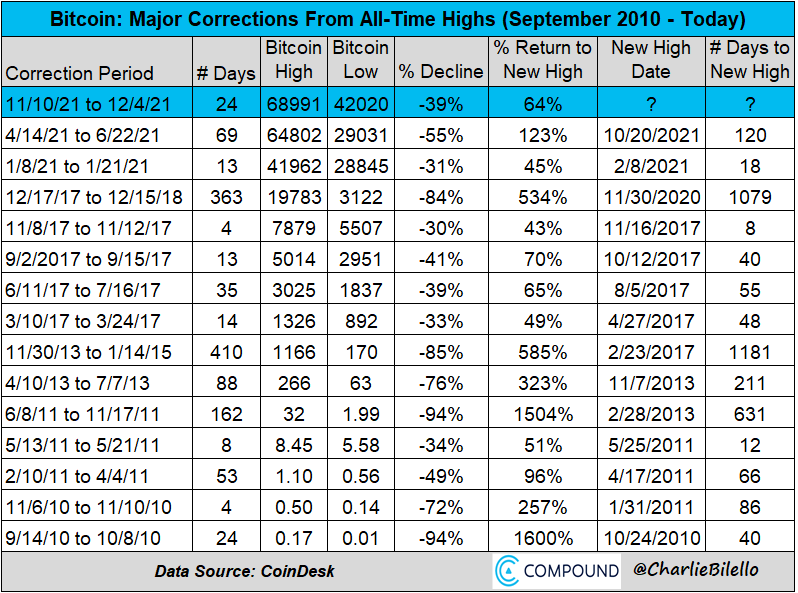

What happened Last Friday marked accelerated an already weak price action, and bottomed at 42,020 corresponding to a loss of 39% since the ATH observed on November 9th.

The loss is the 2th biggest fall in BTC terms in 2021 only.

If we put in relations the depth of market correction and the time span of the drawdown we see we are in a mixed situation:

Anatomy of a crash

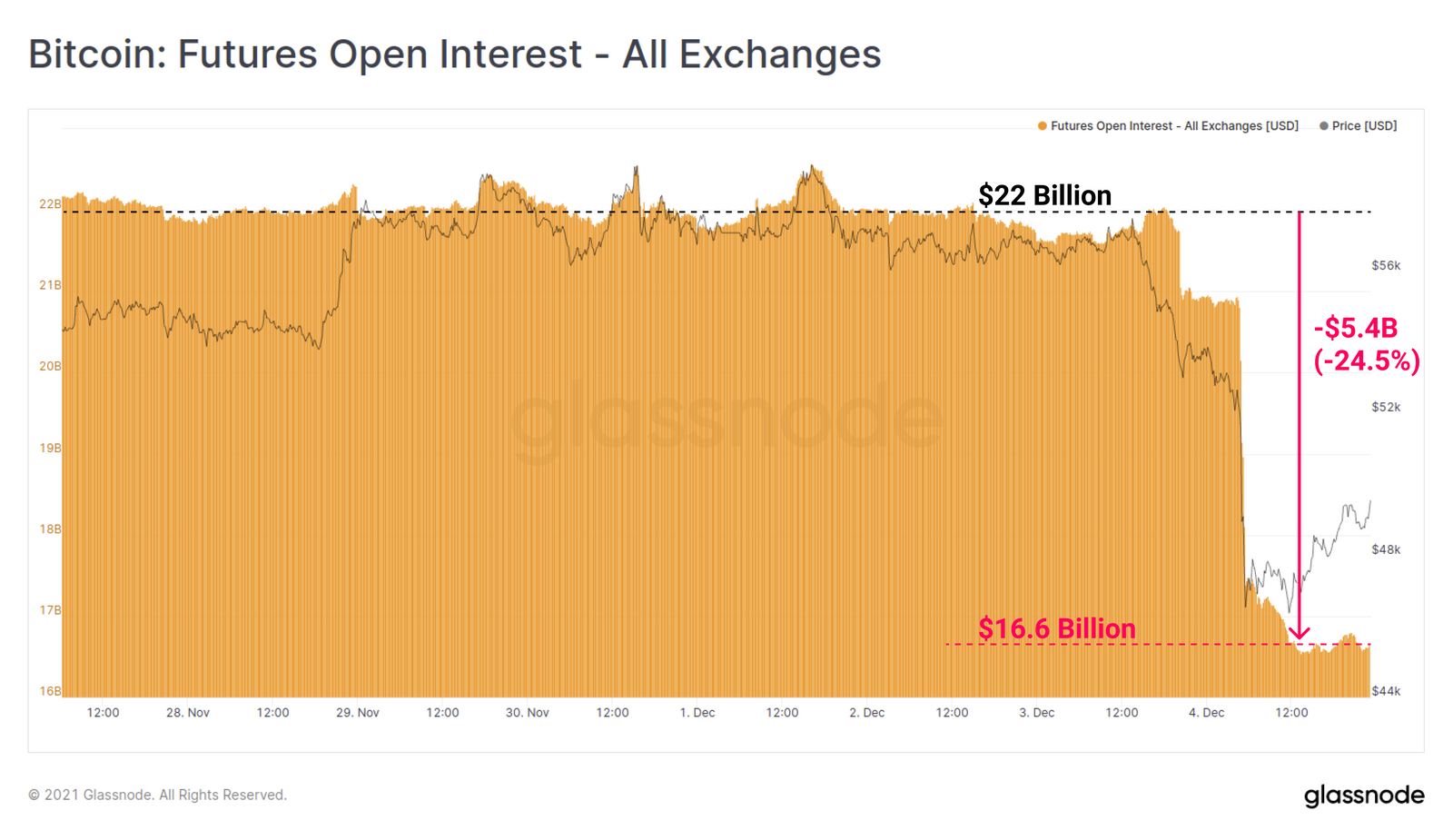

Anatomy of a crash As noted in the Glassnode report, the catalyst was the break of the support level of 53K on Bitcoin on the back of traditional financial markets weakness. I am not fully confident this is the whole story, but often things happen in the financial markets without a clear trigger, and in the post-mortem analysis we usually agree on what was the cause of the movement, while it would be important to know it before the movement, but this is a different story. Once this level broke a flurry of market longs liquidations led to an astonishing reduction of OI: in a few hours a reduction of $5.4BLN, equivalent to the 25% of the total value.

At 58,202 in BTC terms, this liquidation was the second biggest in history, after the one in May which topped 79,244 BTC

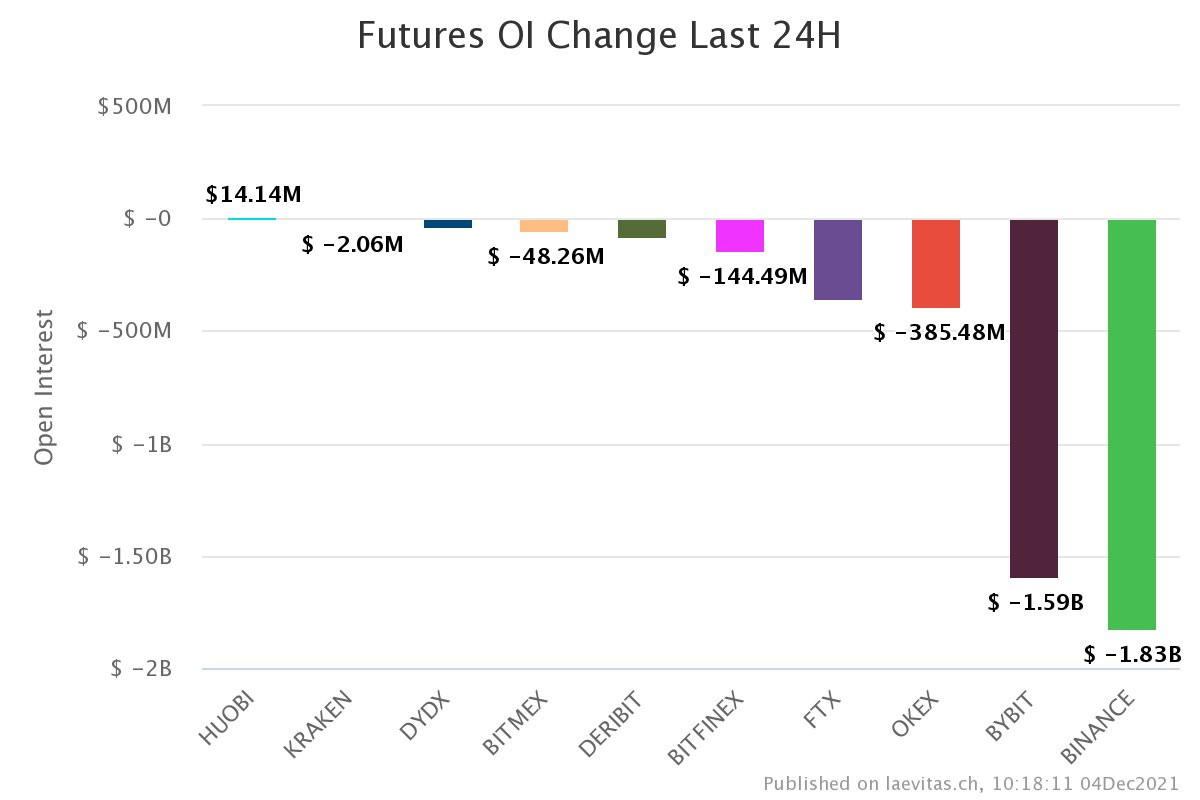

Notably, thi reduction was pretty much evident outside the CME exchange.

The majority of the positions held at the CME are long term ones, as the main customers of this exchange are uber-regulated institutional investors. BITO’s proponents being the biggest of them all holding more than 5,000 futures contracts. Also, the CME being closed helped the poor liquidity of the market, which in turn is one of the reasons why the move took place during a friday night’s lack of liquidity

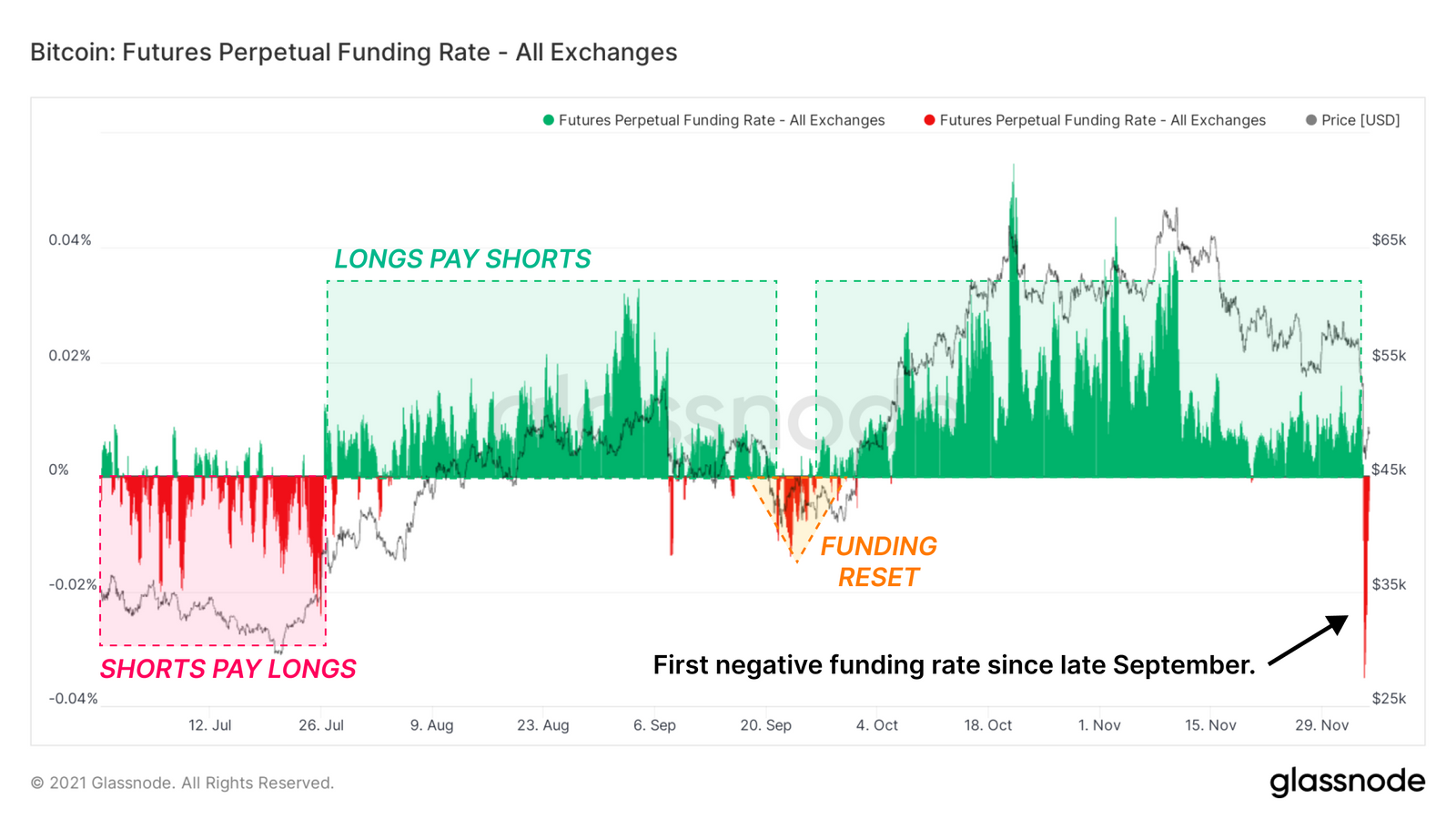

As the long futures positions were liquidated the funding needed to be paid to keep those positions opened fell sharply. As we have already said in this thread, when the funding is positive, long position holder must pay to keep their position open, while the opposite happens when the funding rate is negative. So, funding rate is a sort of “thermometer” of the imbalance of the future market: when the finding is extreme, this means also positioning is extreme, in one way or the other.

When longs are liquidated, suddenly, all the long retail position gets closed out, so only short position are left in the street so funding turns negative:

Funding rate turned to -0.035%, the most extreme level in months.

As you can see, the funding premium has been positive since the beginning of October. Prolonged period of time with positive funding means a high level of confidence by the traders about market bullishness. This confidence can soon turns in complacency, that ignores without taking actions against warning signs of a different market scenario.

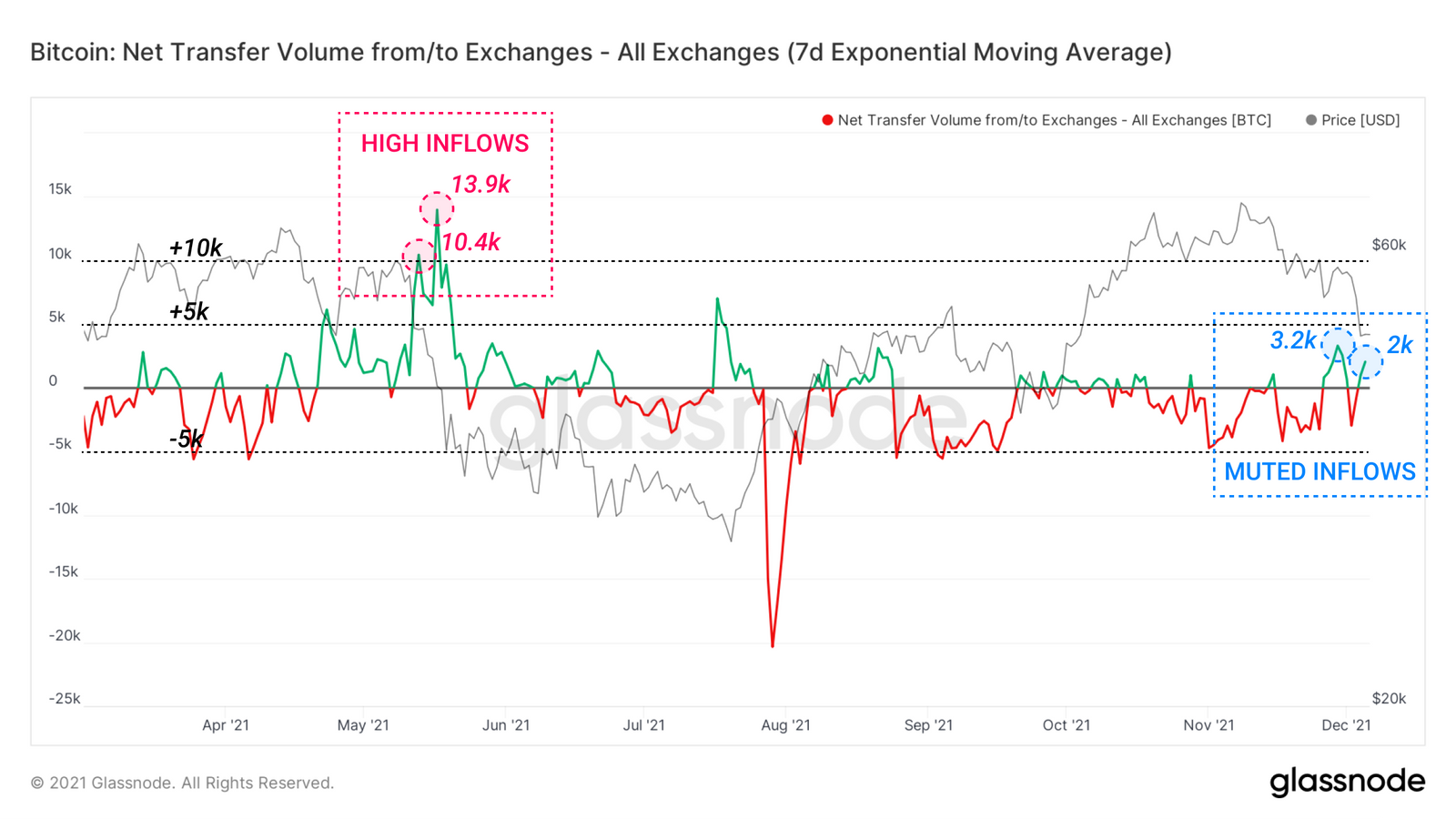

Another sign of this complacency has been the continuous outflows from the exchanges:

Typically, users keep their funds at the exchange when they are in immediate need of trading, hence when exchanges see outflows this means users are willing to sell (either against FIAT or vs Altcoins) while when an outflow is observed this means users aren’t keen on selling their fund too soon.

Also, as noted by Coindesk, market participants didn’t see that coming, as the implied volatility for 1m expiry options had been flat since weeks at a tad less than 80%. When the crash occurred the volatility squeezed higher to 98% and steadily declined later when the context of the move was much more clear .

How to get warning signals.

Elevated funding rates, coupled with non-decreasing non-CME Open Interest and lack of liquidity on the exchange have signalled a certain stance of complacency in the market. This complacency could have led in one or another direction . As things developed, of course the short leg was the one to benefit. Also given the low liquidity on the exchange, market liquidation mechanism resulted in an accelerator of the movement itself, as liquidity was scarce. This makes an obvious recipe to look for another violent measure: Elevated OI are difficult to maintain, if the funding rate get elevated, as those represent the “cost of taking that position”. So those position must be closed sooner or later, either via a liquidation run, or a bull run, when holder naturally close their positions.

Useful links

The Week Onchain (Week 49, 2021)How Bitcoin Set Itself Up for This Sell-OffBitcoin's Saturday sell-off (Paywall)